March 2026

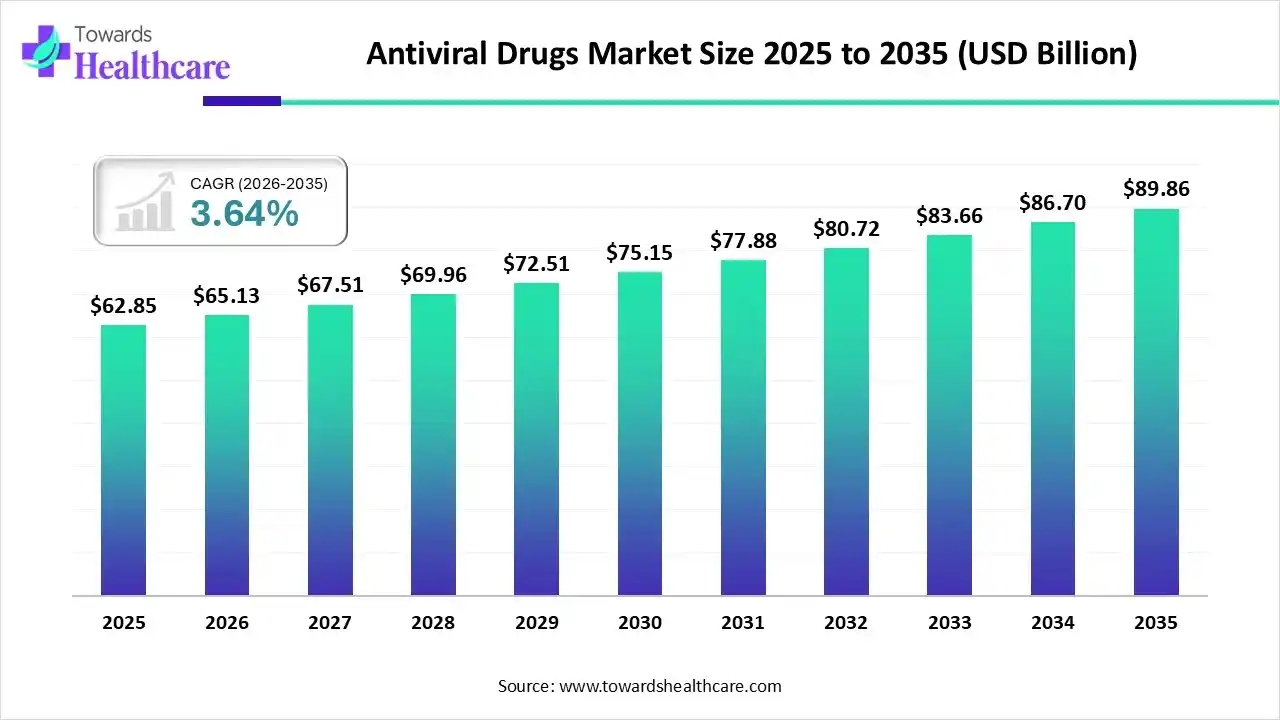

The global antiviral drugs market size was estimated at USD 62.85 billion in 2025 and is predicted to increase from USD 65.13 billion in 2026 to approximately USD 89.86 billion by 2035, expanding at a CAGR of 3.64% from 2026 to 2035.

The market is growing steadily due to the rising prevalence of viral infections, increasing awareness of early treatment, and ongoing drug development. Advancements in antiviral therapies, expanded vaccination programs, and strong research investments by pharmaceutical companies continue to support market expansion globally.

| Key Elements | Scope |

| Market Size in 2026 | USD 65.13 Billion |

| Projected Market Size in 2035 | USD 89.86 Billion |

| CAGR (2026 - 2035) | 3.64% |

| Leading Region | North America |

| Market Segmentation | By Type, By Drug Class, By Distribution Channel, By Application, By Region |

| Top Key Players | Lonza Group Ag, Catalent, Inc, Cytiva, Samsung Biologics, Thermo Fisher Scientific, Inc., Novartis AG |

Artificial intelligence can revolutionize the antiviral drugs market by accelerating drug discovery, improving disease prediction, and enabling personalized treatment approaches. AI-driven data analytics enhance clinical trial efficiency, optimize supply chains, and support faster regulatory decisions.

Why Did the Branded Segment Dominate in the Market in 2025?

The branded segment held the largest antiviral drugs market share due to strong physician trust, proven clinical efficacy, and extensive regulatory approvals. Branded products benefit from robust R&D investments, advanced formulations, and strong patents. protection. Additionally, established distribution networks, higher adoption in hospitals, and continuous post-marketing surveillance further support the dominance of branded antivirals in the market.

Generic

The generic segment is expected to grow at the fastest CAGR due to increasing healthcare cost pressure and broader access to affordable treatments. Patent expirations of key antiviral drugs are enabling more generic entries, while rising demand in emerging markets further boosts uptake. Additionally, supportive government policies and higher prescription volume for cost-effective generics contribute to rapid market expansion.

What Made the Protease Inhibitors Segment Dominant in the Market in 2025?

The protease inhibitors segment led the antiviral drugs market due to its high effectiveness in treating chronic viral infections such as HIV and Hepatitis. These drugs play a critical role in combination therapies, offering strong viral suppression and improved patient outcomes. Widespread clinical acceptance, long-term treatment use, and continuous advancements in protease inhibitor formulations have further strengthened their market dominance.

Reverse Transcriptase Inhibitors

The reverse transcriptase inhibitors segment is expected to grow at the fastest CAGR due to rising HIV prevalence and expanded treatment access globally. Ongoing development of newer, more effective inhibitors with improved safety profiles is attracting strong clinical adoption. Additionally, increased healthcare awareness, broader reimbursement policies, and growing demand in emerging markets are driving higher prescription rates and fueling rapid market growth for this drug class.

How Does the Hospital Pharmacy Segment Dominate the Market in 2025?

The hospital pharmacy segment dominated the antiviral drugs market due to the high use of antiviral drugs in inpatient settings for severe and complex infections. Hospitals are the primary center for diagnosis, initiation of antiviral therapy, and management of critical cases. Availability of specialized medications, trained healthcare professionals, and strong procurement systems further supports higher antiviral drug dispensing through hospital pharmacies.

Online Pharmacy

The online pharmacy segment is expected to grow at the fastest CAGR due to increasing internet penetration, rising e-commerce adoption, and growing preference for home delivery of medications. Convenience, cost-effectiveness, and easy access to a wide range of antiviral drugs are driving consumer demand. Additionally, digital health initiatives, telemedicine integration, and expanding regulatory support for online drug sales are accelerating market growth in this segment.

How will the HIV Segment dominate the Market in 2025?

The HIV segment held the highest antiviral drugs market share due to the global prevalence of HIV infections and the lifelong needs for antiretroviral therapy. Strong government initiatives, widespread awareness programs, and well-established treatment guidelines have boosted drug adoption. Additionally, continuous development of effective combination therapies has reinforced the dominance of HIV application in the market.

Hepatitis

The hepatitis segment is projected to grow rapidly due to the increasing incidence of chronic liver diseases and complications associated with hepatitis infections. Rising healthcare spending, improved diagnostic capabilities, and the introduction of affordable antiviral therapies are driving market expansion. Moreover, government health campaigns, growing patient awareness, and the push for early treatment in both developed and emerging regions are contributing to the segment’s fastest CAGR.

In 2025, North America led the antiviral drugs market owing to early access to advanced treatments, robust pharmaceutical research, and high healthcare spending. The presence of major drug manufacturers, strong regulatory frameworks, and widespread public awareness of viral diseases contributed to its dominant market position.

U.S. Tops Antiviral Market, Driving Maximum Revenue in 2025

The U.S. captured the largest revenue share of the North America antiviral drugs market in 2025 due to advanced healthcare systems, high adoption of innovative antiviral therapies, and significant pharmaceutical R&D investments. Strong regulatory support, widespread awareness of viral infections, and early access to new treatments further boosted demand, making the U.S. the dominant contributor to the market.

Asia Pacific is expected to grow at the fastest CAGR due to rising viral infections, increasing healthcare access, and growing awareness of early treatment. Expansion of pharmaceutical manufacturing, favorable government initiatives, and adoption of cost-effective antiviral therapies in emerging economies are driving strong market growth in the region.

India Set to Lead Rapid Growth in Antiviral Drugs Market

India is expected to grow at the fastest CAGR due to the rising prevalence of viral infections, expanding healthcare infrastructure, and increased access to affordable antiviral medications. Government health initiatives, growing awareness, and a strong generic drug manufacturing base are further boosting demand, making India a Key growth market for antiviral drugs.

Europe is anticipated to grow at a notable CAGR due to advanced healthcare infrastructure, strong government support for infectious disease management, and high adoption of innovative antiviral therapies. Ongoing R&D, rising prevalence of viral infections, and increasing awareness about early treatment are driving steady market expansion in the region.

UK Antiviral Drugs Market to Witness Rapid Expansion

The UK is expected to grow at a rapid CAGR due to the increasing prevalence of viral infections, strong healthcare infrastructure, and high adoption of advanced antiviral therapies. Supportive government initiatives, rising public awareness, and ongoing pharmaceutical R&D efforts are further driving the demand for effective antiviral treatments in the country.

| Companies | Headquarters | Offerings |

| Lonza Group Ag | Basel, Switzerland | Contract development and manufacturing services (CDMO) for biologics, cell and gene therapies, vaccines, and antiviral drugs, including process development, clinical, and commercial-scale manufacturing |

| Catalent, Inc | New Jersey, USA | Drug development solutions, oral and injectable delivery technologies, biologics manufacturing, and antiviral formulation services |

| Cytiva | Massachusetts, USA | Bioprocessing equipment and consumables, single-use systems, and cell culture solutions for antiviral drug and vaccine production |

| Samsung Biologics | South Korea | Contract development and manufacturing services for biologics, including monoclonal antibodies, vaccines, and antiviral therapies. |

| Thermo Fisher Scientific, Inc. | Massachusetts, USA | Laboratory instruments, analytical tools, bioprocessing solutions, and supplies of materials for antiviral drug discovery and production. |

| Novartis AG | Basel, Switzerland | Research, development, and commercialization of innovative antiviral drugs, vaccines, and therapies for infectious diseases, including global distribution. |

By Type

By Drug Class

By Distribution Channel

By Application

By Region

March 2026

March 2026

March 2026

March 2026