February 2026

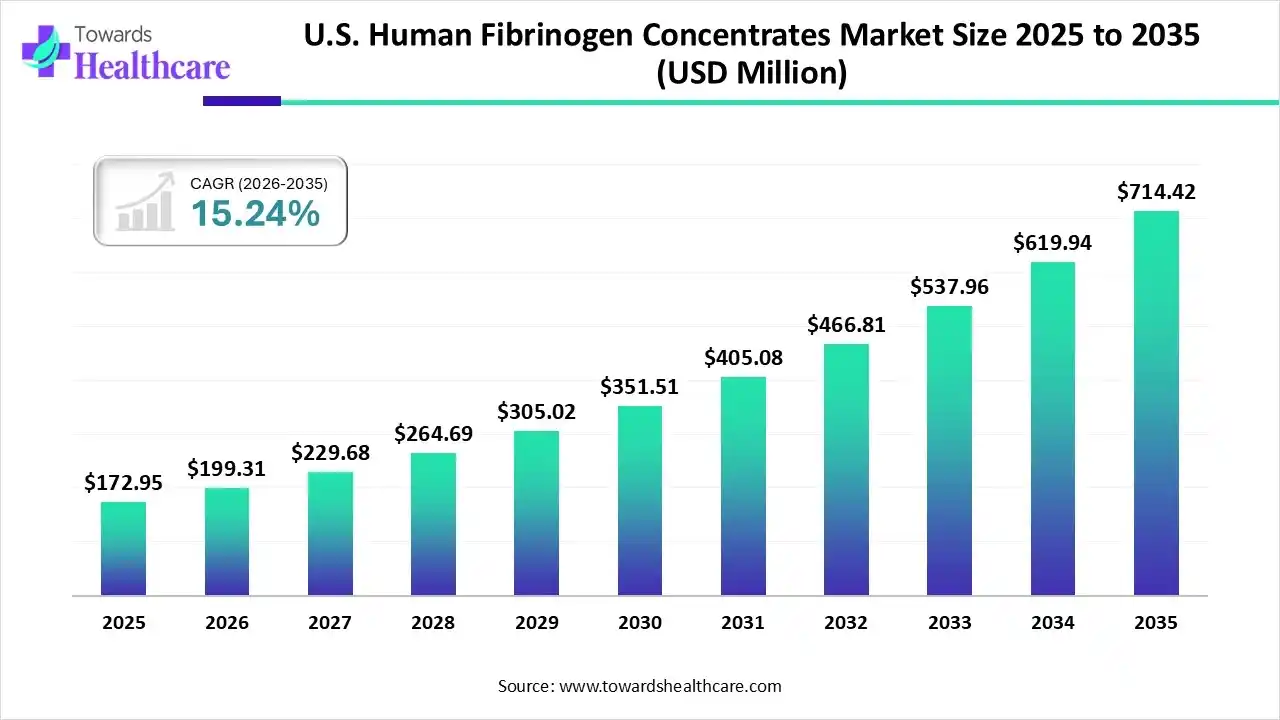

The U.S. human fibrinogen concentrates market size was estimated at USD 172.95 million in 2025 and is predicted to increase from USD 199.31 million in 2026 to approximately USD 714.42 million by 2035, expanding at a CAGR of 15.24% from 2026 to 2035.

The U.S. human fibrinogen concentrates market is significantly driven by a high prevalence of bleeding disorders, a large number of surgical procedures, and major product approvals. The fibrinogen concentrates are highly useful in trauma care and high-risk surgeries.

| Key Elements | Scope |

| Market Size in 2026 | USD 199.31 Million |

| Projected Market Size in 2035 | USD 714.42 Million |

| CAGR (2026 - 2035) | 15.24% |

| Market Segmentation | By Product Type, By Deployment Type, By Application, By End-User, By Region |

| Top Key Players | CSL Behring, Octapharma AG, Grifols, S.A., LFB Group, Baxter International Inc., Kedrion Biopharma, Takeda Pharmaceutical Company Limited, Pfizer Inc., Biotest AG, Haematologic Technologies Inc. |

The U.S. human fibrinogen concentrates market refers to the commercial and clinical segment focused on the production, distribution, and application of purified human fibrinogen products used to treat patients with congenital or acquired fibrinogen deficiencies. These concentrates play a crucial role in managing bleeding disorders, particularly in surgical, trauma, and haematological settings.

Human fibrinogen concentrates offer rapid hemostasis, reduce the risk of transfusion-related complications, and are increasingly preferred over traditional plasma-derived products due to standardized dosing, safety, and ease of administration. The market encompasses all formulations, including lyophilized powders and ready-to-use solutions, and involves a diverse set of stakeholders, including hospitals, specialty treatment centers, and pharmaceutical distributors.

AI contributes to supply chain management, enhances manufacturing efficiency, and assists in post-market surveillance. AI plays a vital role in expanding the U.S. human fibrinogen concentrates market by supporting manufacturing, quality control, predictive maintenance, and inventory management.

How does the Lyophilized Fibrinogen Concentrates Segment Dominate the U.S. Human Fibrinogen Concentrates Market in 2025?

The lyophilized fibrinogen concentrates segment dominated the market in 2025, with a revenue share of 50%, owing to their major advantages in clinical practice, such as standardized and precise dosing, and rapid availability and administration. There are reduced complications, improved safety, and efficacy in bleeding control. They reduce the risk of allergic reactions, volume overload, and transfusion-related acute lung injury.

Liquid Fibrinogen Concentrates

The liquid fibrinogen concentrates segment is expected to grow at the fastest CAGR in the U.S. human fibrinogen concentrates market during the forecast period due to their critical functions in restoring homeostasis, standardized dosing, reduced volume, and ease of use. They reduce the risk of transmitting infectious diseases and enhance safety. They allow for accurate and consistent dosing and treat or prevent excessive bleeding.

What made On-Premise the Dominant Segment in the U.S. Human Fibrinogen Concentrates Market in 2025?

The on-premise segment dominated the market in 2025, with a revenue share of 60%, owing to improved performance, reliability, and enhanced security and compliance associated with on-premise channels. These systems are highly accessible and functional during internet outages. They are important for organizations requiring 24/7 access to their data and applications, even during third-party service disruptions.

Cloud-Based/Centralized Supply Systems

The cloud-based/centralized supply systems segment is estimated to grow at the fastest rate in the U.S. human fibrinogen concentrates market during the predicted timeframe due to improved collaboration and communication, and increased agility and scalability. These systems ensure transparency, cost-efficiency, and advanced analytics. They enable automation of processes and improved risk management and resilience.

How did the Surgical Bleeding Management Segment Dominate the U.S. Human Fibrinogen Concentrates Market in 2025?

The surgical bleeding management segment dominated the market in 2025, with a revenue share of 40%, owing to the major role of human fibrinogen concentrates in surgical settings for rapid and targeted therapy and reduced transfusion needs. The human fibrinogen concentrates serve as a critical alternative to traditional blood products in certain high-risk surgeries. They effectively manage bleeding and avoid the risk of transfusion-related acute lung injury or volume overload.

Congenital Fibrinogen Deficiency

The congenital fibrinogen deficiency segment is anticipated to grow at a notable rate in the U.S. human fibrinogen concentrates market during the upcoming period due to the vital role of fibrinogen as an important protein for blood clotting. This protein allows the formation of stable fibrin clots to stop bleeding and promote healing. It is effective for managing joint bleeds, nose bleeds, and gastrointestinal bleeds.

Why did the Hospitals & Surgical Centers Segment dominate the U.S. Human Fibrinogen Concentrates Market in 2025?

The hospitals & surgical centers segment dominated the market in 2025, with a revenue share of 60%, owing to the clinical applications of human fibrinogen concentrates in treating massive trauma, cardiac surgery, postpartum hemorrhage, and congenital fibrinogen deficiency. Fibrinogen concentrates are studied across spinal, orthopedic, and liver transplant surgeries to manage bleeding and reduce dependency on traditional blood products. They are also used in treating rare inherited disorders like hypofibrinogenemia and afibrinogenemia.

Pharmaceutical & Biotech Companies

The pharmaceutical & biotech companies segment is predicted to grow at a rapid rate in the U.S. human fibrinogen concentrates market during the studied period due to the increased pharmaceutical industry focus on product formulation, quality, and safety. The biotechnology companies prioritize robust R&D, drug discovery, clinical trials, and strategic collaborations. The major pharmaceutical and biotechnology companies in the market are LFB Group, Grifols S.A., Ethicon, CSL Behring, etc.

U.S. Human Fibrinogen Concentrates Market Analysis

In August 2024, the U.S. Food and Drug Administration (FDA) approved the fibrinogen (human) lyophilized powder for reconstitution, named fibryga, to replace fibrinogen in bleeding patients with acquired fibrinogen deficiency. Moreover, the leading companies like Octapharma, U.S., are setting new standards in patient bleeding management. The U.S. government is dedicated to enabling the use of these products in federal healthcare settings and the regulatory approval process through the FDA.

| Sr. No. | Name of the Company | Headquarter | Latest Update |

| 1 | CSL Behring | King of Prussia, Pennsylvania, USA | In October 2025, CSL Behring signed a letter of intent with the Pan-Canadian Pharmaceutical Alliance for the first gene therapy for hemophilia. |

| 2 | Octapharma AG | Lachen, Switzerland | Octapharma AG offers a purified and virus-inactivated fibrinogen concentrate. |

| 3 | Grifols, S.A. | Barcelona, Spain | In November 2025, Grifols, S.A. secured 95% of support from investors to improve its €1.3 billion 7.5% senior secured notes. |

| 4 | LFB Group | Puteaux (La Défense), France | LFB Group primarily focused on manufacturing expansion and strategic planning. |

| 5 | Baxter International Inc. | Deerfield, Illinois, U.S.A. | Baxter International Inc. offered its novel products, such as Tisseel Fibrin Sealant and PerClot Polysaccharide Hemostatic System. |

| 6 | Kedrion Biopharma | Castelvecchio Pascoli, Barga, Tuscany, Italy | In June 2025, Kedrion Biopharma reported that it is advancing knowledge in ultra-rare diseases at the ISTH 2025. |

| 7 | Takeda Pharmaceutical Company Limited | Tokyo, Japan | In November 2025, Takeda presented its advances in hematologic cancers and rare blood disorders at the ASH. |

| 8 | Pfizer Inc. | New York City, U.S. | In November 2025, Pfizer reported the U.S. FDA approval for PADCEV plus Keytruda for patients with bladder cancer. |

| 9 | Biotest AG | Dreieich, Germany | In November 2025, Biotest AG obtained approval for the new human fibrinogen Prufibry in Germany. |

| 10 | Haematologic Technologies Inc. | Essex Junction, Vermont, USA | Haematologic Technologies Inc. stays committed to supplying human fibrinogen as a research-use-only (RUO) product. |

By Product Type

By Deployment Type

By Application

By End-User

By Region

February 2026

January 2026

January 2026

January 2026