January 2026

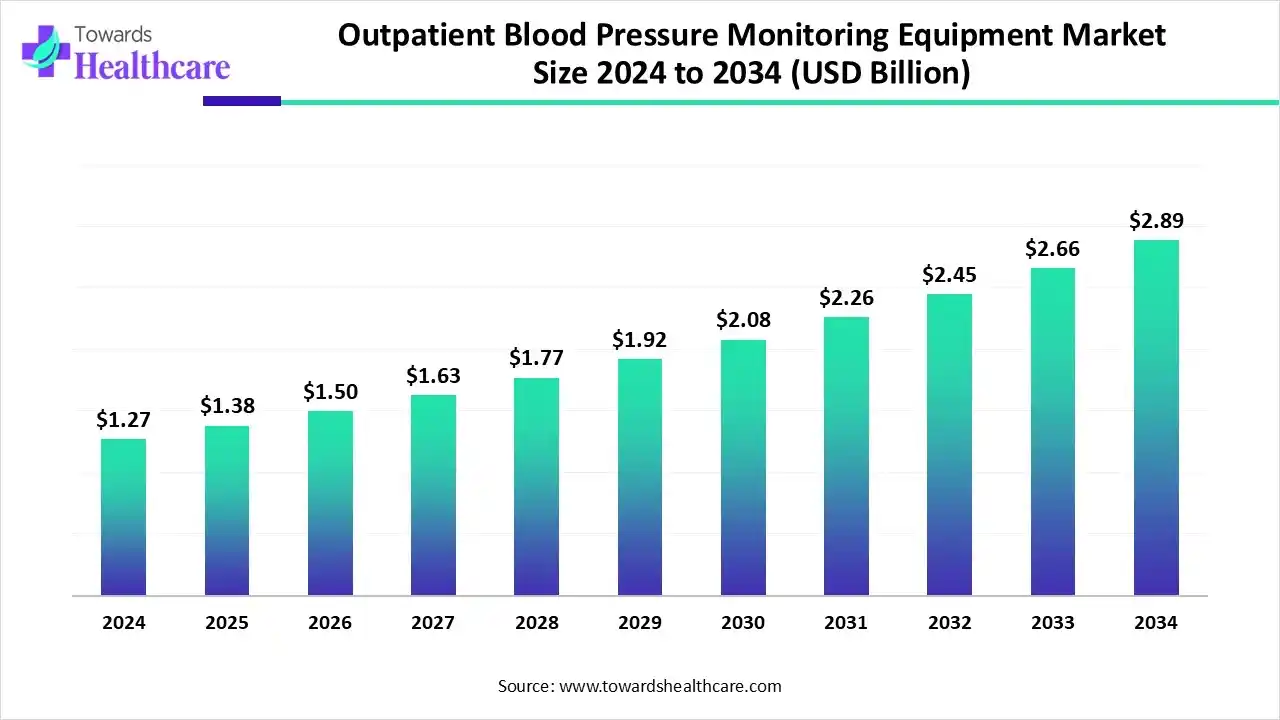

The global outpatient blood pressure monitoring equipment market size is estimated at US$ 1.38 billion in 2025, is projected to grow to US$ 1.50 billion in 2026, and is expected to reach around US$ 3.14 billion by 2035. The market is projected to expand at a CAGR of 8.56% between 2026 and 2035.

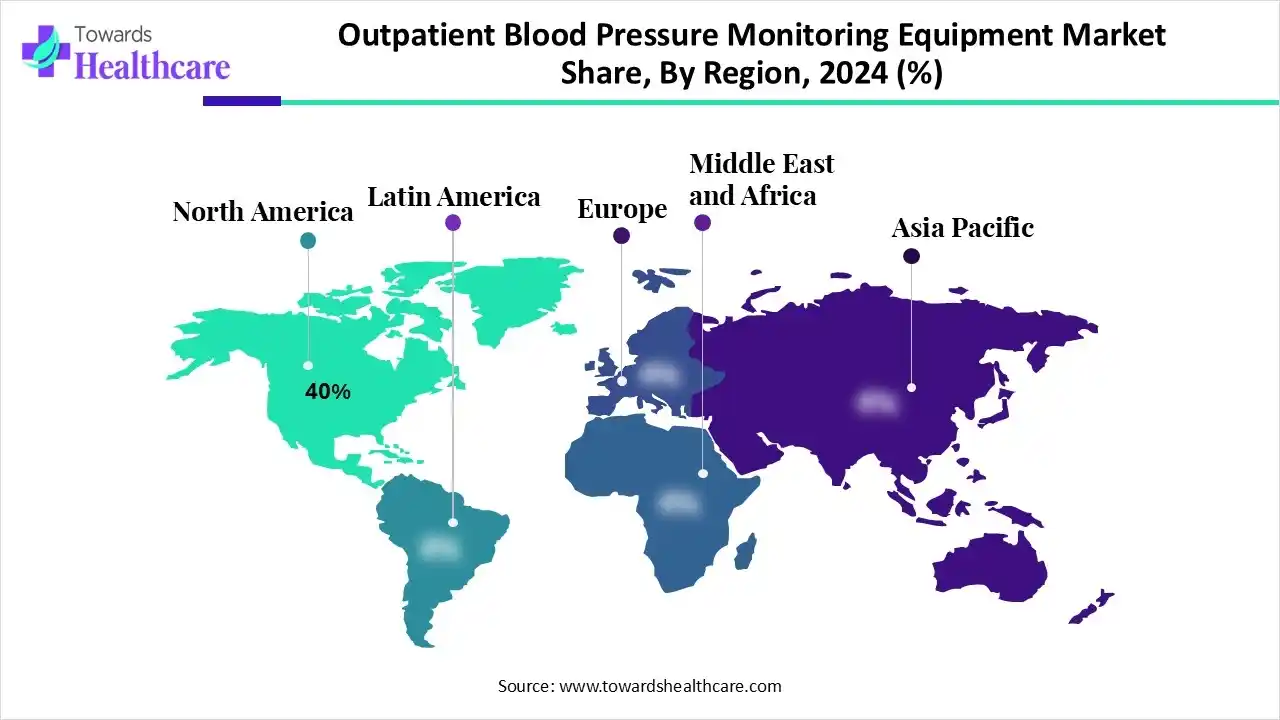

The outpatient blood pressure monitoring equipment market is growing because of the increasing prevalence of cardiovascular diseases and hypertension, the shift toward home-driven and remote patient monitoring, and developments in digital technology. North America is dominant in the market due to the rapid adoption of advanced technology and growing chronic diseases, while the Asia Pacific is the fastest-growing due to a rising aging population that needs continuing health management for chronic conditions.

| Table | Scope |

| Market Size in 2025 | USD 1.38 Billion |

| Projected Market Size in 2035 | USD 3.14 Billion |

| CAGR (2025 - 2034) | 8.56% |

| Leading Region | North America by 40% |

| Market Segmentation | By Imaging Modality, By End User, By Technology, By Connectivity, By Application, By Region |

| Top Key Players | Omron Healthcare, Welch Allyn, A&D Medical, Microlife Corporation, Philips Healthcare, GE Healthcare, Beurer GmbH, Panasonic Corporation, iHealth Labs, Withings, SunTech Medical, Rossmax International, ANDON Health, BioBeat, Qardio |

Outpatient blood pressure monitoring equipment includes devices and systems used to measure and track a patient’s blood pressure outside of a hospital setting. These devices provide continuous or periodic monitoring to aid in diagnosing hypertension, managing cardiovascular diseases, and improving patient care in outpatient and home-based settings.

An AI-based system improves the blood pressure monitor watchstrap powered by a piezoelectric nanogenerator. This system leverages high-sensitivity fiber-optic sensors and collaborating advanced deep-learning algorithms for non-invasive, continuous nocturnal blood pressure monitoring. AI-driven algorithms play a significant role in early recognition by analyzing massive amounts of patient information collected through sensors and wearable devices. AI-driven system in hypertension management, involving remote BP monitoring, machine learning, digital twins, digital biomarkers, and regulatory governance.

For Instance,

By product, the ambulatory blood pressure monitors segment led the outpatient blood pressure monitoring equipment market with a 55% share, as ambulatory blood pressure monitoring identifies irregular changes in BP that might otherwise go unnoticed. It’s a helpful way to detect diverse blood pressure patterns. Ambulatory blood pressure monitoring is a way of measuring and managing high blood pressure. It offers more accurate and inclusive services. The technology has revolutionized hypertension management by allowing for higher-quality measurement and tracking of BP capacities.

On the other hand, the home blood pressure monitors segment is expected to experience the fastest CAGR from 2025 to 2034, as it is a supportive tool for healthcare management of patients with high blood pressure. It provides major advantages, such as the simply which the techniques learned, duplicability of values, sensitivity of measurement, and availability of complex data. HBPM emerged as an operative and convenient means of screening for hypertension, as well as being affordable. HBPM is more efficient when accompanied by input from a medical care provider.

By end user, the clinics segment is dominant in the outpatient blood pressure monitoring equipment market in 2024, with a 45% share, as ABPM to therapeutic valuation has had less of an impact, both on the part of the investigators, also on the part of the investment made by the sponsors of antihypertensive drugs and equipment. ABPM allows a single assessment of some aspects of that treatment, such as the duration of action, by calculating indices that estimate the duration and the homogeneity of the outcome.

The hospitals segment is expected to experience the fastest growth from 2025 to 2034, as using a digital blood pressure monitor provides greater convenience for patients in hospitals. Ambulatory blood pressure monitoring technology is significant for the management and diagnosis of hypertension. It drives the valuation of blood pressure throughout sleep-time; a non-dipping pattern and nighttime hypertension are strongly related to enlarged cardiovascular mortality and morbidity. It provides a reliable method for monitoring the effectiveness of antihypertensive treatments, ensuring patients achieve and maintain their blood pressure targets.

By technology, the automated segment led the outpatient blood pressure monitoring equipment market in 2024, with a 70% share, as automated blood pressure tools improve the precision of readings and reduce transcription errors by recording readings directly in a patient's record. This method is the proper implementation of technique, timing, and equipment for taking a blood pressure reading. An automated BP monitor removes inter-observer variability. These tools are simple to use for self-monitoring at home, and many can wirelessly transfer information to a smartphone.

By connectivity, the Bluetooth/wireless segment is dominant and the fastest-growing in the outpatient blood pressure monitoring equipment market in 2024, with a 60% share, as it is dense, affordable, and portable, making it standard for use at the office, at home, or on the go. This wireless experience improves comfort during measurements, making it easier to obtain readings across different settings. Wireless blood pressure monitors are an outstanding choice for patients seeking convenience and advanced features.

The USB/offline segment is expected to experience the fastest growth from 2025 to 2034, as USB cables are used to power blood pressure monitors as a substitute for batteries. It connects to a USB adapter or power bank. This provides greater convenience by eliminating the need for batteries and enabling flexible, continuous monitoring at home or on the go. It also allows consumers to share their real-time readings with medical care providers or family members.

By application, the hypertension monitoring segment led the outpatient blood pressure monitoring equipment market in 2024 with a 60% share, as BP monitoring equipment employs advanced sensing technologies, safeguarding exact measurements and lowering the potential for human error often related to manual readings. This correctness is important for patients with hypertension or other cardiovascular diseases, where precise monitoring is supreme. It plays an important role in the early identification and prevention of hypertension complications.

The cardiovascular disease management segment is projected to experience the fastest CAGR from 2025 to 2034, as monitoring devices offer detailed insights into cardiac activity, supporting doctors in managing and diagnosing complex heart conditions. These compact devices track heart rhythms and identify arrhythmias. They are lightweight, consumer-friendly, and worn throughout the day, making them standard for continuous monitoring. It records heart events over weeks or months. They are specifically helpful for diagnosing rare arrhythmias and other anomalies.

North America is dominant in the outpatient blood pressure monitoring equipment market in 2024, with approximately 40% share, due to the increasing prevalence of hypertension, progressive healthcare infrastructure, and the strong presence of major market players. Presence of large patient base in this region, for instance, in 2024, 122.4 million, or 47%, of U.S. adults are estimated to have hypertension. Also, expanding governments and healthcare systems in the region run programs to promote regular blood pressure monitoring and raise public awareness of hypertension, which is driving market growth.

In the U.S., increasing acceptance of telemedicine and home healthcare, combined with devices featuring mobile applications and wireless connectivity, has encouraged remote care and monitoring. A major medical devices manufacturing organization provides a broad range of devices, including technologically advanced, consumer-friendly, and portable devices.

For instance,

Asia Pacific is the fastest-growing region in the outpatient blood pressure monitoring equipment market in the forecast period, as the increasing prevalence of chronic conditions, a rapidly growing aging population, rising medical care expenditure, and advancements in technology. Major countries in the Asia Pacific, like China, Japan, and South Korea, have fast-aging populations. Enhancing healthcare infrastructure, particularly in developing economies such as India and China, is making advanced medical devices like outpatient blood pressure monitors more accessible to a wider population.

The growing prevalence of high blood pressure and other cardiovascular diseases in China is increasing the demand for more efficient and unceasing monitoring solutions, involving Ambulatory Blood Pressure Monitoring (ABPM) devices. In China, about 270 million people have hypertension, so increasing requirement for monitoring devices, which drives the growth of the market.

Europe is a notably growing outpatient blood pressure monitoring equipment market region due to the increasing aging population, massive prevalence of cardiovascular diseases, and technological advancement in remote monitoring. Numerous European governments are driving telemedicine and home-based monitoring to address chronic diseases, for instance, in September 2025, the European Commission published a call for evidence on the targeted revision of the EU rules for medical devices and in vitro diagnostics.

In Germany, rising country's aging population, the increasing prevalence of cardiovascular diseases, and the growing demand for home-driven medical care. Key trends include the growth of automatic arm monitors and the growing adoption of connected, wearable ABP monitors. For instance, in April 2024, the G-BA Innovation Fund became permanent in Germany with an annual funding amount of 200 million euros from 2025.

In South America, an incessantly rising burden of non-communicable diseases (NCDs) like hypertension, cardiovascular diseases, and diabetes, specifically as its population lives longer, which increasing the adoption of BP monitoring devices. Home monitoring is rising due to the increased convenience and affordability of devices. Growing medical initiatives, for instance, such as PAHO's flagship initiatives, demonstrate its strategic approaches to address the Region's most pressing health challenges. These initiatives reflect how PAHO's approach is implemented practically, and range from mental health initiatives to others that tackle the economic, manufacturing, and security aspects of health care in the South Americas.

Growing public awareness of cardiovascular health and governmental policies to enhance medical care access are encouraging equipment adoption in both clinical and home settings. Increasing recent launch of smart and digital blood pressure monitors with advanced features such as Bluetooth connectivity, cloud storage, and mobile app integration is driving buyer interest and provider adoption.

For instance,

The Middle East & Africa a notably growing, with rising medical care spending and infrastructure investment. The incorporation of digital technologies, such as telemedicine and remote patient monitoring, is enhancing medical care accessibility and handling chronic diseases, which drives the growth of the market.

For instance,

Constant technological enhancements, with wearable technology and connected devices, are driving market growth. The increasing cases of hypertension, which affects millions of South Africans, are a major driver of market growth. This increases a high demand for both in-clinic and at-home monitoring equipment.

For Instance,

The research and development (R&D) processes for outpatient blood pressure monitoring equipment include conceptualization and design, hardware and electronics development, software and algorithm development, and clinical validation and testing.

Key Players: Omron Healthcare and Philips Healthcare

Clinical trials involving outpatient blood pressure monitoring equipment assess the precision, efficiency, and utility of different devices and approaches for home and ambulatory monitoring.

Key Players: Koninklijke Philips N.V. and SunTech Medical, Inc.

Outpatient blood pressure (BP) monitoring includes services that include patient education, device management, data setup, and follow-up support from a medical care team. A healthcare provider meets with the patient to identify whether ABPM is proper for their requirement.

Key Players: Aktiia SA and Valencell

By Imaging Modality

By End User

By Technology

By Connectivity

By Application

By Region

January 2026

December 2025

December 2025

December 2025