January 2026

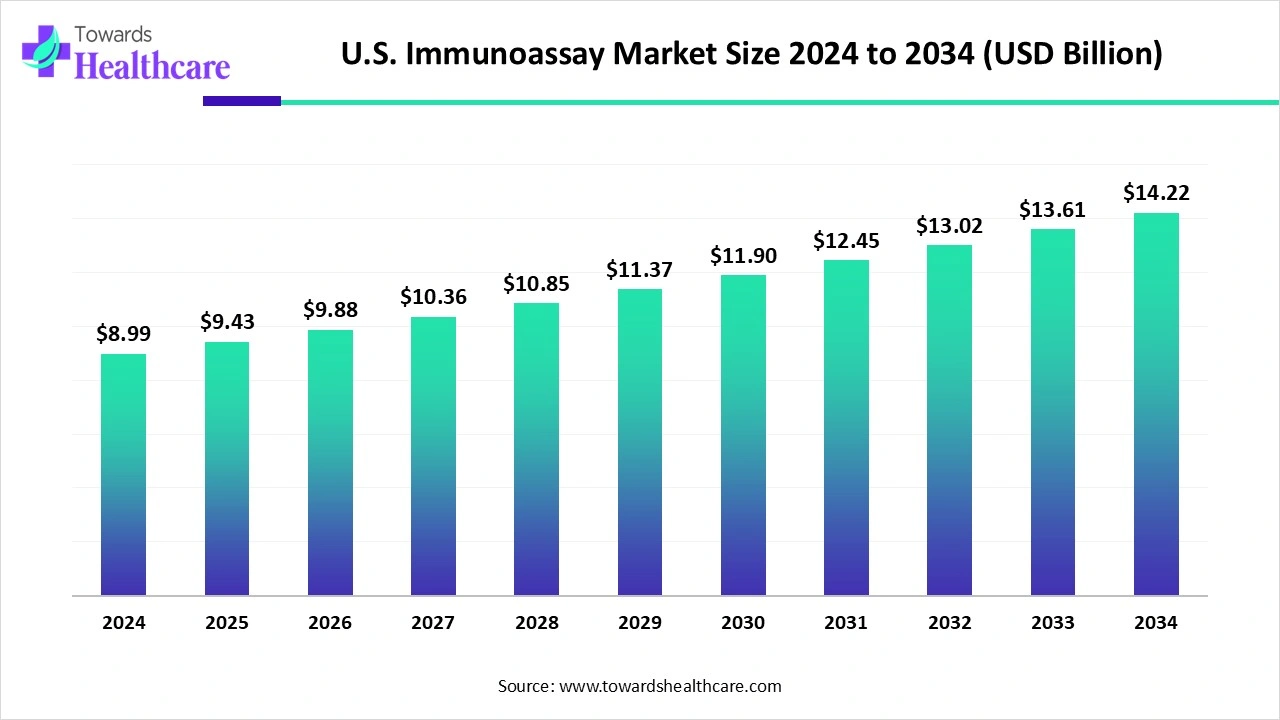

The U.S. immunoassay market size is calculated at US$ 8.99 billion in 2024, grew to US$ 9.43 billion in 2025, and is projected to reach around US$ 14.22 billion by 2034. The market is expanding at a CAGR of 4.93% between 2025 and 2034.

The U.S. immunoassay market is mainly driven by the exciting launch of integrated, efficient, and more compact systems by the leading companies in the U.S. This market revolves around various products like reagents, kits, analyzers, instruments, etc., and technologies like ELISA, RIA, CLIA, and many others. These solutions have diverse applications across cardiology, oncology, infectious disease testing, etc. The potential end users of these versatile services include hospitals, clinical laboratories, and several other healthcare organizations.

| Table | Scope |

| Market Size in 2025 | USD 9.43 Billion |

| Projected Market Size in 2034 | USD 14.22 Billion |

| CAGR (2025 - 2034) | 4.93% |

| Market Segmentation | By Product, By Technology, By Application, By End-use, By Specimen |

| Top Key Players | Abbott Laboratories, Thermo Fisher Scientific Inc., Danaher Corporation, Bio-Rad Laboratories, Becton, Dickinson and Company, Agilent Technologies, F. Hoffmann-La Roche AG, Siemens Healthineers AG |

The expansion of biotechnology and pharmaceutical companies and the robust R&D initiatives fuel the adoption of immunoassays in clinical practices. The majority of the population is getting affected by chronic diseases, which leads to the rise of novel diagnostic and therapeutic solutions. The emergency care services are becoming prominent in case of pandemics and epidemics. The technology integration improves the affordability and accessibility of testing services in remote areas. The government efforts and new product launches accelerate the growth of the U.S. healthcare system.

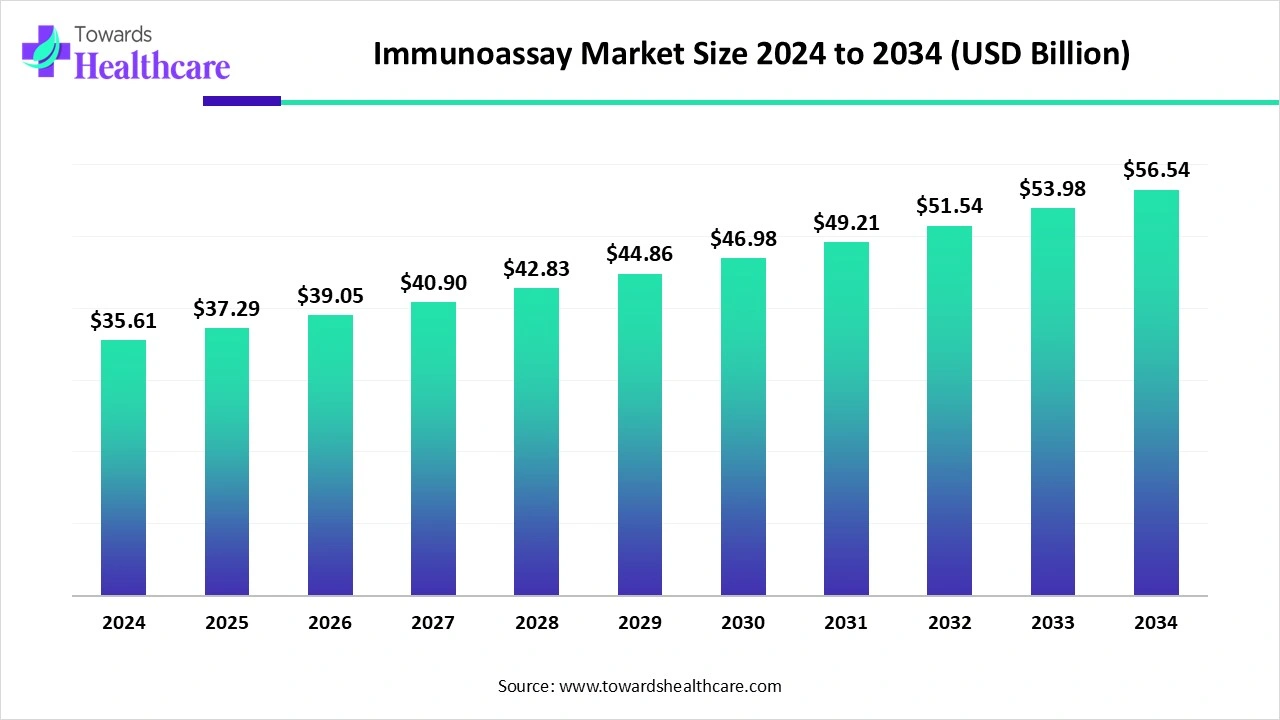

The global immunoassay market is worth US$ 35.61 billion in 2024, expected to rise to US$ 37.29 billion in 2025, and projected to reach about US$ 56.54 billion by 2034, growing at a CAGR of 4.72% between 2025 and 2034.

AI-assisted real-time immunoassay improves clinical sensitivity and specificity. AI helps in the design and development of immunoassays. It assists in improved data analysis and data interpretation. It serves well with increased automation and efficiency.

What are the Major Drifts in the U.S. Immunoassay Market?

The emerging trends in immunoassays include automation and miniaturization in the form of walkaway systems, microfluidics, and lab-on-a-chip technology. The emergence of ultrasensitive and multiplex assays introduced enhanced sensitivity and multiplexing capability.

What are the Potential Challenges in the U.S. Immunoassay Market?

There are standardization and regulatory hurdles, which include the rising need for global standards, complex regulatory approvals, and funding. Certain barriers related to operational efficiency and economic aspects include the high cost of advanced systems and the shortage of skilled personnel.

What is the Future of the U.S. Immunoassay Market?

There is ongoing research and development in certain areas like chemiluminescence immunoassay (CLIA), automation, microfluidics, etc. The point-of-care testing is experiencing massive expansion due to improved accessibility and decentralized healthcare. There is an increased shift towards biomarker discovery and companion diagnostics.

The reagents & kits segment dominated the market in 2024, owing to the extensive use of several reagents and reaction kits such as antibodies, antigen standards, controls, detection labels, enzymes, etc. The immunoassay kits play a pivotal role in driving efficiency, reliability, reproducibility, and convenience. The various types of reaction buffers present in immunoassay kits are also crucial in research and development.

The software & services segment is anticipated to grow at the fastest rate in the market during the predicted timeframe due to the excellent services provided by the inclusion of software, including automation, workflow management, data acquisition, data analysis, etc. The reliable services contribute to assay development, optimization, customization, and regulatory compliance. The CROs provide high-throughput testing and specialty testing while outsourcing immunoassay services.

The enzyme immunoassays segment dominated the market in 2024, owing to the excellence of EIA in clinical diagnostics, detection of infectious diseases, blood screening, autoimmune disease testing, and medical diagnostics. These assays are vital in research and drug discovery, high-throughput screening, and protein expression monitoring. They are widely used in toxicology, forensics, food quality control, and veterinary science.

The radioimmunoassay segment is estimated to grow at the highest rate in the market during the upcoming period due to its wide applications in endocrinology, oncology, infectious disease detection, pharmacology, toxicology, blood bank screening, allergies, and research. It provides high specificity, sensitivity, and quantitative accuracy. It is ideally reliable in biomedical and biochemical research.

The infectious disease testing segment dominated the market in 2024, owing to the primary role of immunoassays in the early and rapid diagnosis and identification of immunity and past infections. The various assays help in disease monitoring and management. They serve in research and vaccine development. The ELISA, RIA, CLIA, LFA, etc., are some of the immunoassays delivering high sensitivity and specificity.

The oncology segment is expected to be the fastest-growing in the market during the studied period due to the key potential of immunoassays in diagnosis and screening. They help in the prognosis of diseases and the monitoring of treatment effectiveness. They deliver speed, throughput, high specificity, and high sensitivity.

The hospitals segment dominated the market in 2024, owing to the emerging need for patient monitoring, improved treatments, and enhanced patient health. The hospitals are crucial in emergency and critical care diagnostics. The various types of immunoassays used in hospitals are important in modern clinical practice.

The clinical laboratories segment is anticipated to achieve the fastest growth in the market during 2025-2034 due to the rising demand for cancer detection, cancer monitoring, and therapeutic drug monitoring. The immunoassays used in clinical laboratories help in cardiac health assessment, autoimmune disease diagnosis, and allergy testing. They serve in rapid testing at the point-of-care and endocrinology.

The blood segment dominated the market in 2024, owing to the extensive use of various types of blood specimens for immunoassays, which include whole blood, plasma, serum, and dried blood spots. The blood specimens are widely applicable in rapid and point-of-care testing. Serum is used as a specimen for tests, including antibodies, hormones, and tumor markers.

The urine segment is estimated to grow at the fastest CAGR in the market during the forecast period due to the key functions of the urine specimen in drug screening, hormone detection, and disease and health monitoring. The urine specimens are useful in pregnancy tests and reproductive health. They help in the analysis of kidney health in diabetes and cancer diagnosis.

According to the National Institutes of Health (NIH), the U.S. Food and Drug Administration published a final rule on laboratory-developed tests in May 2024. It has also provided rules for in vitro diagnostic regulations in the context of anatomic pathology.

In July 2025, the U.S. FDA announced the implementation of a new alternative methods program to advance product testing.

The U.S. Department of Health and Human Services (HHS), BARDA, awarded up to $500 million in project NextGen funding for vaccine clinical trials. The National Institute of Standards and Technology (NIST), the U.S. Department of Commerce, introduced rapid drug analysis and research (RaDAR) to provide real-time insight into the illicit drug landscape.

The R&D process for immunoassays in the U.S. involves feasibility, concept assessment, assay development, optimization, validation, performance testing, manufacturing, standardization, regulatory approval, and commercialization.

Key Players: Abbott Laboratories, Danaher Corporation, Thermo Fisher Scientific Inc., Bio-Rad Laboratories, Inc., QuidelOrtho Corporation, Siemens Healthineers.

The significant regulatory approvals are seen for neurology, Alzheimer's disease, oncology, cardiology, and infectious diseases. Phase 1 study for an mRNA vaccine candidate for the H5N1 virus is one of the examples of ongoing clinical trials that utilize immunoassays.

Key Players: Abbott Laboratories, Danaher Corporation, Thermo Fisher Scientific Inc., Bio-Rad Laboratories, Inc.

The key players and healthcare service providers include pharmaceutical and biotech companies, diagnostic laboratory networks, hospitals, clinics, and independent organizations. The services include point-of-care testing, home-based testing, patient support programs, etc.

Key Players: Abbott Laboratories, Danaher Corporation, Thermo Fisher Scientific Inc.

In February 2025, Marc N. Casper, chairman, president, and CEO of Thermo Fisher Scientific Inc., announced that the company feels delighted to introduce Sanofi’s Ridgefield site to its network and involve more than 200 highly experienced professionals at Thermo Fisher Scientific Inc. He also proclaimed that these efforts will bring a team and world-class facility into the company’s network to strengthen U.S. manufacturing capabilities. This will support biotech and pharmaceutical customers while raising the company’s future expansion.

By Product

By Technology

By Application

By End-use

By Specimen

January 2026

January 2026

January 2026

January 2026