January 2026

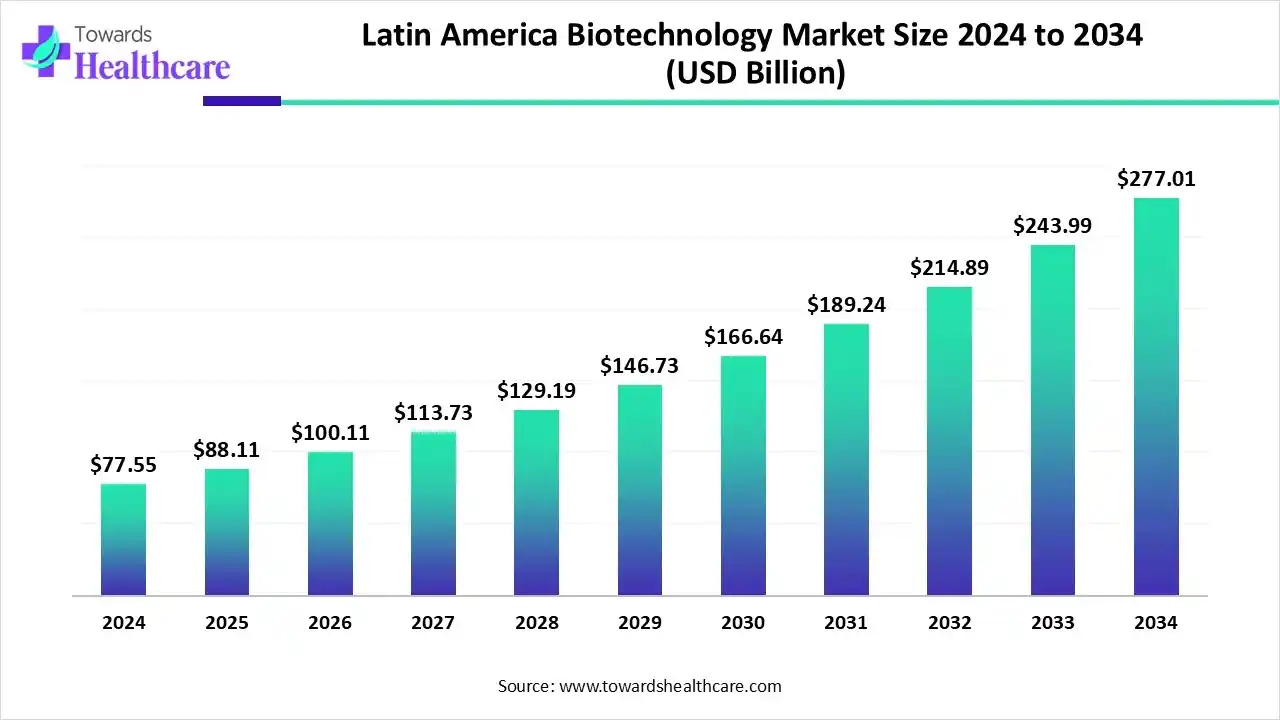

The Latin America biotechnology market size is estimated at US$ 77.55 billion in 2024, is projected to grow to US$ 88.11 billion in 2025, and is expected to reach around US$ 277.01 billion by 2034. The market is projected to expand at a CAGR of 13.10% between 2025 and 2034.

The Latin America biotechnology market is growing because of the rising demand in healthcare applications, and also the rapid use in bioinformatics. Increasing R&D investment, rising chronic diseases burden, and growing interest in precision medicine. Increasing old age population, healthcare requirements, and sustainable biotech solutions. Brazil leads the region in market growth due to government initiatives.

| Table | Scope |

| Market Size in 2025 | USD 88.11 Billion |

| Projected Market Size in 2034 | USD 277.01 Billion |

| CAGR (2025 - 2034) | 13.10% |

| Market Segmentation | By Drug Type, By Region |

| Top Key Players | Roche (Switzerland, global operations in LatAm), Sanofi S.A., Merck & Co., AbbVie, Gilead Sciences, Amgen Inc., Novo Nordisk, Johnson & Johnson, Aché (Brazil), EMS S.A. (Brazil), Genomma Lab Internacional (Mexico), Laboratorios Richmond (Argentina), Laboratorios Bagó (Argentina), Tecnoquímicas (Colombia), Smaller local biologics/biosimilar manufacturers / CROs in Chile, Peru |

The Latin America biotechnology market spans applications in health/medical biotech, agricultural biotech, environmental/industrial biotech, and bioservices (R&D, CROs, CDMOs, bioinformatics). It includes biologics (monoclonal antibodies, vaccines, recombinant proteins), biosimilars, genetic tools, diagnostics, and industrial applications.

Growth is driven by rising incidence of chronic diseases, growing public health spend, desire for local production of biologics & vaccines, increasing regulatory harmonization, and expansion of bioservices & contract manufacturing. Latin America is seen as both a consumer market and increasingly a manufacturing hub for cost-sensitive biologics, vaccines, and biosimilars.

For Instance,

Incorporation of AI drives the growth of the Latin America biotechnology market, as AI-driven technology in biotechnology accelerates drug discovery, delivers analytics, precisely diagnoses healthcare conditions, edits gene structures, develops targeted medicine, and does much more to support researchers. The incorporation of AI in biotechnology has gained momentum in the present year. The biotech sector is redefining its procedures using AI and ML technology to get advanced, faster, and accurate results. AI-driven technology use in biotech companies and solution providers to integrate the systems with progressive expertise. AI-driven is renovating the biotech sector by making processes quicker and highly scalable in fields such as genetic engineering, targeted medicine, drug discovery, and agricultural biotech.

Increasing the conduction of biotechnological programmers, which will help the patient by providing advanced decision-making capability and reducing the burden of chronic diseases.

For instance,

For Instance,

| Startups | Description |

| Esphera SynBio | A preclinical synthetic biology firm initiated a novel project to improve mRNA vaccines in January 2025. |

| The Live Green Co | A plant-driven food tech company in Chile using AI software to develop formulations. |

| Costa Rica | Three biotech startups (Clearleaf, Speratum, and Cenibiot) are each valued at $10–25 million USD. |

In the application/usage segment, the health/medical biotechnology segment led the Latin America biotechnology market, with approximately 45% share, as this type of biotechnology transformed medicine by allowing more accurate diagnostics, specific therapeutics, targeted treatment, and preventive healthcare. Biotechnology allows the production of therapeutic proteins, enzymes, antibodies, vaccines, and other types of drugs from biological sources such as cells and microorganisms, instead of chemical synthesis.

On the other hand, the bioinformatics & technologies segment is projected to experience the fastest CAGR from 2025 to 2034, as bioinformatics and technology enable researchers to achieve experiments on a timeline that matters in a patient's lifetime. Bioinformatics uses computer tools such as data mining, pattern recognition, visualization, and machine learning. By merging domain science knowledge, statistics, and data science, bioinformatics researchers can create more targeted web lab experiments to more rapidly home in on a precise area of research.

By product/biologic type segment, the monoclonal antibodies (mAbs) segment led the Latin America biotechnology market in 2024, with approximately 60-70% share, as this type of antibody is given as maintenance therapies. This is reforming perceptions of some severe conditions from what was once seen as inevitably fatal to a chronic condition. Mabs allow the prescription of particular therapeutics for specific condition antigens in individual patients. Monoclonal antibodies are one of the most useful reagents for a broad range of applications. Their specificity, simple production and conjugation, and usually low toxicity make them beneficial in comparison to small molecules.

On the other hand, the antisense/RNAi/molecular therapeutics segment is projected to experience the fastest CAGR from 2025 to 2034, as antisense are extremely multipurpose molecules that are intended to specifically target and modify RNA transcripts to slow down or halt rare genetic disease development. They provide the potential to target groups of patients or be tailored for separate cases. These molecules have shown massive potential in the treatment of genetic and rare disorders.

By the biotech segment/service infrastructure, the in-house manufacturing & R&D segment led the Latin America biotechnology market in 2024, with approximately 50% share, as in-house manufacturing abilities allow biotechnology companies to speed up their development cycles and enhance their operational agility. Also, in-house manufacturing, organizations promptly address any quality issues, contrivance improvements, and confirm that their products meet the regulatory requirements of the clinical and commercial healthcare sector. It can exert complete control over production, and organizations rapidly iterate and make required adjustments, instead of the delays associated with external partners.

On the other hand, the contract research/CROs & CDMOs/ outsourced manufacturing segment is projected to experience the fastest CAGR from 2025 to 2034, as outsourcing provides momentous expenses and time savings, making it the best option for household or developing biotech companies. With CMOs, there's no requirement to spend on building manufacturing services or hiring and training an operations team. Outsourcing in the biotech industry provides many advantages, such as cost savings, access to particular expertise, and improved flexibility.

By the end user/buyer type, the pharma/biopharma companies segment led the Latin America biotechnology market in 2024, with approximately 50% share, as pharmaceutical biotechnology plays a significant role in drug discovery and development for the consideration of many diseases and their new treatment approaches and therapeutic interventions. Biotechnology enhances the nutritional value of foods to improve overall nutrition and health. Major organizations in the biotech sector tend to have higher expenses, which means they are more volatile compared to the stocks of pharma companies.

For Instance,

Brazil is dominant in the Latin America biotechnology market in 2024, with approximately 35-45% share, due to strong public research infrastructure and massive investments in many sectors such as health, agriculture, and biofuels. Also, the presence of advanced research institutions like the Brazilian Agricultural Research Corporation (Embrapa) and the Oswaldo Cruz Foundation (Fiocruz). Constructive regulatory environment, which is specifically advantageous for startups emerging biological crop protection products, which increases the demand for biotechnology services.

For Instance,

Argentina is the fastest-growing region in the Latin America biotechnology market in the forecast period, due to the presence of a strong public research infrastructure and a helpful government environment. The country's third-largest worldwide position in manufacturing biotech crops highlights a significant focus on agricultural biotechnology. Argentina produces 14% of the world’s biotech crops, making it the major producer after the United States and Brazil.

For Instance,

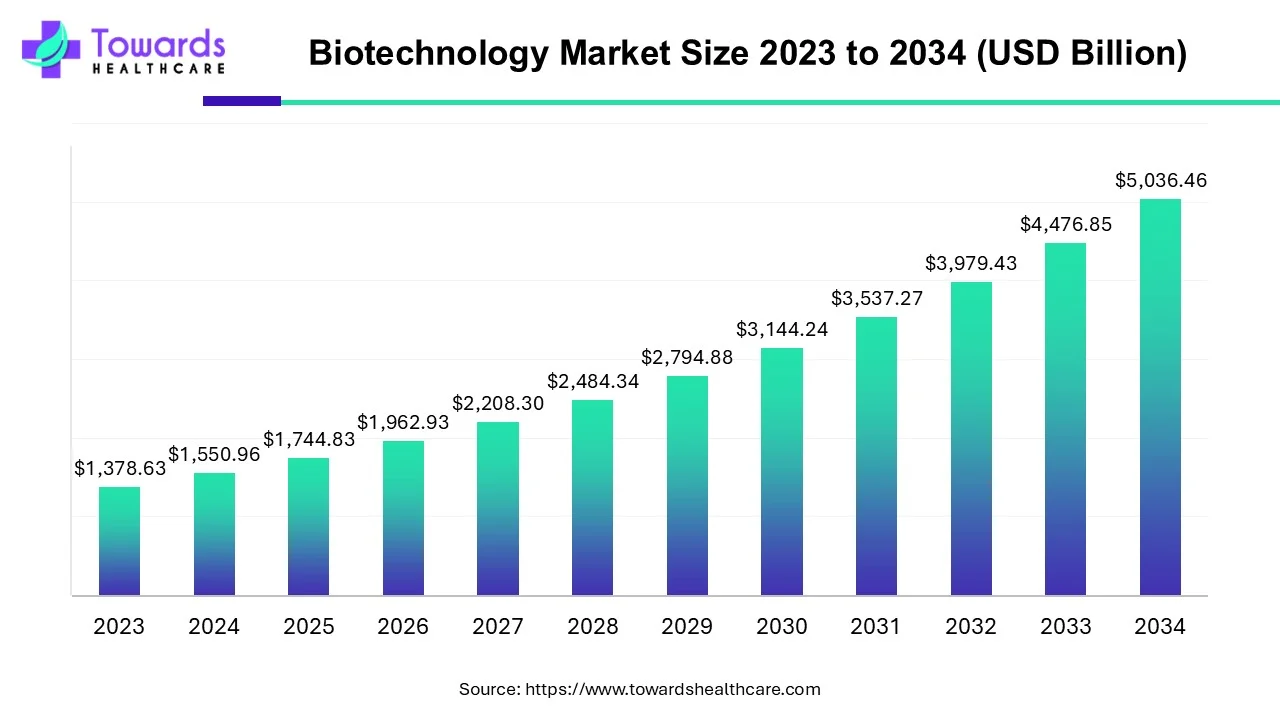

The biotechnology market is projected to grow from USD 1,744.83 billion in 2025 to USD 5,036.46 billion by 2034, registering a CAGR of 12.5% during the forecast period. This growth is driven by continuous innovation and technological advancements in the biotechnology sector.

Major R&D processes include the discovery and research, preclinical research and development, clinical research, scale-up and manufacturing, downstream processing, and quality control.

Key Players: Pfizer and Johnson & Johnson

Biotech clinical trials contribute a carefully planned series of investigations that aim to evaluate the efficacy, safety, and tolerability of a novel health intervention. Biotechnology clinical trial processes include discovery, preclinical research, clinical research, regulatory review (FDA), and post-market monitoring.

Key Players: Syngene and QPS

Biotechnology services have simplified the advancement of rapid diagnostic tests that enable early identification of diseases. These tests allow healthcare providers to diagnose and treat patients promptly, reducing the challenges of complications and enhancing patient outcomes.

Key Players: XCode Life Sciences and String Bio

By Drug Type

By Region

January 2026

January 2026

January 2026

December 2025