January 2026

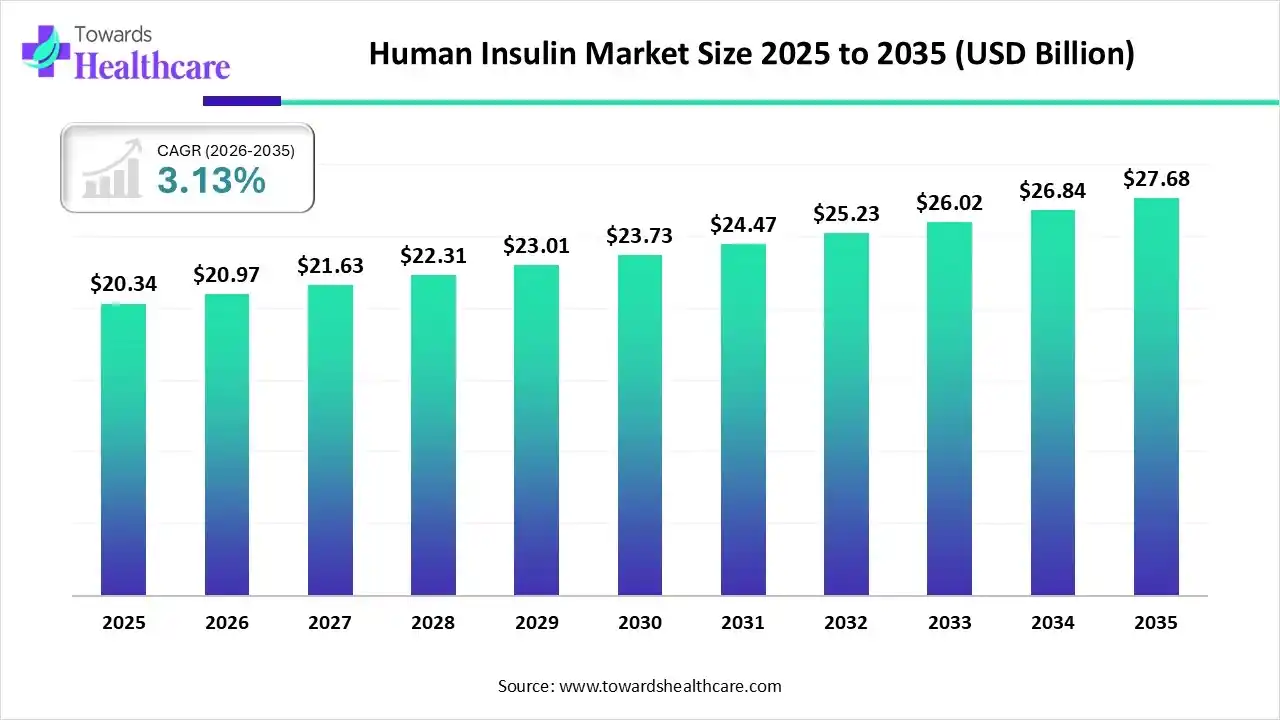

The global human insulin market size was estimated at USD 20.34 billion in 2025 and is predicted to increase from USD 20.97 billion in 2026 to approximately USD 27.68 billion by 2035, expanding at a CAGR of 3.13% from 2026 to 2035.

Due to the growing diabetes burden globally, the demand for human insulin products is increasing. Therefore, the companies are investing in and launching various products, where AI is also being used to develop new systems. Additionally, the robust healthcare, growing investments, and advancing biosimilars are also increasing their use across various regions, promoting the market growth.

| Key Elements | Scope |

| Market Size in 2026 | USD 20.97 Billion |

| Projected Market Size in 2035 | USD 27.68 Billion |

| CAGR (2026 - 2035) | 3.13% |

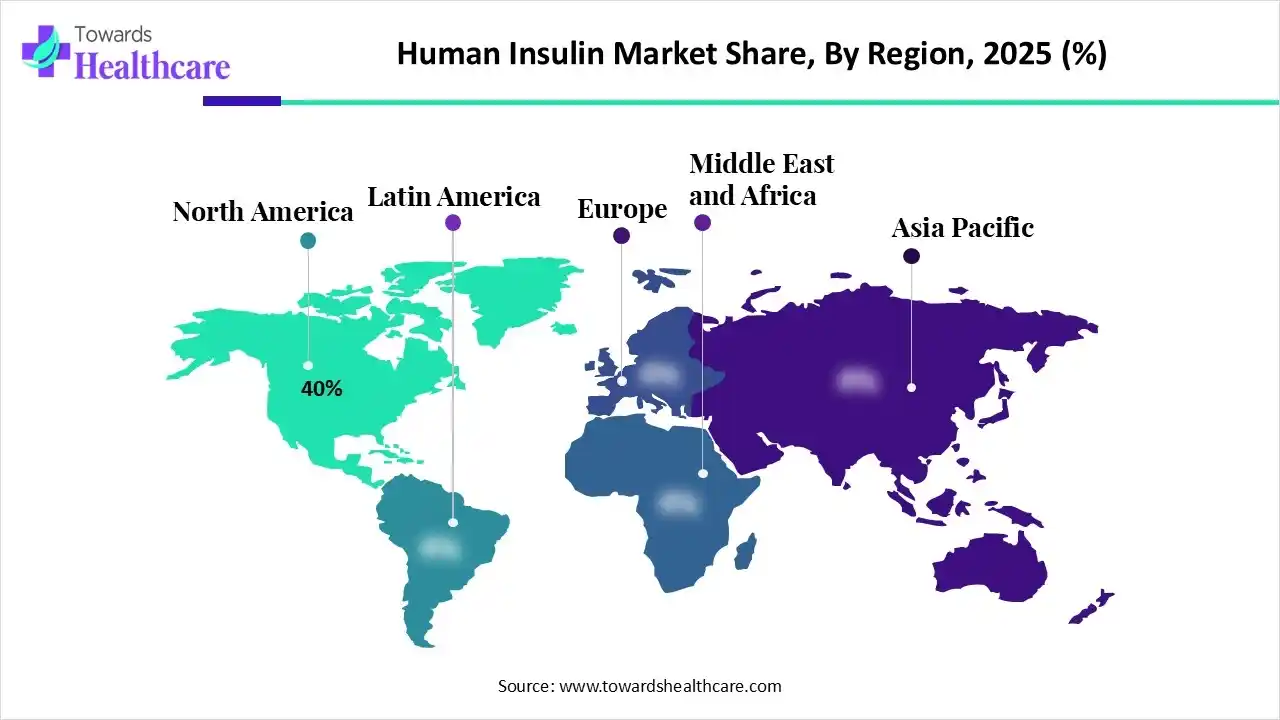

| Leading Region | North America by 40% |

| Market Segmentation | By Product, By Formulation, By End User, By Application, By Distribution Channel, By Region |

| Top Key Players | Novo Nordisk, Sanofi, Eli Lilly and Company, Biocon Limited, Wockhardt Limited, Boehringer Ingelheim, Dispo Van & Unolok Insulin Syringes, Medtronic (Insulin Delivery Devices), AstraZeneca (Diabetes Care Division) |

The human insulin market is driven by growing global incidences of diabetes, increasing geriatric population, and advancements in insulin delivery technologies. Human insulin is a biologically identical form of insulin produced through recombinant DNA technology or extracted from human sources, used to manage diabetes mellitus. It helps regulate blood glucose levels in patients with type 1 and type 2 diabetes, providing effective glycemic control and reducing complications associated with hyperglycemia.

The use of AI in the market is increasing, where it is being used in the identification of blood glucose patterns for the development of personalized insulin dosing. It also helps in managing the blood glucose fluctuations, which is driving the development of the insulin delivery devices. It is also being used for remote patient monitoring and adjusting the insulin regimen depending on the patient's profile.

There is a rise in the use of insulin biosimilars, where their affordability and accessibility are increasing their use, which in turn is also driving their production and innovations.

The industries are developing various novel technologies such as smart delivery devices, remote monitoring systems, insulin pumps, etc, which are increasing their use for accurate dosing and enhancing patient convenience.

To avoid the frequent dosing of insulin, the patients are increasingly adopting the long-acting insulin formulation, which are also being used for a chronic period of time, where their once-a-day approach is also driving their demand.

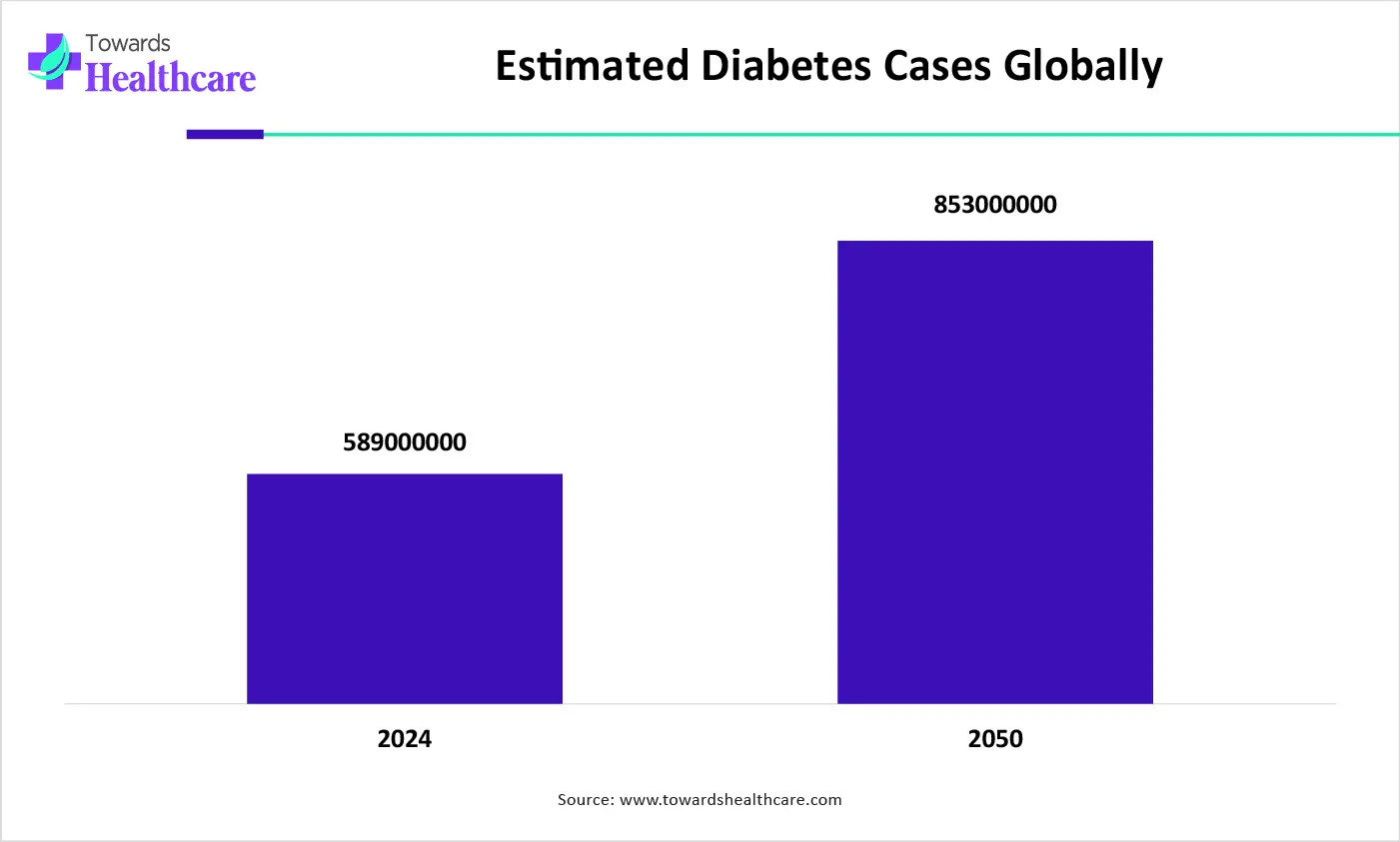

| Year | No. of Diabates Cases Globally |

| 2024 | 589000000 |

| 2050 | 853000000 |

Why Did the Rapid-Acting Insulin Segment Dominate in the Human Insulin Market in 2025?

The rapid-acting insulin segment led the market with a 50% share in 2025, due to its fast control over the blood glucose level. This, in turn, increased their use in gestational diabetes, which offered low fetal risk. Additionally, their fixed dose increased patient convenience and promoted their adherence to the treatment.

Long-Acting Insulin

The long-acting insulin segment is expected to show the fastest growth rate with a CAGR of 8.0% during the predicted time, as it reduces the dosing frequency, enhancing patient convenience. They also reduce the risk of hypoglycemia. Additionally, their growing innovation and combination with other insulin therapies are also increasing their use.

How the Injectable Segment Dominated the Human Insulin Market in 2025?

The injectable segment held the largest share of 65% in the market in 2025, as it offers accurate dosing. At the same time, it also provided rapid absorption and bioavailability, which increased its use in emergency situations as well. Furthermore, their widespread availability also increased their use.

Inhalable

The inhalable segment is expected to grow with the fastest CAGR of 8.5% during the predicted time, driven by its non-invasive approach. Their portability and rapid onset of action are increasing the patient convenience and acceptance rates, respectively. Moreover, they are being used for self-management.

Why Hospitals Segment Dominated the Human Insulin Market in 2025?

The hospitals segment led the market with a 45% share in 2025, due to high patient volume. Hospitals are also considered the primary site for insulin therapies, where the presence of specialized professionals offers safe and accurate insulin administration. This enhanced the patient trust, where the use of advanced solutions also attracted them.

Homecare/Patients

The homecare/patients segment is expected to show the highest growth with a CAGR of 8.0% during the predicted time, due to a growing shift towards self-administration. Additionally, the growing remote monitoring and digital health platforms are also increasing their use to enhance patient convenience and comfort.

Which Application Type Segment Held the Dominating Share of the Human Insulin Market in 2024?

The type 1 diabetes segment held the dominating share of 50% in the market in 2025, as they rely on insulin therapy. This, in turn, increased the use of rapid-acting insulin products. Moreover, their early onset also increased the use of long-acting insulin solutions for a longer duration of time.

Type 2 Diabetes

The type 2 diabetes segment is expected to be the fastest-growing, with a CAGR of 8.0% during the upcoming years, due to its increasing incidence rates. The growing lifestyle and dietary changes, along with increasing awareness, are increasing their early detection. This is driving the demand for human insulin solutions

What Made Hospital Pharmacies the Dominant Segment in the Human Insulin Market in 2024?

The hospital pharmacies segment led the market with a 45% share in 2025, as they provided direct access to the patients. They also offered proper dosing and monitoring of the patients. Additionally, they also provided complex insulin therapies, where their counseling enhanced patient adherence.

Online Pharmacies

The online pharmacies segment is expected to show the highest growth with a CAGR of 9.0% during the upcoming years, as they provide direct-to-patient deliveries. They also offer a wide range of insulin products and devices, where their home delivery increases access to these products and enhances patient convenience.

North America dominated the human insulin market with 40% in 2025, due to the presence of a well-developed healthcare infrastructure. The growth in the diabetes incidence also increased the demand and use of human insulin. Additionally, the early adoption of various insulin therapies and devices also promoted the development of new insulin formulations by the companies, which contributed to the market growth.

The growth in healthcare investments is promoting the adoption of insulin therapies and their delivery devices in the U.S. At the same time, the growing incidence of diabetes is also increasing the demand for human insulin. Additionally, the increasing cases of obesity and geriatric populations are also contributing to their increasing use.

Asia Pacific is expected to host the fastest-growing human insulin market with a CAGR of 9.0% during the forecast period, due to the growing incidence of diabetes. The expanding healthcare sector is also increasing the adoption of various novel insulin therapies, which is driving their products and innovations. The growing awareness and government initiatives are also increasing their use, enhancing the market growth.

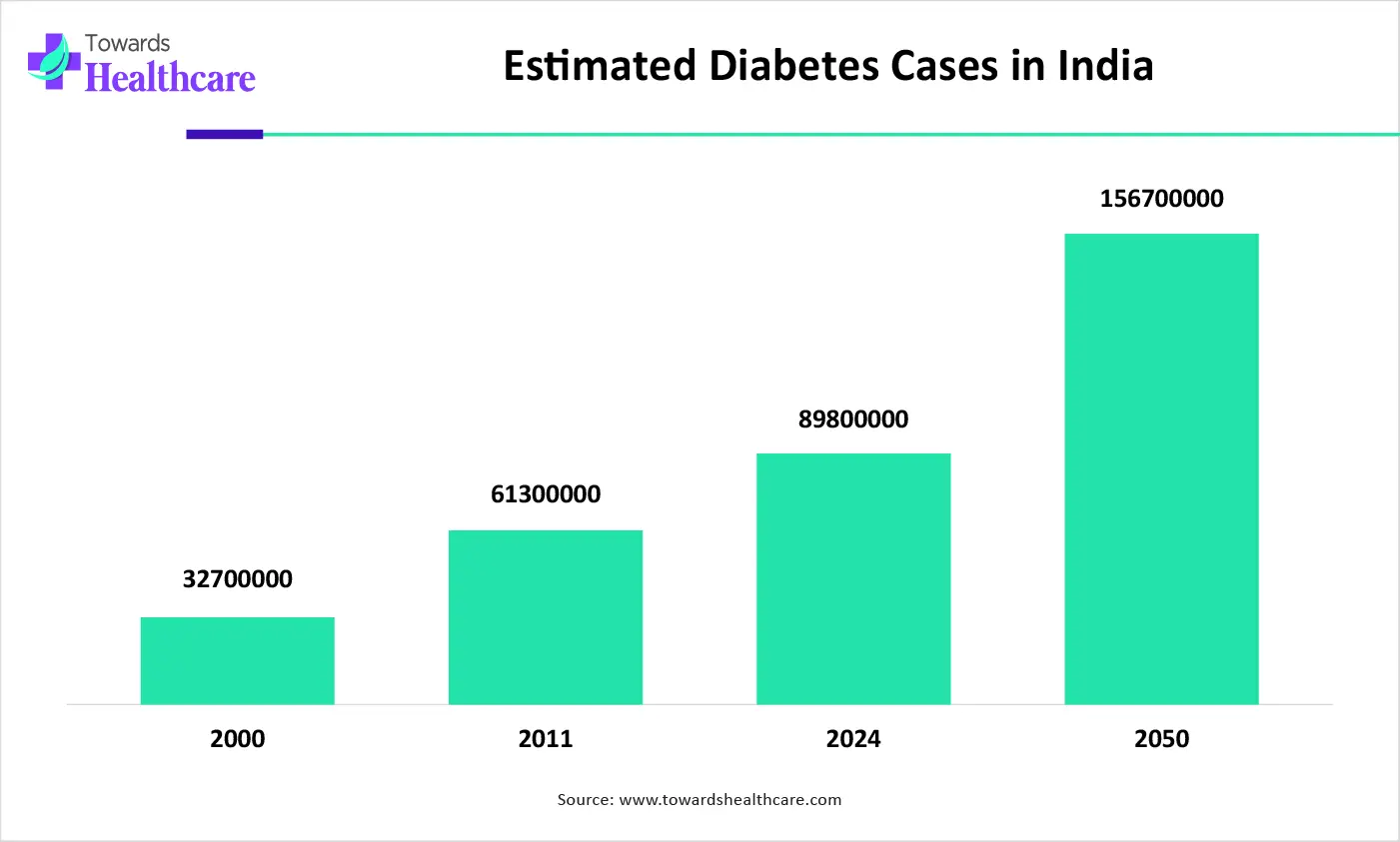

The presence of a large population, lifestyle changes, and rapid urbanization is increasing the diabetes burden. At the same time, the growing awareness is also increasing the demand for human insulin products. The industries are also developing affordable insulin products and their analogs, which are increasing their adoption rates.

| Year | No. of Diabetes Cases in India |

| 2000 | 32700000 |

| 2011 | 61300000 |

| 2024 | 89800000 |

| 2050 | 156700000 |

Europe is expected to grow significantly in the human insulin market with a CAGR of 7.5% during the forecast period, due to the increasing geriatric population. This, in turn, is increasing the incidence of type 2 diabetes, which is driving the adoption of biosimilar insulin products. Moreover, the industries are developing various formulations and delivery devices, which are promoting the market growth.

Due to the presence of robust reimbursement policies, the use of human insulin in the UK is increasing. The growing prevalence of diabetes cases due to increasing sedentary lifestyles and the geriatric population is also driving their demand. Moreover, growing government initiatives are encouraging their innovations, where online platforms are also increasing their accessibility.

| Companies | Headquarters | Human Insulin Products |

| Novo Nordisk | Bagsvaerd, Denmark | Actrapid, Novolin R, Levemir, NovoMix, etc. |

| Sanofi | Paris, France | Insuman, Apidra, and Lantus |

| Eli Lilly and Company | Indiana, U.S. | Humulin R, Humulin N, Humalog, and Humalog Mix |

| Biocon Limited | Bangalore, India | Insugen, Insulin Aspart, and Basalog |

| Wockhardt Limited | Mumbai, India | Wosulin |

| Boehringer Ingelheim | Connecticut, U.S. | SYNJARDY & JENTADUETO |

| HMD Biosciences | Haryana, India | Dispo Van & Unolok Insulin Syringes |

| Julphar | Ras AI Khaimah, UAE | Jusline |

| Medtronic (Insulin Delivery Devices) | Dublin, Ireland | MiniMed 780G and InPen |

| AstraZeneca (Diabetes Care Division) | Cambridge, UK | Forxiga, Onglyza, Qutern, and Kombiglyze XR |

By Product

By Formulation

By End User

By Application

By Distribution Channel

By Region

January 2026

January 2026

January 2026

January 2026