December 2025

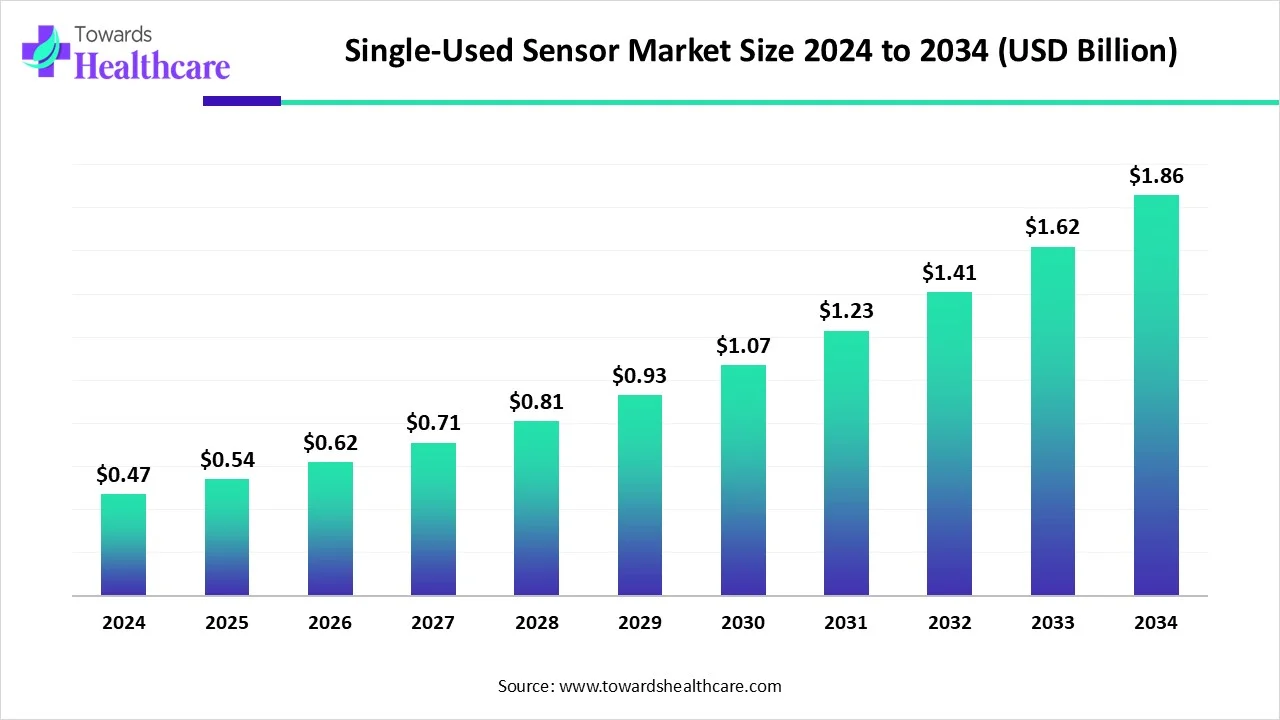

The global single-use sensors market size is calculated at USD 0.47 billion in 2024, grows to USD 0.54 billion in 2025, and is projected to reach around USD 1.86 billion by 2034. The market is expanding at a CAGR of 15.04% between 2025 and 2034.

| Metric | Details |

| Market Size in 2025 | USD 0.54 Billion |

| Projected Market Size in 2034 | USD 1.86 Billion |

| CAGR (2025 - 2034) | 15.04% |

| Leading Region | North America |

| Market Segmentation | By sensor type, By type of bioprocessing, By Regions |

| Top Key Players | Honeywell International, Inc., Infineon Technologies AG, Texas Instruments, NXP Semiconductors, TE Connectivity, Omron, Omega Engineering, Siemens Industry Inc, Bosch |

The single-use sensors market involves disposable sensors used primarily in biopharma and healthcare to monitor process parameters, offering sterile, cost-effective, and contamination-free solutions for one-time use. Innovation is impacted by enhancing real-time monitoring, wireless connectivity, and enhanced data accuracy. Advances in materials and miniaturization have improved sensor performance while maintaining sterility and ease of integration into bioprocessing systems. These innovations support the growing demand for flexible, efficient, and scalable production in biopharmaceuticals, especially for personalized medicine and biologics. As a result, manufacturers are increasingly adopting single-use technologies to optimize workflows and ensure regulatory compliance.

AI is enhancing the market by enabling smarter data analysis, predictive maintenance, and real-time decision-making. Companies like Thermo Fisher Scientific, Sartorius, and GE Healthcare are integrating AI to improve sensor accuracy, process optimization, and automation. AI algorithms help in interpreting sensor data faster, reducing human error, and improving overall bioprocess efficiency. This fusion of AI and sensor technology supports scalable, high-quality production in biopharma, especially for biologics and personalized medicine.

Growing Adoption of Single-Use Technologies

The rising adoption of single-use technologies in biopharmaceutical manufacturing is a major driver for the single-use sensor market. These technologies enable faster turnaround, reduced risk of cross-contamination, and lower operational costs by eliminating the need for cleaning and sterilization. Single-use sensors are designed to integrate seamlessly into these systems, offering accurate real-time monitoring and data collection. As the demand for efficient, flexible, and scalable production increases, especially for biological and personalized medicine, the use of single-use sensors continues to grow rapidly.

For Instance,

Limited Reusability

Limited reusability is a major restraint in the single-use sensors market because it leads to increased operational costs and environmental waste. Unlike reusable sensors, single-use variants must be discarded after each cycle, which can raise concerns about sustainability and long-term affordability. This drawback is particularly significant in large-scale manufacturing, where frequent replacements are needed. Additionally, waste disposable regulations and growing pressure for eco-friendly practices make limited reusability a barrier to wider adoption in some regions.

Integration of Advanced Technologies

The integration of advanced technologies like AI, IoT, and real-time analytics presents a major future opportunity in the single-use sensor market. These technologies enhance sensor functionality by enabling smarter, more accurate monitoring and automated process control in biomanufacturing. Real-time data insights help reduce errors, improve product quality, and optimize workflow efficiency. As biopharma companies seek faster, data-driven production methods, the adoption of tech-enhanced single-use sensors is expected to rise, driving innovation and market growth.

For Instance,

In 2024, the pH sensor segment held the largest share in the single-use sensors market due to its essential role in maintaining ideal conditions during bioprocessing. Accurate pH monitoring is crucial for ensuring proper cell growth and product quality. Single-use pH sensors are preferred because they reduce contamination risk, eliminate clearing steps, and easily integrate with disposable bioreactor systems, making them a practical and efficient choice in various stages of biomanufacturing.

In 2024, the temperature sensor segment is anticipated to experience accelerated growth within the single-use sensors market due to its pivotal role in maintaining optimal conditions during bioprocessing. Precise temperature monitoring is essential for ensuring product quality and process efficiency. The integration of advanced technologies, such as digital sensors and IoT connectivity, enhances real-time monitoring and control, leading to improved operational outcomes. These advancements, coupled with the increasing adoption of single-use systems, drive the demand for innovative temperature-sensing solutions in biomanufacturing.

In the single-use sensor market, the upstream segment dominates due to its critical role in monitoring and controlling conditions during the early stages of bioprocessing, such as cell culture and fermentation. Accurate, real-time data from sensors like pH, dissolved oxygen, and temperature is essential to maintain optimal growth environments. Single-use sensors are particularly suited for upstream processes because they reduce contamination risk, streamline operations, and support flexible manufacturing, making them widely adopted in modern biopharmaceutical production facilities.

The downstream segment is expected to grow fastest in the single-use sensors market because of the increasing demand for efficient purification and filtration processes in biomanufacturing. Single-use sensors enhance the monitoring of critical parameters like pressure, flow, and temperature, ensuring product quality and process consistency. Additionally, the shift towards flexible and disposable downstream systems reduces contamination risks and technological advancements, driving rapid adoption of single-use sensors in downstream bioprocessing during the forecast period.

In 2024, North America led the market, driven by its robust biopharmaceutical industry and early adoption of advanced bioprocessing technologies. The presence of major manufacturers, contract research organizations (CROs), and contract manufacturing organizations (CMOs) in the U.S. and Canada fueled demand for single-use systems. Additionally, significant investments in research and development, along with government support for biomanufacturing initiatives, reinforced the region's dominance in adopting disposable sensor technologies across upstream and downstream processes.

The U.S. market is expanding due to the growing demand for biopharmaceuticals and the adoption of advanced bioprocessing technologies. The presence of key players and increased investments in research and development further support this growth. Additionally, the emphasis on reducing contamination risks and improving operational efficiency drives the shift towards single-use systems in biomanufacturing processes.

For Instance,

Canada's market is expanding due to its robust biopharmaceutical sector and the increasing adoption of advanced manufacturing technologies. The demand for efficient, contamination-free production processes has led to a preference for single-use systems, which minimize cleaning requirements and reduce downtime. Additionally, Canada's commitment to innovation and regulatory support for bioprocessing advancements further drives the integration of single-use sensors in both research and large-scale production environments.

Asia-Pacific is projected to experience the fastest growth in the market during the forecast period, driven by the rapid expansion of its biopharmaceutical sector, particularly in countries like China and India. Government initiatives supporting biotechnology research and the increasing adoption of single-use technologies to enhance manufacturing efficiency and reduce contamination risks are key factors. Additionally, the region's growing demand for cost-effective and scalable bioprocessing solutions further accelerates the uptake of single-use sensors.

For Instance,

China's market is expanding rapidly, driven by the country's growing biopharmaceutical sector and the increasing adoption of disposable bioprocessing technologies. The demand for efficient, contamination-free manufacturing processes has led to a preference for single-use systems, which offer advantages like reduced cleaning requirements and enhanced operational flexibility. Government support for biotechnology research and development further propels this growth, positioning China as a significant player in the global single-use sensor industry.

India's market is expanding due to the rapid growth of its biopharmaceutical sector and the increasing adoption of disposable technologies in manufacturing processes. Single-use sensors offer advantages like reduced contamination risk, lower capital expenditure, and faster turnaround times, making them appealing for biomanufacturing. Additionally, advancements in sensor technologies and government support for biotechnology research further drive the integration of single-use sensors in India's pharmaceutical and biotechnology industries.

Europe is a notable growing region in the market due to its strong biopharmaceutical sector and commitment to innovation. Countries like Germany, the UK, and France are investing heavily in biotechnology research and development, supported by favorable government initiatives. The region's focus on sustainable manufacturing practices and stringent regulatory standards further propels the adoption of single-use technologies, including sensors, to enhance efficiency and reduce contamination risks in bioprocessing operations.

For Instance,

The UK's market is expanding due to its strong biopharmaceutical sector and increasing adoption of disposable technologies. Government support and favorable regulatory frameworks encourage investment in innovative bioprocessing solutions, enhancing manufacturing efficiency and reducing contamination risks. Additionally, the demand for flexible and cost-effective production methods in biologics and personalized medicine further propels the integration of single-use sensors in the UK's biomanufacturing processes.

Germany's market is expanding due to its strong emphasis on biopharmaceutical innovation and manufacturing excellence. The country's focus on personalized medicine and complex biologics necessitates precise monitoring of parameters like pH, dissolved oxygen, and temperature, which single-use sensors provide efficiently. Additionally, the integration of advanced technologies, such as real-time data analytics and automation, enhances process control and scalability, aligning with Germany's commitment to high-quality, flexible, and contamination-free bioprocessing solutions.

In May 2025, Sonair will introduce its groundbreaking Sonair ADAR sensor to North America at the Automate 2025 trade show. This 3D ultrasonic sensor is the first of its kind designed to enhance safety in environments shared by humans and autonomous mobile robots (AMRs). According to CEO Knut Sandven, ADAR simplifies safety by offering full 3D, 360-degree obstacle detection at a much lower cost, helping AMR manufacturers create safer and more cost-effective robots. (Source - Businesswire)

By sensor type

By type of bioprocessing

By Region

December 2025

November 2025

November 2025

November 2025