January 2026

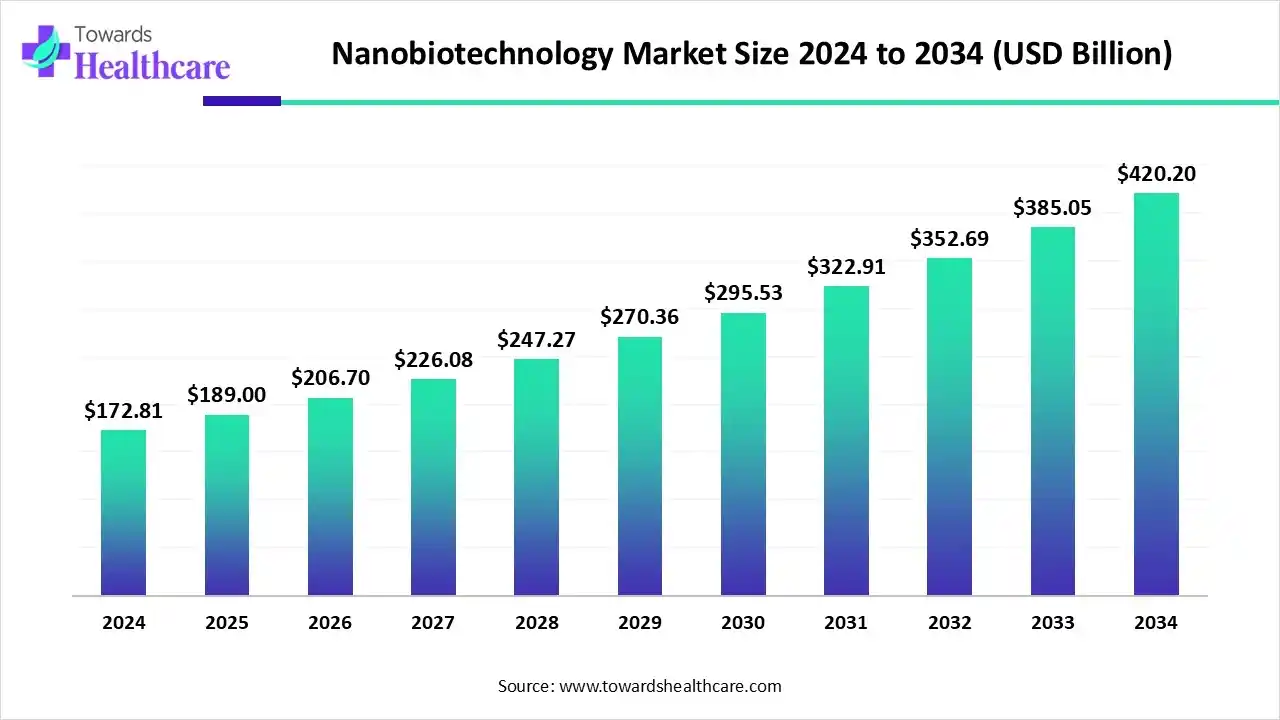

The global nanobiotechnology market size is calculated at US$ 172.81 billion in 2024, grew to US$ 189 billion in 2025, and is projected to reach around US$ 420.2 billion by 2034. The market is expanding at a CAGR of 9.37% between 2025 and 2034.

A number of critical factors are necessary for the global nanobiotechnology market to grow robustly. First and foremost, the continuous development of technological innovations constantly tests the limits of creativity. Innovations in nanoscale science and engineering have created previously unheard-of possibilities and encouraged the development of new instruments and techniques in the field of nanobiotechnology. At the same time, increased spending on R&D in a variety of fields has accelerated the development of nanobiotechnology.

| Table | Scope |

| Market Size in 2025 | USD 189 Billion |

| Projected Market Size in 2034 | USD 420.2 Billion |

| CAGR (2025 - 2034) | 9.37% |

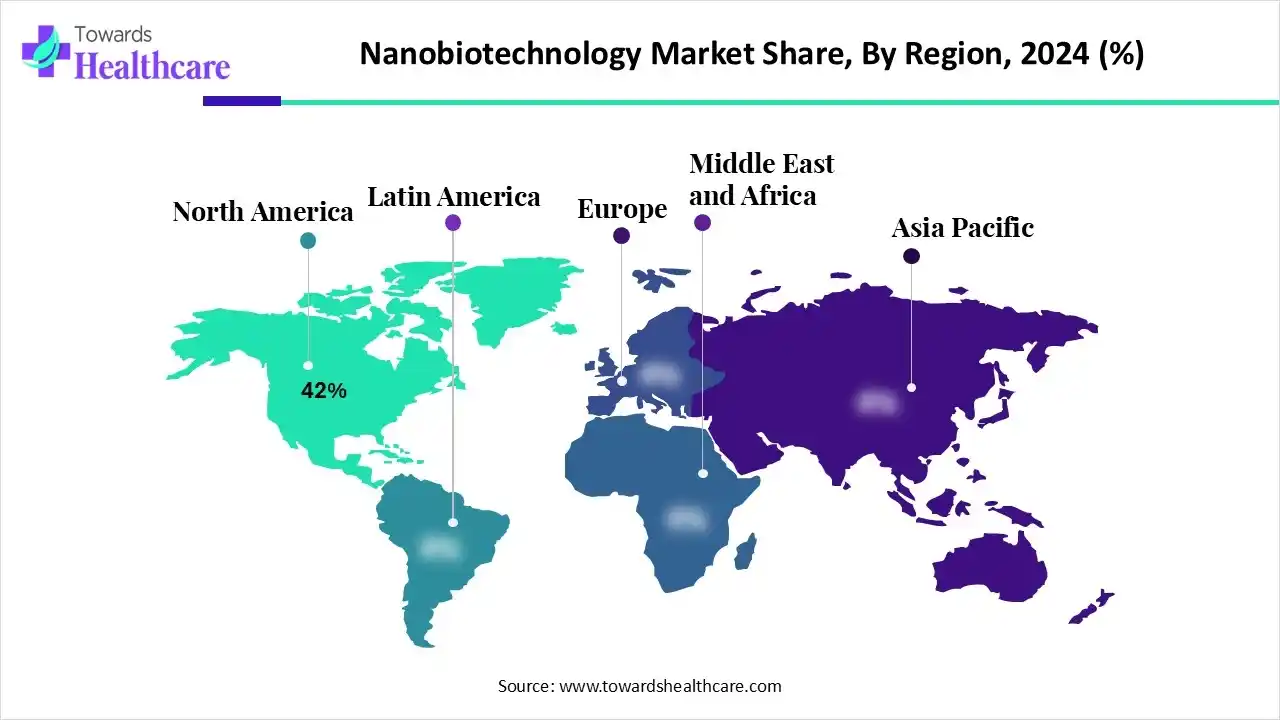

| Leading Region | North America by 42% |

| Market Segmentation | By Application, By Platform / Material Type, By End User/Buyer Type, By Product Type/Offering, By Therapeutic Area, By Region |

| Top Key Players | Moderna, BioNTech, Pfizer, Acuitas Therapeutics, Precision NanoSystems (PNS), Evonik/CordenPharma, Lonza Catalent, Thermo Fisher Scientific, Merck/MilliporeSigma, Nanobiotix, Nanospectra Biosciences, NanoString Technologies, Bruker/Malvern Panalytical, Abcam/Bio-reagent suppliers, Cytiva (historically GE Life Sciences), Pall/Sartorius, Exosome/EV specialists, Celgene/BMS & other large pharma, Specialist nano-CDMOs & startups |

Rising demand for nanoparticle-based therapeutics drives the nanobiotechnology market. Nanobiotechnology (nanobiotech) applies nanoscale materials, devices, and engineering to biological problems. It includes nano-enabled drug delivery (lipid nanoparticles, polymeric nanoparticles, nanocrystals), diagnostics and biosensors (nanoparticle labels, quantum dots, plasmonic sensors), nanomaterials for imaging and theranostics (gold nanoshells, silica, iron oxide), nanoformulation & particle engineering for pharma, nanofabricated tissue scaffolds, exosome/nano-vesicle platforms, and enabling instruments & consumables. Applications span therapeutics, vaccines, in-vitro diagnostics, imaging, regenerative medicine, gene & RNA delivery, agricultural biotech, and biosafety/environmental remediation.

Recent advances in nanotechnology and artificial intelligence (AI) are revolutionising nanomedicine by offering innovative approaches to improve patient outcomes and therapeutic efficacy. By combining AI and nanotechnology, doctors can analyse enormous volumes of patient data to develop customised medication delivery and diagnostic tools that meet each patient's unique needs.

By application, the therapeutics segment dominated the nanobiotechnology market with a share of approximately 38% in 2024. According to recent developments in nanotechnology, nanoparticles offer a lot of potential for use in medicine. Nanoparticles are ideal platforms for the target-specific and controlled delivery of micro- and macromolecules in disease therapy because of their ability to form stable interactions with ligands, vary in size and shape, have a high carrier capacity, and provide easy binding of both hydrophilic and hydrophobic substances.

By application, the instrumentation, consumables & services segment is expected to grow at the fastest CAGR during the forecast period. Nanobiotechnology uses highly specialised equipment, supplies, and services to apply nanotechnology's techniques to biological and medical problems. With applications in tissue engineering, targeted medication delivery, and enhanced diagnostics, the area is growing quickly.

By platform/material type, the lipid nanoparticles (LNPS) & lipid-based systems segment dominated the nanobiotechnology market with a share of approximately 34% in 2024. The therapeutic potential of nanoparticles as innovative drug delivery methods that supplement traditional pharmacology has been extensively recognised during the last 10 years. Lipid-based nanoparticles (LNPs) are one of these nanomaterials that have attracted a lot of attention in preclinical and clinical research due to their exceptional pharmacological performance and encouraging therapeutic results.

By platform/material type, the exosomes & biological vesicles segment is expected to grow at the fastest CAGR during the forecast period. In order to improve therapeutic treatments and illness prognosis, exosome-based nano-theranostic techniques have so drawn a lot of attention. Exosomes are a special type of nanoparticulate carrier for the transport of pharmaceutical drugs because of their advantageous biopharmaceutical characteristics.

By end-user/buyer type, the pharmaceutical & biotech companies segment dominated the market with a share of approximately 46% in 2024. Nanotechnology is mostly used by pharmaceutical and biotech businesses for targeted medication delivery, enhanced bioavailability, decreased adverse effects, and assistance with drug development and diagnostics. This involves employing nanomaterials to create more accurate diagnostic tools that can identify diseases at an earlier stage and developing nano-carriers, such as liposomes, to deliver medications directly to disease locations.

By end-user/buyer type, the CDMOs/CMOs & manufacturing service providers segment is expected to grow at the fastest CAGR during the forecast period. The pharmaceutical business receives medication research and manufacturing services from CDMOs and CMOs. CDMOs are essential to the efficient and economical introduction of novel medications to the market by biotechs and pharmaceutical corporations.

By product type/offering, the nano-formulated therapeutics & vaccines segment dominated the nanobiotechnology market with a share of approximately 40% in 2024. In this new technology, nanovaccines have shown themselves to be a useful piece. Site-specific antigen delivery, enhanced antigen absorption, and a reduced side effect profile are some potential advantages of the nanovaccines. Scientists are developing nanovaccines for a number of uses, including infectious illnesses and cancer immunotherapy.

By product type/offering, the software/analytics & characterization services segment is expected to grow at the fastest CAGR during the forecast period. The complexity of quality control (QC), especially in the pharmaceutical sector, and growing regulatory requirements are driving the expansion of characteriszation, analytics, and software services. The use of cutting-edge technologies like automation, AI, and machine learning is driving fast innovation in this market.

By therapeutic area, the oncology segment dominated the market with a share of approximately 34% in 2024. The use of nanotechnology in cancer diagnosis and treatment has produced a number of encouraging outcomes, including molecular imaging, drug delivery, gene therapy, detection and diagnostics, drug carriage, biomarker mapping, and targeted therapy. Gold nanoparticles and quantum dots are two examples of nanomaterials developed using nanotechnology that are utilised to diagnose cancer at the molecular level.

The number of cancer cases is expected to increase dramatically during the next thirty years. Due to population increase and ageing, predictions show that there would be 26 million new cases by 2030, over 30 million by 2040, and more than 35 million yearly by 2050.

By therapeutic area, the ophthalmology & localized delivery segment is expected to grow at the fastest CAGR in the nanobiotechnology market during the forecast period. The World Health Organisation (WHO) estimates that over 2.2 billion individuals worldwide suffer from vision impairment, demonstrating the enormous impact that ocular disorders have on both eyesight and quality of life. Therapeutic delivery methods based on nanocarriers have shown promise in extending medication release in ocular tissue and improving drug retention and penetration.

North America dominated the nanobiotechnology market in 2024, with a revenue of approximately 42%. Cutting-edge, innovative nanotechnology-based solutions are more needed across a variety of end-use industries as a result of the region's governments investing more in research and development (R&D). Over the course of the forecast period, it is also expected that growing industrial, IT, and healthcare sectors in countries like the US and Canada would boost market development.

In the biotechnology sector in the United States, collaboration is a crucial tactic. Businesses establish alliances for R&D, risk sharing, and talent acquisition. These partnerships, which aim to speed up research and bring novel treatments to market more quickly, can take place between big and small businesses or between US enterprises and foreign partners like China or India.

US biotechnology research investment rebounded significantly in 2024, approaching pre-pandemic levels with venture capital funding of $15.5 billion for early-stage rounds and $7.6 billion for late-stage rounds.

Asia Pacific is estimated to host the fastest-growing nanobiotechnology market during the forecast period. The fast growth of healthcare facilities in nations like China, India, and Japan is the main factor driving the market's rise in the Asia Pacific area. The continuous privatisation of the healthcare industry is driving the Asia Pacific market, which in turn is boosting investment in medical technology. Additionally, nations in the Asia-Pacific region are putting more emphasis on precision medicine, which uses nanotechnology to provide individualised and targeted therapies.

A total of 3,632.68 billion yuan was invested in R&D nationwide in 2024, up 296.97 billion yuan from the year before, or 8.9 percent; the investment intensity of R&D expenditures (as a percentage of GDP) was 2.69 percent, up 0.11 percentage points from the year before. The full-time workload of R&D staff was used to compute the per capita spending, which came to 480 thousand yuan, a 19 thousand yuan increase from the previous year.

Europe is expected to grow at a significant CAGR in the market during the forecast period. Established R&D facilities and the strong demand for technologically advanced goods are the primary factors propelling the nanobiotechnology market's expansion. Furthermore, the market for nanobiotechnology in the UK grew at the quickest rate in the European area, while the market in Germany had the biggest market share.

Research and innovation (R&I) in the UK is highly regarded and ranked highly internationally, and the financing from UK Research and Innovation (UKRI) is essential to its development and upkeep. Just under half of the £20.4 billion the government has promised to spending on R&I in 2025–2026 will come from UKRI.

In nanobiotechnology, research and development entails creating and synthesising nanoparticles, evaluating their characteristics, testing biological interactions for treatments, diagnostics, or drug delivery, and scaling up for use.

Key Players: Bruker, Thermo Fisher Scientific, and Evonik Industries. Emerging players like Sona Nanotech and Nanobiotix are also making significant advances.

Significant preclinical testing, staged clinical studies assessing safety and efficacy, application filing, and agency evaluation (e.g., FDA) on a case-by-case basis are all necessary for regulatory clearance in nanobiotechnology.

Personalised medicine, biosensors for ongoing monitoring, and tailored medication administration are all components of nanobiotechnology patient assistance. Additionally, it incorporates teaching materials and patient participation in ethical and scientific talks to guarantee applications that are safe, efficient, and fair.

Moderna

By employing lipid nanoparticles (LNPs) to transfer messenger RNA (mRNA) instructions into cells for COVID-19 defence, Moderna created the mRNA-1273 vaccination. Rapid and scalable vaccine manufacturing was made possible by this nanocarrier technology.

BioNTech

In collaboration with Pfizer, BioNTech developed the BNT162b2 mRNA vaccine. Their research showed the enormous potential of nanotechnology for the treatment of infectious diseases and cancer by using lipid nanoparticles to transport and preserve mRNA.

Pfizer

Using lipid nanoparticle technology, Pfizer and BioNTech created the COVID-19 vaccination Comirnaty. In order to lessen side effects, their study also looks at the use of nanoparticles in targeted cancer treatments.

Acuitas Therapeutics

The development of lipid nanoparticle (LNP) delivery methods for nucleic acid therapies is the area of expertise for Acuitas Therapeutics. Their technique has uses in a variety of gene treatments and made the Pfizer-BioNTech COVID-19 vaccine possible.

Precision NanoSystems (PNS)

The NanoAssemblr platform, provided by PNS, makes use of microfluidics to facilitate the scalable and repeatable production of nanoparticles, including LNPs for genetic medications. This "nanoparticle factory" speeds up the development of nanomedicine.

By Application

By Platform / Material Type

By End User/Buyer Type

By Product Type/Offering

By Therapeutic Area

By Region

January 2026

January 2026

January 2026

January 2026