February 2026

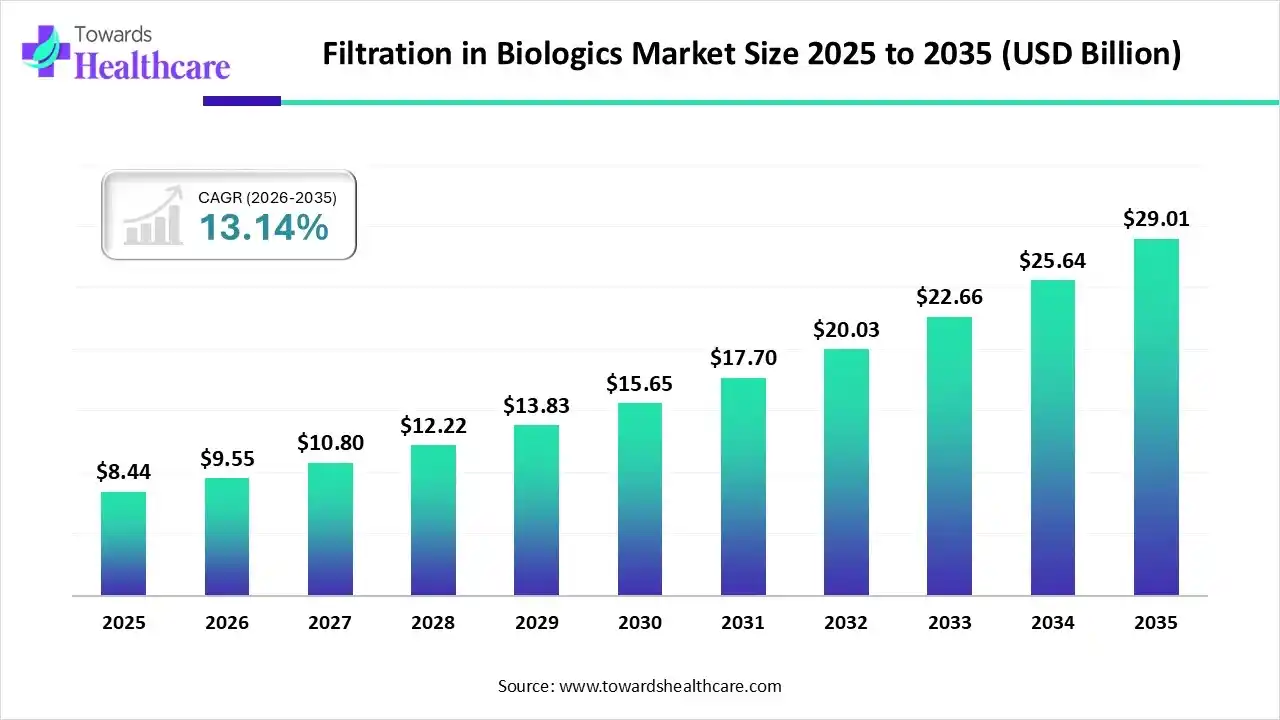

The filtration in biologics market size stood at US$ 8.44 billion in 2025, grew to US$ 9.55 billion in 2026, and is forecast to reach US$ 29.01 billion by 2035, expanding at a CAGR of 13.14% from 2026 to 2035.

One of the major growth areas experiencing global filtration in biologics market is influenced by the growing incidences of chronic diseases like cancer, heart conditions, diabetes, and autoimmune disorders are fueling demand for more efficient and robust bioproduction of biologics, biosimilars, including vaccines, antibodies, in which advanced filtration technologies are required. This increasing demand fueled biopharmaceutical companies to actively invest in R&D activities and develop novel filtration technologies like nano-fibre filtration, eco-friendly, and recyclable membranes.

The filtration in biologics market refers to the use of filtration technologies in the manufacturing and purification of biologic drugs such as monoclonal antibodies (mAbs), vaccines, recombinant proteins, and cell & gene therapies. Primarily, the market is propelled by the rising demand for purification and sterilization of biologics, biosimilars, and vaccines. With a focus on this factor, recently, several advancements in depth filtration, virus filtration, and sterile filtration, with improved efficiency, throughput, and sustainability, are boosting the market expansion. However, another trend is accelerating, such as automation, predictive maintenance, and the use of advanced materials, including nanofiber technology.

AI is transforming filtration processes in the biologics industry by improving efficiency, enhancing performance, and optimizing QC. Whereas rising demand for biologics, which require more effective and scalable production approaches, also in complex filtration, AI can optimize the processes. As well as AI can also streamline filtration processes, reduce waste, and improve yield, thus decreasing overall manufacturing expenses.

Increasing demand for biologics & biosimilars with a focus on product safety

Around the globe, the filtration in biologics market is driven by growing demand for biologics such as vaccines and therapies for cancer and autoimmune disorders, which require well-developed filtration methods for purification and sterilization. Along with accelerating investments in pharmaceutical research and development, and rising focus on product safety and impurities removal under strict regulatory considerations, are fueling the market expansion with advanced filtration systems.

Significant product loss and high operating costs

The filtration in biologics market is facing major limitations, including smaller pore-sized filters resulting in major product loss to achieve a greater purity level. Also, higher initial investment in filtration equipment and continuous spending on maintenance, such as filter replacement, are emerging hurdles for the market expansion.

Accelerating various filtration types applications in biologics

Different filtration types, including membrane filtration, depth filtration, and tangential flow filtration, are vital in the removal of bacteria, viruses, and other particles from biologics, along with clarification and removal of larger impurities, and are essential for concentration, diafiltration, and purification of biologics, respectively, generating numerous opportunities in the filtration in biologics market.

| Key Elements | Scope |

| Market Size in 2026 | USD 9.55 Billion |

| Projected Market Size in 2035 | USD 29.01 Billion |

| CAGR (2026 - 2035) | 13.14% |

| Leading Region | North America by 46.9% |

| Market Segmentation | By Filtration Type, By Product Type, By Biologic Type, By Process Stage, By End User, By Region |

| Top Key Players | Merck KGaA (MilliporeSigma), Sartorius AG, Danaher Corporation (Cytiva & Pall Life Sciences), Thermo Fisher Scientific, 3M Health Care (formerly Purification Solutions), Repligen Corporation, Parker Hannifin (Bioscience Division), GE Healthcare Life Sciences (now Cytiva), Meissner Filtration Products, Asahi Kasei Medical (Planova filters), EMD Millipore, Amazon Filters Ltd., Cole-Parmer, Saint-Gobain Life Sciences, Sterlitech Corporation |

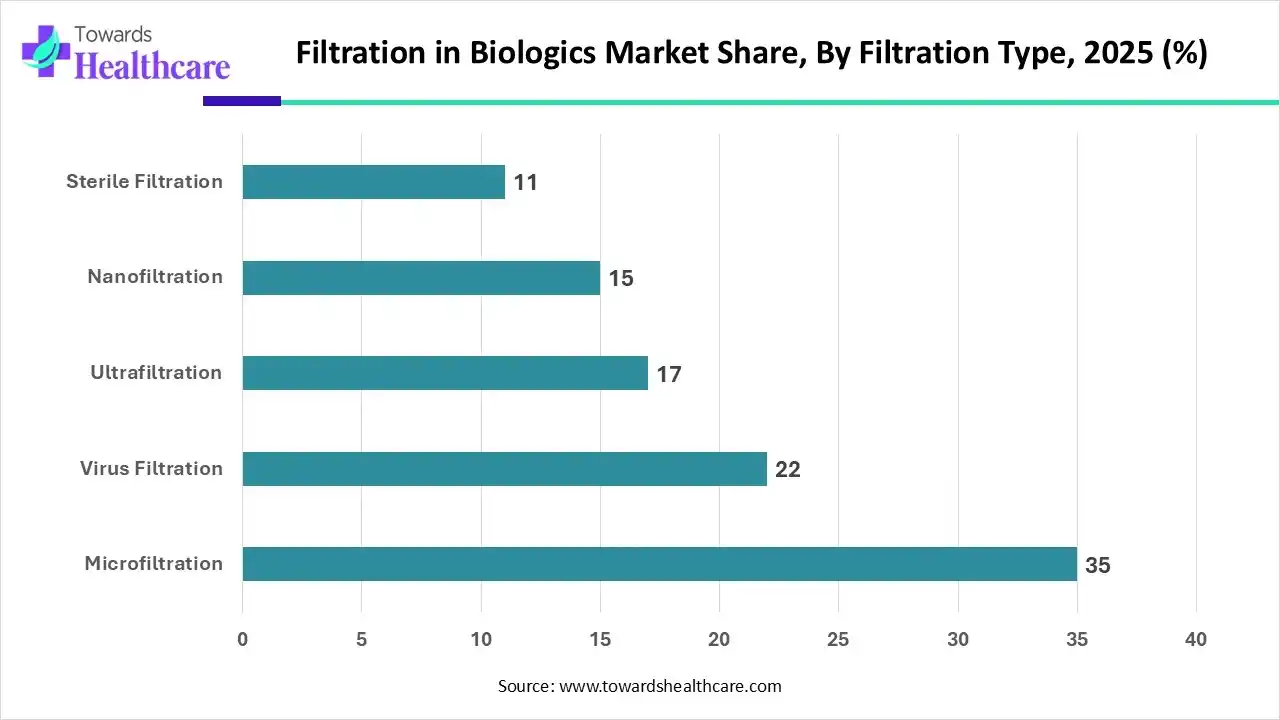

How did the Microfiltration Segment Dominate the Filtration in Biologics Market in 2025?

By filtration type, the microfiltration segment held 35% revenue share in 2025. Along with several bioproductions, novel creations in the filtration materials and designs, such as the development of single-use systems with increasing demand for sterile filtration, microfiltration provides enhanced membrane fouling resistance, more efficiency, reduced costs, and prevents contamination. Thus, the segment is fueling wide demand across the market.

By filtration type, the virus filtration segment is estimated to register rapid growth during 2025-2034. Growing investment in R&D by pharmaceutical and biotechnology companies and rising adoption of single-use virus filtration systems due to their minimized contamination risks, minimal capital costs, and rapid turnaround times are driving the segment expansion.

| Segment | Share 2025 (%) |

| Membrane Filters | 57.10% |

| Pre-filters & Depth Media | 10% |

| Single-Use Systems | 15% |

| Filtration Accessories | 10% |

| Others | 7.90% |

Why did the Membrane Filters Segment Lead the Filtration in Biologics Market in 2025?

The membrane filters segment held the biggest revenue share of the market with 57.10% and is expected to sustain the position during the forecast period. This segment is propelled by its versatility in pore sizes and filtration techniques like microfiltration, ultrafiltration, and nanofiltration, enabling for tailoring to particular biopharmaceutical applications and production rates. Moreover, expansion in the biologics and biosimilars production is also accelerating the segment's growth.

By Biologic Type, Which Segment Held the Largest Share of the Market in 2025?

By biologic type, the monoclonal antibodies (mAbs) segment dominated the global filtration in biologics market with 48.6% in 2024. Increasing advancements in biotechnology, such as genetic engineering, phage display, and hybridoma technology, along with the rising adoption of targeted therapies in growing cases of cancer, autoimmune disorders, and cardiovascular diseases, are boosting the segment and overall market growth.

By biologic type, the cell & gene therapies segment is predicted to show the fastest growth in the studied years. Along with rising cases of rare and autoimmune diseases, other factors like increasing pipeline of cell and gene therapies in clinical trials & more approvals are driving the segment. As well as numerous advancements in production processes, such as filtration techniques, are allowing highly effective and measurable manufacturing of cell and gene therapies.

What made the Downstream Processing Segment Dominant in the Market in 2025?

The downstream processing segment dominated with 62.3% revenue share of the global filtration in biologics market in 2025. The main contributing factors are the rapid biopharmaceutical industry's expansion resulting in demand for downstream processing approaches to clarify, purify, and produce complex biologics. Also, the major utilization of single-use technologies with disposable filtration systems streamlines this process and ultimately decreases the risk of cross-contamination, and boosts production.

By the process stage, the final fill/finish segment is anticipated to grow rapidly during the forecast period. The segment is driven by the growing demand for cell and gene therapies, with its importance in the maintenance of product integrity, especially for biologics, which are delicate to different environmental conditions.

Why did the Biopharmaceutical Companies Segment Dominate the Market in 2025?

By end user, the biopharmaceutical companies segment held 66.2% revenue share of the global filtration in biologics market in 2025. Nowadays, increasing incidences of various diseases are demanding innovative biologics and biosimilars, like antibodies, vaccines. The wide production of these biologics and biosimilars is accelerating the segment and overall market growth, with stringent regulatory guidelines and highly pure compounds.

By end user, the CMOs/CDMOs segment is predicted to register rapid growth over the projected period. The segment is mainly propelled by developing biopharmaceutical companies, are highly rely on CMOs/CDMOs for different stages of drug development and production, such as filtration, to minimize capital expenditure, focus on core competencies, and access specialized expertise.

North America led the global filtration in biologics market by capturing a revenue share of 46.9% in 2024. The region dominance is fueled by the expansion of biologics, including vaccines, monoclonal antibodies, and other complex therapies, which require advanced filtration approaches to achieve highly purified and potent products, along with stringent regulatory guidelines emphasizing sterile production and strong filtration approaches to prevent contamination and achieve drug safety.

The US market is experiencing major expansion due to innovations in nanofiber technology and membrane filtration to enhance the efficiency, capacity, and accuracy of filtration systems. As well as increasing investments in biopharmaceutical R&D activities are fueling the requirement for well-developed filtration solutions.

For instance,

Canada is driven by innovations in filtration systems, including AI-powered approaches, tangential flow filtration (TFF), and single-use filtration systems to achieve impurity-free products. Furthermore, growing advancements in single-use approaches and rising investments in R&D of filtration and biologics processes are propelling the market growth.

Asia Pacific is predicted to grow rapidly in the projected period (2025–2030). Due to increasing cases of cancer, genetic disorders, diabetes, and heart conditions, are highly fueling demand for personalized therapies. However, governments in China, India, and Japan are increasingly providing funds for the development of biotech research hubs and their advanced infrastructure. Whereas these developing research hubs and numerous biotechnology companies are broadly adopting single-use technologies to develop, produce highly effective and less contaminated products.

As mentioned, wide-range investments by governments, along with increased production of biologics and vaccines, as well as antibodies, by collaborating with various biotechnology and pharmaceutical companies, are driving China’s market growth.

For this market,

India is experiencing growth due to many factors, like rising expenditure on pharmaceutical and biopharmaceutical R&D, which is enhancing demand for filtration solutions in various laboratory and analytical applications.

For instance,

Europe is expected to grow significantly, as raised demand for advanced filtration technologies, including membrane filtration, is boosting due to their superior efficiency, higher purity, and versatility in separating particles, microorganisms, and macromolecules. Moreover, rising cases of chronic diseases and the demand for regenerative therapies and personalized medicines are propelling the expansion of the biopharmaceutical company, which ultimately fuels the demand for filtration systems.

In Germany, the market is developing by consistent innovation in filtration membranes such as PES, PVDF, Nylon, PTFE), filter designs, and automation is accelerating the efficiency and reliability of filtration processes. Along with this, filtration in the removal of particulate matter, bacteria, endotoxins, and other contaminants is playing a major role in the development of biologics is fueling the market growth.

The UK market is highly focused on the development of eco-friendly filtration technologies, like recyclable filter housings and bio-based membranes with durability. Also, they are emphasizing Contract Manufacturing Organizations (CMOs) as they need robust and reliable filtration approaches for their biopharmaceutical manufacturing.

For instance,

By Filtration Type

By Product Type

By Biologic Type

By Process Stage

By End User

By Region

February 2026

February 2026

February 2026

February 2026