January 2026

The veterinary oncology market size recorded US$ 1.58 billion in 2024, set to grow to US$ 1.77 billion in 2025 and projected to hit nearly US$ 4.86 billion by 2034, with a CAGR of 12.14% throughout the forecast timeline.

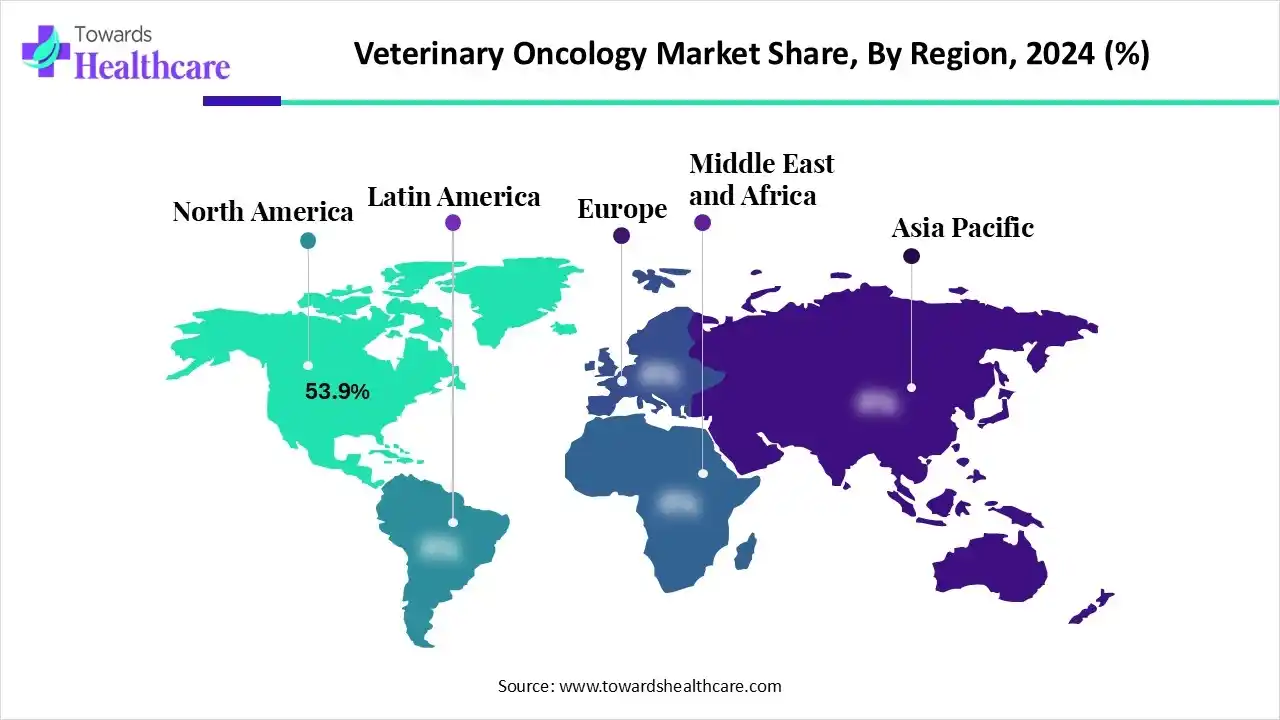

The global veterinary oncology market is growing significantly, driven by the increasing prevalence of cancer among companion animals, rising pet ownership, and advancements in diagnostic imaging and targeted therapies. The market is projected to surpass USD 5 billion by 2034, expanding from around USD 1.7 billion in 2024. North America dominates the sector due to its advanced veterinary infrastructure and high expenditure on pet healthcare.

| Table | Scope |

| Market Size in 2025 | USD 1.77 Billion |

| Projected Market Size in 2034 | USD 4.86 Billion |

| CAGR (2025 - 2034) | 12.14% |

| Leading Region | North America by 53.9% |

| Market Segmentation | By Animal Type, By Therapy Type, By Cancer Type, By Region |

| Top Key Players | Boehringer Ingelheim International GmbH, Siemens Healthineers (Varian), Accuray Incorporated, PetCure Oncology, Nippon Zenyaku Kogyo (ZENOAQ), Morphogenesis Inc., Karyopharm Therapeutics, Regeneus Ltd, OHC (The One Health Company), LiteCure LLC, Cutting Edge Laser Technologies, Aesculight LLC, Mars Petcare, Virbac, Merck & Co., Inc. |

The veterinary oncology market is growing due to rising awareness of animal health and increasing availability of advanced cancer treatments for pets. The Market encompasses the diagnosis, treatment, and management of cancers in animals, primarily companion animals such as dogs, cats, and horses. This market includes a range of services and products, from diagnostic imaging and laboratory tests to surgical interventions, chemotherapy, immunotherapy, and radiation therapy.

The growing prevalence of cancer in pets, advancements in veterinary medical technologies, and increasing pet ownership and expenditure on animal healthcare are driving the expansion of the veterinary oncology market. According to the Veterinary Cancer Society, cancer accounts for nearly half of deaths in dogs, especially those above 10 years, and about one-third in cats. Moreover, one in four dogs is likely to develop tumors or abnormal tissue growth during their lifetime.

AI is poised to transform the veterinary oncology market by improving early cancer detection, enhancing diagnostic accuracy, and enabling personalized treatment plans for pets. Machine learning algorithms can analyze medical imaging and genomic data, helping veterinarians identify tumors faster and predict treatment outcomes more precisely. Additionally, AI-driven platforms streamline research, optimize drug development, and support telemedicine, ultimately increasing efficiency, reducing costs, and improving overall cancer care for companion animals.

| Drug | Disease/Disorder | Date |

| Dectomax-CA1 (Doramectin Injection) | Prevention & treatment of New World Screwworm larval infestations, NWS reinfection. | 30 September 2025 |

| Gamrozyne (Gamithromycin Injection) | Treatment for the bovine respiratory disease in beef and non-lactating dairy cattle. | 28 August 2025 |

| Methimazole Coated Tablet | Treatment of hyperthyroidism in cats. | 22 July 2025 |

| Exzolt (Fluralaner Oral Solution) | Treatment of northern fowl mites in chickens. | 17 July 2025 |

| Bravecto Quantum (Extended-release Injectable Suspension) | Protect dogs against fleas and ticks for 8 to 12 months. | 10 July 2025 |

| Cefovecin Sodium Injection | Treatment of skin infections, such as abscesses and wounds caused by bacteria in dogs and cats. | 24 June 2025 |

| Felycin-CA1 | Management of ventricular hypertrophy & HCM in cats. | 14 March 2025 |

The canine segment dominated the market with the revenue share os approximately 86.09% in 2024 due to a higher prevalence of cancer in dogs compared to other pets. Around 30–40% of dogs develop cancer during their lifetime, with nearly 50% of dogs over 10 years affected. Common cancers include lymphoma, osteosarcoma, and hemangiosarcoma. This high incidence drives greater demand for specialized veterinary oncology services, diagnostics, and treatments, making canines the primary focus for market growth in the animal-type segment.

The feline segment in veterinary oncology is projected to experience a higher compound annual growth rate during the forecast period due to increasing awareness, advancements in diagnostic technologies, and a growing focus on feline-specific treatments. The International Fund for Animal Welfare (IFAW) reports over 220 million pet cats globally, while the American Veterinary Medical Association (AVMA) estimates around 73.8 million pet cats in the U.S. in 2024. The rising incidence and improved detection methods are driving demand for specialized veterinary oncology services tailored for felines.

The surgery segment dominates the market with the revenue share of approximately 36.09% due to its effectiveness in treating various cancers, especially solid tumors in companion animals. Surgical procedures allow for immediate tumor removal, often improving survival rates and quality of life. In 2024, surgery accounted for a significant portion of revenue within therapy types, reflecting widespread adoption in veterinary practices. Its pivotal role in cancer management, combined with advancements in surgical techniques and post-operative care, continues to drive market preference and growth.

The chemotherapy segment in veterinary oncology is anticipated to experience a higher compound annual growth rate during the forecast period due to advancements in drug formulations, improved delivery methods, and increased adoption of combination therapies. These innovations enhance the effectiveness and safety of chemotherapy treatments for companion animals. As a result, veterinary clinics are expanding their oncology services, leading to a greater market share for chemotherapy-based therapies in the veterinary oncology sector.

In 2024, the skin cancer segment led the market with the revenue share of approximately 39.01 % due to the high prevalence of skin tumors in dogs. A study published in PubMed Central in April 2023 reported that 56% of malignant tumors in dogs occurred in the skin, while 69% of benign tumors were also skin-related, highlighting the high prevalence of skin cancers in canines. The skin tumors in dogs are benign, but a significant portion are malignant, including mast cell tumors and melanomas. These tumors often require surgical intervention, and in some cases, additional treatments like chemotherapy or radiation. The widespread occurrence and treatment needs of skin cancers contribute to their dominant market share.

The lymphoma segment in veterinary oncology is projected to grow at the fastest CAGR during the forecast period due to its high prevalence and advancements in treatment options. Canine lymphoma, particularly multicentric lymphoma, is among the most common hematologic cancers in dogs, with an incidence rate of approximately 20–107 cases per 100,000 dogs. According to a July 2024 MDPI article, pulmonary carcinoma is the most common form of primary lung cancer in dogs, with pulmonary adenocarcinoma being the predominant subtype, representing 60–80% of cases. The availability of targeted therapies and improved diagnostic techniques are expected to drive market expansion in this segment.

North America led the market with the revenue share of approximately 53.9 % in 2024, driven by a high pet ownership rate and advanced healthcare infrastructure. The U.S. alone had an estimated 73.8 million pet cats in 2024, contributing to a significant demand for veterinary services. Additionally, the region's well-established veterinary workforce, with over 73,000 veterinary assistants and laboratory animal caretakers, supports the growth of specialized oncology services. These factors collectively positioned North America as the dominant market in veterinary oncology.

In 2024, the U.S. government implemented several initiatives to advance veterinary oncology. The National Institutes of Health (NIH) launched the Animal and Veterinary Innovation Centers (U18) program to foster long-term partnerships addressing critical animal health issues, including cancer research. Additionally, the National Cancer Institute (NCI) announced funding opportunities to enhance mammalian cancer models, aiming to improve translational research and patient outcomes. These efforts reflect a commitment to advancing veterinary oncology through collaborative research and innovation.

Canada is actively advancing veterinary oncology through several initiatives. The Canadian Veterinary Medical Association (CVMA) established the Pharmaceutical Access Advisory Committee (PAAC) in October 2024 to address drug shortages and improve access to essential veterinary health products, including oncology treatments. Additionally, the CVMA offers wellness programs like "The Working Mind" to support mental health among veterinary professionals, ensuring a resilient workforce capable of delivering quality cancer care for animals.

Europe is accelerating its market through strategic initiatives and regulatory advancements. The European Commission's proposed pharmaceutical legislation aims to streamline regulatory processes, enhancing the development and approval of veterinary oncology treatments. Additionally, the European Union's Mission on Cancer emphasizes improving the quality of life for cancer patients, including animals, which supports the integration of veterinary oncology into broader cancer care strategies. These efforts collectively foster innovation and accessibility in veterinary oncology across Europe.

By Animal Type

By Therapy Type

By Cancer Type

By Region

January 2026

January 2026

January 2026

January 2026