January 2026

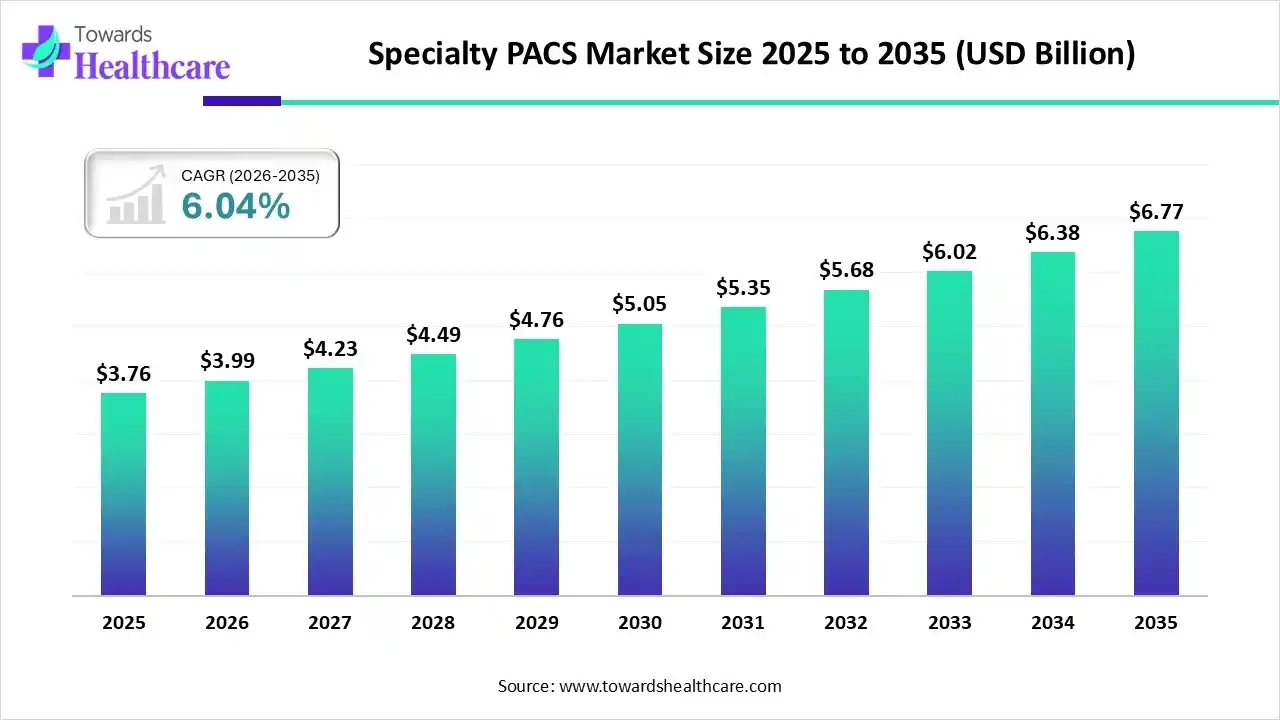

The global specialty PACS market size was estimated at USD 3.76 billion in 2025 and is predicted to increase from USD 3.99 billion in 2026 to approximately USD 3.76 billion by 2035, expanding at a CAGR of 6.04% from 2026 to 2035.

The growing digitalization and increasing chronic diseases are increasing the demand for specialty PACS. AI technologies are being integrated with these systems to enhance their features and applications, where robust healthcare, expanding clinics, and government initiatives are encouraging their adoption in various regions. Additionally, the companies are investing, collaborating, and launching new specialty PACS, promoting the market growth.

| Key Elements | Scope |

| Market Size in 2026 | USD 3.99 Billion |

| Projected Market Size in 2035 | USD 3.76 Billion |

| CAGR (2026 - 2035) | 6.04% |

| Leading Region | North America |

| Market Segmentation | By Product Type, By Deployment Model, By Component, By Application, By Region |

| Top Key Players | GE HealthCare, Philips Healthcare, Siemens Healthineers, Fujifilm Healthcare, Sectra AB, IBM Watson Health/Merge Healthcare, Infinitt Healthcare, Novarad, Carestream Health |

The specialty PACS market is driven by the increasing volume of medical imaging, the geriatric population, and technological advancements. The specialty PACS refers to picture archiving and communication systems designed specifically for individual clinical specialties beyond traditional radiology. These systems enable the acquisition, storage, retrieval, management, sharing, and visualization of medical images generated in departments such as cardiology, pathology, orthopedics, oncology, ophthalmology, women’s health, dentistry, dermatology, and other specialty domains.

The graph represents the comparison between the cancer cases in the years 2025 and 2035 in the U.S. It indicates that there will be growth in the cancer cases, which will increase the demand for specialty PACS, and ultimately promote the market growth.

The use of AI in the specialty PACS is increasing as it provides automated imaging analysis. It also helps in differentiating the critical cases and organizing studies, which promotes the imaging of the diseases. Moreover, the tumor size, biomarkers, and organ volumes are also being measured by AI, where their accuracy and image quality are also enhanced. Additionally, it helps in remote diagnosis and predicts disease progression, which is increasing its use, reducing the manual workload and errors.

The expanding hospital, clinics, and diagnostic centres are increasing the adoption of cloud or hybrid specialty PACS. They offer easier and faster data sharing, scalability, and reduced upfront cost, which is driving their innovations.

The use of cloud-based specialty PACS is promoting remote diagnosis and is supporting telemedicine, enabling healthcare professionals to view and interpret images anywhere, enhancing patient comfort and adherence to the treatment.

The growing innovations of specialty PACS are increasing their use across various areas such as pathology, ophthalmology, cardiology, and orthopedics.

The specialty PACS are being integrated with AI technologies to enhance the image analysis, workflow, accuracy, speed, and promote automated diagnostics.

The increasing incidence of chronic diseases and an aging population is increasing the demand for specialty PACS for accurate and early diagnosis of diverse diseases.

The growing digitalization is driving the adoption of specialty PACS, where the growing government initiatives and investments are promoting their utilization.

How Radiology PACS Segment Dominated the Specialty PACS Market in 2025?

The radiology PACS segment led the market with a 38% share in 2025, due to growth in the imaging volumes. Moreover, they were integrated with multiple imaging modalities, where their high adoption rates also increased their use. Additionally, they were also used for tele-radiology and remote consultations.

The pathology PACS segment is expected to show the fastest growth rate during the forecast period, due to growing cancer cases. At the same time, the growing remote diagnosis and virtual consultations are also increasing their use. Furthermore, the companies are integrating AI technologies to enhance their accuracy.

What Made On-Premise PACS the Dominant Segment in the Specialty PACS Market in 2025?

The on-premise PACS segment held the largest share of 46% in the market in 2025, driven by its growing installation in hospitals. These systems also provided enhanced performance, maintenance, and customization, which increased their use. Moreover, the regulatory compliance also provided security and privacy protection, where their faster imaging also promoted their use.

The cloud-based PACS segment is expected to show the highest growth during the forecast period, due to its improved scalability. They also provided automatic updates and maintenance, which is increasing their utilization. Additionally, their easy integration with AI technologies, enhanced access, and lower upfront cost are also increasing their demand.

Why Did the Software Segment Dominate in the Specialty PACS Market in 2025?

The software segment led the market with a 62% share in 2025, as it is the essential component. As this software offers image storage, viewing, sharing, and retrieval, its use in the healthcare sector has increased. Moreover, they were integrated with advanced features, which enhanced their accuracy and efficiency.

The services segment is expected to show the fastest growth rate during the forecast period, due to growing installations. These systems also require timely maintenance and technical support, which is increasing their demand. Moreover, the growing demand for security and backups is also increasing the use of cloud-based PACS systems.

Which Application Type Segment Held the Dominating Share of the Specialty PACS Market in 2025?

The archiving & image management segment held the dominating share of 42% in the market in 2025, as it is the core function of the PACS. Due to growth in the imaging volumes and compliance with the regulatory standards, their adoption rates increased. They were also integrated with other imaging systems, where their enhanced access also increased their use.

The tele-diagnostics/remote viewing segment is expected to show the highest growth during the forecast period, due to its increasing use in telemedicine and remote consultation. Furthermore, their growing integration with advanced technologies is also enhancing their accuracy and accessibility, which is increasing their use across remote areas.

North America dominated the specialty PACS market with 34% in 2025, due to the presence of a well-developed healthcare infrastructure. They contributed to the early adoption of these devices while the industries also developed new systems with the integration of AI, providing advanced features. Moreover, the growth in healthcare investments and growing telemedicine use also increased their use, which contributed to the market growth.

The US consists of robust companies that are developing and supplying PACS, where their growing early adoption is also increasing their use. The growing healthcare expenditure is increasing these innovations, where the regulatory support is also increasing their innovations. Moreover, the growing diseases are increasing the imaging volumes, which is driving their adoption rates.

Asia Pacific is expected to host the fastest-growing specialty PACS market during the forecast period, due to the expanding healthcare sector. This is increasing the adoption of advanced technologies, where the growing chronic diseases are increasing their demand. Furthermore, the growing demand for telemedicine and remote diagnostics, along with government support, is also increasing their use, which is enhancing the market growth.

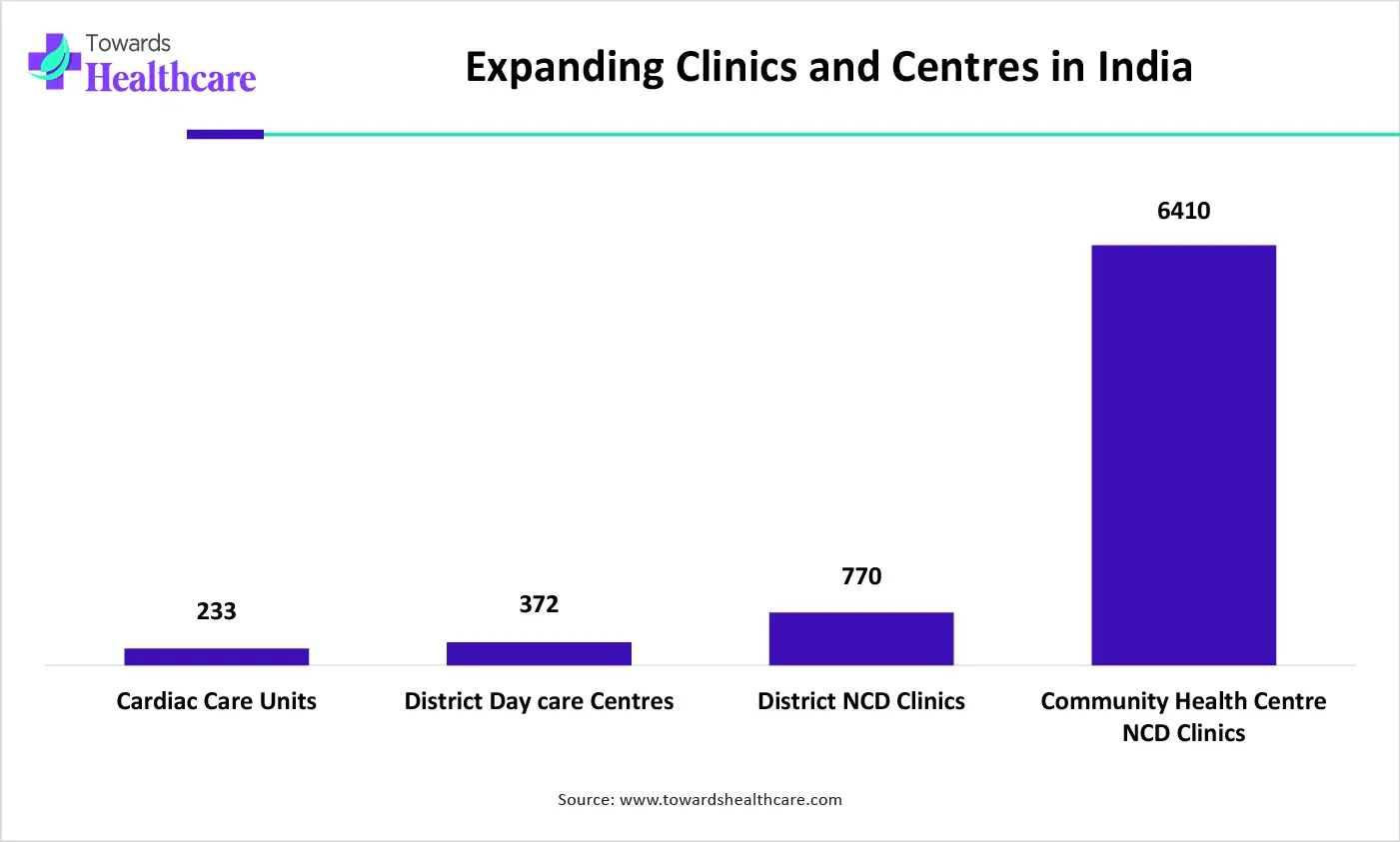

The hospitals and diagnostic centers in India are increasing, which is increasing the utilization of specialty PACS. The growing disease burden is also increasing their use, where the companies are developing digital imaging technology, which is backed by investments from various sources, and the growing remote diagnostics is also encouraging their use.

Europe is expected to grow significantly in the specialty PACS market during the forecast period, due to growing utilization of advanced imaging solutions. The robust healthcare system is increasing its use in the diagnosis of various diseases, where companies are accelerating their development and supplies. The stringent regulations and increasing cancer cases are also increasing their use, promoting the market growth.

The growing government initiatives in the UK are increasing the use of specialty PACS to support telemedicine and remote diagnosis. The well-developed healthcare infrastructure is also increasing the adoption of these systems for efficient imaging. Additionally, the growing chronic diseases are also increasing their adoption rates.

The graph represents the expanding clinics and centers under the government program that is the National Programme for Prevention and Control of Cancer, Diabetes, Cardiovascular Diseases, and Stroke (NPCDCS). It indicates that as the number of centres and clinics increases, the requirement for specialty PACS will also increase, which will ultimately promote the market's growth.

| Companies | Headquarters | Latest Update |

| GE HealthCare | Chicago, U.S. | Provides centricity PACS-IW for cardiology, mammography, etc. |

| Philips Healthcare | Eindhoven, Netherlands | Offer PACS solution for cardiology and radiology |

| Siemens Healthineers | Erlangen, Germany | Provides various imaging solutions |

| Fujifilm Healthcare | Tokyo, Japan | Offers PACS solutions for cardiology and other diagnostic areas |

| Sectra AB | Linkoping, Sweden | Provides imaging solutions for radiology, orthopedics, and digital pathology |

| Intelerad Medical Systems | North Carolina, U.S. | Provides IntelePACS solutions |

| IBM Watson Health/Merge Healthcare | New York, U.S. | Offers Merge PACS software |

| Infinitt Healthcare | Seoul, South Korea | Provides medical imaging technologies |

| Novarad | Utah, U.S. | Offers a full diagnostic suite |

| Carestream Health | New York, U.S. | Provides various PACS solutions for diverse applications |

By Product Type

By Deployment Model

By Component

By Application

By Region

January 2026

January 2026

January 2026

January 2026