January 2026

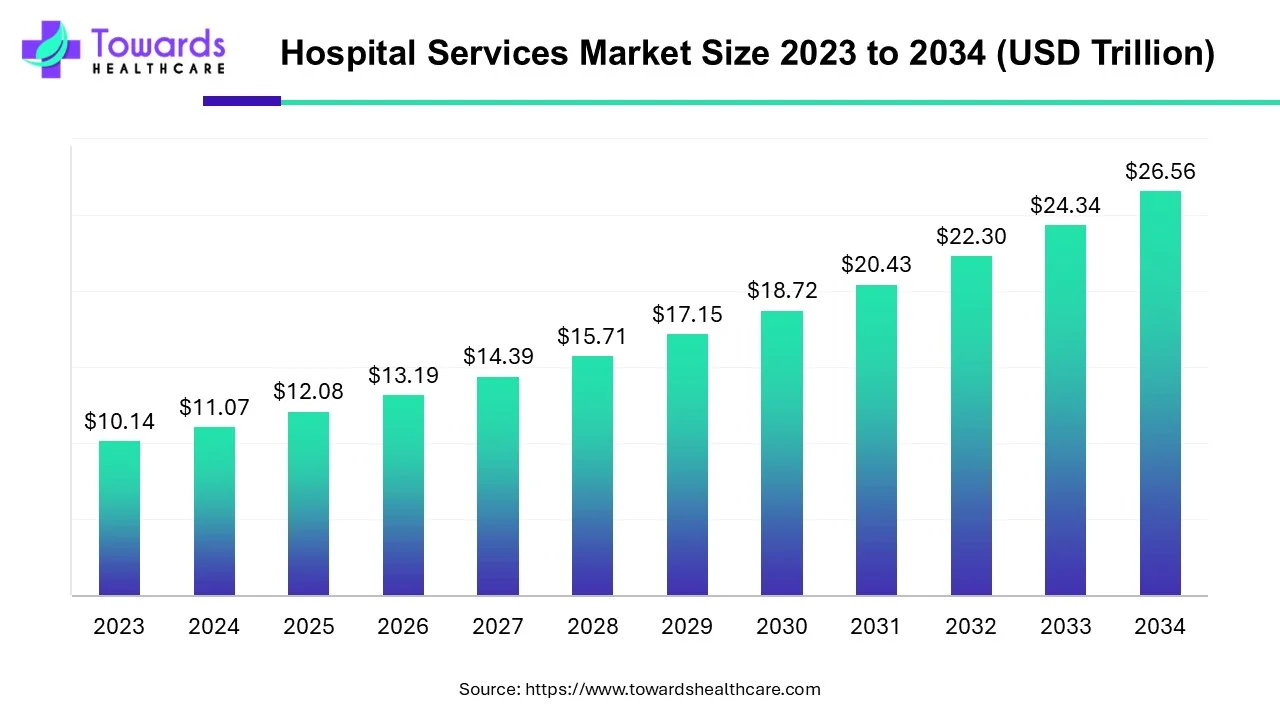

The global hospital services market size was calculated at USD 12.08 trillion in 2025, to reach USD 13.19 trillion in 2026 is expected to be worth USD 28.99 trillion by 2035, expanding at a CAGR of 9.15% from 2026 to 2035. The rising prevalence of chronic disorders, technological advancements, and increasing investments drive the market.

| Key Elements | Scope |

| Market Size in 2025 | USD 12.08 Billion |

| Projected Market Size in 2035 | USD 28.99 Billion |

| CAGR (2026 - 2035) | 9.15% |

| Leading Region | North America |

| Market Segmentation | By Type, By Ownership, By Region |

| Top Key Players | Mayo clinic, HCA Healthcare, Cleveland clinic, Spire Healthcare Group plc, Ramsay Health Care, Ascension Health, Community Health Systems, Inc., Tenet Healthcare, Fortis Healthcare |

Hospital services typically defined as all services that are made to patients, inpatient or outpatient, have gained tremendous traction over the last few years and are expected to continue due to the increasing prevalence of various diseases & illnesses as well as rising awareness among these patients to avail treatment. The rising prevalence of cardiovascular diseases, cancer, and other long-term terminal and non-terminal illnesses have been driving the growth of the global hospital services market for the past few years and are expected to continue

Artificial intelligence (AI) and machine learning (ML) are increasingly adopted in hospital services to revolutionize every aspect of patient care. AI and ML play a major role in various operations, from administrative tasks to patient care. AI can analyze historical patient data to predict treatment outcomes. AI and ML enable hospitals to manage resources, such as predicting patient admissions and optimizing staffing. They aid in scheduling appointments as well as processing insurance claims. They streamline the entire workflow in a hospital, improving efficiency and accuracy. AI can be used to manage patients during emergencies, enhancing patient outcomes. Additionally, AI and ML simplify the tasks of healthcare professionals by accurately diagnosing patients' medical imaging data and providing personalized treatment plans.

According to the International Agency for Research on Cancer (IARC), 1 in 5 people worldwide will develop cancer at some point in their lives, and 1 in 8 men and 1 in 11 women will pass away from the condition. According to these latest projections, more than 50 million people are still alive five years after receiving a cancer diagnosis. Global aging populations and socioeconomic risk factors continue to be the main drivers of this growth. Over the next few decades, it is anticipated that cancer occurrences would rise due to changing lifestyles.

Palliative care is one of several treatments that hospitals provide. Surgery, chemotherapy, and/or radiotherapy are all required for cancer treatment. Patients and their families who are dealing with obstacles brought on by life-threatening illnesses, whether they be medical, psychological, social, or spiritual, benefit from palliative care. The standard of living for caretakers also rises. Hospitals also provide these services.

Future increases in the prevalence of cancer are anticipated to increase the demand for hospital services that maximize patient comfort both during and after treatment. Particularly the younger generation is growing more conscious of their health, taking advantage of routine check-ups. Additionally, people are deliberately choosing cancer-related check-ups and preventive operations as a result of knowledge about the heredity of certain types of cancers, which is fueling the demand for hospital services.

When the knee becomes injured from a variety of causes, such as arthritis or a serious knee injury, a knee replacement treatment is necessary. The demand for knee replacement surgery is mostly driven by the aging population, physical inactivity, accidents, and obesity.

It is anticipated that as knee disorders become more common, more people will choose surgery to reduce pain and improve comfort when walking or engaging in other physical activities. The countries with the greatest rates of knee replacement in Europe are Germany, Austria, Finland, and Switzerland. Given a large number of elderly people, knee replacement surgeries are predicted to rise in the coming years. In consequence, it is anticipated that this would increase demand for hospital services in the future.

According to the World Health Organization (WHO), cardiovascular diseases (CVDs), which claim 17.9 million lives annually, are the leading cause of mortality worldwide. Heart attacks and strokes account for four out of every five CVD deaths, and one-third of these deaths happen before the age of 70.

Stents have improved significantly over the past few years in order to prevent both restenosis and thrombosis. Since its inception in the late 1970s, percutaneous coronary revascularization has been a cornerstone in the treatment of coronary artery disease. By enhancing early outcomes and lowering the risk of restenosis, bare-metal stents and, more recently, first-generation drug-eluting stents (DES), such as sirolimus-eluting (Cypher) and paclitaxel-eluting stents (Taxus), have further improved the outcomes of percutaneous coronary intervention (PCI). However, due to the risk of late stent thrombosis, particularly after stopping the dual antiplatelet medication, there is now disagreement over the safety of these first-generation DES. Next-generation stents are being developed by a number of firms.

Increased angioplasty procedures are anticipated due to rising CVD conditions, early identification, and advancements in stent technology. The market for hospital services will be driven by these reasons globally.

Currently, a large number of patients have insurance coverage, which results in high coverage of these operations. However, in some circumstances, patients might not be covered by insurance companies for all conditions, particularly pre-existing ones, in which case they would be responsible for paying for their own operation.

The cost of surgical procedures varies around the world, with one of the priciest methods being used in the US and Europe. On the other hand, countries like India have considerably cheaper surgery costs. Despite these aspects, surgical operations are often expensive due to a variety of factors, including the surgeons' expertise, the use of replacement components (if any), the hospital's location, and the general pre- and post-op services provided.

Patients who require such treatments frequently suffer from chronic illnesses that affect many organs. The majority of the expense associated with these surgical treatments is related to pre-and post-operative care. Reduced access to healthcare due to insufficient insurance coverage and expensive procedures has an effect on the market for hospital services.

The healthcare industry is integrating digital technology more and more, and it will soon transform how doctors practice their craft. Especially in major hospitals with numerous locations, healthcare companies are increasingly using digital solutions and automation to enhance the patient experience as well as make it simpler for doctors and caregivers to obtain patient information.

Numerous patients are choosing digital means of communication with their doctors in order to avoid leaving their houses. New apps are being released by vendors so that patients may access hospital information. The advent of advanced technologies such as telemedicine and electronic health records (EHR) contribute to future market growth. This allows healthcare professionals to provide advanced care to patients, especially in rural areas, increasing the accessibility of healthcare services. Digital transformation aids in maintaining patient data, eliminating the need to store and retrieve physical data.

| Hospital Type | 2016 | 2020 | 2027 |

CAGR (2020-2027) |

| State-owned Hospital | 2,408.4 | 3,300.4 | 5,619.0 | 7.73% |

| Private Hospital | 1,933.1 | 2,725.4 | 4,870.6 | 8.48% |

| Public/Community Hospitals | 2,611.8 | 3,550.8 | 5,959.5 | 7.51% |

| Total | 6,953.2 | 9,576.6 | 16,449.0 | 7.87% |

By type, the inpatient services segment held a dominant presence in the hospital services market in 2024. The increasing number of hospitalizations due to an increasing number of surgeries and the rising prevalence of acute disorders boosts the segment’s growth. The hospitalization rate has drastically increased due to the COVID-19 pandemic. Hospital staff provide enhanced treatment care and 24/7 facility to hospitalized patients. The favorable reimbursement policies and insurance coverage increase the demand for inpatient services.

By type, the outpatient services segment is expected to grow at the fastest rate in the market during the forecast period. The increasing prevalence of chronic disorders like diabetes, cancer, and cardiovascular disorders promotes the segment’s growth. Patients suffering from these disorders are required to do regular health check-ups to maintain health, potentiating the demand for outpatient services. These services are comparatively cost-effective, increasing affordability and accessibility for patients. Additionally, the increasing number of minimally invasive and non-invasive surgeries propel the segment’s growth.

By ownership, the publicly/government-owned segment led the global market in 2024. Government hospitals provide advanced treatment and care at affordable prices. Sometimes, they also offer free treatment. Hence, mainly patients from low- and middle-income groups prefer government hospitals. Patients get access to government initiatives and policies related to the treatment of numerous diseases. These hospitals maintain law and order, regulate the economy, and protect the environment.

By ownership, the for-profit privately owned segment is projected to expand rapidly in the market in the coming years. Privately owned hospitals provide state-of-the-art services and personalized care to patients, augmenting the segment’s growth. The segmental growth is also attributed to the availability of advanced infrastructure and suitable capital investments. Patients have shorter waiting times and access to modern facilities.

North America held the largest share of the hospital services market in 2024. The presence of key players, rising adoption of advanced technologies, and increasing investments drive the market. The U.S. government provides insurance coverage to patients to increase the accessibility and affordability of advanced healthcare. There are approximately 12.2 million people registered with Medicare-Medicaid insurance policies in the U.S. The increasing number of hospitals in the U.S. and Canada also contributes to market growth. There are around 6,120 hospitals in the U.S. and around 1,017 hospitals in Canada as of 2023.

Asia-Pacific is projected to host the fastest-growing market in the coming years. The rising incidences of chronic disorders are due to an increasing geriatric population, resulting in increased hospitalization. The rising disposable income and availability of affordable hospital services promote the market. The growing medical tourism sector due to advanced medical facilities and skilled healthcare professionals propel the market. Countries like Malaysia, Thailand, Japan, and Singapore are emerging as leaders in medical tourism, attracting foreign visitors for advanced and innovative treatment.

Japan is a significant and rapidly expanding market for hospital services within the Asia Pacific region for hospital services. The Japanese hospital market is assessed at a substantial amount and is projected to continue growing owing to the increased awareness of infectious diseases, advancements in technology, and the aging population. Digital Health is propelling the expansion of the market by transforming Japan's healthcare landscape via introducing telemedicine, robotic surgery, and IoT health devices to improve healthcare infrastructure resilience. Moreover, the Japanese government is actively promoting the adoption of digital health tools like electronic health records (EHRs) and other digital health solutions, which contribute to further growth.

For Instance,

Europe is expected to grow at a considerable rate in the upcoming period in the hospital services market due to the increasing adoption of digital health technologies, including telemedicine, remote patient monitoring, and electronic health records. European Innovation Council is actively supporting emerging technologies and breakthrough solutions in the healthcare sector by addressing societal challenges like pandemics and population aging. Furthermore, the EU is implementing a centralized Health Technology Assessment system to foster a more innovative market for healthcare technologies. Moreover, Several European countries, particularly in Scandinavia, are leading the way in developing super hospitals that are not only technologically advanced but also efficient and patient-centric.

For Instance,

By Type

By Ownership

By Region

January 2026

January 2026

January 2026

January 2026