February 2026

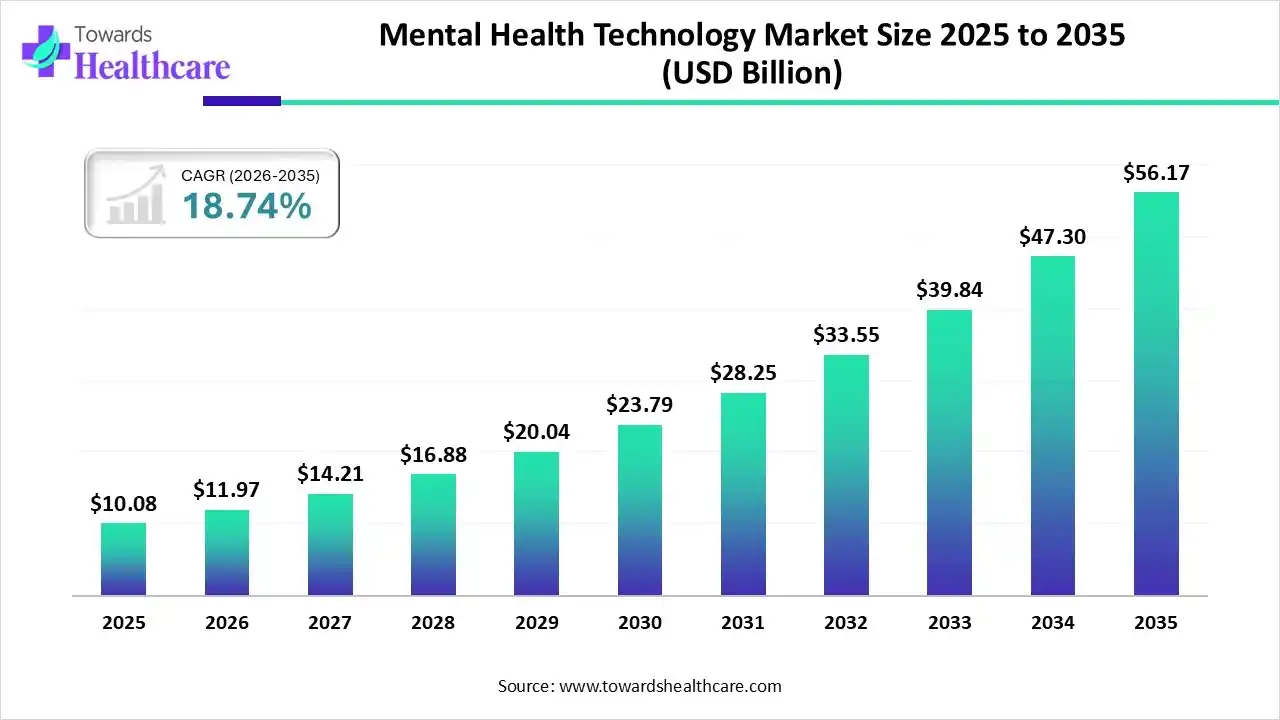

The global mental health technology size was estimated at USD 10.08 billion in 2025 and is predicted to increase from USD 11.97 billion in 2026 to approximately USD 56.17 billion by 2035, expanding at a CAGR of 18.74% from 2026 to 2035.

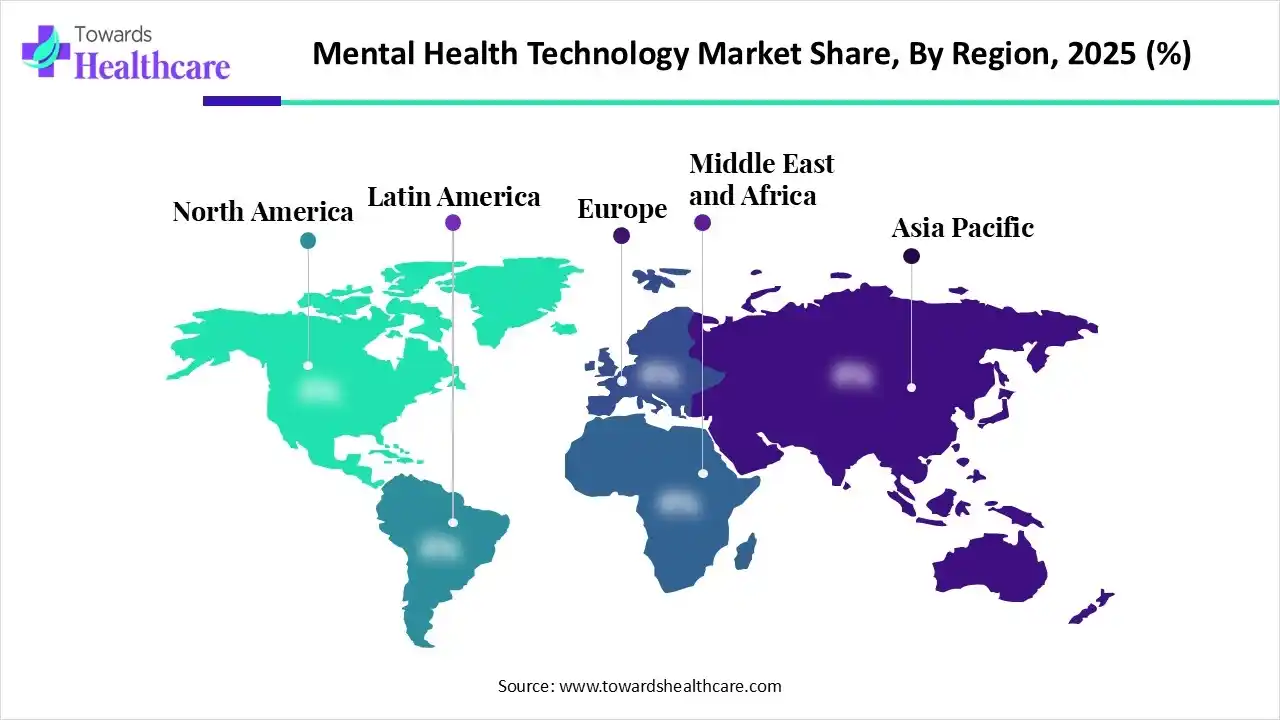

The mental health technology market is expanding rapidly, driven by rising mental health awareness, growing digital health adoption, and increasing demand for accessible care solutions. North America remains the dominant region due to advanced healthcare infrastructure and high technology adoption. Meanwhile, innovations in telemedicine, mobile applications, and AI-enabled tools are reshaping mental health care delivery globally.

| Key Elements | Scope |

| Market Size in 2026 | USD 11.97 Billion |

| Projected Market Size in 2035 | USD 56.17 Billion |

| CAGR (2026 - 2035) | 18.74% |

| Leading Region | North America |

| Market Segmentation | By Technology, By Target Audience, By Application, By Region |

| Top Key Players | BetterHelp (Teladoc Health), Wysa, Headspace (Headspace Health), Calm, Talkspace, Lyra Health, Spring Health, Woebot Health, Mindstrong Health |

The mental health technology market is driven globally by rising awareness of mental health conditions, increasing stress and anxiety levels, growing acceptance of digital healthcare, and widespread smartphone and internet penetration. Supportive government initiatives, employer wellness programs, and the need for accessible, cost-effective mental health solutions further accelerate adoption across developed and emerging economies. Mental health technology refers to the use of digital tools and innovations to support mental well-being, prevention, diagnosis, treatment, and monitoring of mental health conditions. It includes mobile applications, teletherapy platforms, wearable devices, AI-powered chatbots, virtual therapy tools, and data-driven analytics that enable personalized, remote, and continuous mental health care.

AI integration can significantly transform the mental health technology market by enabling more personalized, scalable, and proactive care solutions. Advanced algorithms can analyze behavioral patterns, speech, and biometric data to detect early signs of mental health conditions and support timely interventions. AI-powered chatbots and virtual assistants enhance accessibility by providing continuous support and reducing care gaps. Additionally, AI improves clinical decision-making through predictive analytics, treatment optimization, and outcome monitoring. Automation of administrative tasks also increases efficiency for providers, allowing greater focus on patient care while improving overall service delivery and user engagement.

Telemedicine platforms and virtual therapy solutions are gaining widespread adoption, allowing patients to access mental health care remotely. This trend is driven by convenience, reduced stigma, and the need for continuous support, particularly in regions with limited healthcare infrastructure. Future growth will focus on integrating virtual platforms with AI-driven personalized care.

Artificial intelligence is increasingly being used for early detection, personalized treatment plans, and real-time monitoring of mental health conditions. Predictive analytics and AI-powered chatbots enhance patient engagement and clinical decision-making. In the future, AI is expected to drive more precise, scalable, and proactive mental health interventions.

Mobile applications and digital tools for stress management, meditation, sleep tracking, and mood monitoring are rapidly gaining popularity among consumers. These solutions empower individuals to monitor and manage their mental well-being daily. The future outlook suggests broader adoption, integration with wearables, and expansion into preventive mental health care.

Wearable devices that track physiological indicators like heart rate, sleep patterns, and stress levels are becoming integral to mental health monitoring. These devices provide real-time insights, enabling preventive care and personalized interventions. The mental health technology market is expected to witness continued innovation with AI-enabled wearables enhancing data accuracy and predictive capabilities.

Employers are investing in digital mental health solutions to improve workforce well-being, productivity, and retention. Corporate wellness programs, including subscription-based apps and teletherapy platforms, are on the rise. The future outlook indicates stronger adoption across industries, with integrated solutions combining assessment, therapy, and continuous monitoring.

Cloud computing and advanced analytics allow mental health providers to securely store, analyze, and share patient data. These tools enhance treatment planning, track outcomes, and support research. In the future, data-driven solutions will improve personalized care, facilitate remote collaboration, and optimize resource allocation in mental health services.

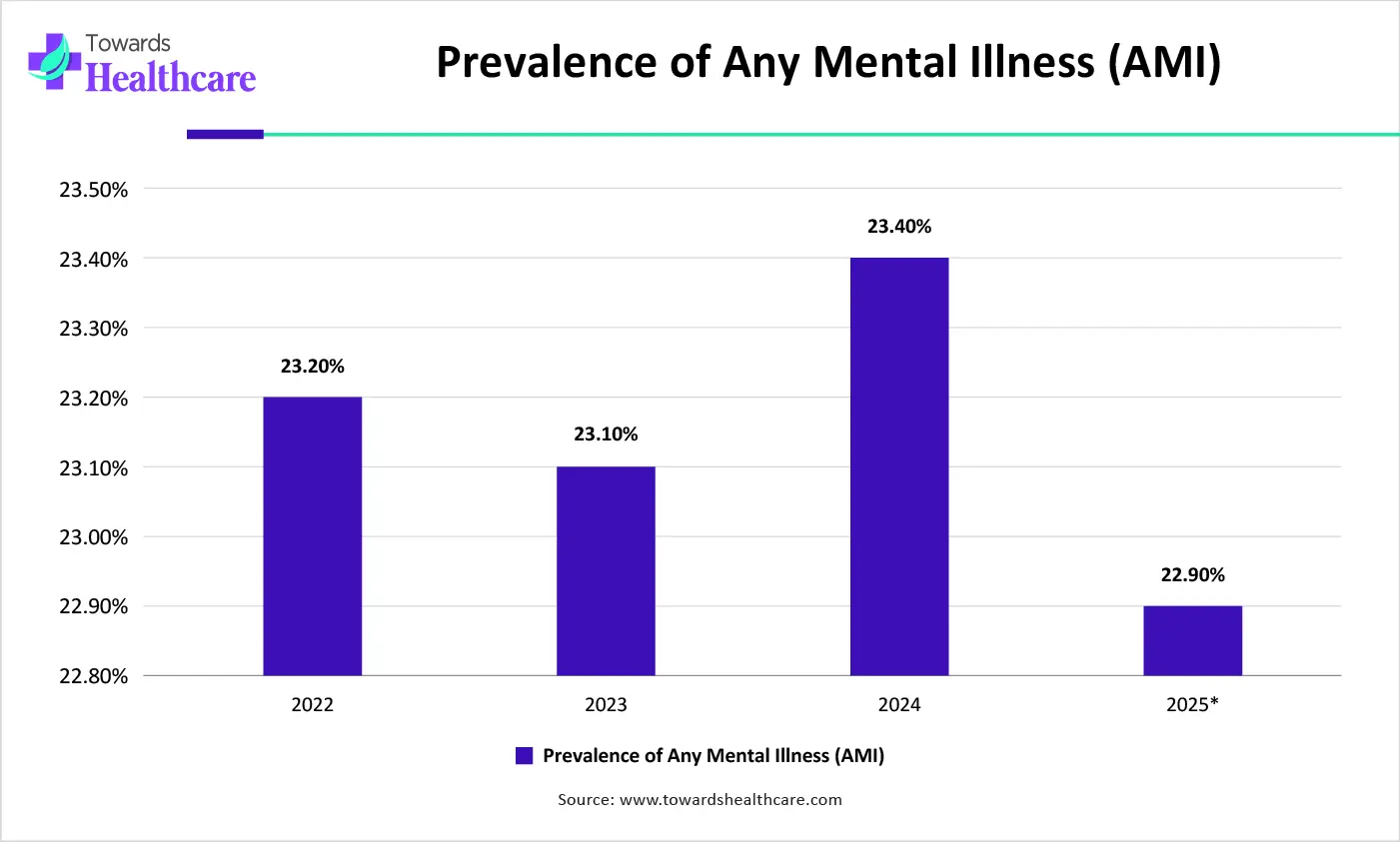

The rising prevalence of mental health disorder has estimated to drive the growth of the mental health technology market.

| Disorder/ Category | Estimated Global Prevalence of Mental Health Disorder (2025) |

| Any Mental Health Disorder | ~ 1.1 Bn |

| Anxiety Disorders | ~359 Mn |

| Depression | ~332 Mn |

| Bipolar Disorder | ~60 Mn |

| Schizophrenia | ~23 Mn |

| Eating Disorders | ~16 Mn |

| Alcohol Use Disorder | ~107 Mn |

| Drug Use Disorder | ~71 Mn |

Which Technology Segment Dominated the Mental Health Technology Market?

The mobile apps segment dominates the market due to widespread smartphone adoption, ease of access, and convenience for users. Apps offer personalized self-help, meditation, mood tracking, and therapy tools, enabling continuous engagement. Their scalability, real-time support, and integration with AI and wearable devices further strengthen their market leadership.

Wearable Technology

The wearable technology segment is estimated to be the fastest‑growing segment in the global mental health technology market due to its ability to continuously monitor physiological and behavioral data, enabling real‑time stress, sleep, and mood tracking. Integration with mobile apps and AI enhances personalized insights and early intervention. Demand for proactive, preventive care and seamless user experience further drives adoption.

Why Did the Individual Customers Segment Dominate the Mental Health Technology Market?

The individual customers segment dominates the global market due to growing awareness of mental well-being, increased smartphone and internet access, and rising preference for convenient, private, and self-guided solutions. Mobile apps, wearable devices, and teletherapy platforms cater directly to personal needs, empowering users to manage stress, anxiety, and overall mental health independently, driving widespread adoption.

Employers

The employers segment is anticipated to be the fastest‑growing segment in the global mental health technology market as companies increasingly invest in employee well‑being to boost productivity, retention, and workplace satisfaction. Employers adopt digital mental health solutions, wellness apps, and virtual therapy services as part of benefits packages, driving rapid demand for scalable, technology‑enabled support across diverse workforces.

Which Application Segment Led the Mental Health Technology Market?

The therapy & treatment segment dominates the mental health technology market due to the critical need for professional intervention in mental health conditions. Digital therapeutics, teletherapy platforms, and AI-assisted treatment tools provide accessible, personalized care, bridging gaps in traditional services and ensuring consistent support for patients, enhancing adoption and effectiveness.

Self‑Management & Well‑Being

The self‑management & wellbeing segment is anticipated to be the fastest‑growing because users increasingly seek convenient, preventive mental health support. Mobile wellness apps, meditation tools, and mood trackers empower individuals to manage daily stress and emotional balance. Easy accessibility, personalization, and seamless integration with smartphones and wearables boost engagement and adoption across diverse user groups.

North America dominated the mental health technology market in 2025, due to advanced healthcare infrastructure, widespread adoption of digital health solutions, and strong investment in innovation. Businesses leverage teletherapy platforms, mobile apps, and AI-driven tools to deliver scalable, efficient, and personalized mental health services. Supportive regulations, corporate wellness initiatives, and high consumer awareness further drive market leadership and revenue generation.

The U.S. is the dominant country in North America’s mental health technology market due to its advanced healthcare ecosystem, high digital adoption, and strong investment in innovation. Extensive telehealth infrastructure, widespread use of mobile mental health apps, and supportive government policies enable businesses to deliver scalable, personalized, and efficient mental health solutions nationwide.

| Year | Prevalence of Any Mental Illness (AMI) |

| 2022 | 23.20% |

| 2023 | 23.10% |

| 2024 | 23.40% |

| 2025* | 22.90% |

Asia Pacific is estimated to host the fastest-growing mental health technology market during the forecast period. The Asia-Pacific region is the fastest-growing in the mental health technology market due to rising mental health awareness, expanding smartphone and internet penetration, and increasing adoption of digital health solutions. Growing government initiatives, emerging startup ecosystems, and demand for accessible, cost-effective care drive rapid market expansion across diverse countries in the region.

China dominates the Asia-Pacific mental health technology market due to its large population, rapid digital adoption, and strong government support for healthcare innovation. High smartphone penetration, widespread use of telemedicine platforms, and growing investment in AI-driven mental health solutions enable businesses to deliver scalable, accessible, and personalized care across the country.

Europe is expected to grow at a significant CAGR in the mental health technology market during the forecast period. Europe is growing at a notable rate in the mental health technology market due to increasing awareness of mental health issues, supportive government policies, and rising adoption of digital health solutions. Investments in teletherapy platforms, mobile apps, and AI-driven tools enable scalable, efficient, and accessible mental health services across the region.

The UK is the dominant country in Europe’s mental health technology market due to its advanced healthcare infrastructure, strong government support, and high digital health adoption. Widespread use of teletherapy platforms, mobile mental health apps, and AI-driven solutions enables scalable and personalized care. Corporate wellness programs and public awareness initiatives further drive market leadership.

| Vendor / Key Player | Offerings / Focus |

| BetterHelp (Teladoc Health) | Online therapy and counseling services connect users with licensed therapists via web, messaging, and phone. |

| Wysa | AI‑driven conversational mental health support, coaching, and digital therapeutic tools for self‑management and clinical integration. |

| Headspace (Headspace Health) | Meditation, mindfulness, and mental wellness app with guided exercises, stress reduction, and workplace mental health offerings. |

| Calm | Meditation, sleep stories, relaxation audio, and wellness programs targeted to individuals and employers. |

| Talkspace | Virtual therapy platform offering licensed therapy through messaging and video sessions. |

| Lyra Health | Employer‑focused mental health benefits platform offering coaching, therapy referrals, and personalized care pathways. |

| Spring Health | AI‑driven precision mental health platform for employers, combining coaching, therapy, and personalized recommendations |

| Woebot Health | AI‑based mental health chatbot providing conversational support, mood tracking, and therapeutic modules. |

| Mindstrong Health | Data‑driven solutions leveraging AI for mental health assessment, personalized insights, and clinical support. |

By Technology

By Target Audience

By Application

By Region

February 2026

February 2026

February 2026

February 2026