January 2026

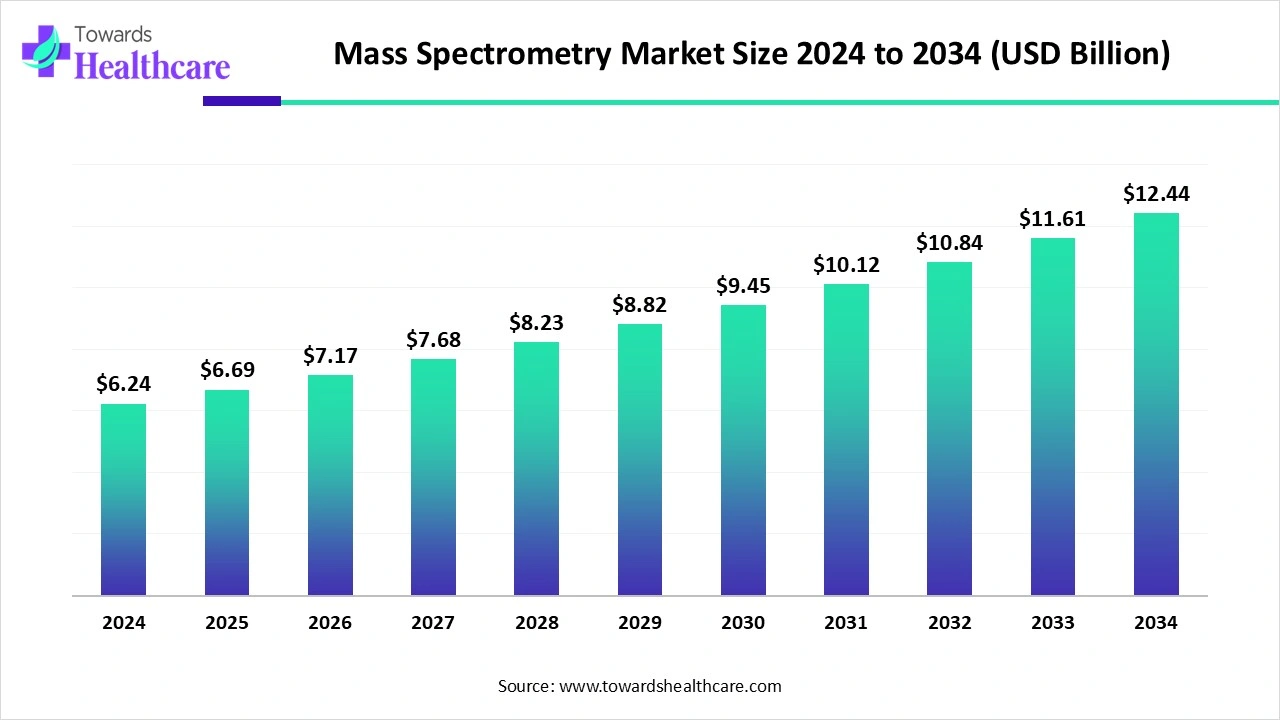

The global mass spectrometry market size recorded US$ 6.69 billion in 2025, set to grow to US$ 7.17 billion in 2026 and projected to hit nearly US$ 13.33 billion by 2035, with a CAGR of 7.14% throughout the forecast timeline.

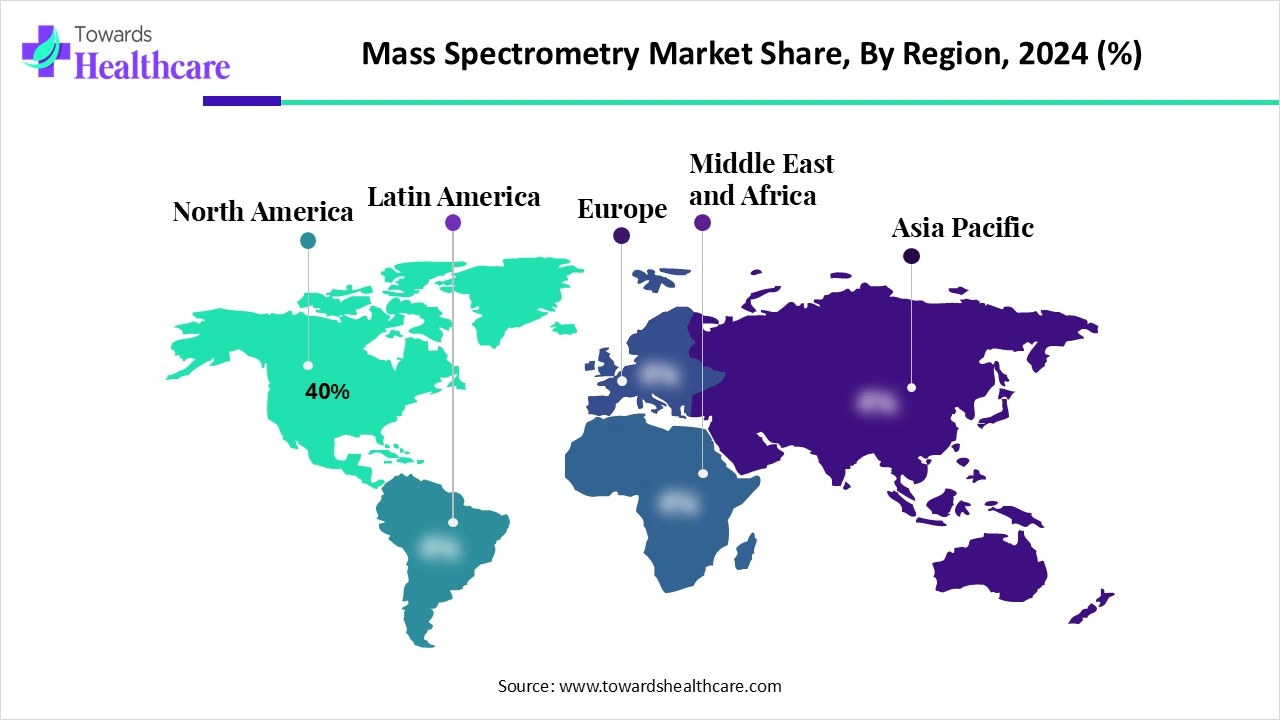

The mass spectrometry market is experiencing robust growth, driven by rising demand in pharmaceuticals, biotechnology, clinical diagnostics, food safety, and environmental testing. Technological advancements offering greater accuracy, sensitivity, and faster analysis further enhance adoption. Among all regions, North America dominates the market, supported by strong R&D investments, advanced healthcare infrastructure, stringent regulatory frameworks, and early adoption of innovative technologies. Growing applications in forensic science, toxicology, and personalized medicine also fuel regional leadership, making North America the key hub for market expansion.

| Table | Scope |

| Market Size in 2025 | USD 6.69 Billion |

| Projected Market Size in 2035 | USD 13.33 Billion |

| CAGR (2026 - 2035) | 7.14% |

| Leading Region | North America 40% |

| Market Segmentation | By Product / Instrument Type, By Ionization / Detection Technology, By Application / End-use (with subsegments), By Service Type / Deployment Model, By End User / Customer, By Region |

| Top Key Players | Thermo Fisher Scientific, Agilent Technologies, Waters Corporation, SCIEX, Bruker Corporation, Shimadzu Corporation, PerkinElmer, JEOL Ltd., LECO Corporation, Analytik Jena / Analytik Jena Group, Restek Corporation, Phenomenex (now brand-level suppliers of columns & sample-prep), Merck / MilliporeSigma (standards, reagents, kits), Thermo Fisher / Dionex lines (columns & consumables), Grace/Waters (sample prep & columns ecosystem) |

Mass spectrometry is an advanced analytical technique used to measure the mass-to-charge ratio of ions, allowing precise identification and quantification of molecules within a sample. It works by ionizing chemical compounds to generate charged particles, which are then separated and detected based on their mass and charge. This method provides highly accurate molecular weight information and structural details, making it valuable in fields such as pharmaceuticals, biotechnology, clinical diagnostics, food safety, environmental monitoring, and forensic science. Known for its sensitivity, speed, and accuracy, mass spectrometry plays a critical role in research, quality control, and regulatory compliance.

Advancements in Instrumentation and Ion Sources: Innovations in mass spectrometry instruments and ion sources are enabling researchers to analyze larger and more complex molecules with higher sensitivity and speed. This trend is facilitating deeper insights into biological data, particularly in studies of diseases such as Alzheimer's and cancer. For instance, at the American Society for Mass Spectrometry (ASMS) 2025 conference, new technologies were showcased that expand analytical capabilities while refining size and workflow efficiency.

Miniaturization and Portability of Instruments: There is a growing demand for benchtop and portable mass spectrometry systems that offer high performance in a compact form. These systems are ideal for on-site analyses in clinical, environmental, and field settings. In 2025, companies introduced new portable mass spectrometers designed for rapid, on-site testing without compromising analytical capabilities.

AI integration can significantly improve mass spectrometry by enhancing data analysis, interpretation, and overall efficiency. Mass spectrometry generates vast and complex datasets, and AI-powered algorithms can quickly process, identify patterns, and detect anomalies with greater accuracy than traditional methods. Machine learning models can improve peak detection, compound identification, and quantification, reducing human error and time consumption. AI can also aid in predictive modeling, enabling faster drug discovery, biomarker detection, and clinical decision-making. Moreover, AI-driven automation optimizes instrument calibration, sample preparation, and workflow management, ensuring consistent performance.

Rising Adoption in Forensic Science and Toxicology

Adoption of mass spectrometry in forensic science and toxicology significantly boosts market growth by enhancing analytical precision, expanding casework capacity, and improving response to evolving substance threats. Mass spectrometry delivers unmatched sensitivity and specificity in identifying drugs, poisons, and metabolites within complex biological and environmental samples. In toxicology, its inclusion in post-mortem investigations, therapeutic drug monitoring, and detection of novel psychoactive substances (NPS) underpins both public health and legal outcomes.

In 2025, in Shillong, India, NEIGRIHMS inaugurated a cutting-edge GC-MS facility in August, elevating forensic toxicology by enabling precise blood alcohol and poison analysis to support regional criminal investigations. Additionally, Wiley released its 2025 Mass Spectra of Designer Drugs database integrating over 1,260 new spectra and 780 unique compounds empowering forensic laboratories worldwide to rapidly identify emerging illicit substances.

Complexity of Operation & Stringent Regulatory Requirements

The key players operating in the market are facing issues due to the stringent regulatory requirements and the complexity of operations. The complexity of the operation requires skilled professionals and extensive training to ensure accurate analysis. Lengthy sample preparation procedures can limit throughput and efficiency. Stringent regulatory requirements, delaying approvals, and restricting use in certain applications.

Rising Investment in R&D

Rising investment in R&D and public-private collaboration are powerful catalysts for the growth of the mass spectrometry market, fueling innovation, accessibility, and adoption across sectors. Such funding enables the development of cutting-edge instruments like hybrid and high-resolution systems that offer superior sensitivity, accuracy, and automation, thereby opening new applications in personalized medicine, proteomics, and environmental analysis. Moreover, partnerships between companies, academic institutions, and government bodies improve knowledge sharing and infrastructure, accelerating technology transfer and workforce training.

For instance, in 2025, the opening of Agilent Technologies’ Biopharma Experience Centre in Hyderabad. This facility integrates chromatography, mass spectrometry, and lab informatics, providing a collaborative environment for industry and academia to simulate real-life workflows, conduct regulatory-ready R&D, and develop life-saving medicines more efficiently. Such initiatives not only expand the market for high-end instruments but also build local capacity, strengthen innovation ecosystems, and create scalable applications of mass spectrometry across healthcare and industrial domains.

The LC-MS/LC-MS/MS systems segment dominates the market due to their high sensitivity, specificity, and versatility across multiple applications. They are widely used in pharmaceutical and biotechnology research for drug discovery, therapeutic drug monitoring, and biomarker identification. The systems’ ability to analyze complex biological and chemical samples with precision makes them essential in clinical diagnostics, food safety, and environmental testing.

The benchtop & portable MS segment is estimated to be the fastest-growing in the market due to increasing demand for compact, easy-to-use, and on-site analytical solutions. Their portability allows rapid testing in clinical diagnostics, environmental monitoring, food safety, and forensic investigations without the need for large laboratory setups. Advances in miniaturization, improved sensitivity, and faster analysis enhance their practical applications.

The electrospray ionization (ESI) segment dominates the market due to its ability to analyze large, polar, and thermally labile molecules with high sensitivity and accuracy. Widely used in pharmaceuticals, proteomics, and metabolomics, ESI enables precise identification and quantification of proteins, peptides, and small molecules. Its compatibility with liquid chromatography (LC) and versatility across clinical diagnostics, drug development, and biomarker discovery further enhances its adoption. Continuous technological improvements and reproducibility reinforce ESI’s position as the leading ionization technique.

The ambient/novel ionization segment is anticipated to be the fastest-growing in the mass spectrometry market due to its ability to analyze samples directly under ambient conditions, reducing the need for extensive sample preparation. Techniques like DESI, DART, and ASAP enable rapid, real-time detection of compounds in clinical, forensic, environmental, and food safety applications. Growing demand for on-site and high-throughput analysis, combined with technological advancements improving sensitivity and accuracy, drives adoption.

The pharmaceuticals & biopharma segment dominates the market due to its critical role in drug discovery, development, and quality control. Mass spectrometry enables precise identification, quantification, and structural characterization of active pharmaceutical ingredients, metabolites, and impurities. Its applications in biomarker discovery, therapeutic drug monitoring, and personalized medicine further enhance adoption. The segment benefits from continuous R&D investments, stringent regulatory requirements, and the growing need for high-throughput, accurate analytical techniques, making mass spectrometry indispensable for pharmaceutical and biopharmaceutical research and production.

The clinical diagnostics segment is estimated to be the fastest-growing in the mass spectrometry market due to increasing demand for accurate, sensitive, and rapid disease detection and personalized medicine. Mass spectrometry enables precise biomarker identification, therapeutic drug monitoring, and detection of metabolic disorders, supporting early diagnosis and treatment optimization. Rising prevalence of chronic diseases, government initiatives to improve healthcare infrastructure, and adoption of advanced diagnostic technologies in hospitals and laboratories further drive growth.

The instrument sales & capital purchases segment dominates the market due to the high demand for advanced, high-performance systems across pharmaceuticals, biotechnology, clinical diagnostics, and environmental testing. Organizations prioritize acquiring state-of-the-art instruments to ensure accuracy, sensitivity, and reliability in analysis. Continuous technological innovations, increasing adoption of LC-MS and LC-MS/MS systems, and the need for high-throughput and reproducible results drive capital investments. Strong R&D initiatives and stringent regulatory requirements further reinforce the focus on direct instrument purchases over other service types.

The software & informatics subscriptions segment is anticipated to be the fastest-growing in the mass spectrometry market due to the increasing complexity and volume of data generated by advanced instruments. AI-powered software and cloud-based informatics solutions enable efficient data processing, analysis, and interpretation, improving accuracy and workflow efficiency. Rising demand for real-time monitoring, predictive analytics, and integration with laboratory information management systems (LIMS) supports adoption. Additionally, the shift toward subscription-based models reduces upfront costs, provides regular updates, and ensures scalability, driving rapid growth in this segment.

The pharmaceutical & biotech companies segment dominates the biospectrometry market due to their extensive use of advanced analytical techniques for drug discovery, development, and quality control. They rely on biospectrometry for precise identification, quantification, and structural analysis of biomolecules, metabolites, and impurities. Strong investments in R&D, coupled with stringent regulatory requirements, drive continuous adoption of high-performance instruments. Additionally, the growing focus on personalized medicine, biomarker discovery, and therapeutic monitoring reinforces the reliance of these companies on biospectrometry, making them the leading segment in the market.

The clinical & diagnostic laboratories segment is estimated to be the fastest-growing in the mass spectrometry market due to increasing demand for accurate, rapid, and high-throughput diagnostic testing. Mass spectrometry enables precise detection of biomarkers, metabolic disorders, and therapeutic drug levels, supporting early diagnosis and personalized treatment. Rising prevalence of chronic and lifestyle diseases, expanding healthcare infrastructure, and government initiatives to enhance diagnostic capabilities further drive adoption. Additionally, technological advancements, automation, and integration with AI and laboratory information management systems improve efficiency, scalability, and reliability in clinical and diagnostic laboratories.

North America dominates the market share 40% due to its strong presence of leading pharmaceutical, biotechnology, and healthcare companies that drive high adoption of advanced analytical technologies. The region benefits from substantial investments in research and development, well-established laboratory infrastructure, and a skilled workforce. Stringent food safety, environmental, and clinical diagnostic regulations further support demand for precise and reliable testing solutions. Additionally, early adoption of technological innovations, coupled with government funding and academic–industry collaborations, strengthens the market. Expanding applications in forensic science, toxicology, and personalized medicine further reinforce North America’s leadership in the global mass spectrometry landscape.

The U.S. holds the dominant share of the market in North America due to its strong pharmaceutical, biotechnology, and healthcare industries that drive continuous adoption of advanced analytical systems. The country benefits from world-class research institutions, heavy R&D investments, and strong collaborations between academia, government, and industry. Strict regulatory standards from agencies like the FDA and EPA fuel demand for accurate impurity profiling, drug validation, and environmental testing. Furthermore, widespread use in clinical diagnostics, particularly in biomarker identification and personalized medicine, alongside advancements in forensic and toxicological testing, reinforces the U.S. as the primary growth hub.

Canada represents the fastest-growing market in North America, supported by increasing government and provincial funding for healthcare research, environmental monitoring, and life sciences innovation. The country is seeing rising adoption of mass spectrometry in clinical diagnostics, food safety, and forensic science, reflecting a growing demand for accurate and efficient analytical methods. Expanding biotechnology clusters and collaborations between public institutions and private companies further accelerate technology transfer and skill development. Canada’s emphasis on sustainability and environmental quality also drives the application of mass spectrometry in detecting pollutants and contaminants, positioning the country as an emerging hub for advanced analytical solutions.

The Asia-Pacific region is the fastest-growing mass spectrometry market for mass spectrometry, driven by rising investments in pharmaceutical and biotechnology research, expanding healthcare infrastructure, and increasing government initiatives to promote advanced analytical technologies. Growing demand for clinical diagnostics, food safety testing, and environmental monitoring further accelerates adoption. Rapid industrialization and stricter regulatory standards across countries like China, India, and Japan enhance the need for precise analytical tools. Additionally, collaborations between global companies and local research institutions strengthen accessibility and innovation, fueling regional market growth.

Key Organizations Involved:

Key Regulatory Organizations:

Organizations Involved:

In June 2025, Chris Lock, vice president of Global R&D at Sciex, stated that the newly launched Mass Spectrometry System named ZenoTOF 8600 can increase sensitivity by up to ten times when compared to its predecessor. The OptiFlow Pro source, improved ion guides (DJet and QJet), and a new optical detector that can handle higher ion currents are some of the technological advancements that have led to this improvement.

By Product / Instrument Type

By Ionization / Detection Technology

By Application / End-use (with subsegments)

By Service Type / Deployment Model

By End User / Customer

By Region

January 2026

January 2026

January 2026

January 2026