January 2026

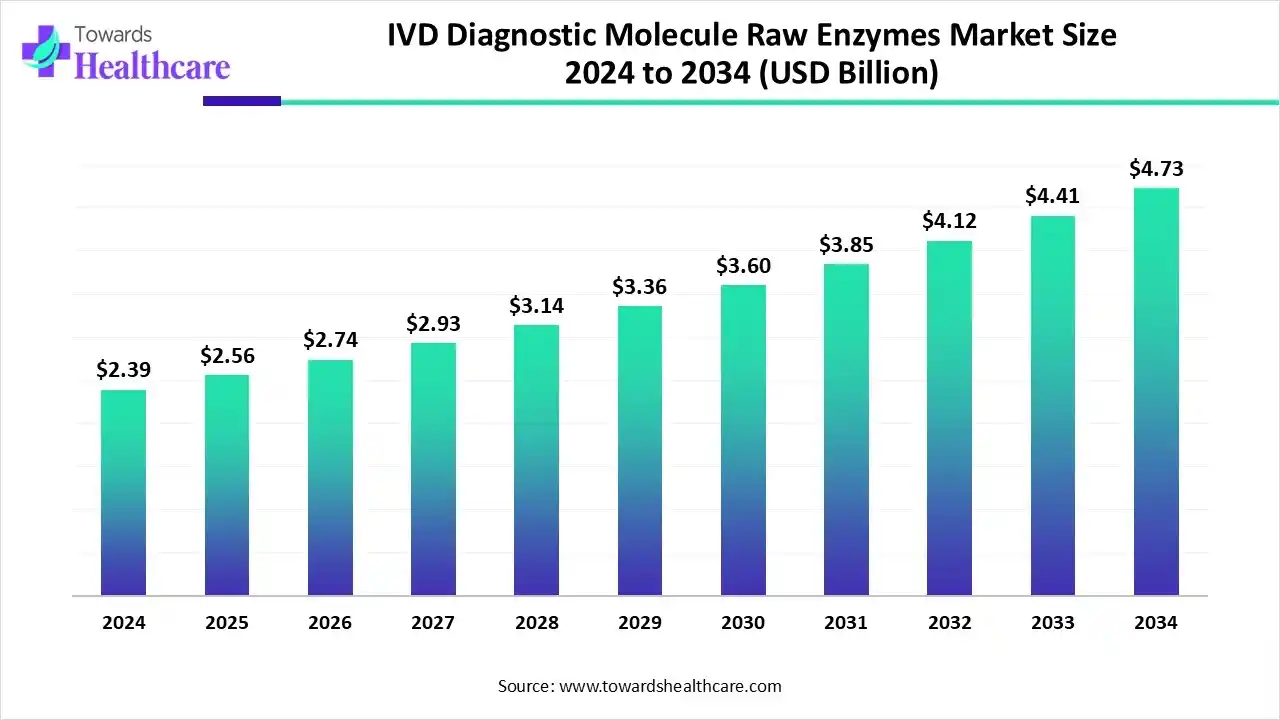

The global IVD diagnostic molecule raw enzymes market size is calculated at US$ 2.39 billion in 2024, grew to US$ 2.56 billion in 2025, and is projected to reach around US$ 4.73 billion by 2034. The market is expanding at a CAGR of 7.13% between 2025 and 2034.

The growing disease burden globally is increasing the use of IVD diagnostic molecule raw enzymes. They are being used for disease testing, oncology/genetic testing, and clinical chemistry testing, where AI is also being used to optimize their effectiveness and stability. The growing R&D investments, strict regulations, and expanding healthcare are increasing their use across various regions, promoting the IVD diagnostic molecule raw enzymes market growth.

| Table | Scope |

| Market Size in 2025 | USD 2.56 Billion |

| Projected Market Size in 2034 | USD 4.73 Billion |

| CAGR (2025 - 2034) | 7.13% |

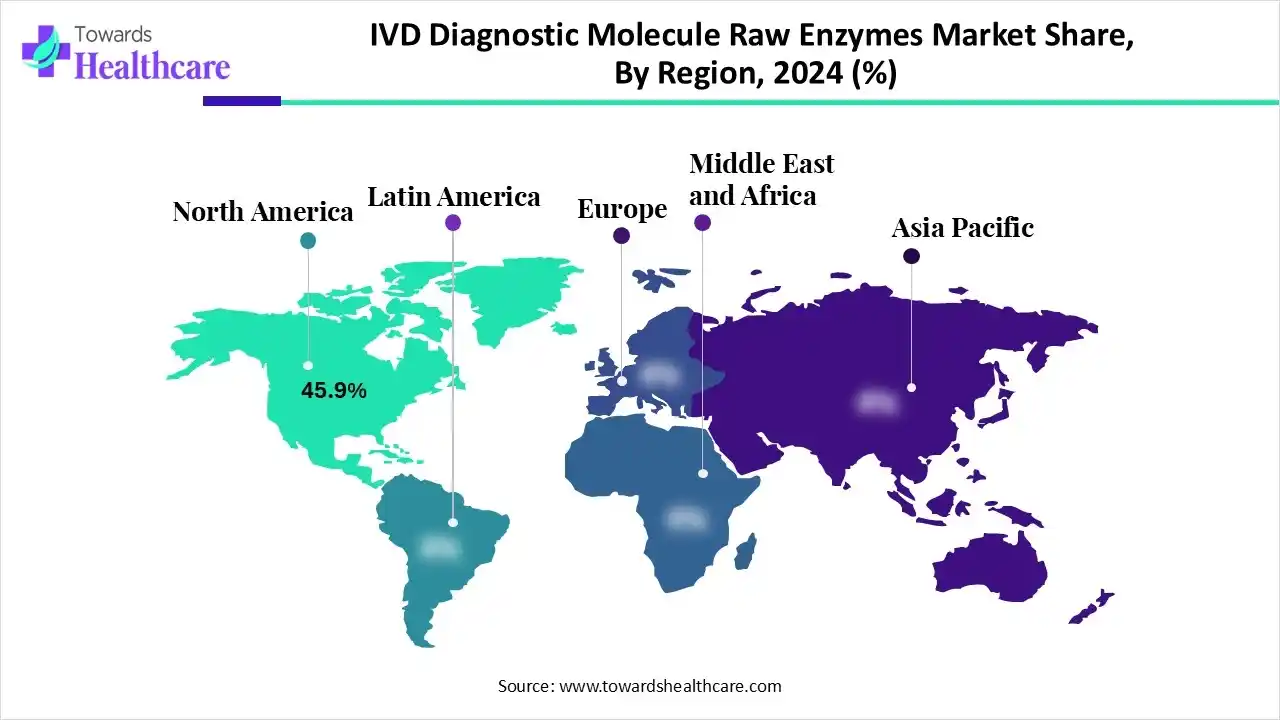

| Leading Region | North America by 45.9% |

| Market Segmentation | By Enzyme Type, By Application, By Technology, By End-User, By Region |

| Top Key Players | New England Biolabs (NEB), QIAGEN, Bio-Rad Laboratories, Takara Bio, Aldevron, Codexis, Amano Enzyme Inc., Advanced Enzymes Technologies Ltd., Biocatalysts Ltd., Enzo Life Sciences, MP Biomedicals, BBI Solutions, EKF Diagnostics, Medix Biochemica, Canvax Biotech |

The IVD diagnostic molecule raw enzymes market is driven by growing global demand for diagnostic testing. The IVD diagnostic molecule raw enzymes refer to the enzyme reagents specifically formulated and qualified for use in in-vitro diagnostic (IVD) assays and molecular diagnostic workflows. This market includes companies that produce clinical-grade or IVD-compatible enzymes, enzyme formulations, and bulk enzyme raw materials sold to diagnostic kit manufacturers, clinical laboratories, and contract manufacturers. The market is shaped by regulatory/quality requirements (IVDR/FDA) and demand for high-purity, lot-to-lot consistent enzyme supplies.

The use of AI in the IVD diagnostic molecule raw enzymes market is increasing as it helps in accelerating the bioengineering and discoveries of the enzymes. With the use of AI algorithms, the stability, specificity, and activities of these enzymes can be enhanced, which provides improved and accurate diagnosis of diseases. Moreover, the performance of these enzymes can be predicted using AI, which also facilitates their optimization and high-throughput screening. Additionally, it is also being used to identify their binding properties, active sites, and structure.

By enzyme type, the polymerase & transcriptase segment held the dominating share of 42.65% in the IVD diagnostic molecule raw enzymes market in 2024, as they were essential for nucleic acid amplification tests (NAATs). They also provided fast results, which enhanced their use in point-of-care diagnostics. At the same time, the growth in infectious diseases increased their use.

By enzyme type, the proteases segment is expected to show the highest growth during the predicted time. They are being used in molecular diagnostics as well as immunoassays. Moreover, their ability to process complex samples is increasing their use in cancer diagnostics and liquid biopsy.

By application type, the infectious diseases segment led the IVD diagnostic molecule raw enzymes market with a 45.5% share in 2024, due to a growth in their incidence rates. This increased the demand for accurate and rapid diagnostics. This, in turn, increased the use of PCR techniques, which contributed to the increased demand for IVD diagnostic molecule raw enzymes.

By application type, the oncology segment is expected to show the fastest growth rate during the predicted time. The growing cancer burden and awareness are increasing their early diagnosis, enhancing the use of IVD diagnostic molecule raw enzymes. Furthermore, they are also used for genetic testing and precision medicine development.

By technology type, the polymerase chain reaction (PCR) segment held the largest share of 50% in the IVD diagnostic molecule raw enzymes market in 2024, driven by their high sensitivity and specificity. Moreover, they also provided fast and accurate results, which increased their use. This increased their use for a wide range of disease testing.

By technology type, the enzyme-linked immunosorbent assay (ELISA) segment is expected to show the highest growth during the upcoming years. Their use in the immune-based diagnostics and other disease detection is increasing due to their high sensitivity and specificity. They are also being used in multiplex testing, driving the use of various enzymes.

By end user, the hospitals & diagnostic laboratories segment led the global IVD diagnostic molecule raw enzymes market with 42% share in 2024, due to the large volume of patients. This, in turn, increased the use of various technologies for the accurate detection of different types of diseases. This increased the demand for IVD diagnostic molecule raw enzymes.

By end user, the biotech & pharmaceutical companies segment is expected to show the fastest growth rate during the upcoming years. The demand for IVD diagnostic molecule raw enzymes is increasing in these companies due to the growing development of companion diagnostics. Moreover, they are also being used for biomarker identification, proteomic, and genomic testing.

North America dominated the IVD diagnostic molecule raw enzymes market with 45.9% in 2024, due to the presence of a well-developed healthcare infrastructure. This increased the use and innovation of various diagnostic platforms, which increased the demand and use of IVD diagnostic molecule raw enzymes. Moreover, the growth in R&D investments supported their utilization, and the growing number of patients enhanced their use, which contributed to the market growth.

The U.S. consists of an advanced healthcare system, which is increasing the use of IVD diagnostic molecule raw enzymes to deal with the growing demand for diagnostics. Additionally, the growing industrial and institutional investments and funding are encouraging their innovations. At the same time, the growth in molecular diagnostics is driving the development of these enzymes, along with the utilization of advanced technologies such as AI, enhancing the IVD diagnostic molecule raw enzymes market growth.

For instance,

Asia Pacific is expected to grow at the fastest CAGR in the IVD diagnostic molecule raw enzymes market during the forecast period, driven by growing incidences of infectious and chronic diseases, which are increasing the use of IVD diagnostic molecule raw enzymes. The expanding healthcare is increasing the adoption of advanced technologies, enhancing R&D, and growing investments. Thus, all these advancements are promoting the market growth.

The growing disease burden is increasing the use of IVD diagnostics, which is increasing the demand for IVD diagnostic molecule raw enzymes. At the same time, the growing government initiatives are supporting and encouraging their innovations. Additionally, the growing awareness is increasing the use of various diagnostic platforms, where the demand for molecular diagnostics and point-of-care diagnostics is increasing, contributing to the growth in the use of the enzymes. Therefore, these factors amplify the IVD diagnostic molecule raw enzymes market growth.

For instance,

Europe is expected to host a significantly growing IVD diagnostic molecule raw enzymes market during the forecast period, due to the strict regulatory standards imposed by the regulatory bodies and government. This, in turn, is increasing the use of higher-quality IVD diagnostic molecule raw enzymes for molecular diagnosis. Additionally, their growing innovations and applications in precision medicine development are also enhancing the market growth.

The growing research and development supported by the government and private investments are driving the IVD diagnostic molecule raw enzymes market growth. At the same time, the growth in chronic diseases is increasing the use of various IVD diagnostic kits, which is increasing the use and production of these enzymes. Moreover, the presence of strict regulations is promoting the development of enhanced specificity, sensitivity, activity, quality, and safe enzymes.

For instance,

The bioengineering of the novel enzymes with improved specificity, catalytic efficiency, and stability to support advanced molecular diagnostics techniques such as next-generation sequencing and point-of-care testing is the focus of the R&D of IVD diagnostic molecule raw enzymes.

Key Players: Merck KGaA, QIAGEN, Thermo Fisher Scientific, Danaher Corporation, F. Hoffmann-La Roche.

The clinical trials and regulatory approval of the IVD diagnostic molecule raw enzymes depend on their analytical performance validation, quality system controls, and documented performance data, ensuring their safety and effectiveness in the completed diagnostic product.

Key Players: Merck KGaA, QIAGEN, Thermo Fisher Scientific, Danaher Corporation, F. Hoffmann-La Roche.

The formulation of the IVD diagnostic molecule raw enzymes includes the combining of enzymes with stabilizing agents and buffers to preserve their activity throughout their storage, while their final dosage involves reconstituting freeze-dried or lyophilized enzyme powder with diluent just before their use.

Key Players: Merck KGaA, QIAGEN, Thermo Fisher Scientific, Danaher Corporation, F. Hoffmann-La Roche.

The manufacturers of the IVD diagnostic molecule raw enzymes provide patient support and services, such as providing clinical context and interpretation of the test results.

Key Players: Merck KGaA, QIAGEN, Thermo Fisher Scientific, Danaher Corporation, F. Hoffmann-La Roche.

By Enzyme Type

By Application

By Technology

By End-User

By Region

January 2026

January 2026

December 2025

December 2025