February 2026

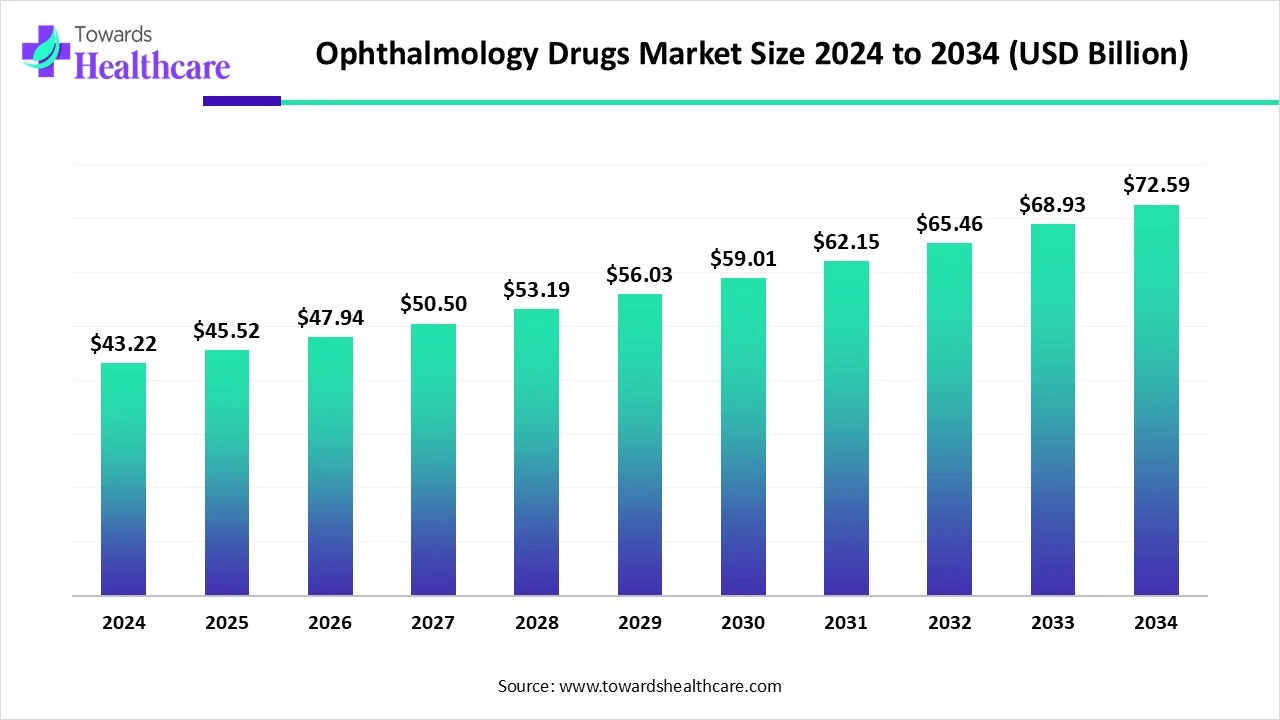

The global ophthalmology drugs market size is calculated at US$ 45.52 billion in 2025, grew to US$ 47.94 billion in 2026, and is projected to reach around US$ 76.51 billion by 2035. The market is expanding at a CAGR of 5.33% between 2025 and 2034.

It is predicted that the number of persons with eye issues would rise as the senior population grows. The danger of developing a number of eye disorders is greatly increased by the expanding adult population and the rising incidence of diseases like diabetes, which fuels market expansion. The market growth stage is high, and the speed of the market expansion is rising. Because of the quick developments in medication delivery, the ophthalmology drugs market is very innovative. One of the main factors propelling the market is the development of gene treatments as a powerful medication delivery system.

The ophthalmology drugs market comprises prescription and OTC pharmaceutical products, biologics, and advanced therapies used to prevent, treat, or manage eye diseases and visual disorders. It includes treatments for retinal diseases (AMD, DME, RVO), glaucoma, dry eye, infectious eye diseases, allergic conjunctivitis, ocular inflammation, and inherited retinal disorders. Growth is driven by an aging population, rising prevalence of diabetes and retinal disease, advances in biologics and gene/cell therapies, increasing screening programs, and growing access to ophthalmic care in emerging markets.

Rising Efforts from Key Market Players: The key market players are taking efforts to provide ophthalmology drugs. Various companies are collaborating with each other to develop high-quality drugs. Apart from this, a lot of investments are also being made in drug development.

For instance,

There are revolutionary prospects to address the inherent difficulties and problems of developing tailored therapeutics for eye illnesses by using artificial intelligence (AI) into ophthalmic drug research and development. AI's capacity to handle enormous datasets can make it easier to find new medication candidates, enhance efficacy and safety forecasts, and expedite the drug development process. Applications might include improving predictive toxicity, chemical screening, and target identification.

Rising Eye Diseases are Driving the Ophthalmology Drugs Market

Refractive diseases will affect more than 21.12 million women and 19.14 million men globally by 2040. Refraction diseases are predicted to cause visual loss in 1.8 billion persons worldwide by 2050. More than 700 million people are expected to be blind or suffer from moderate to severe visual impairment (MSVI) by 2050, mostly as a result of the world's population ageing and expanding. An estimated 4.758 billion people will have myopia globally by 2050, with 938 million of those cases being extreme myopia.

High Cost of Ophthalmology Drugs

Finding a cost-effective way to assist patients in obtaining the appropriate drugs for their conditions has proven to be a difficulty for physicians. One significant barrier is that eye care providers are unaware of the true out-of-pocket expense of the prescription they are prescribing to their patients. Following an assessment, doctors may be presented with an option between two drugs that are equally effective for a certain ailment, but they have no knowledge of which will be more cost-effective for the patient. Furthermore, even with a discount, certain medications are still very costly for a patient.

Development of New Drug Delivery Systems

The development of new drug delivery systems can increase the growth of the ophthalmology drugs market during the forecast period. In order to make dosing easier and more convenient for patients with glaucoma, dry eye, and other conditions, scientists in the industry are creating a novel, long-lasting, non-invasive medication delivery method. It then highlights some typical studies and suggests improvements in ocular medication delivery mechanisms, particularly those based on nanotechnology. Nanocarriers have many advantages over traditional drug administration, such as the ability to target and deliver genes, overcome ocular barriers, increase transcorneal permeability, prolong drug residence time, decrease drug degradation, decrease dosing frequency, improve patient compliance, and achieve sustained/controlled release.

| Table | Scope |

| Market Size in 2026 | USD 47.95 Billion |

| Projected Market Size in 2035 | USD 76.51 Billion |

| CAGR (2026 - 2035) | 5.33% |

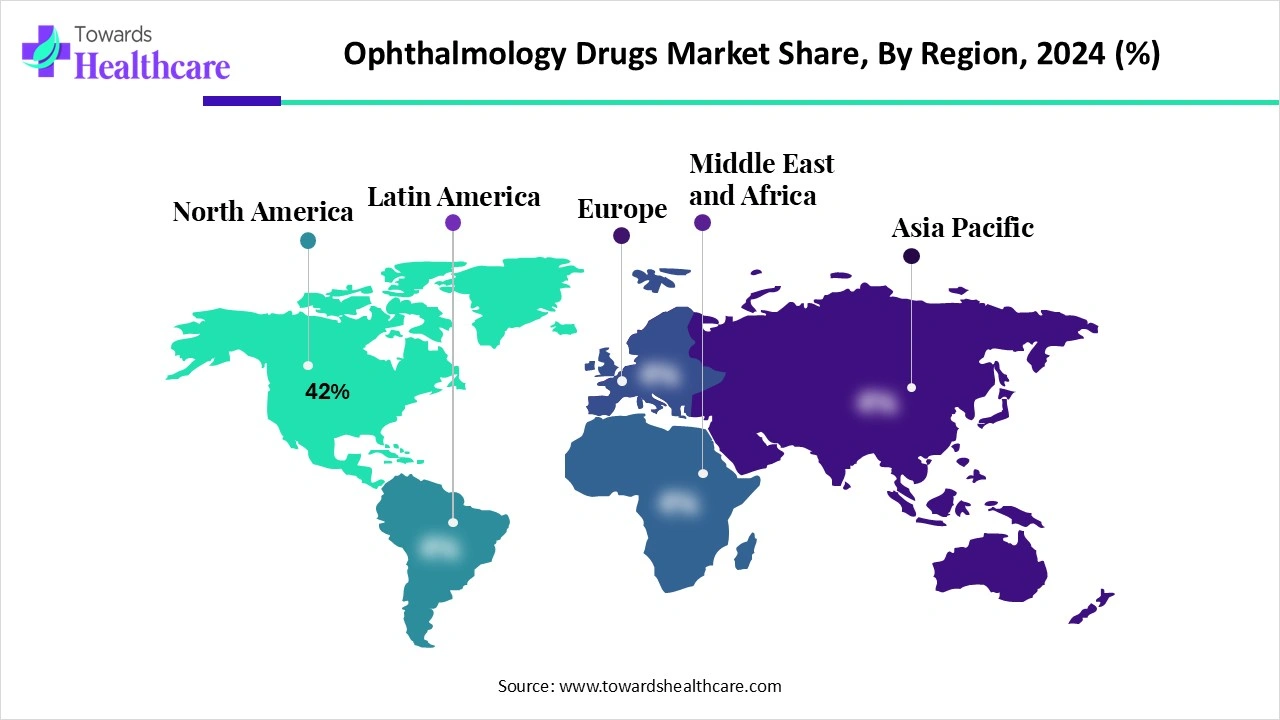

| Leading Region | North America by 42% |

| Historical Data | 2020 - 2023 |

| Base Year | 2025 |

| Forecast Period | 2026 - 2035 |

| Measurable Values | USD Millions/Units/Volume |

| Market Segmentation | By Drug Class, By Indication, By Molecule Type / Modality, By Route of Administration, By End User / Channel, By Region |

| Top Key Players | Regeneron Pharmaceuticals, Genentech/Roche, Novartis, Bayer, Bausch + Lomb (Bausch Health), Alcon, AbbVie/Allergan, Santen Pharmaceutical, Apellis Pharmaceuticals, Iveric Bio/Zimura, Oxurion, Kodiak Sciences, Clearside Biomedical, Regenxbio/Gyroscope Therapeutics, Tarsus Pharmaceuticals, Ophthotech / Adverum Biotechnologies, Aerie Pharmaceuticals, Allakos/Harrow Health, Apellis/Iveric/GenSight/MeiraGTx, Generic/Biosimilar & Contract Manufacturers |

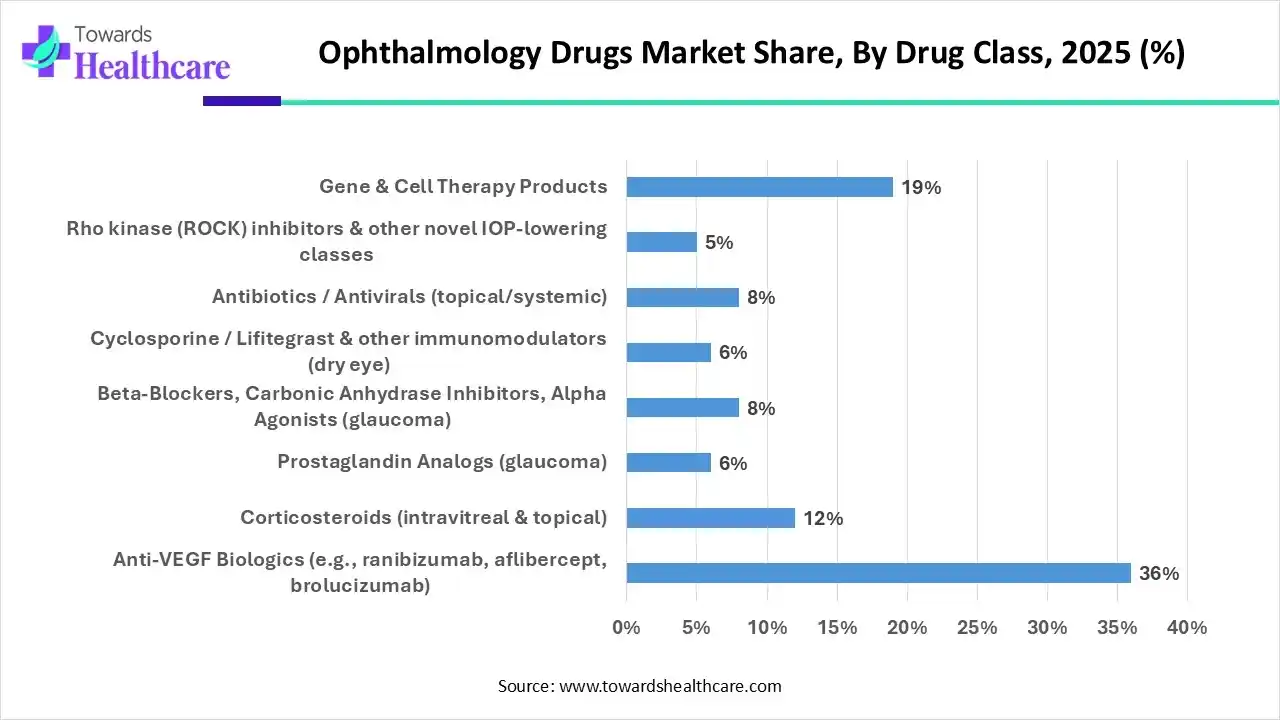

Which Drug Class Segment Dominated the Market in 2025?

By drug class, the anti-VEGF biologics segment was dominant in the ophthalmology drugs market by 36% in 2025. The introduction of intravitreally injected biologic drugs (biologics) acting against vascular endothelial growth factor (VEGF) dramatically improved the clinical results of patients with prevalent VEGF-driven retinal disorders. Since 2022, anti-VEGF biosimilars have begun making their way into the U.S. ophthalmology market.

By drug class, the corticosteroids segment is estimated to grow at the highest CAGR during the upcoming period. When it comes to treating ocular inflammation, such as keratitis, conjunctivitis, scleritis, and uveitis, corticosteroids are crucial. Additionally, corticosteroids work well for postoperative inflammation, retinal vein blockage, and diabetic macular edoema. The primary method of delivering ophthalmic corticosteroids, particularly for anterior ocular disorders, is topical administration.

Why the Retinal Disorders Segment Dominated the Market in 2025?

By indication, the retinal disorders segment captured the major share of the ophthalmology drugs market by 34% in 2025. Over 410 million individuals worldwide are afflicted with retinal diseases. The most prevalent retinal illnesses are age-related macular degeneration (AMD) and diabetic eye disorders, which together account for more than 40% of all retinal disease cases in the United States. They are the main causes of blindness or vision loss and are become increasingly common as the population ages and the prevalence of diabetes rises.

By indication, the dry eye disease segment is anticipated to achieve the highest growth during the forecast period. Because of the expanding use of visual display terminals (VDTs), such as computers, cellphones, and tablets, DED is becoming a major global public health problem. DED is quite common in many populations across the world; estimates vary from 5% to 50%, depending on the research population and diagnostic standards applied. The frequency is continuously high among young individuals, especially medical students. According to international surveys, the prevalences among medical students in Serbia, Thailand, and India are 60.5%, 70.8%, and 46%, respectively.

| Segment | Share 2025 (%) |

| Biologics (monoclonal antibodies, fusion proteins) | 42% |

| Small Molecule Drugs | 24% |

| Long-Acting Implants & Depot Formulations | 10% |

| Gene Therapies (AAV, lentiviral) | 8% |

| Cell Therapies & Regenerative Approaches | 16% |

What Made the Biologics Segment Dominant in the Market in 2025?

By molecule type/modality, the biologics segment led the ophthalmology drugs market by 42% in 2025. Biologics have demonstrated notable effectiveness in the treatment of pan-uveitis and non-infectious posterior uveitis. For NIU, IFX has become one of the most popular biological treatments. For the treatment of ophthalmic disorders, monoclonal antibodies are crucial, but thorough clinical assessment and ongoing innovation are also necessary. To produce safer, more efficient, and more economical therapeutic alternatives, future research should concentrate on creating innovative delivery methods, examining combination treatments, carrying out long-term follow-up studies, and looking into individualised treatment plans.

By molecule type/modality, the small molecule drugs segment is estimated to witness the fastest growth during the forecast period. Solutions, suspensions, emulsions, gels, and ointments are the most often used types of small molecule medication formulations for topical ocular delivery. Small-molecule inhibitors of ocular angiogenesis are required to supplement current treatments.

Why was the Intravitreal Injection Segment Dominant in the Market in 2025?

By route of administration, the intravitreal injection segment held the largest share of the ophthalmology drugs market by 48% in 2025. The gold standard for treating a variety of retinal conditions, such as diabetic retinopathy, retinal vein occlusion, and neovascular age-related macular degeneration (AMD), is intravitreal medication administration. Intravitreal injections have been much more common since anti-vascular endothelial growth factor (VEGF) drugs were first developed. It is crucial to become proficient in the method required to carry out this surgery correctly in order to maximise patient safety and lower the possibility of problems.

By route of administration, the sustained-release implants/inserts segment is estimated to be the fastest-growing during the forecast period. From the standpoint of formulation, sustained-release technologies would be very beneficial to patients and physicians since they would improve IOP control for more than twenty-four hours, eliminate poor adherence, and minimise adverse effects. Drug delivery through intraocular implants might continue for months or even years. They may frequently be injected using a less invasive technique and are ideal for a clinical context.

Which End-User Segment Dominated the Market in 2025?

By end-user/channel, the hospitals & specialty ophthalmology clinics segment dominated the ophthalmology drugs market by 57% in 2025. They are committed to giving people of all ages top-notch eye treatment. To guarantee that patients receive the most cutting-edge care possible, it is made up of a group of highly qualified and experienced ophthalmologists, optometrists, and technicians who have received training in the newest diagnostic and therapeutic methods. Additionally, the department at hospitals and clinics is dedicated to remaining at the forefront of ophthalmology-related technical breakthroughs.

By end-user/channel, the ophthalmic distributors & IDNs segment is anticipated to achieve the highest CAGR during 2025-2024. In the supply chain for eye care goods, ophthalmic distributors are essential because they link producers with healthcare providers, such as Integrated Delivery Networks (IDNs). Groups of hospitals and other healthcare institutions known as IDNs sometimes depend on distributors to get a variety of ophthalmic supplies and equipment.

North America dominated the ophthalmology drugs market share 42% in 2024. A increased frequency of eye illnesses and growing awareness of these conditions are two of the elements contributing to this region's rise. Significant R&D efforts by major market participants have been conducted in the area, which has aided in its expansion. Further supporting the North American market are the presence of prominent firms like Bausch & Lomb, Pfizer Inc., and Alcon.

An additional 50.2 million Americans are undiagnosed and have not gotten treatment from qualified eye specialists, while 16 million Americans suffer from dry eye syndrome, which costs the healthcare system USD 52 billion yearly. As people age, the illness becomes more prevalent; 8.4% of those under 60, 15% of those between 70 and 79, and 20% of those over 80 are affected. According to CDC estimates, medical, nursing care, and supporting services account for $98.7 billion of the $134.2 billion annual economic burden of vision loss and blindness in the United States.

In November 2024, members of the public are more familiar with Bill C-284, the National Strategy for Eye Care Act, which was enacted by the Canadian Parliament. The Canadian Ophthalmological Society's news statement praised the action by activists for eyesight health. Furthermore, eight million Canadians today suffer from one of the top four eye conditions: glaucoma, cataracts, diabetic retinopathy, or age-related macular degeneration, according to the Canadian Ophthalmological Society. The National Strategy for Eye Care Act is a vital step in preserving the well-being and standard of living of diabetics.

Asia Pacific is estimated to host the fastest-growing ophthalmology drugs market during the forecast period. driven by expanding access to eye care services, growing healthcare spending, and sizable patient populations. China, Japan, India, Australia, and South Korea are just a few of the many markets in the area; each has its own healthcare dynamics and market traits. The market is growing as a result of increased acceptance of cutting-edge ophthalmic therapies, better healthcare infrastructure, and growing awareness of eye health. Growing research and development efforts as well as the rise in both local and foreign pharmaceutical enterprises are also advantageous to the region.

Finding and creating possible therapeutic candidates, manufacturing the medication, performing clinical trials, and identifying disease targets are some of the crucial steps in ophthalmology drug research and development. Along with making sure the medication satisfies certain ophthalmic needs like sterility and eye comfort, this procedure also involves optimising drug delivery techniques.

Top Companies: Allergan (now part of AbbVie), Novartis, Bausch + Lomb, and Alcon (a division of Novartis).

Preclinical research, clinical trials (Phases 1-3), and a New Drug Application (NDA) evaluation by regulatory agencies such as the FDA are all steps in the multi-stage process that goes into developing and approving medications for ophthalmology. For continuous safety monitoring, post-market surveillance (Phase 4) is also essential.

Top Companies: Ora, Inc., Lindus Health, ICON plc, PPD (Thermo Fisher Scientific), Syneos Health, and Labcorp Drug Development.

In order to maintain patient safety and regulatory compliance, ophthalmology medication packaging and serialisation require careful consideration of sterility, material selection, and serialisation parameters.

Top Companies: Alcon, Johnson & Johnson, Novartis, Bausch & Lomb, and Allergan (now part of AbbVie).

Education, help with administration, and addressing any adherence challenges are all part of patient care and services in ophthalmology, especially when it comes to medication administration. This include educating patients about medication combinations, making sure they know how to administer their eye drops properly, and giving assistance to people who have cognitive or physical impairments.

Top Companies: Allergan (now AbbVie), Bausch + Lomb, Novartis, Alcon, Johnson & Johnson Vision, Santen Pharmaceutical, and Cipla.

In June 2025, new treatments and research will be supported by an unprecedented $40 million donation to the CU Anschutz Department of Ophthalmology. "As the chair of the CU Department of Ophthalmology and the Sue Anschutz-Rodgers Endow Chair in Retinal Diseases, we have a fantastic opportunity to drive our research enterprise, which is essential to clinical care," stated Naresh Mandava, MD. With your contribution, we will be able to get technologies from the lab to the patient more quickly than previously.

By Drug Class

By Indication

By Molecule Type / Modality

By Route of Administration

By End User / Channel

By Region

February 2026

February 2026

February 2026

February 2026