December 2025

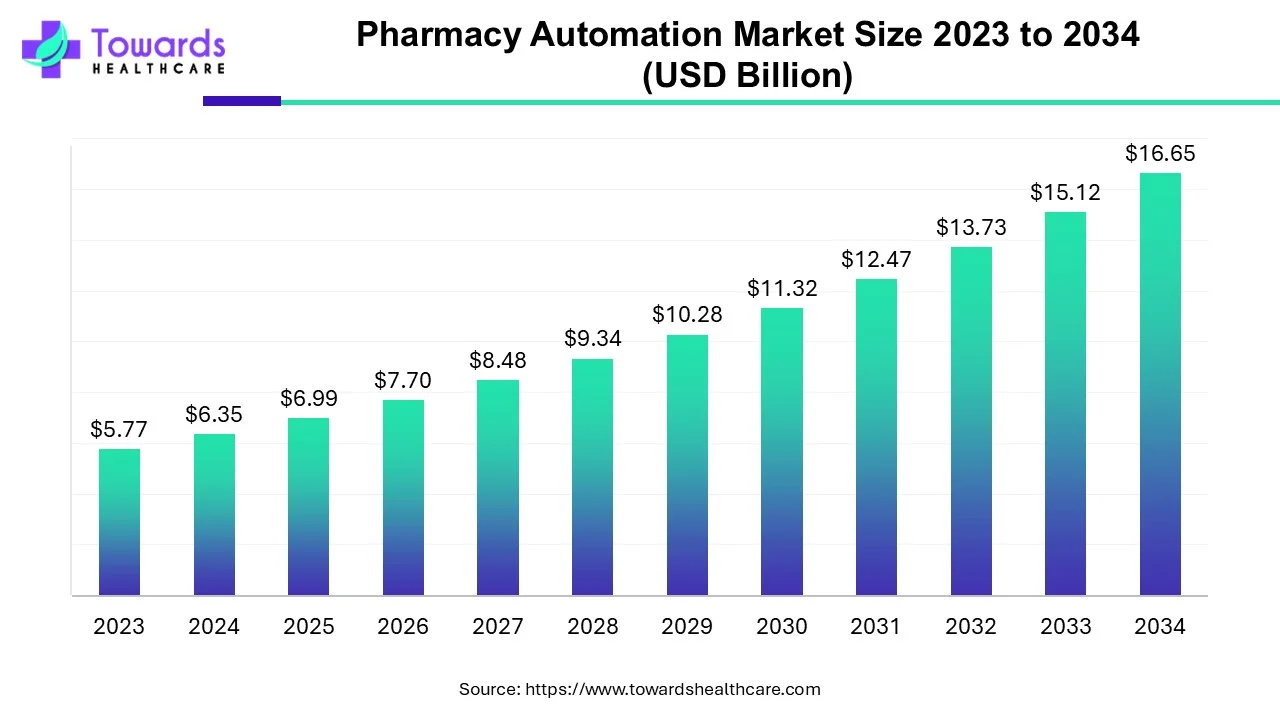

The global pharmacy automation market size is calculated at USD 6.35 billion in 2024, grew to USD 6.99 billion in 2025, and is projected to reach around USD 16.65 billion by 2034. The market is expanding at a CAGR of 10.12% between 2025 and 2034. Technological advancements and the demand for enhanced patient care drive the market.

Pharmacy automation is an electronic process of sorting, packaging, distributing, and counting prescription medications. Certain tasks in pharmacies are prone to errors and are time-consuming; hence, automation is widely adopted. Pharmacy automation dispenses medications, syncs medical records, and ensures regulatory compliance, improving efficiency and accuracy. Automation simplifies the tasks of pharmacists and also benefits patients. It can enhance patient safety due to a reduction in medical errors and ensure scalability and capacity as more patients can be served with fewer staff. Automation also aids in enhanced data management and analytics, enabling pharmacists to make informed decisions.

Several factors are responsible for positively impacting market growth. The growing demand for enhanced patient care and improved workflow of a pharmacy boosts the market. The need for improved accuracy in medication dispensing and reduced manual errors increases the demand for pharmacy automation. Numerous government and private organizations provide funding to install pharmacy automation devices, augmenting the market. The increasing market competitiveness leads to rising collaborations and mergers & acquisitions, promoting the market. Furthermore, advancements in technology revolutionize the market.

The growing adoption of cloud-based pharmacy automation is due to various factors like improved data management, streamlined operations, and enhanced patient care. The rising demand for online healthcare solutions and digital pharmacy services increases the adoption of cloud-based solutions. For instance, in June 2024, Salesforce launched an AI-powered life sciences cloud for pharma and medical technology. This cloud platform helps in automation, healthcare professionals' engagement, streamlining clinical operations, and personalizing patient care.

Artificial intelligence (AI) and machine learning (ML) algorithms streamline the entire workflow of a pharmacy. AI-enabled automation systems allow pharmacists to select drugs and their dosage based on a patient’s condition. AI and ML can analyze large datasets to identify a patient’s condition and predict treatment outcomes. They can also determine potential adverse effects associated with a particular medication, enabling pharmacists to provide personalized treatment. AI enhances the efficiency and accuracy of a pharmacy, minimizing human intervention. It also removes the complexities of tedious administrative tasks, reducing the overall burden on pharmacists. This helps them to focus more on patient-related tasks.

Demand for Enhanced Patient Care

The major growth factor of the pharmacy automation market is the growing demand for enhanced patient care. Pharmacy automation benefits both the pharmacists and the patients. It reduces manual errors and enhances medication safety, eliminating the risk of false medications. Advanced technologies such as barcode scanning enable pharmacists to verify correct medication and dosage, increasing patient safety. Additionally, automation allows pharmacists to dedicate more time to direct patient care, including medication therapy management and personalized consultations. The growing demand for personalized care encourages pharmacists to adopt automation systems. Numerous government organizations impose stringent regulations to enhance patient care, promoting the market. Hence, by delegating routine tasks to machines, pharmacists can expand their services, offer more direct patient care, and perform more clinical work.

High Installation Costs

The major challenge faced by the market is the high installation costs of pharmacy automation systems. The average cost of pharmacy automation systems ranges from a few thousand to several hundred thousand dollars. This limits the affordability of several pharmacies, especially in low- and middle-income countries, and is inaccessible to independent pharmacists.

Adoption of Robots

The future of the pharmacy automation market is promising, driven by the adoption of robotic systems. Manufacturers have designed and developed robots to simplify certain tasks in a drug store. Technological advancements such as AI and ML facilitate the development of robotic systems for pharmacy automation. Robotic machines overcome the difficulties faced by conventional systems, enabling pharmacists to spend more time with customers. Robots can be either semi-automatic or fully automatic. They save a lot of time for pharmacists and boost their sales. Robots provide optimal stock visibility and management and eliminate the need for more staff requirements. They also provide more retail space, allow expanding their self-service area, and, at the same time, improve the comfort of their customers. Thus, leveraging robotic systems communicates the modern approach of pharmacists and creates ample opportunities in the future.

By product, the dispensing systems segment held a dominant presence in the market in 2024. Pharmacy dispensing systems enable dispensing, sorting, and labeling of medications. The rising prevalence of medication dispensing errors and the advent of robotic systems augment the segment’s growth. It is estimated that the global prevalence rate of dispensing errors is around 1.6% across community, hospital, and other pharmacy settings. The installation of a dispensing system significantly reduces medication errors and streamlines the entire workflow. These systems provide a good balance between security, accessibility, and inventory control of medications. Thus, they increase medication adherence and improve patient safety.

By product, the pill sorting machines segment is predicted to witness significant growth in the pharmacy automation market over the forecast period. Pill sorting machines can seamlessly sort, count, and label pill bottles. They can segregate prescribed medications (tablets or capsules) into the correct dosage for patients, reducing manual errors and increasing efficiency. They can be either semi-automatic or automatic. The growing demand for personalized treatment and the need for reduced human errors boost the segment’s growth. These machines offer flexibility by accommodating a variety of dimensions and shapes for capsules without any adjustments.

By end-use, the retail pharmacies segment led the global market in 2024. The segmental growth is attributed to the presence of trained professionals and favorable infrastructure. The increasing number of retail pharmacies potentiates the accessibility of customers to buy medications from retail pharmacies. There were approximately 40,634 pharmacies & drug stores in the U.S. as of 2024. It is estimated that 88.9% of the U.S. population lives within 5 miles of a community pharmacy. Retail pharmacies offer special discounts and free home-delivery services, attracting more customers toward retail pharmacies.

By end-use, the outpatient pharmacies segment is anticipated to grow with the highest CAGR in the pharmacy automation market during the studied years. The rising prevalence of chronic disorders and the availability of generic medications promote the segment’s growth. The increasing cases of common cold, cough, fever, and other viral diseases necessitate patients to buy medicines from outpatient pharmacies. The growing demand for personalized medicines for such common disorders increases the adoption of automated systems. Automation significantly reduces waiting time at pharmacies.

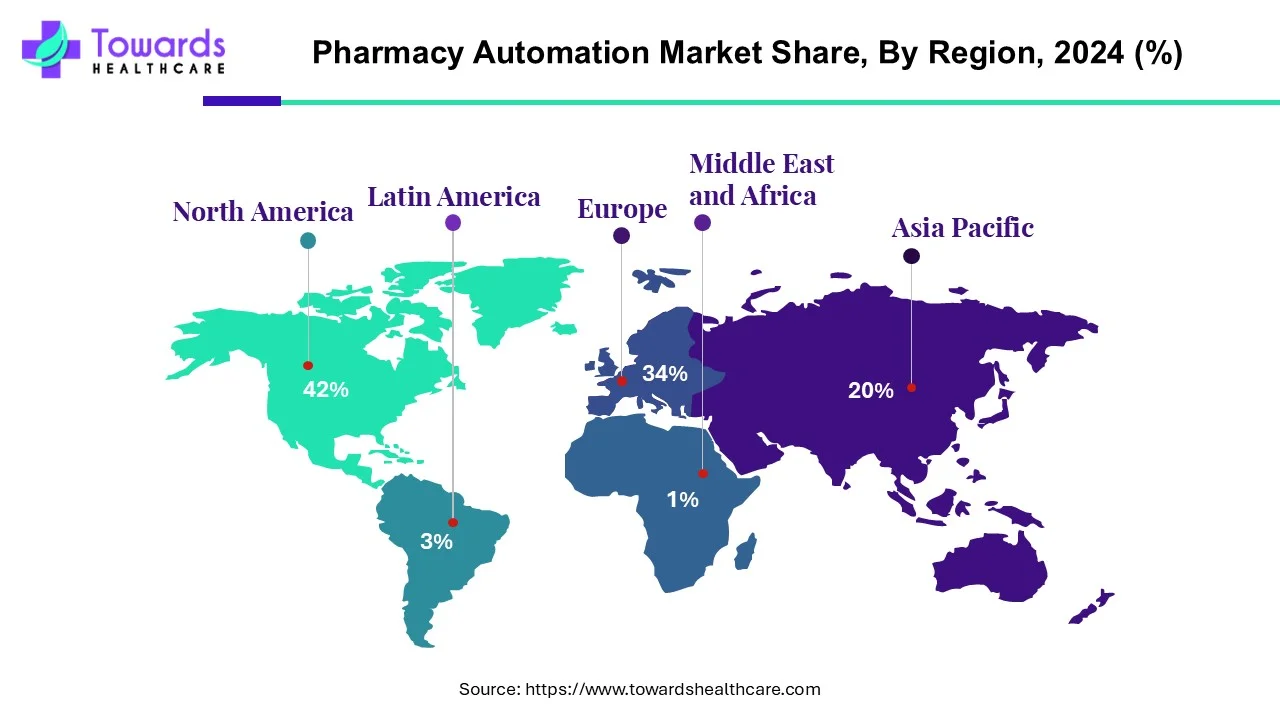

North America held the largest share of 42% in the pharmacy automation market in 2024. The rising adoption of advanced technologies and favorable regulatory policies drive the market. Stringent regulations on enhanced patient care enable pharmacists to adopt automated systems. Advanced healthcare infrastructure and rising healthcare expenditure boost the market. Several government and private organizations provide funding to install automated systems in drug stores. The rising collaborations and mergers & acquisitions allow key players to strengthen their position in the market.

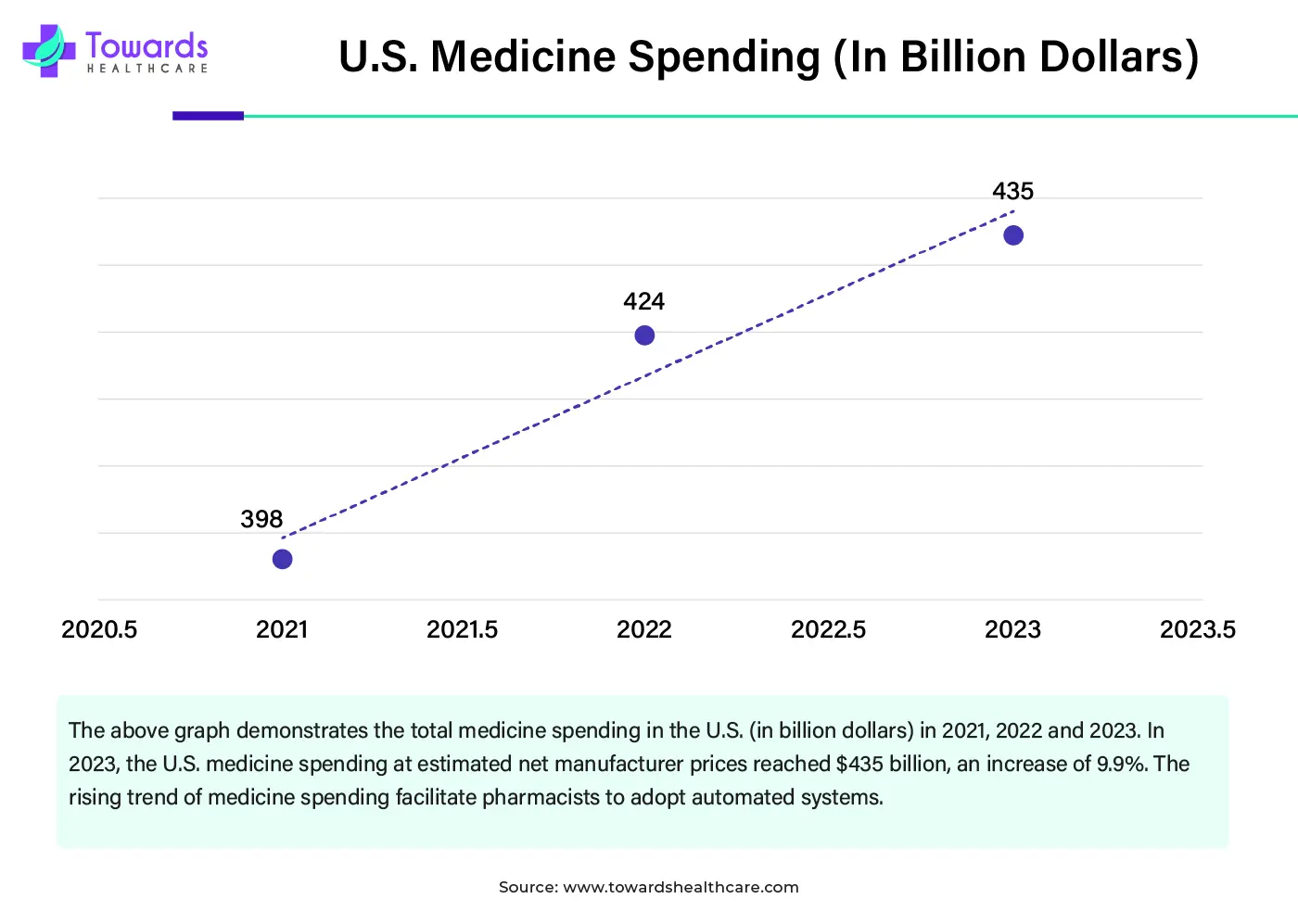

The presence of key players contributes to market growth in the U.S. Key players like Amazon Pharmacy, RxSafe, LLC, and McKesson Corporation hold a major share of the market. The increasing number of retail and hospital pharmacies increases the demand for pharmacy automation in the U.S. Retail drug stores in the U.S. dispense approximately 138,000 prescriptions annually. The Food and Drug Administration regulates medication disbursement in the U.S. The rising medicine expenditure facilitates market growth.

The market is growing in Canada due to the aging population of people, and rising chronic diseases increase demand for well-prescribed medications, which fuels demand for pharmacy automation. The growing demand for cost-effective and efficient processes like inventory management and prescription filling increases the demand for automation. The shortage of pharmacists in the country helps in the market growth, which helps to improve the workload. The growing demand for improving patient safety and minimizing human errors fuels the demand for pharmacy automation. Furthermore, the rapidly growing Canadian pharmacy industry supports the growth of pharmacy automation.

Asia-Pacific is expected to grow at the fastest rate in the pharmacy automation market during the forecast period. The rising prevalence of chronic disorders leads to the increasing number of prescriptions dispensed. The growing geriatric population also contributes to the market. The burgeoning pharmaceutical sector and the increasing manufacturing of medications favor the market. The rising disposable income and technological advancements also support market growth.

Favorable government policies and regulatory frameworks promote the pharmacy automation market. The Chinese government has committed to providing access to medicines for its people. It also provides funding to adopt digital systems and automated machines in hospitals and pharmacies. Additionally, the government launches policies to boost the pharmaceutical and healthcare sectors as well as encourage international cooperation. The increasing number of chronic disorders necessitate the purchase of medications in China. Approximately 81.1% of Chinese older adults, accounting for 179.9 million people, have chronic disorders.

Japan experiences significant growth in the pharmacy automation market. The growing technological advancements in robotic dispensing arms, automated dispensing systems, and other technologies help in the growth of the market. The government of Japan is encouraging the use of technology in the healthcare sector, which increases demand for pharmacy automation to reduce costs and enhance efficiency. The growing demand for perfect medication dispensing increases the demand for pharmacy automation. The growing workload for pharmacies & increased demand for prescriptions due to an aging population fuel demand for pharmacy automation, which contributes to the overall market growth.

The market growth in India is driven by a variety of factors, such as the availability of affordable medications and the increasing number of drug stores. The growing demand for generic drugs and over-the-counter (OTC) drugs increases the accessibility of medicines in India. There are over 850,000 independent pharmacy retail stores in India as of 2024. The increasing number of prescriptions dispensed also fuels the market. Around billions of prescriptions are dispensed annually, owing to the increasing population and the rising prevalence of chronic disorders.

Europe is anticipated to show notable growth in the pharmacy automation market over the coming years. Favorable regulatory policies and increasing awareness about pharmacy automation drive the market. According to a European Association of Hospital Pharmacists (EAHP) survey, there is a considerable way to go in Europe to move towards more automated medication management systems in hospitals. Systematic and EU-wide achievement of electronic prescribing, administration, and use of electronic medical records would improve patient safety.

The rising adoption of advanced technologies in Germany propels the pharmacy automation market. A recent study states that around 79% of the pharmacies, among 253 community pharmacies, in Germany have adopted robotic dispensing systems. Germany is the fourth largest market for pharmaceuticals globally. Favorable government policies also promote the adoption of automated systems in pharmacy. The German government recently launched “Strategy Paper 4.0 – Improving the General Conditions for the Pharmaceutical Sector in Germany” focusing on research and manufacturing as well as improving market access and pricing environment.

The increasing number of prescriptions dispensed contributes to the market. According to the European Federation of Pharmaceutical Industries and Associations (EFPIA), approximately 4,451 prescriptions were dispensed in France in 2023. Numerous pharmacies and drug stores in France have adopted automated systems to strengthen their position and increase sales. It is estimated that 84% of hospital pharmacies in France have automated systems.

Latin America is expected to grow at a notable CAGR in the pharmacy automation market in the foreseeable future. The increasing adoption of advanced technologies and growing investments by government and private organizations drive the market. The rising number of pharmacies and drug stores, and the growing prevalence of acute and chronic disorders, facilitate market growth. Favorable government initiatives support the use of automated solutions for pharmaceutical distribution.

There are around 59,488 businesses in the pharmacies and drug stores sector in Mexico. The Mexican government supports the integration of AI in the healthcare sector, thereby enhancing efficiency, improving patient outcomes, and navigating the complexities of modern healthcare.

Brazil hosts about 8,600 stores operated by leading pharmacy chains in Brazil. The recent BRICS Summit emphasized cooperation among BRICS countries to bolster joint research and the development of innovation platforms to improve global sanitary response. The integration of AI in diagnostic processes, hospital management, and epidemiologic monitoring can optimize resources and enhance response capacity. (Source: BRICS)

Cory Kwarta, President and CEO of Swisslog Healthcare, commented on partnering with BD that the collaboration represents a significant advantage for hospital pharmacies as they implement pharmacy automation solutions. He also said that the effort demonstrates their commitment to innovation, customer-centricity, and a focused strategy centered on robotic medication management solutions.

By Product

By End-Use

By Region

December 2025

October 2025

February 2026

December 2025