January 2026

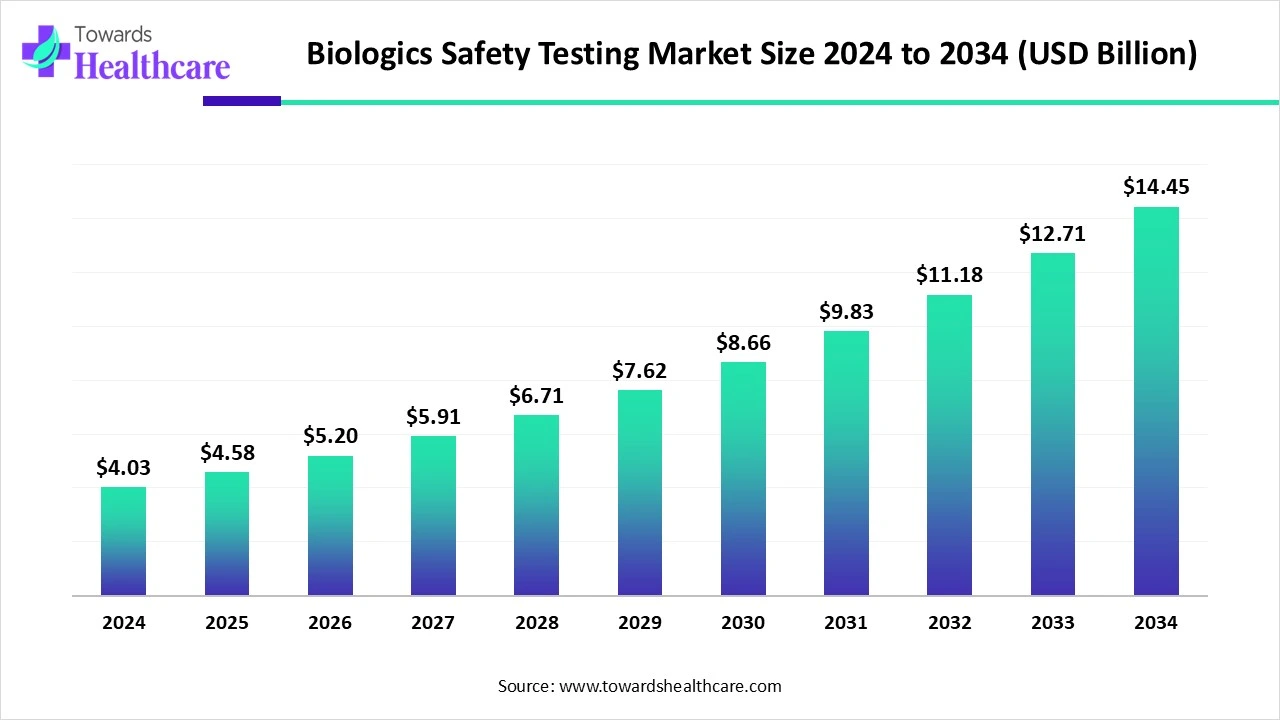

The global biologics safety testing market size is calculated at USD 4.03 billion in 2024, grew to USD 4.58 billion in 2025, and is projected to reach around USD 14.45 billion by 2034. The market is expanding at a CAGR of 13.64% between 2025 and 2034.

The biologics safety testing market is primarily driven by the growing demand for biologics and increasing research activities. Favorable government support and stringent regulatory policies necessitate the assessment of the safety and efficacy of novel biologics. Key players collaborate and invest heavily in research activities to develop novel biologics and their safety testing tools. The future looks promising, with advancements in safety testing tools and the integration of AI and machine learning (AI/ML) in testing.

| Metric | Details |

| Market Size in 2025 | USD 4.58 Billion |

| Projected Market Size in 2034 | USD 14.45 Billion |

| CAGR (2025 - 2034) | 13.64% |

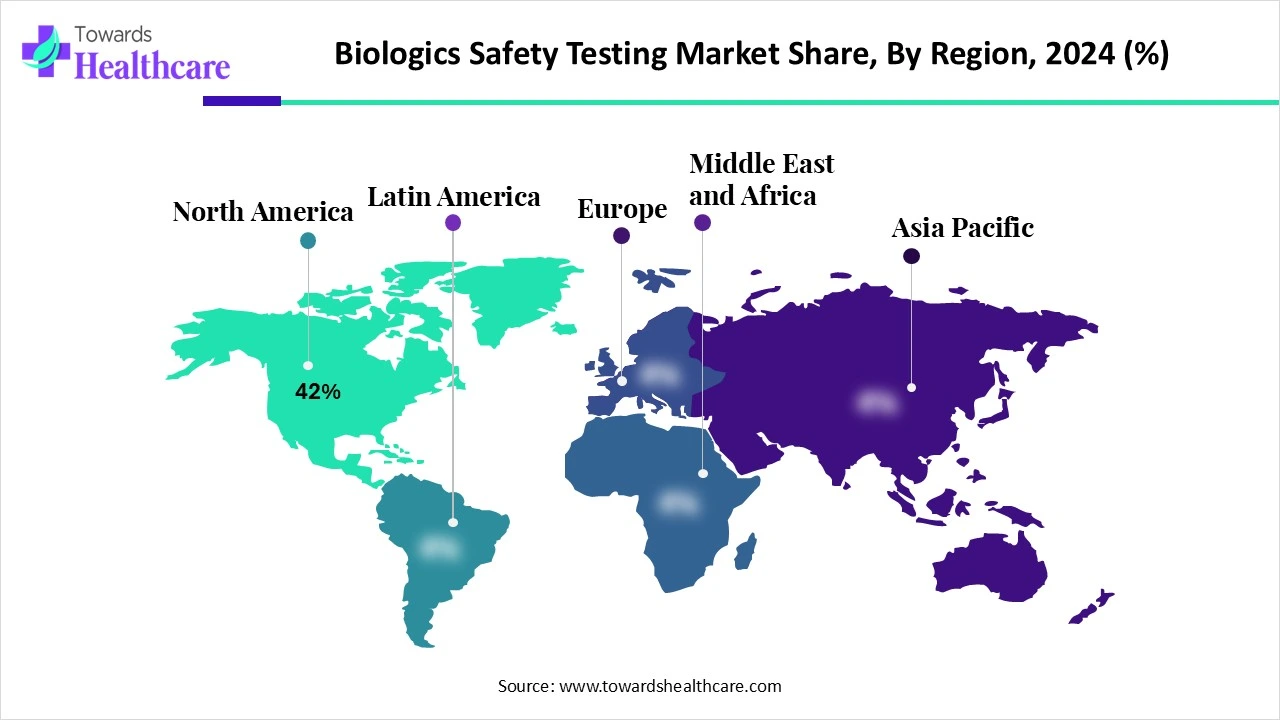

| Leading Region | North America share by 42% |

| Market Segmentation | By Product Type, By Test Type, By Application, By End User, By Technology, By Region |

| Top Key Players | Charles River Laboratories International, Inc., Sartorius AG, Thermo Fisher Scientific Inc., Merck KGaA (MilliporeSigma), Lonza Group AG, Eurofins Scientific SE, SGS S.A., WuXi AppTec, BioReliance (Merck subsidiary), Pace Analytical Services, LLC, Becton, Dickinson and Company (BD), Promega Corporation, Bio-Rad Laboratories, Inc., Nelson Laboratories, LLC, TheraIndx Lifesciences, Stemcell Technologies Inc., Q2 Solutions (IQVIA Lab Subsidiary), GenScript Biotech Corporation, Vironova AB (electron microscopy-based virus detection), Clean Biologics (Naobios, Clean Cells) |

The biologics safety testing market encompasses a range of products and services used to ensure the safety, purity, and quality of biologics, including vaccines, monoclonal antibodies, recombinant proteins, cell and gene therapies, and tissue-derived products. Safety testing is mandated by regulatory agencies such as the FDA, EMA, and ICH to detect adventitious agents, mycoplasma, endotoxins, and residual host cell DNA/proteins. The growing pipeline of biologics, stricter regulations, and technological advancements in rapid testing are fueling market growth.

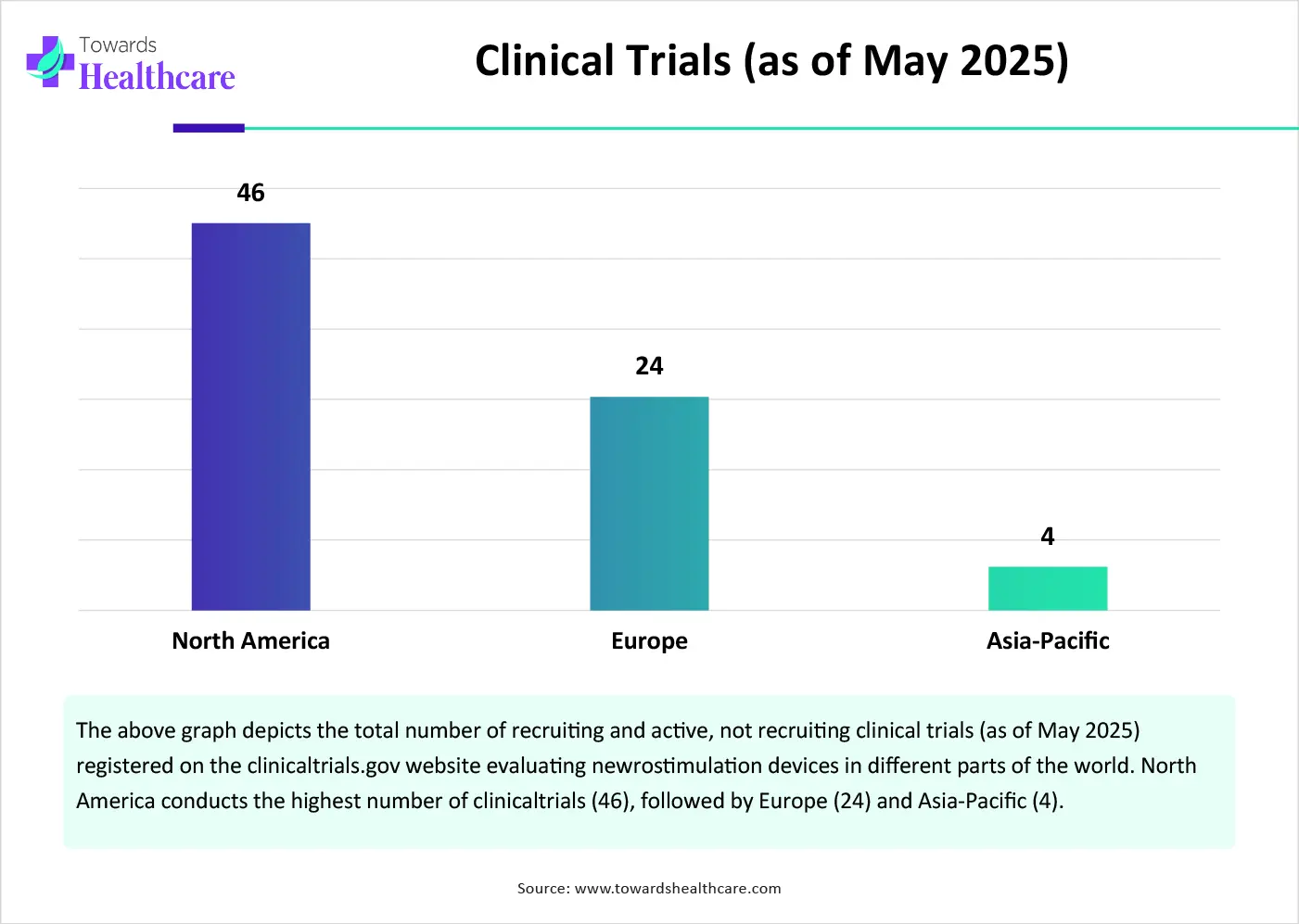

Other factors influencing market growth include the rising prevalence of chronic disorders, growing research and development activities, and increasing clinical trials, leading to the development of novel biologics. Government organizations support the development of biologics for various disorders through funding. The increasing R&D investments by major companies also govern market growth. The growing demand for personalized medicines and advancements in genomic technologies boost market growth.

Artificial intelligence (AI) plays a vital role in biologics safety testing by introducing automation, thereby supporting regulatory compliance. AI and ML can predict different properties of biologics, including pharmacokinetic, pharmacodynamic, and toxicological properties. This helps researchers in the initial screening of biologics, thereby eliminating those biologics that are estimated to have poor efficacy or enhanced toxicity by computational tools. Furthermore, AI and ML can assist in data analysis and interpretation and in predicting potential defects. They can optimize testing strategies and aid in decision-making.

Demand for Biologics

The major growth factor of the biologics safety testing market is the growing demand for biologics. This demand is mainly driven by the need for personalized medicines and the superior advantages of biologics over small molecules. Biologics offer targeted treatment with enhanced efficacy and reduced systemic side effects. They often treat complex, chronic, genetic, and rare disorders that are otherwise difficult to treat with conventional drugs. According to a recent article, the FDA approved a total of 253 biologics from 1980 to 2022, demonstrating the significance of biologics (Source - Nature)

Animal Testing Concerns

Several private and government authorities are concerned about the use of animals for the safety testing of biologics. Various animal species, including mice, rats, rabbits, dogs, and other animals, are used to assess the safety of biologics before human trials. Thus, ethical issues related to animal use may hinder market growth.

What is the Future of the Biologics Safety Testing Market?

The future of the market is promising, driven by advancements in genomic technologies, such as PCR and NGS techniques. Such advancements lead to the latest innovations in safety testing tools. Novel genomic techniques overcome the challenges of conventional methods and enhance the specificity and selectivity of testing. They can identify novel viruses or endotoxins that are otherwise difficult to detect with conventional methods. Additionally, CRISPR-based gene editing techniques have made significant strides in the development of cell and gene therapy, presenting opportunities for personalized treatment.

By product type, the kits & reagents segment held a dominant presence in the market in 2024. This segment dominated because of the increasing demand for kits and reagents for various testing. Kits and reagents are cost-effective and can help perform multiple experiments simultaneously. They enable researchers to test the safety of biologics anywhere with enhanced specificity. Major players provide kits and reagents based on experimental conditions and the type of experiments.

By product type, the instruments segment is expected to grow at the fastest CAGR in the market during the forecast period. Instruments are designed and developed to ensure lab safety and meet stringent biosafety standards. The availability of easy-to-operate instruments augments the segment’s growth. Instruments simplify the task of researchers and aid in data analysis. Technological advancements introduce automation in instruments and detect complex experimental outcomes, enhancing efficiency and accuracy.

By test type, the endotoxin tests segment held the largest revenue share of the market in 2024. This is due to higher chances of contamination by pyrogens in biologics. These pyrogens derive from gram-negative bacterial contamination in biologics. They trigger TLR response, leading to inflammation, fever, and sometimes shock and organ failure. Regulatory authorities mandate endotoxin test data before approving novel biologics. Conventional tests include the bacterial endotoxins test (BET) and rabbit pyrogen test (RPT). The Recombinant Factor C (rFC) test is emerging as an alternative to the LAL test.

By test type, the sterility tests segment is expected to grow with the highest CAGR in the market during the studied years. Sterility tests are conducted to assess the presence of viable microorganisms in biological samples. These tests are performed by direct inoculation or membrane filtration methods. Novel methods are developed using fully automated microbial detection technology, offering rapid testing. This enables researchers to evaluate microbial growth independently of culture turbidity, making it suitable for short shelf-life products, such as cell & gene therapies and vaccines.

By application, the monoclonal antibodies segment contributed the biggest revenue share of the market in 2024. This segment dominated due to the ability of monoclonal antibodies to treat a wide range of chronic, immunological, and neurological disorders. Monoclonal antibodies provide targeted delivery for the desired pharmacological response, reducing systemic side effects. They have high specificity and sensitivity and low variability. The FDA approved 12 novel antibody-based therapeutics in 2023.

By application, the cell & gene therapy products segment is expected to expand rapidly in the market in the coming years. Ongoing research efforts are made to develop novel cell & gene therapy (CGT) products and study the efficacy of these products for various disorders. These therapeutics can treat a disease from its root cause, thereby curing untreatable diseases. The rising prevalence of chronic and genetic disorders potentiates the demand for CGT products.

By end-user, the pharmaceutical & biopharmaceutical companies segment led the global market in 2024. The segmental growth is attributed to suitable capital investment and increasing manufacturing of biologics. Capital investment enables pharma and biopharma companies to adopt novel safety testing tools. They focus on expanding their biologics pipeline and strengthening their position in the market.

By end-user, the contract research & manufacturing organizations (CROs/CDMOs) segment is expected to witness the fastest growth in the market over the forecast period. The increasing number of pharma and biotech startups favors the demand for CROs and CDMOs. Large companies also outsource their research and manufacturing services to focus on their core capabilities. CROs and CDMOs have skilled professionals to provide tailored services to companies.

By technology, the traditional methods segment held a major revenue share of the market in 2024. This is due to the easy procedure of traditional methods and cost-effective testing. Traditional testing methods, such as culture-based assays and the LAL test, have been the most commonly used tests for decades. They eliminate the need for specialized infrastructure and skilled professionals for performing complex procedures.

By technology, the rapid microbiological methods segment is expected to show the fastest growth over the forecast period. Rapid microbiological methods are more advanced than conventional methods, offering high speed and enhanced efficiency. They overcome several limitations of traditional methods. Traditional methods generally take 4-5 weeks to derive outcomes. PCR and NGS allow highly sensitive detection of adventitious agents within only a few days.

North America dominated the global market share by 42% in 2024. The presence of key players, strong regulatory oversight, and increasing R&D investments are the major growth factors of the market in North America. The availability of state-of-the-art research and development facilities leads to the development of novel biologics. The growing demand for personalized medicines and favorable government support governs market growth.

Key players, such as Thermo Fisher Scientific, Inc., Merck KGaA, and Bio-Rad Laboratories, are the major contributors to the market in the U.S. The FDA approved a total of 50 drugs in 2024, of which 16 were biologics. As of 2024, the FDA has approved 63 biosimilars across 17 unique reference products. The FDA regulates the safety testing of biologics in the U.S.

As of February 2024, Health Canada approved 55 biosimilars of reference biologics in Canada. The Government of Canada invested more than $2.5 billion in 43 projects in the biomanufacturing, vaccine, and therapeutics ecosystem to strengthen domestic pandemic response capabilities and life science innovation. (Source - Canada)

Asia-Pacific is expected to grow at the fastest CAGR in the biologics safety testing market during the forecast period. Countries like China, India, and South Korea are at the forefront of developing novel biologics. The local regulatory harmonization for biologics necessitates researchers and companies to conduct biologics safety testing. The rising prevalence of genetic and rare disorders and the growing geriatric population augment market growth. The burgeoning pharmaceutical and biopharmaceutical sectors and increasing venture capital investments contribute to market growth.

The National Medical Products Administration (NMPA) regulates the approval of biologics and biosimilars in China. In 2024, 93 therapeutic biological products were approved in China. In June 2025, LTZ Therapeutics and Beijing Sungen Biomedical raised $40 million each based on their clinical assets with novel mechanisms of action. (Source - Citeline)

The Indian government initiatives, like “Make in India”, encourage researchers and local manufacturers to develop and manufacture novel biologics. The federal government’s “Guidelines on Similar Biologics” focus on minimizing animal testing, advocating for in vitro studies. Moreover, India positioned itself as the second-largest venture capital destination in Asia-Pacific. (Source - India)

Europe is expected to grow at a notable CAGR in the biologics safety testing market in the foreseeable future. The growing research and development activities and favorable government support boost the market. Government organizations launch initiatives to encourage people to screen for and early diagnosis of genetic and rare disorders. The European Medicines Agency (EMA) regulates the approval of biologics in Europe. The increasing collaboration among key players and academic researchers facilitates the development and launch of biologics.

Germany is the fourth-largest pharma market in the world. SGS SA and AGC Biologics are the major companies that manufacture biologics in Germany. The pharma sales in Germany increased by almost 8% from 2023 to 2024 to reach more than EUR 55 billion. Additionally, EUR 2 billion in fresh capital flowed into the industry. (Source - Gtai)

The UK’s innovative life sciences and biotech sector raised an investment of £1.98 billion in the first and second quarters of 2024, an increase of £1.80 billion from last year. Around 523 and 253 clinical trials related to vaccines and gene therapy are registered on the clinicaltrials.gov website in the UK. (Source - Clinical trials)

Scott Jefers, Chief Technical Officer at GenSight Biologics, commented that the collaboration with Catalent, Inc. is a significant milestone for the company in securing the supply of LUMEVOQ for clinical use and supporting the planned regulatory submissions. This collaboration proved to be highly effective in completing the technology transfer process, as well as improving yield and upgrading analytical methods to reinforce control over the safety and quality of each batch. (Source - Biospace)

By Product Type

By Test Type

By Application

By End User

By Technology

By Region

January 2026

January 2026

January 2026

December 2025