January 2026

The worldwide oral iron supplements market size is experiencing significant expansion, with projections indicating a revenue increase reaching several hundred million dollars by the end of the forecast period, spanning 2024 to 2034. This growth is driven by emerging trends and strong demand across key sectors.

Oral iron supplements are nutritional medications used for managing and treating iron-deficiency anemia. They are also used in people with nutritional deficiency, malabsorption, chronic inflammatory state, blood loss, or an increase in the body’s need for iron. Oral iron supplements are readily available as ferrous sulfate (20% elemental iron), ferrous gluconate (12% elemental iron), and ferrous fumarate (33% elemental iron). The main aim of oral iron supplements is to supply sufficient iron to restore normal stores and replenish hemoglobin deficits. They are widely preferred as they can be easily administered and are most cost-effective.

Several factors govern the oral iron supplements market growth, including the rising prevalence of iron-deficient anemia, necessitating the use of oral iron supplements. Government and private institutions are at the forefront of increasing awareness among the general public about iron supplements and their benefits. The increasing number of pregnant women and the growing number of surgeries also boost the demand for iron supplements. Moreover, the rising cases of trauma lead to blood and hemoglobin loss, promoting iron supplements.

Artificial intelligence (AI) can play a vital role in screening and detecting anemia in high-risk individuals. It can suggest different combinations of iron supplements depending on the patient’s condition. It can also determine the dose of iron components, including ferrous sulfate, ferrous gluconate, and ferrous fumarate. AI and machine learning (ML) algorithms can analyze vast amounts of patient data and predict the potential side effects of oral supplements. This enables healthcare professionals to make proactive clinical decisions to reduce GI side effects.

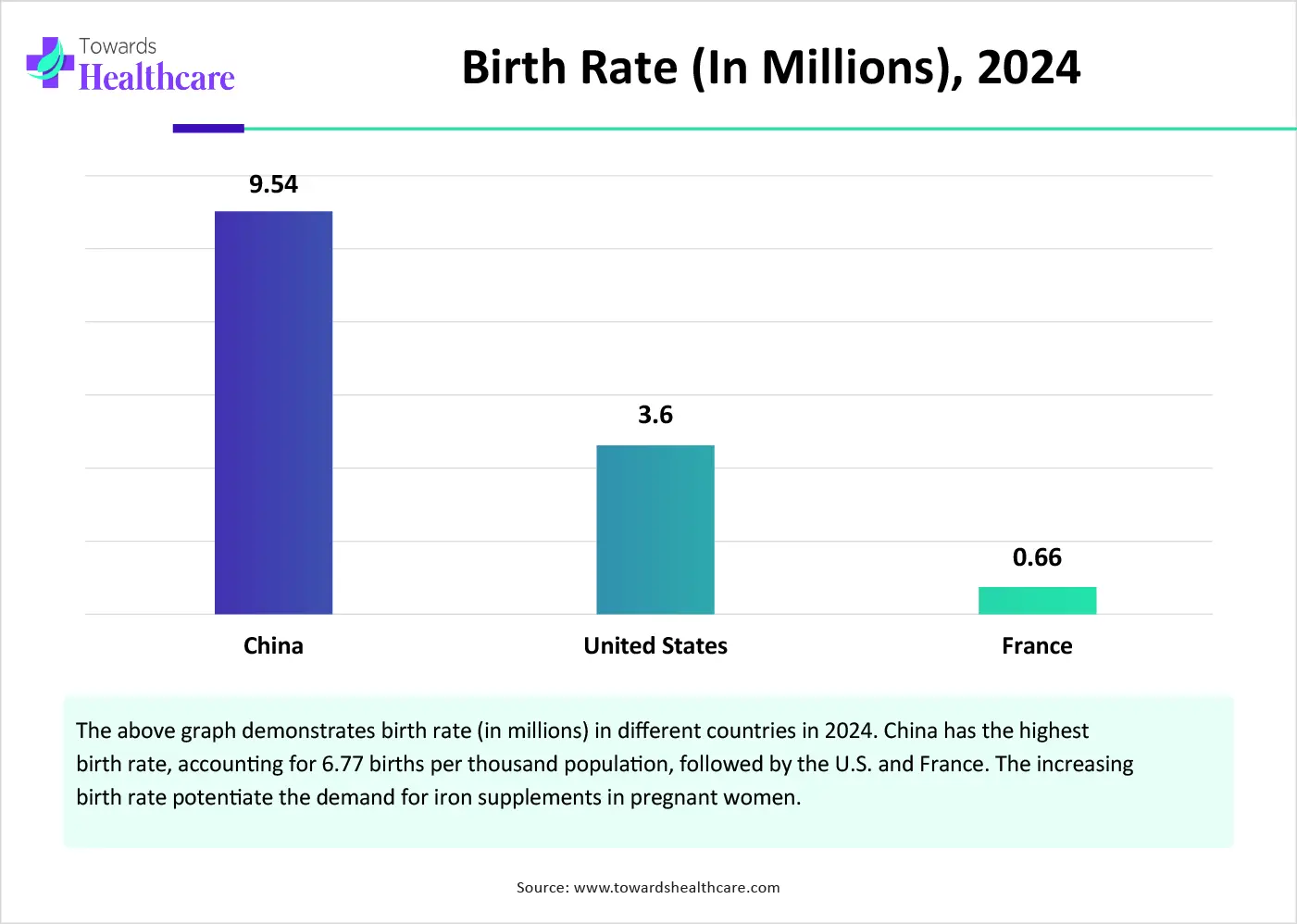

Increasing Number of Pregnant Women

The major growth factor of the oral iron supplements market is the increasing number of pregnant women. Oral iron supplements are mandatory during pregnancy to reduce maternal anemia and iron deficiency at term. Iron is essential for the production of hemoglobin, which carries oxygen to both the mother and fetus through the blood. According to a recent report published in the Cochrane Database of Systematic Reviews, women taking iron supplements during pregnancy are probably less likely to have infants with low birthweight, compared to placebo. (Source - PubMed) Several regulatory bodies also recommend iron supplements during pregnancy. The Centers for Disease Control and Prevention (CDC) recommends 30mg of iron per day at the first prenatal visit, and the World Health Organization (WHO) suggests 60mg per day for all pregnant women.

GI Side Effects

The major challenge of the oral iron supplements market is the gastrointestinal side effects of oral supplements. The most common side effects include nausea/vomiting, constipation or diarrhea, flatulence, metallic taste, staining of the teeth, or epigastric distress. These side effects combat the use of oral iron supplements, restricting market growth.

Growing Research and Development

The future of the market is promising, driven by growing research and development activities. Several researchers conduct research activities to develop novel drug delivery formulations and different combinations of iron sources in a formulation. Novel iron formulations like spherical lipid-coated particles, microspheres, nanoparticles, SLNs, liposomes, and sucrosomial iron have been developed to reduce GI side effects. These formulations contain encapsulated iron to improve bioavailability based on higher solubility. The increasing investments and collaborations among academic researchers support iron supplements research.

By product, the ferrous sulfate segment held a dominant presence in the oral iron supplements market in 2024. Ferrous sulfate is the most widely preferred iron supplement used to treat iron deficiency anemia. Its demand is increasing due to its cost-effectiveness and high tolerability. Additionally, it has higher elemental iron content per dose compared to ferrous gluconate. Several studies have proved that ferrous sulfate has better bioavailability and acceptable tolerability. Another study found that ferrous sulfate results in a greater increase in hemoglobin concentration at 12 weeks compared to iron polysaccharide complex.

By product, the iron bisglycinate segment is expected to grow at the fastest rate in the market during the forecast period. Iron bisglycinate is another preferred iron supplement for iron deficiency anemia. They play a vital role in increasing hemoglobin concentration and reducing GI adverse effects among pregnant women. The increasing number of pregnant women globally boosts the segment’s growth. It results in better absorption compared to other iron supplements, improves energy levels, and reduces fatigue.

By application, the iron deficiency anemia (IDA) treatment segment led the global oral iron supplements market in 2024. The rising prevalence of iron deficiency anemia augments the segment’s growth. Anemia is a major health concern, especially among children, pregnant women, and menstruating adolescent girls and women. The World Health Organization (WHO) reported that it affects around 40% of all children aged 6-59 months, 37% of pregnant women, and 30% of women aged between 15 and 49 years. (Source - World Health Orgnization) Several regulatory agencies take numerous measures to effectively screen, diagnose, and treat IDA. The WHO has launched the “Comprehensive Implementation Plan on Maternal, Infant, and Young Child Nutrition” to reduce anemia.

By application, the sports nutrition segment is anticipated to grow with the highest CAGR in the market during the studied years. The increasing number of sports athletes and the growing demand for physical activity promote the need for iron supplements. A report from the Sports & Fitness Industry Association (SFIA) mentioned that 242 million people in the U.S., or 80% of Americans aged 6 years and older, participated in at least one sports activity in 2023. (Source - Sports DESTINATION MANAGEMENT) Daily iron supplementation is beneficial for athletes to maintain and improve their wellness.

By form, the tablets segment held the largest share of the oral iron supplements market in 2024. The segmental growth is attributed to easy administration and cost-effectiveness. Tablets are available in various types, such as chewable, buccal, effervescent, and controlled-release tablets. This helps patients to mask the bitter taste of liquids, making tablets a preferable choice. Tablets eliminate the need for measuring precise doses, as they are already available in fixed doses.

By form, the liquid segment is projected to expand rapidly in the market in the coming years. The demand for liquids or syrups is increasing as they can be easily administered or swallowed. Liquids can be administered by people of all age groups, including young children. They are easily absorbed and have higher bioavailability compared to tablets. They also have a faster onset of action and fewer GI side effects.

By distribution channel, the pharmacies segment registered its dominance over the global market in 2024. The increasing number of pharmacies and the presence of skilled professionals augment the segment’s growth. Pharmacies have suitable infrastructure to store a wide variety of iron supplements. The availability of over-the-counter (OTC) and generic alternatives attracts more customers to pharmacies.

By distribution channel, the online retailers segment is predicted to witness the fastest growth in the market over the forecast period. The rapidly expanding e-commerce sector and the rising adoption of smartphones foster the segment’s growth. Advancements in cellular technology and the increasing geriatric population also potentiate the demand for online pharmacies. People can purchase iron supplements in the comfort of their homes from anywhere and at any time.

North America dominated the global market in 2024. The increasing risk of iron deficiency and the rising demand for a healthy lifestyle are the major growth factors of the market. Growing research and development activities lead to the development of novel and innovative iron supplements’ formulations. Several government organizations regulate the use of oral iron supplements. The growing demand for sports activities and the increasing number of surgeries favor the use of oral iron supplements.

HUS is the largest provider of specialized healthcare in the U.S. According to a recent study among more than 8,000 Americans, 14% of adults had absolute iron deficiency, or a depletion or reduction in iron stores. It was also found that 15% of adults from the survey had functional iron deficiency, which is marked by a reduced ability for the body to use it.

Iron deficiency is a public health concern, with an estimated 6-7% of Canadians being iron deficient. It is also estimated that approximately 2% of the Canadian population suffers from iron deficiency anemia (IDA). Health Canada regulates the use of iron supplements in Canadians. It recommends a supplement with 16 to 20 mg of iron in each daily dose.

Asia-Pacific is projected to host the fastest-growing oral iron supplements market in the coming years. The increasing awareness of a nutritional diet with iron sources and the rising prevalence of IDA drive the market. The growing population, resulting in an increasing number of pregnant women, also necessitates the use of iron supplements. Numerous government and private organizations conduct seminars and conferences to encourage the general public to include iron supplements in their daily diet.

A recent systematic review and meta-analysis study published in Nutrients demonstrated that the prevalence of iron deficiency and iron-deficiency anemia among pregnant women in China was 30.7% and 45.6%, respectively. (Source - MDPI) The Chinese government has launched the “National Nutrition Plan (2017-2030) to recommend daily folic acid supplementation as a public health intervention to improve iron status and reduce the risk of anemia in women of reproductive age.

The Indian government has launched the “Anemia Mukt Bharat” with a 6x6x6 strategy, including 6 interventions, 6 target groups of beneficiaries, and 6 institutional mechanisms. The government released data on its strategy till Q2 of FY 2024-25. Approximately 4.7 crore children (6-59 years) received 8-10 doses of iron-folic acid (IFA) syrup every month. Additionally, 4.9 crore children (5-9 years) received 4-5 IFA Pink monthly, and 5.9 crore adolescents (10-19 years) received 4-5 IFA Blue tablets monthly. Pregnant women (1.5 crore) also received 180 IFA Red tablets during antenatal care. Moreover, 0.9 crore lactating women received 180 IFA Red tablets during postnatal care. (Source - Azadi ka Amrit Mahotsav)

Europe is expected to grow at a considerable rate in the oral iron supplements market in the upcoming period. The rising prevalence of iron deficiency anemia, due to the increasing demand for sports participation and the growing number of surgeries, governs market growth. The European Commission reported that 1.55 million people were employed in the sports sector in the EU in 2023, representing 0.76% of the total employment. (Source - eurostat)

HUS is the largest provider of specialized healthcare in Finland, with 27,000 top professionals treating nearly 700,000 patients annually. In 2024, a total of 91,572 surgeries were performed at HUS, an increase of 4% from 2023. The amount of operating room hours at HUS totaled 204,496, and the number of neurosurgeries increased by as much as 32%. Nôgel organics, Hankintatukku Oy, and Ruohonjuuri are the major manufacturers and distributors of oral iron supplements in Finland.

Julian Oliver, Commercial Lead General Medicines and Business Operations, Kye Pharmaceuticals, commented that the availability of ACCRUFeR across Canada provides patients and physicians with a valuable treatment option between OTC iron supplements and more invasive IV iron supplements. The company is proud to bring an evidence-based oral iron therapy to demonstrate long-term efficacy and safety in placebo-controlled and active comparator clinical trials. (Source - CISION)

By Product

By Application

By Form

By Distribution Channel

By Region

January 2026

January 2026

November 2025

November 2025