October 2025

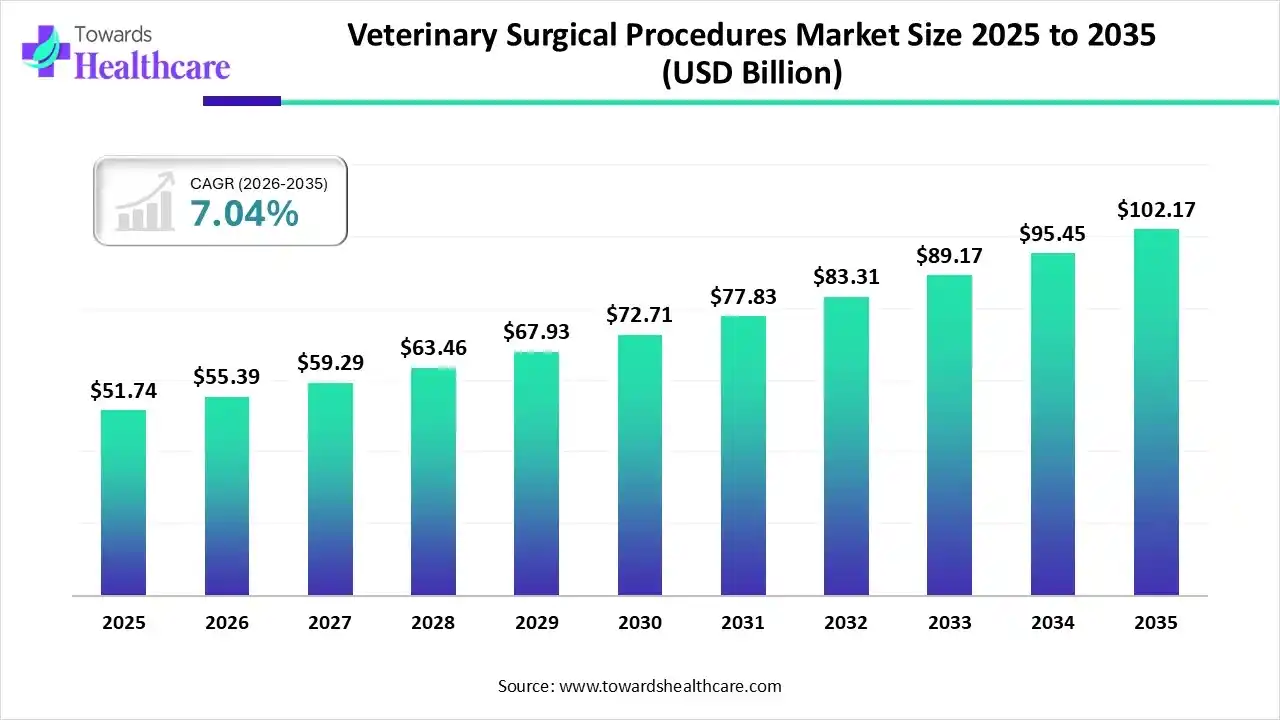

The global veterinary surgical procedures market size was estimated at USD 51.74 billion in 2025 and is predicted to increase from USD 55.39 billion in 2026 to approximately USD 102.17 billion by 2035, expanding at a CAGR of 7.04% from 2026 to 2035.

The growing animal health awareness globally is increasing the demand for veterinary surgical procedures. The growing use of AI, expanding veterinary infrastructure, increasing pet ownership, and new product launches are also promoting the market growth.

The veterinary surgical procedures market is driven by technological advancements and a shift in how society views animals. The veterinary surgical procedures comprise medical interventions performed on animals to treat injuries, diseases, or congenital abnormalities. It ranges from routine elective surgeries like spaying and neutering to complex specialized procedures such as orthopedic reconstructions, neurosurgeries, and oncology-related tumor removals, supported by advanced anesthesia and minimally invasive technologies.

AI plays an important role in the market as it helps in the pre-surgical planning of the veterinary surgical procedures by detecting the abnormalities. They also assist the surgeons, offer real-time animal health monitoring, and diagnostic support, reducing the human error and enhancing outcomes. They are also used in the development of wearable sensors, personalized rehabilitation plans, and workflow optimization.

The growing pet owner awareness is increasing the demand for preventive care solution which is increasing the early use of various veterinary surgical procedures, during routine practices.

Due to growing digitalization, the use of various digital healthcare solutions is increasing to assist the veterinary surgical procedures, offer precise decisions, and enhance the surgical outcomes.

Different types of veterinary surgical tools, such as laparoscopy, robotic surgery, advanced therapeutic implants, and laser systems, are being developed, which are increasing the success rates and the demand for veterinary surgical procedures.

| Key Elements | Scope |

| Market Size in 2026 | USD 55.39 Billion |

| Projected Market Size in 2035 | USD 102.17 Billion |

| CAGR (2026 - 2035) | 7.04% |

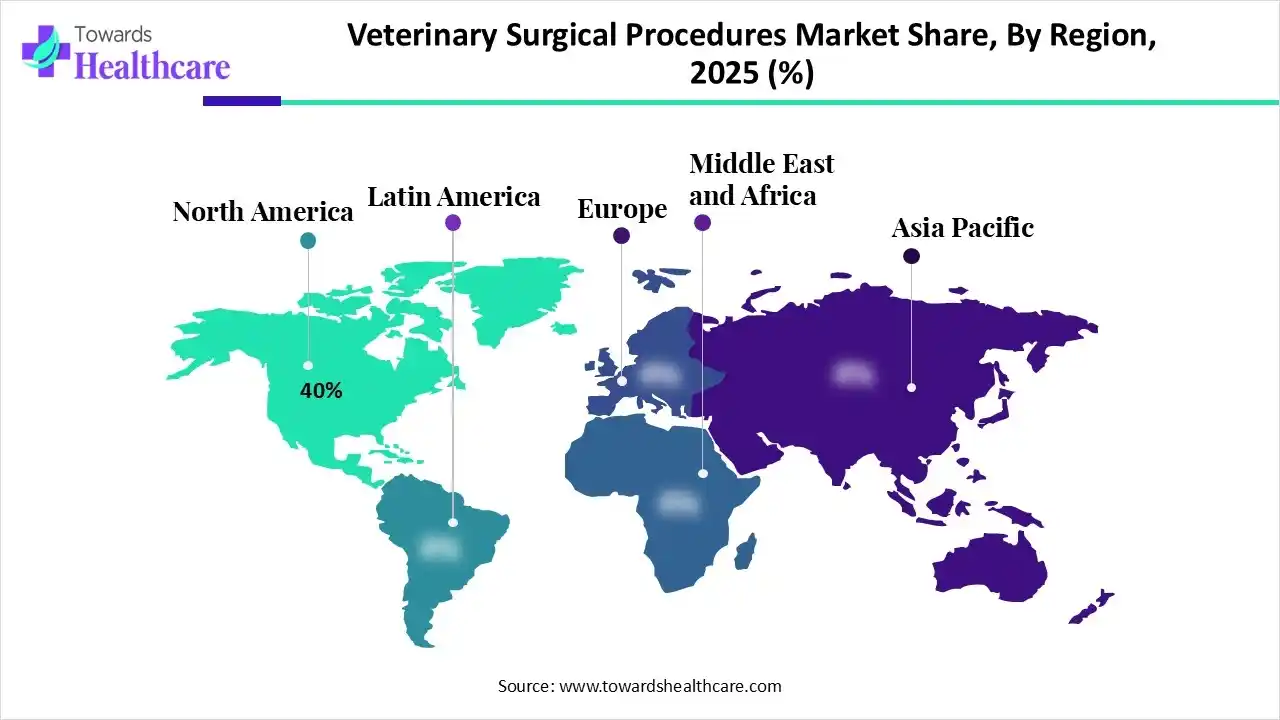

| Leading Region | North America by 40% |

| Market Segmentation | By Procedure Type, By Animal Type, By End-User, By Region |

| Top Key Players | Medtronic plc , B. Braun Melsungen AG, Ethicon Inc. (Johnson & Johnson), Integra LifeSciences Holdings Corp., Smith & Nephew plc, Steris Corporation, Mars Inc. (VCA Animal Hospitals), Zoetis Inc., Covetrus, Inc., Jorgensen Laboratories |

Which Procedure Type Segment Held the Dominating Share of the Veterinary Surgical Procedures Market in 2025?

The spaying/neutering segment held the dominating share of approximate 45% in the market in 2025, due to growth in the pet volumes. This increased their demand, where its adoption as a preventive care solution also increased their adoption rates. Moreover, their affordability and high success rates also increased their acceptance rates.

Orthopedic Surgery

The orthopedic surgery segment is expected to show the highest growth during the predicted time, due to the growing number of pet injuries and degenerative joint diseases. At the same time, the growing pet healthcare spending, increasing surgery success rates, and technological advancements are also increasing their acceptance rates.

Why Did the Small Animals (Dogs/Cats) Segment Dominate in the Veterinary Surgical Procedures Market in 2025?

The small animals (dogs/cats) segment led the market with approximate 65% share in 2025, driven by their increased ownership. Furthermore, the growth in the shift towards pet humanization also increased the demand for their preventive surgical procedures. Additionally, the growth in the veterinary clinics also increased their use, which were backed by investments from various sources.

Exotic Animals

The exotic animals segment is expected to show the fastest growth rate during the predicted time, due to expanding exotic pet clinics and ownership. The growing awareness is also increasing the demand for better surgical care, driving the adoption of advanced surgical tools. Moreover, growing demand for preventive care solutions and willingness to invest in the same is also increasing the use of veterinary surgical procedures.

What Made Veterinary Hospitals the Dominant Segment in the Veterinary Surgical Procedures Market in 2025?

The veterinary hospitals segment held the largest share of approximate 55% in the market in 2025, due to the presence of advanced surgical infrastructures. Additionally, the 24/7 emergency care services and enhanced capability to handle complex cases also increased the reliance on them. The growth in the pet population also increased their demand.

Veterinary Clinics

The veterinary clinics segment is expected to show the highest growth during the upcoming years, due to their rapid expansion. They also offer routine checkups and minor surgeries, which are also increasing their acceptance rates. Furthermore, the presence of skilled personnel and advanced modern equipment’s are also attracting the pet owners.

North America dominated the veterinary surgical procedures market with approximate 40% in 2025, due to growth in pet ownership. The presence of advanced veterinary infrastructure, backed by high veterinary health care spending, also increased the use of various veterinary surgical procedures. The growth in the adoption of advanced technologies also contributed to the market growth.

U.S. Market Trends

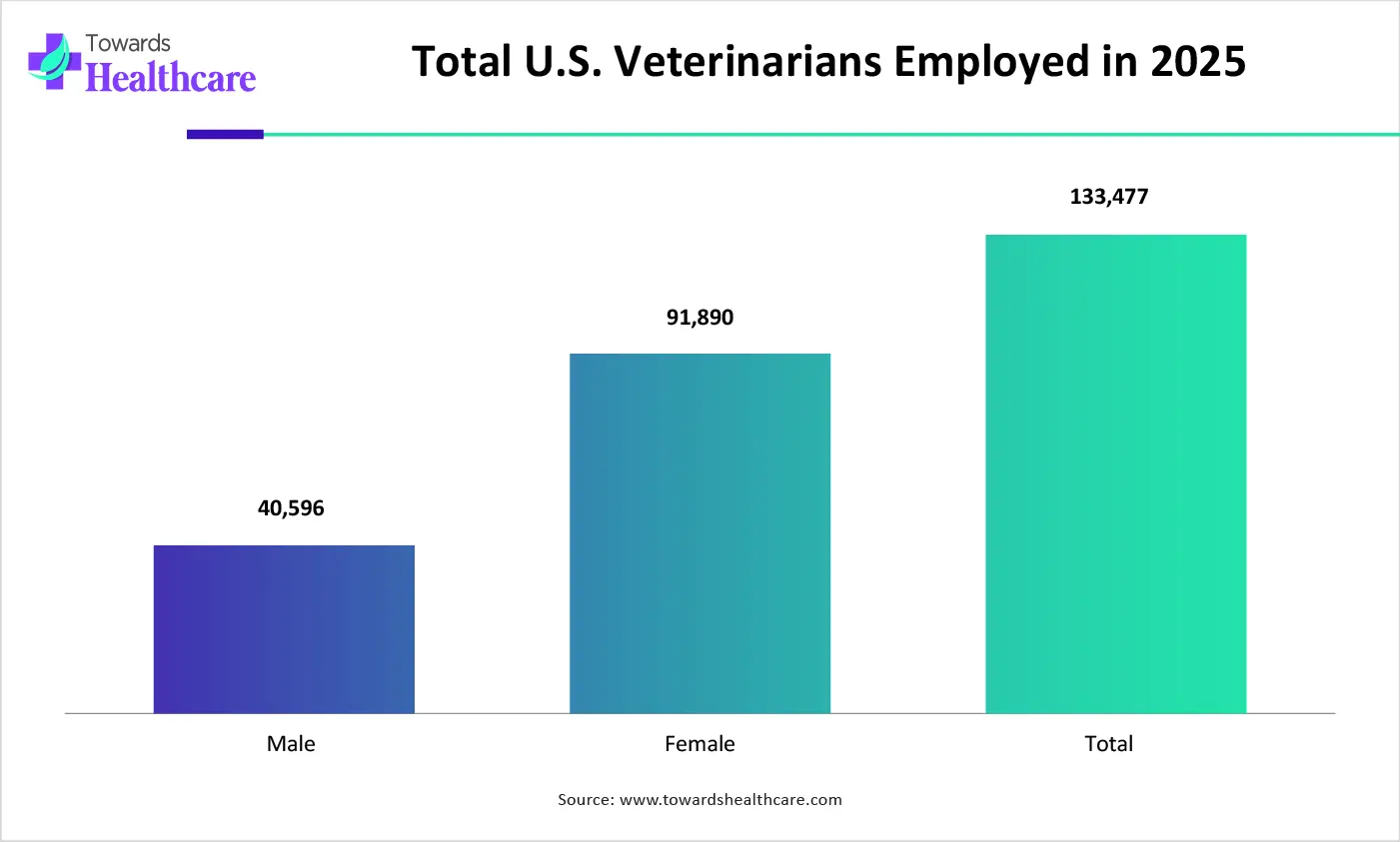

The growing number of pet owners in the U.S. is increasing the routine checkups at veterinary hospitals, which is increasing the adoption of various veterinary surgical procedures. The presence of advanced veterinary infrastructure and technologies is also increasing their use for preventive care.

Asia Pacific is expected to host the fastest-growing veterinary surgical procedures market during the forecast period, due to expanding veterinary clinics, which are increasing the availability of various veterinary surgical procedures. The increasing pet ownership and disposable income are also increasing their demand. Additionally, the growing number of veterinarians and technological innovations are also enhancing the market growth.

India Market Trends

India is experiencing a rise in pet ownership and disposable income, which is increasing the demand for advanced veterinary surgical procedures. The expanding hospitals and clinics are also increasing their use. Moreover, the growing awareness is also increasing the shift towards preventive care.

Europe is expected to grow significantly in the veterinary surgical procedures market during the forecast period, due to the presence of a well-developed veterinary infrastructure. The growing pet humanization and their spending are also increasing the adoption of various veterinary surgical procedures. Additionally, increasing demand for preventive care solutions is also promoting the market growth.

UK Market Trends

The growing veterinary healthcare spending and increasing pet humanization in the UK are increasing the adoption and use of various veterinary surgical procedures. The growing R&D activities are increasing the development of their new solution, which is driving their early adoption, to enhance the surgery success rates.

| Companies | Headquarters | Veterinary Surgical Products |

| Medtronic plc | Dublin, Ireland | General surgical instruments and advanced imaging technologies |

| B. Braun Melsungen AG | Tuttlingen, Germany | Cannular, central venous catheter systems, syringes, and specific surgical instruments |

| Ethicon Inc. (Johnson & Johnson) | Ohio, U.S. | Sutures, trocars, staplers, and endoscopic instruments |

| Integra LifeSciences Holdings Corp. | New Jersey, U.S. | Surgical instruments, neurosurgical, and reconstructive surgery devices |

| Smith & Nephew plc | Watford, England | Orthopaedic reconstruction, trauma products, and advanced wound management solutions |

| Steris Corporation | Ohio, U.S. | Sterilization containers, surgical lighting, and other surgical instruments |

| Mars Inc. (VCA Animal Hospitals) | AniCura, Europe | Soft tissue surgery, emergency trauma, and advanced orthopaedics and oncology solutions |

| Zoetis Inc. | New Jersey, U.S. | Anti-infectives, sedation products, and diagnostic solutions |

| Covetrus, Inc. | Maine, U.S. | Anesthesia systems, orthopaedic power tools, surgical tables, and patient monitors |

| Jorgensen Laboratories | Colorado, U.S. | Cryosurgical kits, orthopedic instruments, and electrosurgery units |

By Procedure Type

By Animal Type

By End-User

By Region

October 2025

October 2025

October 2025

November 2025