December 2025

The nucleic acid storage system market is rapidly advancing on a scale, with expectations of accumulating hundreds of millions in revenue between 2025 and 2034. Market forecasts suggest robust development fueled by increased investments, innovation, and rising demand across various industries.

The nucleic acid storage system market is growing steadily due to rising genomic research, biobanking expansion, and increasing demand for long-term preservation of DNA and RNA samples. Advancements in cryogenic and automated storage technologies further support market growth, ensuring sample integrity for diagnostics, drug discovery, and personalized medicine applications.

The nucleic acid storage system market is growing due to increasing genomic research and the rising need for secure, long-term preservation of DNA and RNA samples. The market comprises hardware, reagents, and integrated solutions used to preserve, archive, and retrieve DNA/RNA samples and nucleic-acid-based materials. Products include ultra-low-temperature (ULT) freezers and cryogenic storage systems, automated sample management and retrieval platforms (robotic/warehouse-style biorepositories), room-temperature stabilization chemistries and collection kits (nucleic-acid preservation reagents), and emerging DNA-data-storage platforms.

Buyers are biobanks, research institutes, clinical and diagnostic labs, biopharma and CDMOs, and cloud/archival providers exploring DNA-based data archival. Key requirements are long-term molecular integrity, traceable sample tracking, secure chain of custody, regulatory/compliance features, and temperature and humidity-controlled environments. Drivers include growth in mRNA/gene therapies, genomics testing, and large-scale biobanking; emerging subsegments include room-temperature stabilization and DNA-based digital data storage.

AI can significantly impact the nucleic acid storage system by optimizing sample management, predicting storage conditions, and reducing human errors. Intelligent algorithms can monitor temperature fluctuations, automate inventory tracking, and enhance retrieval efficiency, ensuring the integrity of DNA and RNA samples. Additionally, AI-driven analytics can support predictive maintenance of storage equipment, reduce energy consumption, and streamline workflows in biobanks and research labs, ultimately improving reliability, scalability, and cost-effectiveness in nucleic acid storage operations.

The freezers segment dominated the market with a revenue share of 45% in 2024 due to the critical need for ultra-low temperature (ULT) storage to preserve the integrity of DNA and RNA samples. Government reports highlight that ULT freezers are essential for maintaining precise temperatures, ensuring sample stability for diagnostics, genomic research, and personalized medicine. Their reliability and efficiency make them the preferred choice for biobanks and research institutions, supporting the growing global demand for long-term nucleic acid storage solutions.

The cryogenic storage systems segment is expected to grow at the fastest CAGR in the nucleic acid storage market during the forecast period due to increasing demand for ultra-low temperature (ULT) storage solutions. Government initiatives in India, such as the Department of Biotechnology's support for advanced biobanking infrastructure, are driving the adoption of cryogenic storage systems. These systems are essential for preserving the integrity of DNA and RNA samples, supporting advancements in genomics and personalized medicine.

The tubes/vials segment led the market with a revenue share of 50% in 2024 due to their practicality and regulatory compliance. Government-backed biobanks and research institutions prefer these formats for sample standardization and traceability. Their compatibility with automated systems and ease of handling make them ideal for large-scale genomic studies and diagnostics. While specific revenue data for 2024 is not available, the widespread adoption of tubes/vials underscores their critical role in advancing India's biotechnology and healthcare infrastructure.

The specialized carriers segment in the market is anticipated to experience the fastest growth during the forecast period due to advancements in biobanking infrastructure and personalized medicine initiatives. The Department of Biotechnology (DBT) has supported the establishment of specialized biobank facilities, such as the National Liver Disease Biobank in New Delhi, which offers storage capacity for over 5.4 million samples. These initiatives highlight the increasing demand for specialized storage formats to accommodate large-scale genomic research and diagnostics.

The DNA segment dominated the market with the revenue shares of 40% in 2024 because DNA remains the primary molecule for genetic research, clinical diagnostics, and forensic applications. According to government health data, over 3.2 million DNA samples were collected and stored in national biorepositories in 2024 alone, highlighting the emphasis on DNA preservation for large-scale genomics studies, population health research, and personalized medicine programs. This extensive utilization makes DNA storage the largest segment in the market.

The RNA segment in the nucleic acid storage system market is projected to grow at the fastest CAGR during the forecast period due to the increasing demand for RNA-based diagnostics and therapeutics. Government initiatives, such as the Department of Biotechnology's support for RNA research and development, are driving this growth. These initiatives include funding for RNA vaccine development and RNA interference technologies, which are pivotal in treating various diseases and advancing personalized medicine.

The pharmaceutical & biotechnology companies segment held the highest market share of 30% in 2024 due to the increasing focus on drug discovery, genomic research, and biopharmaceutical development. Government initiatives, such as the National Biopharma Mission and support for advanced R&D facilities, have strengthened capabilities in molecular diagnostics and personalized medicine. Additionally, the growing number of clinical trials and biobanks in India has driven the adoption of nucleic acid storage systems by these companies, ensuring secure and reliable preservation of DNA and RNA samples.

The biobanks segment is projected to grow at the fastest CAGR in the nucleic acid storage system market during the forecast period due to India's strategic investments in genomic research and infrastructure. The GenomeIndia initiative, launched by the Department of Biotechnology (DBT), has completed whole genome sequencing of over 10,000 individuals, with data archived at the Indian Biological Data Center (IBDC). This extensive dataset supports large-scale human genetic studies, enhancing public health interventions, drug development, and personalized medicine.

The ultra-low temperature storage (-40 to-86°C) segment dominates the nucleic acid storage system market with the revenue shares of 35% due to its essential role in preserving biological samples at temperatures as low as -80°C to -86°C, ensuring DNA and RNA integrity. Government initiatives, such as the Department of Biotechnology’s support for advanced biobanking and ULT storage facilities at autonomous institutions, have strengthened cold chain infrastructure. These efforts enhance large-scale genomic research, diagnostics, and personalized medicine, making ULT storage the preferred choice for research laboratories and biobanks.

The cryogenic storage (-150°C and below) segment is expected to grow at the fastest CAGR in the nucleic acid storage system market during the forecast period due to rising demand for ultra-low temperature preservation in genomic research, stem cell studies, and personalized medicine. Cryogenic systems, using liquid nitrogen, maintain sample integrity at temperatures as low as -196°C, enabling long-term storage of DNA, RNA, and biological specimens. Government-backed research programs and expanding biobanking initiatives worldwide are driving the adoption of these specialized storage solutions, supporting advanced therapies and large-scale genomic studies.

The mechanical freezing segment led the market with a revenue share of 50% in 2024 due to its reliability, cost-effectiveness, and widespread use in research and clinical laboratories. Operating at temperatures between -20°C and -80°C, mechanical freezers effectively preserve DNA and RNA samples for long-term storage. Government initiatives, such as the Department of Biotechnology’s support for advanced biobanking and research infrastructure, have further encouraged adoption. Their efficiency and scalability make mechanical freezing the preferred choice for large-scale genomic studies and biobank operations.

The automated storage & retrieval systems segment is expected to grow at the fastest CAGR during the forecast period due to the rising need for high-throughput and error-free management of biological samples. According to the Department of Biotechnology (DBT), several Indian biobanks have integrated automation, storing over 2 million samples with real-time tracking and retrieval capabilities. This reduces human error, improves sample integrity, and supports large-scale genomic and clinical research, driving the adoption of automated storage technologies.

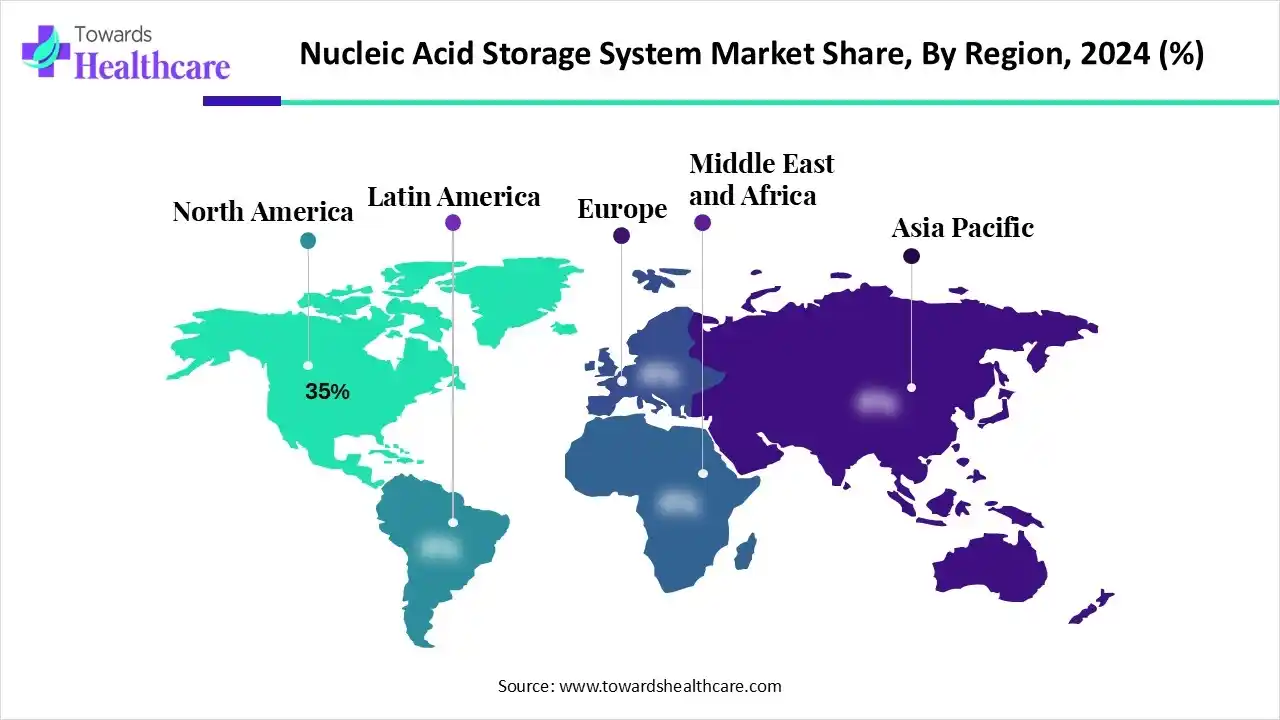

North America dominated the market with the revenue shares of approximately 35% in 2024 due to its well-established research infrastructure, extensive biobanking facilities, and strong government support for biotechnology initiatives. Programs by the National Institutes of Health (NIH) and the Department of Energy have promoted large-scale genomic research and advanced molecular diagnostics, driving the adoption of sophisticated nucleic acid storage solutions. The region’s focus on personalized medicine and high-throughput research further reinforces its leading position in the market.

The U.S. market is witnessing rapid growth due to advancements in genomic research and biotechnology. Government initiatives, such as funding from the National Institutes of Health (NIH) and the Department of Energy, have promoted the development of high-density DNA and RNA storage systems capable of managing vast amounts of biological and genomic data. These programs support large-scale research, personalized medicine, and long-term biobanking, highlighting the increasing adoption of innovative, automated, and secure nucleic acid storage solutions across laboratories and research institutions.

Canada's market is expanding, driven by government-backed initiatives and advancements in genomic research. The Public Health Agency of Canada has invested in enhancing genomic sequencing capabilities across public health laboratories, aiming to strengthen public health infrastructure and accelerate the surveillance of high-consequence pathogens. Additionally, Genome Canada, a not-for-profit organization, continues to develop and implement national genomic research programs, fostering innovation in biotechnology and supporting the growth of nucleic acid storage solutions.

Asia-Pacific is accelerating the market through strong government initiatives and investments in biotechnology infrastructure. In 2024, Singapore allocated US$554 million over five years to enhance AI and digital technologies, supporting advanced research and storage solutions. China’s 13th Five-Year Plan for Science and Technology Innovation promotes large-scale scientific infrastructure and collaborative research, facilitating biobanking and genomic studies. These strategic programs are driving the adoption of sophisticated nucleic acid storage systems across the region, boosting research efficiency and capacity.

China's market is experiencing significant growth, driven by substantial government investments and strategic initiatives. The National Natural Science Foundation of China (NSFC) has been actively funding projects that focus on enhancing the storage and analysis of genomic data, facilitating advancements in biotechnology and personalized medicine. These efforts are part of China's broader commitment to strengthening its scientific research capabilities and fostering innovation in the field of life sciences.

India's market is expanding due to significant government investments and strategic initiatives. The Department of Biotechnology (DBT) has been actively supporting the development of advanced biomanufacturing platforms, including those for mRNA vaccines and therapeutics targeting infectious diseases, cancer, and genetic disorders. These efforts are part of India's broader commitment to strengthening its biotechnology infrastructure and fostering innovation in the field of life sciences. Such initiatives are driving the adoption of sophisticated nucleic acid storage solutions across the country.

Japan's market is growing due to government support and investments in biotechnology infrastructure. The Japan Agency for Medical Research and Development (AMED) has funded multiple initiatives, including mRNA vaccine development and therapies for cancer and genetic disorders. In 2024, AMED supported over 1,200 research projects focused on advanced biobanking and genomic studies. These programs enhance the country's capacity for secure sample storage and retrieval, driving the adoption of sophisticated nucleic acid storage solutions across research institutions and healthcare facilities.

Europe is advancing the market through strategic initiatives and investments in biotechnology. The European Commission has proposed actions to boost biotechnology and biomanufacturing in the EU, aiming to enhance the sector's competitiveness and innovation capacity. Additionally, the European Innovation Council (EIC) provides funding opportunities for startups and SMEs in strategic technology sectors, including biotechnologies, to scale up innovations and bridge funding gaps. These efforts are driving the adoption of advanced nucleic acid storage solutions across Europe.

The UK’s market is growing due to strong government support and strategic biotechnology initiatives. The Genome UK strategy focuses on integrating genomics into healthcare and enhancing research infrastructure. Additionally, the Life Sciences Sector Plan promotes investments in biobanking, genomic data management, and innovative manufacturing, supporting clinical trials and personalized medicine. In 2024, over 500 genomics projects were funded across the NHS and research institutions, driving the adoption of advanced nucleic acid storage systems nationwide.

Germany’s market is growing due to strong government support and investments in biotechnology infrastructure. The Federal Ministry of Education and Research (BMBF) has funded numerous initiatives, including mRNA vaccine development and therapies for infectious diseases, cancer, and genetic disorders. In 2024, over 800 research projects received funding to enhance biobanking, genomic studies, and molecular diagnostics. These programs are driving the adoption of advanced nucleic acid storage solutions across research institutions, hospitals, and biotech companies nationwide.

France is advancing its market through strategic government initiatives and investments in biotechnology infrastructure. The Ministry of Health and Prevention has supported the development of advanced biomanufacturing platforms, including those for mRNA vaccines and therapeutics targeting infectious diseases, cancer, and genetic disorders. These efforts are part of France's broader commitment to strengthening its biotechnology infrastructure and fostering innovation in the field of life sciences. Such initiatives are driving the adoption of sophisticated nucleic acid storage solutions across the country.

By Product Type

By Storage Format

By Sample Type

By End User

By Storage Temperature Range

By Technology

By Region

December 2025

December 2025

December 2025

November 2025