February 2026

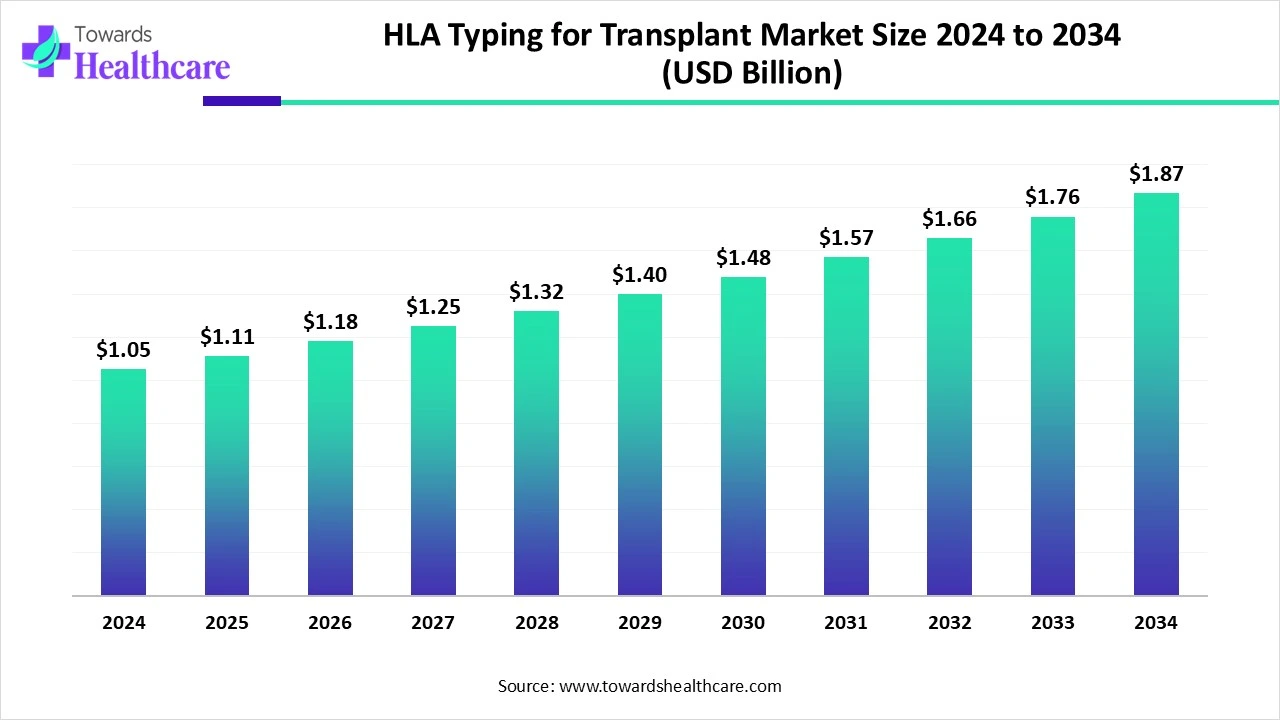

The global HLA typing for transplant market size was estimated at US$ 1.05 billion in 2024, projected to increase to US$ 1.11 billion in 2025 and reach US$ 1.87 billion by 2034, showing a healthy CAGR of 5.93% across the forecast years.

The HLA typing for transplant market is experiencing robust growth, driven by the increasing organ transplantation procedures and the rising prevalence of chronic disorders. The growing public-private partnerships and increasing investments boost the market. Numerous government organizations support organ transplantations by launching initiatives. Integrating artificial intelligence (AI) in HLA typing aids in data analysis and interpretation, thereby enhancing efficiency and accuracy. The future looks promising, with advancements in genomic technologies.

| Metric | Details |

| Market Size in 2025 | USD 1.11 Billion |

| Projected Market Size in 2034 | USD 1.87 Billion |

| CAGR (2025 - 2034) | 5.93% |

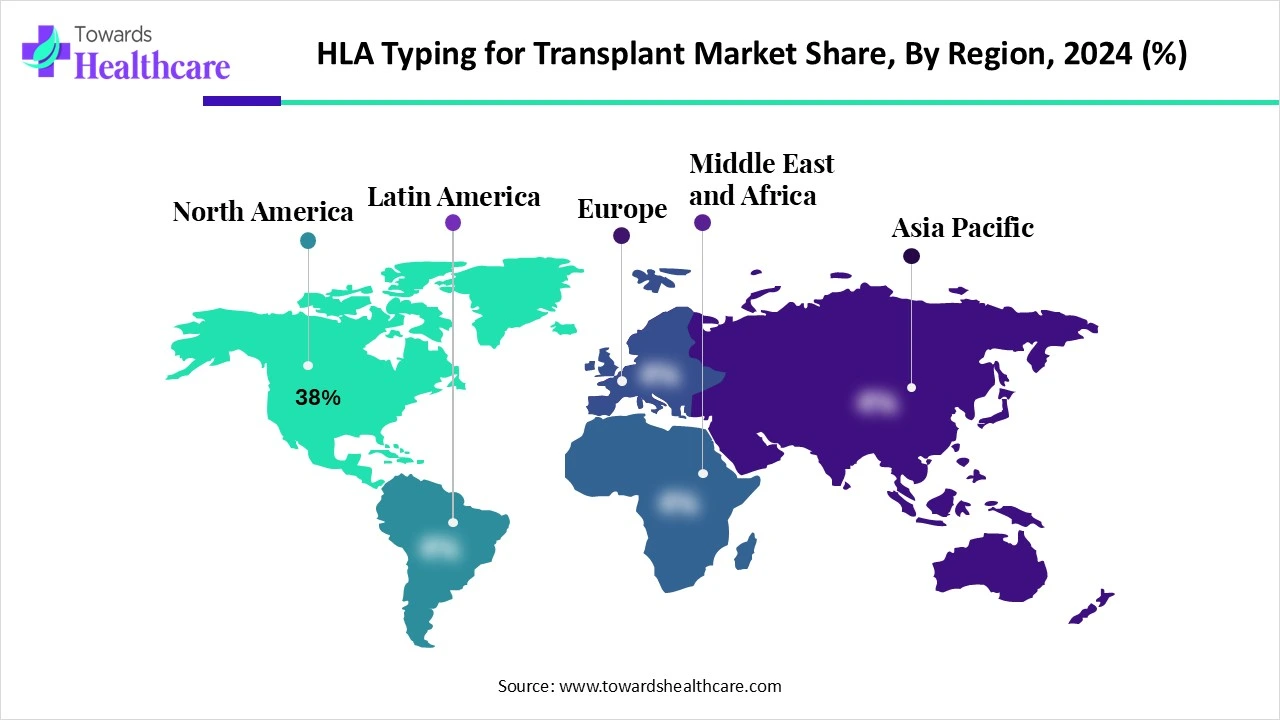

| Leading Region | North America Share 38% |

| Market Segmentation | By Products & Services, By Technology, By Application, By End-User, By Region |

| Top Key Players | Thermo Fisher Scientific, Bio-Rad Laboratories, QIAGEN N.V., F. Hoffmann-La Roche Ltd, Immucor Inc., CareDx, Inc., Illumina, Inc., Omixon Inc., GenDx, HistoGenetics, Becton, Dickinson and Company, Bio-Techne Corporation, Luminex Corporation (Now part of DiaSorin), Takara Bio Inc., Abbott Molecular, TBG Diagnostics, BAG Health Care GmbH, Linkage Biosciences (acquired by Thermo Fisher), Labcorp, Eurofins Scientific |

HLA (Human Leukocyte Antigen) typing for transplant is a molecular diagnostic process that identifies genetic compatibility between donors and recipients by determining the specific variants of HLA genes. These antigens, located on the surface of white blood cells, play a vital role in immune response regulation. Accurate HLA matching minimizes the risk of organ rejection and graft-versus-host disease (GVHD), making it a critical step in solid organ transplantation and hematopoietic stem cell transplantation (HSCT). The HLA typing market encompasses various technologies and services used in clinical labs, hospitals, transplant centers, and research settings to perform genotyping and antigen detection.

AI plays a vital role in performing numerous functions, such as identifying interactions of HLA antibodies, HLA genotype, and donor HLA expression. AI and machine learning (ML) algorithms can analyze vast amounts of data and determine patterns in HLA data. They can also identify potential HLA-associated diseases in a patient. AI and ML can simplify the interpretation of HLA analysis data, reducing manual errors. AI aids researchers in developing personalized medicines based on the results of HLA typing and the HLA alleles involved.

Demand for Organ Transplants

The major growth factor for the HLA typing for transplant market is the growing demand for organ transplantations. This is due to the rising prevalence of chronic disorders, such as cardiovascular disorders, chronic kidney disease, and hepatic disorders. The prolonged condition of such disorders leads to organ failure, potentiating the demand for organ transplants. The WHO reported that more than 150,000 solid organ transplants are performed globally each year. Government organizations raise awareness among the general public about organ donations.

Lack of Skilled Professionals

Certain underdeveloped and developing countries have a lack of skilled professionals to understand the clinical significance of different alleles. The HLA typing system is complex and polymorphic, requiring specialized expertise.

What is the Future of the HLA Typing for Transplant Market?

The market future is promising, driven by advancements in genomic technologies. Next-generation sequencing (NGS) offers effective solutions for complex HLA typing. The use of bioinformatics mitigates the risk of sequencing errors. Researchers are developing online software tools for sequencing. Advances in genomic technologies enhance the efficiency and reproducibility of sequencing techniques, expanding their services. This leads to lower costs and swift turnaround times, accelerating the speed of overall diagnosis. Technological advancements present ample opportunities for market players and improve diagnostic precision.

By product & services, the reagents & consumables segment held a dominant presence in the market in 2024. This is due to the easy availability of reagents and their affordability. Reagents & consumables enable researchers to perform multiple experiments simultaneously. Key players offer a wide range of reagents, such as PCR and flow cytometry reagents and sequencing kits, for research and clinical purposes. Researchers can refill their research requirements through reagents.

By product & services, the software & services segment is expected to grow at the fastest CAGR in the market during the forecast period. Software & services eliminate the need for specialized infrastructure. They also reduce the cost of regular maintenance of instruments. Services provide relevant expertise to complex research problems. Ongoing efforts are made to develop advanced software to simplify data analysis and interpretation.

By technology, the molecular assay technologies segment held the largest revenue share of the market in 2024 and is expected to expand rapidly in the market in the coming years. This segment dominated because of the burgeoning molecular biology sector and advances in assay techniques. Molecular assay technologies enable the measurement of molecular characteristics and interactions. Researchers develop advanced instruments to enhance the precision of assay methodologies and aid in data analysis. Molecular assay technologies provide a deeper understanding of HLA variants and the compatibility of transplants.

The PCR-based molecular typing sub-segment dominated the market. Polymerase chain reaction (PCR) is a conventional gene sequencing technique to amplify specific DNA sequences. This technique is widely preferred due to its accuracy, reliability, high speed, and sensitivity. It is cost-effective and can analyze small amounts of DNA samples.

The NGS-based sequencing sub-segment is expected to grow rapidly. Next-generation sequencing (NGS) is a more advanced gene sequencing technique with higher sensitivity, precision, and accuracy compared to the PCR technique. It can detect rare genetic variants and screen multiple samples cost-effectively.

By application, the solid organ transplantation segment contributed the biggest revenue share of the market in 2024. This is due to the rising prevalence of chronic disorders, leading to organ failures. HLA typing is essential to assess the compatibility of the donor organ with the recipient. Several government organizations encourage people to donate organs. The increasing number of organ transplantations globally potentiates the need for HLA typing.

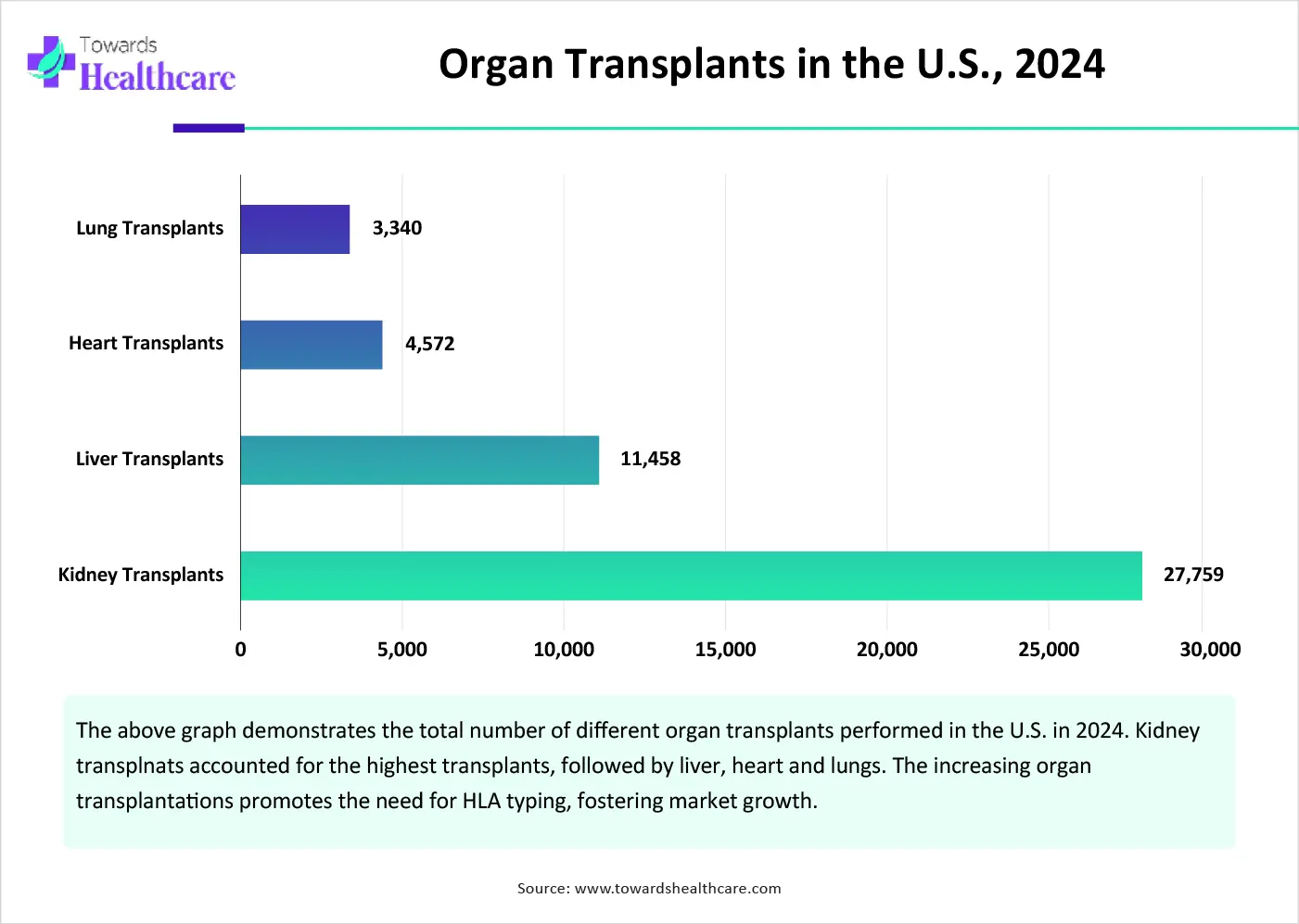

The kidney sub-segment held a major revenue share. The rising prevalence of chronic kidney disorder (CKD) and the increasing number of kidney transplants propel the segment’s growth. It is estimated that over 700 million people in the world have CKD. Kidney transplants were the highest among all organ transplants in the U.S., accounting for 27,759 in 2024, an increase of 1.6%.

By application, the stem cell transplantation segment is expected to witness the fastest growth in the market over the forecast period. The growing demand for personalized medicines and expanding applications of stem cells augment the segment’s growth. Allogeneic stem cell transplantation is a procedure that requires HLA typing, as stem cells from different individuals are transferred to the patient. The donor may or may not be related to the recipient. It is preferred for different blood cancers, such as leukemia, myelofibrosis, and lymphoma.

By end-user, the hospitals & transplant centers segment led the global market in 2024. Hospitals & transplant centers have favorable infrastructure and suitable capital investment to adopt advanced technologies. They have skilled professionals to perform HLA typing tests and consult patients. The increasing number of organ transplants also contributes to the segment’s growth.

By end-user, the biopharmaceutical companies segment is expected to show the fastest growth in the upcoming years. HLA typing is essential for research purposes, including drug development, personalized medicine, and transplantation. Biopharmaceutical companies have advanced research infrastructure and trained professionals. The growing number of biopharma startups increases competition among key players. This enables them to develop and launch innovative HLA typing products.

North America dominated the global market share by 38% in 2024. The presence of a robust healthcare infrastructure, the increasing number of organ transplantations, and favorable government support are factors that govern the market growth in North America. The rising investments and collaborations among key players favor market growth. The presence of key players contributes to market growth by providing advanced HLA typing test tools.

The Organ Procurement and Transplantation Network (OPTN) reported that 48,149 organ transplants were performed in the U.S. in 2024, representing an increase of 3.3% from 2023. Key players, such as Illumina, Inc., Bio-Techne Corporation, and Labcorp, are the major contributors to the market in the U.S.

In 2024, a total of 3,212 organ transplants were performed in Canada, of which 82% organ donations were from deceased donors and 18% used living donors’ organs. The Government of Canada announced an investment of $2 million to focus on cutting-edge research in the area of organ and tissue donation. The funding was made to help institutions develop and test their AI prototype to match organ donors with recipients.

Asia-Pacific is expected to grow at the fastest CAGR in the HLA typing for transplant market during the forecast period. The increasing awareness of organ donations and favorable government initiatives bolster market growth. Government organizations organize campaigns and create social media awareness to promote organ donations. The rising prevalence of chronic disorders and the growing geriatric population potentiates the demand for HLA typing.

Chinese Premier signed a decree of the State Council to unveil rules on human organ donation and transplantation to meet the demands of changing procedures and ensure the healthy development of the cause. As of 2024, more than 7 million people were registered as organ donors. China recorded more than 58,000 organ donations, 63,000 body donations, and 110,000 corneal donations.

In 2024, India performed over 18,900 organ transplants, setting a new record for the highest number in a single year. It ranks third globally in organ transplants, after the U.S. and China. The Indian government has also launched a national campaign, “Angdaan-Jeevan Sanjeevani Abhiyan”, to promote organ and tissue donation across the country.

Europe is expected to grow at a notable CAGR in the HLA typing for transplant market in the foreseeable future. The rising adoption of advanced technologies and increasing investments boost the market. The growing public-private partnerships and suitable government support propel market growth. The increasing awareness about HLA typing’s significance in successful transplants and the growing demand for personalized medicines facilitate market growth. The expansion of donor registries in European countries provides organs to patients.

The NHS Blood and Transplant (NHSBT) estimates that only around 100,000 donors are HLA typed. Hence, it launched a pilot programme to help reduce the formation of immune system antibodies and transplant rejection. NHSBT predicts that at least 130,000 blood donors will need to be HLA typed to make the full supply of HLA-matched red cells for kidney transplant patients

Prof. Samaila Mungadi, the Director of the UDUTH Center, Sokoto, at the Transplant inaugural program, commented on the successful completion of the kidney transplant that extensive tests were performed to assess kidney function, overall health, and compatibility for the transplant. Different tests include blood tests, imaging, and tissue matching (HLA typing).

By Products & Services

By Technology

By Application

By End-User

By Region

February 2026

February 2026

February 2026

January 2026