January 2026

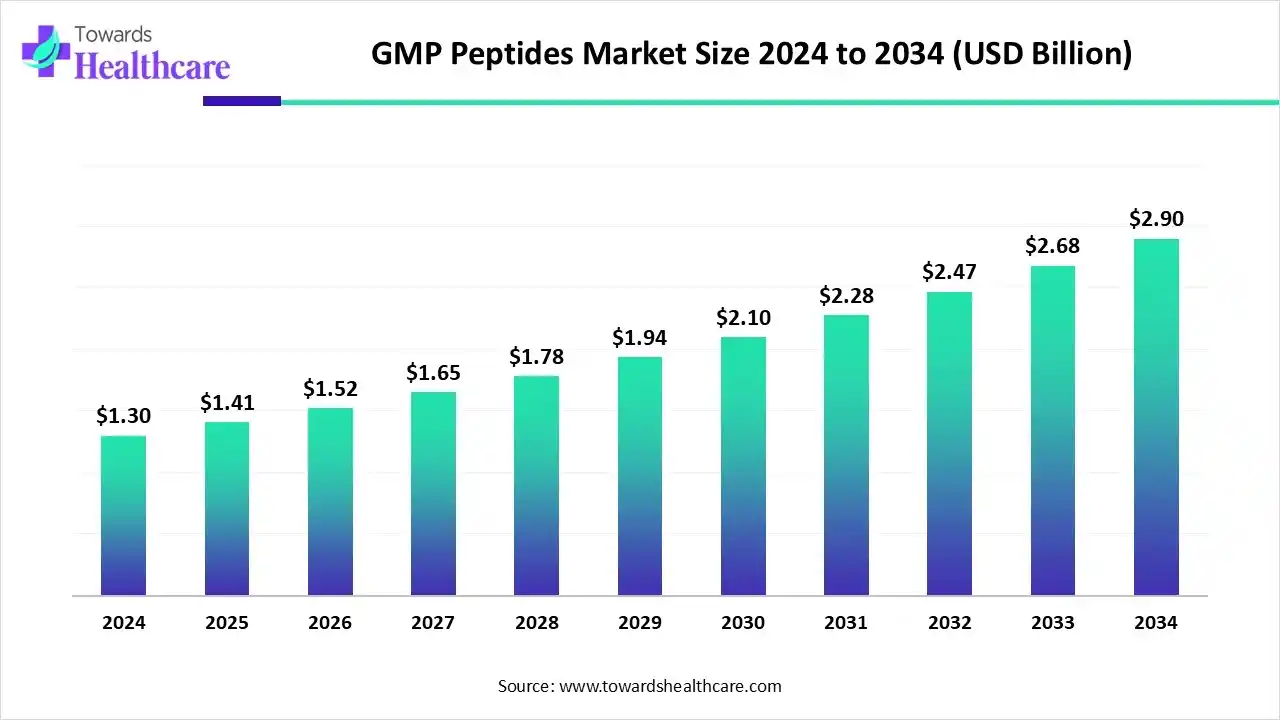

The global GMP peptides market size is calculated at USD 1.3 billion in 2024, grew to USD 1.41 billion in 2025, and is projected to reach around USD 2.9 billion by 2034. The market is expanding at a CAGR of 8.35% between 2025 and 2034.

The GMP peptides market is primarily driven by the rising prevalence of chronic disorders and advancements in peptide synthesis. The increasing funding for peptide drug discovery fuels demand for GMP-grade peptides and facilitates new drug discovery. The growing focus on GMP-compliant manufacturing ensures high-quality, safe peptides for clinical applications. Artificial intelligence (AI) introduces automation in peptide synthesis, accelerating its speed.

| Table | Scope |

| Market Size in 2025 | USD 1.41 Billion 2025 |

| Projected Market Size in 2034 | USD 2.9 Billion 2034 |

| CAGR (2025-2034) | 8.35% |

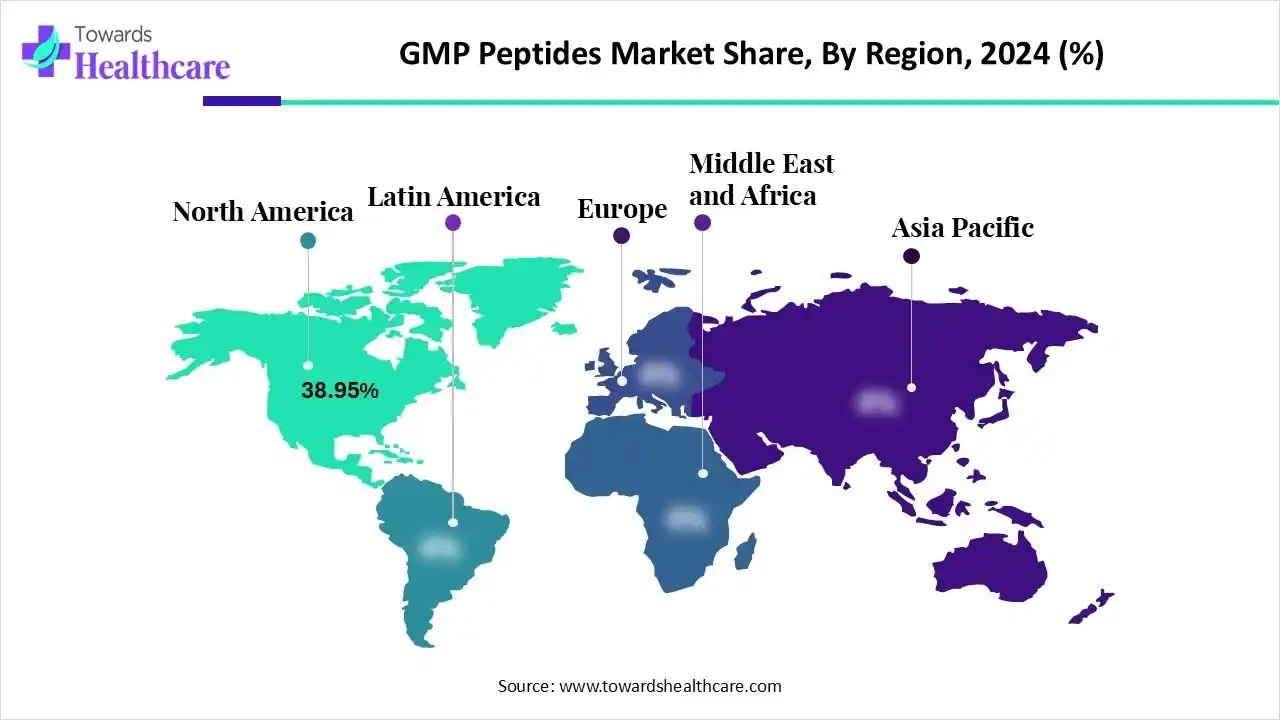

| Leading Region | North America by 38.95% |

| Market Segmentation | By Type, By Synthesis Method, By Service Type, By Application Area, By End-Use, By Region |

| Top Key Players | ScinoPharm / ScinoPharm Taiwan, Lonza Group, Thermo Fisher Scientific (Patheon), Catalent, GenScript Biotech, Almac Group, Asymchem, Peptide Institute, JPT Peptide Technologies, CSBio, BCN Peptides, AnaSpec, Senn Chemicals (Senn), Piramal Pharma Solutions, Peptide 2.0 |

The GMP peptides market is experiencing robust growth, driven by the rise of peptide drugs (e.g., GLP-1 analogues, hormone therapies), biologic conjugates, and growing outsourcing to GMP-capable CDMOs. It comprises the contract development and manufacturing services (CDMO) and in-house production of clinical- and commercial-grade synthetic peptides and peptide APIs that are manufactured to regulatory standards suitable for human use. It includes solid-phase and liquid-phase peptide synthesis, conjugation (e.g., peptide-drug conjugates), downstream purification, analytical testing, aseptic filling/packaging, and regulatory support for IND/CTA and commercial approvals.

AI plays a vital role in peptide synthesis, from discovery to manufacturing of GMP-grade peptides. AI and machine learning (ML) algorithms assist in designing peptide scaffolds and optimizing peptide synthesis routes. They can analyze large datasets of known peptides and their biological activities to predict the activity of new peptides. They can also predict peptide-protein interactions and analyze the structural features of target peptides and proteins. AI and ML can expedite the speed of peptide synthesis, leading to the development of more efficacious peptides with fewer side effects.

By type, the innovative peptides segment held a dominant presence in the market with a share of approximately 60% in 2024, due to the growing need for personalized medicines, as well as the need for finding novel applications for peptides. Innovative peptides are patented formulations that cannot be developed by any other company, providing intellectual property rights to the innovator company. Innovative peptides are regulated by regulatory agencies and are proven to be safe and effective for a specific condition.

By type, the peptide-drug conjugates segment is expected to grow at the fastest CAGR in the market during the forecast period. Peptide-drug conjugates (PDCs) are next-generation antibody-drug conjugates (ADCs) that have a much broader application as targeted therapeutics. PDCs offer superior advantages over ADCs, such as more accessible industrial synthesis, high tissue penetration, and rapid clearance with low immunotoxicity. They can be used for various disorders, including COVID-19.

By synthesis method, the solid-phase peptide synthesis (SPPS) segment held the largest revenue share of approximately 58% in the market in 2024, due to its faster, more efficient, and cost-effective method. SPPS is a method for assembling amino acids on a solid support or resin. This method enables researchers to synthesize peptides in a controlled, efficient, and scalable manner. The purification process of peptides generated through the SPPS method is much simpler compared to liquid-phase synthesis, making it a suitable technique for both research and pharmaceutical manufacturing.

By synthesis method, the hybrid/mixed-phase synthesis segment is expected to grow with the highest CAGR in the market during the studied years. Hybrid/mixed-phase synthesis combines the benefits of both solid-phase and liquid-phase synthesis and overcomes the limitations of both methods. TAG-assisted peptide synthesis (TAPS) is an example of mixed-phase synthesis that is highly efficient, sustainable, and a scalable alternative to traditional peptide synthesis. Thus, mixed-phase synthesis improves manufacturing flexibility and contributes to environmental sustainability.

By service type, the API development & manufacturing segment contributed the biggest revenue share of approximately 42% in the market in 2024, due to high complexities in API development and the need for specialized equipment. Peptide development and manufacturing involve the synthesis of a chain of amino acids, leading to desired modifications in peptide therapeutics. Manufacturers leverage advanced technologies to reduce production costs and improve manufacturing efficiency and reproducibility.

By service type, the formulation development segment is expected to expand rapidly in the market in the coming years. Novel delivery systems are developed to directly deliver the peptide to the target site. Effective formulation strategies are employed to stabilize therapeutic peptides within the human body. These strategies enable researchers to develop peptides with improved pharmacokinetic and pharmacodynamic properties. To optimize the utilization of formulation strategies for stable injectable peptide development, a deep understanding of peptide structure and degradation pathways is required.

By application area, the oncology treatments segment held a major revenue share of approximately 35% in the market in 2024, due to the rising prevalence of cancer and the need for targeted treatments. Peptide therapeutics offer enhanced specificity, reduced toxicity to normal tissues, and versatility in targeting multiple pathways simultaneously. The different types of peptides for cancer treatment include hormones, growth factors, and neurotransmitters. The American Cancer Society estimated that more than 2 million new cancer cases will be reported in 2025 in the U.S.

By application area, the diagnostic applications segment is expected to witness the fastest growth in the market over the forecast period. The use of peptides in diagnostics, such as immunoassays, biosensors, or microarrays, has increased in the last few decades. Synthetic short peptides have more advantages than recombinant proteins in the detection of specific antibodies. Advancements in microfluidic technologies facilitate the development of clinical diagnostics, disease management, and patient care.

By end-use, the pharmaceutical companies segment led the market with a share of approximately 66.74% in 2024, due to favorable infrastructure and suitable capital investments. Large companies invest heavily in their GMP manufacturing facility to leverage advanced technologies and expand their geographical presence. This enables them to develop novel peptide-based therapeutics, strengthening their market position.

By end-use, the CDMOs & CROs segment is expected to show the fastest growth over the forecast period. The increasing number of startups potentiates the need for CDMOs and CROs. Startups lack suitable facilities and skilled professionals to synthesize innovative peptides. CDMOs & CROs provide relevant expertise to complex problems associated with the research, manufacturing, and approval of peptides. Since large pharma and biotech companies conduct multiple projects simultaneously, they collaborate with CDMOs & CROs to help them focus on their core competencies.

North America dominated the market with a share of approximately 38.95% in 2024. The availability of state-of-the-art R&D facilities, the strong presence of pharmaceutical companies, and favorable regulatory support are the major factors that govern market growth in North America. Government organizations provide funding and launch initiatives to support the development and manufacturing of peptides. North American countries have an advanced healthcare and manufacturing infrastructure.

Companies like Bachem, CordenPharma, and CEM Corporation are major players that focus on manufacturing and delivering peptides in the U.S. The U.S. has a robust clinical trial infrastructure, supporting the development of innovative peptides. Out of 34,580 studies, about 15,867 studies related to peptides are registered in the U.S., accounting for 45.88% of the total clinical trials. As of 2024, the FDA has approved over 100 peptide-based therapeutics.

There are around 2,706 clinical trials related to peptides registered in Canada as of October 15, 2025. Key players, such as Bio Basic, Inc., Biosynth, and ResolveMass Laboratories, Inc., provide a wide array of peptide services for custom peptide synthesis and manufacturing. Health Canada regulates the approval and manufacturing of peptides in Canada.

Asia-Pacific is expected to host the fastest-growing market in the coming years. Countries like China, India, South Korea, and Japan have suitable manufacturing infrastructure, encouraging foreign companies to set up their facilities. Government and private institutions conduct seminars, workshops, and conferences to share the latest updates among researchers and create awareness about peptide drugs. The increasing prevalence of chronic disorders and the growing geriatric population augment the market.

China is emerging as a global hub in the biotech sector, supported by venture capital investments and product innovations. In 2023, WuXi TIDES, a Chinese CRDMO, alone supported 50 preclinical to commercial stage peptide projects and produced more than 15 metric tons of peptide APIs and intermediates. Apart from therapeutics, the significance of peptides in the cosmetic sector fosters their demand. As of January 2025, 22 of 226 new cosmetic ingredients approved in China are peptide-based.

The Indian government supports pharmaceutical manufacturing through the production-linked incentive (PLI) scheme. The PLI scheme has attracted investments worth Rs 1.76 lakh crore across 14 key sectors. In the first three years, pharma sales under PLI crossed Rs 2.66 lakh crore. The increasing collaboration and merger & acquisition activities also boost market growth in India. In February 2025, Granules India acquired Senn Chemicals AG to expand peptide therapeutics and CDMO capabilities.

HLB PEP Co., Ltd. and Anygen Co., Ltd. are some of Korea’s first facilities specialized in the production of peptide drugs. It is estimated that there are around 53 companies in South Korea that focus on the development of peptide therapeutics. South Korea also exports peptides to the world. From November 2023 to October 2024, 21 South Korean collagen peptide suppliers exported to 25 buyers globally.

Europe is expected to grow at a considerable CAGR in the GMP peptides market in the upcoming period. Favorable government support, the rising adoption of advanced technologies, and increasing investments propel the market. The European Medicines Agency (EMA) regulates the approval of peptides and addresses specific aspects regarding the manufacturing process and characterization of peptides. The increasing new drug discovery research and expansion of manufacturing infrastructure contribute to market growth.

The German government established the National Cancer Prevention Center in Heidelberg with a donation of 5 million euros. The funding will help the laboratory to conduct research into more effective early detection and screening methods. Additionally, Sanofi, a French pharmaceutical giant, invested 1.3 billion euros to expand insulin production in the western German city of Frankfurt am Main.

There are over 5.8 million people living with diabetes in the UK. This necessitates researchers to develop insulin and other peptide-based drugs to reduce the burden of diabetes. The UK is one of the global exporters of diagnostic peptides. From July 2023 to June 2024, the UK exported 19 shipments of c-peptides, mainly to Peru, the Philippines, and India.

Research activities for GMP peptides refer to producing novel potent, selective, and safe peptide therapeutics. Innovative delivery platforms and vaccines are being developed for expanded applications.

Key Players: Eli Lilly and Company, BioMed X, and Novo Nordisk.

Clinical trials are conducted to assess the safety and efficacy of peptides, which are subsequently approved by regulatory agencies, like the FDA, EMA, and NMPA.

Key Players: Rousselot BVBA, Oryx GmbH & Co. KG, and Xequel Bio, Inc.

GMP ensures that peptides meet the highest purity and quality standards by enforcing rigorous standards at every step of the manufacturing process.

Key Players: Bachem, AmbioPharm, Polypeptide Labs, and Aapptec Peptides.

By Type

By Synthesis Method

By Service Type

By Application Area

By End-Use

By Region

January 2026

January 2026

January 2026

January 2026