December 2025

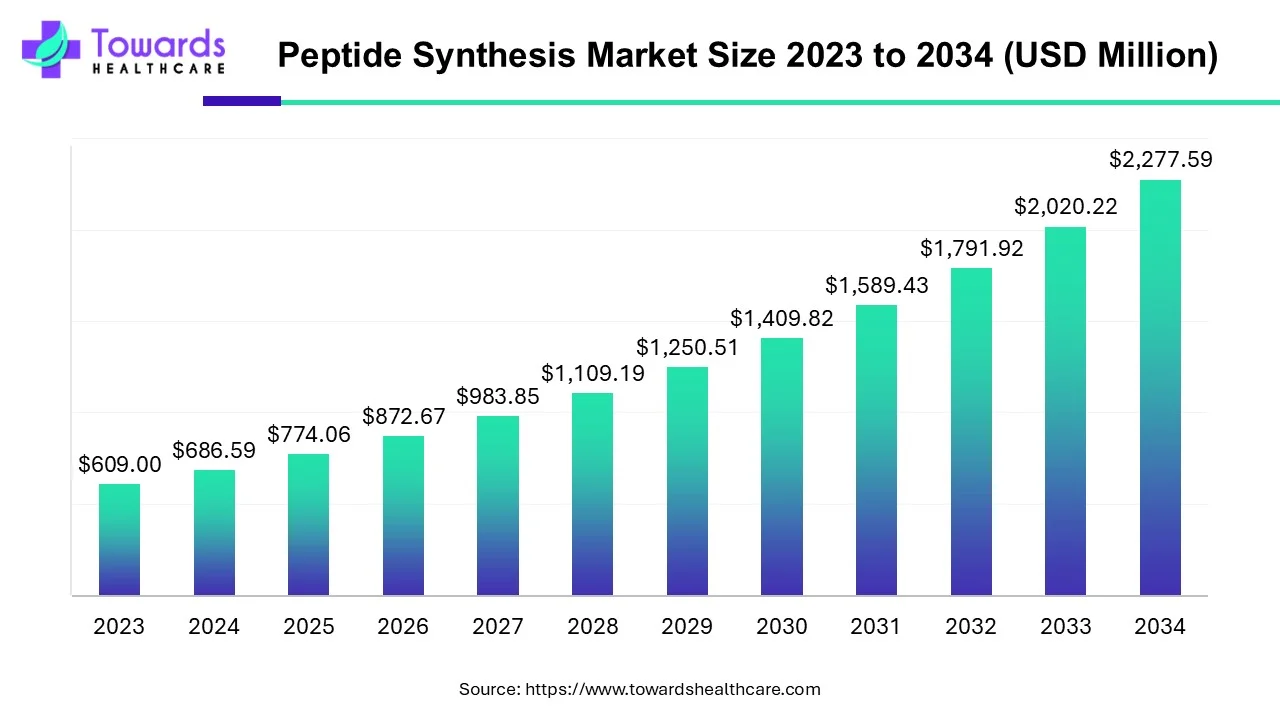

The global peptide synthesis market size is calculated at USD 686.59 million in 2024, grew to USD 774.06 million in 2025, and is projected to reach around USD 2277.59 million by 2034. The market is expanding at a CAGR of 12.74% between 2025 and 2034.

Peptides are short chains of amino acids that are the building blocks of proteins. Peptide synthesis includes the synthesis of peptides, where multiple amino acids are linked via peptide or amide bonds. Peptides are synthesized by linking the carboxy-terminal of one amino acid with the amino-terminal of another amino acid using a coupling reagent. They are usually synthesized using two methods: solid-phase and solution-phase synthesis. Synthetic peptides are used for various purposes, such as the study of protein functions and the treatment of numerous chronic disorders like cancer.

The rising incidences of chronic disorders lead to the growing research and development involving the synthesis of novel peptides. Synthesized peptides can either be used as therapeutics to treat chronic disorders or as agents to study the proteins involved in a disease. The burgeoning biotechnology and cell biology sectors boost market growth. The advent of advanced technologies promotes the development of novel methods for the synthesis of peptides. Additionally, the increasing investments by various government and private organizations and public-private partnerships favor market growth.

Artificial intelligence (AI) and machine learning (ML) algorithms have the potential to revolutionize peptide synthesis. AI and ML can aid in designing novel peptides and help validate the drug discovery process. They positively influence the biomedicine sector, significantly impacting drug discovery. ML algorithms can identify diverse peptide activities, and ML-based predictive models can assess the binding affinities of protein-peptide interactions. This helps to screen potential peptides, accelerating the drug development process and improving efficiency. AI and ML can also help to develop novel methods for synthesizing peptides, overcoming the limitations of traditional methods. They introduce automation in the synthesis process, and robots can facilitate enhanced productivity. Furthermore, AI algorithms can aid in the prediction of peptide bioactivity and toxicity, enabling early identification and prioritization of lead candidates.

Growing Research and Development

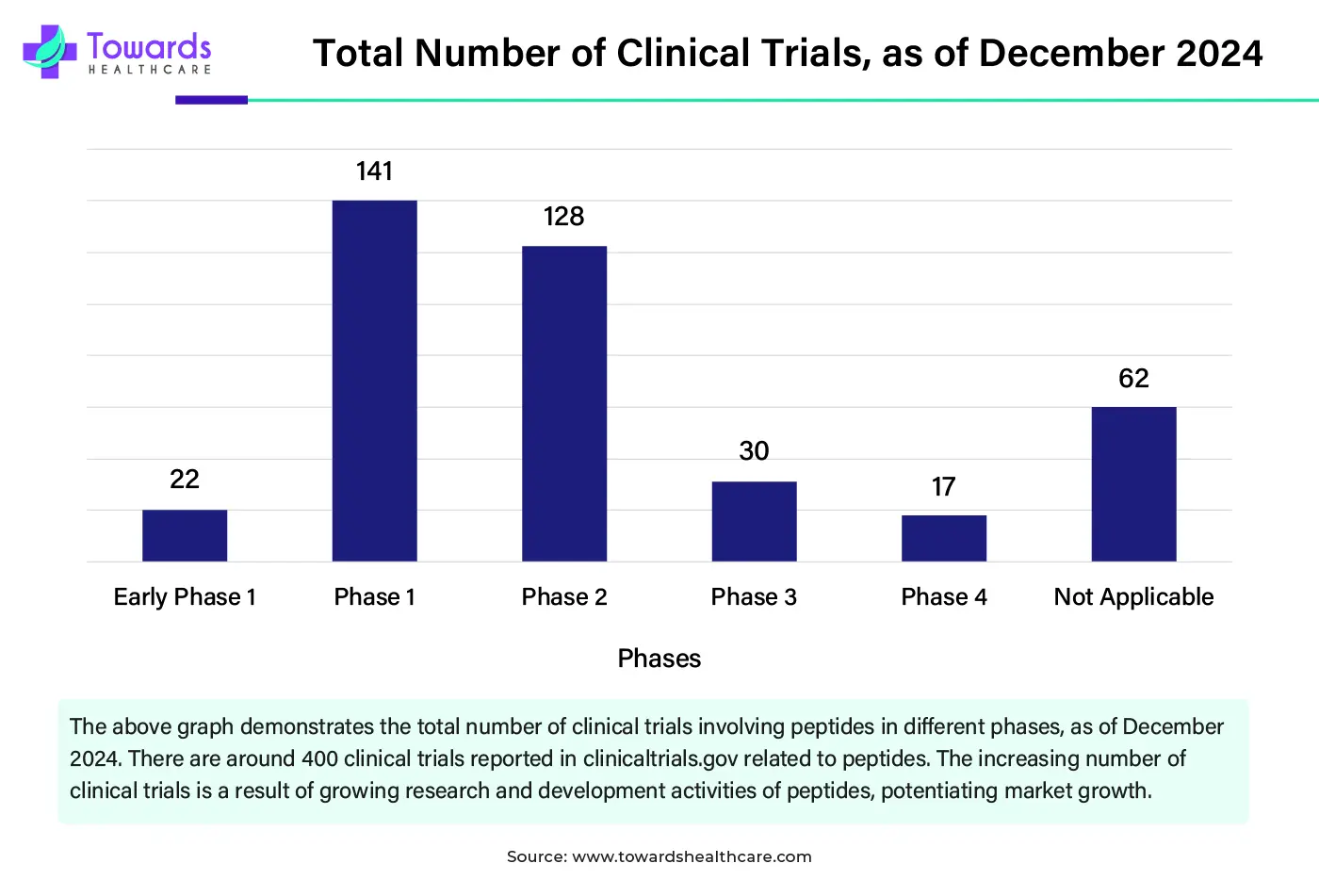

The growing research and development activities promote the latest advancements in synthetic peptides. The rising incidences and prevalence of chronic disorders necessitate research and development. Several researchers are investigating the role of synthetic peptides in numerous disorders and other extended applications. Currently, peptide-based therapeutics have found immense potential in various diseases, such as oncology and infectious diseases, immunology, neurology, and metabolic disorders. Synthetic peptides are also used to develop epitope-specific antibodies against pathogenic proteins. They are also used as standards and reagents in mass spectrometry-based applications. They also find applications in vaccines, biomaterials, and histological probes. The growing demand for these biologicals and macromolecules to treat various disorders fuels the growth of the peptide synthesis market. The research activities are supported by favorable government policies and investments & collaborations.

Sustainability Issues and High Purification Costs

The major challenge of the peptide synthesis market is the sustainability issues of synthetic procedures. The use of strong solvents, hazardous coupling agents, and difficulties used in recycling resins are some of the sustainability issues while synthesizing peptides, hampering market growth. Another major challenge of the market is the high purification costs of peptides. The longer peptides are often contaminated with byproducts and other reagents used in peptide synthesis that require a separate, costly purification process.

Recombinant Peptide Synthesis

The future of the peptide synthesis market is promising with the latest advancements in recombinant peptide synthesis techniques. Recombinant methods use several biotechnology techniques, such as DNA expression and gene expression approaches, to synthesize the desired peptide. In recombinant peptide synthesis, the gene-expressing peptides are introduced into bacterial, yeast, or mammalian host cells using vectors that use natural biological processes to produce the desired peptides. This technique is preferred as it helps produce peptides on a large scale, maximize production yields, and increase the purity of products. Some researchers use a semi-synthetic approach for peptide synthesis, combining recombinant and synthetic processes. This results in efficient and reliable production of synthetic peptides on a large scale. These techniques are also used to enhance the stability and physiological activity of peptides.

By product, the reagents & consumables segment held a dominant presence in the peptide synthesis market in 2023. Reagents & consumables are essential for peptide synthesis. Some common examples of reagents & consumables include building blocks, chelators, coupling reagents, protecting reagents, amino acids, and resins. They accelerate the synthesis of peptides and increase the specificity of synthesized peptides. This results in customization, flexibility, and a wide range of products.

By product, the equipment segment is expected to grow at the fastest rate in the market during the forecast period. The equipment helps to synthesize the peptides, allowing controlled and precise addition of amino acids in sequence. It can also be used for drug lead optimization, structure-activity studies, and receptor binding studies. Technological advancements and the latest innovations in equipment augment the segment’s growth. Novel equipment is developed to increase the speed and improve the efficiency of the procedure.

By technology, the liquid phase peptide synthesis segment led the global peptide synthesis market in 2023. Liquid phase peptide synthesis (LPPS) is a method for synthesizing peptides in a solution. The demand for LPPS increases as it aids in the scalability of peptides and reduces the use of reagents and solvents, making it more sustainable and environmentally friendly than other synthesis methods. Another advantage of LPPS includes easy detection of side reactions as products are purified after each step.

By technology, the hybrid technology segment is anticipated to grow with the highest CAGR in the market during the studied years. Hybrid peptide synthesis involves combining two different methods to produce peptides. It enables producing high-quality peptides on a large scale. It offers flexibility and precision of chemical synthesis methods while leveraging the efficiency and sustainability of recombinant methods. Thus, hybrid technology is the future of peptide synthesis, which allows researchers to produce complex structures and modifications that are difficult to produce using a single technique.

By application, the therapeutics segment held the largest share of the peptide synthesis market in 2023. Peptide-based therapeutics act as inhibitors or activators to treat various chronic disorders. The rising prevalence of chronic disorders necessitates the development of peptide drugs, boosting the segment’s growth. The increasing investments and new product launches also promote the segment’s growth. The US FDA approved 26 novel peptides from 2016 to 2022 for the treatment of numerous diseases. They offer superior advantages over small molecules, leading to target specificity and potency and fewer side effects.

By application, the diagnosis segment is projected to expand rapidly in the market in the coming years. Peptides are used in the diagnosis of various diseases by detecting and quantifying biomarkers in biological samples. Peptides are also used as probes for imaging techniques due to their good tissue penetration and non-immunogenicity. Favorable government policies for early detection and accurate diagnosis of chronic disorders potentiate the segment’s growth.

By end-use, the pharmaceutical & biotechnology companies segment dominated the global peptide synthesis market in 2023. The availability of suitable capital investment, favorable infrastructure, and the presence of trained professionals propel the segment’s growth. These companies also have specialized labs for performing reactions and advanced tools for peptide synthesis, enhancing their potential for novel innovations.

By end-use, the contract development & manufacturing organization (CDMO)/contract research organization (CRO) segment is estimated to show the fastest growth over the forecast period. The segment’s growth is attributed to the increasing number of CDMOs/CROs, suitable infrastructure, and the presence of skilled professionals. Pharma and biotech companies conduct peptide synthesis on a contract basis, reducing their time and achieving high-quality results.

North America held the major share of the peptide synthesis market in 2023. The rising incidence of chronic disorders, state-of-the-art research and development facilities, and the presence of key players drive the market. Key players, including Thermo Fisher Scientific, Sigma Aldrich, GenScript, Aragen Life Sciences, etc., share a major contribution to the market growth. The increasing number of new product launches also potentiates market growth. In 2023, the U.S. Food and Drug Administration approved 5 peptides for the diagnosis and treatment of many chronic and rare disorders. Additionally, the increasing funding by the U.S. and Canadian Governments supports the development of peptides in North America.

Asia-Pacific is projected to host the fastest-growing peptide synthesis market in the coming years. The rising adoption of advanced technologies, increasing investments & collaborations, and the burgeoning pharmaceutical & biotech sector drive the market. Peptides are part of the generic pharmaceuticals. The generic pharma industry of India is considered the world’s third largest by volume. The Indian Government provides funding and launches initiatives to strengthen cost-effective generics, encouraging the development of innovative drugs and fostering manufacturing. China's government also supports pharmaceutical R&D activities by encouraging international cooperation. In 2023, around 220 innovative drug licensing and partnership deals were made in China, amounting to $37 billion.

Europe is anticipated to grow at a notable rate in the foreseeable future. The growing demand for biologics and the presence of state-of-the-art research and development facilities encourage researchers to develop novel peptide therapeutics. The increasing investments by government and private institutions favor the market. The presence of key players contributes to market growth. Key players, such as GenScript, BioCat, and Biosynth, hold a major share of the market in Europe. Several government and private organizations also conduct seminars, conferences, and workshops to train professionals and create awareness of novel peptide synthesis techniques. The Royal Society of Chemistry announced a “European Peptide Synthesis Conference 2025” from 25 August 2025 and 27 August 2025 in Portugal.

Latin America is expected to grow significantly in the peptide synthesis market during the forecast period. The industries in Latin America are expanding, which in turn is increasing the research and development, driving the demand for peptide synthesis. Advanced technologies are also being utilized to develop automated synthesis platforms, enhancing the development and production of peptides. At the same time, growing diseases are increasing their demand for the development of new therapeutics. Moreover, the growing healthcare investments are also supporting these developments. Thus, this is enhancing the market growth.

The Middle East and Africa are expected to show lucrative growth in the peptide synthesis market during the predicted time. The growing demand for peptide-based therapies is increasing the peptide synthesis. This is tun, leading to new collaborations among the companies. New startups are also contributing to the same. Their research and development are supported by government funding. Thus, these advancements are promoting the market growth.

In July 2025, the financial results for the second quarter ended June 28, 2025, were released by Thermo Fisher Scientific Inc. There was a growth in the revenue by 3% to $10.85 billion, and a 2% growth in the organic revenue. An increase in the GAAP diluted EPS was observed, amounting $4.28. Whereas $1.83 billion was noted to be the GAAP operating income for the second quarter of 2025. Additionally, the $2.35 billion was recorded to be the adjusted operating income for the second quarter of 2025.

In March 2025, financial results for the full year ended on December 31, 2024, were announced by GenScript Biotech Corporation. A $3.2 billion growth was obsereved in the cell therapy business. An increase in the revenue from the continuing operations was reported with the gain of $594.5 million. $2.9 billion was noted to be the profit of the group. Additionally, around $59.8 million was the adjusted net profit of the Group from continuing operations, which indicated a growth compared to the prior period.

In August 2025, after announcing the collaboration between BioDuro and Atombeat Inc. for enhancing peptide drug discovery, the co-founder of Atombeat, Dr. Dongdong Wang, stated that their strengths in AI-driven drug design are being complemented by the deep expertise in peptide testing and synthesis of BioDuro. Hence, an integrated and intelligent platform for peptide drug discovery and evaluation will be developed by them by integrating experimental processes with AI. Moreover, to provide solutions to the unmet clinical needs globally and to drive innovation in pharmaceutical development is their common commitment.

Dr. Brad Pentelute, CEO of Amide Technologies, commented that the rising prevalence of cancers and metabolic disorders, with increasing investments in novel drug research and development, raises the demand for peptide therapeutics. He emphasized that the company’s advanced synthetic capabilities enable biopharma companies to rapidly develop and iterate complex peptides. He also added that the company aims to produce thousands of peptides in short timeframes to meet global demand.

By Product

By Technology

By Application

By End-Use

By Region

December 2025

October 2025

October 2025

October 2025