HPV-Associated Disorders Market Size, Key Players with Forecast and Shares

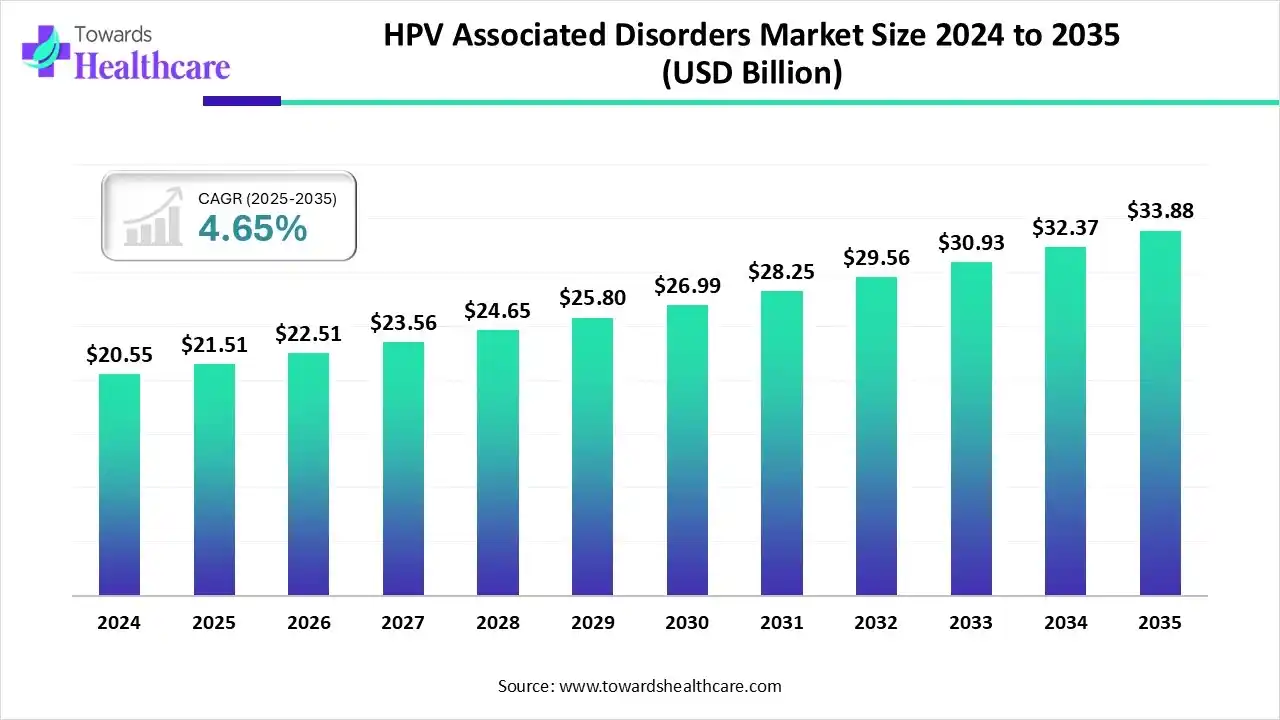

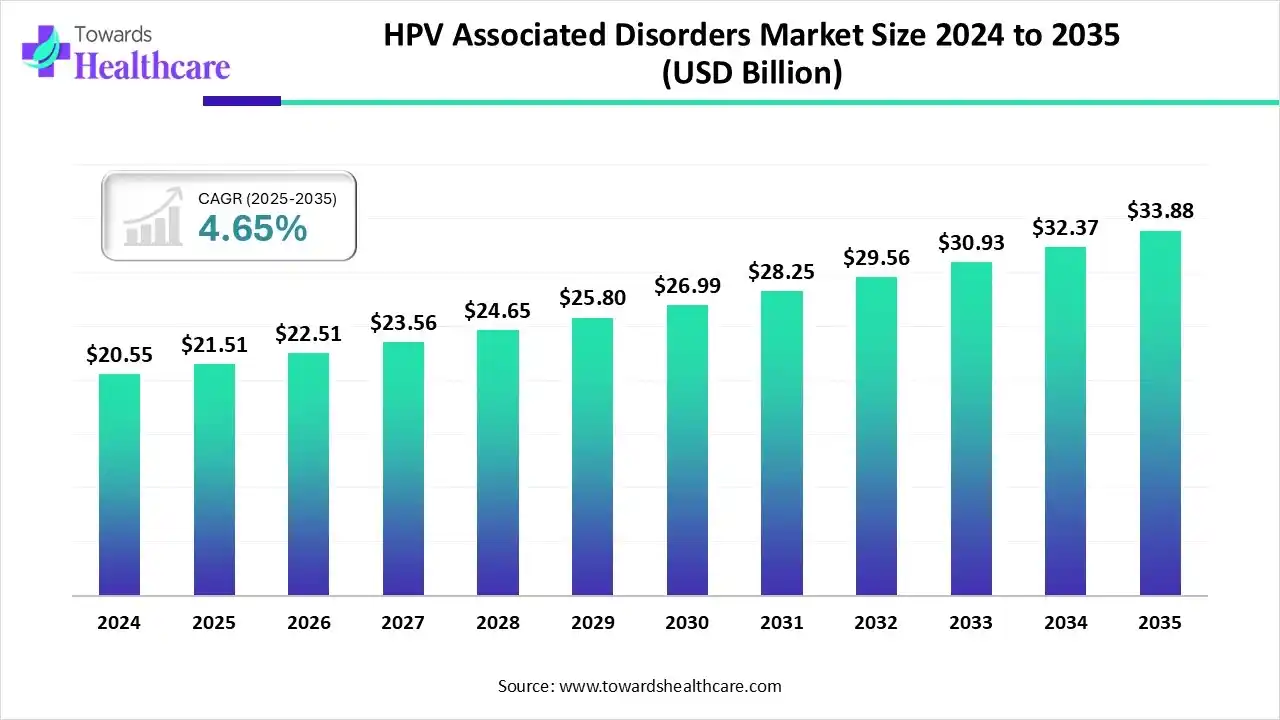

The global HPV-associated disorders market size is calculated at US$ 21.51 billion in 2025, grew to US$ 22.51 billion in 2026, and is projected to reach around US$ 33.88 billion by 2035. The market is expanding at a CAGR of 4.65% between 2026 and 2035.

The HPV-associated disorders market is expanding due to the rising prevalence of HPV infections and related cancers. North America is dominated by increasing screening programs and a strong presence of major healthcare organizations. Asia Pacific is the fastest growing as rising awareness and better healthcare infrastructure in various areas.

Key Takeaways

- The HPV-associated disorders market will likely exceed USD 21.51 billion by 2025.

- Valuation is projected to hit USD 33.88 billion by 2035.

- Estimated to grow at a CAGR of 4.65% starting from 2026 to 2035.

- North America dominated the HPV HPV-associated disorders market in 2024.

- Asia Pacific is expected to grow at the fastest CAGR during the forecast period.

- By type, the cervical cancer segment dominated the market in 2024.

- By type, the cervical intraepithelial neoplasia (CIN) segment is expected to grow at the fastest rate during the forecast period.

- By treatment, the vaccines segment dominated the market in 2024.

- By treatment, the anti-viral drugs segment is expected to grow at the fastest rate during the forecast period.

- By distribution channel, the hospital pharmacies segment dominated the HPV HPV-associated disorders market in 2024.

- By distribution channel, the retail pharmacies segment is expected to grow at the fastest CAGR during the forecast period.

Key Indicators and Highlights

| Table |

Scope |

| Market Size in 2025 |

USD 21.51 Billion |

| Projected Market Size in 2035 |

USD 33.88 Billion |

| CAGR (2026 - 2035) |

4.65% |

| Leading Region |

North America |

| Market Segmentation |

By Type Outlook, By Treatment Outlook, By Region |

| Top Key Players |

Merck & Co., Inc., GlaxoSmithKline plc, F. Hoffmann-La Roche Ltd, Pfizer Inc., AstraZeneca, Biocon, Lilly, AbbVie Inc. |

What are HPV-Associated Disorders?

The HPV-associated disorders market is driven by increased HPV prevalence, a growing focus on early identification and vaccination, and the advancement of novel therapies. HPV is related to a noteworthy burden of disease and cancer, with anogenital warts and recurrent breathing papillomatosis, and oropharyngeal and anogenital cancers. They are allied with a spectrum of diseases, from benign verrucae vulgares and condylomata acuminata to the cancer of the vulva, cervix, penis, and anus. HPVs are identified in skin tags, lichen sclerosus, seborrheic keratoses, actinic keratoses, epidermal cysts, plucked hairs, and psoriatic plaques.

HPV-Associated Disorders Market Outlook

- Industry Growth Overview: The market is expected to increase rapidly between 2025 and 2034 due to the increasing prevalence of HPV-related conditions such as cervical, anal, and oropharyngeal cancers. Technological novelties like next-generation sequencing (NGS) and molecular testing.

- Global Expansion: This market is driven by rising HPV associated cases, increased awareness, government vaccination programs, and development in diagnostics and treatments. North America is the largest market, and the Asia-Pacific region is expanding the fastest due to government initiatives and increased advancement in healthcare programs.

- Startup Ecosystem: The HPV-associated disorders market startup ecosystem is dynamic and growing, driven by development in diagnostics and targeted medicine for HPV-related cancers. Significant startups involve those in diagnostics, such as Papcup, and oncology-focused biotechs like Popvax. This startup has advanced a non-invasive, at-home test for identifying high-risk HPV strains in menstrual blood

How AI is Revolutionizing the HPV Associated Disorders Market?

Integration of AI-driven technology in HPV associated disorders drives the growth of the HPV-associated disorders market, as this technology shifts from being a simple diagnostic device to being used as a tool for performance challenges analysis of HPV-related disease evolution. AI-based technology, through multifactorial analysis, is able to generate a challenge score that better stratifies patients and supports clinicians in selecting highly targeted treatments. AI-driven visual evaluation supports triage of HPV-positive patients. Magnified and highly illuminated visual evaluation of the cervix by clinicians using colposcopy is considered the ideal of care in high-resource settings. AI-driven technology applied to radiology and digital pathology allows the extraction of predictive features that identify challenge stratification in HPV associated diseases.

Segmental Insights

Type Insights

Which Type is Dominating the Market?

The cervical cancer segment was dominant in the HPV-associated disorders market share in 2024, as this type of cancer is by far the utmost common HPV-related disease. Around 99.7% of cervical cancer cases are initiated by persistent genital high-risk human papillomavirus (HPV) infection. Cervical cancer is the most common cancer in women, with an estimated 528,000 new cases

Cervical Intraepithelial Neoplasia (CIN)

The cervical intraepithelial neoplasia (CIN) segment is expected to grow at the fastest CAGR in the HPV-associated disorders Market during the 2025-2034 period, as Cervical intraepithelial neoplasia is a precancerous condition. An HPV infection causes it. Deprived of treatment, cervical intraepithelial neoplasia leads to cervical cancer. Early identification and management prevent these abnormal cells from becoming cancerous.

Anal Cancer

The anal cancer segment is expected to grow at a significant CAGR during the forecast period as this cancer is one of the cancers with a documented HPV etiology, with around 90% of cases existing HPV-driven. Most squamous cell anal cancers are related to infection with HPV. It is a group of more than 150 related viruses.

Treatment Insights

What made the Vaccine Segment Dominant in the Market in 2024?

By treatment, the vaccines segment was dominant in the HPV-associated disorders market share in 2024. The HPV vaccine can lower the chances of HPV-related cancers and genital warts in any sexually active patient. HPV vaccination rates in men remain low. This is particularly concerning, given the increase in HPV-related throat cancers in this group. The vaccine prevents these cancers as well as anal and penile cancers.

Anti-viral drugs

The anti-viral drugs segment is expected to grow at the fastest CAGR in the HPV-associated disorders market during the 2025-2034 period, as antivirals have been evaluated for the treatment of HPV. Ongoing studies and anecdotal clinical cases are using existing antiviral medications, primarily acyclovir (ACV) and valacyclovir.

Others

The other segment is expected to grow significantly during the forecast period as patients with human papillomavirus (HPV)-associated disease remain at risk for subsequent HPV infection and related disease after treatment of particular lesions. Prophylactic HPV vaccines show advantages in preventing subsequent HPV-related disease when directed before or soon after treatment.

Distribution Channel Insights

Which Distribution Channel Dominated the Market in 2024?

The hospital pharmacies segment dominated the HPV-associated disorders market in 2024. It improved partnership with other healthcare doctors, a wider scope of practice with chances for specialization and compounding, and superior access to patient healthcare records. As compared to retail pharmacy, hospital pharmacy does not always have to deal with insurance organizations or give vaccinations.

Retail Pharmacies

The retail pharmacies segment is expected to grow at the fastest CAGR in the HPV-associated disorders market during the 2025-2034 period, as retail pharmacies play a significant role in medical care by offering convenient access to medicines, a broad range of products, and valuable additional solutions. Retail pharmacies are an important part of medical systems and, in various countries, are responsible for providing a large amount of health products and associated services.

Regional Insights

North America: Large Adoption of Progressive Diagnostic Technology

North America dominated the HPV-associated disorders market in 2024 as the region benefits from mature screening programs and the broad adoption of progressive diagnostic technologies, like molecular HPV tests and self-collection services, which aid in early identification and treatment. Major presence of pharmaceutical and diagnostic companies, including Merck & Co., Inc., Pfizer Inc., and Hologic, Inc., drives the growth of the market.

For Instance,

- In October 2025, Ghana Health Services, in partnership with Gavi, the Vaccine Alliance (Gavi), the World Health Organization (WHO), and UNICEF, launched the country’s first nationwide human papillomavirus (HPV) vaccination campaign. The five-day campaign, running from 8 to 11 October, aims to reach 2.4 million girls aged 9 to 14 years, both in and out of school, providing life-saving protection against cervical cancer.

Well-organized HPV Screening and Immunization Programs: A Major Market Driver in the U.S.

The U.S. conducts and supports well-organized HPV screening and immunization programs, strongly supported by the CDC and various government medical agencies, which drive high screening rates and vaccination. Significant healthcare investment in the U.S. facilitates the quick adoption of advanced diagnostics and new therapeutic techniques.

For Instance,

- In September 2025, The University of Texas MD Anderson Cancer Center, along with 61 National Cancer Institute (NCI)-Designated Cancer Centers, leading national organizations and the University of Puerto Rico Comprehensive Cancer Center, endorsed a joint statement urging the nation’s health care systems, physicians and other health care providers and professionals, parents, caregivers and the public to promote and choose human papillomavirus (HPV) vaccination for cancer prevention.

Is a Large Population a Growth Factor for the Asia Pacific?

Asia Pacific is estimated to host the fastest-growing HPV-associated disorders market during the forecast period, as the region has an increasing incidence and prevalence of HPV infections and associated diseases, specifically cervical cancer. There has been a noteworthy increase in public health campaigns and educational efforts by governments and medical care organizations to encourage a wider understanding of HPV-related health challenges, which contributes to the growth of the market.

For Instance,

- In October 2025, the International Vaccine Institute (IVI) is hosting the 2025 Introductory Course for Standard Practice (GxP) from 27 October to 14 November at Seoul National University’s Siheung Campus. Following an online pre-training phase, the three-week in-person program officially commenced. This course is part of the Global Training Hub for Biomanufacturing (GTH-B) initiative, jointly led by the Korean Ministry of Health and Welfare (MoHW) and the World Health Organization (WHO), and co-organized by the GTH-B Support Foundation and IVI.

High Risk of Cervical Cancer in Women in India

In India, there is a large population, and in this region, women are at risk, with over 123,900 new cervical cancer cases and 77,300 deaths yearly. The Indian government and different medical care organizations launched various initiatives and vaccination programs to encourage widespread adoption of HPV vaccines.

Europe: Increasing Advanced Healthcare Program?

Europe is expected to grow at a significant CAGR in the HPV-associated disorders market during the forecast period, as most European countries have established worldwide healthcare systems that allow broad and affordable access to HPV vaccines, diagnostics, and treatment solutions. Increasing public awareness campaigns and well-organized cervical cancer screening programs, which progressively use HPV testing

Is the government increasing HPV Vaccination in the UK?

In the UK, widespread vaccination coverage and high vaccination rates, specifically among younger cohorts vaccinated in school, led to significantly decreased rates of cervical cancer. Many studies show the program has considerably lowered the incidence of cervical cancer and high-grade cervical intraepithelial neoplasia (CIN3), with noteworthy decreases observed in all levels of socioeconomic lack.

South America's Disease Burden

The HPV-associated disorders market expands to treat the high disease load; the region suffers three times the cervical cancer mortality rate of North America. This spurs growth in therapeutics for Cervical Intraepithelial Neoplasia (CIN 2/3) and anal cancer, driven by public health crisis funding.

Brazil's Screening Shift

Brazil's market grows due to 70% of new cervical cancer cases occurring in women without adequate screening. Government health programs are now shifting from Pap tests to high-performance HPV DNA testing, directly increasing demand for advanced molecular diagnostics technology.

MEA's Access Programs

The MEA HPV-associated disorders market grows via international and government aid, addressing the fact that sub-Saharan Africa has a 24% HPV prevalence. Partnerships with GAVI ensure a supply of subsidized vaccines, directly fueling the market for both primary prevention and treatment of genital warts.

GCC's Diagnostics Investment

The GCC market is driven by state investment in high-quality diagnostics. The Middle East HPV testing market size reached $60 million in 2024, reflecting government spending on early detection of high-risk HPV types to minimize future treatment costs for associated cancers.

HPV-Associated Disorders Market – Value Chain Analysis

R&D

The R&D process for HPV associated disorders involves a multi-stage pipeline from general scientific research to healthcare application and continuing surveillance. These processes cover the advancement of both preventive vaccines, therapeutic vaccines, and different treatment modalities

Key Players: Merck & Co. and GlaxoSmithKline (GSK)

Clinical Trials

Clinical trials for HPV-associated disorders follow the standard four-phase process, adapted to the specific nature of HPV prevention (vaccines) and treatment

Key Players: Serum Institute of India Pvt Ltd and Xiamen Innovax Biotech Co., Ltd.

Patient Services

Patient services processes for human papillomavirus (HPV) and associated disorders involve a coordinated pathway of prevention, screening, diagnosis, treatment, and long-term monitoring and support.

Key Players: Shanghai Zerun Biotechnology Co., Ltd.

Company Landscape

Merck & Co., Inc.

Company Overview

- Corporate Information (Headquarters, Year Founded, Ownership Type), Rahway, New Jersey, United States, 1891 (U,S, founding), Public, Traded as MRK on the New York Stock Exchange.

- History and Background, Established as the U,S, arm of the German Merck, seized during WWI, and later grew into a major global research-intensive pharmaceutical company focusing on vaccines, oncology, and general medicine.

- Key Milestones/Timeline, 2006, FDA approval of Gardasil (quadrivalent HPV vaccine), 2014, FDA approval of GARDASIL 9 (nonavalent HPV vaccine), 2024, Announced successful Phase 3 outcomes for GARDASIL 9 in Japanese men aged 16 to 26.

- Business Overview, A global healthcare company providing prescription medicines, vaccines, biologic therapies, and animal health products, Vaccines and Oncology (specifically KEYTRUDA and GARDASIL 9) are key growth drivers.

Business Segments/Divisions, Pharmaceutical, Animal Health.

- Geographic Presence, Worldwide, with major markets in North America, Europe, China, and Asia Pacific, North America held the dominant share, valued at $4,20 billion in 2024.

- Key Offerings, GARDASIL 9 (nonavalent HPV vaccine, protects against 9 HPV types), KEYTRUDA (oncology), PNEUMOVAX 23/VAXNEUVANCE (pneumococcal vaccines).

- End-Use Industries Served, Public Health and Government Immunization Programs, Hospitals, Retail Pharmacies, Specialty Clinics.

Key Developments and Strategic Initiatives

- Mergers & Acquisitions, Completed the acquisition of Verona Pharma in October 2025, adding a first-in-class COPD maintenance treatment to its portfolio.

- Partnerships & Collaborations, Works closely with Gavi and UNICEF to expand GARDASIL 9 access in low, and middle-income countries.

- Product Launches/Innovations, Planning trials beginning in late 2024/early 2025 to evaluate a single-dose regimen for GARDASIL 9 and a multi-valent vaccine offering protection against more strains.

- Capacity Expansions/Investments, Investing over $12 billion in U,S, capital investments since 2018, including a $1 billion HPV vaccine plant, to expand global GARDASIL 9 manufacturing capacity.

- Regulatory Approvals, Expanded approval for GARDASIL 9 in China for men aged 9 to 25 announced in late 2024, early 2025.

- Distribution channel strategy, Heavily relies on Government Suppliers (which held 48,5% of the market share in 2025) for large-scale immunization programs, supplementing Hospital & Retail Pharmacies.

Technological Capabilities/R&D Focus

- Core Technologies/Patents, Expertise in recombinant virus-like particle (VLP) technology, the platform for its HPV vaccines, Extensive patent portfolio protecting GARDASIL 9.

- Research & Development Infrastructure, Major R&D centers globally, focusing on oncology, infectious diseases (vaccines), and immunology, committing to over 80 Phase 3 trials in 2025.

- Innovation Focus Areas, Next-generation HPV vaccines with broader valency, simplified dosing (single-dose), and therapeutic HPV vaccines to treat existing infections.

Competitive Positioning

- Strengths & Differentiators, Dominant market share with GARDASIL 9, offering the broadest protection against nine HPV types, positioned as the global gold standard in prevention.

- Market presence & ecosystem role, The undisputed market leader, whose supply decisions heavily influence global public health vaccination campaign planning, especially due to prior supply constraints.

- SWOT Analysis, Strengths, Market dominance (over 85%), broadest protection, Weaknesses, Sales volatility in key markets (China sales declined 41% in Q1 2025 due to inventory), Threats, Major $8 billion lawsuit related to Gardasil underway in January 2025, emergence of low-cost competitors.

Recent News and Updates

- Press Releases, Announced successful Phase 3 trial results for its pneumococcal vaccine, CAPVAXIVE, in October 2025, demonstrating pipeline diversification outside of HPV.

- Industry Recognitions/Awards, Continues to be recognized for its leadership in vaccine innovation and access programs.

GlaxoSmithKline plc (GSK)

Company Overview

- Corporate Information (Headquarters, Year Founded, Ownership Type), London, England, UK, 2000 (formed by a merger), Public, Traded as GSK on the London Stock Exchange (LSE).

- History and Background, Formed by the merger of Glaxo Wellcome and SmithKline Beecham, tracing roots back to the 1700s, A science-led global healthcare company with a strong focus on Vaccines, Specialty Medicines, and HIV.

- Key Milestones/Timeline, 2007, FDA approval of Cervarix (bivalent HPV vaccine), 2022, China NMPA authorized the two-dose schedule of Cervarix for girls aged 9 to 14.

- Business Overview, Focuses on developing, manufacturing, and marketing vaccines, specialty medicines (e,g,, HIV, Oncology), and general medicines, Vaccines remain a core growth area.

- Business Segments/Divisions, Specialty Medicines, Vaccines, General Medicines.

- Geographic Presence, Operates in 75 markets worldwide, with a strong footprint in Europe, North America, and emerging markets, utilizing partnerships for access in low-income countries.

- Key Offerings, Cervarix (bivalent HPV vaccine, protects against HPV types 16 and 18), Shingrix (shingles vaccine), Arexvy (RSV vaccine), Pharmaceuticals for HIV (ViiV Healthcare).

- End-Use Industries Served, Public Health and Government Immunization Programs, Global Health Organizations (e,g,, Gavi), Hospitals.

Key Developments and Strategic Initiatives

- Mergers & Acquisitions, Separated its Consumer Healthcare division (Haleon) in 2022 to focus resources on the Vaccines and Specialty Medicines pipelines.

- Partnerships & Collaborations, Major partner with Gavi, the Vaccine Alliance, supporting the deployment of Cervarix in lower-income countries where affordability is key.

- Product Launches/Innovations, Discontinued its Phase 2 HPV vaccine candidate (GSK4106647) in July 2024, citing a lack of best-in-class potential to compete with existing market leaders.

- Capacity Expansions/Investments, Commits to investing £1 billion over the next decade in Global Health R&D to develop 30+ potential new vaccines and medicines.

- Regulatory Approvals, Received US FDA approval for Blenrep (relapsed/refractory multiple myeloma treatment) in October 2025, showcasing pipeline strength outside of vaccines.

- Distribution channel strategy, Focuses on Government Suppliers and international aid organizations due to Cervarix's competitive pricing and simpler two-dose schedule in many countries.

Technological Capabilities/R&D Focus

- Core Technologies/Patents, distinct expertise in proprietary adjuvant systems which enhance the immune response of its vaccines, including Cervarix.

- Research & Development Infrastructure, major R&D hubs focusing on the science of the immune system and human genetics, with a shift toward mRNA and MAPS technologies.

- Innovation Focus Areas, prioritizing development where it can demonstrate a differentiated asset, including novel vaccines for respiratory and infectious diseases.

Competitive Positioning

- Strengths & Differentiators, provides protection against the two most high-risk types (16 and 18), often a more cost-effective option than nonavalent vaccines, and is a preferred choice for Gavi programs.

- Market presence & ecosystem role, a major player in global public health, ensuring vaccine supply equity, especially in Asia and Africa, where it has a competitive advantage in pricing and simplicity.

- SWOT Analysis, Strengths, Bivalent vaccine is highly effective against 70% of cervical cancers, strong partnerships with global health bodies, Weaknesses, Narrower protection spectrum (bivalent) versus the market leader, Opportunities, High demand for more affordable vaccines in developing countries, Threats, Intense competition from Merck and new low-cost entrants (e,g,, Serum Institute of India).

Recent News and Updates

- Press Releases, delivered a strong Q3 2025 performance, upgrading its full-year 2025 guidance, driven by key specialty medicines and vaccines like Shingrix and Arexvy.

- Industry Recognitions/Awards, consistently recognized for its commitment to Global Health, including high rankings in the Access to Medicine Index.

Top Vendors in the Branded Generics Market & Their Offerings

| Company |

Headquarters |

Key Strengths |

Latest Info (2025) |

| Merck & Co., Inc. |

Rahway, New Jersey |

Advance research and development capabilities |

In August 2025, the Company received two approvals in Japan: its nine-valent HPV vaccine for use in males. |

| GlaxoSmithKline plc |

London, England |

Pioneering vaccine development, adjuvant system expertise, demonstrated cross-protection, and extensive clinical evidence. |

In August 2025, GSK decided to discontinue the development of its phase 2 human papillomavirus (HPV) vaccine, GSK4106647. |

| F. Hoffmann-La Roche Ltd |

Basel, Switzerland |

Innovation in sample collection, focus on risk-based assessment |

Roche provides a holistic solution for screening, triage, diagnosis, and patient management to help prevent cervical cancer. |

| Pfizer Inc. |

Spiral in Manhattan, New York |

Oncology focus, research, and future directions |

In April 2024, the Food and Drug Administration granted traditional approval to tisotumab vedotin-tftv |

| AstraZeneca |

Cambridge, United Kingdom |

Advanced delivery technology, extensive R&D, and strategic partnerships |

December 2025, MEDI-0457 is under clinical development by AstraZeneca and is currently in Phase II for Human Papillomavirus (HPV) Associated Cancer. |

Top Companies in the HPV-Associated Disorders Market

Recent Developments in the HPV-Associated Disorders Market

- In June 2025, Governments, donors, multilateral institutions, the private sector, and partners announced significant policy, programmatic, and financial commitments to eliminate one of the most preventable cancers.

- In September 2025, PHASE Scientific International Limited announced the official launch of the world’s largest clinical study for urine-based cervical cancer (HPV) screening, with the first site established in Guang’an, Sichuan Province, China. This study is led by Peking University Shenzhen Hospital, with participation from West China Guang’an Hospital of Sichuan University and technical and diagnostic support by PHASE Scientific.

- In November 2025, UNICEF joined the World Health Organization in congratulating the Government of China on its historic decision to include the HPV vaccine in the country's National Immunization Program. This life-saving policy will protect millions of girls from cervical cancer and is also a major step forward towards health equity and gender equality in China.

- In September 2025, the Government of Pakistan’s Federal Directorate for Immunization (FDI), in partnership with Gavi, the Vaccine Alliance (Gavi), UNICEF, and the World Health Organization (WHO), today launched the human papillomavirus (HPV) vaccination campaign to protect adolescent girls from cervical cancer in later stages of their lives.

- In December 2024, Unitaid and Gavi, the Vaccine Alliance (Gavi), will pilot integrated cervical cancer screening and treatment with human papillomavirus (HPV) vaccination programs through a new partnership. The initiative will build off Unitaid’s existing cervical cancer screen-and-treat programs in Côte d’Ivoire and Nigeria, incorporating vaccination awareness and service delivery with the goal of increasing coverage for both women and girls.

Segments Covered in the Report

By Type Outlook

- Cervical Intraepithelial Neoplasia (CIN)

- Cervical Cancer

- Anal Intraepithelial Neoplasia (AIN)

- Anal Cancer

- Genital Warts

- Others

By Treatment Outlook

- Vaccines

- Anti-viral Drugs

- Others

- Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

- Hospital Pharmacies

- Retail Pharmacies

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Rest of North America

- South America

- Brazil

- Argentina

- Rest of South America

- Europe

- Western Europe

- Germany

- Italy

- France

- Netherlands

- Spain

- Portugal

- Belgium

- Ireland

- UK

- Iceland

- Switzerland

- Poland

- Rest of Western Europe

- Eastern Europe

- Austria

- Russia & Belarus

- Türkiye

- Albania

- Rest of Eastern Europe

- Asia Pacific

- China

- Taiwan

- India

- Japan

- Australia and New Zealand

- ASEAN Countries (Singapore, Malaysia)

- South Korea

- Rest of APAC

- MEA

- GCC Countries

- Saudi Arabia

- United Arab Emirates (UAE)

- Qatar

- Kuwait

- Oman

- Bahrain

- South Africa

- Egypt

- Rest of MEA