February 2026

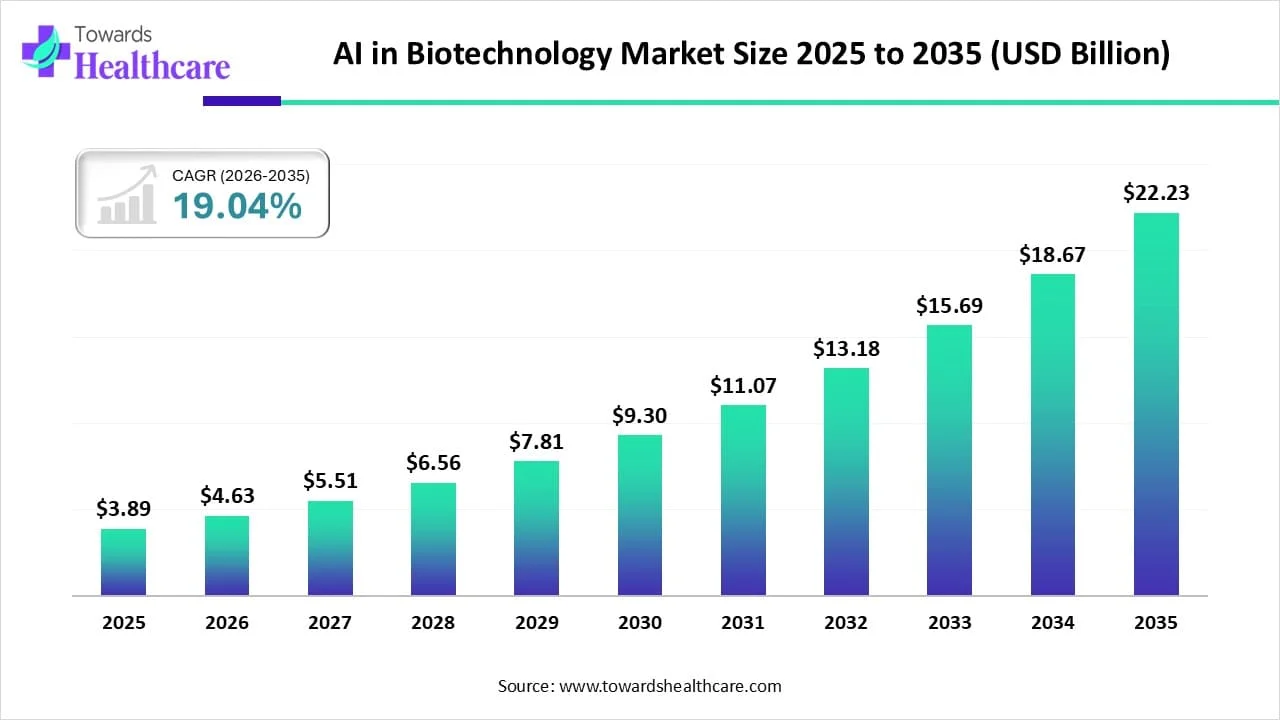

The AI in biotechnology market size reached US$ 3.89 billion in 2025 and is anticipate to increase to US$ 4.63 billion in 2026. By 2035, the market is forecasted to achieve a value of around US$ 22.23 billion, growing at a CAGR of 19.04%.

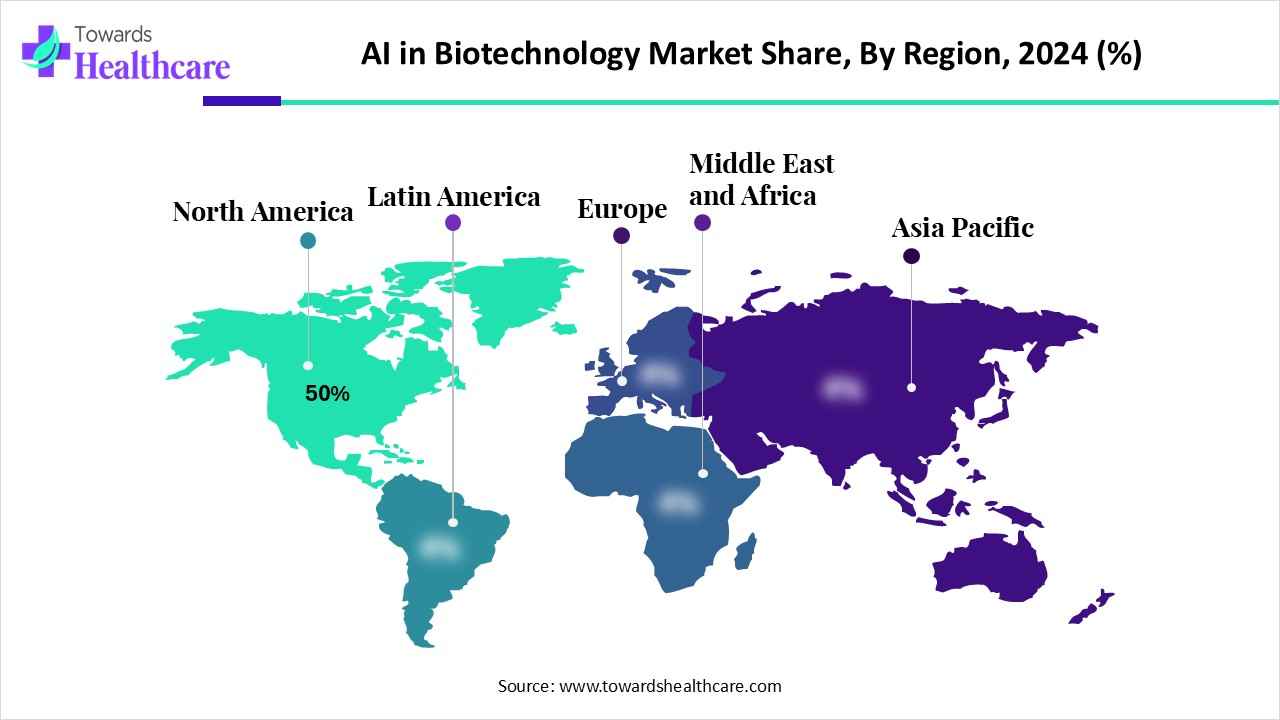

The AI in biotechnology market is rapidly expanding as artificial intelligence enhances drug discovery, genomics, protein engineering, and personalized medicine. Growing demand for faster, cost-effective R&D, coupled with advanced computing and data analytics is driving adoption. North America leads due to strong biotech infrastructure and high R&D investment, while Europe and Asia-Pacific are witnessing accelerated growth through AI integration in research, diagnostics, and biopharmaceutical development, positioning AI as a transformative force in biotech.

| Table | Scope |

| Market Size in 2026 | USD 4.63 Billion |

| Projected Market Size in 2035 | USD 22.23 Billion |

| CAGR (2026 - 2035) | 19.04% |

| Leading Region | North America by 50% |

| Market Segmentation | By Primary Application / Use Case, By Core AI Technology, By Commercial Model, By End User / Buyer Type, By Region |

| Top Key Players | Exscientia , Recursion Pharmaceuticals , Insilico Medicine, Atomwise, BenevolentAI, Schrödinger, Deep Genomics, Valo Health, Cyclica / Numinus, Relay Therapeutics, NVIDIA, Microsoft / Azure, Alphabet / DeepMind, IQVIA, Certara, Evotec, Charles River / Labcorp, Atomwise, Benchling / Collaborative data platforms, Startups & aggregators |

The AI in biotechnology market is expanding as AI enables advanced predictive modelling, protein structure analysis, and automated laboratory processes, improving research efficiency and innovation. AI in Biotechnology describes tools, platforms, and services that apply machine learning, deep learning, graph neural networks, natural-language processing, and generative models to biological problems from in-silico target identification, de-novo molecule design, and single-cell analytics to clinical trial optimization, diagnostics, and biomanufacturing process control.

The market spans AI-native drug-discovery companies, AI modules embedded inside CROs/CDMOs and in-house pharma platforms, plus infrastructure vendors (cloud/GPUs) that enable scale.

Key technological shifts in the market are driving faster and more efficient research. Machine learning and deep learning are widely used for drug discovery, protein structure prediction, and biomarker identification. AI-powered genomics and proteomics analysis provide precise insights, while automation and robotic labs improve workflow efficiency. Big data integration enables rapid processing of complex datasets, supporting personalized medicine and predictive modeling. These innovations are enhancing research accuracy, reducing costs, and accelerating the development of advanced biotechnological solutions worldwide.

For Instance,

| Company | Major Investment/Acquisition |

| Exscientia | Acquired by Recursion Pharmaceuticals in 2024 for $688 to combine AI drug discovery with Recursion’s development capabilities. |

| Atomwise | Raised $123M series C in 2024 and Partnership with Sanofi for potential drug target |

| NVIDIA | Secured a significant deal with Microsoft, where Microsoft committed up to $19.4 billion to acquire over 100,000 Nvidia GB300 GPUs for internal AI projects. This agreement is part of Microsoft's broader strategy to enhance its AI infrastructure. |

In 2024, the drug discovery & lead generation segment held the largest market share, accounting for approximately 36% of the total market. This growth is driven by the adoption of AI-enabled screening platforms, which reduced discovery timelines by nearly 30% and global R&D investments exceeding USD 20 billion. Additionally, the launch of multiple innovative drug candidates during early development phases strengthened the market dominance by accelerating pipeline progression and improving discovery efficiency.

The agriculture/industrial biotech application segment is expected to grow at the fastest pace during the forecast period, driven by the rising adoption of biofertilizers, genetically engineered crops, and enzyme-based industrial processes. Over 120 new biotech products are projected to be launched globally in this market, and increasing investment exceeding USD 5 billion in sustainable biomanufacturing are supporting its expansion. Government initiatives promoting eco-friendly agriculture and industrial biotech innovations further strengthen market growth.

The classical ML/deep learning models segment dominated the market with the revenue shares of approximately 30%, due to its widespread adoption in predictive analytics, drug-targeted identification, and biomarker discovery. During the forecast period, over 100 AI-driven drug discovery platforms were implemented globally using these models, accelerating early-stage research. Additionally, increasing investments of around USD 3.5 billion in AI-based R&D and collaboration between tech and pharma companies strengthened the market dominance, enabling faster, more accurate decision-making in drug discovery workflows.

The generative AI segment is expected to grow at a faster pace during the forecast period due to its ability to create novel drug candidates, optimize molecular structure, and accelerate lead generation. Increasing investments in AI-driven drug discovery and its capability to improve prediction accuracy and reduce early-stage development timelines are driving rapid adoption across pharmaceutical R&D.

By commercial model, the SaaS/cloud AI platforms segment led the market in 2024, with a revenue of approximately 48% due to its scalability, flexibility, and ease of deployment for pharmaceutical and biotech applications. These platforms enable faster implementation of AI-driven drug discovery workflows and support remote collaboration and data accessibility across research teams. Increasing adoption of cloud-based computational resources and integration with AI tools is enhancing early-stage research efficiency. This combination of convenience, efficiency, and cost-effectiveness is expected to drive faster growth during the forecast period.

The large pharma & big biotech segment held the highest market share in 2024, with a revenue of approximately 52% due to their robust R&D infrastructure, strong financial capabilities, and extensive global pipelines. These organizations widely adopted AI-driven drug discovery and advanced computational platforms, enabling faster lead identification, target validation, and preclinical development. Their ability to invest in cutting-edge technologies and manage large-scale projects allowed them to dominate early-stage research, making them the primary drivers of innovation and efficiency in the global drug discovery landscape.

The biotech startups & virtual biotechs segment is expected to grow at a faster pace during the forecast period due to their agility, focus on niche therapeutic areas, and rapid adoption of AI-driven drug discovery platforms. These companies leverage cloud-based tools and computational models to accelerate early-stage research with lower capital requirements. Supportive government initiatives, incubators, and increasing venture capital funding are further enabling startups and virtual biotechs to expand their pipelines and drive innovation in the market.

North America dominated the market share by 50% in 2024 due to its well-established pharmaceutical and biotech industry, advanced computational infrastructure, and high adoption of AI technologies. The region benefits from significant R&D investments, supportive government initiatives, and a strong network of research institutions and startups. Additionally, widespread implementation of cloud-based AI platforms and machine learning tools enabled faster drug discovery and development, solidifying North America’s leadership and contributing to its largest market share globally.

The US is approaching the market by heavily investing in AI-driven drug discovery, precision medicine, and computational biology. Federal initiatives and programs support the integration of AI in healthcare research. This effort expands on the National Cancer Institute’s Childhood Cancer Data Initiative (CCDI), a $500 million program launched in 2024 over ten years, aimed at collecting and sharing extensive data on childhood cancers. Additionally, the US emphasizes regulatory support, data-sharing frameworks, and advanced cloud infrastructure, enabling faster early-stage research, clinical trials optimization, and accelerated innovation in biotechnology applications.

Canada is contributing to the expansion of the market through research collaborations, government initiatives, and startup support. Currently, 87% of Canadian healthcare organizations utilize AI in some capacity, up from 72% in the previous year, reflecting rapid adoption in drug discovery and diagnostics. Additionally, over 150 AI-focused biotech projects are underway, supported by national AI research programs and innovation hubs. These efforts are accelerating the integration of AI into biotechnology applications across the country.

Asia-Pacific is accelerating the market through increased adoption of AI-driven drug discovery platforms, generative AI tools, and computational biology solutions. Countries like China and India are leading in implementation, with over 80% of biotech firms actively integrating AI technologies for early-stage research, diagnostics, and predictive modeling. Supportive government policies, research collaborations, and the growth of AI-focused biotech startups are further driving innovation, positioning Asia-Pacific as a key hub for AI-enabled biotechnology advancements during the forecast period.

For Instance,

China is advancing the market through major investments, policy support, and development of advanced computational infrastructure. The country is leveraging centralized health data from over 38,000 hospitals to enhance AI-driven drug discovery, diagnostics, and personalized medicine. Additionally, widespread adoption of generative AI tools in research and healthcare is accelerating early-stage development and innovation, positioning China as a key player in the global AI-enabled biotechnology landscape.

India is accelerating its sectors through strategic investments, policy support, and academic initiatives. The IndiaAI Mission allocates ₹10,371 crore (~$1.2 billion) to enhance AI infrastructure and support startups. Institutes like IIT Indore are introducing AI healthcare and bioinformatics programs, while the BioE3 Policy focuses on establishing bio-AI hubs and biomanufacturing facilities. These combined efforts are strengthening innovation, early-stage research, and the integration of AI into biotechnology across the country.

Europe is driving the expansion of AI in biotechnology through strategic investments, regulatory support, and research collaborations. In 2024, the EU launched a €200 billion investment plan to strengthen AI capabilities, including high-performance computing hubs for biotech research. The Artificial Intelligence Act, effective from August 2024, ensures safe and ethical AI deployment. Additionally, AI Factories in countries like Finland, Germany, and Sweden provide infrastructure for startups and researchers, accelerating innovation and adoption of AI technologies across the biotechnology sector.

Germany is boosting its AI in biotechnology sector through strategic investments, infrastructure, and policy initiatives. In 2025, the government launched a €5.5 billion national AI strategy, aiming to integrate AI into 10% of GDP by 2030. The Innovation Park Artificial Intelligence (IPAI) in Heilbronn, a 30-hectare campus, fosters collaboration among research institutions, businesses, and public entities. These efforts, along with investments in AI infrastructure and human-centered AI, position Germany as a key player in advancing AI-driven biotechnology innovation

By Primary Application / Use Case

By Core AI Technology

By Commercial Model

By End User / Buyer Type

By Region

February 2026

February 2026

February 2026

February 2026