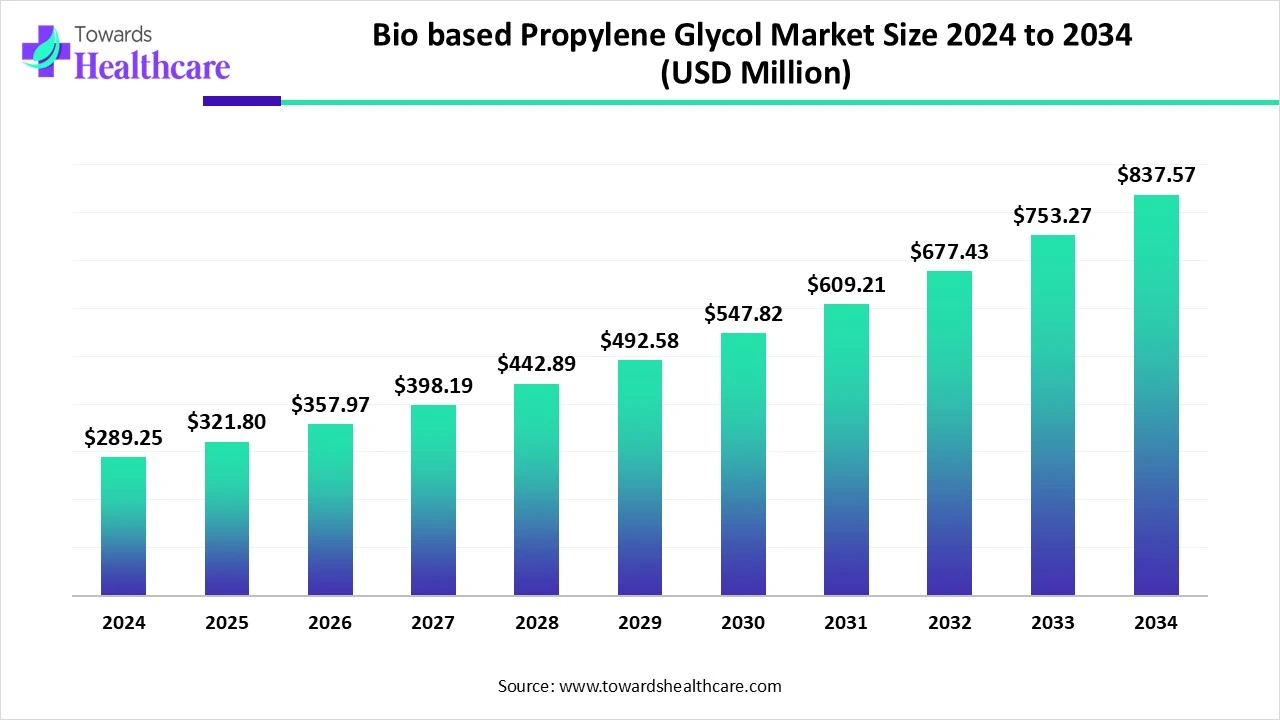

The global bio-based propylene glycol market size is calculated at USD 289.25 million in 2024, grew to USD 321.8 million in 2025, and is projected to reach around USD 837.57 billion by 2034. The market is expanding at a CAGR of 11.25% between 2025 and 2034.

The bio-based propylene glycol market is primarily driven by the increasing number of new drug discovery research studies. The growing demand for environmental sustainability and the rising emphasis on pharmaceutical excipients from natural sources potentiate the need for bio-based propylene glycol. The burgeoning pharmaceutical and food sectors contribute to market growth. The future looks promising, driven by the increasing use of 3D printing techniques and the integration of AI and ML in research activities.

Bio-based Propylene Glycol (Bio-PG) is a sustainable, renewable alternative to petroleum-based propylene glycol. It is primarily produced from plant-based feedstocks such as glycerin, sorbitol, glucose, and starch through hydrogenolysis or fermentation processes. Bio-PG serves as a versatile intermediate and solvent used in a wide array of applications, including personal care, pharmaceuticals, antifreeze, de-icing fluids, food additives, and unsaturated polyester resins (UPRs). In the pharmaceutical sector, it is used as a solvent, humectant, and stabilizer.

The major growth factors of the market are the growing research and development activities and increasing R&D investments. Ongoing research leads to the development of novel drugs and drug delivery systems, necessitating the use of polymers. The increasing need for environmental sustainability also potentiates the demand for Bio-PG. The widespread applications of Bio-PG in multiple industries facilitate market growth. The burgeoning pharmaceutical sector and increasing collaborations among key players boost the market.

Artificial intelligence (AI) can revolutionize the manufacturing process of Bio-PG, increasing productivity and reducing costs. AI can automate the thermochemical conversion and microbial conversion of sugars to derive Bio-PG. It can enable bulk manufacturing with high-quality products, enhancing efficiency and reproducibility. AI enables manufacturers to continuously monitor the production process and take necessary actions. AI-based predictive analytics can detect potential errors in manufacturing, allowing manufacturers to make proactive decisions. AI and machine learning (ML) algorithms can aid researchers in determining the compatibility of Bio-PG with other excipients and drug products.

Environmental Sustainability

The major growth factor of the bio-based propylene glycol market is the growing need for environmental sustainability. Pharmaceutical industries generate a substantial amount of waste during manufacturing, including chemicals and packaging materials. It is estimated that for every 1 kilogram of drug produced in the pharmaceutical industry, 100 kilograms of waste are produced. This necessitates several government organizations to impose stringent guidelines on the use of natural and biodegradable materials. Bio-PG lowers carbon footprint, reduces reliance on fossil fuels, thereby minimizing environmental impact. It has been found to reduce greenhouse gas emissions by 61%.

Supply Chain Disruption

Natural disasters, pandemics, geopolitical issues, and economic instability are the major aspects that lead to supply chain disruption. The raw materials used to produce Bio-PG are used in numerous sectors, resulting in reduced supply. Such supply chain disruption restricts market growth.

What is the Future of the Bio-based Propylene Glycol Market?

The future of the market is driven by the increasing use of 3D printing technology. 3D printing technology is used in the pharmaceutical sector to manufacture personalized medicines and drug delivery systems. While in the food sector, 3D printing is used in manufacturing edible products. The increasing investments by government and private organizations are favoring the adoption of advanced technologies in pharmaceutical and food companies. 3D printing technology offers a high efficiency rate and reduced material wastage. The demand for Bio-PG is increasing in 3D printing techniques as a plasticizer in both the pharmaceutical and food sectors.

By source, the glycerin segment held a dominant presence in the market in 2024. This segment dominated due to the easy availability of glycerin and its cost-effectiveness. Glycerin is widely used for producing renewable propylene glycol using the hydrogenation process. Researchers have developed novel catalysts to reduce the production steps, eliminating the need for separating intermediates. Deriving Bio-PG from glycerin results in higher selectivity and higher product yields.

By source, the corn glucose segment is expected to grow at the fastest CAGR in the market during the forecast period. The demand for corn glucose is increasing as it provides sustainable and renewable bio-based propylene glycol. This is also due to lower production costs and an abundant corn supply. Corn sugar is a comparatively cost-effective and safer alternative. It is primarily used in the food and pharmaceutical industries, reducing the risk of toxicity.

By application, the industrial & manufacturing segment led the global market in 2024. This is due to the growing demand for diverse applications of Bio-PG in manufacturing. Bio-PG is used in various sectors, including automotive, cosmetic, pharmaceutical, and food. Several industries focus on generating less waste during manufacturing and using products derived from natural sources.

The unsaturated polyester resins (UPR) sub-segment held the largest revenue share of the bio-based propylene glycol market in 2024. In the medical sector, UPR is used in the fabrication of prosthetics and orthopedic devices. It produces lightweight devices and enables customization based on patients’ requirements. It is also used in tissue engineering and the production of molds and casts for medical models. UPR has poor linear shrinkage and excellent wettability properties.

By application, the personal care & cosmetics segment is expected to grow with the highest CAGR in the market during the studied years. The growing demand for natural cosmetic products and the burgeoning cosmetic sector boost the segment’s growth. The changing consumer demands towards eco-friendly products potentiate the use of Bio-PG. Bio-PG is used as a solvent and humectant in cosmetic products to enhance aesthetic appearance. Several researchers have proved Bio-PG to be safe in cosmetic products.

By grade, the industrial grade segment held the largest revenue share of the market in 2024. Industrial-grade Bio-PG is preferred due to its widespread applications in various industries. The growing need for environmental sustainability and stringent government regulations augments the segment’s growth. Due to these stringent regulations, industries use propylene glycol derived from natural sources.

By grade, the food grade segment is expected to expand rapidly in the market in the coming years. Food grade Bio-PG is non-toxic and safe, as well as easy to handle. It is widely used in the pharmaceutical, cosmetic, and food sectors. It is used as a moisturizer in skin care, cosmetics, and shampoo. It is also used as a solvent in drug formulations. Regulatory agencies regulate the use of edible and non-toxic excipients.

By production process, the hydrogenolysis of glycerol segment contributed the biggest revenue share of the market in 2024. Hydrogenolysis of glycerol is a process where glycerol molecules are catalytically converted into propylene glycol. It is a renewable route to produce propylene glycol. Metal catalysts are used to accelerate the reaction process, such as Pt, Ru, Pd, and Cu.

By production process, the fermentation of glucose segment is expected to witness the fastest growth in the market over the forecast period. Fermentation of glucose to propylene glycol is a multi-step conversion process. Glucose is initially converted to lactic acid, which is further converted to propylene glycol. Integrated design of the fermentation and catalytic steps is crucial for efficient and cost-effective production of propylene glycol.

By end-use, the pharmaceuticals segment held a major revenue share of the market in 2024 and is expected to demonstrate the fastest growth in the upcoming years. This is due to the burgeoning pharmaceutical sector and the growing need for natural products as excipients. The increasing manufacturing of pharmaceutical products and the rising demand for medical devices propel the segment’s growth. Bio-PG is used as a solvent, humectant, and emulsifier in various drug formulations, including oral, injectable, and topical medications.

By distribution channel, the direct sales (B2B) segment registered its dominance over the global market in 2024. The segmental growth is attributed to the growing demand for propylene glycol in various industries for manufacturing diverse product ranges. Manufacturers receive Bio-PG at affordable rates and of high quality with excellent after-sales services. Large-scale manufacturing of different products requires Bio-PG in larger quantities. The increasing collaborations among key players also help expand market reach.

By distribution channel, the online platforms segment is expected to show the fastest growth over the forecast period. The burgeoning e-commerce sector and the increasing adoption of smartphones favor the segment’s growth. Online platforms offer numerous services, including free home delivery and several discounts. They can be used to purchase Bio-PG in smaller and larger quantities.

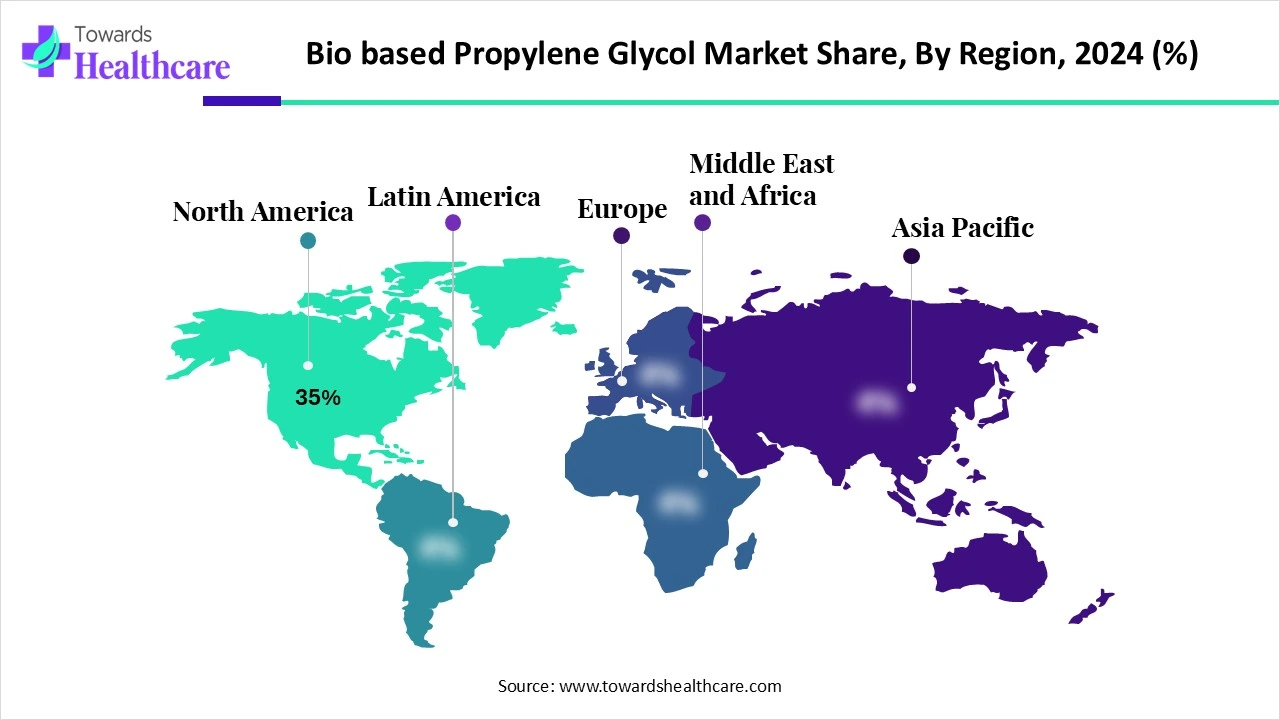

North America dominated the global market share by 35% in 2024. The increasing R&D investments, the presence of key players, and the availability of state-of-the-art research and development facilities are the major growth factors of the market in North America. The increasing awareness of environmental sustainability and stringent regulations promote the use of renewable resources.

Key players, such as Archer Daniels Midland Company, Cargill, Inc., and Shell Chemicals, are the major contributors to the market in the U.S. The Food and Drug Administration (FDA) regulates the use of up to 5% of propylene glycol in alcoholic beverages. The U.S. Environmental Protection Agency (EPA) strictly evaluates the potential risk of the drug or feed additive to cause significant environmental impacts.

The Canadian government launched the 2023-2027 Departmental Sustainable Development Strategy, providing a balanced view of the environmental, social, and economic dimensions of sustainable development. (Source - Government of Canada) Major companies like ADM and IMCD Canada are the primary suppliers of bio-based propylene glycol in Canada.

Asia-Pacific is expected to host the fastest-growing bio-based propylene glycol market in the coming years. The presence of a suitable manufacturing infrastructure enables foreign players to set up their manufacturing facilities in the Asia-Pacific countries. Countries like China, Japan, and India are at the forefront of supplying low-cost raw materials globally. The burgeoning pharmaceutical sector and the increasing number of pharmaceutical startups contribute to market growth.

Japan was the leading exporter of pharmaceutical excipients from October 2023 to September 2024. Japan exported 356 shipments mainly to India, Vietnam, and Kazakhstan. The Japan Ministry of Health, Labor, and Welfare (MHLW) announced a new 10-year government fund in January 2025 to support innovative drug development. (Source - Express Pharma)

India is among the top exporters and importers of pharmaceutical excipients in the world. Most of India’s pharmaceutical excipients go to Tanzania, the UAE, and Russia. According to the India Brand Equity Foundation (IBEF), India is home to a network of 3,000 drug companies and approximately 10,500 manufacturing units. (Source - IBEF)

Europe is considered to be a significantly growing area in the bio-based propylene glycol market in the foreseeable future. The rising adoption of advanced technologies and the increasing need for environmental sustainability bolster the market. Government organizations launch initiatives to utilize excipients from natural sources and reduce waste. The rising collaboration among key players favors the development of novel pharmaceuticals.

Germany is one of the world’s most favorable locations for pharmaceutical manufacturing. The total revenue from the pharmaceutical industry was EUR 59.8 billion in 2023. (Source - GTAI) The federal government aims to be climate-neutral by 2045. It has set a target of reducing 65% of greenhouse gas emissions by 2030, and 88% by 2040.

The latest research focuses on developing novel extraction methods for synthesizing bioPG.

Key Players: Archer Daniels Midland (ADM) Company, BASF SE, and The Dow Chemical Company.

Manufacturers distribute BioPG to pharmaceutical and biotech companies and academic institutions, either directly or through distributors or wholesalers.

Key Players: BioBiz, Silver Fern Chemical, Inc., and Orlen.

BioPG is derived from plant-based sources and is used as a sustainable ingredient in various pharmaceutical, cosmetic, and food products, thereby providing safer alternatives to harmful chemicals.

Shin Takemoto, Associate Professor, Graduate School of Science, Osaka Metropolitan University, commented that their research offers a sustainable alternative to conventional propylene production methods and contributes to the development of an environmentally friendly chemical industry. The researchers aim to further advance the technology and explore its broader applications. (Source - AZO Materials)

By Source (Feedstock Type)

By Application

By Grade

By Production Process

By End-Use

By Distribution Channel

By Region