March 2026

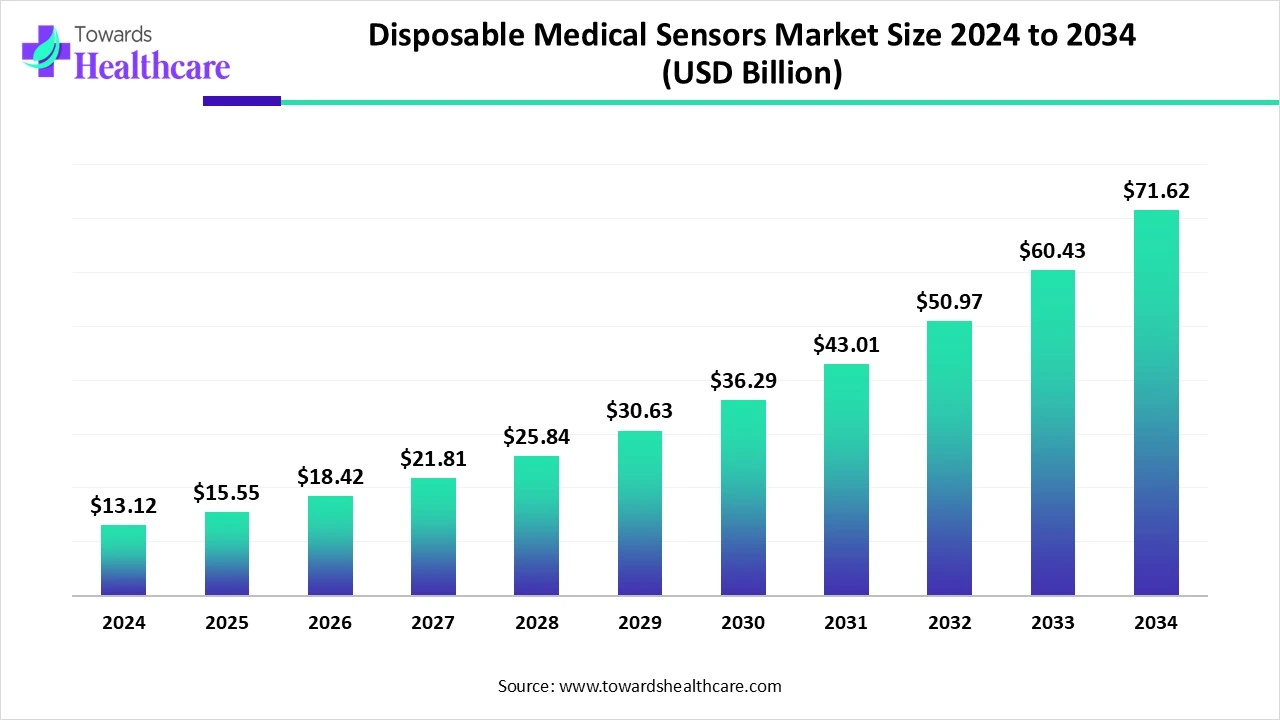

The global disposable medical sensors market size is calculated at US$ 13.12 billion in 2024, grew to US$ 15.55 billion in 2025, and is projected to reach around US$ 71.62 billion by 2034. The market is expanding at a CAGR of 18.54% between 2025 and 2034.

China and India are experiencing a rise in diabetic patients is highly fueling the crucial developments in point-of-care testing, home monitoring/consumer health. This further accelerates demand for immensely sophisticated single-use biosensor patches (wearable disposable patches) and blood glucose test strips in the progressing global disposable medical sensors market. Moreover, an increasing focus on more comfortable, reliable, and further integrated sensors for both clinical and at-home applications is driving the widespread adoption and demand for ACSs and ambulatory clinics with streamlined workflow. Alongside, these disposable medical sensors are offering advantages in more sterilization, reduced cross-contamination, and ease of use.

| Table | Scope |

| Market Size in 2025 | USD 15.55 Billion |

| Projected Market Size in 2034 | USD 71.62 Billion |

| CAGR (2025 - 2034) | 18.54% |

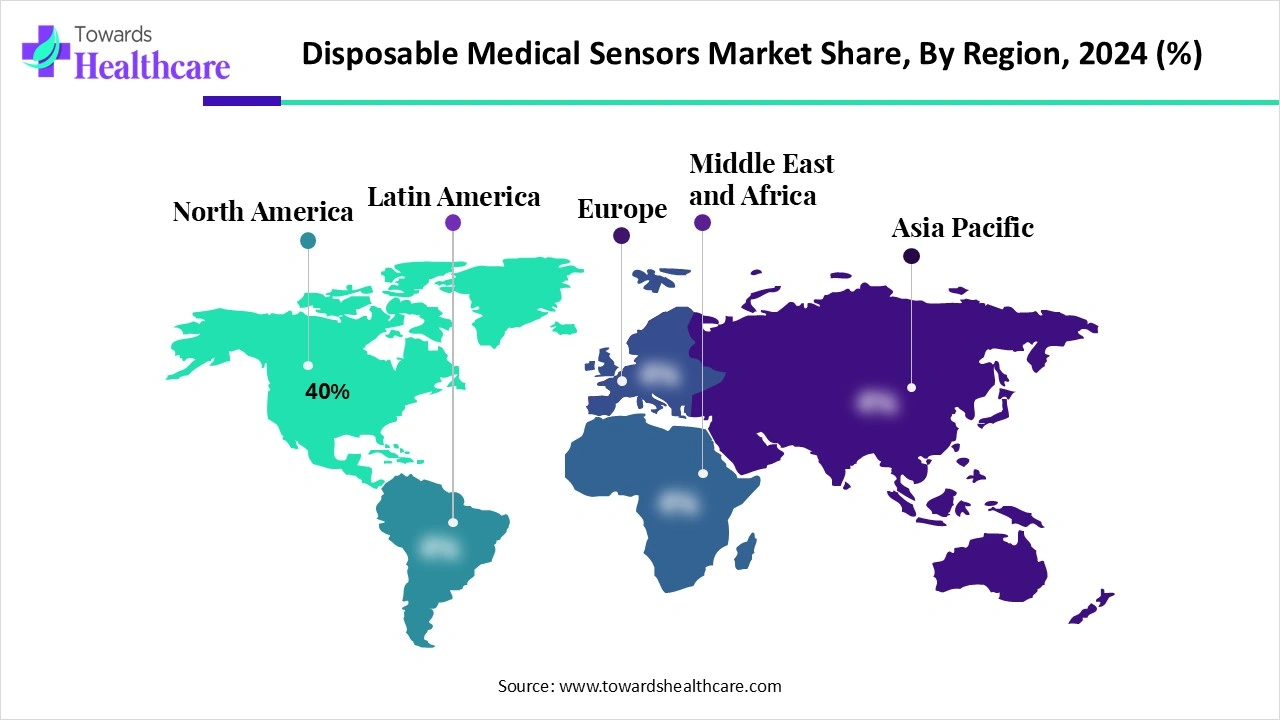

| Leading Region | North America Share 40% |

| Market Segmentation | By Product Type, By Technology / Sensing Principle, By Application / Clinical Use, By End User / Setting, By Commercial Mode, By Region |

| Top Key Players | Abbott, Dexcom, Medtronic, Roche Diagnostics, Siemens Healthineers, Johnson & Johnson / LifeScan, Becton, Dickinson & Co. (BD), Masimo, Nihon Kohden, 3M (3M Healthcare), Cardinal Health / Medline, iRhythm Technologies, Philips, BioTelemetry, VitalConnect , BioIntelliSense, Trividia Health / ACON, Nova Biomedical, BD / Alere / Abbott, OEM sensor module & chemistry suppliers |

The disposable medical sensors market covers single-use sensing devices and sensor consumables that measure physiological, biochemical, or environmental signals and are discarded after one patient use or one monitoring episode. Examples include blood-glucose test strips, single-use ECG electrodes, disposable pulse-oximeter sensors, single-use capnography/CO₂ cannulas and cartridges, lateral-flow/POC test cartridges, single-use biosensor patches (wearable disposable patches), disposable temperature probes, single-use biochemical cartridges (POC blood-gas / chemistry), and single-use sensor tips for infusion/ventilator lines. Drivers include growth of point-of-care testing, home monitoring/consumer health, infection-control preferences, rising chronic-disease monitoring (diabetes, cardiac), expansion of ambulatory and home infusion care, and the move to single-use to reduce cross-contamination and reprocessing costs.

Around the globe, the incorporation of AI-powered disposable sensors is offering consistent, real-time monitoring of critical signs and health data from a distance, further assisting remote care and minimizing the burden on healthcare systems. Along with this, ongoing advances include AI-driven optosensors, flexible bioelectronics for monitoring sweat and tears, and intelligent self-sustainable systems. As well as the FDA is actively providing guidance for the life cycle management of AI-enhanced medical devices to ensure safety and effectiveness.

Active Affordability and Other Technological Advances

Ongoing phenomenal advancements in sensor technology are widely boosting the comprehensive development of the global disposable medical sensors market. This factor mainly encompasses developing miniaturization, in which sensors are going to become tiny and more compact. This is favourable for use in devices, such as disposable endoscopes and capsule endoscopes. Apart from this, raising emphasis on wireless connectivity, which accelerates data transmission and allows remote patient monitoring. However, another benefit of these advancements is a rise in affordability than reusable devices, particularly growing concessions in the reprocessing and maintenance.

Raised Performance and Data Quality Concerns

In some cases, a question may arise regarding the accuracy and reliability of disposable sensors, mainly for often or long-term monitoring. As well as there is another barrier related to data quality, which needs a strong validation and quality assurance solution for these disposable sensors.

Major Developments in Materials and Diagnostics

In the coming era, the widespread revolutionary activities in R&D areas are fueling innovative opportunities in the overall global disposable medical sensors market progression. Primarily, this market will undergo crucial developments in disposable sensor materials, with a wider focus on increasing the flexibility, biocompatibility, and skin-friendliness of these materials. This results in more comfortable, reliable, and further integrated sensors for both clinical and at-home applications. Besides this, continuous sophistication in sensors will give rise to the effective detection of critical biomarkers, such as exosomes from tumor cells, for early cancer detection without invasive approaches.

In 2024, the blood-glucose test strips segment accounted for the biggest revenue share of the market. Around the world, there is a rise in cases of diabetes and a higher demand for ease of use and portability, which is mainly driving the segment growth. Currently, the market is focusing on the integration of these sensors into patches, which are greatly useful to wear on the skin and further collect sweat for analysis. Alongside, other breakthroughs in these sensors are to create consistent, real-time monitoring of multiple parameters, mainly pH, temperature, and glucose, often coupled with microfluidic systems for sweat collection and analysis. Moreover, the escalating acceptance of self-diagnosis, government support, and advancements in sensor technology for rapid, more accurate results are also fueling the ultimate market development.

And, the single-use wearable biosensor patches segment is anticipated to expand rapidly during 2025-2034. Major advantages of these patches are their reduced need for sterilization and contamination risk, as well as their inexpensiveness, and enhanced accuracy and precision levels are highly influencing the segment expansion. Nowadays, the market is emphasizing the developments in flexible biomaterials, comprising textiles and paper, advanced transduction mechanisms like laser-graphene sensors and nucleic acid assays, and AI-enabled data integration for more personalized and proactive health management, which are broader influential factors in this segment growth.

The electrochemical segment led with a major share of the disposable medical sensors market in 2024. This kind of technology itself leads to the fabrication of small, portable, and even wearable sensors that are unique for point-of-care use. Along with this, these types of sensors are developed for the simultaneous detection of multiple biomarkers from a single sample, which offers comprehensive diagnostic information. Enhancing the application of graphene, carbon nanotubes, and other nanoparticles is majorly boosting their electrical conductivity and electrocatalytic properties, and ultimately a rise in sensor sensitivity.

Whereas, the adhesive patch MEMS/multi-modal sensors segment is estimated to witness the fastest growth in the upcoming years. The segment will have vital growth factors, including their broader emergence for miniaturizing sensors, further allowing the establishment of compact, flexible, and more effective adhesive patch sensors. Day by day, ongoing advanced algorithms united with multi-sensor data from accelerometers and gyroscopes that facilitate deeper insights into daily activities, impactful for rehabilitation and long-term health tracking. Moreover, the growing adoption of wearable technologies for health and wellness the essential for non-invasive monitoring, and opportunities in women health and post-surgical recovery tracking, are also propelling the overall segment development.

In the disposable medical sensors market, the diabetes self-monitoring & diabetes care segment captured the biggest share in 2024. Immensely developed continuous glucose monitors are widely offering real-time glucose data, assisting patients and their doctors to understand glucose trends, as well as to mitigate severe hypo- and hyperglycemia, and improve insulin dosages, resulting in excellent overall diabetes management. Inclusion of other advances in these CGMs, like factory-calibrated, eliminates the requirement for painful finger-prick calibrations and minimizes user error and pain. Alongside, a surge in newer models, such as the Dexcom G7, is allied with the sensor and transmitter into a single, fully disposable unit, which reduces steps and improves ease of use.

However, the point-of-care & rapid infectious disease testing segment will expand rapidly during the forecast period. Around the globe, continuous advances in telemedicine, the need for faster and accessible diagnostics in resource-limited areas, and the convenience of home-based care are fueling the segment expansion. Usually employed paper-based microfluidic sensors, screen-printed electrochemical sensors, and lateral flow assays (LFAs), which are utilized in glucose meters, rapid pregnancy tests, strep tests, and COVID-19 tests. Although other transformations in wearable sensors allow healthcare providers to remotely monitor patients with infectious diseases, they also protect both caregivers and the public.

In 2024, the home/consumer segment held a major share of the disposable medical sensors market. The increasing geriatric population associated with chronic diseases is developing a consistent demand for at-home monitoring devices that enable discreet, continuous tracking of health. Furthermore, other developments, including flexible, stretchable, and biodegradable options, uniting AI and IoT for remote patient monitoring, and evolving biosensors for non-invasive chronic disease management, are mainly driving the overall segment and market growth.

And, the ambulatory clinics & ASCs segment will register the fastest growth during 2025-2034. A wider emphasis on quick turnaround, sterility, and portability makes disposable sensors indispensable for monitoring patient vitals and assisting surgical interventions are boosting the segment developments. As well as other recent advancements in continuous glucose monitors (CGMs), wearable continuous vital sign monitors, and disposable endoscopes, fueled by a need for enhanced patient safety, reduced infection risk, and accelerated remote patient monitoring capabilities, are widely expanding their adoption in the progressing ASCs. Major benefits of this segment are a rise in workflow efficiency and patient safety in outpatient settings, in which minimally invasive procedures are highly incorporated.

By commercial mode, the per-unit/consumable sales segment led the disposable medical sensors market in 2024. The segment is majorly impacted by the growing need for biosensors, temperature sensors, and wearable patches, which are sold to hospitals and other healthcare accommodations for immediate, single-patient use. Whereas the accelerating efforts in innovations, including the VivaLNK platform, novel CMOS image sensors for minimally invasive procedures, and expanded technologies for diabetes and COVID-19 management, likewise Medtronic MiniMed 780G system and Philip Biosensor BX100, are further boosting their wide range of applications at the commercial model.

On the other hand, the device + consumable co-pack segment is predicted to expand at the fastest CAGR during 2025-2034. This segment usually consists of an integrated, ready-to-use solution for remote patient monitoring and home-based care, bundling a reusable sensor device with disposable, single-use components that work together for accurate data collection and analysis. Primarily, these kinds of modes are a tiny, frequent reusable, sensor device with single-use, disposable consumables (e.g., probes, cartridges, strips) that are employed with the device for each monitoring period. Moreover, continuous developments in miniaturization, smart integration, and sustainability for applications like food packaging and medical devices are increasingly expanding their overall applications.

North America was dominant in the disposable medical sensors market share 40% in 2024. The region is driven by its high per-capita chronic disease monitoring, strong consumer adoption of SMBG/CGM, and large hospital procurement budgets. As well as this region is mainly aiming at innovations in miniaturization, flexible electronics, MEMS technology, and advanced data processing, including AI, which are evolving into more accurate, compact, and user-friendly sensors. Along with this, the expansion is propelled by the accelerating demand for affordable measures, a push for remote patient care, and an emphasis on eliminating healthcare-associated infections (HAIs).

The wider focus on the rising demand for at-home diagnostics and point-of-care devices, like glucose monitoring strips and pulse oximeters, is expanding the US market. Apart from this, a huge use of these sophisticated sensors in monitoring critical signs during and after surgical procedures and in managing chronic diseases through therapeutic devices, especially insulin pumps and smart catheters, is also impacting this region development.

For this market,

The Canadian government is stepping in to enhance healthcare access, escalate healthcare infrastructure, support technological innovation, also boost the expansion of the disposable medical sensors market in Canada. Besides this, developing IoT integration, wearable technology, and the use of disposable strips for home glucose monitoring are highly fueling this regions market expansion.

During the forecast period, the Asia Pacific is anticipated to expand rapidly due to the accelerating cases of diabetes, mainly in China and India. Additionally, the ASAP market encompasses several efforts by diverse governments in the heavy investments made in the development of healthcare infrastructure. This further assists in improving patient comfort and minimizing hospitalization spending, with raised demand for home-use disposable medical sensors.

For instance,

The disposable medical sensors market has major R&D stages, including a significant start from conceptualization and feasibility studies for a certain need, going through prototype design and development, and then to rigorous design and material qualification for disposability and function.

Key Players: Dexcom, Inc., Gentag, Inc., Starboard Medical Inc., and SSI Electronics, etc.

This mainly comprises the beginning of preclinical research (bench testing, simulations, animal studies), followed by the submission of an Investigational New Drug (IND) for human trials.

Key Players: Stryker Sustainability Solutions, Sheba Medical Center, and The Cleveland Clinic, etc.

The disposable medical sensors market is accelerating patient support and services by facilitating continuous, real-time monitoring outside clinical settings, optimizing diagnostic accuracy, and reducing hospital-acquired infections (HAIs) through single-use, sterile applications.

Key Players: Medtronic, Philips Healthcare, Abbott Laboratories, GE Healthcare, etc.

By Product Type

By Technology / Sensing Principle

By Application / Clinical Use

By End User / Setting

By Commercial Mode

By Region

March 2026

March 2026

March 2026

March 2026