February 2026

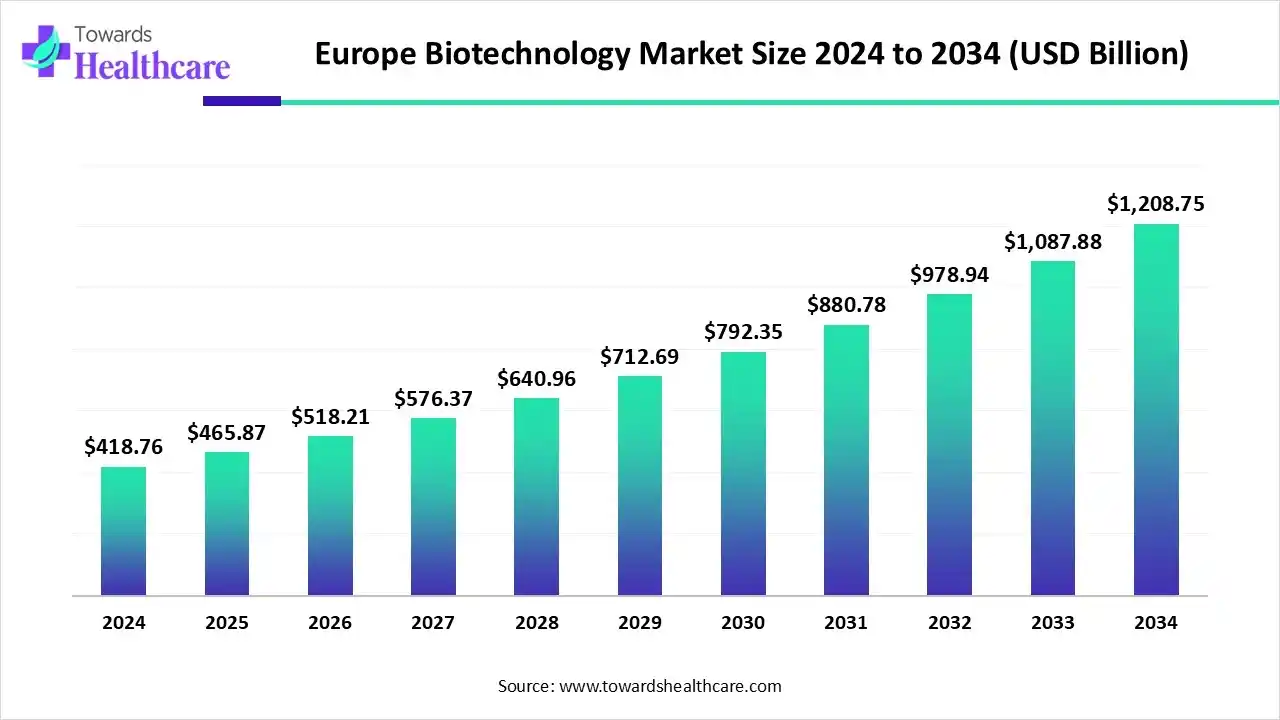

The Europe biotechnology market size is calculated at US$ 418.76 billion in 2024, grew to US$ 465.87 billion in 2025, and is projected to reach around US$ 1208.75 billion by 2034. The market is expanding at a CAGR of 11.30% between 2025 and 2034.

Day by day, Europe is expanding its biotech and pharma facilities across different countries, with the greater adoption of advanced technologies, like AI, gene editing technologies. Moreover, the rising diversity of chronic illnesses is supporting the continuous investment in R&D, along with a phenomenal EU support. The emergence of leading companies, like Roche, Novartis, and Bayer AG, is leveraging sophisticated bio-services and innovation in targeted therapies. Whereas, Nordics are bolstering the cluster of biotech & research academic institutions for novel solutions in genomics, & DNA sequencing.

| Table | Scope |

| Market Size in 2025 | USD 465.87 Billion |

| Projected Market Size in 2034 | USD 1208.75 Billion |

| CAGR (2025 - 2034) | 11.30% |

| Market Segmentation | By Product/Service, By Technology, By Application, By End User, By Country |

| Top Key Players | Merck KGaA (Germany), Qiagen (Germany/Netherlands), Evotec SE (Germany) , Sanofi (France), Ipsen (France), Servier (France), AstraZeneca (UK), GSK (UK), Oxford Biomedica (UK), Genmab (Denmark), Bavarian Nordic (Denmark), Novo Nordisk (Denmark), Actelion (Switzerland, J&J subsidiary), BioNTech (Germany), CureVac (Germany) |

The Europe biotechnology market covers biopharmaceuticals, agricultural biotech, industrial biotech, and bio-services across the region. Outsourcing, biotech hubs (Germany, Switzerland, UK, France, Netherlands, Scandinavia), and collaboration between academia and industry are major market drivers. Europe is a global leader in biopharma R&D, cell & gene therapy innovation, and biosimilars adoption, supported by strong regulatory oversight from the European Medicines Agency (EMA) and robust research funding under programs like Horizon Europe. The region’s strengths lie in advanced biologics manufacturing, stem cell research, and synthetic biology, while growing demand for sustainable biofuels, bioplastics, and agri-biotech is diversifying the sector.

| Regulatory Body | Initiatives |

| UK Government | Launched a new industrial strategy that comprises a commitment to invest £380m in engineering biology. |

| InvestAI | Securing €200 billion to develop "AI gigafactories" in several sectors, including biotech. |

| Horizon Europe | Invested €7.3 billion 2025 work program for research and innovation allocates substantial funding to areas related to biotechnology. |

The respective market is widely utilizing AI algorithms in various areas of biotechnology, particularly in drug discovery, diagnosis, and personalized treatment. Recently, various companies have presented their approaches, including Cytocast's digital twin patient platform for drug development, Exscientia's AI-assisted drug discovery for Sanofi, and Elixir Health's utilization of AI in fertility treatment by analyzing patient data.

For instance,

The biopharmaceuticals segment held 43% revenue share of the market in 2024. The segment is mainly driven by a rise in instances of chronic disease, with a preference for targeted biologics and advancements in gene therapies. In the last few days, a proposed new European biotech act has focused on a holistic approach to regulation and funding, with major investments in R&D by companies, including Sanofi and BioNTech's acceleration into tailored cancer vaccines, and innovative solutions, especially Bayer's cell and gene therapy for Parkinson's research.

Whereas the bioservices segment is anticipated to expand rapidly in the coming era. The presence of a robust research ecosystem, outsourcing R&D, manufacturing, and support functions, is impacting the comprehensive bioservices in Europe. Current milestone steps in bioservices, such as a crucial M&A activity with companies like Genmab acquiring Merus, breakthroughs in gene therapy with UniQure's trial success, and continuous emphasis on soil biodiversity projects like the EU-funded BIOservicES initiative to boost land management and sustainability.

In 2024, the DNA sequencing & genomics segment captured 27% revenue share of the Europe biotechnology market. The segment covers the increasing demand for personalized medicine, technological advances, and escalated government funding for genomic research. Nowadays, Europe is focusing on large-scale, collaborative initiatives like the Genome of Europe (GoE) project, comprising the 1+Million Genomes initiative, over 30 countries are contributing to whole-genome sequencing and data sharing via the secure Genomic Data Infrastructure (GDI) project.

However, the CRISPR & gene editing segment is predicted to expand at a rapid CAGR. Involvement of a strong biotech & pharmaceutical hub, and programs like Horizon Europe with significant funding for genome editing research, supporting both public and private sectors to adopt CRISPR technology. Ongoing research activities, such as a huge contribution of the European Research Council (ERC) in the exploration of CRISPR for applications in cancer gene regulation, neurodegenerative diseases, and other areas, are also propelling the overall market growth.

In 2024, the healthcare/medical biotechnology segment held the biggest revenue share of 47% of the market. The segment is eventually fueled by the growing demand for customized treatments based on individual genetic profiles by European consumers and healthcare systems. Alongside, Europe is fostering the transformation of new solutions, such as cardio-immunology and microbiome therapies, and the expansion of antibody-based treatments for autoimmune diseases. The medical sector is imposing advances in gene therapies (like for Huntington's disease) and mRNA vaccines.

Moreover, the industrial biotechnology segment will register the fastest growth during 2025-2034. The arising demand for sustainability approaches, innovation, and supportive government policies is encouraging industrial biotechnology progress. Furthermore, Europe is putting efforts into developments in molecular and computational tools that allow the design of specific traits in microorganisms and plants, resulting in robust and targeted applications. Ongoing manipulation of materials at the nanoscale is bolstering the revolution of drug delivery systems and sophisticated biosensors.

In the Europe biotechnology market, the pharma & biotech companies segment registered dominance with 45% revenue share in 2024. Consistent healthcare expenses are assisting innovative technological advancements in areas like AI and CRISPR, and progress in research areas is fostering the various pharma & biotech companies in Europe. The latest step, like the French startup Bioptimus, is seeking the use of generative AI for drug discovery. Novo Nordisk is involved in new diabetes and obesity treatments, while companies like Polygon Therapeutics are pursuing new immunotherapies for cardiovascular conditions.

Whereas the CROs & CDMOs segment is predicted to expand fastest in the coming era. The widespread adoption of advanced technologies, like AI & big data, ongoing strategic trend of outsourcing to enhance accessibility of expertise, expenditure, and effectiveness. These facilities are experiencing regulatory and societal pressures, with a raised focus on green chemistry, energy-efficient equipment, and zero-waste manufacturing to optimize sustainability.

By capturing 22% revenue share of the Europe biotechnology market, Germany registered dominance in 2024. A prominent catalyst is the prioritizing of biotechnology by both the German government and the EU, with heavy investment in infrastructure, funding innovation, and encouraging biotechnology research and development.

For instance,

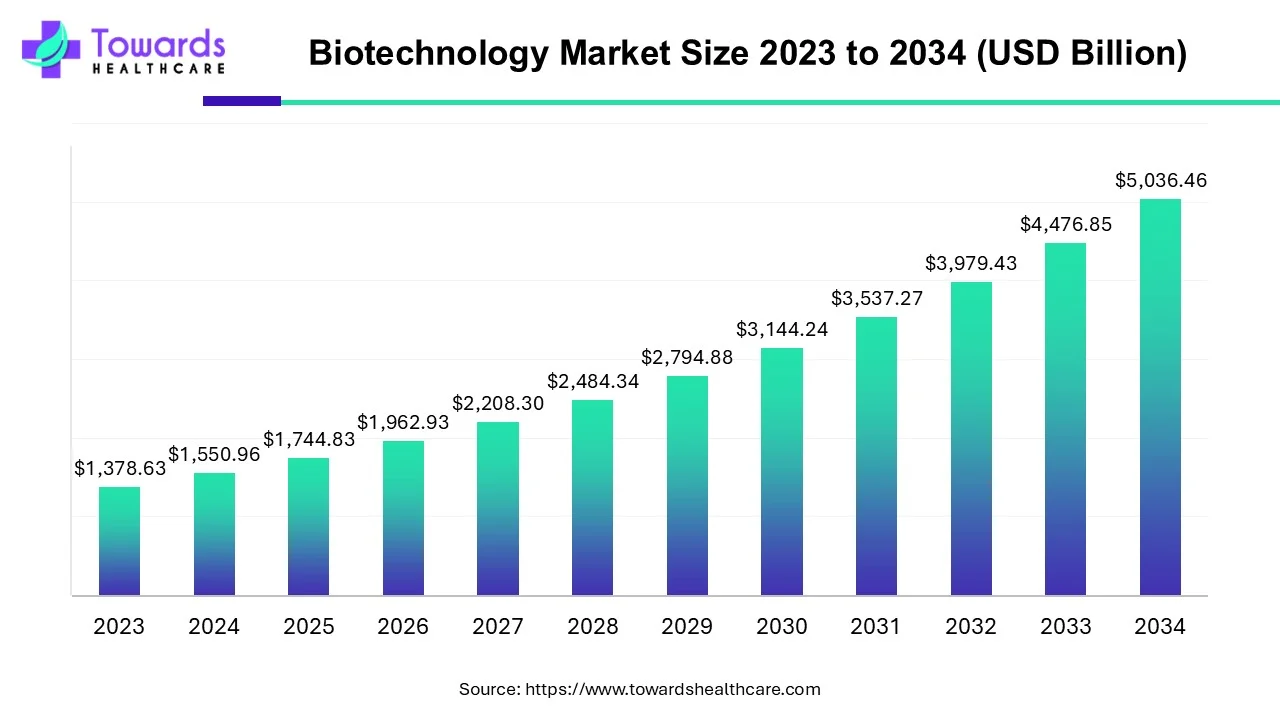

The biotechnology market is projected to grow from USD 1,744.83 billion in 2025 to USD 5,036.46 billion by 2034, reflecting a CAGR of 12.5% over the period, driven by innovation and technological advancements in the industry.

In the future, the Nordics will grow at a rapid CAGR in the Europe biotechnology market. This expansion will be fueled by the rigorous biotech clusters, such as Medicon Valley, spanning Copenhagen (Denmark) and southern Sweden, which act as magnets for R&D. Additionally, the Nordics possess world-class universities and research institutions, especially the Karolinska Institute in Sweden and the Technical University of Denmark. These institutions are promoting alliance among academia and industry, leading to a robust pipeline of talent and spin-off companies.

For this market,

By Product/Service

By Technology

By Application

By End User

By Country

February 2026

February 2026

February 2026

February 2026