mRNA Quality Monitoring Market Size, Key Players with Growth and Trends

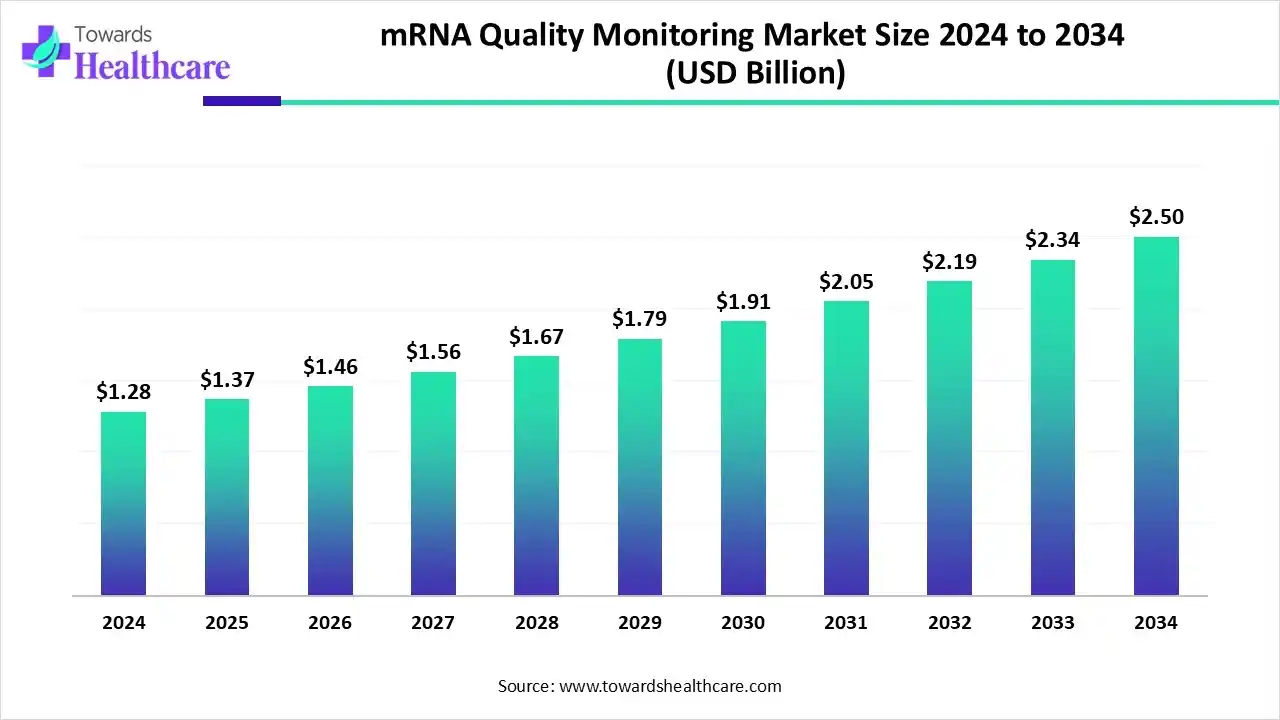

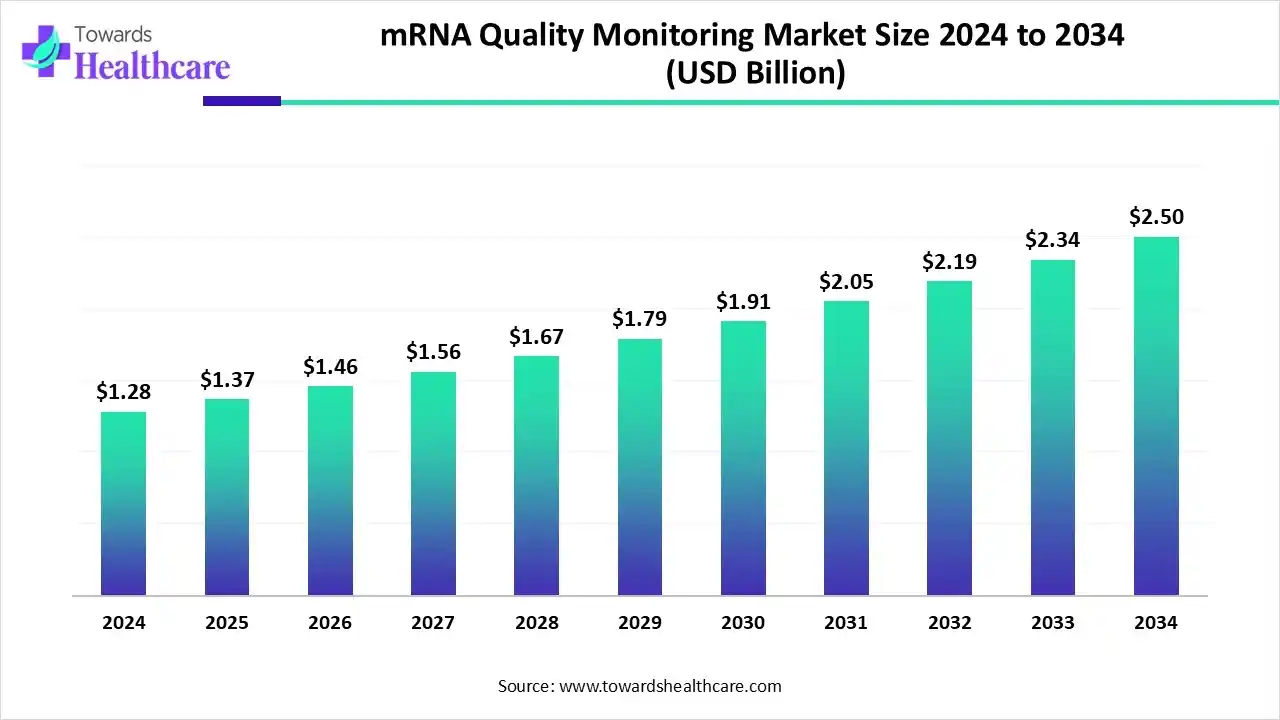

The global mRNA quality monitoring market size is calculated at US$ 1.37 billion in 2025, grew to US$ 1.46 billion in 2026, and is projected to reach around US$ 2.5 billion by 2034. The market is expanding at a CAGR of 6.97% between 2024 and 2034.

Around the world, the global mRNA quality monitoring market is putting efforts into advancements in analytical services, such as various chromatography methods, like LC-MS. Moreover, the growing instances of infectious and chronic diseases are boosting demand for novel mRNA therapies. Along with this, the market is promoting the widespread application of NGS (next-generation sequencing) technology due to its ability to provide high-throughput, comprehensive, and sensitive analysis of mRNA integrity and sequence precision.

Key Takeaways

- mRNA quality monitoring market to crossed USD 1.37 billion by 2025.

- Market projected at USD 2.5 billion by 2034.

- CAGR of 6.97% expected in between 2024 to 2034.

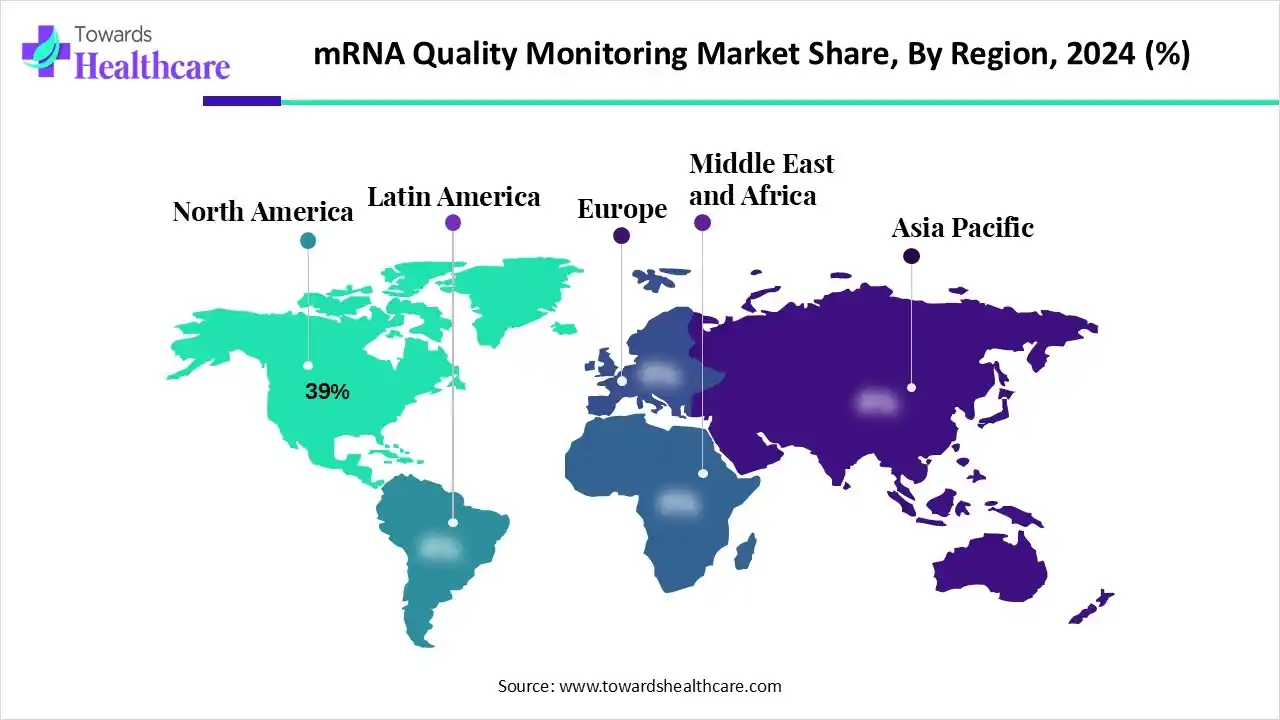

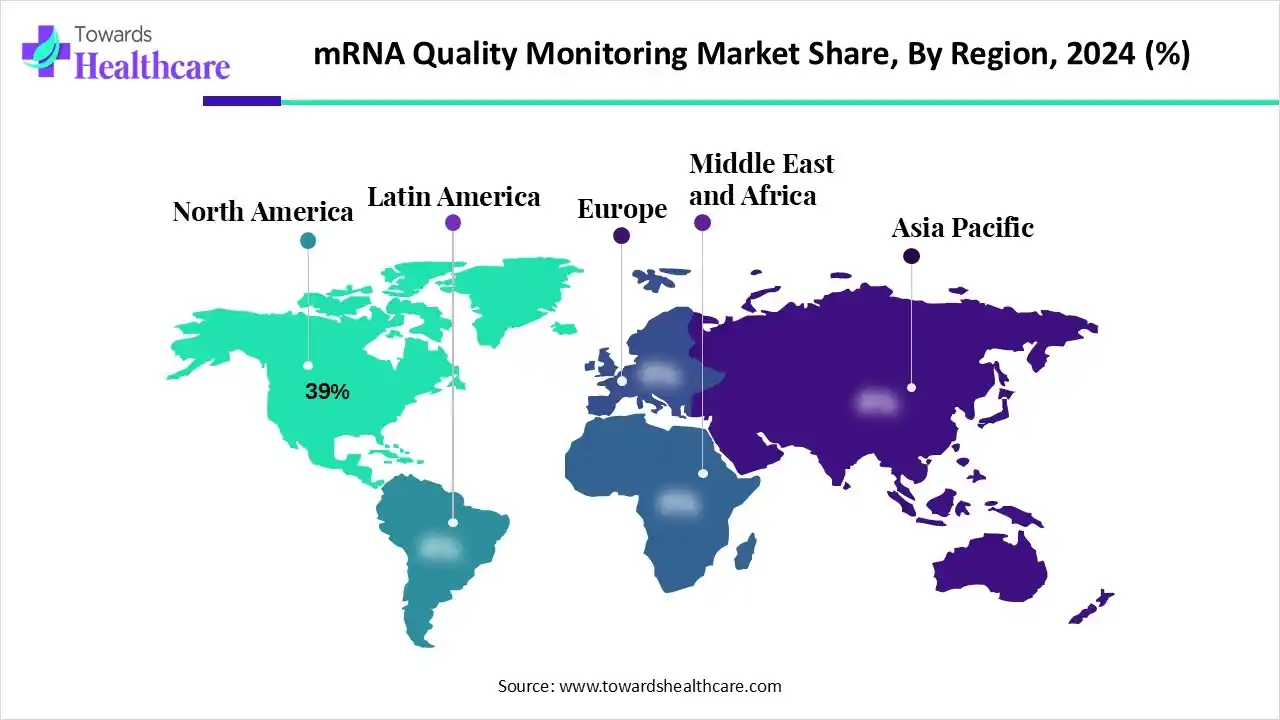

- North America held nearly 39% revenue share of the market in 2024.

- Asia Pacific is expected to grow at the fastest CAGR in the upcoming years.

- By product & service, the kits, assays & reagents segment led with an approximate 52% share of the market in 2024.

- By product & service, the instruments & software segment is expected to be the fastest-growing during 2025-2034.

- By technology, the electrophoresis technologies segment registered dominance with nearly 38% share of the mRNA quality monitoring market in 2024.

- By technology, the NGS (Next-Generation Sequencing) for sequence fidelity segment is expected to grow fastest over the projected period.

- By end-use, the biopharmaceutical & biotechnology companies segment captured approximately 58% revenue share of the market in 2024.

- By end-use, the CDMOs/CROs & analytical service providers segment is expected to witness rapid expansion in the studied years.

- By application area, the vaccine development & commercial manufacturing segment dominated with an approximate 48% share in 2024.

- By application area, the therapeutic mRNA segment is expected to be the fastest-growing during 2025-2034.

Quick Facts Table

| Table |

Scope |

| Market Size in 2025 |

USD 1.37 Billion |

| Projected Market Size in 2034 |

USD 2.5 Billion |

| CAGR (2024 - 2034) |

6.97% |

| Leading Region |

North America by 39% |

| Market Segmentation |

By Product & Service, By Technology, By End-Use, By Application Area, By Region |

| Top Key Players |

Agilent Technologies, Inc., Revvity, Inc., Revvity, Inc., Sartorius AG, QIAGEN N.V., Illumina, Inc., TriLink BioTechnologies (Maravai LifeSciences), GenScript Biotech Corporation, Charles River Laboratories, Creative Biolabs, Vazyme Biotech Co., Ltd., Eurofins Scientific SE |

Impactful R&D Activities: How is the mRNA Quality Monitoring Exploring?

The global mRNA quality monitoring market includes analytical instruments, reagents, assay kits, software, and testing services used to evaluate the physical, chemical, and biological quality attributes of messenger RNA (mRNA) used in vaccines, therapeutics, and gene therapy.

Key monitored parameters include mRNA integrity, capping efficiency, purity, sequence identity, double-stranded RNA contamination, endotoxin content, residual DNA, and stability under formulation and storage conditions. These QC and characterization solutions are deployed across R&D, process development, GMP manufacturing, and regulatory release testing to ensure product consistency, efficacy, and compliance with ICH/FDA guidelines.

mRNA Quality Monitoring Market Outlook

- Global Expansion: This progression is mainly fueled by a rise in regulatory approvals for various therapies and technological breakthroughs. In July 2025, Wacker Chemie started its new Biotechnology Center in Munich, Germany, to expand the development of nucleic acid manufacturing processes.

- Major Investor: In August 2025, the US Department of Health and Human Services (HHS) announced $500 million in grant cuts for mRNA vaccine progression for respiratory viruses, especially COVID-19 and the flu.

- Startup Ecosystem: In July 2024, ReviR Therapeutics, a startup, secured a $30 million Series A funding round for novel mRNA solutions to evolve therapeutics in different health conditions.

Benefits of Assay-based Technologies & Others: Prospective Focus

In this era, the global mRNA quality monitoring market is stepping into the widespread adoption of advanced assay-based technologies, such as CGE. CGE is a microfluidics-based capillary electrophoresis that offers high-throughput integrity analysis with reduced sample volume. These solutions have significance in GMP-level quality control, robust detection of degradation, and confirm the quality of the mRNA substance. For in-depth mRNA understanding, LC-MS-based oligonucleotide mapping plays a major role, which integrates enzyme digestion with high-resolution separation.

Segmental Insights

Product & Service Insights

Which Product & Service Segment Led the mRNA Quality Monitoring Market in 2024?

In 2024, the kits, assays & reagents segment held nearly 52% share of the market. Primarily, a rise in the scale of mRNA production shifts from research to clinical and commercial manufacturing is fueling the demand. Recent developments comprise encapsulation of mRNA in lipid nanoparticles (LNPs), new kits and protocols employ non-heat-based reagents, including Triton X-100 and formamide for gentle, heat-free mRNA extraction from LNPs.

Instruments & Software

Moreover, the instruments & software segment will expand rapidly in the mRNA quality monitoring market. Mainly, a growing demand for mRNA-based therapies and vaccines, broader investment in mRNA research, and the demand for high-throughput and automated solutions are supporting the adoption and demand for these services. Softwares, like Waters_Connect Informatics Platform, are widely employed with Waters LC-MS systems for the interpretation of data from mRNA quality attributes, like 5' capping effectiveness and poly(A) tail heterogeneity.

QC Testing & Analytical Services

The QC testing & analytical services segment will expand significantly. These days, the globe is focusing on monitoring specific critical quality attributes (CQAs), particularly the 5' cap and 3' poly(A) tail, and new guidelines need additional tests for items, including residual T7 RNA polymerase and double-stranded RNA (dsRNA). Also, this encompasses LC-MS, NGS, and SEC for the analysis of integrity, purity, and folding.

Technology Insights

How did the Electrophoresis Technologies Segment Dominate the Market in 2024?

In 2024, the electrophoresis technologies segment captured approximately 38% share of the mRNA quality monitoring market. The segment is mainly driven by the increasing demand for precision medicine, which depends on the accurate analysis of nucleic acids, encouraging the wider adoption of this technology. Currently, the players are aiming to raise resolution, speed, and automation through microchip and capillary techniques, highlighting major risks in the production & analysis of complex therapeutic RNA.

NGS (Next-Generation Sequencing) for Sequence Fidelity

By technology, the NGS (Next-Generation Sequencing) for sequence fidelity segment will expand rapidly. Prominently, this offers high-throughput, comprehensive, and sensitive analysis of mRNA integrity and sequence accuracy. Alongside, it ensures the accurate transcription of mRNA from its DNA template. It is increasingly used in the assessment of multiple CQAs simultaneously, like mRNA integrity, capping efficiency, and poly(A)-tail length.

Liquid Chromatography & Mass Spectrometry (LC-MS)

The liquid chromatography & mass spectrometry (LC-MS) segment will witness notable expansion. This era utilizes isotope-dilution mass spectrometry for precise quantification, specialized enzymatic digestion with immobilized enzymes for larger fragments. Whereas, high-resolution mass spectrometry (HRMS) facilitates the characterization of modifications like 5'-capping and the integrity of the poly(A) tail.

End-use Insights

What Made the Biopharmaceutical & Biotechnology Companies Segment Dominant in the Market in 2024?

The biopharmaceutical & biotechnology companies segment held nearly 58% share of the mRNA quality monitoring market in 2024. Involvement of major factors, like a rise in the pipeline of mRNA vaccines and therapeutics, and the rising requirement for quality control to ensure product safety and efficiency, is promoting the overall progression. Also, they are shifting towards the integration of AI/ML for data analysis, the application of sophisticated analytical techniques, including next-generation LC-MS and dPCR.

CDMOs/CROs & Analytical Service Providers

Although the CDMOs/CROs & analytical service providers segment is predicted to expand rapidly during 2025-2034, day by day, the market is fostering the pipeline of mRNA therapeutics for diverse diseases, and alliances that support smaller companies to accelerate the availability of analytical capabilities without heavy capital investment. Moreover, many players are experiencing a higher need for CDMOs with modular, multi-product facilities to manage a range of production volumes.

Academic & Research Institutes

The academic & research institutes segment will expand notably. The huge contribution of government-funded research and academic institutions, with ongoing advances in science and groundbreaking applications for mRNA, is propelling the expansion. These institutes are exploring the widespread use of mRNA beyond vaccines, into oncology and other diseases.

Application Area Insights

Which Application Area Led the mRNA Quality Monitoring Market in 2024?

By capturing nearly 48% share, the vaccine development & commercial manufacturing segment dominated the market in 2024. Mainly, the inherent feasibility of mRNA technology enables faster design and development of vaccines customized to particular patient profiles, particularly in oncology. The key players are stepping into continuous processing to enhance effectiveness, material use, and quality control, which further describes bottlenecks linked with traditional batch manufacturing.

Therapeutic mRNA

The therapeutic mRNA segment is estimated to register rapid expansion. Due to the success of COVID-19 vaccines and the progression of mRNA technology into newer diseases, especially cancer and genetic disorders, the segmental development is expected. Nowadays, the market is bolstering research in the use of transient, non-genomic platforms for diverse other diseases, with novel mRNA vaccines.

Gene Editing & CRISPR mRNA QC

The gene editing & CRISPR mRNA QC segment is anticipated to expand at a significant CAGR. The broader adoption of CRISPR-edited messenger RNA is being developed to create a specific protein in the body, mainly for a tailored cancer treatment or to replace a defective gene. Ongoing research activities in CRISPR systems enable external stimuli like light, heat, or ultrasound, promote on-demand genome editing with increased specificity.

Regional Insights

What made North America Dominant in the mRNA Quality Monitoring Market in 2024?

In 2024, North America led the market with an approximate 39% share. This region has a strong R&D infrastructure, major investments in mRNA technology, and the presence of vital mRNA developers, including Moderna and BioNTech. The region is also leveraging large-scale commercial manufacturing, automation, and digital solutions, which are efficiently combined into QC workflows to ensure standardization and reproducibility.

For instance,

- In September 2025, Moderna announced that the first mRNA vaccines fully manufactured in Canada were being delivered to provinces and territories.

Exposure to Regulatory Updates: Impacts the US Market

In the U.S., beyond the presence of a robust R&D hub and major players, they are boosting key updates in their regulations. The recent updates include the third edition of its draft guidelines on Analytical Procedures for Quality of mRNA Vaccines and Therapeutics. This covers the comprehensive product lifecycle, from DNA templates to finished products, and merges new approaches and standards for critical quality attributes.

Expansion in Demand for mRNA Products is Fueling the Asia Pacific.

During the prospective period, the Asia Pacific is anticipated to register rapid expansion in the mRNA quality monitoring market. Many countries in the ASAP are having a vital rise in instances of infectious & chronic diseases, with the growing need for vaccines supporting the wider adoption of mRNA therapeutics and their quality monitoring. However, this region is emphasizing outsourcing trends, which escalates the greater requirement for specialized expertise, scalable production, and robust facilities.

Emphasis on Scientific Advances: Promoting the Chinese Market

Ongoing advances in mRNA systems are impacting the Chinese market, with consistent research steps in the critical quality attributes (CQAs) of mRNA, particularly the impact of double-stranded RNA (dsRNA) impurities, alongside, the emergence of innovative analytical methods that are focused on the excellent CQAs of lipid nanoparticle (LNP), such as their size, structure, and delivery effectiveness.

Strengthening Clinical Pipelines & Harmonized Standards are Driving Europe

Across Europe, the mRNA quality monitoring market is growing at a notable CAGR. This expansion is propelled by the rising clinical pipelines for innovating mRNA therapies, specifically by various European biotech companies, including BioNTech (Germany), CureVac (Germany), and eTheRNA (Belgium). Furthermore, the emergence of new quality control standards for mRNA production in the European pharmacopeia is also assisting the ultimate revolution of the mRNA quality monitoring sector.

Exploration of Quality by Design: Fostering the German Market

In this era, many German researchers & companies are widely employing the QbD solution for the integration of quality control and the manufacturing process from the design stage. Along with this, German companies are demonstrating innovations in nanopore sequencing, new methods for nanoparticles, and the development of ribonucleases.

Rising Adoption in South America

The mRNA quality monitoring market in South America is expanding rapidly, driven by increasing biopharmaceutical research, government-backed vaccine initiatives, and growing investments in RNA-based therapeutics manufacturing and testing facilities. Demand for advanced analytical tools continues to strengthen regional market growth.

Brazil Leading Regional Expansion

Brazil dominates South America’s mRNA quality monitoring market, propelled by strong biotech infrastructure, rising vaccine production, and collaborations between research institutions and global pharma firms. Regulatory support and domestic mRNA development projects further accelerate Brazil’s leadership in RNA quality assurance technologies.

A Surge in Crucial Programs is Driving the Middle East and Africa (MEA)

Recently, the WHO has initiated the mRNA Technology Transfer (TT) Program, which is being implemented at Afrigen in South Africa and encompasses 14 manufacturing partners, or "spokes," across multiple regions, such as Egypt, Kenya, Nigeria, Senegal, and Tunisia.

For instance,

- In February 2025, EVA Pharma, one of the fastest-growing healthcare organizations in the MEA, announced an innovative start to accelerate mRNA vaccine advances and development in Africa.

Transformations in mRNA Stability: Leveraging the Egyptian Market

A prominent factor involved in the growth of the Egyptian mRNA quality monitoring market is the growing emphasis on the use of kinetic modeling to assess mRNA vaccine stability relies on temperature data throughout the distribution chain.

In December 2024, Egypt's regulatory system for medicines acquired a WHO maturity level 3, the second-highest level, which represents that Egypt's regulatory authority, the Egyptian Drug Authority (EDA), is strongly operating, with the conduction of critical regulatory functions.

Company Landscape

Agilent Technologies, Inc.

- Company Overview: A global leader in analytical instruments, software, and services for life sciences, diagnostics, and applied chemical markets.

- Corporate Information: Headquarters: Santa Clara, California, U.S. Year Founded: 1999 (spin-off from Hewlett-Packard) Ownership Type: Publicly traded (NYSE: A)

- History and Background: Formed in 1999 as HP’s measurement & test/spin-off business; shifted into life sciences and diagnostics over the years.

Key Milestones / Timeline:

- 1999: Company founded.

- 2014: Spin-off of electronic measurement business into Keysight.

- 2024 (July): Agilent announced the acquisition of Biovectra for US$925 m to expand biologics/biopharma services.

- 2025 (May): Strong Q2 earnings, revenue growth ~6 % and full-year guidance raised.

- Business Overview: Provides instrumentation, consumables, software, and services spanning discovery, development, manufacturing, and QC in life sciences and diagnostics.

- Business Segments / Divisions: Major segments include Life Sciences & Diagnostics Markets Group, Agilent CrossLab, and Applied Markets.

- Geographic Presence: Operates globally in ~110 countries, with major operational footprint in the Americas, EMEA, and Asia-Pacific.

- Key Offerings: Instruments such as liquid chromatography-mass spectrometry (LC/MS), capillary electrophoresis, automation systems, software workflows for QC & analytics.

- End-Use Industries Served: Pharmaceutical & biotechnology companies, contract manufacturing organizations (CMOs/CDMOs), academic & government labs, diagnostics.

Key Developments & Strategic Initiatives:

- Acquisition of Biovectra (2024) to enhance biopharma/contract services.

- New biopharma experience center opened in Hyderabad, India (2025) to support local/regional innovation.

- Mergers & Acquisitions: Biovectra acquisition (2024); past acquisitions of life-science instrument firms (e.g., BioTek in 2019)

- Partnerships & Collaborations: Strategic expansion into biologics/biopharma through services partnerships and global labs (e.g., India center)

- Product Launches / Innovations: Continues to innovate in instrumentation and digital-lab workflows; strong R&D in analytical solutions for nucleic acids and biologics.

- Capacity Expansions / Investments: Biopharma center in India; large-scale investment in manufacturing/biologics services.

- Regulatory Approvals: Strong focus on regulated workflows for QC in pharmaceuticals and biotech; instrumentation supports regulatory compliance.

- Distribution Channel Strategy: Combines direct sales, distributors, e-commerce, and service/consumable replenishment globally.

- Technological Capabilities / R&D Focus: Deep capabilities in chromatography, mass spec, automation, lab informatics; R&D investments to stay ahead in biologics & nucleic acid QC.

- Core Technologies / Patents: Platforms in LC/MS, capillary electrophoresis, digital lab automation, software workflows for analytics; many patents in measurement tech.

- Research & Development Infrastructure: Global labs, regional innovation centers (e.g., Hyderabad), internal R&D groups (Agilent Laboratories)

- Innovation Focus Areas: Biologics/large-molecule analytics, nucleic acid QC (including mRNA), lab automation and connectivity, digital workflows.

- Competitive Positioning: Positioned as a premium analytical instrument & service provider for high-end life-science/biopharma QC needs; strong brand, global reach.

- Strengths & Differentiators: Broad product portfolio, global service network, deep regulatory/QC focus, cross-segment expertise in life sciences + diagnostics.

- Market presence & ecosystem role: Key supplier to mRNA-based therapeutics developers and manufacturing QC labs, major player in QC instrumentation for mRNA.

SWOT Analysis:

- Strengths: Global footprint, broad tech platform, high-end instrumentation leadership.

- Weaknesses: High dependency on funding for academic/biotech clients, exposure to macroeconomic slowdowns.

- Opportunities: Growth in mRNA/biologic therapeutics, emerging markets (India, Asia-Pacific) for QC services.

- Threats: Competitive pressure, funding constraints in biotech, regulatory shifts, tariffs/trade impact.

Recent News and Updates / Press Releases:

- Q2 FY 2025 revenue +6 % and raised full-year forecast. IBD rating upgrade of stock RS Rating to 73 (Oct 2025).

- Industry Recognitions / Awards: Although specific awards in mRNA QC are not listed here, the company is widely recognized for lab instrumentation excellence globally.

Revvity, Inc.

Company Overview: A global life-sciences and diagnostics technologies company supplying reagents, instruments, software, and services, including QC and analytics workflows relevant to mRNA monitoring.

Corporate Information:

- Headquarters: Waltham, Massachusetts, U.S. Year

- Founded: 2023 (rebranded after split from PerkinElmer)

- Ownership Type: Publicly traded (NYSE: RVTY)

- History and Background: Originated from the life-sciences/diagnostics arm of PerkinElmer, Inc.; split in 2022–23, rebranded as Revvity.

Key Milestones / Timeline:

- 2023 May 16: Company began trading as Revvity under ticker RVTY.

- Feb 2024: Unveiled brand at SLAS2024 and launched LabChip® AAV empty/full characterization solution.

- Apr 2025: Q1 2025 results: sales $664.76 m, beat estimates; raised 2025 sales outlook to $2.85 billion.

- Business Overview: Offers integrated solutions across discovery to development, diagnostics to cure, spanning multi-omics, automation, payload analysis, instrument & software platforms.

- Business Segments / Divisions: Starting FY2025, Life Sciences Solutions & Software (reagents/instruments/consumables), and Diagnostics (immunodiagnostics, reproductive health) segments.

- Geographic Presence: Global operations across >190 countries.

Key Offerings:

- Reagents/consumables, instruments, automation (e.g., chemagic™ 360), LabChip® solutions, software (Signals®), analytics for genetic payloads including viral vectors and mRNA workflows.

- End-Use Industries Served: Pharmaceutical & biotech companies, diagnostics labs, academic & government research, CDMOs/CROs.

Key Developments & Strategic Initiatives:

- Raised sales outlook for 2025 after strong Q1 results.

- Organizational restructuring to deepen customer focus and alignment (2025).

- Mergers & Acquisitions: Formed via the split of PerkinElmer’s applied/food/enterprise services, sold to New Mountain Capital (~$2.45 billion).

- Product Launches / Innovations: LabChip® AAV empty/full characterization solution (2024) targeted at gene-therapy workflow, relevant for mRNA QC adjacent markets.

- Capacity Expansions / Investments: Increased R&D investment since rebranding; internal transformation to boost software, automation.

- Regulatory Approvals: Supports regulated workflows for diagnostics and life sciences; relevant for mRNA QC, but specific approvals are not listed.

- Distribution Channel Strategy: Global direct sales plus channel partners; focus on software/automation enablement.

- Technological Capabilities / R&D Focus: Emphasis on automation, multi-omics, payload analytics (including genetic therapies), software integration, and high-throughput instruments.

- Core Technologies / Patents: LabChip® analytics, Signals® software for scientific data, automation platforms like chemagic™, Omni™ LH 96.

- Research & Development Infrastructure: Post-split ramp up in R&D, software investment, enabling new modality analytics.

- Innovation Focus Areas: Genetic payload engineering, cell and gene therapy analysis, automation of sample prep and QC, overlaps with mRNA quality monitoring needs.

- Competitive Positioning: Emerging comprehensive solutions provider combining reagents, instruments, software, and services; positioned to support mRNA QC via analytics and automation.

- Strengths & Differentiators: Broad instrument + reagent + software stack, newly sharpened focus, agility post-split, strong growth momentum.

- Market presence & ecosystem role: Important supplier to biotech/diagnostics firms, supports QC workflows for nucleic acids, including mRNA; strong growth orientation.

SWOT Analysis:

- Strengths: Broad offerings, agile new brand, growing global footprint, strong recent performance.

- Weaknesses: Recent transition risk, legacy integration challenges, still building a full identity separate from PerkinElmer.

- Opportunities: Growth in mRNA & gene-therapy analytics, automation trend, and outsourcing of QC services.

- Threats: Competition from established instrument companies, macroeconomic headwinds, and funding pressures in biotech.

- Recent News and Updates / Press Releases: Q1 2025 better-than-expected results led to raised 2025 guidance ($2.85 billion) for RVTY. R&D ramp-up announced Oct 2024.

Key Companies and Their contributions and offerings

- Thermo Fisher Scientific Inc., in June 2025, partnered with Ethris to offer a completely integrated messenger ribonucleic acid (mRNA) solution to biopharmaceutical developers.

- Merck KGaA (MilliporeSigma)- It has branded itself as the foremost CTDMO to facilitate combined services for all stages of mRNA technology.

- Bio-Rad Laboratories, Inc. - In February 2024, it unveiled the Vericheck ddPCR Replication Competent Lentivirus Kit & Replication Competent AAV Kit.

- Waters Corporation - In April 2025, it addressed the use of intact mRNA testing with Size Exclusion Chromatography coupled with Multi-Angle Light Scattering (SEC-MALS).

Top Companies in the Market

- Revvity, Inc.

- Sartorius AG

- QIAGEN N.V.

- Illumina, Inc.

- TriLink BioTechnologies (Maravai LifeSciences)

- GenScript Biotech Corporation

- Charles River Laboratories

- Creative Biolabs

- Vazyme Biotech Co., Ltd.

- Eurofins Scientific SE

What are the Major Developments in the mRNA Quality Monitoring Market?

- In September 2025, Creative Diagnostics introduced validated inorganic pyrophosphatase ELISA Kits for mRNA vaccine production quality control.

- In April 2025, MEPSGEN US Inc., a global pioneer in scalable nanoparticle production technology, launched NanoCalibur, a cutting-edge, scalable nanoparticle (NP) production system in the US.

- In March 2025, Primrose Bio launched Prima RNApols ExTend, an RNA Polymerase for long-template mRNA production.

Segments Covered in the Report

By Product & Service

- Kits, Assays & Reagents

- Integrity assays (capillary electrophoresis, fragment analysis)

- Purity assays (HPLC, LC-MS, UV-Vis quantification)

- Endotoxin & dsRNA detection reagents

- Instruments & Software

- Electrophoresis systems (capillary, gel, microfluidic)

- LC-MS & chromatography systems

- Software for data analytics, traceability & automation

- QC Testing & Analytical Services

- Contract testing

- GMP release & stability studies

- Biosafety & regulatory documentation services

By Technology

- Electrophoresis Technologies

- Capillary electrophoresis (CE)

- Microfluidic chip-based electrophoresis

- Liquid Chromatography & Mass Spectrometry (LC-MS)

- LC-MS for molecular weight & purity profiling

- UHPLC for small impurity detection

- PCR-based Methods

- qPCR for sequence verification

- RT-PCR for residual DNA quantification

- ELISA/Immunoassays

- dsRNA detection

- capping enzyme quantification

- Advanced/Emerging Technologies

- NGS (Next-Generation Sequencing) for sequence fidelity

- CRISPR-based QC for transcript validation

By End-Use

- Biopharmaceutical & Biotechnology Companies

- mRNA vaccine developers

- Therapeutic mRNA producers

- CDMOs/CROs & Analytical Service Providers

- Contract QC & process validation labs

- GMP lot release & stability testing

- Academic & Research Institutes

- Pre-clinical characterization

- Process optimization & method development

By Application Area

- Vaccine Development & Commercial Manufacturing

- Therapeutic mRNA

- Gene Editing & CRISPR mRNA QC

- Process Development & Validation

- Regulatory Release & Stability Testing

By Region

- North America

- U.S.

- Canada

- Mexico

- Rest of North America

- South America

- Brazil

- Argentina

- Rest of South America

- Europe

- Western Europe

- Germany

- Italy

- France

- Netherlands

- Spain

- Portugal

- Belgium

- Ireland

- UK

- Iceland

- Switzerland

- Poland

- Rest of Western Europe

- Eastern Europe

- Austria

- Russia & Belarus

- Türkiye

- Albania

- Rest of Eastern Europe

- Asia Pacific

- China

- Taiwan

- India

- Japan

- Australia and New Zealand

- ASEAN Countries (Singapore, Malaysia)

- South Korea

- Rest of APAC

- MEA

- GCC Countries

- Saudi Arabia

- United Arab Emirates (UAE)

- Qatar

- Kuwait

- Oman

- Bahrain

- South Africa

- Egypt

- Rest of MEA