March 2026

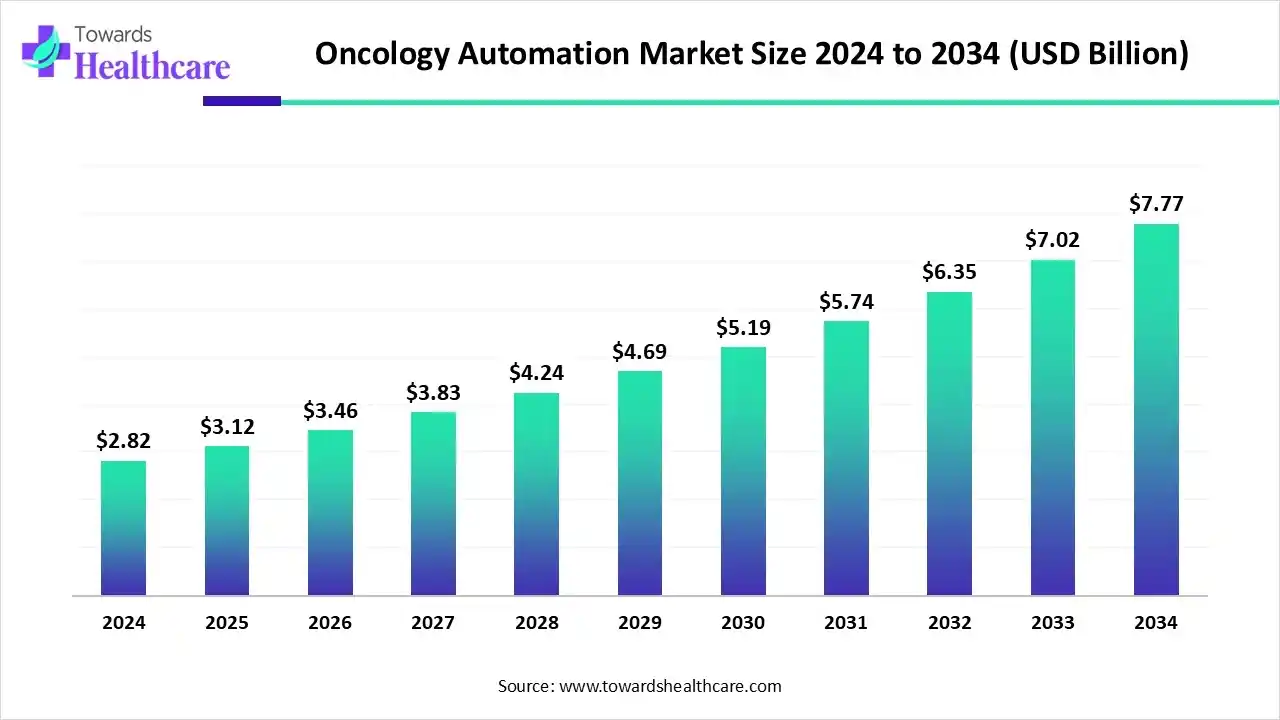

The global oncology automation market size is calculated at US$ 2.82 billion in 2024, grew to US$ 3.12 billion in 2025, and is projected to reach around US$ 7.77 billion by 2034. The market is expanding at a CAGR of 10.68% between 2025 and 2034.

The rising incidence of cancer globally and the growing demand for accuracy and effectiveness in cancer treatment methods are the key growth factors propelling this oncology automation market. Technological developments and the incorporation of AI and machine learning in healthcare are also driving the need for automation in oncology. An essential part of contemporary healthcare is the use of automated systems in oncology, which reduce human error and improve the course of treatment.

| Table | Scope |

| Market Size in 2025 | USD 3.12 Billion |

| Projected Market Size in 2034 | USD 7.77 Billion |

| CAGR (2025 - 2034) | 10.68% |

| Leading Region | North America by 45% |

| Market Segmentation | By Application, By Technology, By End-User, By Region |

| Top Key Players | Varian Medical Systems, Elekta AB, Accuray Incorporated, Intuitive Surgical, Inc., Medtronic plc, Siemens Healthineers AG, Brainlab AG, ViewRay, Inc., C-RAD AB, IBA Worldwide, Mevion Medical Systems, Inc., RefleXion Medical, Inc., RaySearch Laboratories AB, Mirada Medical Ltd., Vision RT Ltd., ZAP Surgical Systems, Inc., Theragenics Corporation, CureMetrix, Inc., Xcision Medical Systems, LLC, Tempus AI |

The oncology automation market is driven by the increasing global cancer prevalence, demand for precision and efficiency in treatment procedures, advancements in AI, robotics, and machine learning, and the need for standardized and reproducible diagnostics. The market encompasses technologies and solutions designed to automate various processes within oncology care. This includes the automation of diagnostics, treatment planning, radiation therapy, chemotherapy preparation, and patient management. The aim is to enhance precision, reduce human error, improve efficiency, and streamline workflows in oncology departments and clinics.

| Date |

Country/Org. |

Project/Programme |

Funding/Investment |

Purpose |

| October 2025 | India (Govt.) | Biomedical Research Career Programme (Phase-III) | ₹1500 crore | To support biomedical research careers |

| October 2025 | Ireland (Govt./POI) | Precision Oncology Ireland (Phase-II) | €28 million | Advance cancer diagnostics and treatments through collaboration |

| May 2025 | UK (BioNTech & Govt.) | BioNTech R&D Expansion | £1 billion (BioNTech); £129M (UK Govt. grant) | Expand innovative medicine R&D in the UK over 10 years |

| September 2025 | BCRF (Global) | Breast Cancer Research Funding (2025–26) | $74.75 million | Fund 260+ scientists; focus on precision prevention & cancer disparities |

By application, the chemotherapy segment was dominant in the oncology automation market with a revenue of approximately 30% in 2024. With its accuracy, usefulness, speed, and affordability, the SmartCompounders raises the bar for automated cytotoxic drug preparation. It provides technicians and pharmacists with the resources they need to expedite, improve the process, and get rid of mistakes in dose amounts and medicine identification.

By application, the immunotherapy segment is expected to grow at the fastest CAGR during the forecast period. By examining genomic, transcriptomic, and proteomic data, AI has made a substantial contribution to the discovery of biomarkers that forecast the effectiveness of immunotherapy. Additionally, it predicts the best treatment regimens, optimising combo medicines. Predictive models powered by AI aid in evaluating how well patients respond to immunotherapy, directing medical judgement and reducing adverse effects. AI also makes it easier to find new therapeutic targets, such neoantigens, which makes it possible to create customised immunotherapies.

By technology, the artificial intelligence (AI) segment was dominant in the oncology automation market with a revenue of approximately 35% in 2024. Rapid advancements in AI integration in healthcare are changing several facets of medical oncology. From personalised therapy suggestions to diagnostic assistance, AI systems are quickly becoming indispensable resources for oncologists. These technologies advance the area of cancer care by increasing the accuracy of diagnoses, expediting the planning of therapies, and customising care for each patient.

By technology, the machine learning segment is expected to grow at the fastest CAGR in the oncology automation market during the forecast period. Machine learning, a subset of artificial intelligence (AI), is becoming more and more important in the diagnosis and management of different cancers. It is anticipated that machine learning would become a crucial tool for medical professionals. When compared to conventional staging techniques, the ML model has already improved patient prognostic prediction. The use of ML might potentially have a significant positive impact on the direct synthesis of the required medicinal compounds (small molecule mixtures) at the point of treatment.

By end-user, the hospitals segment was dominant in the oncology automation market with a revenue of approximately 40% in 2024. Well-known cancer centres are automating patient care, diagnostic, surgical, and administrative processes. The use of AI for precision oncology at Apollo Cancer Centre, robotic surgery and diagnostics at SSO Cancer Hospital, and robotic devices like the DaVinci Surgical System for minimally invasive procedures at other medical facilities are a few examples.

By end-user, the homecare settings segment is expected to grow at the fastest CAGR during the forecast period. Home health agencies can increase their productivity and profitability by implementing automation and artificial intelligence. Even with limited resources, these technologies will enable them to make the most impact possible, optimise operations, and eventually improve their financial health, opening the door for expansion.

North America dominated the oncology automation market in 2024, with a revenue of approximately 45%. Favourable reimbursement policies, significant government support, and sophisticated digital infrastructure are the main drivers of the region's impressive performance. Along with strong federal and state-level initiatives supporting AI integration in oncology, the US market benefits from significant investment in healthcare technology and research. In a similar vein, Canada's market expansion is facilitated by its encouraging government policies and investments in healthcare innovation.

The growing incidence of cancer, the need for efficiency, the use of advanced technologies like artificial intelligence, and the trend towards personalised medicine are all driving growth in the U.S. oncology automation market. The U.S. government has also made substantial investments in cancer research in 2024 and 2025, with the National Cancer Institute (NCI) receiving a $7.22 billion budget for both fiscal years.

In April 2025, Canada's Immunotherapy Network, BioCanRx, is pleased to announce $12.5 million in new funding for four core facilities and 20 research projects. 13 new projects chosen from an open call for proposals held in late 2024 are among the funded projects, including seven that will expand on previously funded work. These innovative Canadian initiatives will boost the development of immunotherapy as a cancer treatment and increase Canada's ability to produce state-of-the-art biotherapeutic solutions.

Asia Pacific is estimated to host the fastest-growing oncology automation market during the forecast period. with swift healthcare digitisation and growing investments in cancer care infrastructure. The region is experiencing an increase in the incidence of cancer, which is driving the need for oncology automation. In an attempt to improve patient outcomes, nations like China, India, and Japan are adopting oncology information systems. Growing government programmes and financing for healthcare modernisation also promote growth. Additionally, Asia is using more advanced oncology solutions due to increased partnerships with foreign technology vendors.

From basic research to clinical deployment, research and development (R&D) is a multi-phase process that advances oncology automation. Artificial intelligence (AI)-based automation tools are being used in clinical trials, diagnosis, and treatment, among other areas of oncology.

Key Companies Include: Siemens Healthineers, Medtronic, Roche Diagnostics, Tempus, Bristol-Myers Squibb, Intuitive Surgical, Flatiron Health, Onc.AI, Orakl Oncology, AstraZeneca, etc.

Distributing oncology automation systems, equipment, and software to clinics, hospitals, and ASCs is a difficult process that is influenced by various healthcare providers' particular requirements as well as stringent regulatory requirements. Distributors and manufacturers must follow different routes for software and physical hardware, with supply chain management, compliance, and customer integration being crucial at every stage.

Through appointment scheduling, communication simplification, and administrative task automation, automation improves patient support in oncology while freeing up clinical staff and improving the patient experience. The steps listed below show how automation helps patients at every stage of their cancer journey, from early diagnosis to ongoing monitoring.

By Application

By Technology

By End-User

By Region

March 2026

March 2026

March 2026

March 2026