February 2026

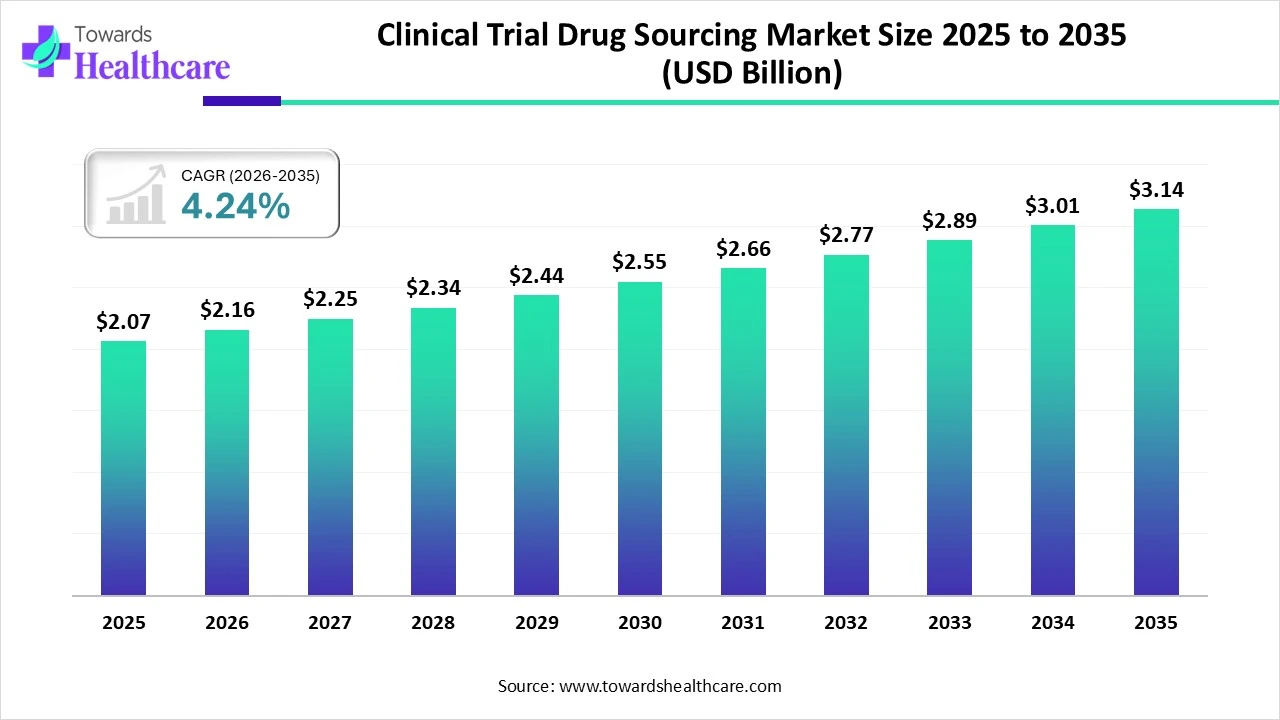

The global clinical trial drug sourcing market size was estimated at USD 2.07 billion in 2025 and is predicted to increase from USD 2.16 billion in 2026 to approximately USD 3.14 billion by 2035, expanding at a CAGR of 4.24% from 2026 to 2035.

The clinical trial drug sourcing market is growing as sourcing high-quality investigational drugs and medical devices lowers the challenges of adverse effects related to substandard products.

The clinical trial drug sourcing market is expanding because it primarily focuses on securing affordable and reliable suppliers for the mass manufacturing and distribution of pharmaceutical products. Drug sourcing plays a significant role in the clinical trial ecosystem. It includes identifying, acquiring, and supplying approved reference medicine commonly referred to as comparator drugs that are vital for comparing the effectiveness and safety of new investigational products. It is a highly regulated, specialized service essential for conducting clinical trials. Clinical trials based on the ethical and scientific comparison of new drugs with previously approved reference treatments.

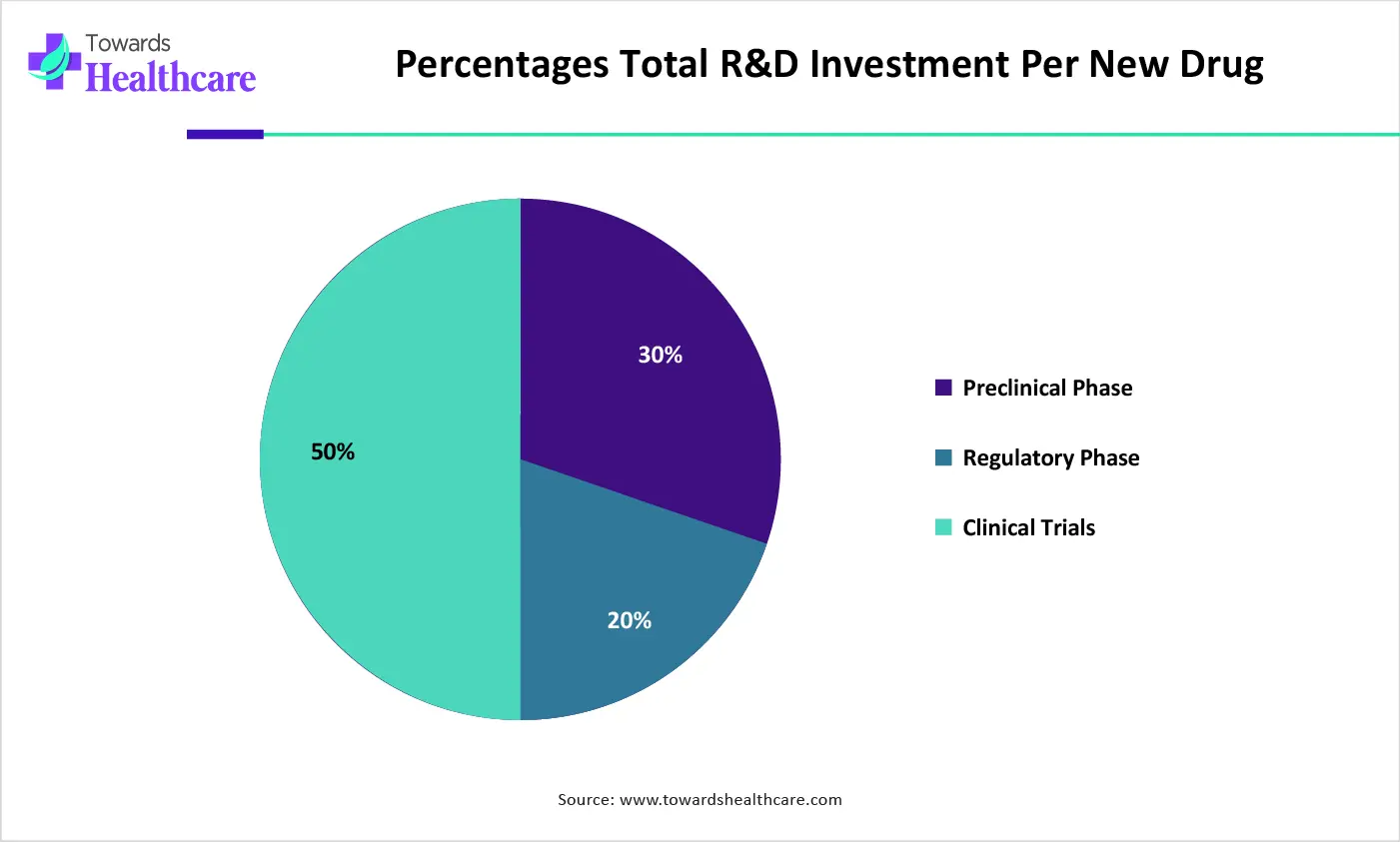

| Phase | Percentages |

| Preclinical Phase | 30% |

| Regulatory Phase | 20% |

| Clinical Trials | 50% |

Integration of AI-driven technology in clinical trial drug sourcing drives the growth of the market, as the AI-based algorithms analyze historical information, enrollment patterns, and clinical trial site performance to more precisely predict clinical trial supply requirements. AI-based technology recommends optimal inventory levels in the clinical trial sites. This can supports lowers waste while ensuring adequate availability of clinical trial supplies. AI-enhanced systems with IoT sensors offer real-time tracking of the location and condition of clinical trial supplies, detecting challenges such as temperature fluctuations immediately.

| Key Elements | Scope |

| Market Size in 2026 | USD 2.16 Billion |

| Projected Market Size in 2035 | USD 3.14 Billion |

| CAGR (2026 - 2035) | 4.24% |

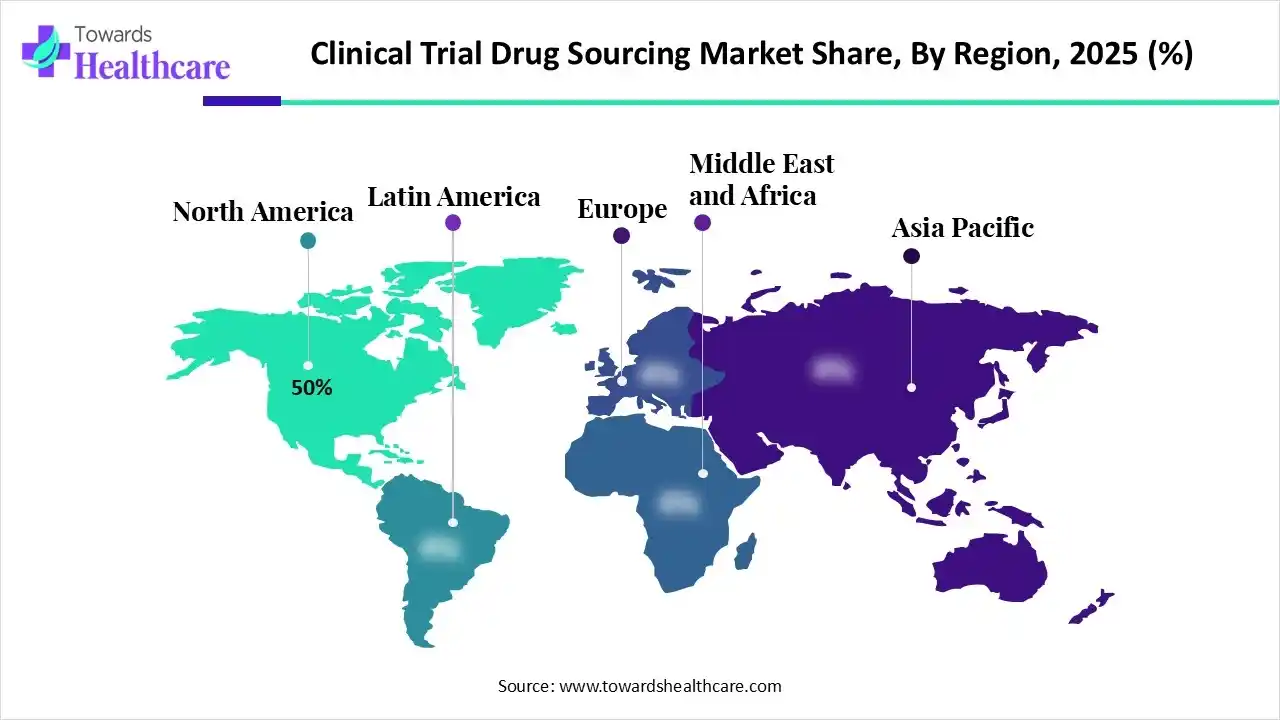

| Leading Region | North America by 50% |

| Market Segmentation | By Sourcing Type, By Clinical Phase, By Service Type, By End-User, By Region |

| Top Key Players | Thermo Fisher Scientific Inc., IQVIA Holdings Inc., Catalent, Inc, Almac Group, Parexel International Corporation |

Which Sourcing Strategy Led the Clinical Trial Drug Sourcing Market in 2025?

In 2025, the central sourcing segment held the dominant market position with approximately 55.6% share in 2025, as central sourcing enables standardised events and advanced quality control measures. Central suppliers often have strict quality assurance protocols, lowering the challenges of variability that could affect trial results. This confirms all trial sites receive pharmaceuticals of consistent quality, which is significant for maintaining the honor of clinical trial results. Central sourcing, particularly from international suppliers, results in longer lead times because of shipping and customs clearance technology.

Local Sourcing

Whereas the local sourcing segment is estimated to be the fastest-growing in the market, as local sourcing allows sourcing partners to obtain products more rapidly than they would through other sourcing strategies. Local sourcing offers major benefits and opportunities for lower timelines, effective supply, and expense savings.

Why did the Phase III Segment Dominate the Market in 2025?

The phase III segment was the dominant clinical trial drug sourcing market, with approximately 48.9% share in 2025, as phase III trials offer the bulk of data required for the package insert and labeling of a medicine, after it has been FDA accepted. Phase 3 trials generate regulatory-grade data significant for drug approval, including rigorous study protocols and safety monitoring by independent boards like Data and Safety Monitoring Boards (DSMBs).

Phase I

Whereas the phase I segment is estimated to be the fastest-growing in the market, as phase I clinical trials mark the significant first step in evaluating a novel drug’s safety and tolerability in humans. These trials set the basis for all subsequent phases, determining whether a compound has the potential to advance toward wider patient populations. Phase I trials significantly influence pharmaceutical investment decisions. This phase supports refining the patient eligibility standards and endpoint definitions that shape later-stage research.

Why did the Oncology Segment Dominate the Market in 2025?

The oncology segment was dominant in the clinical trial drug sourcing market with approximately 36.8% share in 2025, as trial supports scientists learn more about cancer and support people in the future. Clinical outsourcing cost-efficient way to gather the resources and experts needed to successfully carry out a clinical trial. Clinical trials are significant to cancer care, supporting to find better ways to prevent and manage the disease.

Immunology/Rare Disease

Whereas the immunology/rare disease segment is estimated to be the fastest-growing in the market, as rare disease trials focus on conditions that affect a small percentage of the population, while standard disease trials mark more prevalent conditions. Healthcare outsourcing very affordable way to gather the resources and experts required to successfully carry out a healthcare trial or programme. Efficient clinical research in rare diseases is significant for novel treatments to reach patients.

Why did the Small Molecules Segment Dominate the Market in 2025?

The small molecules segment was dominant in the clinical trial drug sourcing market in 2025, as small molecule pharmaceuticals generally have a longer shelf life compared to other multifaceted drug formulations. Small-molecule drugs are manufactured reproducibly, a benefit for researchers seeking a return on their spending. Small molecules have consistently allowed medical breakthroughs and tackled unmet healthcare requirements, thus saving countless lives.

Biologics/Cell and Gene

Whereas the biologics/cell and gene segment is estimated to be the fastest-growing in the market, as biologics has uge potential to treat a wider range of conditions and serve small patient populations such as those with rare or orphan diseases. Biologics differ from chemically based drugs in ways that affect their expenses, manufacturer, administration, and clinical effectiveness. Manufacturing complexities of biologics offer distinct advantages that small-molecule drugs do not.

In 2025, North America dominated the clinical trial drug sourcing market with approximately 50.0% share, as rapid advances in immunotherapy, specific drugs, and artificial intelligence-based research are reshaping oncology. The biotechnology sector employs the techniques of modern molecular biology to lower the ecological impact of manufacturing. A primary center for genomics and diagnostics, maintained by institutions such as the Salk Institute and Scripps Research.

For Instance,

U.S. Market Trends

In the U.S., the biotech industry is investing massively in research, with R&D spending. Ground-breaking pharmaceutical organization makes substantial spending in high-risk R&D, with clinical trials accounting for half of their R&D costs. The United States leads the region with the largest number of clinical trials, driven by the presence of major pharmaceutical organizations.

Asia Pacific is expected to see rapid growth in the clinical trial drug sourcing market, driven by well-developed healthcare infrastructures and expense savings. Biopharmaceutical companies’ faster enrolment, lower costs, highly motivated investigators, and less competition. The Asia-Pacific Strategy for emerging diseases is comprehensive, seeking to enhance the ability to respond to infectious diseases, which drives the growth of the clinical trial drug sourcing market.

India Market Trends

India was evolving as a major hub for clinical trials. The country’s massive and genetically varied population made it an ideal location for pharmaceutical organizations conducting large-scale research. The increasing of digital health services and rising investments in clinical trials highlight India's role as a home for innovative medical research. India launches pharma-MedTech & PRIP schemes, with the goal to strengthen R&D, encourage novelty, and support India in becoming a leader in drug discovery and medical tools.

| Company | Headquarters | Latest Update |

| Thermo Fisher Scientific Inc. | Denmark | Thermo Fisher and OpenAI aim to accelerate clinical trials and allow the delivery of novel medicines to patients sooner. |

| IQVIA Holdings Inc. | United States | In September 2025, IQVIA announced the launch of its Clinical Trial Financial Suite (CTFS), an AI-driven platform orchestrating all financial aspects of clinical trials. |

| Catalent, Inc | Florida | In September 2025, Science 37 and Catalent announced a strategic partnership redefining how investigational medicinal products (IMPs) are delivered directly to patients’ homes for clinical research. |

| Almac Group | Ireland | In November 2025, Almac Group announced a multi-million-pound investment to expand its facility in Singapore, as the company marks ten years of operations in the country. |

| Parexel International Corporation | North Carolina | Parexel remains the only CRO to be recognised with both an ACE Award and a Catalyst Award, highlighting its ongoing commitment to inclusivity, both in the organisation and in the way it serves patients. |

| ICON plc | Ireland | In January 2026, ICON plc announced a significant expansion of oncology research abilities in its Accellacare Site Network through the opening of the Brian Moran Cancer Institute at Duly Health and Care in Illinois. |

By Sourcing Type

By Clinical Phase

By Service Type

By End-User

By Region

February 2026

February 2026

February 2026

February 2026