February 2026

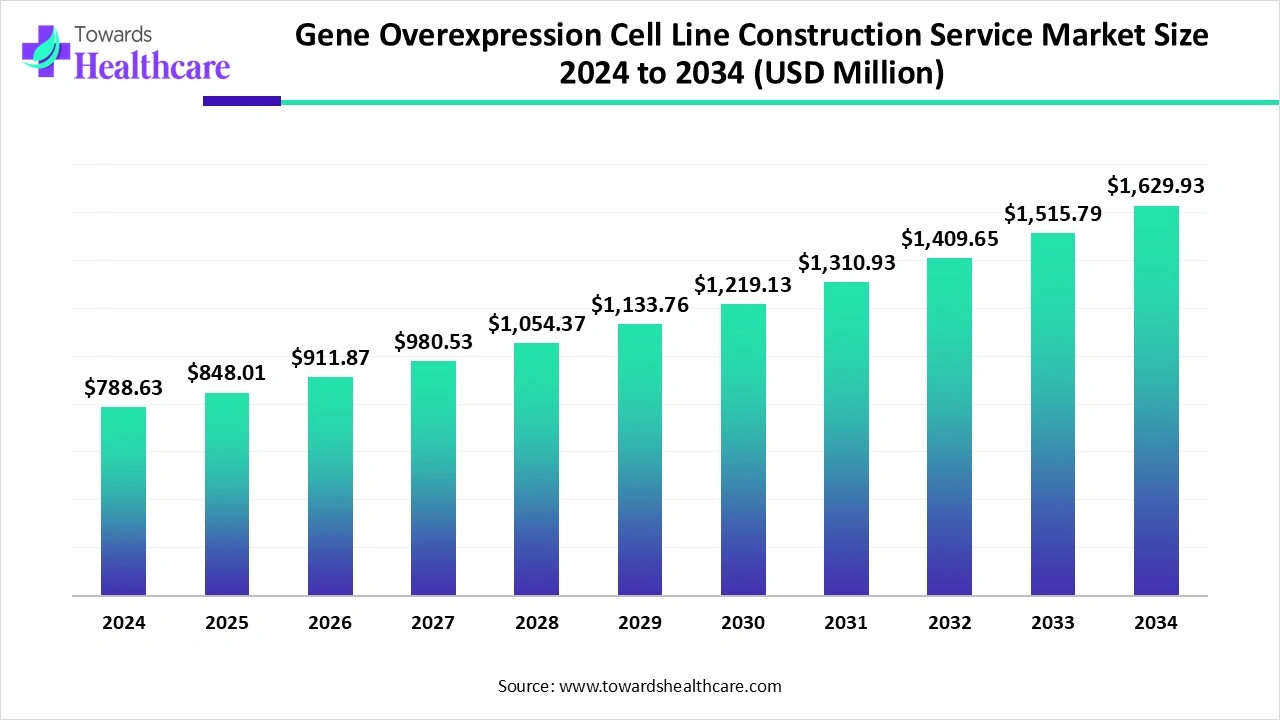

The global gene overexpression cell line construction service market size is calculated at US$ 788.63 million in 2024, grew to US$ 848.01 million in 2025, and is projected to reach around US$ 1,629.93 million by 2034. The market is expanding at a CAGR of 7.53% between 2025 and 2034.

Gene overexpression is significant in research into gene function and biological protein production. Gene overexpression cell lines are widely applicable in protein engineering, biological research, drug discovery, and recombinant antibody production. These solutions enable the integration of a desired gene into the host cell after transduction and its transfer to expression in the next generation of cells. Cutting-edge gene editing technology allows the production of stable cell lines. The cell line services allow researchers and end-users to use non viral and viral vectors for a strong overexpression of target genes. The creation of stable cell lines introduces enhanced, satisfactory solutions to customers.

| Table | Scope |

| Market Size in 2025 | USD 848.01 Million |

| Projected Market Size in 2034 | USD 1,629.93 Million |

| CAGR (2025 - 2034) | 45% |

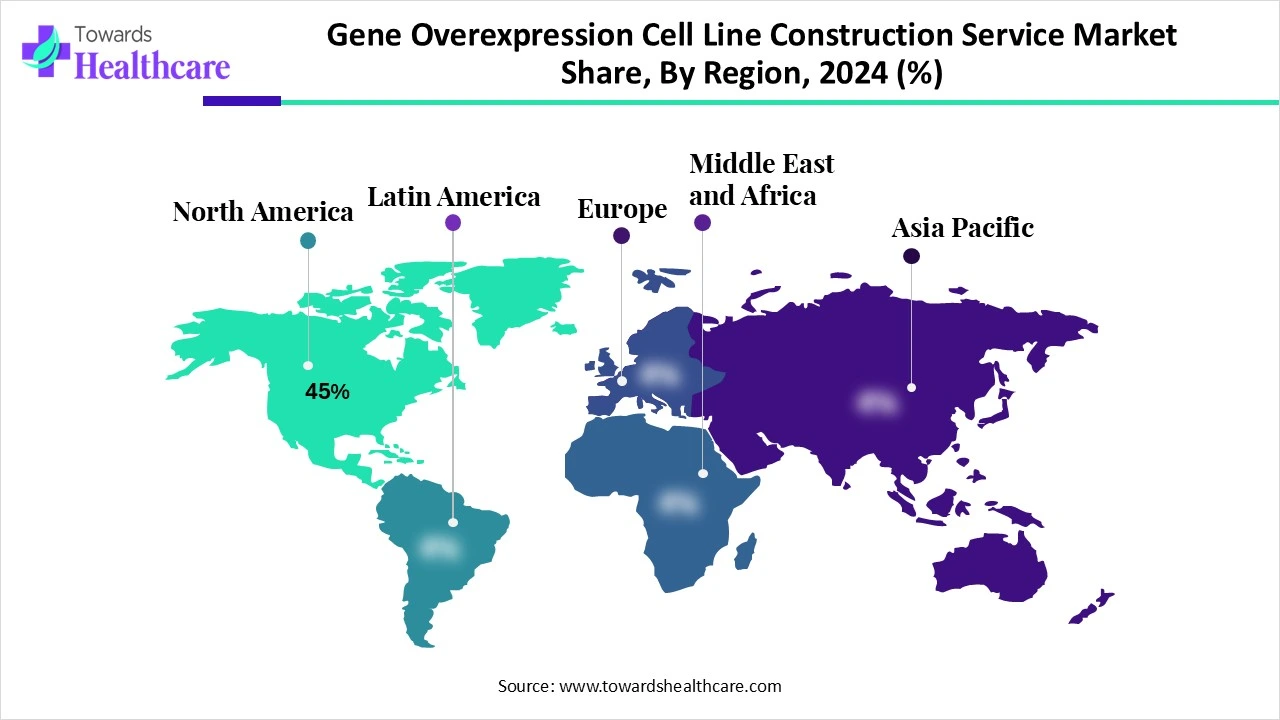

| Leading Region | North America Share 45% |

| Market Segmentation | By Service Type, By Expression System / Host Cell Type, By Gene Delivery Method, By Application, By End User, By Region |

| Top Key Players | Thermo Fisher Scientific, GenScript Biotech, Creative Biogene, Bio-Rad Laboratories, OriGene Technologies, Promega Corporation, Sino Biological Inc., Horizon Discovery (PerkinElmer), VectorBuilder Inc. , GeneCopoeia Inc., QIAGEN N.V., Applied Biological Materials (ABM), Cyagen Biosciences, Vigene Biosciences (Charles River), Addgene |

The gene overexpression cell line construction service market refers to the ecosystem of technologies, tools, and service providers that develop customized cell lines engineered to overexpress a specific gene or protein. These services are widely used in biopharmaceutical R&D, drug discovery, target validation, functional genomics, protein production, and assay development. Service providers typically utilize advanced molecular cloning, CRISPR/Cas9, transfection, viral vector delivery, and stable cell line generation techniques to deliver tailored solutions. The demand is rising due to growing biologics development, personalized medicine, and high-throughput screening applications.

The funding and investments from government organizations foster innovative therapies to cure various diseases. For instance, in July 2025, the Australian Government, the Department of Health, Disability, and Aging, invested $50 million to accelerate genomics research that will introduce personalized treatments for several diseases through funding from the Medical Research Future Fund (MRFF).

AI contributes to the design of synthetic gene constructs to regulate the expression of transcription factors. This enhances clinical decisions about stem cell fate to improve clinical outcomes. AI improves the speed, accuracy, and precision of complex tasks. It plays a major role in stem cell classification, cell manufacturing, and synthetic biology through computational approaches and artificial intelligence.

What are the Major Drifts in the Market?

The emerging trends in cutting-edge technologies include gene editing, high-throughput screening, and cloud-based platforms. The other advancements include metabolic engineering and an increased focus on speed, quality, and regulatory compliance.

What are the Potential Challenges in the Market?

There are certain regulatory challenges in the development of cell and gene therapy, which include diverse regulatory frameworks across regions, complex regulatory processes, etc. Moreover, they involve additional standards for GMO therapies, safety standards, and long-term follow-up. The clinical trial regulatory approval processes for investigational products might be complex with genetically modified organisms.

What is the Future of the Market?

The international harmonization efforts include collaborations between various regulatory bodies and organizations like the U.S. FDA, WHO, and the International Council for Harmonization of Technical Requirements for Pharmaceuticals for Human Use (ICH). The other opportunities come up with strategic planning and engagement with regulators. Furthermore, specialized expertise in GMO therapies and innovative safety monitoring solutions also drives the development of cell and gene therapies.

The stable cell line construction segment dominated the gene overexpression cell line construction service market in 2024, owing to key benefits such as long-term and scalable production, consistency, and reproducibility. It provides cost-effective solutions and advanced research and development capabilities. It is broadly applicable in recombinant protein production, drug discovery, functional genomics, gene therapy, and vaccines.

Under the stable cell line construction segment, the CRISPR/Cas9-mediated overexpression segment is expected to grow at the fastest CAGR in the market during the forecast period due to its advantages in stable expression, and it mimics natural gene expression. It provides simplified workflow, reduced costs, and improved experimental consistency. It also offers enhanced reproducibility and high-throughput screening.

The mammalian cell lines segment dominated the gene overexpression cell line construction service market in 2024, owing to the major role of these cell lines in complex protein production, research, and therapies. They provide clinically relevant models, help with drug screening and toxicology, enable vaccine and gene therapy production, and favor tissue engineering. They allow accurate protein modifications, correct protein folding, and effective secretion of correctly folded proteins during protein production.

The insect cell lines segment is expected to grow at the fastest CAGR in the market during the forecast period due to the significance of these cell lines in manufacturing, protein expression, vaccine and therapeutic development, and research. They result in high protein yield, post-translational modifications, and high-volume vaccine production. They enable rapid screening and research, present reduced ethical concerns, and provide models for cellular and toxicological studies.

The viral vector-based segment dominated the gene overexpression cell line construction service market in 2024, owing to the high efficiency, robust gene transfer, and sustained and long-term gene expression. It enables controlled and targeted delivery and delivers versatile applications. It can treat genetic disorders, develop advanced immunotherapies, and create vaccines.

The non-viral-based segment is expected to grow at the fastest CAGR in the market during the forecast period due to the key benefits of non-viral vectors, such as enhanced safety, cost-effectiveness, and manufacturing ease. They have potential for targeted delivery and deliver increased versatility. They offer broad therapeutic applications and simplified regulatory compliance.

The biopharmaceutical production segment dominated the gene overexpression cell line construction service market in 2024, owing to the health-related benefits of biopharmaceutical products along with improved efficacy, targeting, and enhanced safety. Production offers economic benefits in terms of cost reduction, continuous manufacturing, and access to medicines. It focuses on reducing pollution and achieving eco-friendliness.

The discovery & development segment is expected to grow at the fastest CAGR in the market during the forecast period due to the rising trends of precision medicine, biomarker discovery, target identification, and validation. Drug discovery improves quality of life, enhances public health, delivers new treatments for diseases, and drives economic growth and innovation. Functional genomics in drug discovery results in increased efficiency and personalized treatment approaches.

The biopharmaceutical & biotechnology companies segment dominated the gene overexpression cell line construction service market in 2024, owing to the numerous benefits of these companies to healthcare, the public, the economy, and the environment. They create employment opportunities and drive economic competitiveness. They contribute to sustainable manufacturing, cleaner energy, and bioremediation.

The contract research organizations (CROs) segment is expected to grow at the fastest CAGR in the market during the forecast period due to expertise, operational efficiency, cost, and time savings delivered by CROs. They enable access to resources and offer global reach through extensive networks and advanced technologies. They ensure scalability, focus on core competencies, and support strategic partnerships.

North America dominated the gene overexpression cell line construction service market share 45% in 2024, driven by technological advancements and R&D efforts. The American Society of Gene & Cell Therapy (ASGCT) plays a major role for scientists, patient advocates, physicians, and other professionals with research interests in cell and gene therapy. It works with hospitals, universities, foundations, government agencies, biotechnology, and pharmaceutical companies. It aims to advance awareness, education, and knowledge that lead to scientific discoveries and clinical applications of gene and cell therapies to cure human diseases that benefit patients and society. According to ASGCT, oncology and rare diseases remain prominent areas of non-genetically modified cell therapies. The National Institutes of Health (NIH) and the Office of Research Infrastructure Programs (ORIP) introduced programs and conducted activities to advance the study of human diseases.

CRISPR Therapeutics, situated in California, reported $72.5 million in R&D expenses for the first quarter of 2025 and is leading in advancing gene-editing platforms. The Ultra-rare Gene-based Therapy Program was introduced by the National Institute of Neurological Disorders and Stroke, which aims to support the discovery of state-of-the-art gene-based therapies for ultra-rare neurological diseases that affect millions of people in the U.S. Moreover, the Bespoke Gene Therapy Consortium (BGTC) is a crucial part of the Accelerating Medicines Partnership (AMP) program, which is a public-private partnership among the U.S. Food and Drug Administration (FDA) and several other entities.

The federal government of Canada planned to support cutting-edge technologies like robotics-enabled cell and gene therapy manufacturing and AI. In February 2025, the Government of Canada launched the Canadian Genomics Strategy to accelerate innovations and economic growth.

Asia Pacific is expected to grow at the fastest CAGR in the gene overexpression cell line construction service market during the forecast period due to the rapid development of gene therapies in this region. The Alliance for Regenerative Medicine encourages the development and global access to cell and gene therapies through activities like the Asia Pacific virtual summit on cell and gene therapy horizons held in September 2025. The governments in this region are focusing on transforming healthcare and driving interdisciplinary research. There is a revolution in personalized healthcare and the rapid growth of the bioeconomy.

The R&D process for gene overexpression cell line construction service includes gene synthesis, vector construction, transfection/transduction, stable selection, clone isolation and expansion, validation, and characterization.

Key Players: Creative Biogene, Cyagen, Sino Biological, VectorBuilder, System Biosciences, and AcceGen.

The clinical trials involve the increased focus on safety, continued growth in trials and funding, and the use of real-world evidence. The regulatory approvals are given for therapies like Elevidys, Rytelo, Amtagvi, and Lenmeldy.

Key Players: Thermo Fisher Scientific Inc., Lonza, Catalent, WuXi AppTec, Charles River Laboratories, AGC Biologics.

These services include initial consultation, customized strategy design, vector design and construction, quality control and testing, regular progress reporting, technical support, documentation, etc.

Key Players: Creative Biogene, Creative Biolabs, Creative Bioarray, Cyagen, System Biosciences.

In January 2025, Norman Schwartz, CEO of Bio-Rad Laboratories, proclaimed that Bio-Rad Laboratories will remain prominent in clinical diagnostics and digital biology to advance science and improve lives through improved healthcare outcomes. Geneoscopy’s ColoSense screening test is introduced for use with the QXDx ddPCR platform of Bio-Rad and offers an efficient detection of colorectal cancer and advanced adenomas. Bio-Rad will support Geneoscopy’s R&D and commercialization efforts and advance Bio-Rad’s droplet digital PCR platform for oncology applications across translational research and clinical diagnostics.

By Service Type

By Expression System / Host Cell Type

By Gene Delivery Method

By Application

By End User

By Region

February 2026

February 2026

January 2026

January 2026