February 2026

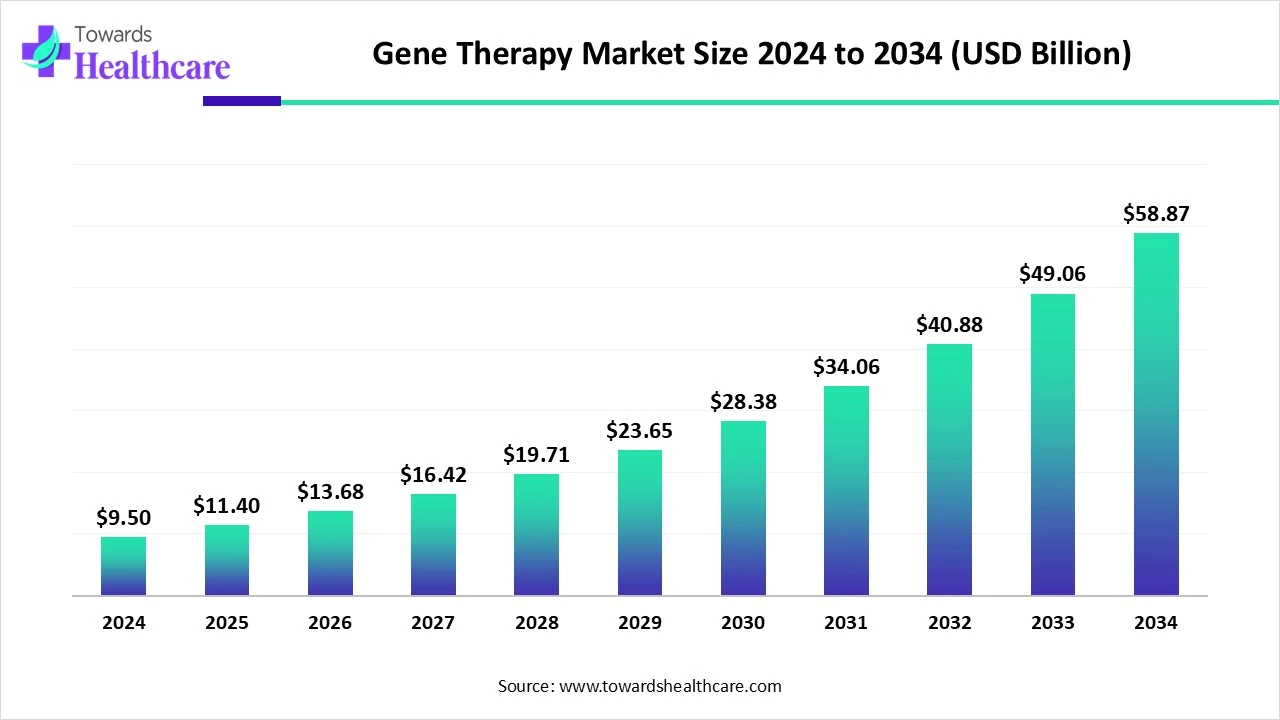

The global gene therapy market size is calculated at USD 9.5 in 2024, grew to USD 11.4 billion in 2025, and is projected to reach around USD 58.87 billion by 2034. The market is expanding at a CAGR of 20% between 2025 and 2034.

Tremendous financing from both public and private entities has allowed gene therapy research to make tremendous strides in recent years. These investors want to spur market expansion by expediting the approval of innovative gene therapies. For instance, the adoption of viral vectors, which are well known for their low toxicity and high immunological efficacy, has indicated a shift toward safer, more efficient treatment alternatives.

Ongoing technological advancements and accelerated regulatory processes are expected to mitigate these challenges and ensure consistent market growth. Small and large market players are collaborating to spur innovation and save costs by combining resources and expertise.

| Metric | Details |

| Market Size in 2025 | USD 11.4 Billion |

| Projected Market Size in 2034 | USD 58.87 Billion |

| CAGR (2025 - 2034) | 20% |

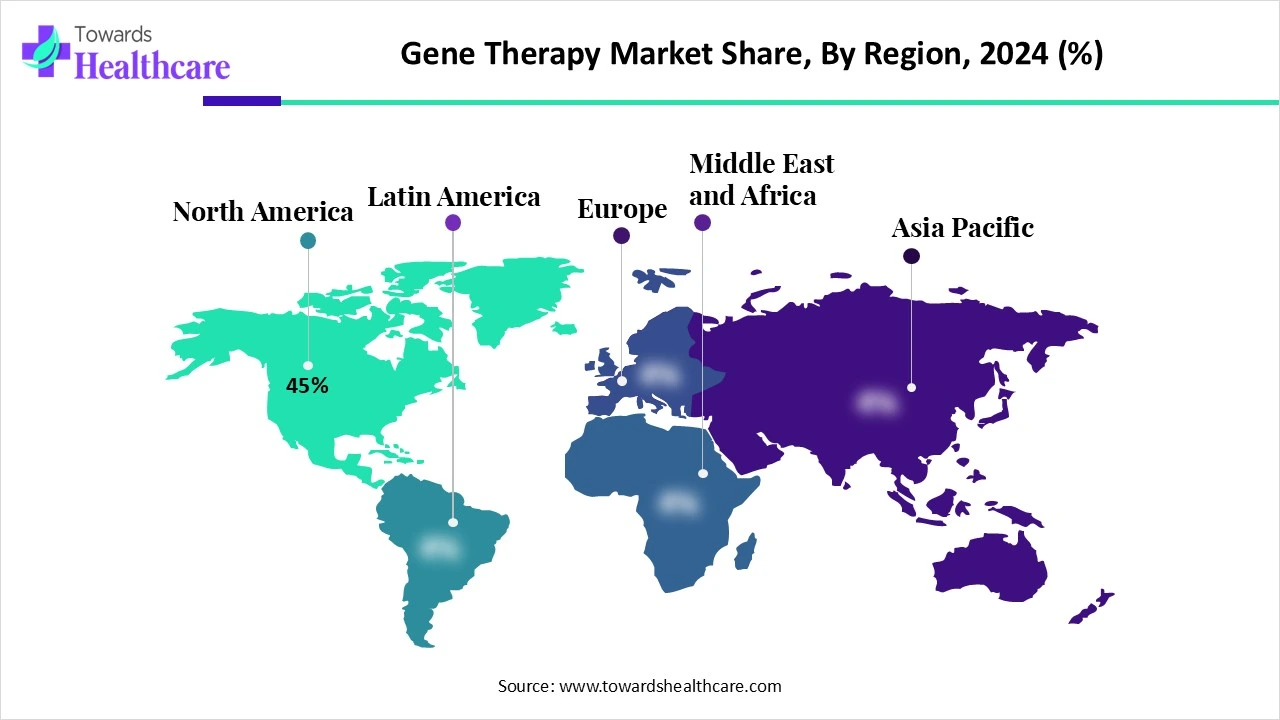

| Leading Region | North America share by 45% |

| Market Segmentation | By Therapy Type, By Vector Type, By Gene Type, By Disease Indication, By Delivery Method, By End User, By Region |

| Top Key Players | Amgen Inc., Novartis AG, F. Hoffmann-La Roche, Gilead Sciences, Inc., bluebird bio, Inc., Bristol-Myers Squibb Company, Legend Biotech., BioMarin., uniQure N.V., Merck & Co., Sarepta Therapeutics, Inc., Krystal Biotech, Inc., CRISPR Therapeutics. |

The gene therapy market refers to the global industry involved in the development, manufacturing, and commercialization of gene therapies. Gene therapy is a cutting-edge biomedical approach that involves modifying or manipulating a person's genes to treat or prevent diseases. This can include replacing, inactivating, or introducing genes into a patient’s cells to correct genetic disorders, cancers, or other diseases caused by genetic abnormalities. The market encompasses various therapeutic modalities, delivery technologies, treatment areas, and end users, with significant research and clinical advancements driving growth.

The different government initiatives for gene therapy include:

Advanced Therapies Expected to Reach the Market in 2025 Across Oncology, Rare Diseases and Gene Therapy

| Therapy Name | Generic / Scientific Name | Year | Indication | Country | Company |

| Qartemi | varnimcabtagene autoleucel | 2025 | B-cell Non-Hodgkin’s Lymphoma (B-NHL) | India | Immuneel Therapeutics |

| Encelto | revakinagene taroretcel | 2025 | Macular telangiectasia type 2 (MacTel) | US | Neurotech |

| BBM-H901 | dalnacogene ponparvovec | 2025 | Hemophilia B | China | Belief BioMed |

| Zevaskyn | prademagene zamikeracel | 2025 | Recessive dystrophic epidermolysis bullosa (RDEB) | US | Abeona Therapeutics |

Qartemi, developed by Immuneel Therapeutics in India, introduces varnimcabtagene autoleucel as a CAR-T therapy for B-cell Non-Hodgkin’s Lymphoma. This therapy strengthens India’s position in advanced oncology care by expanding patient access to personalized cell-based treatments. Encelto, from Neurotech in the US, uses revakinagene taroretcel to address Macular Telangiectasia type 2. This therapy directly targets retinal degeneration and represents a major step forward in long-term ocular disease management through gene-based intervention.

BBM-H901, created by Belief BioMed in China, delivers dalnacogene ponparvovec for Hemophilia B. This gene therapy aims to correct the underlying genetic cause of the disease, reducing dependence on lifelong factor replacement and improving patient quality of life. Zevaskyn, developed by Abeona Therapeutics in the US, applies prademagene zamikeracel to treat recessive dystrophic epidermolysis bullosa. This therapy directly repairs skin integrity at the genetic level, offering hope for patients living with a severe and painful rare disorder.

Together, these therapies demonstrate how global biopharmaceutical companies actively push the boundaries of innovation, accelerate regulatory progress, and reshape treatment standards across oncology, ophthalmology, and rare genetic diseases.

Artificial Intelligence (AI) has fundamentally altered the interpretation and assessment of data in biomedical research. One of the main ways that AI is helping to create gene therapy is by evaluating big genomic databases, simulation results, and experimental outcomes. This skill yields insights that would need a lot more time to comprehend by human researchers. Convolutional neural networks (CNNs) and recurrent neural networks (RNNs), two advanced deep learning (DL) structures, as well as more traditional machine learning methods like support vector machines, random forests, and Bayesian learning, are just a few examples of the many applications of AI algorithms.

Growing Research for Developing Novel Therapies

Ongoing research and development (R&D) initiatives are expected to have a substantial influence on gene testing technology sales. Many companies are looking to construct a gene therapy platform with an emphasis on building a transformational portfolio through internal faculty and strengthening those talents through strategic collaborations, R&D expansion, potential licensing, and merger and acquisition activities.

High Cost

With list prices ranging from USD 373,000 to USD 4.25 million, single-dose cures put a strain on payer budgets and challenge the willingness of society to pay for curative treatments. According to providers, the primary barriers to access are prior authorization, travel distance, and deficiencies in social support. Although they still require sophisticated data exchange and long-term follow-up infrastructure, innovative compensation solutions, including outcome-based contracts, amortization models, and warranties, are gaining popularity.

Growing Product Pipelines & Investments

The increasing number of research initiatives and innovations in the field is expected to have a major influence on the market. The growing funding and expenditures in gene therapy research and development (R&D) are supporting the market expansion. Because of its enormous potential to address unmet medical needs and provide long-term benefits, gene therapies are attracting a lot of attention. The prognosis for the gene therapy industry is improving as a result of big pharmaceutical corporations creating their own gene therapy departments or purchasing gene therapy startups to speed up research.

By therapy type, the in vivo gene therapy segment dominated the gene therapy market in 2024. Numerous fields of study have demonstrated the effectiveness of gene therapy delivered in vivo. A few of the gene treatments that are currently authorized convey genetic material in vivo. As researchers continue to improve gene delivery techniques, targeted in vivo gene therapy will develop further.

By therapy type, the ex vivo gene therapy segment is expected to grow at the fastest CAGR during the forecast period. Professionals can provide a genetically modified cellular treatment that specifically addresses the issue that needs to be fixed by merging cutting-edge technology with ex vivo gene therapy processes. New studies are exploring the application of these medicines for even more diseases and conditions that affect children and adults.

By vector type, the viral vectors segment held the largest share of the market in 2024. Viral vector applications for gene therapy have seen a promising new beginning in recent years. Viral vector-based therapy is currently at the forefront of modern medicine because of significant developments in vector engineering, delivery, and safety. Numerous diseases, such as infectious diseases, cardiovascular, muscular, hematologic, ophthalmologic, metabolic, and malignancies, have been treated by viral vectors.

By vector type, the non-viral vectors segment is estimated to grow at the highest CAGR during the predicted time frame. Non-viral vectors offer a substantial safety advantage over viral techniques because to their shown reduced pathogenicity, low cost, and ease of production. The primary advantage of using non-viral vectors is biosafety. Non-viral vectors have garnered a lot of attention due to their lower immunotoxicity.

By gene type, the deficiency genes segment dominated the market in 2024. In the U.S., rare diseases impact 15.5 million individuals and result in annual medical costs of USD 997 billion. Although the incidence of rare diseases is unclear globally due to diagnostic challenges, estimates place the number at over 100 million. Gene therapy is one innovative way to treat primary immune deficiencies (PIDs). For those who have genetic mutations that lead to sickness, gene therapy may be a transformative option.

By gene type, the tumor suppressor genes segment is anticipated to grow at the fastest CAGR during 2025-2034. The number of possible tumor suppressors that might be used in clinical settings to stop the spread of cancer cells is growing. Tumor suppressor gene therapy is one possible cancer treatment strategy that aims to restore or enhance the function of tumor suppressor genes in cancer cells. The goals of this treatment are to limit the spread of cancer, induce apoptosis (cell death), and inhibit tumor formation.

By disease indication, the cancer segment held the largest share of the gene therapy market in 2024. Gene therapy is a broad field that provides a number of innovative treatments that are likely to significantly lower the number of deaths from cancer. In therapeutic trials, gene therapy has been shown to dramatically increase the life expectancy and survival rate of cancer patients. Additionally, a number of innovative therapeutic strategies, including zinc finger nucleases (ZFNs), transcription activator-like effector nucleases (TALENs), clustered regularly interspaced short palindromic repeats/CRISPR-associated protein 9 (CRISPR/Cas9), etc., have been developed to complement conventional cancer treatments that directly modify DNA as gene transfer technologies have progressed.

By disease indication, the genetic disorders segment is estimated to grow at the highest rate during the forecast period. Gene therapy may be used to treat a wide range of acquired and genetic human illnesses. The number of completed, ongoing, or pending gene therapy trials in the world is now above 600. In the U.S. and Europe, the majority of them are phase I safety studies for cancer treatment, with those for vascular, infectious, and monogenetic illnesses coming next.

By delivery method, the intravenous (IV) segment dominated the gene therapy market in 2024. IV medications provide several benefits and have been demonstrated to be effective in a number of clinical situations and to meet a wide range of therapeutic needs. This kind of administration is particularly helpful for providing timely, controlled treatment. The intravenous route is the fastest way to deliver medication and refill fluids because it delivers pharmaceuticals directly into the circulatory system, where they are quickly distributed throughout the body.

By delivery method, the intrathecal / Intraocular segment is anticipated to grow at the highest CAGR during the upcoming years. Intraocular and intrathecal injections offer targeted gene therapy delivery, minimizing systemic side effects and optimizing therapeutic results. Intrathecal administration, or injection into the cerebrospinal fluid, is an effective treatment for neurological illnesses because it circumvents the blood-brain barrier. Intraocular delivery, whether by injections or implants, enables the restricted treatment of eye diseases by taking advantage of the immune-privileged location and segmented structure of the eye.

By end-user, the hospitals segment led the gene therapy market with a revenue share of ~65% in 2024. The success of gene therapy can be greatly impacted by selecting the appropriate facility and specialist. Selecting the appropriate hospital is essential for complete care, in addition to identifying the best expert. As this cutting-edge medical field gathers traction, several hospitals across the globe have established themselves as leaders in gene therapy research and implementation.

By end-user, the specialty clinics segment is anticipated to be the fastest growing during the forecast period. Multispecialty clinics aim to satisfy patient requests by using a single practice. A multispecialty clinic's focus on offering top-notch medical care is very beneficial to patients. One's overall medical expenses might be significantly decreased by using multispecialty clinics.

North America dominated the gene therapy market share by 45% in 2024. Growing cancer and rare disease occurrences and prevalence, rising product approvals for gene therapy, and favorable government funding for gene therapy are driving the North American market. Additionally, patients now have greater access to gene treatments due to insurance coverage and payments. Additional factors driving market expansion include rising healthcare costs and R&D investments.

The U.S. is growing significantly due to the growing cancer and rare disease cases. In the U.S., cancer is the second leading cause of death overall and the leading cause of death for people under 85. In 2025, there will likely be 618,120 cancer-related fatalities and 2,041,910 new cancer cases in the U.S. In the U.S., rare diseases are estimated to affect 25 to 30 million people, making up a significant portion of the population.

The Canadian government is working hard to boost the nation's biomanufacturing and life sciences sectors in order to deliver safe and effective next-generation treatments. For instance, in March 2025, the Canadian federal government announced its support for the manufacture of gene and cell therapies enabled by sophisticated robotics and artificial intelligence (AI). OmniaBio's project will focus on advanced treatments for chronic diseases, including diabetes, autoimmune diseases, cancer, and neurological and cardiovascular conditions.

Asia Pacific is estimated to host the fastest-growing gene therapy market during the forecast period. The need for gene therapy is rising in the Asia Pacific region due to the rise in a variety of chronic disorders. At the same time, this is influenced by the expanding healthcare sector. Companies and organizations are also focusing on developing new gene therapies to address the increasing number of inherited diseases. As a result, industrial collaboration is increasing. Similarly, utilizing state-of-the-art technology facilitates their development. Additionally, the government is helping to lower the cost of these therapies.

The fast advancement of gene therapy in China can be attributed to significant investments in research and development. Chinese researchers are at the forefront of treating genetic diseases, including hemophilia, thalassemia, and sickle cell anemia, because of cutting-edge tools like CRISPR-Cas9. Currently, gene treatment costs about $250,000 USD in China.

In India, 80 million people suffer from rare diseases, 80 percent of which are inherited. Due to innovations like the Genome India Project, India is well-positioned to take the lead in customized gene treatment. Extending the successes of CAR-T cell therapy and gene therapy for hemophilia. For efficient implementation, collaboration among the government, healthcare providers, researchers, and industry is essential, as is a comprehensive program that addresses costs, regulations, infrastructure, and public opinion.

Europe is expected to grow significantly in the gene therapy market during the forecast period. The European Union's 'Horizon Europe Mission on Cancer,' which was launched in September 2023 to accelerate research and innovation in cancer therapies, is one initiative that supports the region's progress. The nation is able to establish itself in the gene therapy business because of government initiatives that foster innovation.

The German government aims to increase Germany's appeal as a center for pharmaceutical and healthcare innovation by putting in place a number of focused initiatives, including the National GCT Strategy. Following the German government's recognition of gene and cell therapies as a critical strategic industry, new laws and policies should be rapidly and firmly enacted to execute the National GCT Strategy.

The UK government shared pledges for UK-wide implementation from 2022 to 2025 as part of its ambitious goal to ensure genomics research and healthcare can flourish nationwide. £26 million for a state-of-the-art cancer effort, £105 million for a ground-breaking research project, £22 million for Genomics England to address health inequities in genetic medicine, and up to £25 million in funding led by the Medical Research Council are among them.

In September 2024, according to Ryan Confer, President and Chief Executive Officer at Genprex, we think our gene therapy strategy would position NewCo as an innovator in new diabetic medicines, potentially addressing the whole diabetes market," Confer added. When insulin was initially developed more than a century ago to treat people with type 1 diabetes, it marked the most important breakthrough in the treatment of the disease. By eliminating the requirement for GLP-1 therapies in type 2 diabetes and the daily hassle of insulin replacement therapy and blood glucose monitoring, we think our treatment has the potential to upend the diabetes business. (Source - Genprex)

Gene therapy research refers to developing novel therapeutics for the prevention, diagnosis, and treatment of genetic, rare, and other chronic disorders. The latest research activities also focus on the development of novel delivery systems.

Key Players: CRISPR Therapeutics, Novartis AG, and Kriya Therapeutics.

Gene therapies are assessed for their safety and efficacy on humans through clinical trials and are subsequently approved by regulatory agencies of respective countries.

Key Players: Allucent, Capsida Biotherapeutics, Inc., and Expression Therapeutics LLC.

Patient support & services involve offering comprehensive programs that help patients receive advanced therapeutics at the right time during their treatment.

By Therapy Type

By Vector Type

By Gene Type

By Disease Indication

By Delivery Method

By End User

By Region

February 2026

February 2026

February 2026

February 2026