February 2026

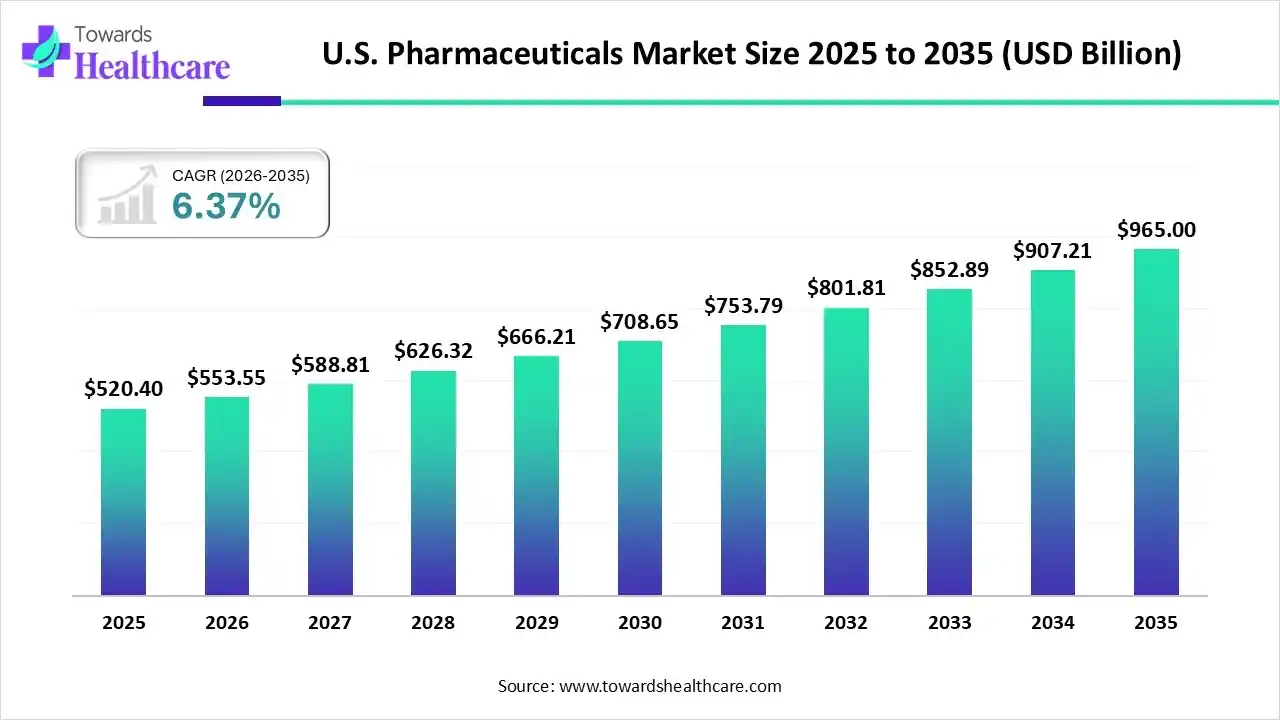

The U.S. pharmaceutical market size is calculated at USD 520.4 billion in 2025, grew to USD 553.55 billion in 2026, and is projected to reach around USD 965 billion by 2035. The market is expanding at a CAGR of 6.37% between 2026 and 2035.

The U.S. pharmaceutical market is primarily driven by the rising prevalence of chronic disorders, the growing demand for personalized medicines, and favorable regulatory support. Government organizations launch initiatives and provide funding to develop novel pharmaceuticals and enhance access to treatment. Artificial intelligence (AI) assists researchers in accelerating drug discovery and development, streamlining manufacturing and supply chain, and enabling personalized medicines.

| Key Elements | Scope |

| Market Size in 2025 | USD 520.4 Billion |

| Projected Market Size in 2035 | USD 965 Billion |

| CAGR (2026 - 2035) | 6.37% |

| Market Segmentation | By Drug Type, By Therapy Type, By Formulation, By Distribution Channel, By Manufacturer Type, By Region |

| Top Key Players | Bristol Myers Squibb, Amgen, Inc., Regeneron Pharmaceuticals, Inc., Biogen Inc., Gilead Sciences, Vertex Pharmaceuticals, Moderna Inc., Sanofi U.S., GlaxoSmithKline (GSK), AstraZeneca Pharmaceuticals LP, Viatris Inc., Boehringer Ingelheim USA |

The U.S. pharmaceutical market is fueled by rising chronic disease prevalence, aging demographics, advanced healthcare infrastructure, and the dominance of global pharma leaders headquartered or heavily operating in the U.S. It represents the largest and most advanced pharmaceutical ecosystem globally, encompassing research, manufacturing, distribution, and commercialization of prescription and over-the-counter (OTC) drugs. It is characterized by high R&D spending, rapid biologics and biosimilars adoption, a strong generics market, and increasing digital integration in drug discovery and patient care.

AI revolutionizes the U.S. pharmaceutical market by accelerating drug development and optimizing pharmaceutical research. AI and machine learning (ML) algorithms analyze large datasets of biological, chemical, and patient data and help generate personalized medicines. They can also predict the behavior of drug-like candidates within the body and their therapeutic response. Moreover, AI and ML can assist in managing patient recruitment, optimizing study designs, and monitoring real-time patient responses in clinical trials. They can streamline pharmaceutical manufacturing, enhancing efficiency and reproducibility. Thus, AI and ML are reshaping the pharma value chain and bringing life-saving therapies to market faster.

Which Drug Type Segment Dominated the U.S. Pharmaceutical Market?

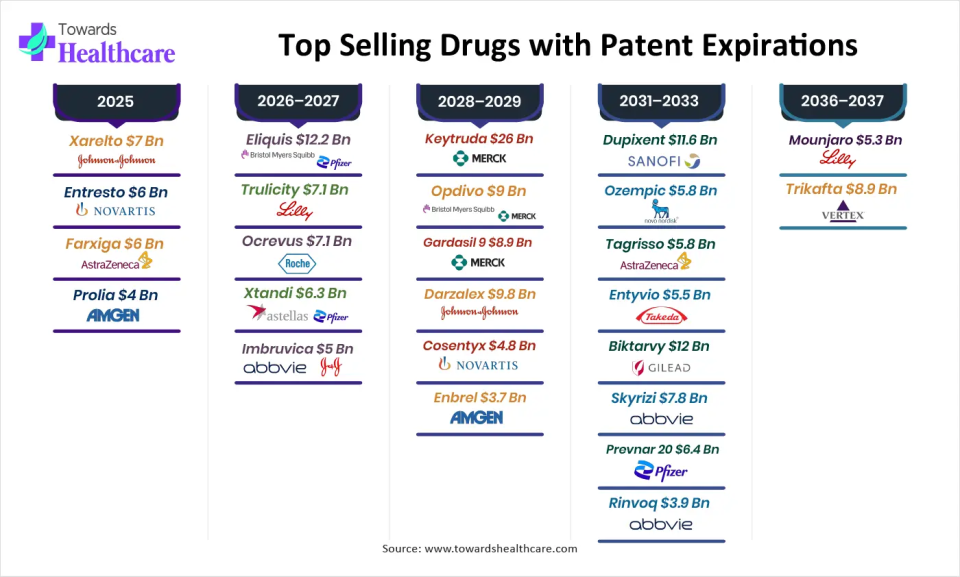

The branded drugs segment held a dominant presence in the market with a share of approximately 68% in 2024, due to proven safety and efficacy profiles and patent protection. Branded drugs include patented and innovative therapies with premium pricing, led by oncology, immunology, and diabetes portfolios. Developers can take exclusive advantage of intellectual property rights and generate more revenue. Branded drugs have more recognizable or attractive packaging, enhancing patient trust and confidence.

Biosimilars

The biosimilars segment is expected to grow at the fastest CAGR in the U.S. pharmaceutical market during the forecast period. The growing demand for affordable targeted drugs and the U.S. Food and Drug Administration (FDA)’s streamlined approval pathways boost the segment’s growth. Biosimilars are derived from the same types of sources and are just as safe and effective as biologic reference products. As of October 2025, the U.S. FDA has approved 76 biosimilars.

Generic Drugs

The generic drugs segment is expected to grow in the coming years, due to low cost and increased patent expiration. Generic drugs have similar pharmacological and chemical effects to branded drugs. There are more than 32,000 generic drugs in the U.S. It is estimated that 91% of all prescriptions are filled with generic drugs. Generic drugs can be manufactured by multiple manufacturers for a drug product, thereby reducing drug shortages.

Why Did the Oncology Segment Dominate the U.S. Pharmaceutical Market?

The oncology segment held the largest revenue share of approximately 23% in the market in 2024, due to the rising prevalence of oncology and favorable government support. Government organizations launch initiatives to promote screening and early diagnosis of cancer disorders, enabling healthcare professionals to provide early intervention. In 2025, more than 2 million new cancer cases and over 0.6 million cancer deaths are projected to occur in the U.S.

Rare Diseases

The rare diseases segment is expected to grow with the highest CAGR in the U.S. pharmaceutical market during the studied years, due to breakthrough FDA approvals and strong biotech innovation. Over 7,000 rare diseases affect more than 30 million Americans. The Rare Diseases Clinical Research Network (RDCRN) is funded by the National Institute of Health (NIH) to advance research in rare diseases.

Cardiovascular Diseases

The cardiovascular diseases segment is expected to grow significantly, due to increasing heart attacks and growing research activities. Approximately 805,000 people in the U.S. have a heart attack annually. This necessitates researchers to develop novel medicines. A total of 28 new molecular entities (NMEs) were approved by the FDA for cardiovascular diseases from 2011 to 2023.

How the Oral Drugs Segment Dominated the U.S. Pharmaceutical Market?

The oral drugs segment contributed the biggest revenue share of approximately 54% in the market in 2024, due to enhanced patient convenience and high affordability. Oral drugs, such as tablets, capsules, and syrups, remain the most common delivery forms of chronic conditions. They are easy to administer and can be administered by all age groups. They can be modified to alter drug release, such as immediate or sustained release, depending on patients’ conditions.

Injectable Drugs

The injectable drugs segment is expected to expand rapidly in the U.S. pharmaceutical market in the coming years, due to faster onset of action and high bioavailability. Injectable drugs bypass the gastrointestinal pathway, eliminating first-pass metabolism. They have faster absorption and more immediate effects. They are useful for patients who cannot take oral medicines due to excessive vomiting or unconsciousness.

Topical & Inhalation Drugs

The topical & inhalation drugs segment is expected to show notable growth, due to targeted delivery and treatment accessibility. Topical & inhalation drugs have reduced systemic side effects and provide localized effects. They minimize the exposure of healthy tissues to the drug, enhancing the therapeutic outcome.

What Made Retail Pharmacies the Dominant Segment in the U.S. Pharmaceutical Market?

The retail pharmacies segment accounted for the highest revenue share of approximately 49% in the market in 2024, due to the availability of favorable infrastructure and suitable capital investments. This encourages pharmacies to store and manage advanced pharmaceutical products. The increasing number of retail pharmacies enhances patient accessibility. There are a total of 118,473 retail pharmacies in the U.S., reflecting a rich and diverse landscape.

Online Pharmacies

The online pharmacies segment is expected to witness the fastest growth in the U.S. pharmaceutical market over the forecast period. The burgeoning e-commerce sector and the rising adoption of smartphones augment the segment’s growth. Online pharmacies enable patients to order medications from a wide range of options. They provide superior benefits, such as special discounts, free home delivery, and virtual consultations.

Hospital Pharmacies

The hospital pharmacies segment is expected to show lucrative growth. Hospital pharmacies are widely preferred, especially when patients visit hospitals for disease treatment. They possess all essential drugs and medical devices that are prescribed by healthcare professionals. They are in high demand during emergencies and surgeries. They enhance patient safety through automated systems and medication review.

Which Manufacturer Type Segment Led the U.S. Pharmaceutical Market?

The multinational innovator companies segment led the market with a share of approximately 64% in 2024, due to capital investments and increasing competition. Multinational innovator companies develop innovative pharmaceutical products to serve a large patient population. The increasing competition among key players facilitates them to expand their product portfolio and strengthen their market position, generating more revenue.

Contract Development & Manufacturing Organizations (CDMOs)

The contract development & manufacturing organizations (CDMOs) segment is expected to show the fastest growth in the U.S. pharmaceutical market over the forecast period. CDMOs possess specialized infrastructure and skilled professionals to perform complex research and manufacturing activities. Skilled professionals provide tailored services to large companies and startups. The segmental growth is attributed to outsourcing trends and demand for flexible, small-batch biologics manufacturing.

Generic Manufacturers

The generic manufacturers segment is expected to grow in the forthcoming years, due to the growing demand for affordable pharmaceuticals and increasing healthcare expenditure. Generic manufacturers expand access and ensure that critical medicines reach those who need them. They produce approximately 80% of the global supply of pharmaceutical products.

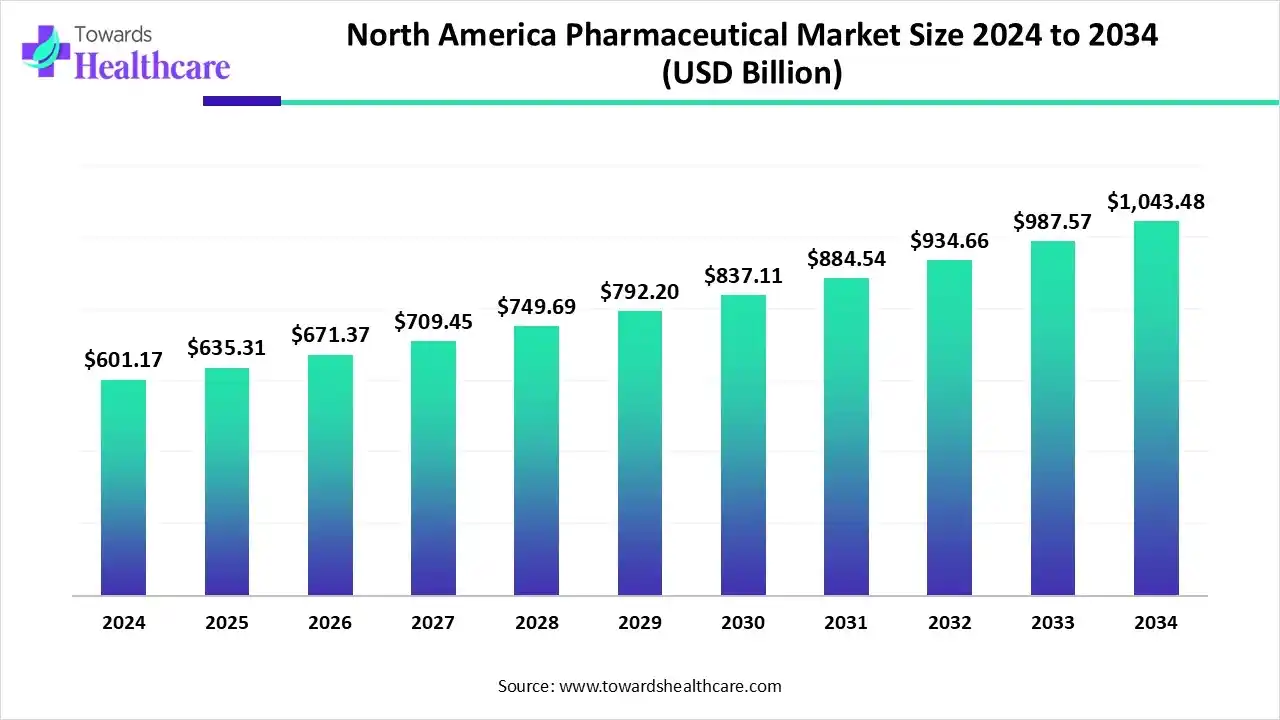

The North America pharmaceutical market size is calculated at US$ 601.17 billion in 2024, grew to US$ 635.31 billion in 2025, and is projected to reach around US$ 1043.48 billion by 2034. The market is expanding at a CAGR of 5.67% between 2025 and 2034.

The pharmaceutical market in the U.S. is one of the largest in the world and is experiencing robust growth driven by an aging population, the increasing prevalence of chronic disorders, and growing R&D investment. A strong presence of pharmaceutical and biopharmaceutical companies and favorable government support propel the market. The increasing number of startups and venture capital investments also contributes to market growth. In 2023, the volume of U.S. pharma merger & acquisition activity had numerous deals in the range of $225-275 billion. The U.S. is expected to remain the center of global pharma innovation and thus attract foreign buyers.

The Northeast region dominated the U.S. pharmaceutical market with a share of approximately 38% in 2024. States like New Jersey, Massachusetts, and Pennsylvania have a concentrated presence of major pharma headquarters, and Boston-Cambridge has biotech clusters. In 2023, Cambridge witnessed a total funding $7.26 billion among 72 biotech companies.

The West Coast region is expected to grow at the fastest CAGR in the market during the forecast period. The rapid expansion of biotech startups and digital therapeutic innovations driven by Silicon Valley and academic hubs fosters market growth in the region. The biotech sector in New York profited from regulatory changes, enabling companies to provide a tax credit of up to $250,000 per year for annual companies.

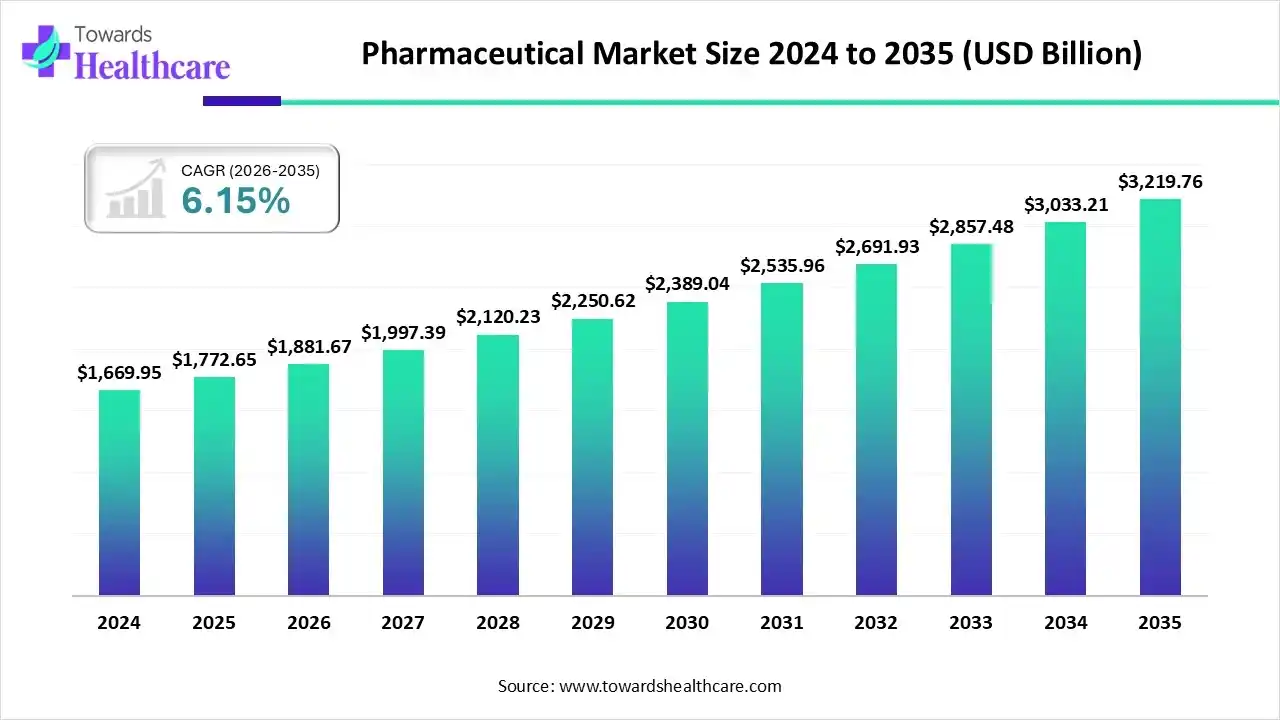

The pharmaceutical market is valued at US$ 1,772.65 billion in 2025 and is projected to maintain steady growth, reaching US$ 1,881.67 billion in 2026 and US$ 3,219.76 billion by 2035, with a CAGR of 6.15%.

The pharmaceutical research is driven by advances in genomic technologies and innovations in nanotechnology.

Key Players: WuXi AppTec, PPD, Fortrea, Gilead Sciences, and Johnson & Johnson.

Pharmaceutical clinical trials assess the safety and efficacy of new drugs and medical devices.

Key Players: Nona Biosciences, IQVIA, Parexel, and Syneos Health.

Pharmaceuticals are either distributed by manufacturers or by distributors to wholesalers to U.S. hospitals and retail pharmacies.

Key Players: McKesson Corporation, Allied Medical Products, Inc., and Kingworld Medicines Group Ltd.

Corporate Information:

History and Background

Key Milestones/Timeline

Business Overview

Geographic Presence:

Operates worldwide. In 2024, U.S. sales were ~US$50.3 billion, and International ~US$38.5 billion.

Key Offerings:

End-Use Industries Served:

Mergers & Acquisitions:

Partnerships & Collaborations:

Partnership/licensing agreements, external R&D collaborations to accelerate pipeline growth.

Product Launches/Innovations:

Capacity Expansions/Investments:

Regulatory Approvals:

Numerous approvals globally through its Innovative Medicine business; detailed approvals not enumerated here.

Distribution Channel Strategy:

Global direct sales, partnerships, distribution via wholesalers, hospitals, and clinics; major wholesalers account for a significant proportion of revenue.

Technological Capabilities / R&D Focus:

Strength in biologics, small molecules, and antibody-drug conjugates (via acquisitions like Ambrx Biopharma).

Research & Development Infrastructure:

Multiple global R&D sites; heavy investment (~US$50 billion since Jan 2024 for R&D and inorganic).

Innovation Focus Areas:

Strengths & Differentiators:

Market Presence & Ecosystem Role:

One of the largest healthcare companies globally plays a key role in innovation-ecosystem partnerships, manufacturing, and the global supply chain of pharmaceuticals and medical devices.

SWOT Analysis:

Recent News and Updates

2024 Annual Report: operational sales growth 7% excluding COVID vaccine impact.

Recent News:

In October 2025, announced plan to spin off its orthopaedics business (DePuy Synthes) into a standalone company — refocusing on pharma and MedTech.

Corporate Information:

History and Background

Key Milestones/Timeline

Business Overview

Focused biopharmaceutical company (no large device or consumer business).

Geographic Presence:

Operates globally in 170+ countries.

Key Offerings:

Medicines treating immunology, oncology, neuroscience, aesthetics, and eye care.

End-Use Industries Served:

Healthcare providers/hospitals, specialty clinics, and global markets with pharmaceuticals.

Key Developments and Strategic Initiatives

Acquired or licensed drugs and pipelines (e.g., recent up-to US$2.2 billion licensing deal).

Collaboration with Pfizer on Emblaveo drug.

Skyrizi & Rinvoq showing strong growth: Skyrizi up 58% and Rinvoq up 46% in Q4 2024.

Focus on pipeline and internal innovation investment.

2025: U.S. FDA approval of Emblaveo for complicated intra-abdominal infections.

Distribution Channel Strategy:

Global commercial infrastructure delivering branded therapies across developed/emerging markets; patient assistance programmes (e.g., myAbbVie Assist).

Technological Capabilities / R&D Focus:

Strong biologics/immunology franchise; extended exclusivity for Rinvoq until ~2037 gives competitive edge.

Pipeline in 75+ conditions, ~55,000 employees.

Immunology, oncology, neuroscience, and emerging obesity treatment (via amylin-analog licensing).

Competitive Positioning

SWOT Analysis:

Recent News and Updates

Recognized for strong growth and innovation in 2024–25.

| Companies | States | Offerings | Revenue (2024) |

| Eli Lilly and Company | Indianapolis, Indiana | Specializes in obesity, sleep apnea, cancer, diabetes, dermatology, and autoimmune diseases | $45.04 billion |

| Pfizer, Inc. | New York | Offers biologics and biosimilars for multiple disorders, such as cancer and respiratory diseases | $63.6 billion |

| Johnson & Johnson | New Brunswick, New Jersey | Specializes in innovative medicines and medical devices for oncology, cardiovascular, immunology, and neuroscience | $88.8 billion |

| Merck & Co., Inc. | New Jersey | Develops essential medicines and vaccines, serving humanity for over 130 years | $57.4 billion |

| AbbVie, Inc. | North Chicago, Illinois | Delivers and develops innovative medicines and solutions to address complex health issues and enhance people’s lives | $15.10 billion |

By Drug Type

By Therapy Type

By Formulation

By Distribution Channel

By Manufacturer Type

By Region

February 2026

February 2026

February 2026

February 2026