February 2026

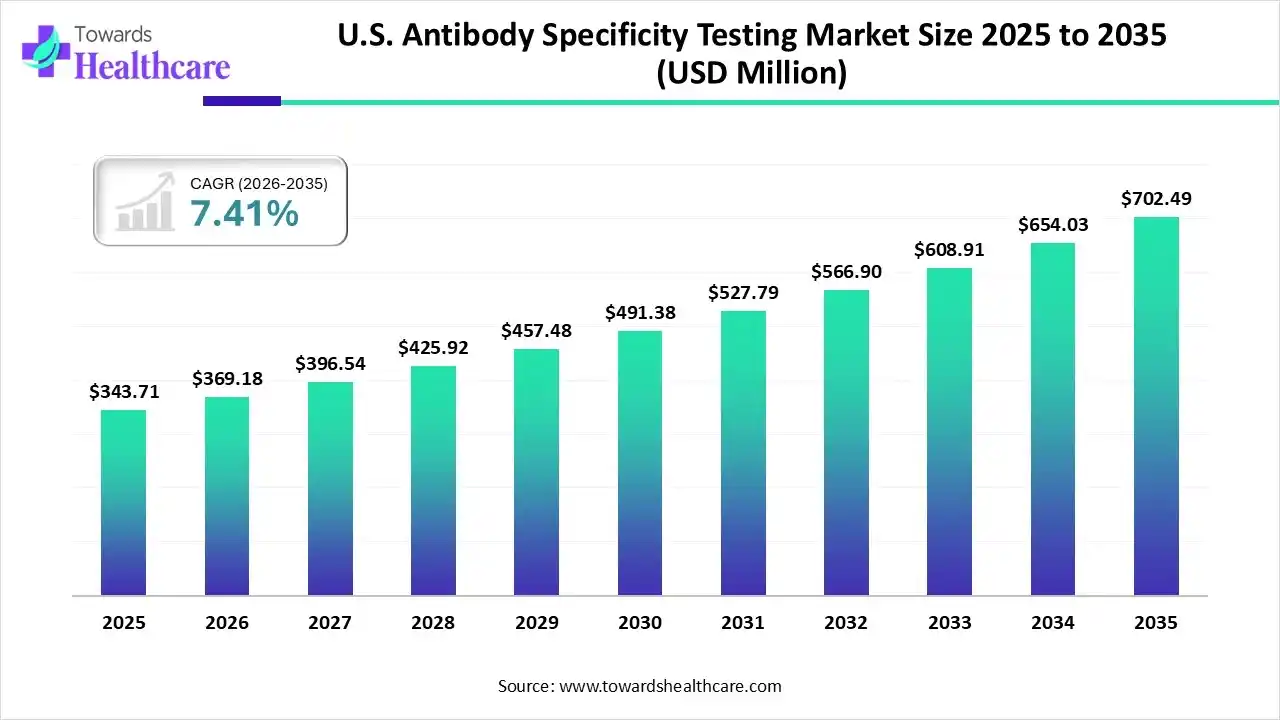

The U.S. antibody specificity testing market size was estimated at USD 343.71 million in 2025 and is predicted to increase from USD 369.18 million in 2026 to approximately USD 702.49 million by 2035, expanding at a CAGR of 7.41% from 2026 to 2035.

The U.S. antibody specificity testing market is growing because, in healthcare settings, high specificity in tests like ELISAs or Western blots, it lowers the challenges of false-positive results, preventing misdiagnosis or needless treatments.

| Key Elements | Scope |

| Market Size in 2026 | USD 369.18 Million |

| Projected Market Size in 2035 | USD 702.49 Million |

| CAGR (2026 - 2035) | 7.41% |

| Market Segmentation | By Product & Services, By Technology, By Application, By End-use |

| Top Key Players | Danaher, Thermo Fisher Scientific Inc., Bio-Rad Laboratories, Inc., Merck KGaA, Cell Signaling Technology, Inc., BD |

High‐throughput platforms are meeting to deliver significant novel workflows for monoclonal antibody discovery and engineering. These processes allow the precise modification, optimization, and expression of antibodies via genetic engineering techniques.

Application of mass spectrometry imaging to instantaneously identify and quantify up to 30 different antibodies in a tissue section. The interaction of MSI with other molecular imaging processes provides highly relevant complementary data to explore novel scientific fields.

The growing trend of personalized medicine is driving significant growth in antibody specificity testing by increasing demand for highly precise, patient-centric diagnostics and therapies, particularly for multifaceted diseases such as cancer.

Which Products and Services Led the U.S. Antibody Specificity Testing Market in 2024?

In 2025, the products segment held the dominant position and is projected to witness the fastest CAGR over the forecast period, as these products are significant tools in diagnostics and research studies. They allow the identification, isolation, and imaging of their target antigens in a wide range of experimental technologies such as western blotting, immunocytochemistry, immunohistochemistry, immunoprecipitation, and ELISA. They confirm that an antibody binds exclusively to its projected target, reducing cross-reactivity with unconnected molecules.

Antibody Validation & Specificity Testing Services

Whereas the antibody validation & specificity testing services segment is the fastest growing in the market, as these services are significant for creating precise and reliable scientific outputs. By employing severe validation methods, scientists ensure antibody specificity, reproducibility, and sensitivity, lowering false positives and negatives. Standardization of validation protocols and open sharing of validation data strengthen scientific integrity and drive the partnership in the scientific community.

Why did the Immunoassay-Based Technologies Segment Dominate the Market in 2024?

The immunoassay-based technologies segment is dominant in the U.S. antibody specificity testing market in 2025, as it enhances the analysis performance by growing the sensitivity, reducing the analysis time, simplifying the assay technology, automating the process, and miniaturizing the analytical tool. This is significant for emergency settings and rural medical care, providing the advantage of immediate diagnosis and treatment decisions.

Genetic Validation-Based Technologies

Whereas the genetic validation-based technologies segment is the fastest growing in the market, as Genetic techniques for antibody validation have many advantages. This technology enables the simultaneous, high-throughput analysis of thousands of protein targets. Antibody-enhanced validation provides additional data to help ensure antibody specificity and performance, and to address the antibody reproducibility crisis.

Why did the Research & Development Segment Dominate the Market in 2024?

The research & development segment is dominant in the U.S. antibody specificity testing market in 2025, which comprises detection biomarkers for significant diseases like diabetes, Alzheimer’s disease, cancer therapy, Parkinson’s disease, and others. It aids in diagnosing infections, evaluating immunity, and monitoring autoimmune conditions.

Clinical Diagnostics

Whereas the clinical diagnostics segment is the fastest growing in the market, as antibody specificity testing detects minute amounts of antigens, confirming precise and reliable outputs. The sensitivity of these tests means that they identify diseases in their early stages, allowing prompt healthcare intervention and increasing the chances of successful treatment. Antibody-driven diagnostics creates the opportunity for targeted medicine by recognizing specific biomarkers that indicate a patient’s response to specific treatments.

Why did the Pharmaceutical & Biotechnology companies Segment Dominate the Market in 2024?

The pharmaceutical & biotechnology companies segment is dominant in the U.S. antibody specificity testing market in 2025, as antibody specificity testing helps major healthcare companies identify potential challenges early, and it saves both time and resources in drug advancement. High specificity reduces off-target binding, avoiding unintended biological responses or toxicity in patients, significant for therapeutic antibodies.

Diagnostic Laboratories

Whereas the diagnostic laboratories segment is the fastest growing in the market, as antibody-based diagnostics lie in the particular affinity antibodies have for their specific antigens. This specificity ensures that the diagnostic tests can precisely detect and identify the presence of some pathogens or biomarkers related to diseases.

U.S.: Increasing Autoimmune Diseases

In the U.S., the growing prevalence of autoimmune diseases and other immune-mediated disorders is associated with an increased risk of malignancy, influenced by long-term inflammation, immune dysregulation, and treatment-related factors, which increases the demand for antibody specificity testing. The advancement of quick, affordable biosensors has allowed detailed monitoring of therapeutic drugs and disease biomarkers in real-time, which drives the growth of the market.

| Company | Headquarters | Latest Update |

| Danaher | United States | In May 2024, Danaher Corporation launched a partnership with AstraZeneca to develop and commercialize novel diagnostic tools and tests intended to help clinicians better determine which patients would most benefit from precision medicine treatments. |

| Thermo Fisher Scientific Inc | United States | In November 2025, Thermo Fisher Scientific Inc., the world leader in serving science, announced 510(k) clearance of the EXENT Analyser and Immunoglobulin Isotypes (GAM) Assay, a first-of-its-kind automated platform for clinical laboratories. The EXENT System combines enhanced sensitivity and automation to provide accurate results, helping clinicians make a fast diagnosis for patients with multiple myeloma and related disorders. |

| Bio-Rad Laboratories, Inc. | United States | Bio-Rad has expanded its portfolio of recombinant monoclonal anti-idiotypic antibodies and SpyCatcher reagents, enhancing support for bioanalytical assay development and antibody drug research. |

| Merck KGaA | Germany | In October 2025, Merck entered into a partnership with Promega Corporation, a global life science solutions and service leader based in Madison, Wisconsin, in the US, to co-develop novel technologies that advance drug screening and discovery. |

| Cell Signaling Technology, Inc. | United States | In 2025, Cell Signaling Technology (CST) will continue to emphasize its commitment to rigorous antibody validation and lot-to-lot consistency. |

| BD | United States | BD (Becton, Dickinson and Company) has significantly expanded its role in antibody specificity and validation through new spectral imaging technologies. |

By Product & Services

By Technology

By Application

By End-use

February 2026

February 2026

February 2026

February 2026