March 2026

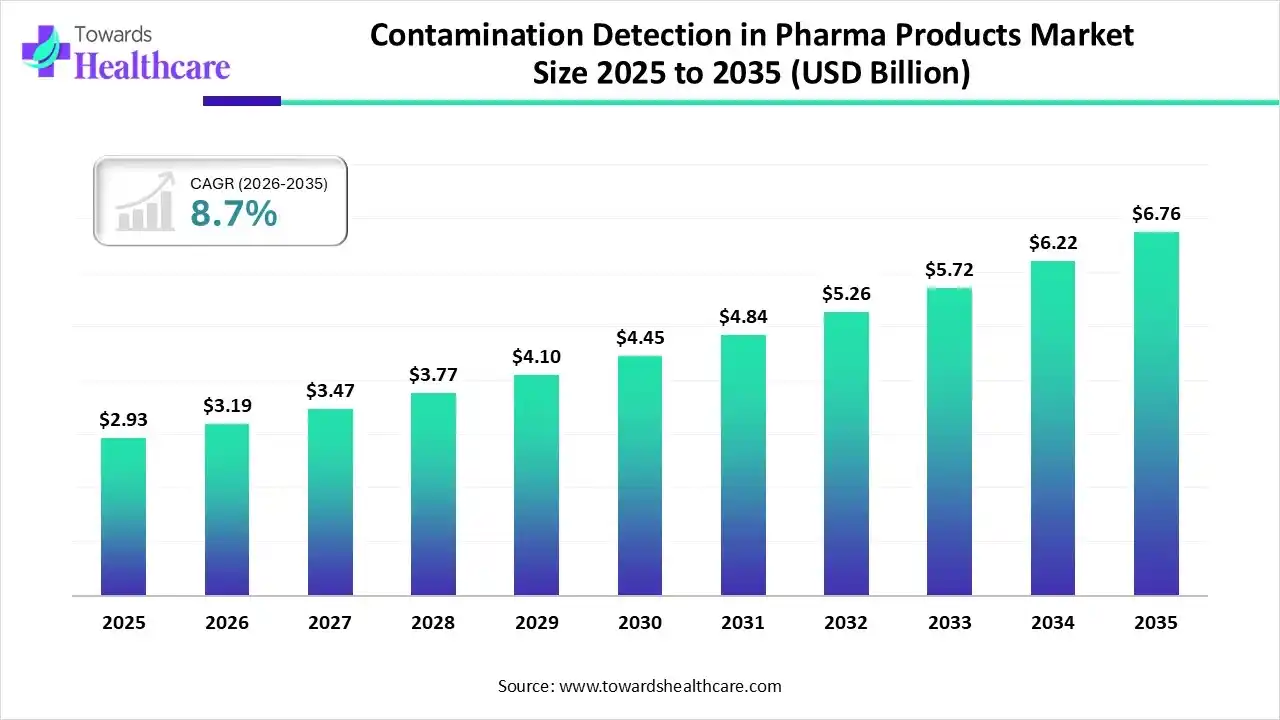

The contamination detection in pharma products market size was reported at US$ 2.93 billion in 2025 and is expected to rise to US$ 3.19 billion in 2026. According to forecasts, it will grow at a CAGR of 8.7% to reach US$ 6.76 billion by 2035.

The contamination detection in pharma products market is rapidly expanding because of strict government standards, growing healthcare production, and increasing awareness related to the safety of the product. It includes technologies such as chromatography, spectroscopy, and rapid microbiological processes to detect contaminants in biologics, drugs, and medical tools. North America is dominated due to increasing demand for advanced-quality medicines, and the emergence of advanced detection methods drives the market growth. Asia Pacific is fastest growing as major pharmaceutical companies are investing in R&D to improve the speed and sensitivity of detection systems.

Contamination detection in pharmaceutical products refers to the processes and technologies used to identify the presence of unintended substances, biological, chemical, or physical, in drugs, biologics, and other pharmaceutical formulations. These contaminants can compromise product safety, efficacy, and quality, making their detection a critical aspect of pharmaceutical manufacturing and compliance. By conducting various contamination testing, producers can uphold quality standards and shield the health of consumers. Contamination testing involves analysis of pharmaceutical products to detect contaminants or impurities, maintaining their safety and efficacy. This important process protects the public health by confirming the integrity of medications before they reach consumers.

AI integration in contamination detection in pharma products is driving the growth of the market as the real-time monitoring abilities of AI-driven systems help in the prompt detection of defects, driving appropriate intervention and preventing the release of faulty products. The integration of AI-driven technology into pharmaceutical contamination detection improves product quality, improves productivity, and ensures the safety and efficacy of pharmaceutical products. AI-based technologies integration in pharmaceutical sustainability, efficiency, and safety in the supply AI has been increasingly applied to enhance chemical analysis and monitoring of contaminants in pharmaceutical products.

Increasing Application of Biologics and Biosimilars

Biologic drugs are a major force in the pharmaceutical industry for good reason. They make up over half of the drugs in development and have the potential to treat many chronic diseases and unmet medical needs. These medicines are transforming what treatments can achieve for millions affected by these conditions. Government agencies are promoting innovation and competition in biologics and supporting the development of safe, effective biosimilars. Because biologics are highly sensitive to microbial and particulate contamination, there is a need for advanced detection systems. This rising demand boosts the growth of contamination detection technology within the pharmaceutical market.

Ongoing Contamination Issues

The ongoing contamination issues are likely caused by a lack of knowledge, noncompliance with GMP, confusion from varying GMP standards, and weak enforcement. These factors hinder the advancement of contamination detection in the pharmaceutical market.

Increasing Adoption of Portable Devices

Emerging detection technology utilizing framework materials offers a highly sensitive, cost-effective, and rapid platform for detecting pharmaceutical contaminants. Integrating portable devices with these materials meets the requirement for on-site pharmaceutical safety testing. While developments in portable detection have enhanced field applications, these devices often lack effective pretreatment processes, which can hinder accurate measurement of contaminants in complex samples. This gap presents an opportunity for contamination detection in the pharmaceutical product market.

| Key Elements | Scope |

| Market Size in 2026 | USD 3.19 Billion |

| Projected Market Size in 2035 | USD 6.76 Billion |

| CAGR (2026 - 2035) | 8.7% |

| Leading Region | North America |

| Market Segmentation | By Contamination Type, By Detection Technology, By Product and Service Type, By Sample Type, By End User, By Region |

| Top Key Players | Thermo Fisher Scientific, Agilent Technologies, Shimadzu Corporation, PerkinElmer, Waters Corporation, Bio-Rad Laboratories, Bruker Corporation, Mettler-Toledo International Inc., HORIBA Scientific, Danaher Corporation |

Why the Chemical Contamination Segment Dominated the Market?

By contamination type, the chemical contamination segment dominated in the contamination detection in pharma products market in 2024 with a 36.5% share, as this contamination occurs when the pharmaceutical product comes into contact with a chemical, which can lead to chemical poisoning if the product is consumed. This could be a diversity of things, as there are chemicals in numerous items used in the pharmaceutical industry.

The microbial contamination segment is expected to grow at the fastest CAGR over the forecast period, 2025 to 2035, as there are various microorganisms that contaminate pharmaceutical products, which contain viruses, fungi, and bacteria. The presence of these contaminants affects the safety, quality, and efficiency of pharmaceutical products, leading to product recalls, harm to reputation, and economic losses. So, pharmaceutical manufacturers are required to implement advanced quality control measures to identify and avoid microbial contamination, including stringent sanitation and cleaning procedures, monitoring, and microbiological testing.

Why is the Spectroscopy-Based Segment Dominant in the Market?

By detection technology, the spectroscopy-based segment is dominant in the contamination detection in pharma products market in 2024, with a 34.2% share, as investigators demonstrated an advanced approach that applied machine-learning aided UV absorbance spectroscopy to identify contamination during the manufacture of cell therapy products. It is an affordable and non-invasive procedure that offers a fast output with negligible sample preparation and sample volume. This spectroscopy-based technique is applied as a feasible indicator and classification tool to detect pharmaceutical contamination in surface waters and groundwater.

The PCR and molecular diagnostics segment is expected to fastest-growing over the forecast period 2025 to 2035 as PCR assays for the detection of low levels of bacterial and mold contamination in therapeutic samples, comprising less than 10 CFU, and to compare the assays to standard conventional procedures. A wide range of procedures, like pathogen genome detection, electron microscopy, and culture by polymerase chain reaction (PCR), are used.

Why is the Instruments Segment Dominant in the Market?

By product and service type, the instruments segment is dominant in the contamination detection in pharma products market in 2024 with 49.6% share, as these instruments support in detecting foreign material contaminants, while the production process can support preventing unsafe products from reaching the marketplace, protecting product quality, consumers, and brand reputation. It offers several advantages, primarily focusing on ensuring product quality, patient safety, and operational efficiency.

The consumables & reagents segment is expected to fastest-growing over the forecast period 2025 to 2035 as it is an effective and simple procedure for screening tissue cultures for contamination by microorganisms. They are used to identify contamination in different settings, including laboratories and manufacturing processes, to ensure product safety, quality, and regulatory compliance.

Why is the Instruments Segment Dominant in the Market?

By sample type, the finished pharmaceutical products segment is dominant in the contamination detection in pharma products market in 2024 with 52.8% share, as end-products of pharmaceuticals are crucial to world healthcare due to their offering standardized quality, government compliance, and ready-to-administer formulations. This safeguards timely treatment, streamlines distribution on the borders, and helps effective medical care delivery on a large scale. They design every dosage form to meet particular therapeutic requirements, ensuring optimal drug delivery and better patient outcomes.

The biologics & cell culture samples segment is expected to fastest-growing over the forecast period 2025 to 2035, as applications of biologics and cell culture for these applications are the reproducibility and consistency of output that can be obtained from using a batch of clonal cells. Used as a model system to study basic biochemistry and cell biology, to study the interaction between cells and disease-causing agents such as viruses, to research the effect of drugs, to study the effects of the elderly, and also it is used to study triggers for ageing.

Why is the Pharmaceutical Companies Segment Dominant in the Market?

By end user, the pharmaceutical companies segment is dominant in the contamination detection in pharma products market in 2024 with 63.4% share, as the use of different types of contamination detectors by pharma companies for prevention and control of contamination is supreme in the pharmaceutical sector to ensure the quality and safety of products. These detectors are generally used in pharmaceutical production facilities for identifying or tracing out the presence of metallic objects, like ferrous, non-ferrous, or stainless-steel contaminants in mediates and in end pharmaceutical products.

The biotechnology companies segment is expected to fastest-growing over the forecast period 2025 to 2035 as speedy detection is significant to limit the extent of contamination in a manufacturing facility. Implementation of novel technology would allow teams to test for foreign pollutants remotely, provided that real-time 24/7 readings, using a natural microorganism, that causes a reaction when certain chemicals are found.

North America is dominant in the contamination detection in pharma products market with the largest revenue share, as growing pharmaceutical manufacturing in this region, with a 45.2% share, due to North America-based manufacturing, allows medical manufacturing companies to improve quality control, specifically for complex or temperature-sensitive drug products. Advanced drug production technology provides a level of oversight across the entire production lifecycle that is complex to achieve with overseas services, which increases the demand for contamination detection solutions. For Instance, in 2023, North America accounted for 53.3% of world pharmaceutical sales compared with 22.7% for Europe. Also, increasing demand for advanced therapies and biologics, as well as the challenges and resource-intensive nature of establishing independent manufacturing abilities.

U.S. Contamination Detection in Pharma Products Market Trends

In the U.S., medical drug manufacturers employ a variety of contamination control approaches that span facility design, personnel practices, equipment, and modern technology. Robust manufacturing influences cutting-edge technologies to modernise production, which integrates seamless processes, knowingly lowering production times and enhancing quality control, which surges demand for high-precision contamination detection systems such as AI-driven contamination detectors.

Canada Contamination Detection in Pharma Products Market Trends

The Canadian government announced plans for a large increase in expenditure on research and development, including novel investments in artificial intelligence, research infrastructure, sterility testing labs, and validation services from CROs. Increasing demand for pharmaceuticals and cost savings encouraged pharmaceutical organizations to shift production to this developing pharma manufacturing technology, which is growing the demand for contamination detection solutions in this manufacturing.

The Asia Pacific region is projected to experience the fastest growth in the market during the forecast period, because Asia Pacific is poised to become a pharmaceutical manufacturing hub, advancing in clinical trials and biotechnology innovations. Biotech investment in the APAC region is on the increase, driven by various factors, including funding and precision medicine. As the region continues to grow and innovate, we will likely see even more exciting developments in the biotech industry in the upcoming period.

China Contamination Detection in Pharma Products Market Trends

China is becoming a key force in worldwide drug development, providing fast trials, affordable costs, and a wide range of research areas. Also, the Chinese pharma manufacturing sector has undergone noteworthy transformation and is becoming a key hub for revolution, so there is growing adoption of advanced contamination detection technology for the pharma product, which contributes to the growth of the market.

Increasing Pharmaceutical Manufacturing in India

India ranks as the global third-largest medicine manufacturer, contributing 10% of global volume, and it grasps the thirteenth position in terms of value, which is a major growth driver of the market. There is a growing adoption of advanced manufacturing technologies, like automation and digital integration, in the manufacturing sector to improve efficiency and precision.

Europe is expected to grow significantly in the market during the forecast period, as the presence of supportive regulatory systems, such as the European Medicines Agency (EMA) and bodies such as EDQM, maintains the high-quality pharmaceutical standards in Europe. European biotech offers investors space for momentum and growth. With a strong science base, Europe has ample opportunities to translate innovation into products., This drives the growth of the market.

For Instance,

Increasing Investment in Germany

The increasing pharmaceutical manufacturing in Germany is driving the growth of the market. For Instance, in 2023, pharmaceutical industry sales in Germany increased by 5.8 percent, reaching EUR 59.8 billion. Germany belongs to the global leading clinical trial locations and, based on R&D investment and patent application levels, is the leading pharmaceutical novelty location in Europe. In 2022, pharma companies in Germany invested EUR 9.6 bn in R&D, and some 613 patents were registered with the European Patent Office by the pharmaceutical industry in Germany, which contributes to the growth of the market.

South America is expected to grow significantly in the contamination detection in pharma products market during the forecast period, due to stringent regulations. The expanding pharmaceutical industries are also increasing their adoption rates. Furthermore, the growing development of biologics and increasing contamination detection tools are also promoting the market growth.

Brazil Market Trends

Due to growing safety concerns, the demand for contamination detection solutions for pharma products is increasing in Brazil. At the same time, the growing pharmaceutical industries and stringent regulations are also increasing their use. Furthermore, the growing development of various impurity detection solutions is also promoting their advancements.

MEA is expected to grow significantly in the contamination detection in pharma products market during the forecast period, due to expanding pharmaceutical industries. The growing production of vaccines, injectables, and biologics are also increasing their adoption rates. Moreover, growing healthcare investments and technological advancements are also enhancing the market growth.

Saudi Arabia Market Trends

Saudi Arabia consists of robust regulatory frameworks, which is increasing the adoption of contamination detection solutions across the pharmaceutical industry. The growing production rates of various sterile products are also driving their demand. Additionally, the increasing investments and growing government support are also enhancing their adoption rates.

In April 2025, Hesham Abdullah, Senior Vice President, Global Head Oncology, R&D, GSK, states, “approval of Blenrep combinations in the UK is a transformative milestone for patients with multiple myeloma, a cancer marked by remission and relapse. As the only BCMA-targeted ADC therapy, Blenrep has the potential, supported by robust phase III data, to extend survival and remission versus standard of care and redefine treatment at or after first relapse.”

By Contamination Type

By Detection Technology

By Product and Service Type

By Sample Type

By End User

By Region

March 2026

March 2026

March 2026

March 2026