January 2026

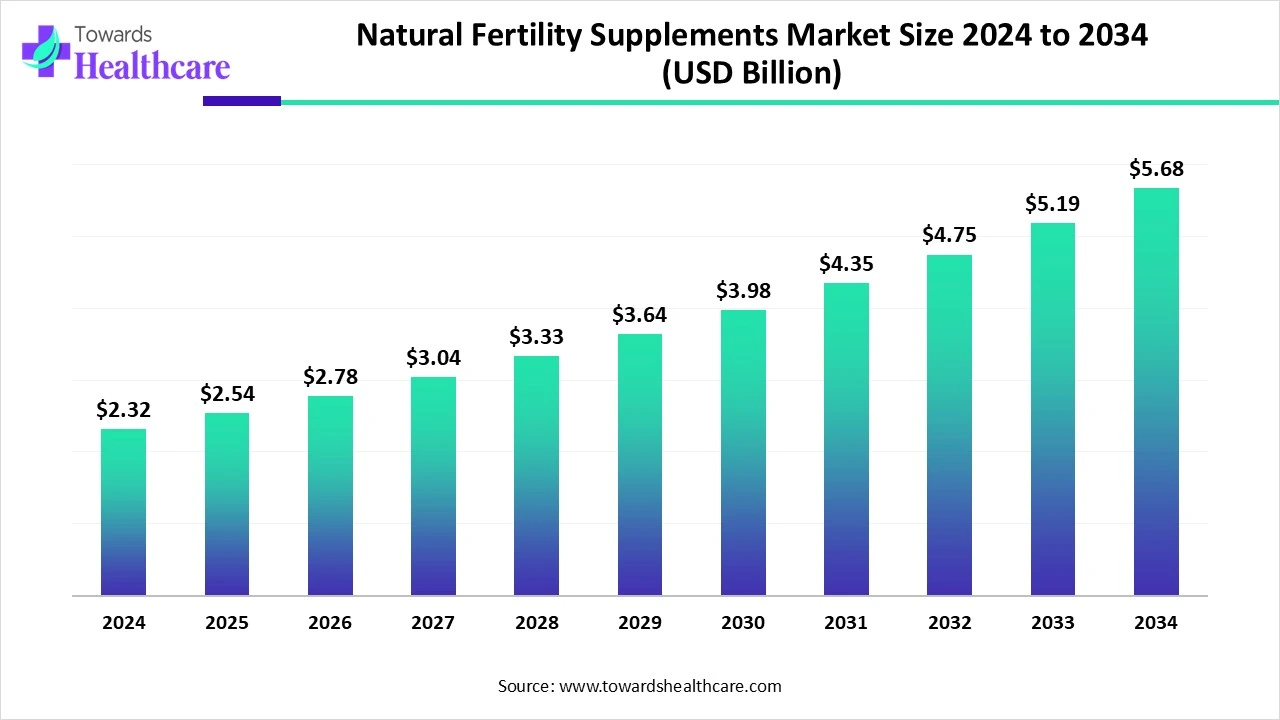

The global natural fertility supplements market size is calculated at USD 2.32 in 2024, grew to USD 2.54 billion in 2025, and is projected to reach around USD 2.54 billion by 2034. The market is expanding at a CAGR of 9.44% between 2025 and 2034.

| Metric | Details |

| Market Size in 2025 | USD 2.54 Billion |

| Projected Market Size in 2034 | USD 2.54 Billion |

| CAGR (2025 - 2034) | 9.44% |

| Leading Region | North America |

| Market Segmentation | By Product, By End-use, By Distribution Channel, By Region |

| Top Key Players | Royal Cosun (Netherlands), Greenyard (Belgium), Himalaya Food International Ltd. (India), J.R. Simplot Company (U.S.), Lamb Weston Holdings, Inc. (U.K.), General Mills, Inc. (U.S.), Mondelez International, Inc. (U.S.), THE KRAFT HEINZ COMPANY (U.S.), Royal Ingredients Group (Netherlands), Pioneer Industries Limited (India), Cargill, Incorporated (U.S.), Meelunie B.V. (Netherlands), Permolex Ltd (Canada), Amilina AB (Lithuania), Z&F Sungold Corporation (China), Tereos SCA (France), Ardent Mills LLC (U.S.), Bryan W. Nash & Sons Limited (U.K.) |

The natural fertility supplements market comprises vitamins, minerals, and other nutrients, which boost reproductive health and surely increase the chances of conception. Generally suggested widely used supplements are folic acid, vitamin D, CoQ10, vitamin E, omega-3 fatty acids, zinc, inositol, and selenium, which support enhancing egg quality, sperm health, hormone balance, and overall reproductive health. In recent years, rising infertility issues, raised awareness in both men and women have significantly influenced the growth of the market. Along with this, increasing demand for natural and organic supplements by consumers is propelling the market growth.

As AI can scrutinize the data to determine trends in patient histories and test outcomes, this is leading to highly precise diagnoses of infertility. Due to this, AI is playing a significant role in the market, specifically in domains like personalized treatment and upgrading IVF methods. AI-powered supports embryologists in selecting healthy embryos to transfer by assessing turnaround imaging and morphological data. Although AI assists in the estimation of ovulation cycles, assessment of patient data, which results in a rise in achievement rates.

Rising Recognition and Preferences for Natural Solutions

The natural fertility supplements market is facing significant growth as propelled by factors like rising recognition of fertility concerns, enhanced infertility rates, and increasing preference for natural solutions over synthetic ones. Apart from this, transforming lifestyles, belated pregnancies, and advances in R&D are also driving the market growth.

Inconsistency of Scientific Evidence

The significant challenge for this market is the insufficiency of strong scientific evidence that assists the efficiency of these products, which makes it inconsistent. This inconsistency may result in manufacturers losing the trust of consumers and may raise the uncertainty. Due to this, consumers have doubts regarding products if they are not revealed with their advantages.

Rising Personalized Solutions to Specific Reproductive Health Concerns

The substantial growth of the natural fertility supplements market is particularly impacted by enhanced recognition of reproductive health, escalating infertility instances, and rising preferences for natural solutions. Also, the market is involved in serving the personalized demands, along with formulation development customized for particular reproductive health concerns by manufacturers, including hormonal imbalance, ovulation concerns, and sperm health, which leads to personalized solutions for respective conditions.

By product, the capsule segment led the market in 2024. Due to some advantages like customer selection for easy administration, faster dissolution, and potential delivery system of ingredients, making to capsule segment is a crucial part of the natural fertility supplements market. Apart from this, manufacturers also appreciate that it has a feasible filling process, storage of ingredients, and a safe dosage form.

By product, the liquid segment is estimated to be the fastest growing in the upcoming years. This type of product has numerous applications in different areas such as enhancing embryo quality, improving sperm quality, and assisting in overall reproductive health. Particularly, containing CoQ10 and DHEA, are employed in the enhancement of egg quality and ovarian response to treatment in women who are going through IVF or IUI cycles. In addition to enhancing the motility and morphology of sperm quality, by using omega-3 fatty acids, CoQ10, and other antioxidants contained in liquid supplements, driving the natural fertility supplements market growth.

By end-use, the women segment dominated the market in 2024. As women follow the fertility cycle, these supplements play a vital role in this journey, with consultation from healthcare professionals before beginning the new regimen. Generally used supplements are folic acid, vitamin D, iron, omega-3 fatty acids, CoQ10, and zinc. Modified lifestyles lead to the utilization of several micronutrients in the improvement of egg quality, ovulation cycles, and drive market growth. In pregnancy, vital nutrients are used, such as folic acid, vitamin B12, and other vitamins and minerals.

By end-use, the men segment is observed to be the fastest-growing during the forecast period. Rising demand for male fertility products and growing awareness are impacting on growth of the natural fertility supplements market. Involvement of several supplements such as antioxidants like vitamin C, vitamin E, selenium, CoQ10, zinc, and carnitine has enhanced the sperm quality as well as its motility, and concentration, with overall accelerating reproductive health by minimizing the oxidative stress in sperm.

By distribution channel, the OTC segment led the market in 2024. The market has been raised by a crucial share of sales and revenue. Major contributing factors are like easily approachable without a prescription, cheap, and comfort for purchase, including growing awareness about the advantages of fertility supplements, which are driving the natural fertility supplements market growth.

By distribution channel, the prescribed segment is expected to witness the fastest rate of growth during the predicted timeframe. Usually, prescribed natural fertility supplements are used to maintain complete reproductive health and increase the possibilities of conception. More often employed prescribed supplements are folic acid and vitamin B are highly recommended for both men and women, specifically in and before pregnancy, to support the avoidance of neural tube defects, and improve the development of health.

North America dominated the market in 2024. Rising prevalence concerns, including restraint about infertility, which is widely affecting on reproductive health of both males and females, are a driving factor for dominance of North America in the natural fertility supplements market. Although, growing trend of belated pregnancies and fertility concerns regarding stress is also contributing a major role in the growth of the market.

In the US, the market is showing significant growth, which is impelled by the growing awareness in the reproductive health sector and an increasing number of infertility instances. With the inclusion of rising consumer choices in natural and organic fertility remedies, the growth of the market is impacted.

The market is expected to grow as customers’ increasing interest in natural and organic fertility solutions, including the rising prevalence of fertility issues, with growing awareness in reproductive health systems, are influencing the market growth. Furthermore, progression in nutritional science and developments in research methods are also emerging in the production of more efficient formulations.

Asia-Pacific is predicted to grow fastest in the forecast period. Major factors influencing the growth of the market are subsidized fertility rates, an increase in the number of fertility treatment approaches, and rising awareness about reproductive health. Due to the modified lifestyle, inclusive of delayed pregnancies, stress, sedentary habits, consumption of alcohol, smoking, and caffeine, fertility rates are declining, which significantly increases the demand for natural fertility supplements, and market growth is fueled.

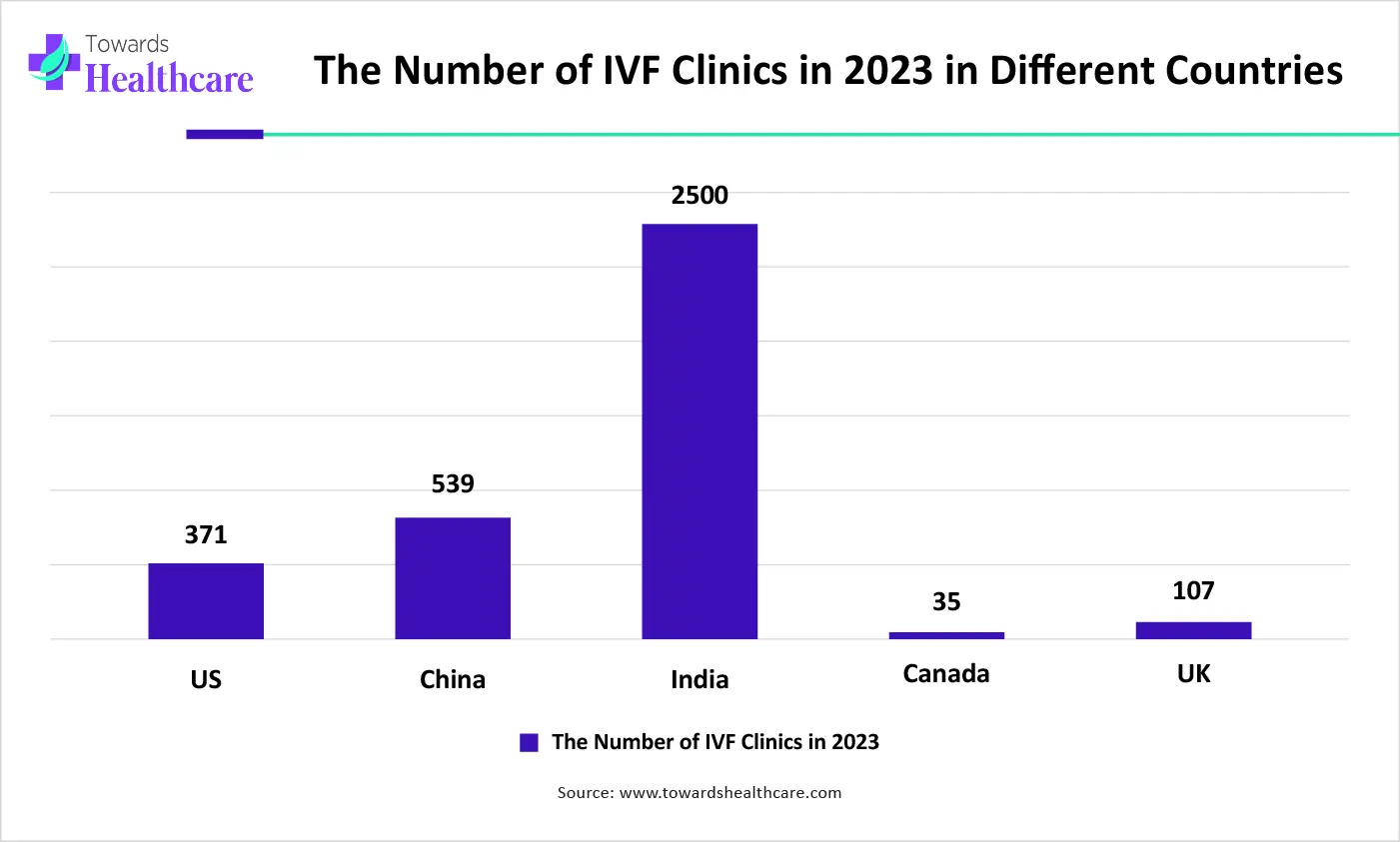

In China, a geriatric and growing population, enhanced consumer income, and growing awareness about infertility medications are majorly factors involved in the growth of the market. Moreover, Chinese couples are approaching fertility medications in greater numbers, particularly in vitro fertilization (IVF). The government of China took the step towards a one-child policy in 2015 is also a contributing factor to market growth.

The market in India is driven by the rising earnings of middle-class consumers, who are mostly involved in improving their well-being and taking fertility supplements. Also, robust traditional medicine systems in India, including herbal and natural remedies for different health concerns like fertility issues, are emerging factors in the market's growth.

Europe is considered to be a significantly growing region during the forecast period. Majorly rising chronic diseases like obesity are having an adverse effect, such as infertility. These conditions highly demand natural supplements to maintain reproductive health. Including changing lifestyles like ingestion of fast food, decreased physical activity, are contributing to increased infertility rates, widely affecting the market growth.

In the UK, market growth is propelled by significant factors like rising preference in consumers for natural and organic fertility solutions, also arising awareness about potential side effects of synthetic supplements. The market is divided into two categories, such as natural and synthetic, or a blend of natural and synthetic, from which natural supplements are experiencing a rising growth in the market.

The rising market in France is impacted by rising awareness about reproductive health and stress related to fertility concerns. For this, natural supplements play a vital role, which may show significant growth in the market in the forecast timeframe. However, the strong healthcare infrastructure of the France system supports fertility treatments and supplements as well.

In October 2024, Premom, a rising company in women’s fertility technology, and impulse by Amazon’s best-selling ovulation tests, which has announced recent innovations, such as a premium, female doctor-formulated supplement line. Dr. Patti Haebe, Senior Medical Advisor and Chief Formulator at Premom, mentioned that their all-time objective has been to empowerment of women by using the tools, technology, and knowledge they need to fulfill their dream of pregnancy. (Source - GlobeNewswire)

By Product

By End-use

By Distribution Channel

By Region

January 2026

December 2025

November 2025

November 2025