January 2026

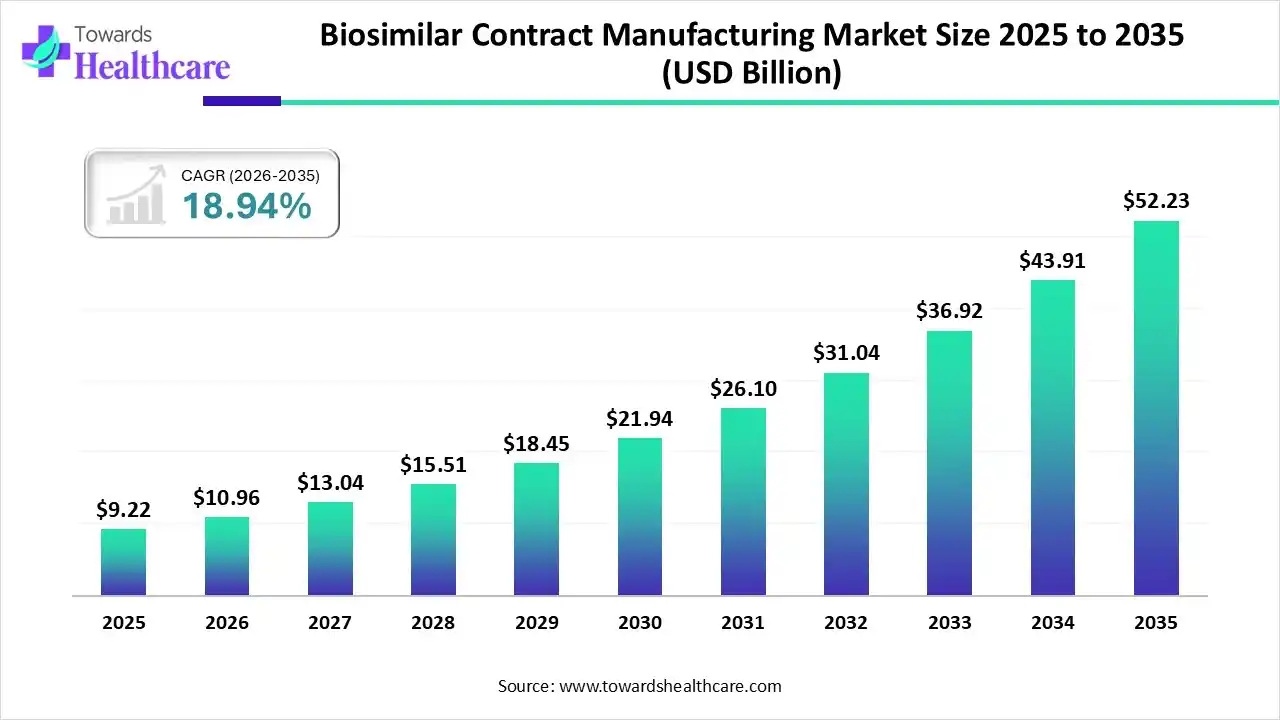

The global biosimilar contract manufacturing market size is calculated at US$ 9.22 billion in 2025, grew to US$ 10.96 billion in 2026, and is projected to reach around US$ 52.23 billion by 2035. The market is expanding at a CAGR of 18.94% between 2026 and 2035.

The biosimilar contract manufacturing market is experiencing robust growth, driven by the rising number of patent-expired drugs, growing demand for affordable medicines, and evolving regulatory landscapes. Key players invest heavily in manufacturing technologies to streamline biosimilars development. The increasing collaboration and government support favor market growth. Artificial intelligence (AI) can optimize manufacturing processes and lead to high-quality biosimilars.

| Key Elements | Scope |

| Market Size in 2026 | USD 10.96 Billion |

| Projected Market Size in 2035 | USD 52.23 Billion |

| CAGR (2026 - 2035) | 18.94% |

| Leading Region | North America |

| Market Segmentation | By Source, By Services, By Therapeutic Area, By Region |

| Top Key Players | Dr. Reddy’s Laboratories, Laurus Labs Ltd., Pfizer CentreOne, Merck Millipore, Kemwell Pharma, Hikma Pharmaceuticals LLC, Polpharma Biologics, mAbxience |

Biosimilar Contract Manufacturing: Outsourcing Ecosystem

The biosimilar contract manufacturing market includes the development and manufacturing services of biosimilars. Biopharmaceutical companies collaborate with contract development and manufacturing organizations (CDMOs) to access advanced technologies and relevant expertise. The development process of biosimilar drugs is centered around the characterization of the reference biologic, saving time and cost for manufacturers. Contract manufacturers allow parent companies to focus on their core competencies, such as product sales and marketing.

Smarter Biosimilars: AI-Driven Contract Manufacturing

The integration of AI in research and manufacturing of biosimilars marks a revolutionary change in the biopharmaceutical industry. AI and machine learning (ML) algorithms enhance the efficiency and accuracy of biosimilar drug development. The Internet of Things (IoT) is embedded to monitor and manage biosimilar production using sensors and connected devices. This enables manufacturers to get real-time updates on manufacturing and take necessary decisions. AI and ML can analyze large amounts of biological data and optimize their development.

Investment Landscape in the Biosimilar Contract Manufacturing Market

The rising prevalence of chronic disorders, such as cancer and autoimmune disorders, facilitates the development of biosimilars.

The increasing number of biologics patent expiration leads to biosimilar development and manufacturing. About 13 biologics patents are estimated to expire over the next 5 years in the U.S. (2025-2029).

Collaboration among key players is essential to access advanced technologies and relevant expertise, as well as expand their geographical presence.

Single-use technologies and advanced analytics are among the innovative manufacturing techniques that improve efficiency and reduce costs.

Government bodies impose stringent regulations on environmental sustainability, encouraging manufacturers to reduce waste and CO2 emissions from biosimilar production.

Mammalian

The mammalian segment held a dominant position in the market in 2025, due to the ability of mammalian cell lines to produce stable and high-yield biosimilars. Most of the biologics are developed from mammalian cells. As more biosimilar products are needed, due to the rising disease prevalence, high productivity and scalability are of prime importance. Mammalian cell lines can be modified to derive the desired biosimilar product.

Non-mammalian

The non-mammalian segment is expected to grow at the fastest CAGR in the market during the forecast period. Non-mammalian cell lines are primarily used for less complex biosimilars, such as vaccines. They are derived from plant-based sources, such as yeast or bacteria. The demand for non-mammalian cells is increasing due to their cost-effectiveness, high efficiency, and simple genetic modification.

Recombinant Non-glycosylated Proteins

The recombinant non-glycosylated protein segment led the market in 2025, due to the ability of proteins to influence stability, activity, and immunogenicity. Recombinant non-glycosylated proteins are derived to mimic original therapeutic proteins developed through recombinant DNA technology. Numerous non-glycosylated antibodies have been approved by regulatory agencies, and many are under clinical trials. Most of the non-glycosylated proteins are developed for autoimmune disorders.

Recombinant Glycosylated Proteins

The recombinant glycosylated protein segment is expected to grow with the highest CAGR in the market during the studied years. Glycosylated proteins are proteins that undergo glycosylation using recombinant technology, essential for cell development and physiology. The post-translational modifications in proteins influence biological and immunogenic functions. The vector provides the signals and mechanisms necessary for RNA transcription and its translation into protein.

Rheumatoid Arthritis

The rheumatoid arthritis segment held the largest revenue share of the market in 2025, due to the rising prevalence of rheumatoid arthritis and the growing demand for targeted therapy. The global prevalence of rheumatoid arthritis is estimated to be 0.5-1.0%. Rheumatoid arthritis is a chronic autoimmune disorder, causing inflammation of the joints. As of June 2025, the U.S. FDA has approved nine biosimilars for adalimumab as the reference product.

Oncology

The oncology segment is expected to expand rapidly in the market in the coming years. Cancer is the leading cause of morbidity and mortality across different nations. The American Cancer Society projected over 2 million new cancer cases in the U.S. in 2025. The growing research activities allow researchers to identify novel targets and biomarkers involved in cancer progression. As of 2023, 21 biosimilars have been approved by the U.S. FDA for cancer.

North America registered dominance in the biosimilar contract manufacturing market in 2025.

North America registered dominance in the biosimilar contract manufacturing market in 2025.Which Factors Contribute to the Biosimilar Contract Manufacturing Market in North America?

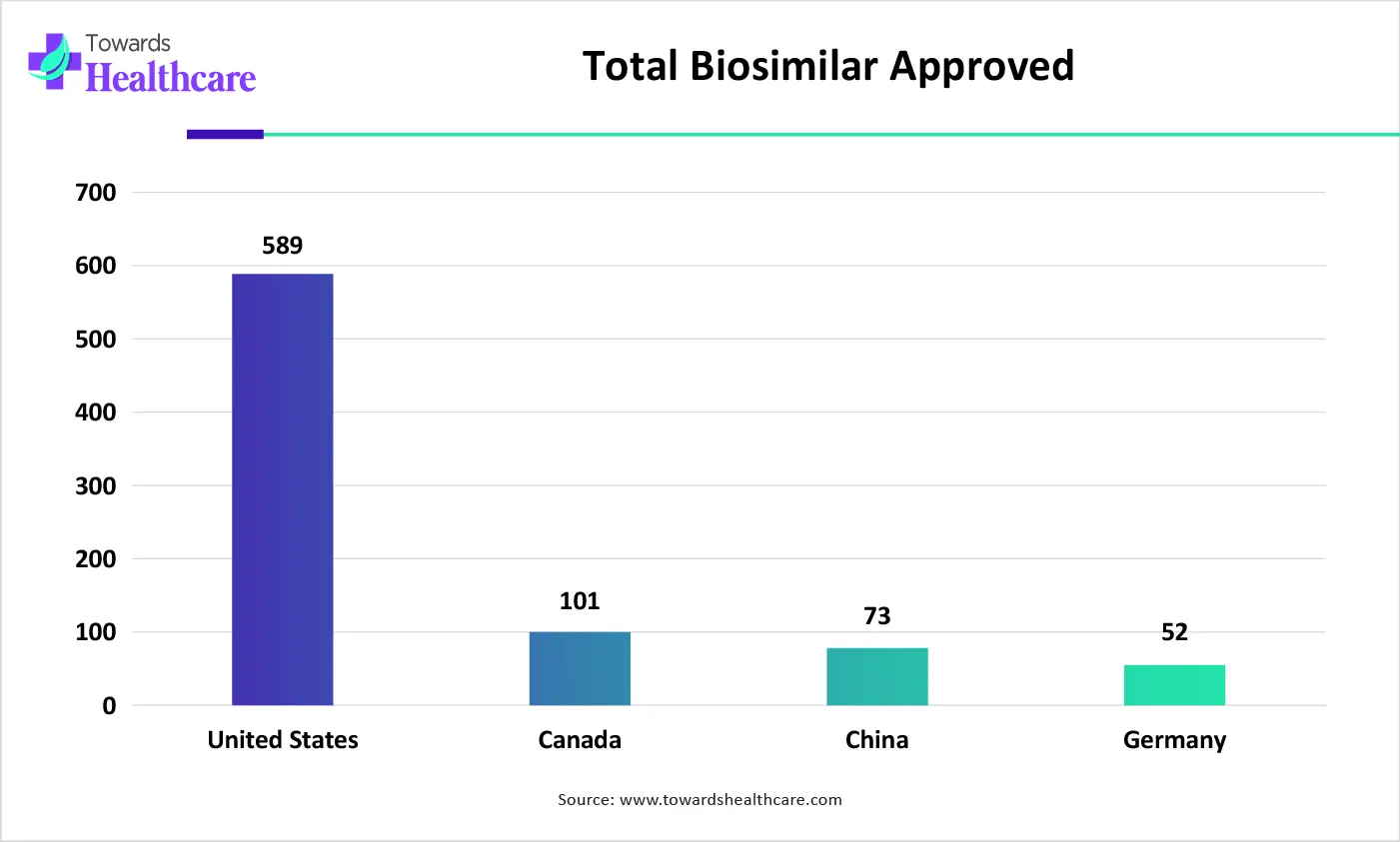

North America dominated the global market in 2025. North American countries have a strong presence of major biotech and biopharmaceutical companies, resulting in the expansion of the biosimilar pipeline. Favorable regulatory support and the rising adoption of advanced technologies boost the market. Government bodies launch initiatives and provide funding to support biosimilar development and manufacturing. The increasing collaboration among key players fosters market growth.

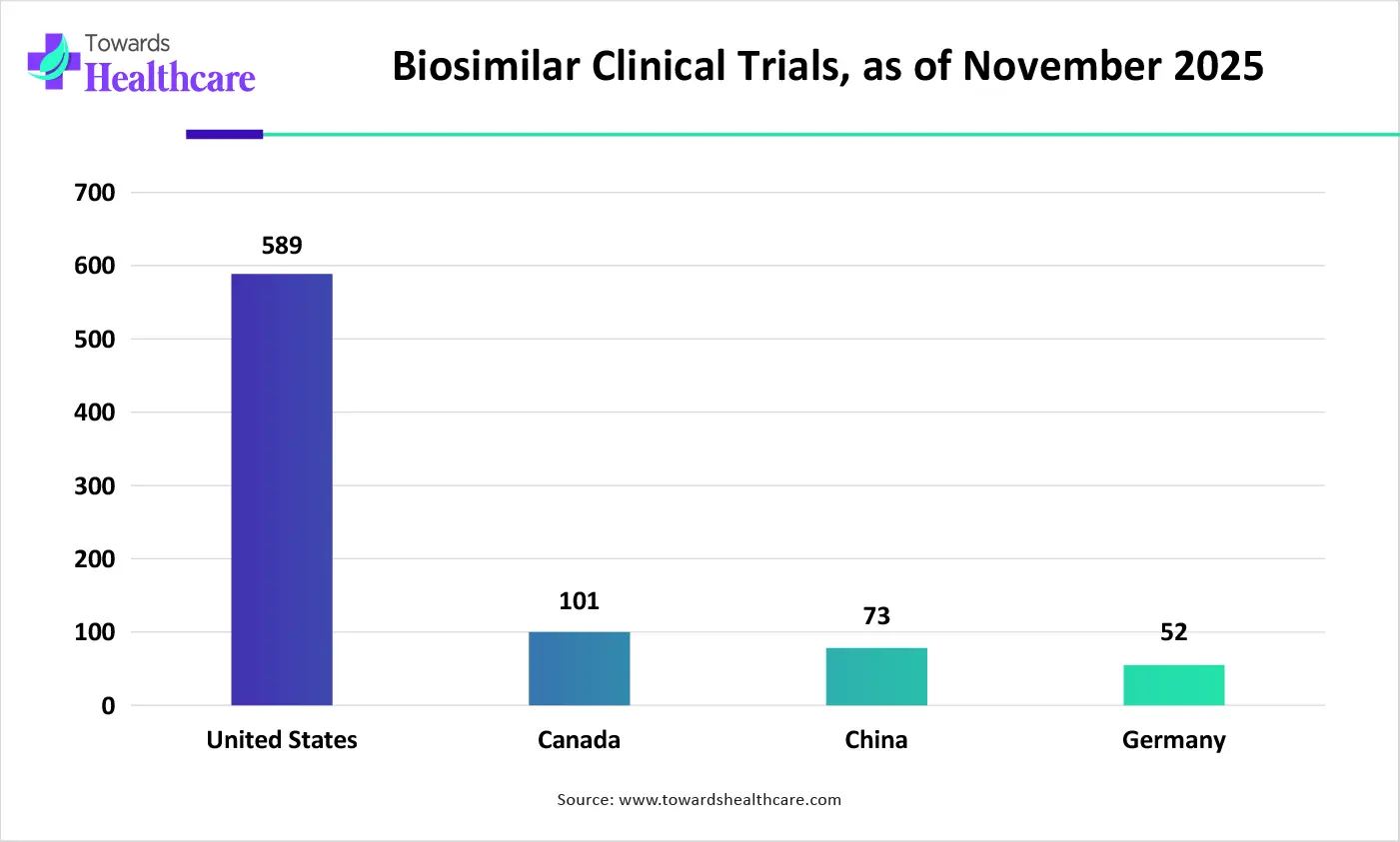

The U.S. is home to over 5,000 pharmaceutical companies. Key players, such as Avid Bioservices, AGC Biologics, and Polpharma Biologics, are major firms providing contract manufacturing services for biosimilars in the U.S. Generic medication prescriptions account for approximately 95% of all prescription types, further potentiating the need for developing biosimilars. It is estimated that about 10% of biologic drugs will lose patent protection in the next decade.

Growing Emphasis on Indigenous Manufacturing Promotes the Asia-Pacific

Asia-Pacific is expected to grow at the fastest CAGR in the biosimilar contract manufacturing market during the forecast period. Countries like China, India, and Japan are at the forefront of establishing a suitable manufacturing infrastructure. This encourages foreign companies to set up their manufacturing facilities in the region, serving a larger patient population. The rapidly expanding biotech sector and evolving regulatory landscapes propel the market. Key players collaborate to expand their geographical presence.

For instance,

Venture Capital Investments to Drive Europe’s Growth

Europe is considered to be a significantly growing area in the biosimilar contract manufacturing market over the coming years. Favorable government support and rising investments augment the market. The growing demand for cost-effective, high-quality targeted therapeutics is driving the development of biosimilars. The European Medicines Agency (EMA) regulates the approval of biosimilars in European nations. Countries like Germany, the UK, and France are becoming global hubs in clinical trials.

The increasing number of biotech startups and venture capital investments promotes biosimilar development in the UK. In Q1 2025, the overall equity financing in the biotech sector rose to £924 million across 15 venture capital (VC) and follow-on funding. Alvotech, Gedeon Richter Plc, and Advanz Pharma are UK-based companies that are involved in biosimilar contract manufacturing.

| Companies | Headquarters | Specialty | Revenue |

| Dr. Reddy’s Laboratories | Hyderabad, India | The company has a capacity to produce 12 million vials and 18 million PFS annually. | Rs 325,535 million (FY2025) |

| Midas Pharma GmbH | Rheinland-Pfalz, Germany | It offers individual support in end-to-end contract manufacturing. | - |

| Laurus Labs Ltd. | Hyderabad, India |

Laurus Bio, a subsidiary of Laurus Labs, offers manufacturing and precision fermentation expertise as a CDMO service. |

Rs 1,653 crore (Q2 FY2026) |

| Samsung Biologics | Incheon, South Korea |

It offers biologics/biosimilars manufacturing services, combining quality, capacity, and operational efficiency. |

KRW 1,660.2 billion (Q3 2025) |

| Pfizer CentreOne | New York, United States | It provides premium manufacturing to help ensure the lightspeed delivery of life-changing therapies. | $1.15 million (FY 2024) |

| Merck Millipore | Massachusetts, United States | It offers contract manufacturing services for monoclonal antibodies, protein expression, and polyclonal antibodies. | €21.2 billion (FY 2024) |

| Kemwell Pharma | Bangalore, India | Provides CDMO services for monoclonal antibodies, complex fusion proteins, recombinant proteins, and bispecific antibodies | - |

| Hikma Pharmaceuticals LLC | London, United Kingdom | The company has 29 manufacturing facilities in the U.S., Europe, and the MENA region, offering high-quality injectable, oral, and respiratory manufacturing capabilities. | $3.127 billion (FY 2024) |

| Polpharma Biologics | Gdańsk, Poland | The company has expertise in cell line development, PQA modulation, and process development. | - |

| mAbxience | Madrid, Spain | It offers tailored CDMO services through its fully integrated single-use technology. | - |

SWOT Analysis

Strenght

Weakness

Opportunity

Threats

January 2026

January 2026

December 2025

November 2025