January 2026

The global smart medical devices market size is calculated at US$ 26.62 billion in 2025, grew to US$ 28.55 billion in 2026, and is projected to reach around US$ 53.65 billion by 2035. The market is expanding at a CAGR of 7.26% between 2026 and 2035.

2025 and the coming era are emphasizing innovations in chronic disease management, preventive care solutions, and advanced home healthcare approaches, which are fueling the overall smart medical devices market expansion. Moreover, the digitalizing globe is increasingly establishing AI and ML-guided health solutions to enhance remote patient monitoring, robotic surgery, and innovative advanced implantable sensors. Also, the ongoing vast production of smart wearables is impacting its wider demand with increased flexibility and accuracy in the chronic issues.

| Table | Scope |

| Market Size in 2025 | USD 26.62 Billion |

| Projected Market Size in 2035 | USD 53.65 Billion |

| CAGR (2026 - 2035) | 7.26% |

| Leading Region | North America 43% |

| Market Segmentation | By Product Type, By Technology, By Application, By End User, By Region |

| Top Key Players | Abbott Laboratories, Medtronic, Philips Healthcare, GE HealthCare, Siemens Healthineers, Dexcom Inc., Insulet Corporation, Omron Healthcare, Fitbit (Google/Alphabet), Apple Inc., Garmin Ltd., Boston Scientific Corporation, Johnson & Johnson (Biosense Webster, etc.), Roche Diagnostics, Withings, iRhythm Technologies, Masimo Corporation, AliveCor Inc., NeuroMetrix Inc., Biotronik |

The smart medical devices market consists of connected, sensor-enabled, and intelligent devices used for monitoring, diagnosis, and treatment of patients in real time. These devices integrate IoT, AI, data analytics, and wireless communication to improve clinical decision-making, patient engagement, and chronic disease management. Applications range from wearable biosensors and smart implants to connected diagnostic tools and therapeutic devices. Rising demand for remote monitoring, personalized healthcare, chronic disease burden, and telehealth expansion are major drivers of market growth.

Around the world, the widespread adoption of digital health solutions and breakthroughs in wireless technologies are acting as significant growth factors in the respective market expansion.

The fastest FDA-approved devices and advancements in generative AI and foundation models are supporting the overall AI application in novel technologies. Besides this, the emergence of AI-enabled imaging software, such as that by Aidoc, assists in the analysis of medical scans like X-rays and CT scans. This further helps in the identification of vital conditions, particularly collapsed lungs or signs of breast cancer. AI also provides smart wearables to track heart health and find issues like atrial fibrillation, alerting users and providers to possible concerns.

Global Emphasis on Health Consciousness

The global smart medical devices market is driven by combined factors, like a rise in chronic conditions, expanding demand for remote patient monitoring, and personalized care. Additionally, the rising worldwide awareness regarding physical health and the advantages of proactive healthcare propels the adoption of smart devices, mainly wearable technologies for fitness tracking and preventive care. Robust government support and exploration of telemedicine and digital healthcare initiatives by policymakers are crucial for innovations in smart medical device solutions.

Arising Concerns About Expenses and Data Privacy

Highly developed smart medical devices use advanced technology, which is creating a barrier to expenditure for individuals and healthcare providers. Additionally, these devices, like wearables, offer the collection of large personal health data through sensors and cloud connectivity, raising critical privacy issues.

Expansion in 5G Technology and Diagnostics

Globally ongoing digitalization in the healthcare sector is supporting the growth of the global smart medical devices market in the future. This encompasses the broader range of applications of nanotechnology, and biointegrated sensors will merge as non-invasive methods for finding biomarkers in sweat, tears, or breath, delivering early screening for diseases, such as cancer and cardiovascular conditions. Alongside, other integrated 5G technologies will allow rapid data transfer and enhanced connectivity, which will develop novel potentials for the functionality and application of smart medical devices.

In 2024, the diagnostic & monitoring devices segment registered dominance in the market. The segment is mainly driven by a rise in demand for robust real-time health monitoring, early disease detection, customized patient engagement, and more effective management of long-term illnesses. Currently, the research area is working on innovations in flexible lab-on-skin devices and wearable biosensors for sweat diagnostics, as well as portable tools, such as AI-guided ultrasound and digital stethoscopes for remote application.

However, the smart wearables segment is predicted to expand rapidly during 2025-2034. Eventually, the globe is putting efforts to raise health and fitness awareness, and remote patient monitoring is boosting the widespread demand for these wearables. Ongoing drifts are emphasizing leveraging biocompatible sensors for detailed integration, smart textiles with embedded health-monitoring capabilities, on-body drug delivery systems for treatment, and advances in manufacturing for strong production. Moreover, the digitalization is imposing novel wearable systems to deliver drugs, especially Narcan for opioid overdose or insulin.

In 2024, the wireless & IoT-enabled devices segment captured a major share of the smart medical devices market. Widely advancing sensor technology, Wi-Fi, and other connectivity options, alongside cloud computing and AI, are supporting the progression in this type of technology. Furthermore, the market is developing several IoT devices, including smart inhalers and connected glucose monitors facilitate personalized monitoring and medication reminders, leading to improvements in chronic disease management for conditions like diabetes and asthma. This technology encompasses significant applications, like remote robotic surgery, decentralized clinical trials, and smart hospital management.

On the other hand, the AI & machine learning-integrated devices segment is anticipated to witness rapid growth. This era is elevating breakthroughs in data processing for diagnostics, mainly radiology and cardiology, and government steps promoting R&D and digital health adoption are influencing the overall market development. As well as these devices further demonstrate accelerated image analysis for disease determination, tailored treatment strategies based on patient data, and predictive analytics for proactive health management. Alongside, they are offering the transformation in robotic surgery and real-time patient tracking, focusing on optimizing accuracy, simplifying workflows, and lowering manual error.

The chronic disease management segment accounted for the biggest share of the market in 2024. Globally rising geriatric population, various chronic diseases, and wider emphasis on adopting advanced preventive care are escalating the use the smart medical devices in CCM. The digital health solutions in these cases, comprising innovative and smart insulin pens, connected blood pressure monitors, and wearable ECGs, aim to revolutionize care for diabetes, cardiovascular, and respiratory concerns. Involvement of connected devices and telehealth platforms is enabling continuous monitoring and timely intervention from afar, and further enhances access and efficiency.

Alongside, the patient monitoring & preventive care segment is estimated to register rapid growth in the upcoming era. Primarily, the growing burden of chronic issues, like diabetes, hypertension, heart concerns, and other severe issues, requires long-term monitoring to resolve these issues, impacting the broader demand for medical devices. Nowadays, the public is highly using sophisticated tools, particularly smart otoscopes and dermatoscopes for non-invasive examinations, alongside portable, AI-enabled ultrasound systems and smart pill dispensers for medication adherence, which are increasingly promoting preventive care among patients and healthcare professionals. Also, the expanding applications of highly advanced biosensors are supporting continuous patient monitoring.

In the smart medical devices market, the hospitals & clinics segment registered dominance with a major share in 2024. The segment is propelled by the escalating demand for patient-centric care, for which hospitals and clinics are widely dependent on the real-time, data-driven insights offered by smart devices for decision-making, mainly for diagnostics and treatment, with improved patient outcomes. Hospitals are currently looking for the application of autonomous nursing robots that can help in tasks, including sanitation and supply delivery, whereas surgical robots deliver expanded precision and minimally invasive procedures. Innovations in the utilization of Internet of Medical Things (IoMT) for interconnected devices, 3D printing for personalized implants, and advanced telehealth platforms are also greatly assisting these healthcare facilities.

Moreover, the home healthcare segment will witness rapid expansion during 2025-2034. Inclusion of diverse devices, like blood glucose monitors, pulse oximeters, blood pressure monitors, smart pill dispensers, CPAP/BiPAP machines & ventilators, and wearable ECG sensors, is broadly used in home healthcare. Although consistent developments in medical devices consisting of biometric monitoring devices, likewise cardiac implantable monitors and neurostimulators, provide continuous, real-time data for long-term patient surveillance is also further boosting the comprehensive home healthcare area.

North America accounted for the largest revenue share of the smart medical devices market share 43% in 2024. This region comprises wider, stronger digital health adoption, FDA-approved smart devices, and also, the rising chronic disease prevalence is accelerating demand for novel and highly developed smart medical devices.

For instance,

In September 2025, Olympus Corp., a global medical technology company, made an exclusive global distribution agreement with MacroLux Medical Technology Co., Ltd. to distribute single-use urology products.

In June 2025, iGan Partners did a Seed+ financing round for Cosm Medical, a medical device company revolutionizing pelvic health through personalized gynecological care.

In the future, the Asia Pacific is estimated to grow rapidly in the smart medical devices market due to a large patient pool. Along with this, ASAP’s various countries' governments are stepping into government-backed digital health initiatives, which are also expanding the adoption of innovative medical solutions. Also, the growing wearable adoption in China, India, and Japan is highly fostering ASAP’s market expansion. ASAP is also bolstering the development of connected pacemakers and knee systems, and improving local R&D and manufacturing to meet regional demand.

In June 2025, the Arab Organization for Industrialization (AOI) and Chinese company XGY Medical Devices fostered a partnership agreement to evolve the Arab-Chinese Medical Industries Company for localizing medical device manufacturing.

In June 2025, HekaBio K.K. signed a strategic partnership agreement with Alfresa Holdings Corporation, the leading pharmaceutical wholesaler group in Japan, to boost the commercialization of innovative medical products in Japan.

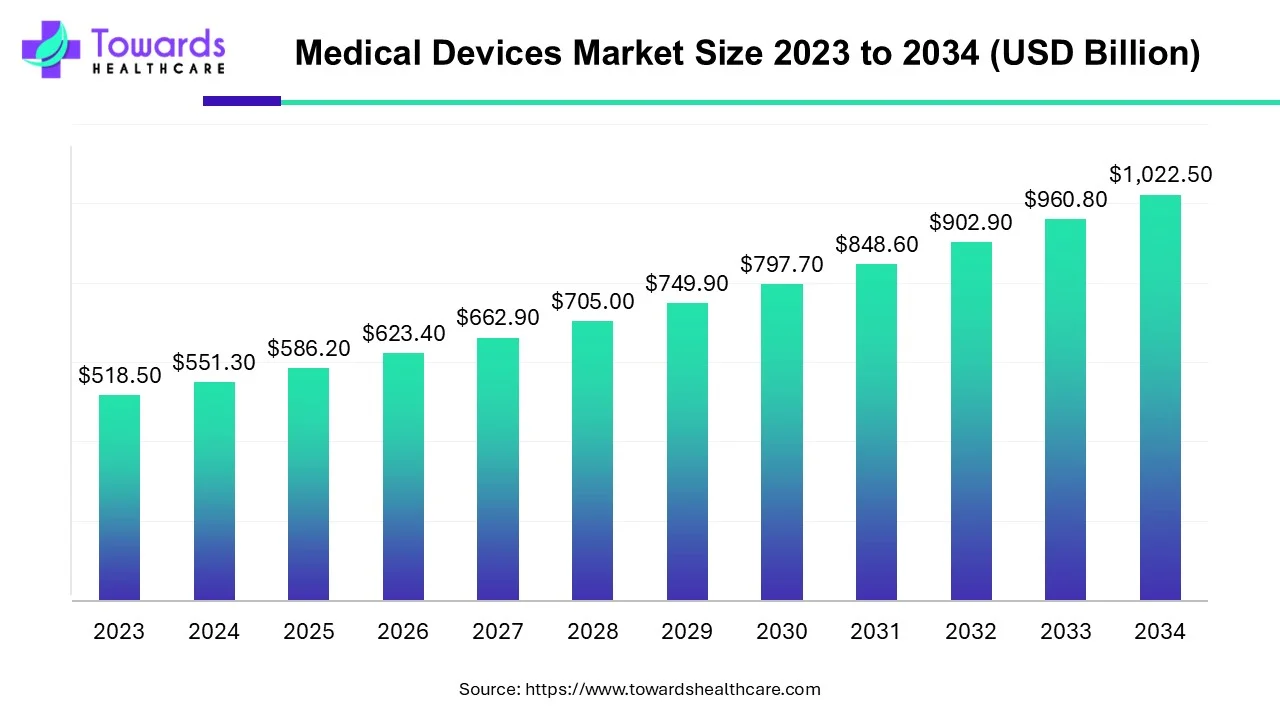

The global medical devices market size is calculated at USD 586.20 billion in 2025, grew to USD 623.37 billion in 2026, and is projected to reach around USD 1083.96 billion by 2035. The market is expanding at a CAGR of 6.34% between 2026 and 2035. Technological advancements and favorable government policies drive the market.

The global smart medical devices market consists of finding a need, subsequently conceptualization, prototyping, and iterative testing to ensure the device's safety and effectiveness.

Key Players: Medtronic, Siemens Healthineers, and GE Healthcare, etc.

This can be done either by complex supply chains involving manufacturers, authorized distributors, or e-commerce/online platforms, while ensuring devices are stored in proper conditions and transported safely to healthcare providers.

Key Players: McKesson and Cardinal Health, Henry Schein, Entero Healthcare, etc.

The global market includes diverse technical assistance, patient education, regulatory compliance support, post-market surveillance, and remote patient monitoring, delivered via specialized contact centers, online portals, and field support.

Key Players: Medtronic, McKesson, e-Sanjeevani, and other platforms.

By Product Type

By Technology

By Application

By End User

By Region

January 2026

January 2026

January 2026

January 2026