December 2025

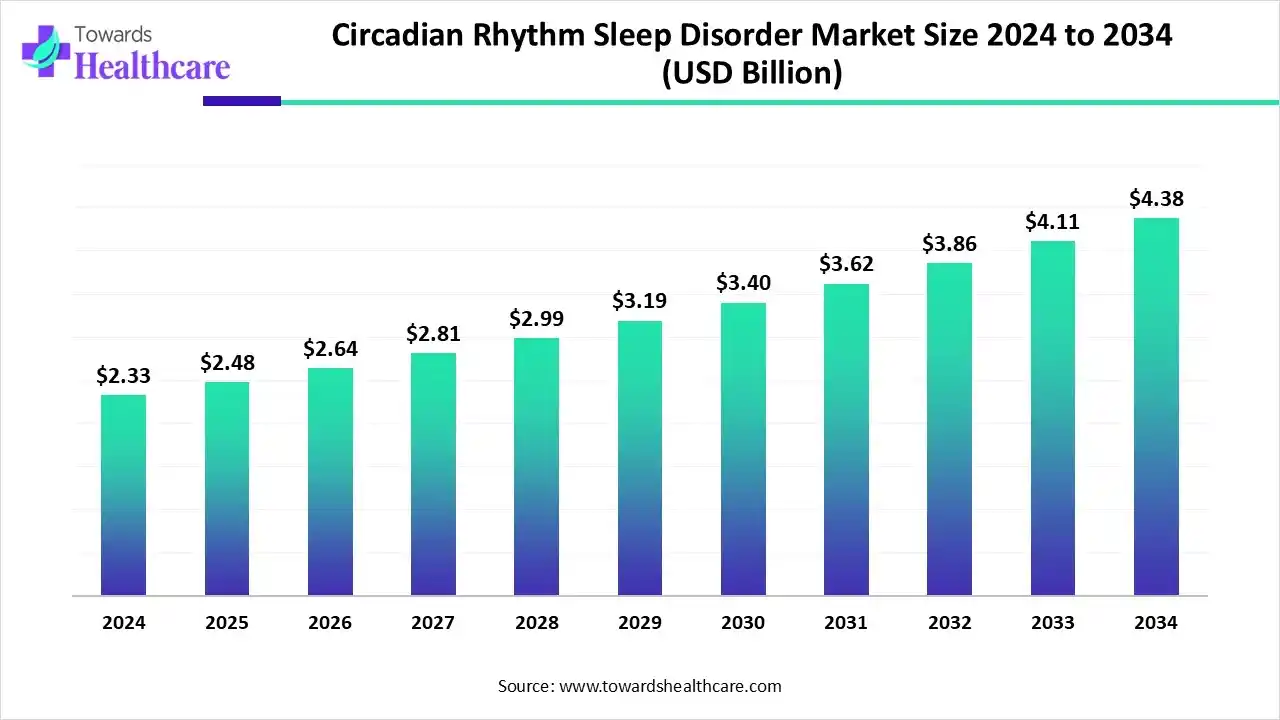

The global circadian rhythm sleep disorder market size is calculated at US$ 2.48 billion in 2025, grew to US$ 2.65 billion in 2026, and is projected to reach around US$ 4.69 billion by 2035. The market is expanding at a CAGR of 6.56% between 2026 and 2035.

More public health efforts, education campaigns, and the spread of knowledge via digital platforms are all responsible for the growing awareness of circadian rhythm sleep problems. Another element influencing the increase in diagnostic rates is patients' and doctors' growing awareness of CRSD symptoms. The circadian rhythm sleep disorder market is expanding because more people are searching for suitable treatment and management options as diagnosis becomes more accessible.

| Table | Scope |

| Market Size in 2026 | USD 2.65 Billion |

| Projected Market Size in 2035 | USD 4.69 Billion |

| CAGR (2026-2035) | 6.56% |

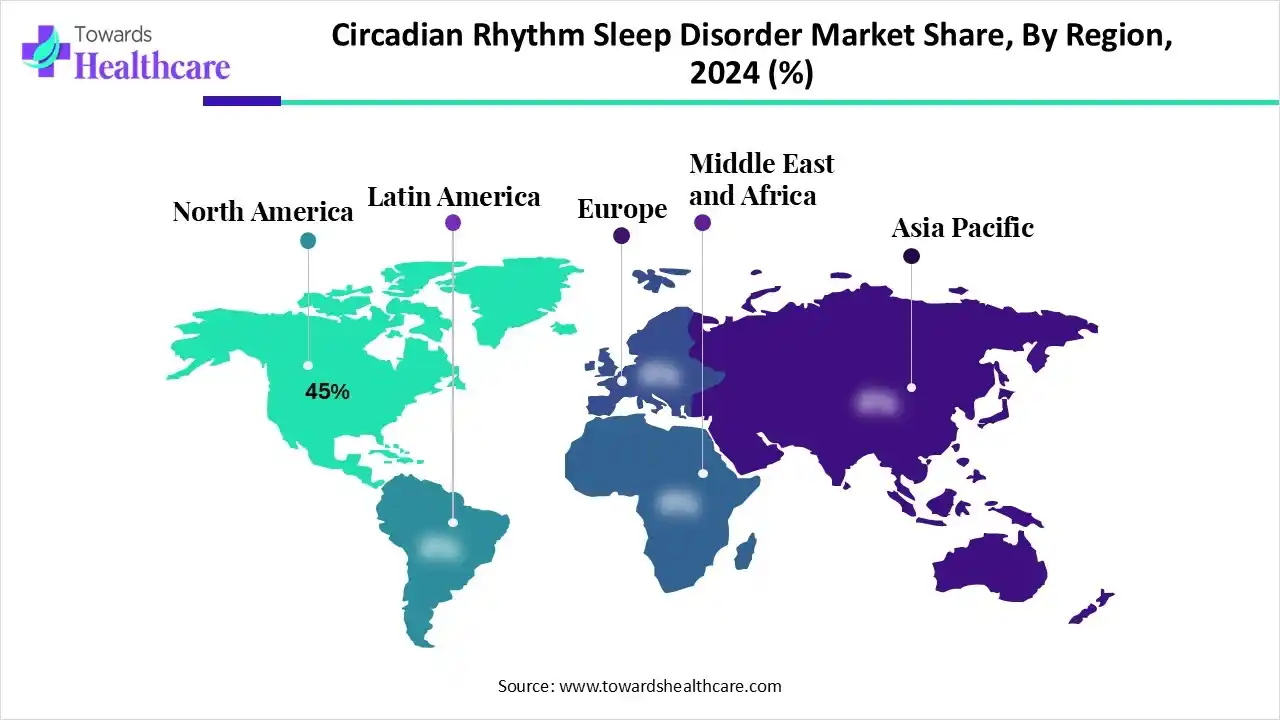

| Leading Region | North America by 45% |

| Market Segmentation | By Disorder Type, By Treatment Type, By End-User/Customer Segment, By Patient Demographics / Age Group, By Region |

| Top Key Players | Vanda Pharmaceuticals, Inc., Takeda Pharmaceutical Company Limited, Pfizer Inc., Teva Pharmaceutical Industries Ltd., Jazz Pharmaceuticals plc, Merck & Co., Inc., GlaxoSmithKline (GSK), Eisai Co., Ltd., ResMed Inc., Koninklijke Philips N.V. (Philips Respironics), Fisher & Paykel Healthcare Corporation Limited, Compumedics Limited, Natus Medical Incorporated, Becton, Dickinson and Company (BD), Medtronic plc, Arena Pharmaceuticals, Neurocrine Biosciences, Inc., Harmony Biosciences Holdings, Inc., Boehringer Ingelheim GmbH, Fabre-Kramer Pharmaceuticals |

The circadian rhythm sleep disorder market is driven by rising awareness among the population about sleep disorders and the importance of their treatments. Circadian rhythm sleep disorders are a group of conditions in which the internal body clock (circadian system) is misaligned with the external 24-hour day or sleep-wake requirements, producing chronic or recurrent sleep timing problems and daytime impairment. Common CRSDs include non-24-hour sleep-wake disorder, delayed sleep-phase disorder, advanced sleep-phase disorder, irregular sleep-wake rhythm, and shift-work sleep disorder.

Diagnosis relies on clinical history, sleep diaries, actigraphy, and sometimes polysomnography; treatments combine behavioral interventions (sleep scheduling, light therapy, chronotherapy), pharmacologic approaches (melatonin and melatonin receptor agonists, wake-promoting agents where indicated), and device/diagnostic solutions for sleep monitoring. The market therefore spans pharmaceuticals (including melatonin receptor agonists and other sleep drugs), medical devices and diagnostics (sleep study equipment, wearable/monitoring devices), and digital therapeutics/behavioral solutions.

Clinical artificial intelligence has great promise for transforming the circadian rhythm sleep disorder market through automated sleep study grading and early sleep problem detection. Large-scale datasets are analysed by machine learning (ML) algorithms to categorise relationships between treatment results, sleep physiology, and patient characteristics.

More effective sleep therapies, early problem identification, and real-time health optimisation are being made possible by AI's integration of machine learning with wearable sensors, cloud-based monitoring, and smart home technologies. AI-driven sleep research will advance in precision, predictiveness, and personalisation as technology develops further, eventually resulting in better sleep habits and general well-being for people everywhere.

By disorder type, the delayed sleep phase disorder (DSPD) segment captured the largest revenue of 30% of the circadian rhythm sleep disorder market in 2024. Between 1 to 16 percent of teenagers and young adults have DSPD. The effects on the person are profound, especially when it comes to mental health and performance at work and in school. Administering melatonin seems to be a straightforward and successful therapy for DSPD in adolescents. The more intricate combination of bright light therapy and cognitive behavioural therapy is equally beneficial after treatment and seems to have long-term effects.

By disorder type, the non-24-hour sleep-wake disorder segment is estimated to witness the highest growth during the forecast period. It is estimated that non-24-hour sleep-wake disorder affects around half of all blind individuals. While non-24-hour sleep-wake syndrome can strike sighted people at any age, it often manifests in childhood. Tasimelteon, an FDA-approved melatonin receptor agonist, and melatonin supplements are frequently used to treat non-24-hour sleep-wake disorder.

By treatment type, the pharmacological therapies segment captured the largest revenue of 50% of the circadian rhythm sleep disorder market in 2024. Benzodiazepines (e.g., temazepam, flurazepam) and non-benzodiazepine hypnotics (e.g., zolpidem, eszopiclone) for insomnia, melatonin receptor agonists (e.g., ramelteon) for regulating the sleep-wake cycle, and dopamine agonists (e.g., modafinil) for excessive daytime sleepiness in conditions like narcolepsy are examples of pharmaceutical treatments for sleep disorders.

By treatment type, the digital therapeutics & mobile apps segment is estimated to witness the highest growth during the forecast period. Digital therapies for sleep problems are now available via platforms including the Internet, smartphone apps, and virtual reality thanks to the quick growth of digital technology in recent years. Data tracking, individualised care, remote care, and many more uses are beneficial.

By end-user/customer segment, the hospitals & sleep clinics segment captured the largest revenue of 35% of the circadian rhythm sleep disorder market in 2024. Deeper knowledge, sophisticated diagnostics like sleep studies, and individualised, comprehensive treatment programmes are all provided by specialised sleep clinics. Compared to general care, this targeted strategy results in more precise diagnoses and improved long-term patient outcomes.

By end-user/customer segment, the occupational health & corporate wellness segment is estimated to witness the highest growth during the forecast period. In order to ensure the general well-being of employees, sleep is an essential part of corporate wellness programmes. Businesses may assist their workers get better sleep, which will improve their health, productivity, and job happiness. They can do this by integrating sleep tests into executive health checks, encouraging exercise, and putting effective stress management strategies into practice.

By patient demographics/age group, the young adults segment captured the largest revenue of 30% of the circadian rhythm sleep disorder market in 2024. The prevalence of identified sleep disorders described in the literature ranges from 5% to 15%, with between 10% and 30% of the general adult population suffering from poor sleep quality and sleep issues. Due to lifestyle issues including excessive screen time, unpredictable sleep cycles, and late-night digital device use, younger individuals frequently struggle to initiate sleep.

By patient demographics/age group, the adolescents segment is estimated to witness the highest growth in the circadian rhythm sleep disorder market during the forecast period. About 40% of people have a mental problem by the time they are 14 years old, and almost all psychiatric disorders peak during adolescence. Intervention and early detection are crucial. Numerous interventions, including delaying school start times, limiting mobile and social media use, and promoting physical exercise, may be implemented at the individual, family, and school levels to enhance and sustain the length and quality of teenage sleep.

North America dominated the circadian rhythm sleep disorder market share by 45% in 2025, with a share of 45% due to the prevalence of sleep disorders in the region. The presence of significant market participants, research facilities, and state-of-the-art healthcare infrastructure is driving the industry's growth. The market is expanding as a result of the established healthcare system and sizable patient base in the United States.

About 50 to 70 million adults in the United States suffer from chronic sleep disorders, the most common of which are sleep apnea and insomnia. An estimated 80.6 million people suffered from obstructive sleep apnea in 2024, and a 2024 survey found that roughly one-third of Americans sleep in a different room from their partners because of sleep problems like snoring or restlessness.

Asia Pacific is estimated to host the fastest-growing circadian rhythm sleep disorder market during the forecast period. Increases in sleep-related health problems have been caused by the region's mass-market potential, rapidly ageing population, rapid urbanisation, rising work-related stress, and the relatively recent adoption of Westernised lifestyles (especially with regard to technology use and artificial light exposure). Sleeping well with natural light is a part of traditional lifestyles in Asia Pacific nations like China, Japan, India, and South Korea.

Loss of sleep is no longer a problem that only affects adults in China. A growing public health concern that also impacts children is inadequate sleep, which is brought on by late bedtimes, trouble falling asleep, and other sleep-related issues.

China plans to open sleep and mental health clinics in every city at the prefecture level by the end of 2025 as part of a larger initiative to address sleep and mental health issues for people of all ages. This will increase access to professional assistance for people who are experiencing psychological and sleep-related anxiety.

Europe is expected to grow at a significant CAGR in the circadian rhythm sleep disorder market during the forecast period. The European Commission predicts that the old-age dependence ratio in Europe, the proportion of people 65 and older compared to those between the ages of 15 and 64, will increase from 29.6% in 2021 to 51.2% in 2030, making sleep problems more common in the future. Thanks to the European Medicines Agency's coordinated regulatory procedures and universal coverage, Europe continues to grow steadily.

Between 13 and 18 million people in France suffer from sleep disorders, making them a public health concern. Given that 13% of French people have been diagnosed with chronic insomnia and 19% report having its symptoms, chronic insomnia is a serious public health concern. Additionally, OSAS is 4.8% and restless legs syndrome is 8.5% common in the French population.

Research and development for sleep disorders is a multi-phase process that moves from basic scientific discovery to clinical implementation and improvement. Understanding sleep mechanisms, finding and confirming novel therapeutic targets, creating and evaluating novel interventions, and establishing best practices for their application are all part of this process. The ultimate objective is to develop safer, more individualised, and more effective treatments for diseases like narcolepsy, sleep apnea, and insomnia.

Phase I–III clinical trials for safety and efficacy, FDA review of the New Drug Application (NDA), approval, post-market phase IV surveillance for long-term safety, and preclinical testing are among the steps.

To ensure adherence and manage progress, steps include diagnosing and educating patients, offering therapy like CBT-I, providing equipment like CPAP machines, and conducting ongoing counselling and monitoring.

By Disorder Type

By Treatment Type

By End-User/Customer Segment

By Patient Demographics / Age Group

By Region

December 2025

December 2025

December 2025

November 2025