January 2026

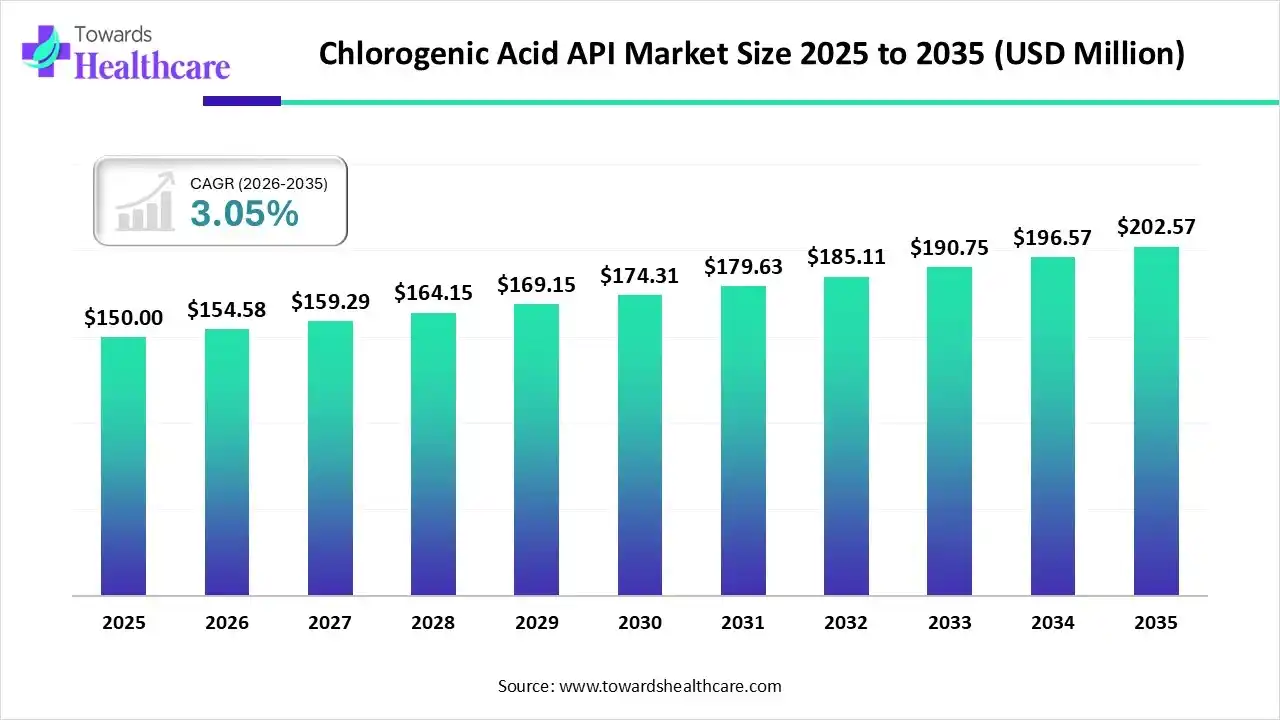

The global chlorogenic acid API market size was estimated at USD 150 million in 2025 and is predicted to increase from USD 154.58 million in 2026 to approximately USD 202.57 million by 2035, expanding at a CAGR of 3.05% from 2026 to 2035.

The market is growing, driven by rising use of natural antioxidants in dietary supplements, pharmaceuticals, and cosmetics, supported by increasing health awareness and strong demand for green coffee-based ingredients.

Chlorogenic acid is a naturally occurring polyphenol found mainly in coffee and plants, known for its antioxidant, anti-inflammatory, and metabolic health-supporting properties. The chlorogenic acid API market is growing due to rising consumer preference for natural and plant-based ingredients, increased use in nutraceuticals and functional foods for antioxidant and metabolic benefits, and expanding application in pharmaceutical cosmetics. Growing health awareness, demand for green coffee extract, and research into therapeutic properties further boost market adoption.

AI can revolutionize the chlorogenic acid API market by optimizing extraction and purification processes, improving yield consistency, and reducing production costs. Advanced analytics can accelerate drug formulation, predict stability, and enhance quality control. AI-driven demand forecasting and supply-chain optimization further support efficient scaling, faster innovation, and improved regulatory compliance across global markets.

| Key Elements | Scope |

| Market Size in 2026 | USD 154.58 Million |

| Projected Market Size in 2035 | USD 202.57 Million |

| CAGR (2026 - 2035) | 3.05% |

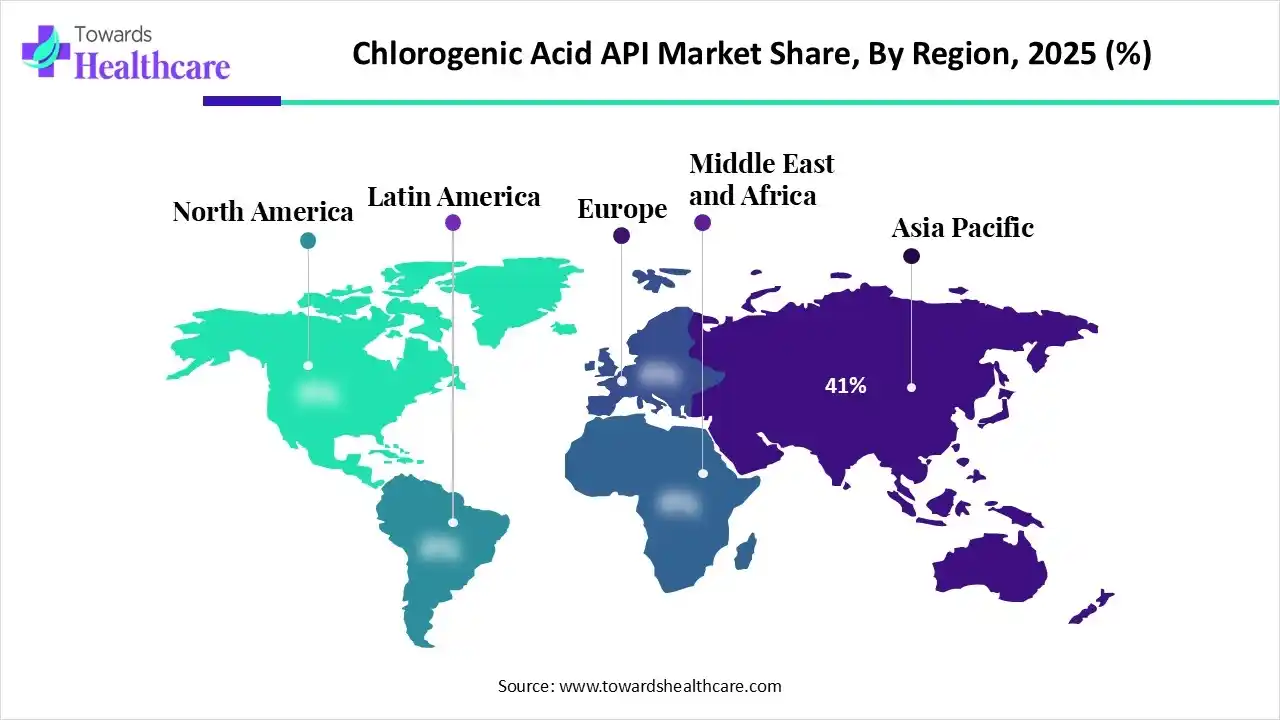

| Leading Region | Asia Pacific by 41% |

| Market Segmentation | By Source/Type, By Purity Level, By Application, By Region |

| Top Key Players | Naturex (Givaudan), Euromed S.A., Applied Food Sciences (AFS), Sabinsa Corporation, Zhejiang Skyherb Biotechnology, Indfrag Bioscience |

Why Did the Green Coffee Bean Extract Segment Dominate in the Market in 2025?

The green coffee bean extract segment dominated the chlorogenic acid API market with a share of approximately 65% due to chlorogenic acid content, reliable availability, and cost-effective sourcing. Strong scientific evidence supporting its antioxidant and metabolic benefits, along with wide acceptance in nutraceuticals, weight-management supplements, and functional foods, further reinforced its leading market position. Additionally, established supply chains and standardized extraction processes supported consistent quality and large-scale commercialization.

Synthetic

The synthetic segment is expected to grow fast pace because it ensures consistent purity, scalable production, and predictable supply, reducing dependency on agricultural variability. Manufacturers favor synthetic chlorogenic acid for precise quality control in pharmaceuticals and high-end nutraceuticals. Advancements in synthesis technologies, cost efficiencies, and increasing demand for standardized APIs further accelerate adoption over natural sources during the forecast period.

How the HPLC 45%-50% Segment Dominated the Chlorogenic Acid API Market in 2025?

The HPLC 45%-50% segment dominates the market with a revenue share of approximately 55% in 2025 because this standard purity offers the best balance of efficacy, cost-effectiveness, and supply reliability for mainstream supplements and functional products. Its established acceptance in weight management and antioxidant formulations, combined with efficient extraction from coffee beans and strong consumer trust, makes it the preferred choice for most manufacturers and brands.

HPLC 98% (High Purity)

The HPLC 98% (High Purity) segment is projected to grow at the fastest rate as pharmaceuticals and premium nutraceutical manufacturers increasingly demand highly standardized, contaminant-free APIs. This Purity level supports accurate dosing, strong clinical validation, and compliance with strict regulatory requirements. Growing R&D activities, rising use in advanced therapeutic formulations, and improvements in purification technologies are further accelerating the adoption of high-purity chlorogenic acid during the forecast period.

Why the Dietary Supplements Segment Dominated the Chlorogenic Acid API Market?

The dietary supplements segment dominated the market with a share of approximately 46% due to consumer demand for natural antioxidants supporting weight management, metabolic health, and cardiovascular wellness. Wide product availability in capsules, powders, and functional blends, along with growing preventive healthcare awareness and easy regulatory pathways compared to pharmaceuticals, significantly boosted supplements, and strong retail and e-commerce presence supported sustained segment leadership.

Pharmaceuticals

The pharmaceuticals segment is expected to grow at the fastest CAGR as demand rises for high-purity chlorogenic acid in developing drugs for metabolic disorders, diabetes, and cardiovascular conditions. Increasing clinical research validating its health benefits, coupled with strict quality and regulatory requirements, is driving adoption. Additionally, advances in formulation technologies and growing emphasis on preventive and functional medicine are accelerating the use of chlorogenic acid API in pharmaceutical applications.

| CVD Type | Estimated Global Mortality | Estimated Morbidity |

| Ischemic Heart Disease | 8.9 million | 197 million |

| Stroke | 6.8 million | 101 million |

| Hypertensive Heart Disease | 1.6 million | 32 million |

| Peripheral Artery Disease | - | 122 million |

| All CVD | 19.2 million | 523 miilion |

Asia Pacific dominated the global market in 2025, capturing around 41% share due to abundant green coffee bean production, cost-effective manufacturing, and strong nutraceutical and pharmaceutical demand. Growing health awareness, rising preventive healthcare adoption, and expanding R&D activities in countries like China, India, and Japan further reinforced the region’s leadership in supply, innovation, and market consumption.

India Emerging as a Key Growth Engine in Chlorogenic Acid API Market

India is anticipated to grow at a rapid CAGR due to its abundant raw material availability, cost-effective production capabilities, and expanding pharmaceutical and nutraceutical industries. Increasing health awareness, rising demand for dietary supplements, and supportive government initiatives for biotechnology and herbal product manufacturing are driving market expansion. Additionally, growing R&D investments and export opportunities position India as a fast-growing hub in the global market.

North America dominated the market in 2025 due to high consumer awareness of health and wellness, strong adoption of dietary supplements, and wellness, strong adoption of dietary supplements, and well-established pharmaceutical and nutraceutical industries. Advanced research, stringent quality standards, and wide availability of premium green coffee-based products further strengthened the region’s market leadership, supported by robust retail, e-commerce channels, and increasing investments in functional food and supplement innovations.

U.S.: Driving Maximum Revenue in the Chlorogenic Acid API Market

The U.S. led the market in 2025 by capturing the largest revenue share, driven by high consumer demand for dietary supplements, functional foods, and preventive healthcare products. Strong pharmaceutical and nutraceutical industries, advanced research on health benefits, and widespread adoption of green coffee–based formulations reinforced its market dominance. Additionally, robust regulatory frameworks and well-developed distribution channels supported sustained revenue growth.

Europe is anticipated to grow at a notable CAGR during the forecast period due to rising demand for natural, plant-based APIs and increasing focus on preventive healthcare. Strong regulatory emphasis on quality and safety, expanding nutraceutical and pharmaceutical research, and growing consumer preference for clean-label supplements are supporting market growth. Additionally, innovation in functional foods and increasing adoption of antioxidant-rich formulations across major European countries are further accelerating regional expansion.

UK Accelerating Growth in the Chlorogenic Acid API Market

The UK is anticipated to grow at a rapid CAGR during the forecast period due to increasing consumer focus on preventive healthcare and natural supplements. Rising demand for antioxidant-rich and weight-management products, coupled with strong pharmaceutical research activities and supportive regulatory frameworks, is driving adoption. Additionally, growing interest in plant-based ingredients, expanding nutraceutical brands, and robust retail and e-commerce channels are accelerating market growth across the country.

| Companies | Headquarters | Offerings |

| Naturex (Givaudan) | Avignon, France | Standardized green coffee bean extracts rich in chlorogenic acid for pharmaceutical, nutraceutical, and functional food applications, with a strong focus on traceability and quality compliance. |

| Euromed S.A. | Barcelona, Spain | High-purity botanical extracts, including chlorogenic acid–rich plant extracts, tailored for pharmaceutical APIs, dietary supplements, and clinical-grade nutraceutical formulations. |

| Applied Food Sciences (AFS) | Texas, USA | Branded green coffee bean extracts with defined chlorogenic acid content, primarily serving dietary supplements, weight-management, and metabolic health formulations. |

| Sabinsa Corporation | New Jersey, USA | Science-backed herbal and botanical APIs, including chlorogenic acid extracts, are supported by clinical validation for pharmaceutical, nutraceutical, and preventive healthcare products. |

| Zhejiang Skyherb Biotechnology | Zhejiang, China | Cost-effective chlorogenic acid and green coffee bean extracts at multiple purity levels, supplying bulk APIs to pharmaceutical, nutraceutical, and functional food manufacturers globally. |

| Indfrag Bioscience | Bengaluru, India | Natural plant-based extracts and APIs, including chlorogenic acid ingredients, are focused on pharmaceutical-grade quality, sustainability, and global export markets. |

By Source/Type

By Purity Level

By Application

By Region

January 2026

December 2025

November 2025

November 2025