January 2026

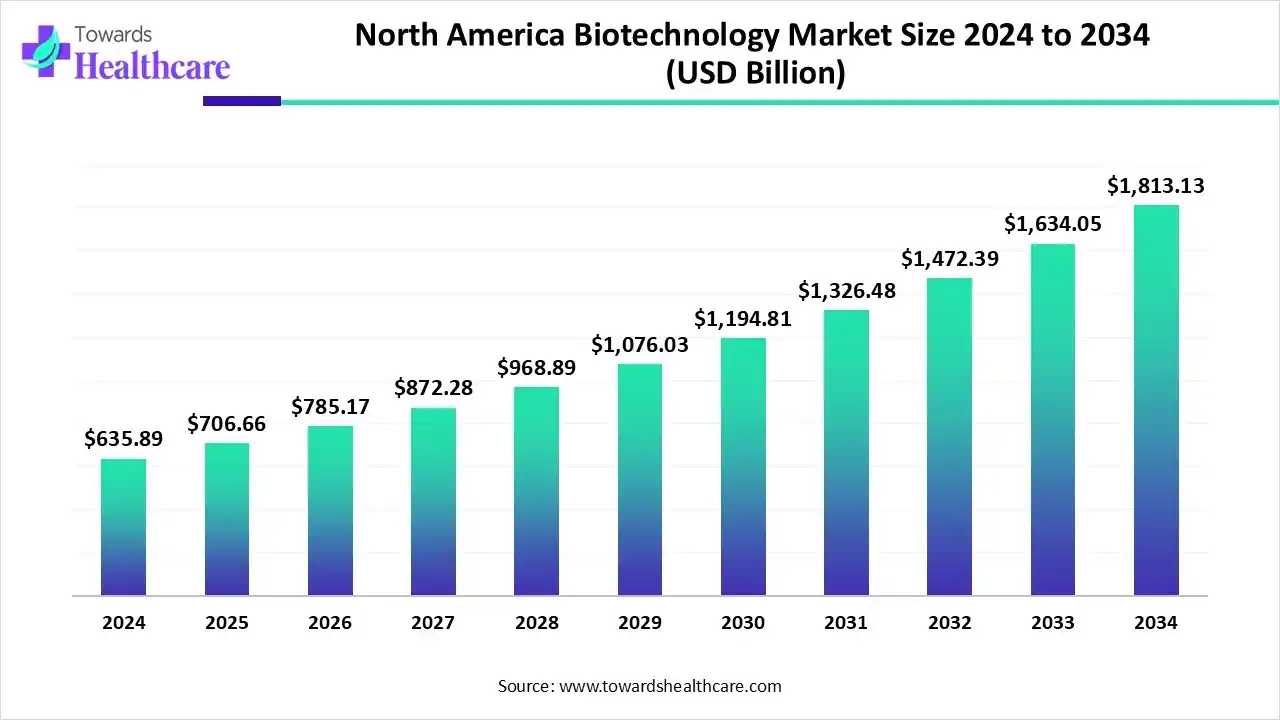

The North America biotechnology market size is calculated at USD 635.89 billion in 2024, grew to USD 706.66 billion in 2025, and is projected to reach around USD 1813.13 billion by 2034. The market is expanding at a CAGR of 11.80% between 2025 and 2034.

The North America biotechnology market is primarily driven by the rising prevalence of chronic disorders and the growing demand for personalized medicines. Government organizations create awareness among the general public about the screening and early diagnosis of chronic disorders, enabling healthcare professionals to provide early intervention. Artificial intelligence (AI) transforms the biotech industry by accelerating processes and enhancing efficiency and accuracy. Technological innovations drive the future of the biotechnology market.

| Table | Scope |

| Market Size in 2025 | USD 706.66 Billion |

| Projected Market Size in 2034 | USD 1813.13 Billion |

| CAGR (2025 - 2034) | 11.80% |

| Market Segmentation | By Technology/Platform, By Application, By End-User, By Service Type, By Distribution Channel, By Geography, By Geography |

| Top Key Players | Moderna, Inc., Illumina, Inc., Thermo Fisher Scientific, Lonza Group, Pfizer Biotech, CRISPR Therapeutics, Bluebird Bio, Sangamo Therapeutics, Danaher Corporation, Charles River Laboratories |

The North America biotechnology market is experiencing robust growth, driven by innovation in genomics, proteomics, regenerative medicine, and industrial biotech, as well as strong funding, regulatory support, and robust infrastructure in the U.S. and Canada. The market includes biotechnology products, services, and technologies, such as biopharmaceuticals, gene and cell therapies, molecular diagnostics, bioinformatics, and research tools. It spans R&D, clinical development, manufacturing, and commercialization.

AI plays a crucial role in the biotech sector by revolutionizing research, clinical development, manufacturing, and treatment. It accelerates biotech processes, saving time and costs for researchers and manufacturers. AI and machine learning (ML) algorithms analyze vast amounts of data and provide solutions to complex problems. They can transform drug discovery and development into cheaper, quicker, and more efficient processes. Additionally, AI and ML ensure the timely delivery of biotech products to the right patient.

Insilico Medicine, an AI-based biotech company, offers a flagship AI platform, Pharma.AI, to facilitate target identification, molecular generation, and predictive analytics. The company focuses on developing medicines for aging and age-related disorders.

The Government Initiatives for the Biotechnology Industry in North America Include:

The U.S. government recently launched the “National Biotechnology Initiative Act of 2025” to advance biotech for the U.S. national security, economic productivity, and competitiveness. The bill would establish a National Biotechnology Coordination Office to lead and coordinate federal biotech efforts.

The Canadian government’s “Canadian Genomics Strategy” aims to advance commercialization and adoption of genomics applications, strengthen leadership of the genomic enterprise to foster collaboration and improve data accessibility, and develop top-tier talent in Canada’s genomics sector.

| Month, Year | Investor | Amount | Company | Purpose |

| July, 2025 | Coriolis Pharma | $10 million | - | To build a development and manufacturing facility in Morrisville |

| January, 2024 | Dimension | $115 million | Aspect Biosystems | To advance multiple bioprinted tissue therapeutics for people living with serious metabolic and endocrine diseases |

| May, 2024 | Samsung Life Science | $54 million | Latus Bio | To promote novel gene therapy development for CNS disorders, using its proprietary technologies |

| May, 2024 | Canada’s Immuno-Engineering and Biomanufacturing Hub | $140 million | University of British Columbia | 4 projects: 1) Advanced Therapeutics Manufacturing Facility; 2) AVENGER; 3) PROGENITOR; 4) Bridge Research Consortium |

By technology/platform, the monoclonal antibodies & biologics segment held a dominant presence in the market in 2024, due to the ability of monoclonal antibodies (mAbs) to diagnose and treat a wide range of disorders. mAbs provide personalized treatment to patients as they have high specificity and affinity for the antigen. They are more precise than other treatments, improving effectiveness and reducing side effects. The U.S. Food and Drug Administration (FDA) approved 13 mAbs in 2024, accounting for over 25% of all drugs approved.

By technology/platform, the gene therapy & gene editing segment is expected to grow at the fastest CAGR in the market during the forecast period. Advances in genomic technologies, such as CRISPR/Cas9 technology, enable researchers to develop innovative gene therapy products. Gene therapy cures a disease from its root cause, preventing its recurrence. The demand for gene therapy is increasing as it can treat complex disorders that are difficult to treat with conventional small-molecule drugs.

By application, the therapeutics segment held the largest revenue share of the market in 2024, due to the need for personalized treatment and the rising prevalence of chronic disorders. Major players develop novel, innovative therapeutics to treat a wide range of disorders, such as oncology, rare diseases, and immunology. Therapeutics improve the quality of life of individuals by alleviating symptoms and combating a disease.

By application, the diagnostics segment is expected to grow with the highest CAGR in the market during the studied years. Government organizations launch initiatives to promote early diagnosis and screening of chronic disorders. This allows healthcare professionals to detect a disease at an initial stage and provide early intervention. The increasing use of advanced diagnostics, such as point-of-care diagnostics and digital diagnostics, boosts the segment’s growth.

By end-user, the pharmaceutical & biotechnology companies segment contributed the biggest revenue share of the market in 2024, due to suitable capital investment and increasing competition. Pharma & biotech companies adopt advanced technologies to transform their research and manufacturing activities. The increasing number of startups potentiates competition among pharma & biotech companies. This encourages them to develop innovative products, strengthening their market position.

By end-user, the CROs/CMOs segment is expected to expand rapidly in the market in the coming years. Large companies outsource their research and manufacturing activities to focus on their core competencies, such as product sales and marketing. CROs/CMOs have a favorable infrastructure and skilled professionals. Skilled professionals provide relevant expertise for complex problems to companies. Small companies lack appropriate infrastructure, necessitating them to collaborate with CROs/CMOs.

By service type, the research and development services segment accounted for the highest revenue share of the market in 2024, due to the growing need for personalized medicines and novel diagnostics. R&D services provide tools to make progress faster during the development of a new drug or a diagnostic assay. Some pharma & biotech companies have limited financial and technological resources to perform all projects in-house. Hence, R&D services offer tailored solutions and optimize research processes.

By service type, the bioinformatics & data analytics services segment is expected to witness the fastest growth in the market over the forecast period. The increasing use of AI/ML technologies in research activities enables researchers to develop more effective products. Bioinformatics analyzes large datasets of compounds and predicts pharmacokinetics and pharmacodynamic properties of potential drug candidates. Data analytics simplifies the researcher’s task in analyzing complex data.

By distribution channel, the direct sales segment led the market in 2024, due to the availability of affordable biotech products. Direct sales allow manufacturers to sell their proprietary products directly to customers or healthcare organizations. This eliminates the interference of a third-party organization. Direct sales can lead to the timely delivery at more affordable rates.

By distribution channel, the online/e-commerce platforms segment is expected to show the fastest growth over the forecast period. The burgeoning e-commerce sector and advancements in connectivity technologies augment the segment’s growth. Online platforms allow patients and healthcare professionals to order products from a wide range of options. They offer numerous benefits, such as free home delivery, special discounts to attract customers, and virtual consultations.

By regulatory compliance, the FDA-approved products & services segment held a major revenue share of the market in 2024. The U.S. FDA is a major regulatory agency that approves biological products, including therapeutics, diagnostics, and medical devices. It is responsible for protecting public health by ensuring the safety and effectiveness of medications, food, cosmetics, medical devices, and other products. The FDA also provides accurate, science-based health information to the public.

By regulatory compliance, the CLIA/ISO certified labs & services segment is expected to show the highest growth in the upcoming years. The Clinical Laboratory Improvement Amendments (CLIA) are a laboratory regulation that provides the authority for certification and oversight of clinical laboratories and lab testing. CLIA certification is essential before testing human samples. CLIA-certified labs ensure high-quality testing of samples, increasing customers’ trust.

The major growth factors for the market include the rising prevalence of chronic disorders, increasing investments, and the rapidly expanding biotech sector. Biotechnology is a burgeoning field in North America, driven by innovation in biopharmaceuticals, personalized medicines, and advancements in genomics and proteomics. The increasing number of startups and the growing healthcare expenditure contribute to market growth. North America has a strong presence of pharma and biotech companies that deliver advanced biotech products.

The U.S. dominated the market in 2024. Key players, such as Amgen, Inc., Charles River Laboratories, Thermo Fisher Scientific, and Pfizer, are the major contributors to the market in the U.S. The federal government is at the forefront of promoting domestic manufacturing of biological products, reducing reliance on imports. The National Science Foundation (NSF) invests in biotech to accelerate scientific discoveries. The President’s FY 2025 budget for NSF was $10.183 billion, an increase of 3.1% from the FY 2023 budget.

Canada is projected to host the fastest-growing North America biotechnology market in the coming years. It is home to over 2,000 life science firms, including local and foreign companies. The Canadian Public Health Association (CPHA) reported that approximately 44% of Canadians have at least one chronic disorder, accounting for 67% of all deaths. Health Canada approves drugs, biologics, and medical devices for Canadians. As of March 2025, a total of 67 biosimilars have been approved by Health Canada, including human growth hormone, insulin, and monoclonal antibodies.

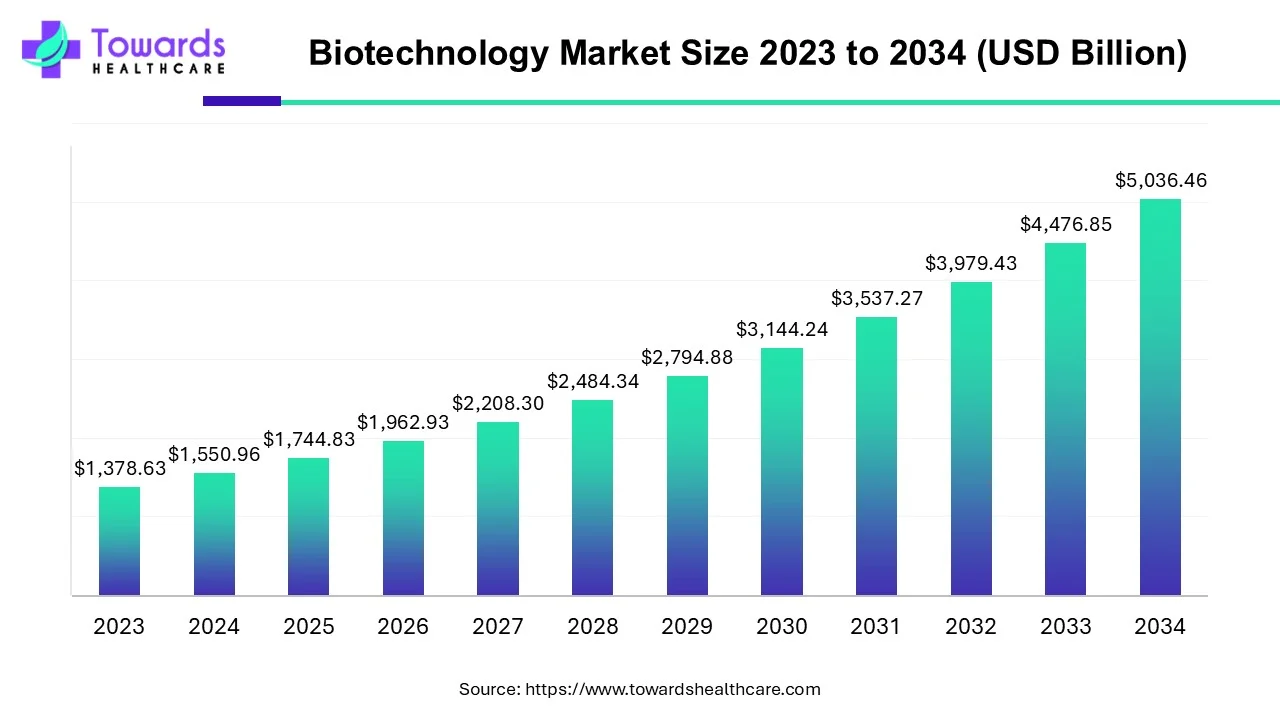

The biotechnology market is projected to grow from USD 1,744.83 billion in 2025 to USD 5,036.46 billion by 2034, representing a CAGR of 12.5% over the forecast period, driven by innovation and technological advancements in the industry.

R&D refers to the exploration and manipulation of biological systems and living organisms to create novel solutions.

Key Players: Ionis Pharmaceuticals, Abbott Laboratories, and Illumina.

Regulatory agencies provide approval to initiate human trials based on the results from preclinical pharmacological and animal toxicity studies. The results of human trials are the basis for product approval.

Key Players: Parexel, IQVIA, Syneos Health, and Charles River Laboratories.

Patient support & services encompass programs that help patients initiate and continue biological therapies. Healthcare professionals train individuals about the appropriate dose and use of biotech products.

According to our analysis, the biotechnology sector in North American countries has a promising future, driven by technological innovations, the strong presence of key players, and expanding biomanufacturing capabilities. The shifting trend towards personalized medicines and a focus on domestic manufacturing further opens new avenues for the sector. Venture capital investments and the increasing clinical trials present opportunities for market growth. The growing awareness among end-users about environmental sustainability positively impacts the market.

By Technology/Platform

By Application

By End-User

By Service Type

By Distribution Channel

By Geography

By Geography

January 2026

January 2026

January 2026

December 2025