February 2026

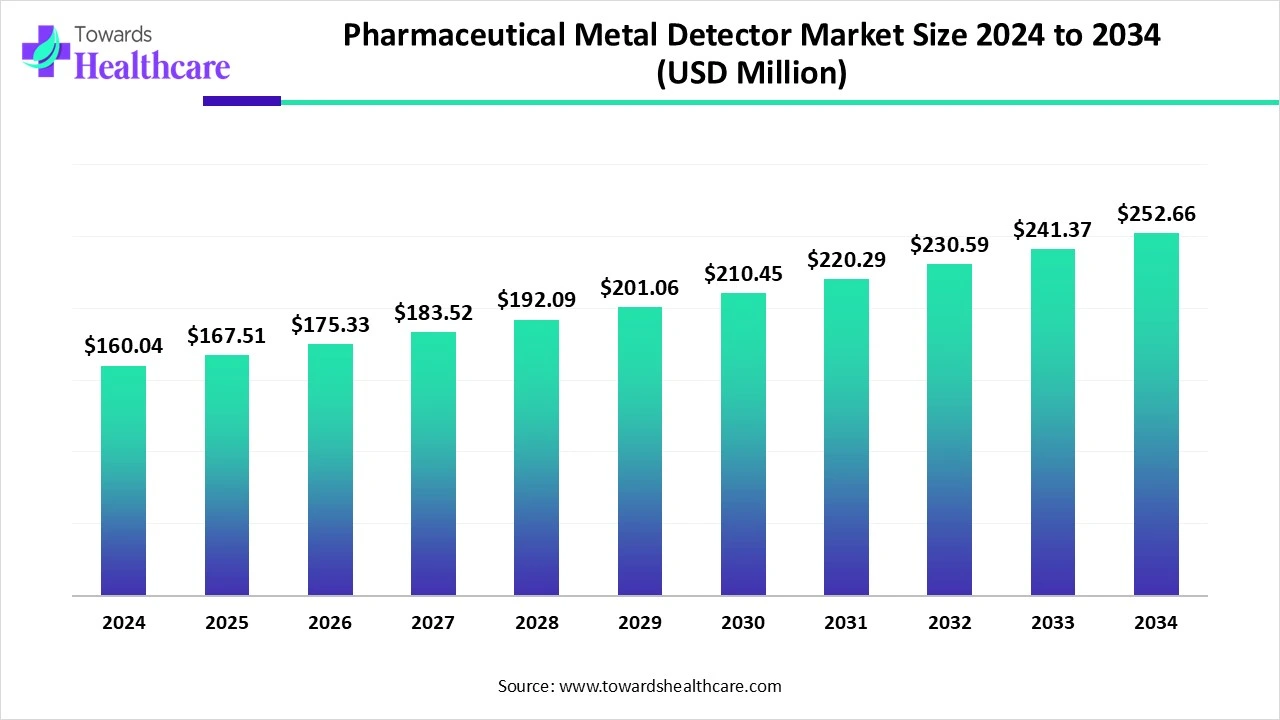

The global pharmaceutical metal detector market size is estimated at US$ 160.04 million in 2024, is projected to grow to US$ 167.51 million in 2025, and is expected to reach around US$ 252.66 million by 2034. The market is projected to expand at a CAGR of 4.67% between 2025 and 2034.

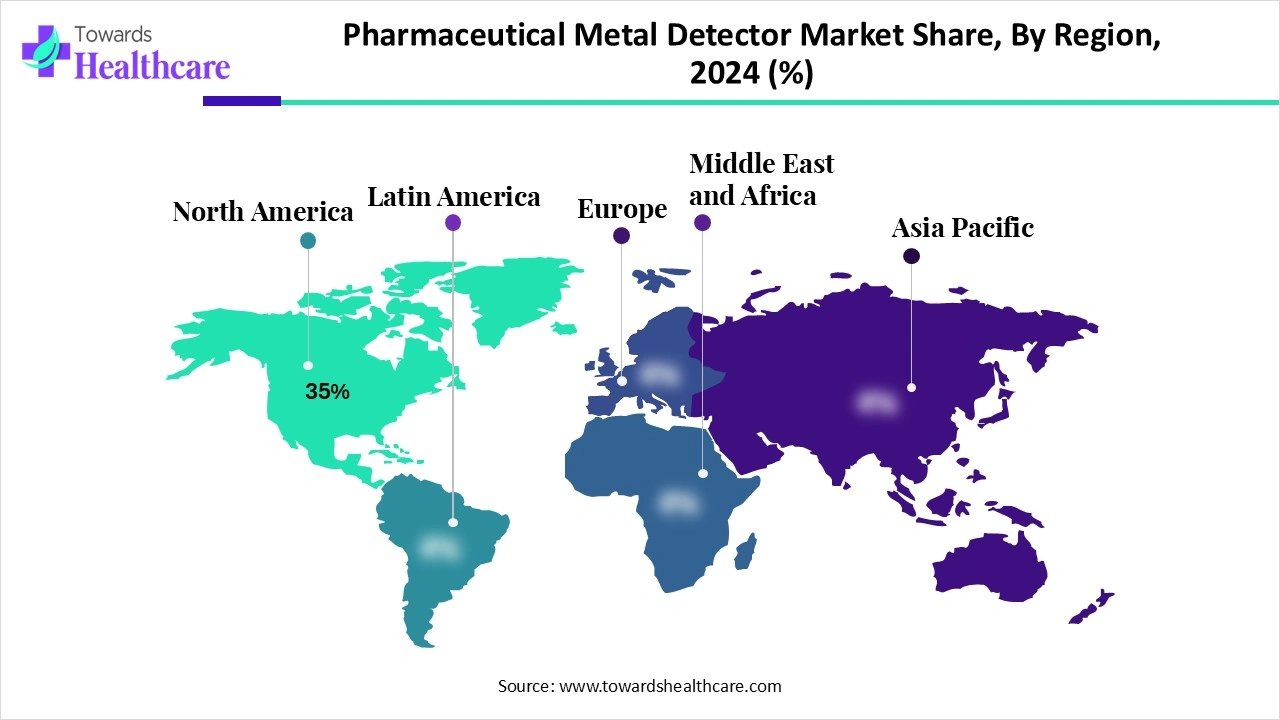

The pharmaceutical metal detector market is expanding rapidly due to increasing demand for cutting-edge safety and quality control standards in drug manufacturing. Metal detector plays a significant role in ensuring product purity by identifying and removing metallic contaminants during production and packaging methods. North America is dominant in the market due to growing regulatory compliance requirements through agencies such as the FDA and EMA. Asia Pacific is the fastest growing as increasing pharmaceutical manufacturing and growing awareness of people about product safety.

| Table | Scope |

| Market Size in 2025 | USD 167.51 Million |

| Projected Market Size in 2034 | USD 252.66 Million |

| CAGR (2025 - 2034) | 4.67% |

| Leading Region | North America Share 35% |

| Market Segmentation | By Product Type, By Technology, By Contaminant Type, By Application, By End-Use, By Region |

| Top Key Players | Mettler-Toledo International Inc., Thermo Fisher Scientific Inc., CEIA S.p.A., Fortress Technology Ltd., Minebea Intec GmbH, Anritsu Infivis Co. Ltd., Sesotec GmbH, Ishida Co. Ltd., Bizerba SE & Co. KG, METTLER-TOLEDO Safeline, DMT GmbH & Co. KG, Nishizaki Co. Ltd., Detectamet Ltd., Globus (Italy), Control Dynamics Ltd., Loma Systems Ltd., Key Technology Inc., Goring Kerr Ltd., Automation Components Inc., A&D Company Ltd. |

The pharmaceutical metal detector market refers to the global industry of devices and systems used in the pharmaceutical manufacturing and packaging process to detect and remove metallic contaminants from products. These detectors are critical for ensuring product safety, regulatory compliance, and quality control, protecting end-users from harmful contamination. The market includes stand-alone metal detectors, integrated systems, and advanced inspection technologies designed to detect ferrous, non-ferrous, and stainless steel contaminants in tablets, capsules, powders, liquids, and other pharmaceutical forms.

Recent advancements in pharmaceutical metal detection systems offer a fully integrated inspect and reject solution for manufacturers of powdered APIs, capsules, and tablets, which drives the growth of the market.

For instance,

Increasing adoption of next-generation pharmaceutical metal detectors, which are not only more sensitive but also faster, smarter, and more integrated, contributes to the growth of the market.

For Instance,

Integration of AI in pharmaceutical metal detectors drives the growth of the market, as AI-driven metal detectors enhance safety and security in various pharmaceutical settings. An AI-based detector automatically detects the metal impurities from pharmaceutical manufacturing, giving a warning to keep employees safe. AI-driven technologies are more effective in the detection and removal of heavy metals from biotic and abiotic systems. These detection technology systems support improving efficiency. By incorporating deep learning and data analysis, modern metal detectors robotically identify and classify various types of metals, significantly improving detection precision. These inspection systems are supporting pharma processors in improving metal detection, reducing product waste, and lowering the cost of ownership, which drives the growth of the market.

Increasing Growth of the Pharmaceutical Industry

The pharmaceutical industry is growing, with continuous development, launch, and marketing of new pharmaceutical products. These products are governed by a wide range of laws and regulations worldwide. The rising demand for pharmaceuticals and the need to comply with strict regulations have led many pharmaceutical companies to outsource manufacturing to specialized Contract Manufacturing Organizations. The industry’s positive effects include the creation of life-saving drugs, contributions to economic growth through high-paying jobs, and encouragement of healthcare innovation. As production processes become more complex and packaging becomes more diverse, challenges like metal contamination increase, driving the demand for efficient, adaptable metal detectors. This, in turn, fuels the growth of the pharmaceutical metal detector market.

Major Challenges in Pharmaceutical Metal Detectors

Basic metal detectors find it difficult to operate effectively when there are variations in product density, temperature, or orientation. However, modern technologies have addressed some of these issues. An increasing number of manufacturers are adopting multi-frequency or multi-scan detectors that minimize product effects, which in turn limits the expansion of the pharmaceutical metal detector market.

Recent Advancements in Multi-frequency Pharmaceutical Metal Detectors

Recent advancements in multi-frequency pharmaceutical metal detectors involve multi-coil arrangements that enhance the signal received by the receiver. These detectors operate on the principle of transmitting and receiving multiple frequencies using these coils. This setup improves detection by increasing the clarity of the signal for the receiver. Compared to single-transmitter systems with two receivers, multi-coil arrangements can increase detection capabilities, such as the size of detectable metal spheres, by up to 20%. Utilizing multiple frequencies allows these detectors to gather more detailed information about buried objects, opening new opportunities in the pharmaceutical metal detector market.

By product type, the integrated systems segment led the pharmaceutical metal detector market, due to the integrated metal detectors being automated devices that incorporate metal detection and weight detection functions, broadly used in the manufacturing processes of products like pharmaceuticals, food, and chemicals. This device is mainly used to detect whether metal impurities are mixed in products, confirming that the production products are free of metal contamination, and it enhances production efficiency.

On the other hand, the standalone segment is projected to experience the fastest CAGR from 2025 to 2034, as standalone metal detectors, intended to rapidly reject contaminated pharmaceutical products whilst continuing product flow. Using advanced technology systems and data capture, metal detection devices are built to deal with high-performance environments, offering both an instant uptick in efficiency and contributing towards expense reduction, in the form of reduced downtime and fewer challenges of damage to downstream equipment.

By technology, the electromagnetic induction segment is dominant in the pharmaceutical metal detector market in 2024, as electromagnetic induction is used to detect metal by insertion the metal into a magnetic field, and because of a change in magnetic emf, flux is induced in the metal. The vortex current will pass through the metal due to there is no complete loop for the voltage to be induced. It is an important type of metal detector measures in a pharmaceutical manufacturing process.

The radio x-ray segment is projected to grow at the fastest CAGR from 2025 to 2034, as x-ray systems provide a broader range of inspection functions than metal detectors. X-ray inspects the piece for contamination, fill level, missing components, and proper seals. It uses electromagnetic radiation to identify physical contaminants by density differentiation. The X-rays can pass through less dense materials effortlessly, while more dense materials absorb more of them and appear darker in the image.

By contaminant type, the ferrous segment led the pharmaceutical metal detector market in 2024, as this pharmaceutical ferrous detection metal detector is intended to identify the presence of metals in the capsules and tablets produced by tablet presses, as well as the parts that are used for quality control. The detector used for detecting ferrous in pharmaceutical products, magnetic, and contaminants like rust or other unwanted metals. The main goal of this device is to detect and reject contaminants from pharmaceutical products; it is used for efficient manufacturing production lines.

The stainless steel segment is projected to experience the fastest CAGR from 2025 to 2034, as stainless-steel contaminants in medicinal manufacturing products are noticed using metal detectors that employ electromagnetic induction. These detectors generate a magnetic field that, when disrupted by the presence of stainless steel, activates an alarm and initiates a rejection mechanism.

By application, the tablet & capsule segment led the pharmaceutical metal detector market in 2024, as a metal detector is intended for the identification and elimination of minute pieces of stainless steel, ferrous, and nonferrous contaminations in tablets and other pharmaceutical products. Such particles occasionally enter the product stream from failing processing apparatus, such as worm sieve wires or splintered dies. These detectors allow detecting even trace quantities of metals in capsules or tablets and separating them from the main production line as a damaged item.

On the other hand, the liquid & syrup segment is projected to experience the fastest CAGR from 2025 to 2034, as it is broadly used to improve the quality of liquid and syrup products by eliminating the metallic contaminations before packing. A metal detector for liquid and syrup bottles is a dedicated device applied in the pharmaceutical or biotech industry to recognise and eliminate metal contaminants from packaging.

By end use, the pharmaceutical manufacturing plants segment led the pharmaceutical metal detector market in 2024, as he metal detector is helpful in conserving the medicines because if a minor quantity of metal is also present, then it may damage the medicines. The use of the detectors reduces any metal contamination, ensuring the food safety of the consumers. The metal detector necessitates less maintenance, hence it is affordable.

On the other hand, the biotechnology companies segment is projected to experience the fastest CAGR from 2025 to 2034, as the applications of pharmaceutical metal detectors support biotech companies in saving their expenses from lower downtime and less product wastage. These detectors help to promote a clean product environment. The use of pharmaceutical metal detectors supports medicine companies in saving their costs from reduced downtime and less product wastage.

North America is dominant in the market share 35% in 2024, as pharma manufacturing organizations are increasingly investing in North America plants to strengthen supply chain resilience and lower dependence on international facilities, and 66.9% of sales of novel medicines launched during the period 2019-2023, which increases the demand for pharmaceutical metal detectors. Advanced manufacturing technologies have huge potential to speed up the production of drug products, enhance the quality of medicines, alleviate drug shortages, and improve the reliability of the medicinal supply chain, which contributes to the growth of the market.

In the U.S., strong presence of leading companies such as Pfizer, Johnson & Johnson, Merck & Co., AbbVie, Bristol Myers Squibb, Eli Lilly and Co., Amgen, Gilead Sciences, and Regeneron, which increase rapid product adoption and technological advancement. The US emphasis on strengthening pharmaceutical supply chains and confirming product safety in the regulated sector drives the growth of the market.

In Canada, growing demand for cost-effective healthcare solutions, both domestically and internationally, is driving the growth pharma manufacturing sector, which increases the requirement for pharmaceutical metal detectors. Canada’s pharmaceutical sector is the most advanced. It is composed of companies emerging and manufacturing novel drugs and generic pharmaceuticals, as well as over–the-counter drug products; all factors contribute to the growth of the market.

Asia Pacific is the fastest-growing region in the pharmaceutical metal detector market in the forecast period, as this region accounts for around two-thirds of the worldwide population and increasing healthcare awareness and product safety, particularly in China, where the senior citizen cohort is currently growing by 10mn annually. Growing disposable incomes are also driving medical care spending of the middle class across the region. Increasing government policies and support are fuelling the growth of the market.

Many types of pharmaceutical metal detectors are made of stainless steel, and other components, such as plastic or elastomers, can be manufactured with embedded metallic particles, enabling them to be detected as well. Use of sophisticated technology and high-grade material for the manufacturing of pharmaceutical metal detectors.

Key players: Mettler-Toledo International Inc., Thermo Fisher Scientific Inc., Anritsu Corporation, Eriez Manufacturing Co., CEIA S.p.A., and Fortress Technology Inc.

Pharmaceutical metal detectors fit easily into the manufacturing process with negligible extra space requirements. These systems are fit onto the presenting product lines to examine for metal contaminants instead of halting the flow of pharmaceutical production.

Key players: Thermo Fisher Scientific, Sesotec, Eriez, and Fortress Technology

Pharmaceutical metal detectors are generally distributed by particular wholesalers and manufacturers directly to hospitals and pharmacies. By applying metal detection systems at different stages of the supply chain, pharmaceutical organizations avoid the distribution of contaminated products.

Key players: Mettler-Toledo and CEIA

In March 2025, Roland Busch, President and CEO of Siemens AG, stated, “We welcome the Altair community of customers, partners, and colleagues to Siemens. Adding Altair’s groundbreaking innovations to the Siemens Xcelerator platform will create the world's most complete AI-powered design, engineering, and simulation portfolio. Together, we will help our customers to innovate at the scale and speed that today's complexity-driven world demands.”

By Product Type

By Technology

By Contaminant Type

By Application

By End-Use

By Region

February 2026

February 2026

February 2026

February 2026