January 2026

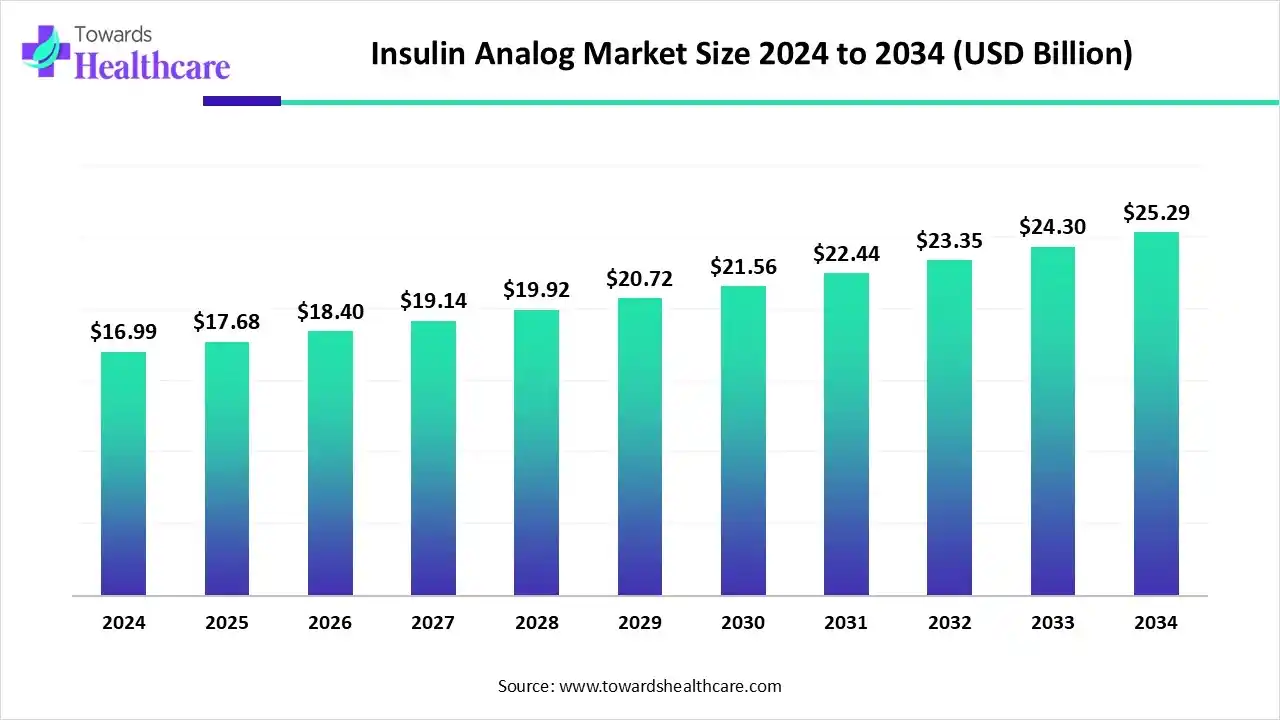

The global insulin analog market size is estimated at US$ 16.99 billion in 2024, increased to US$ 17.68 billion in 2025, and is expected to reach around US$ 25.29 billion by 2034. The market is growing at a CAGR of 4.06% from 2025 to 2034.

The growing global diabetes burden is increasing demand for insulin analogs, with AI technologies being used to optimize and develop them. At the same time, better healthcare, increased awareness, ongoing innovations, and rising adoption of biosimilars are broadening the use of insulin analogs across different regions. Moreover, companies are launching, developing, and investing in these products, fueling market growth.

| Table | Scope |

| Market Size in 2025 | USD 17.68 Billion |

| Projected Market Size in 2034 | USD 25.29 Billion |

| CAGR (2025 - 2034) | 4.06% |

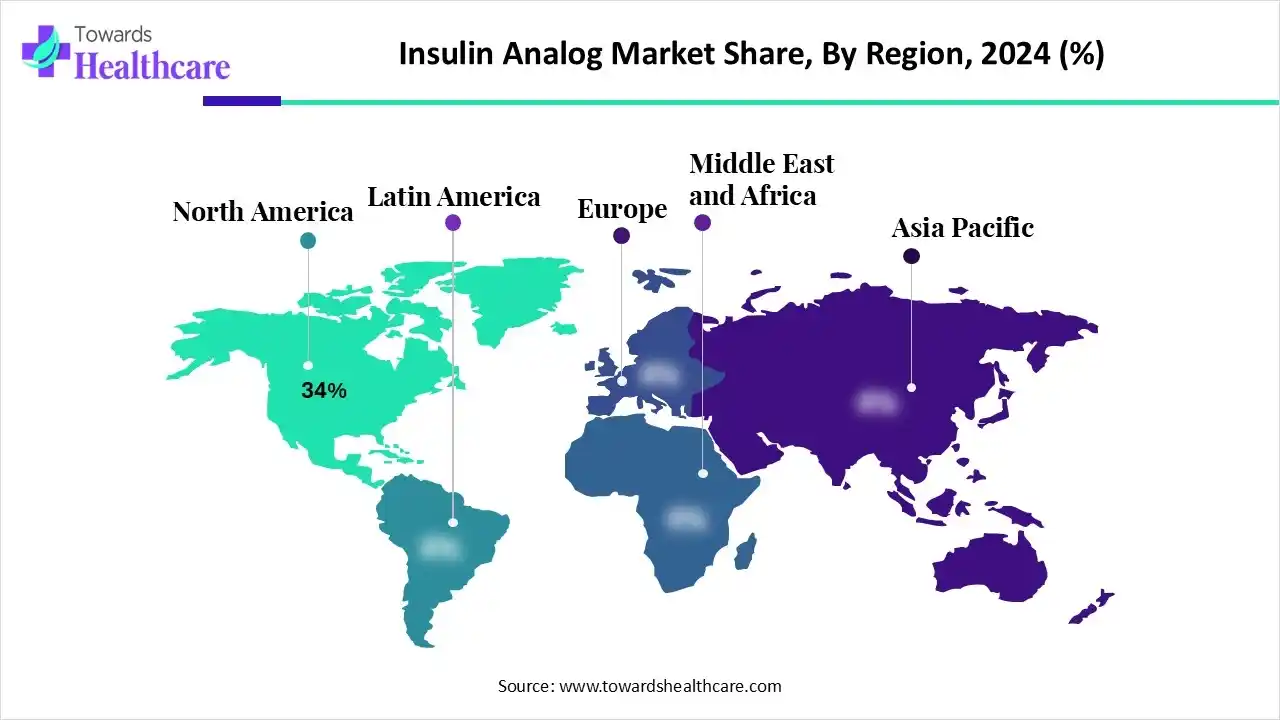

| Leading Region | North America by 34% |

| Market Segmentation | By Molecule/Action Profile, By Dosage Form/Presentation, By Therapeutic Indication/Patient Type, By End-User/Customer Segment, By Technology/Formulation Innovation, By Region |

| Top Key Players | Novo Nordisk A/S, Sanofi S.A., Eli Lilly and Company, Biocon Limited, Gan & Lee Pharmaceuticals |

The insulin analog market is driven by an aging population, rising obesity rates, and sedentary lifestyles. It includes pharmaceutical products that are genetically engineered or chemically modified versions of human insulin designed to change the onset, peak, and/or duration of action (such as rapid-acting, short-acting, intermediate-acting, and long-acting analogs). These analogs are used to control blood glucose levels in people with both type 1 and type 2 diabetes and are administered through vials, prefilled pens, cartridges, inhalation systems, and increasingly through integrated pump and hybrid closed-loop delivery systems.

AI plays a crucial role in transforming the insulin analog market by predicting the stability and potency of insulin molecules and optimizing them based on their duration of action. It also aids in screening potential insulin candidates and supports the development of personalized insulin therapies and delivery systems. Additionally, AI enhances continuous glucose monitoring, detects glucose fluctuations, and enables automated insulin delivery, helping to reduce dosing errors and the risk of hypoglycemia.

Why Did the Rapid-Acting Analogs Segment Dominate the Insulin Analog Market in 2024?

The rapid-acting analogs segment dominated the market with a 30% share in 2024, driven by their effective postprandial glucose control and fast onset of action. Moreover, their flexible dosing increased their use for both before and after meals. Additionally, they are widely used in insulin pumps, thereby enhancing their acceptance.

The long-acting analogs segment is expected to grow at the highest CAGR during the projection period. They are preferred because they reduce dosing frequency with their sustained release action. Additionally, they help in lowering the risk of hypoglycemia, which improves patient adherence to treatment.

The premixed/combination analogs segment is expected to grow rapidly in the near future. They offer a simplified treatment with a single injection, reducing the frequency of insulin doses. They are effective for managing both fasting and postprandial blood glucose levels, and their ready-to-use solutions are boosting their adoption.

What Made Prefilled Pens/Pen Cartridges the Dominant Segment in the Insulin Analog Market?

The prefilled pens/pen cartridges segment dominated the market by holding the largest share of 45% in 2024 due to their ease of use. Their enhanced portability also increased their adoption rate. Additionally, they were used for self-administration, which further supported market growth.

The vials (liquid) segment is expected to grow at the fastest rate during the forecast period. They are widely used in hospitals and clinics. Additionally, they allow for dosage adjustments based on patient needs and are affordable, increasing their use across patients of different ages.

The insulin pumps/continuous subcutaneous insulin infusion (CSII) consumables segment is expected to experience significant growth during the forecast period. These delivery systems provide continuous insulin infusion, which reduces the need for daily injections. Additionally, their automated delivery improves glucose management.

How Does the Type 1 Diabetes Segment Lead the Insulin Analog Market in 2024?

The type 1 diabetes segment led the market with a 35% share in 2024 due to insulin deficiency, which drives their long-term treatment needs. This, in turn, increased the use of insulin analogs. Additionally, various types of delivery systems were used for their management.

The type 2 diabetes segment is expected to experience the highest growth in the coming years. Their rising incidence rates are boosting the demand for insulin therapies and oral medications. Additionally, increased awareness is leading to greater use of insulin analogs to help prevent hypoglycemia risks.

The pediatric use segment is expected to grow significantly during the forecast period. With an increasing number of children being diagnosed with type 1 diabetes, the demand for insulin analogs is rising. This trend is driving greater adoption of insulin pens and pumps for their convenience and comfort.

What Made Hospitals & Clinics the Dominant Segment in the Insulin Analog Market in 2024?

The hospitals & clinics segment held the largest share of 30% in the market in 2024, due to high patient volume. At the same time, they offer advanced delivery systems and novel insulin analogs to patients. Moreover, patient monitoring and treatment of complex cases improved patient outcomes.

The retail pharmacies/community pharmacies segment is expected to grow the fastest in the coming years. They are favored due to the increasing number of outpatients. Additionally, their widespread availability is improving access to insulin analogs, enhancing patient convenience.

The home care & self-administration segment is expected to grow significantly during the forecast period. Patients are moving toward self-administration and home care for long-term diabetes management. Additionally, advancements in delivery systems are encouraging self-administration, which improves patient comfort.

Why Did the Standard Aqueous Formulations Segment Dominate the Insulin Analog Market in 2024?

The standard aqueous formulations segment dominated the global market with a 55% share in 2024, thanks to their improved safety and effectiveness. This, in turn, boosted their use in various types of insulin analogs. Likewise, they were created in different delivery systems and were affordable, which increased their acceptance.

The smart/connected delivery systems segment is expected to grow at the highest CAGR during the forecast period. Their adoption is increasing due to their precise dosing. Additionally, continuous glucose monitoring and automated insulin delivery are seeing rising adoption rates.

The concentrated/high-strength formulations segment is expected to experience significant growth during the forecast period. These formulations deliver higher doses, which in turn reduces their dosing frequency. Additionally, their compatibility with various delivery systems enhances glucose management, leading to increased usage.

North America led the insulin analog market with a 34% share in 2024, driven by rising diabetes rates. Meanwhile, the presence of advanced healthcare systems boosted the use of insulin analogs, supported by reimbursement policies. Additionally, company innovations contributed to the market’s growth.

The presence of advanced healthcare infrastructure in the U.S. has significantly boosted the use and accessibility of insulin analogs. Rising diabetes prevalence and growing public awareness have further driven their adoption across the country. Additionally, many hospitals and healthcare providers are increasingly implementing advanced insulin therapies and innovative delivery systems, making treatment more efficient and appealing to patients.

Asia Pacific is expected to experience the fastest growth in the market during the forecast period, driven by rising diabetes awareness and early diagnosis, which are promoting wider use of insulin analogs. The growing diabetes burden and the expansion of healthcare infrastructure across countries are further accelerating the adoption of advanced and smart insulin delivery systems, contributing to overall market growth.

In India, the increasing incidence of diabetes, largely due to lifestyle changes and dietary shifts, is significantly driving demand for insulin analogs. Government and private awareness campaigns are encouraging early diagnosis and timely treatment, while expanding R&D efforts supported by new investments and funding are strengthening market growth.

For instance,

Europe is expected to experience significant growth in the market during the forecast period due to the increasing adoption of biosimilar insulin. Additionally, healthcare systems are adopting long-acting insulin analogs alongside their new insulin delivery systems. Furthermore, these advancements are supported by government initiatives that promote market growth.

The insulin analog industry in the Netherlands is fostering innovation through the development of advanced insulin formulations and modern delivery systems. Companies are increasingly integrating cutting-edge technologies to enhance performance and patient convenience, supported by strong investment inflows from both domestic and international sources. Additionally, the country’s comprehensive healthcare and insurance coverage is improving the accessibility of these treatments.

In September 2025, ViCentra, a Netherlands-based company, announced the successful completion of an $85 million Series D funding round, which will be used to launch its next-generation Kaleido 2 patch pump, expand manufacturing capabilities, and facilitate its entry into the U.S. market.

South sAmerica is expected to show significant growth during the forecast period, driven by the increasing use of biosimilars due to their affordability. Different types of insulin analogs are also being developed along with smart insulin delivery systems. Additionally, government initiatives are promoting their production, further boosting market growth.

The increasing prevalence of diabetes and awareness are boosting the use of insulin analogs in Brazil for improved glucose control. This, in turn, is spurring innovation, especially in controlled release and self-administration methods. Additionally, government initiatives are supporting these advances and improving access to these products.

MEA is expected to experience robust growth during the forecast period due to the rising incidence of diabetes, which is increasing the demand for insulin analogs. Advances in technology are driving the development of insulin pumps and pens, supporting home care. Furthermore, companies are collaborating to develop new analogs and affordable solutions, which further fuels market growth.

The growing sedentary lifestyle in Saudi Arabia is raising diabetes rates, increasing the use of insulin analogs. Simultaneously, heightened awareness through government screening programs and campaigns for early diabetes detection is boosting demand. Additionally, government initiatives and investments are fostering innovation in this area.

R&D efforts in the insulin analog market are focused on creating innovative delivery methods such as oral and inhalable insulin, as well as developing smart insulins capable of automatically regulating blood glucose levels. Companies are also working on ultra-rapid-acting and once-weekly formulations to improve patient convenience and treatment adherence.

Key Players: Eli Lilly and Company, Sanofi, Novo Nordisk.

Clinical trials for insulin analogs emphasize demonstrating safety, efficacy, and improved therapeutic outcomes to meet regulatory requirements. These processes are critical for introducing new analogs and delivery systems to the market.

Key Players: Sanofi, Eli Lilly and Company, Novo Nordisk.

Manufacturers offer patient assistance programs, educational resources, and personalized coaching to help individuals manage diabetes effectively. These initiatives aim to enhance treatment adherence, improve quality of life, and ensure better health outcomes for insulin users.

Key Players: Novo Nordisk, Eli Lilly and Company, Sanofi.

Corporate Information

Business Overview

Novo Nordisk is a global healthcare company with a heritage in diabetes care. It researches, develops, manufactures, and markets pharmaceutical products and devices, especially for diabetes, obesity, rare diseases, growth disorders, and hormone replacement. In the insulin analog market in particular, Novo is a major player, with numerous analog insulin products (basal, rapid-acting) and delivery systems designed for diabetic patients.

Business Segments / Divisions

Geographic Presence

Key Offerings (Relevant to Insulin Analogs)

Novo Nordisk’s insulin analog portfolio includes products like:

SWOT Analysis

Strengths

Weaknesses

Opportunities

Threats

Recent News

| Company | Headquarters | Relevant Strengths |

| Sanofi S.A. | France | Strong presence in basal insulin analogs (e.g., Lantus, Toujeo) and global reach in diabetes care. |

| Eli Lilly and Company | U.S. | Key player in insulin analogs and biosimilars, with a broad distribution network and development of next-gen formulations. |

| Biocon Limited | India | Emerging player in insulin analog biosimilars, particularly in lower-cost markets and partnerships. |

| Gan & Lee Pharmaceuticals | China | Growing regional player in insulin analogs and biosimilars with a focus on Chinese market expansion. |

By Molecule/Action Profile

By Dosage Form/Presentation

By Therapeutic Indication/Patient Type

By End-User/Customer Segment

By Technology/Formulation Innovation

By Region

January 2026

January 2026

January 2026

January 2026