February 2026

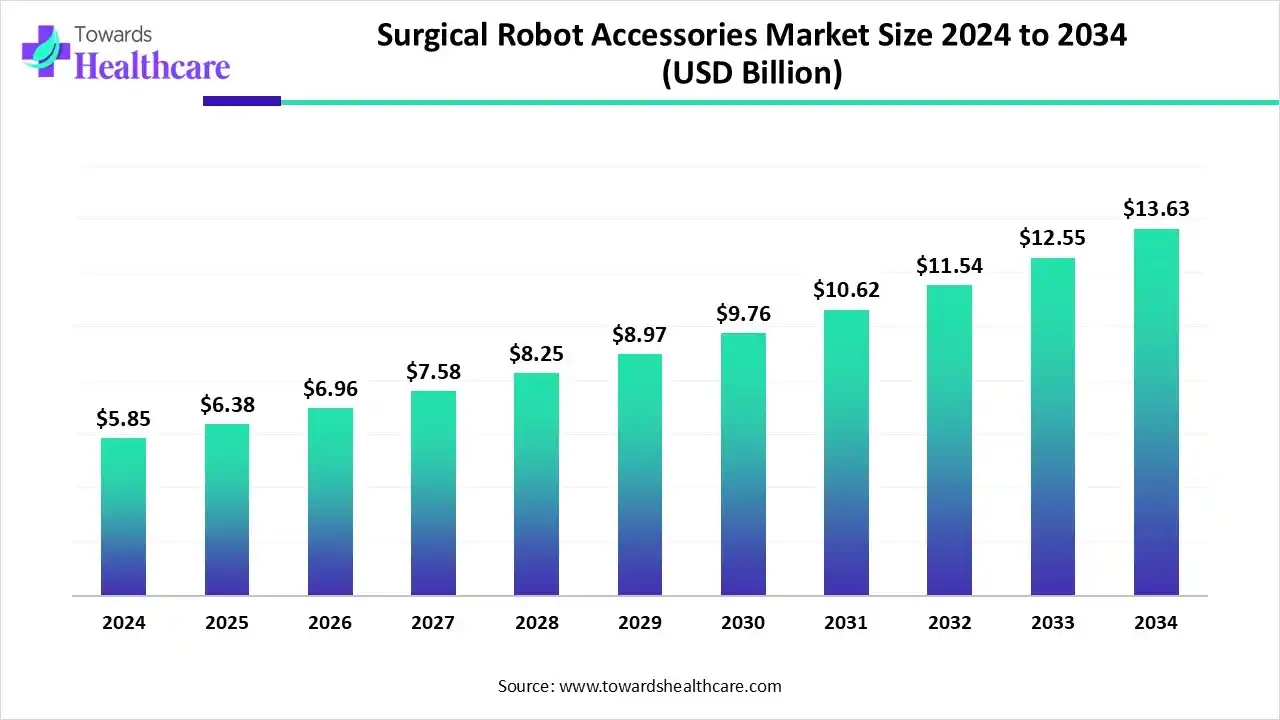

The surgical robot accessories market size marked US$ 5.85 billion in 2024 and is forecast to experience consistent growth, reaching US$ 6.38 billion in 2025 and US$ 13.63 billion by 2034 at a CAGR of 9.07%.

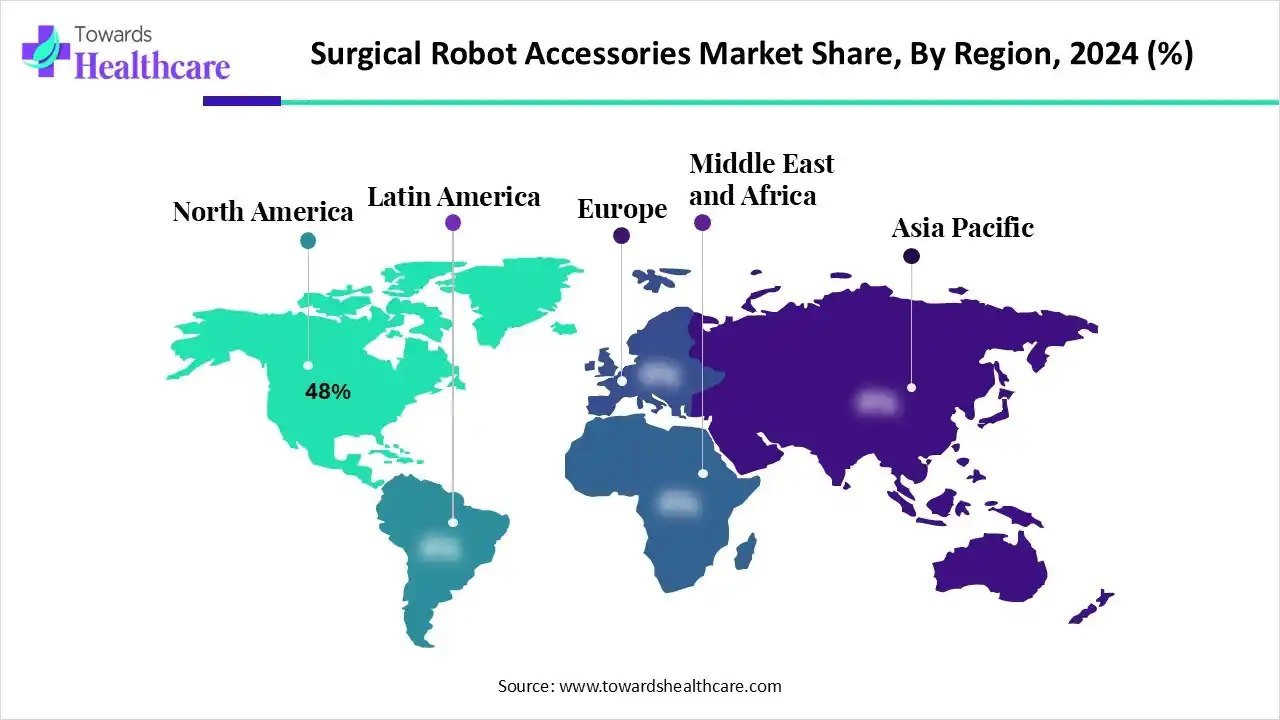

The surgical robot accessories market is witnessing rapid growth, driven by rising adoption of minimally invasive and robotic-assisted surgeries, technological advancements, and increasing demand for precision surgical tools. North America dominates the market due to advanced healthcare infrastructure, strong presence of key manufacturers, and supportive government policies. Continuous R&D and innovation in robotic systems, along with growing surgical procedures globally, are further fueling demand for high-quality, efficient, and specialized surgical robot accessories.

| Table | Scope |

| Market Size in 2025 | USD 6.38 Billion |

| Projected Market Size in 2034 | USD 13.63 Billion |

| CAGR (2025 - 2034) | 9.07% |

| Leading Region | North America by 48% |

| Market Segmentation | By Product Type, By Surgery Type, By Technology, By Usage Pattern, By End User, By Region |

| Top Key Players | Johnson & Johnson (Ethicon / Auris Health), Zimmer Biomet (Rosa Robotics), Smith & Nephew, Asensus Surgical, Inc., Corindus Vascular Robotics (Siemens Healthineers), Globus Medical (ExcelsiusGPS), CMR Surgical, Verb Surgical (J&J + Verily JV), Titan Medical Inc., THINK Surgical, PROCEPT BioRobotics, Virtual Incision, Preceyes BV (Eye Surgery Robotics), Medicaroid Corporation, Microbot Medical, SS Innovations, Meere Company, Inc. |

Surgical robot accessories refer to specialized tools, instruments, and components that support robotic-assisted surgeries. They include items like robotic arms, end-effectors, instruments, and replacement parts, enhancing precision, safety, and efficiency during minimally invasive and complex surgical procedures. The surgical robot accessories market's growth is fuelled by the growing demand for minimally invasive surgeries, the adoption of robotic surgery across several medical specialties, and continuous technological innovation.

For instance,

AI integration is revolutionizing the surgical robot accessories market by enhancing precision, efficiency, and safety. AI-powered systems enable real-time analytics, motion control, and predictive modelling, allowing surgical robots to perform complex procedures with minimal errors. Intelligent algorithms optimize instrument movement and reduce human fatigue, improving overall surgical outcomes. This drives demand for advanced, compatible accessories designed to support AI-enabled robotic systems, such as precision end-effectors and adaptive instruments.

The surgical robot accessories market is rapidly growing due to rising minimally invasive surgeries, AI integration, advanced imaging, hospital adoption, ambulatory center expansion, technological innovation, and increasing demand in North America and the Asia-Pacific.

The surgical robot accessories market is adopting sustainability through reusable instruments, eco-friendly packaging, energy-efficient systems, AI-driven maintenance, circular economy practices, and sustainable manufacturing, reducing waste while enhancing surgical performance and environmental responsibility.

Global expansion of the surgical robot accessories market is driven by rising healthcare investments, adoption of robotic surgeries in emerging regions, technological innovations, strategic partnerships, favorable regulations, and increasing demand for minimally invasive procedures worldwide.

Major investors in the global surgical robot accessories market include SoftBank, Trinity Capital, Eclipse Ventures, Sofinnova Partners, NVIDIA, EQT, Threshold Ventures, and Lux Capital. These investments support the development, commercialization, and global expansion of advanced robotic systems, enhancing surgical precision, AI integration, and accessibility across multiple specialties.

Rising Number of Surgical Procedures

The rising number of surgical procedures, especially minimally invasive and complex surgeries, drives the growth of the surgical robot accessories market by increasing demand for precision instruments, specialized tools, and compatible robotic components, ensuring improved accuracy, efficiency, and patient outcomes.

Complex Installation and Maintenance & Limited Skilled Surgeons

The key players operating in the market are facing issues due to limited skilled surgeons and complex installation, as well as maintenance. Setting up robotic systems requires skilled personnel and ongoing maintenance, which can be challenging. A shortage of trained professionals capable of operating robotic systems restricts widespread use.

Technological Advancements

Technological innovation is a significant driver of growth in the surgical robot accessories market. Advancements in artificial intelligence (AI), robotics, and imaging technologies have led to the development of more precise, efficient, and cost-effective surgical tools.

For instance,

Additionally, in October 2024, the FDA's approval of CMR Surgical's Versius system in 2025 marked a milestone in surgical robotics, expanding the market for compatible accessories. These innovations not only improve surgical precision but also increase the demand for specialized accessories, thereby driving market growth.

| Year | Company/Device | Type of Approval | Notes |

| 2023 | Momentis Surgical Ltd. | 510(k) | FDA clearance for a robotic surgical system. |

| 2023 | Asensus Surgical, Inc. | 510(k) | FDA clearance for the Senhance Surgical System. |

| 2023 | THINK Surgical, Inc. | 510(k) | FDA clearance for robotic knee replacement system. |

| 2023 | Biobot Surgical Pte Ltd | 510(k) | FDA clearance for a robotic surgical system |

| 2024 | Intuitive Surgical, Inc. | 510(k) | FDA clearance for the da Vinci SP Surgical System and accessories. |

| 2024 | Asensus Surgical, Inc. | 510(k) | FDA clearance for the Senhance Surgical System. |

| 2024 | Orthosoft Inc. (Zimmer CAS) | 510(k) | FDA clearance for ROSA Shoulder System |

| 2024 | Rebotix Repair | 510(k) | FDA clearance for robotic surgical system repair services. |

| 2025 | THINK Surgical, Inc. | 510(k) | FDA clearance for robotic knee replacement system. |

| 2025 | Koh Young Technology Inc. | 510(k) | FDA clearance for a robotic surgical system. |

| 2025 | Momentis Surgical Ltd. | 510(k) | FDA clearance for a robotic surgical system. |

| 2025 | Mako Surgical Corp. | 510(k) | FDA clearance for a robotic surgical system. |

| 2025 | Jaco Jacobs | 510(k) | FDA clearance for a robotic surgical system. |

The instruments & accessories segment dominates the market, with a revenue of approximately 74% due to their recurring demand, as they require regular replacement after each surgical procedure. Rising adoption of minimally invasive surgeries, technological advancements in precision tools, and growing surgeon preference for enhanced dexterity and efficiency further strengthen the segment’s dominance.

The vision & imaging components segment is estimated to be the fastest-growing in the surgical robot accessories market due to rising demand for advanced visualization technologies that improve surgical accuracy and safety. Enhanced 3D imaging, real-time navigation, and integration of AI-driven imaging tools enable surgeons to achieve greater precision in complex procedures. Increasing adoption of minimally invasive surgeries and continuous technological innovation in imaging systems further accelerate the growth of this segment.

The general surgery segment holds dominance in the market, with a revenue of approximately 38% as robotic systems are increasingly adopted in common procedures such as hernia repair, gallbladder removal, and bariatric surgery. High procedural volumes, coupled with the growing preference for minimally invasive techniques, drive consistent demand for robotic instruments and accessories. The ability of robotic platforms to enhance precision, reduce complications, and shorten recovery times further supports their widespread use in general surgery, reinforcing this segment’s strong market position.

The orthopedic segment is anticipated to be the fastest-growing in the surgical robot accessories market due to rising cases of joint disorders, increasing demand for knee and hip replacements, and advancements in robotic-assisted orthopedic systems. Enhanced accuracy, better implant positioning, and improved patient outcomes are driving the rapid adoption of robotic accessories in orthopedic procedures.

The multi-port robotic systems segment dominates the market, with a revenue of approximately 67% as it is widely used across various surgical specialties, offering flexibility and precision in complex procedures. Its ability to perform multiple tasks simultaneously through different entry points enhances surgical efficiency and patient safety. Surgeons prefer multiport systems for their advanced dexterity, reduced invasiveness, and faster recovery benefits. Continuous technological improvements, broader clinical applications, and growing hospital adoption further reinforce the dominance of the multiport robotic system segment in the market.

The single-port robotic systems segment is estimated to be the fastest-growing in the surgical robot accessories market due to rising demand for minimally invasive procedures that reduce scarring and recovery time. Their ability to provide access through a single incision with enhanced precision and control is driving rapid adoption across multiple surgical specialties.

The reusable instruments segment dominates the market, with a revenue of approximately 58% because of its cost-effectiveness and long-term value for healthcare providers. These instruments can be sterilized and used multiple times, reducing overall surgical expenses while maintaining efficiency. Hospitals and surgical centers prefer reusable tools for their durability, reliability, and compatibility with a wide range of robotic systems. Additionally, growing emphasis on sustainability and waste reduction in healthcare further supports the preference for reusable instruments, reinforcing their leading position in the market.

The single-use instruments segment is estimated to be the fastest-growing in the surgical robot accessories market due to increasing focus on patient safety, infection control, and compliance with stringent regulatory standards. These instruments eliminate the risk of cross-contamination and ensure consistent performance in every procedure. Growing adoption of minimally invasive surgeries, along with rising hospital preference for sterile, ready-to-use instruments that reduce sterilization costs and turnaround time, is further accelerating the demand for single-use robotic surgical accessories.

The hospitals segment dominates the market, with a revenue of approximately 70% as hospitals perform a higher volume of complex surgical procedures requiring advanced robotic systems. Their strong financial capacity, better infrastructure, and availability of skilled surgeons drive greater adoption of robotic accessories, ensuring improved patient outcomes and reinforcing hospitals’ leading market position.

The ambulatory surgery centers (ASCs) segment is anticipated to be the fastest-growing in the surgical robot accessories market due to the rising shift toward outpatient care, offering cost-effective and efficient surgical solutions. ASCs benefit from shorter procedure times, reduced hospital stays, and faster patient recovery, making robotic-assisted surgeries highly attractive. Growing investments in equipping ASCs with advanced robotic systems, coupled with the increasing demand for minimally invasive procedures in convenient settings, are driving the rapid expansion of this segment.

North America dominates the surgical robot accessories market, with a revenue of approximately 48% due to advanced healthcare infrastructure, high adoption of robotic-assisted surgeries, and the strong presence of leading market players. Growing investments in research and development, availability of skilled surgeons, and favorable reimbursement policies further support market growth. Additionally, rising awareness of minimally invasive procedures, increasing demand for improved surgical precision, and early adoption of cutting-edge technologies in hospitals and surgical centers reinforce North America’s position as the leading regional market for surgical robot accessories.

The U.S. is the dominant country in North America due to its advanced healthcare infrastructure, early adoption of robotic-assisted surgeries, and strong presence of leading market players. High procedural volumes, skilled surgeons, and favorable reimbursement policies drive consistent demand for surgical robot accessories, reinforcing the country’s leading position in the regional market.

Canada is the fastest-growing country in North America for surgical robot accessories. Increasing investments in modern healthcare facilities, growing awareness of minimally invasive and robotic-assisted surgeries, and expanding hospital networks are accelerating adoption. Supportive government initiatives, rising patient demand for precision surgeries, and technological advancements contribute to rapid market growth in Canada.

The Asia-Pacific region is the fastest-growing in the surgical robot accessories market due to increasing healthcare infrastructure, rising adoption of minimally invasive surgeries, and growing awareness of robotic-assisted procedures. Supportive government initiatives, expanding hospital networks, and rising investments in advanced surgical technologies further drive the rapid growth of robotic accessories in the region.

Organizations:

By Product Type

By Surgery Type

By Technology

By Usage Pattern

By End User

By Region

February 2026

November 2025

February 2026

November 2025