Generic Pharmaceuticals Contract Manufacturing Market Size, Key Players with Insights and Trends

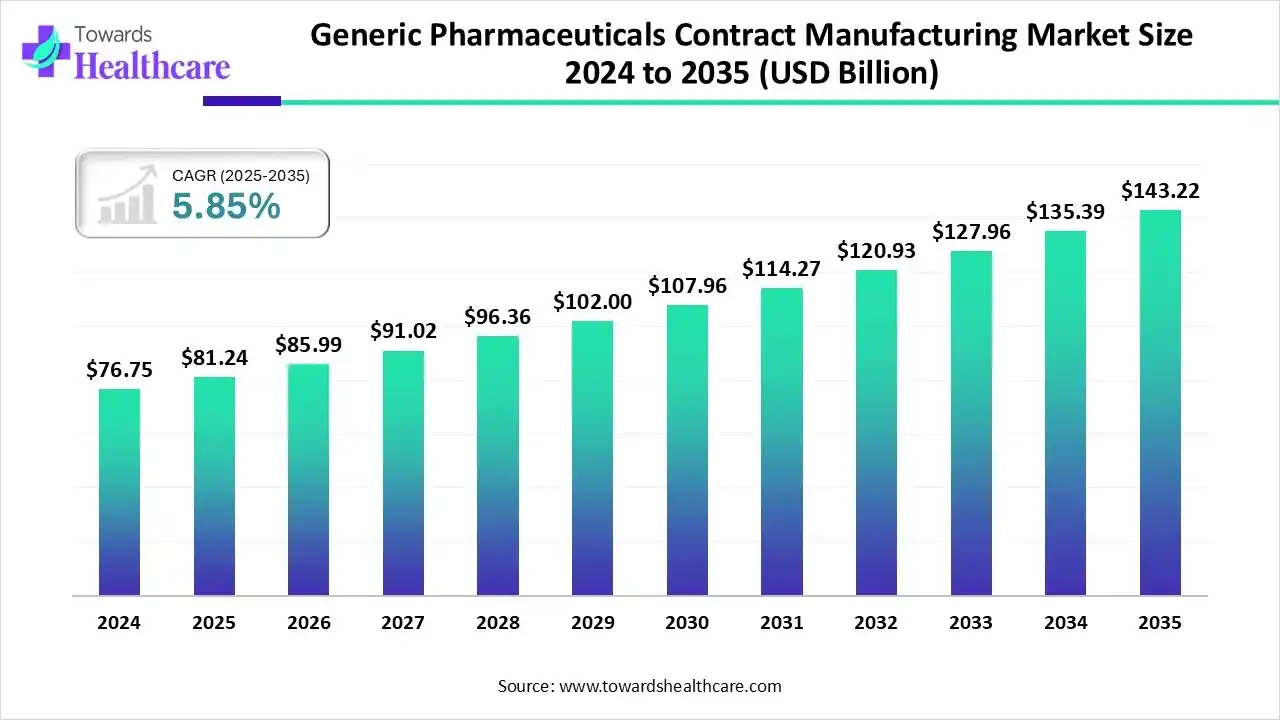

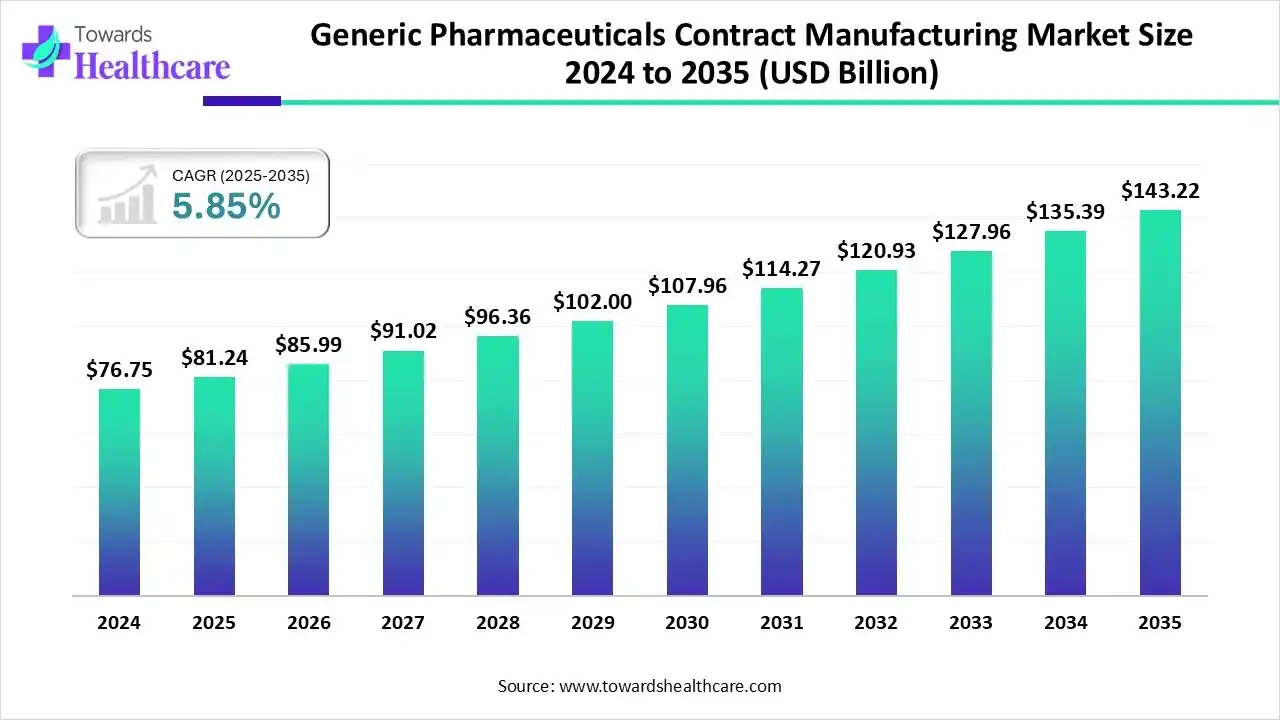

The global generic pharmaceuticals contract manufacturing market size is calculated at US$ 81.24 billion in 2025, grew to US$ 85.99 billion in 2026, and is projected to reach around US$ 143.22 billion by 2035. The market is expanding at a CAGR of 5.85% between 2026 and 2035.

2025 is the era where the world is facing a rise in different chronic diseases, which are fueling demand for inexpensive therapeutics, such as biosimilars & biologics. Moreover, the generic pharmaceuticals contract manufacturing market is fostering innovations in formulations, like sterile injectables, with the expansion of CDMO services for emerging companies. With the greater regulatory support, emphasis on large-scale production and supply chain reliance is further impacting the ultimate expansion.

Key Takeaway

- Generic pharmaceuticals contract manufacturing industry poised to reach USD 81.24 billion by 2025.

- Forecasted to grow to USD 143.22 billion by 2035.

- Expected to maintain a CAGR of 5.85% from 2026 to 2035.

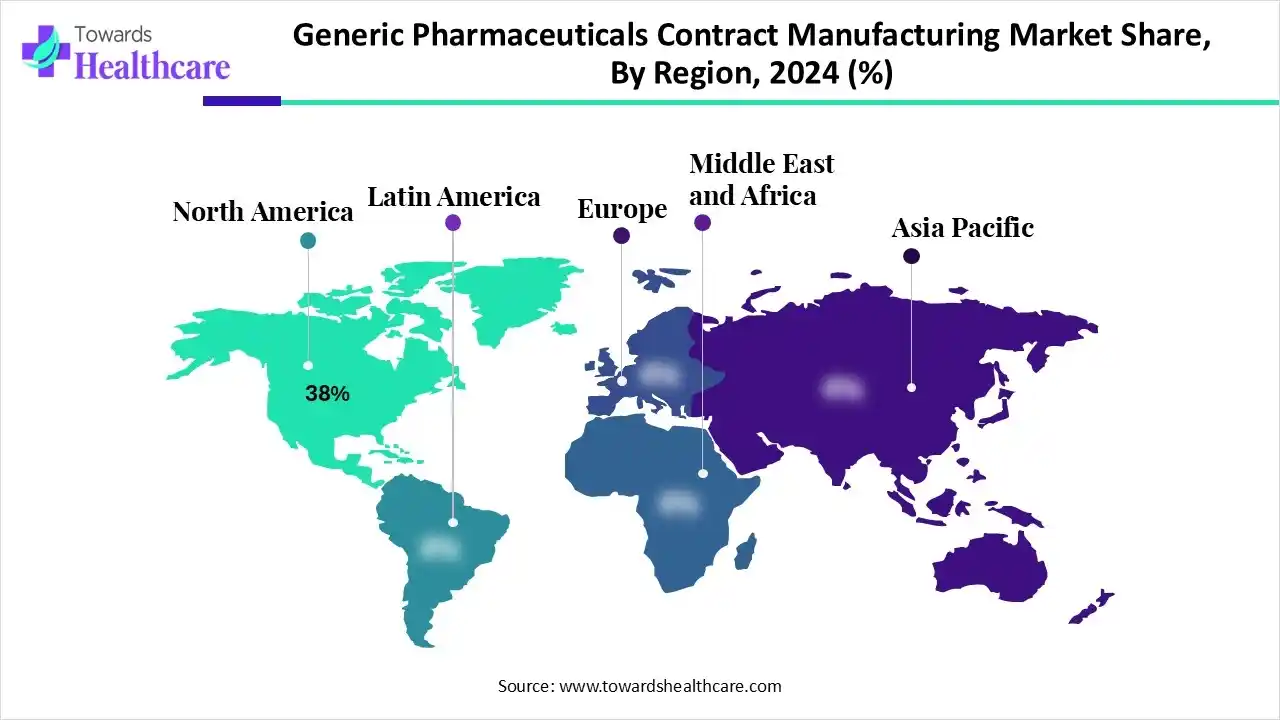

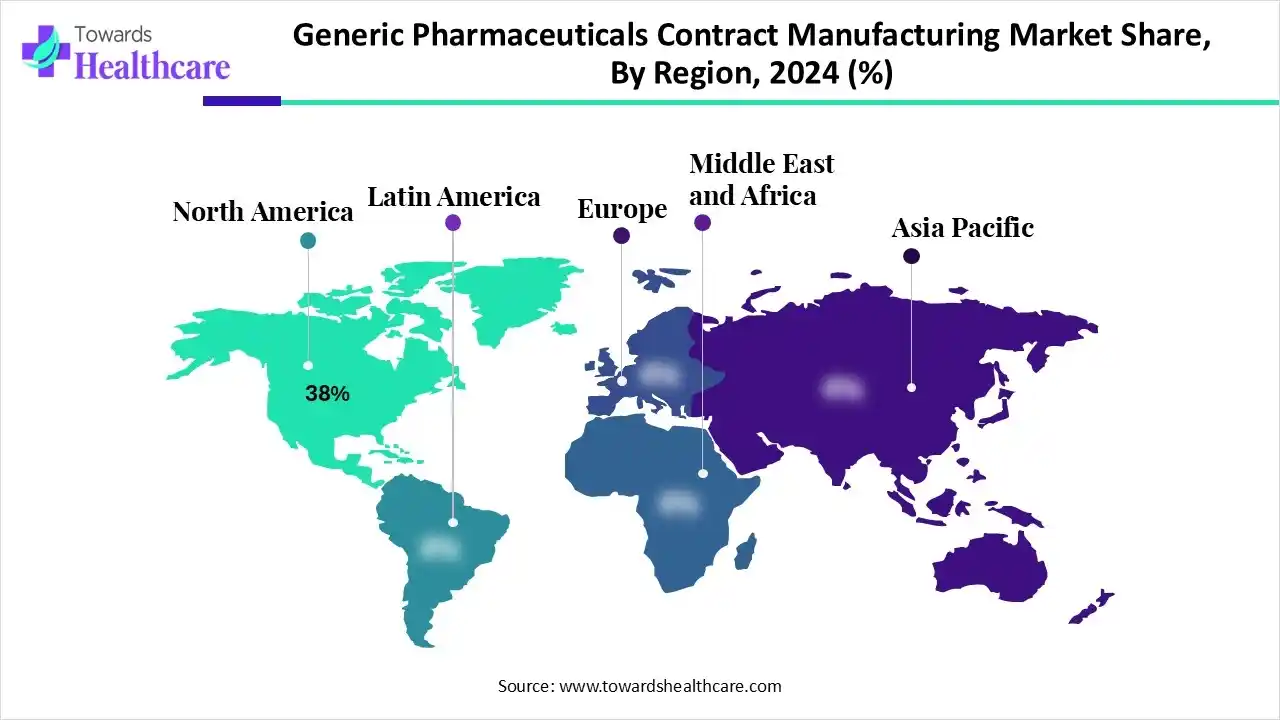

- North America dominated the market with 38% revenue share in 2024.

- Asia Pacific is expected to grow at the fastest CAGR during 2025-2034.

- By service type, the API manufacturing segment led with 30% share of the market in 2024.

- By service type, the integrated CDMO segment is expected to be the fastest-growing in the coming years.

- By drug type, the small-molecule generics segment held a major share of 50% of the generic pharmaceuticals contract manufacturing market in 2024.

- By drug type, the biosimilars & biologics segment is expected to grow rapidly in the studied years.

- By formulation, the solid oral segment captured 48% revenue share of the market in 2024.

- By formulation, the sterile injectables segment is expected to be the fastest-growing during the forecast period.

- By end-user industry, the retail pharmacies & outpatient channels segment led with 46% share of the market in 2024.

- By end-user industry, the hospitals & clinics segment is expected to grow rapidly during 2025-2034.

Key Indicators and Highlights

| Table |

Scope |

| Market Size in 2025 |

USD 81.24 Billion |

| Projected Market Size in 2035 |

USD 143.22 Billion |

| CAGR (2026 - 2035) |

5.85% |

| Leading Region |

North America by 38% |

| Market Segmentation |

By Service Type, By Drug Type, By Formulation, By End-User Industry, By Region |

| Top Key Players |

Boehringer Ingelheim, Recipharm, Piramal Pharma Solutions, Jubilant Life Sciences/Jubilant Pharmova, Siegfried Holding, Cambrex Corporation, Aenova Group, Fareva Group, Almac Group, Ajinomoto Bio-Pharma Services, Pfizer CentreOne, Vetter Pharma International, Alcami Corporation, PCI Pharma Services, Curia |

What is the Generic Pharmaceuticals Contract Manufacturing?

The generic pharmaceuticals contract manufacturing market (often part of the broader pharmaceutical CMO/CDMO space) comprises companies that manufacture finished-dosage generics, produce active pharmaceutical ingredients (APIs), and provide development-to-commercialisation services on contract for generic drug owners. The market is driven by patent expiries, cost pressures on brand owners, and increased outsourcing of commoditized small-molecule and sterile dosage manufacturing to specialist contract partners.

These providers offer formulation development, scale-up, analytical testing, regulatory support and large-scale manufacturing, allowing generic drug companies to outsource capacity, lower fixed costs, accelerate time-to-market and improve supply-chain resilience.

Generic Pharmaceuticals Contract Manufacturing Market Outlook:

- Global Expansion: This expansion is mainly driven by the increasing demand for inexpensive alternatives in the diverse chronic diseases. In June 2025, Chengdu, China, announced the construction of a new microbial drug product (DP) facility with a 60,000-litre capacity.

- Major Investor: In March 2025, Endo and Mallinckrodt announced a $6.7 billion merger, which integrates their generic pharmaceuticals businesses with an intent to probably separate those parts later on.

- Startup Ecosystem: In September 2024, Serán Bioscience announced a new facility to facilitate integrated drug delivery and final dose capabilities.

A Major Step by the Indian Government in Generic Drug Stores: Leveraging the Progression

Recently, the government announced the expansion of its network of generic drug stores, known as Jan Aushadhi Kendras (JAKs), to more than 16,000by mid-2025, with a target of 25,000 by March 2027. Also, this program has recorded the sales of generic medicines in the 2024–2025 financial year, with sales reaching ₹1,760 crore in February 2025.

AI Emergence in Process Optimization: Empowering the Market Progress

Across the globe, many companies are increasingly adopting digital solutions in their development stages, including the use of AI-assisted algorithms. The generic pharmaceuticals contract manufacturing market is widely employing AI-driven Algorithms in modelling and improving the manufacturing process. This primarily includes job shop scheduling and batch manufacturing, which support lowering changeover times, enhancing throughput, and conserving resources.

Segmental Insights

Service Type Insights

How did the API Manufacturing Segment Lead the Market in 2024?

The API manufacturing segment captured a 30% share of the generic pharmaceuticals contract manufacturing in 2024. A prominent factor is a rise in drug development approaches, and the increasing complexity of drug molecules is propelling the greater demand for API. Current efforts into bioproduction for the development of APIs sustainably, and investments in high-potency and peptide API capacity are also impacting the overall expansion.

Integrated CDMO (Development + Manufacturing)

In the future, the integrated CDMO segment will expand rapidly. Due to the growing demand for affordable and effective drug development and manufacturing, it enables companies to outsource for minimal infrastructure expenditures and gain specialized expertise. They will offer several services from early development to commercialization, and integrated CDMOs will further support clients in streamlining processes.

In June 2025, Cohance Lifesciences Limited and Suven Pharmaceuticals Limited announced planned partners to explore CDMO capabilities.

Finished Dosage Form (FDF) Manufacturing

The finished dosage form (FDF) manufacturing segment is predicted to expand significantly. The players are revolutionizing with the adoption of nanotechnology to generic drug formulations to enhance bioavailability, solubility, and stability, for the further creation of "super generics" with optimized therapeutic profiles. Also, they are promoting the use of 3D printing, AI and robotics solutions.

Drug Type Insights

Why did the Small-Molecule Generics Segment Dominate the Market in 2024?

By capturing a 50% share, the small-molecule generics segment led the generic pharmaceuticals contract manufacturing market in 2024. The growing ageing population and cases of cancer, diabetes, and cardiovascular disease are driving the demand for these drug types. CDMOs are putting efforts into supply chain resilience and sustainability, and a significant shift towards the production of higher-value, complex molecules. In early 2025, Eluxadoline, Buspirone Hydrochloride, and Fludeoxyglucose F-18 were approved by the US FDA.

Biosimilars & Biologics

The biosimilars & biologics segment is estimated to register rapid expansion. As a biosimilar acts as an affordable choice for biologics, with ongoing innovations in bioprocessing, like cell and gene therapies, are supporting the overall progress. Moreover, the consistent record-breaking FDA approvals and crucial licensing and collaboration agreements are impacting the production and marketing of these drug types.

OTC & Consumer Health Products

The OTC & consumer health products segment is estimated to witness notable growth. Primarily, the accelerating e-commerce, with online channels, is acting as a crucial driver for OTC products. Whereas, a rise in consumer preference for OTC medications, dietary supplements, and personal care products is further assisting wider adoption. The emergence of vitamins, minerals, and supplements is boosting the demand.

Formulation Insights

Which Formulation Led the Generic Pharmaceuticals Contract Manufacturing Market in 2024?

The solid oral segment held a 48% share of the market in 2024. The widespread benefits are the expanded accessibility, convenience for all kinds of populations, and diverse diseases, as well it offering affordable solutions. The researchers have explored mini-tabs, mini-particulates, ODTs, ODFs, and digital pills. The escalated adoption of Physiologically Based Pharmacokinetic (PBPK) modeling is supporting the estimation of drug absorption and performance.

Sterile Injectables

The sterile injectables segment is anticipated to grow at the highest CAGR in the generic pharmaceuticals contract manufacturing. Raised demand for new therapeutics, especially GLP-1s and cell/gene therapies, focus on expansion of capacity for large-molecule biologics, and the growth of specialized technologies like isolator lines are boosting the respective advances. In 2025, the Phytonadione Injectable Emulsion received FDA approval for blood clotting concerns.

Inhalation & Nasal

The inhalation & nasal segment is predicted to expand notably. A surge in wider development of these formulations, fueled by the accelerating instances of asthma, Chronic Obstructive Pulmonary Disease (COPD), and allergic rhinitis. However, generic drug producers are shifting from hydrofluoroalkane (HFA) propellants to alternatives with lower global warming potential (GWP). Innovations, like vibrating mesh nebulizers that are portable, battery-powered is also advancing.

End-user Insights

How did the Retail Pharmacies & Outpatient Channels Segment Lead the Market in 2024?

In 2024, the retail pharmacies & outpatient channels segment captured a 46% share of the generic pharmaceuticals contract manufacturing market. Prominently, the expanding digital offerings, like online ordering and home delivery, are making them more accessible, with increased generic drug sales. The use of AI-enabled tools is assisting pharmacies in forecasting demand and improving inventory for both generic and branded products.

Hospitals & Clinics

During the prospective period, the hospitals & clinics segment will witness the fastest expansion. The rising emphasis on complex generics, the use of technology, specifically AI, for development and tailored medicine, with new policies for boosting their application and quality. For conducting numerous clinical trials, they are using AI and ML for the identification of drug targets, optimizing formulations, predicting bioequivalence, and simplifying clinical trials.

Institutional/Government Tenders

The institutional/government tenders segment is estimated to grow significantly in the generic pharmaceuticals contract manufacturing. These kinds of tenders are a formal and competitive procurement process employed to purchase pharmaceuticals for public healthcare systems. Usually, they consider product quality, supplier reliability, delivery conditions, and regulatory compliance.

Regional Insights

Why did North America Dominate the Market in 2024?

In 2024, North America held a major revenue share of 38% of the generic pharmaceuticals contract manufacturing market. The regional growth is prominently fueled by a rise in demand for cost-effective drugs and complex therapies, including biologics, and extensive outsourcing by various companies to minimize capital spending and boost time-to-market. Alongside, the region is focusing on unbrandedd generics, as well as the wider adoption of AI and other technological advances.

For instance,

- In July 2025, Amphastar Pharmaceuticals, Inc., a bio-pharmaceutical company, announced a multi-year expansion of its U.S. manufacturing operations at its headquarters in Rancho Cucamonga, California.

Raised Investment in Sterile Injectables & Biosimilars: Foster the US market.

In North America, the U.S. a one of the major countries, which has rigorous regulatory frameworks for a variety of pharmaceuticals, including sterile injectables & biosimilars. For this, numerous CDMOs are encouraging a broader investment in these complex pharmaceuticals, which impacts the accelerates patient demand for seamless formats.

For instance,

- In October 2025, Eli Lilly and Company planned to invest more than $1 billion over the next few years into new contract manufacturing to facilitate sophisticated technical capabilities and oversight for its contract manufacturing network across India.

Exploration of Suitable Government Policies is Driving the Asia Pacific

In the upcoming era, the Asia Pacific is anticipated to witness rapid expansion in the generic pharmaceuticals contract manufacturing market. This will be mainly influenced by the widespread implementation of different but suitable government policies that support the pharmaceutical industry and empower high-quality standards like Good Manufacturing Practice (GMP), especially in India & China. Alongside, these countries are immensely transforming their infrastructures through major investment, with the progression of more high-capacity facilities and GMP-compliant plants.

For instance,

- In October 2025, Wheeler Bio, a U.S.-based contract development and biomanufacturing organization (CDMO), partnered with Mitsubishi Corporation to boost its commercial reach and business development activities across the Asia-Pacific region.

Impactful Shifts in Value Chain & APIs: Promoting the Chinese Market

Day by day, diverse Chinese contract manufacturers are gaining significance in the value chain. At the same time, these players are accelerating their active investment in many complex areas, particularly in oncology APIs, controlled substances, and peptides, as well as biologics.

For instance,

- In August 2025, WuXi Biologics, a leading global Contract Research, Development, and Manufacturing Organization (CRDMO), received its first approval from the European Medicines Agency (EMA) for its Dundalk, Ireland, facility as a commercial manufacturing site for a global client’s novel biologic.

Patient Expiration & Technological Advances are Driving Europe

A significant expansion of Europe’s generic pharmaceuticals contract manufacturing market is fueled by the patent expiration, which escalates the development of generic versions. This accelerates demand for advanced contract manufacturing services for the production of inexpensive alternatives. Moreover, they are widely leveraging sophisticated technologies, like continuous manufacturing (CM) and digital integration.

For instance,

- In June 2024, ESTEVE planned to invest 100 million euros by 2026 to develop a new manufacturing unit at its Celrà plant (Girona), emphasizing the production capacity of active pharmaceutical ingredients in its main industrial center.

A Surge in New International Trade Agreements: Assisting the UK Market

Primarily, the UK’s generic pharmaceuticals contract manufacturing is expanding because they are looking for innovative trade agreements to accelerate its manufacturing and export opportunities.

For instance,

- In July 2025, the UK and India signed a Free Trade Agreement (FTA) that encompasses zero duty for generic medicines, which could boost the competitiveness of Indian generics in the UK market.

Latin America’s Outsourcing Boom

Generic pharmaceuticals contract manufacturing in South America is expanding rapidly, fueled by growing healthcare access and demand for affordable drugs. Regional governments are simplifying regulatory pathways, while rising R&D collaborations with CMOs are accelerating formulation, packaging, and quality testing capabilities across major countries.

Brazil’s Generic Drive Accelerates

Brazil is strengthening its pharmaceutical backbone with new facilities dedicated to generic manufacturing partnerships. Increased domestic API production, government incentives for local sourcing, and strong collaborations between multinational CMOs and Brazilian firms are advancing technology transfer and improving supply chain reliability nationwide.

Across the Middle East and Africa, nations are modernizing pharmaceutical infrastructure to support large-scale generic manufacturing. Investments in formulation plants, technology upgrades, and regulatory harmonization are enabling CMOs to meet surging regional demand for essential therapies, antibiotics, and chronic disease medications.

GCC’s Local Production Shift

The GCC region is witnessing a strategic shift toward domestic generic drug production. Countries like Saudi Arabia and the UAE are promoting partnerships with CMOs to build sustainable supply chains, enhance manufacturing autonomy, and ensure uninterrupted access to high-quality, cost-effective medicines.

Company Landscape

Catalent, Inc. (Now a part of Novo Holdings)

Company Overview:

- Catalent is a global leader in providing advanced delivery technologies, development, and manufacturing solutions for drugs, biologics, gene therapies, and consumer health products.

- It operates as a full-service Contract Development and Manufacturing Organization (CDMO), playing a crucial role in the generic, branded, and biopharma supply chains.

Corporate Information (Headquarters, Year Founded, Ownership Type):

- Headquarters: Tampa, Florida, U.S. || Year Founded: 2007, spun out of Cardinal Health, with roots dating back to the 1930s. || Ownership Type: Private, acquired by Novo Holdings A/S (the holding company of the Novo Nordisk Foundation) in December 2024.

History and Background:

- Catalent was originally the Pharmaceutical Technologies and Services division of Cardinal Health.

- It was acquired by the private equity firm Blackstone Group in 2007 and renamed Catalent Pharma Solutions.

- The company went public in 2014 (NYSE: CTLT) before being taken private again by Novo Holdings in late 2024.

Key Milestones / Timeline:

- 2014: Initial Public Offering (IPO) on the New York Stock Exchange.

- 2019: Acquired gene therapy CDMO Paragon Bioservices for $1.2 billion, significantly expanding biologics capabilities.

- 2020-2022: Major role in COVID-19 vaccine manufacturing, including agreements with Johnson & Johnson and Moderna.

- Dec 2024: Novo Holdings completes its acquisition of Catalent for approximately $16.5 billion enterprise value.

- Oct 2025: Unveiled its new corporate brand and relocated its global headquarters to Tampa, Florida.

Business Overview:

- Catalent provides end-to-end solutions, from drug development and clinical supply to commercial manufacturing and packaging for various dosage forms.

- The company supports over 1,000 active development programs annually and produces billions of doses per year.

Business Segments / Divisions:

- Biologics: Biologics drug substance manufacturing, fill/finish, and cell and gene therapies.

- Clinical Supply Services: Clinical trial materials supply, packaging, and logistics.

- Oral Dose: Softgel capsules, oral solids, Zydis (Fast-Dissolve) technology, and specialty drug manufacturing.

- Self-Care: OTC medicines, supplements, and topical skin care.

Geographic Presence:

A vast global network of over 40 sites across North America, Europe, Latin America, and the Asia Pacific.

Key Offerings:

- Drug Product Manufacturing: Oral solids, softgel capsules, sterile injectables, inhalations.

- Advanced Delivery Technologies: Zydis (Orally Disintegrating Tablets), OptiPill (Bi-layer, Controlled Release tablets), OptiDose.

- Biologics Services: Cell line development, cell and gene therapy manufacturing, formulation, and fill/finish.

End-Use Industries Served:

Pharmaceutical, Biopharmaceutical (including novel therapies and generics), and Consumer Health/OTC.

Key Developments and Strategic Initiatives:

- Mergers & Acquisitions: Acquired Paragon Bioservices (2019), Master Cell Bank (MCB), and Virus Seed Stock (VSS) facility in Italy from Bristol Myers Squibb (2020).

- Partnerships & Collaborations: Collaboration with Galapagos NV (Jan 2025) to further expand Galapagos' decentralized CAR-T manufacturing network in the U.S.

- Product Launches / Innovations: Continues to promote its proprietary delivery platforms like Zydis (Orally Disintegrating Tablet) and OptiPill as key differentiators.

- Capacity Expansions / Investments: Ongoing investments across all segments, particularly in sterile fill/finish capacity and gene therapy manufacturing globally.

- Regulatory Approvals: Supports regulatory filing and approval for approximately half of all new FDA drug approvals over the past decade.

Distribution Channel Strategy:

- Direct business-to-business (B2B) sales model to pharmaceutical, biotech, and consumer health companies globally.

- Global integrated Clinical Supply Services network for efficient, secure distribution of clinical trial materials.

Technological Capabilities / R&D Focus:

- Core Technologies / Patents: Softgel capsule technology, Zydis fast-dissolve technology, OptiPill drug delivery.

- Research & Development Infrastructure: Operates R&D and clinical sites globally, focusing on advanced formulation and delivery science.

- Innovation Focus Areas: Biologics and advanced modalities (Cell & Gene Therapy), enhanced small molecule bioavailability, and continuous manufacturing.

Competitive Positioning:

- Strengths & Differentiators: Scale and scope, deep expertise in formulation and delivery technologies, leading position in softgel and Zydis ODT, and a rapidly growing presence in the highly lucrative biologics and cell/gene therapy CDMO market.

- Market presence & ecosystem role: Global market leader, particularly strong in North America and Europe, serving large pharma, mid-sized biotech, and generic manufacturers.

SWOT Analysis:

- Strengths: Extensive global network, proprietary delivery technologies, strong position in high-growth biologics/gene therapy, and robust regulatory compliance.

- Weaknesses: Integration challenges following a rapid acquisition strategy, reliance on large capital expenditure, and historical operational issues.

- Opportunities: Expansion in Asia-Pacific, growth in complex small molecule generics, and leveraging parent company Novo Holdings' resources for further investment.

- Threats: Intense competition from Thermo Fisher, Lonza, and Asian CDMOs, and regulatory compliance risks.

Recent News and Updates:

- Press Releases: October 28, 2025: Catalent Debuts New Corporate Brand, Elevating Customer Service Excellence by “Championing the Missions that Matter™.” October 27, 2025: Announced the opening of its new global corporate headquarters in Tampa, Florida.

- Industry Recognitions / Awards: Frequently recognized as a top CDMO partner in industry surveys for quality and service.

Recipharm AB

Company Overview:

Recipharm is a leading European Contract Development and Manufacturing Organization (CDMO), providing end-to-end services across the drug life cycle, with a long history of serving the generic and branded pharmaceutical markets.

It offers manufacturing services for both small molecules and advanced biologics.

Corporate Information (Headquarters, Year Founded, Ownership Type):

- Headquarters: Jordbro, Sweden. | Year Founded: 1995. | Ownership Type: Private, majority-owned by the EQT IX fund.

History and Background:

- Founded in 1995 when Lars Backsell and Thomas Eldered acquired the pharmaceutical manufacturing unit of Kabi Pharmacia in Sweden.

- Recipharm grew primarily through a strategy of acquiring manufacturing sites from pharmaceutical companies like AstraZeneca, Pfizer, and others across Europe.

- This strategy built a vast network of facilities adept at manufacturing established, often generic or branded generic, products.

Key Milestones / Timeline:

- 2007-2015: Rapid international expansion through multiple acquisitions of manufacturing sites in France, Germany, the U.K., and India.

- 2020: Acquired Consort Medical, significantly strengthening its sterile fill/finish, respiratory, and device capabilities (Bespak division).

- 2022: Acquired Arranta Bio and Vibalogics, marking a major strategic move into the high-growth Advanced Biologics market (Cell & Gene Therapy, Viral Vector).

- Sep 2025: Strengthened its brand to reinforce customer focus and manufacturing leadership, including rebranding the advanced therapies division to Recipharm Advanced Bio.

- Oct 2025: Inaugurated a state-of-the-art parenteral development and sterility laboratories.

Business Overview:

The company offers comprehensive services for drug product manufacturing, from clinical trial material to commercial supply, with a focus on both traditional dosage forms and advanced therapeutic modalities.

Business Segments / Divisions:

- Oral Dosage: Oral solids, semi-solids, and oral liquids.

- Sterile Delivery: Sterile liquids, freeze-dried products, Blow-Fill-Seal (BFS) technology, and pre-filled syringes.

- Advanced Bio (formerly ReciBioPharm): Biologics drug substance and drug product, including Live Biotherapeutic Products (LBPs), Viral Vectors, and Vaccines.

Geographic Presence:

Significant presence in Europe (Nordics, France, Germany, U.K., Italy), as well as a growing footprint in North America and Asia (India).

Key Offerings:

- Drug Product Manufacturing: Tablets, capsules, liquids, gels, creams, sterile injectables, and respiratory devices.

- Specialized Manufacturing: High Potency Active Pharmaceutical Ingredients (HPAPI), Beta-lactams, Hormones.

- Development Services: Formulation, analytical, clinical supply, and process optimization.

End-Use Industries Served:

Large and mid-sized pharmaceutical companies, virtual/biotech companies, and generic manufacturers (both branded and unbranded).

Key Developments and Strategic Initiatives:

- Mergers & Acquisitions: Recent acquisitions include Consort Medical (2020), Arranta Bio (2022), and Vibalogics (2022).

- Partnerships & Collaborations: Collaboration with NeuroSense Therapeutics (Sep 2025) to advance ALS therapy PrimeC toward Phase 3 trials.

- Product Launches / Innovations: Introduced branded tools like ReciPredict™ (AI-driven modeling), ReciDev™ (development offerings), and Recimagine™ (inline analytical ecosystem).

- Capacity Expansions / Investments: Inaugurated state-of-the-art parenteral development and sterility laboratories (Oct 2025). Secured a major additional grant to develop AI-enabled manufacturing technologies (Oct 2025).

- Regulatory Approvals: Supports customers through all phases of regulatory filing and manufacturing under GMP compliance (FDA, EMA, etc.).

Distribution Channel Strategy:

Primarily a direct B2B model, leveraging its global network of cGMP facilities to supply products to customers' distribution centers and global markets.

Technological Capabilities / R&D Focus:

- Core Technologies / Patents: Blow-Fill-Seal (BFS) sterile technology, Dry Powder Inhalers (DPI) and respiratory devices (via Bespak).

- Research & Development Infrastructure: Dedicated R&D and analytical laboratories across Europe and India, focusing on complex injectables and advanced biologics.

- Innovation Focus Areas: Advanced Biologics (Cell & Gene Therapy), applying AI and digital solutions (ReciPredict™, ReciCore™) to optimize manufacturing, and sustainability (achieved 100% renewable electricity across all sites).

Competitive Positioning:

- Strengths & Differentiators: A strong European heritage and footprint, robust capabilities in complex sterile delivery and respiratory devices, and a rapidly expanding, integrated offering in advanced biologics. Known for reliable supply of established, complex generic products.

- Market presence & ecosystem role: One of the largest European CDMOs, acting as a key manufacturing partner for numerous generic and mid-sized pharma companies.

SWOT Analysis:

- Strengths: Global network spanning multiple dosage forms, strong position in European generics and injectables, successful diversification into advanced biologics, and commitment to sustainability.

- Weaknesses: Potential for fragmentation due to growth by acquisition, and significant capital outlay needed for biopharma expansion.

- Opportunities: High demand for advanced modalities (gene therapy, vaccines) and complex generic injectables, and leveraging AI/digitalization to improve efficiency.

- Threats: Competition from global giants like Lonza/Thermo Fisher and Asian CDMOs with lower cost structures.

Recent News and Updates:

- Press Releases: October 28, 2025: Secured major additional grant to develop AI-enabled manufacturing technologies. October 13, 2025: Inaugurated state-of-the-art parenteral development and sterility laboratories.

- Industry Recognitions / Awards: Achieved an A- Climate CDP rating (leading and outperforming the industry) for its environmental performance.

Key Companies and Their contributions and offerings

- Lonza Group- It has launched its new Design2Optimize platform in May 2025 to expand the process development of APIs.

- Thermo Fisher Scientific (Patheon)- It offers the development and manufacturing of small molecule APIs, the biologically active component of a drug.

- Catalent- In December 2024, Novo Holdings acquired this company to facilitate specialized manufacturing services.

- Samsung Biologics- It is leveraging its biosimilar development arm, Samsung Bioepis, to avoid possible conflicts of interest with its CDMO clients.

- WuXi AppTec- It has added 621 novel molecules to its small-molecule development and manufacturing pipeline in the first three quarters of 2025.

Top Companies in the Market

- Boehringer Ingelheim

- Recipharm

- Piramal Pharma Solutions

- Jubilant Life Sciences/Jubilant Pharmova

- Siegfried Holding

- Cambrex Corporation

- Aenova Group

- Fareva Group

- Almac Group

- Ajinomoto Bio-Pharma Services

- Pfizer CentreOne

- Vetter Pharma International

- Alcami Corporation

- PCI Pharma Services

- Curia

Recent Developments in the Generic Pharmaceuticals Contract Manufacturing Market

- In October 2025, the global pharma major Lupin Limited (Lupin) launched an authorized generic version of Ravicti (Glycerol Phenylbutyrate) Oral Liquid, 1.1g/mL, in the United States.

- In August 2025, NATCO Pharma unveiled generic Bosentan tablets for oral suspension in the United States.

- In May 2025, Meitheal Pharmaceuticals launched a generic paclitaxel formulation in the United States through an exclusive commercial licensing agreement.

Segments Covered in the Report

By Service Type

- API Manufacturing

- Small-molecule API synthesis

- Custom/toll API production

- Finished Dosage Form (FDF) Manufacturing

- Tableting & encapsulation

- Liquid & sterile filling

- Integrated CDMO (Development + Manufacturing)

- Process development & scale-up

- Tech transfer & validation

- Packaging & Secondary Operations

- Blistering & bottle filling

- Labeling & serialization

- Analytical, QC & Stability Services

- Method development

- Stability testing & release testing

- Sterile/Biologics Fill-Finish

- Aseptic vial/syringe filling

- Lyophilization services

- Clinical Trial/Small-Batch Supplies

- Phase I–III clinical supply manufacturing

- Comparator sourcing

By Drug Type

- Small-molecule Generics

- Oral solids generics

- Generic injectables (non-sterile)

- Biosimilars & Biologics

- Monoclonal antibodies & recombinant proteins

- Biosimilar development services

- Sterile Injectables

- Multi-dose & single-dose vials

- Pre-filled syringes

- OTC & Consumer Health Products

- OTC tablets & syrups

- Self-care topicals

- Topicals & Transdermals

- Creams, gels, ointments

- Transdermal patches

- Others (Ophthalmic, Suppositories)

By Formulation

- Solid Oral

- Immediate release tablets

- Modified/controlled release capsules

- Sterile Injectables

- Aseptic vials & syringes

- Biologic parenterals

- Liquids & Syrups

- Oral suspensions & solutions

- Oral rehydration & pediatric formulations

- Topicals & Semisolids

- Creams, gels, ointments

- Transdermal systems

- Inhalation & Nasal

- Transdermal Patches

- Others (Ophthalmic, Suppositories)

By End-User Industry

- Retail Pharmacies & Outpatient Channels

- Retail prescription generics

- OTC retail lines

- Hospitals & Clinics

- Inpatient sterile injectables & parenterals

- Hospital formulary generics

- Institutional/Government Tenders

- Public health tenders

- Vaccine/essential medicine procurement

- Research Institutions & CROs

- Clinical trial supplies

- Comparator & reference products

- Export/International Distributors

- Third-party distribution hubs

- Private label export lines

- Animal Health/Veterinary

- Others (Cosmetics adjacent, Nutraceutical OEM)

By Region

- North America

- U.S.

- Canada

- Mexico

- Rest of North America

- South America

- Brazil

- Argentina

- Rest of South America

- Europe

- Western Europe

- Germany

- Italy

- France

- Netherlands

- Spain

- Portugal

- Belgium

- Ireland

- UK

- Iceland

- Switzerland

- Poland

- Rest of Western Europe

- Eastern Europe

- Austria

- Russia & Belarus

- Türkiye

- Albania

- Rest of Eastern Europe

- Asia Pacific

- China

- Taiwan

- India

- Japan

- Australia and New Zealand

- ASEAN Countries (Singapore, Malaysia)

- South Korea

- Rest of APAC

- MEA

- GCC Countries

- Saudi Arabia

- United Arab Emirates (UAE)

- Qatar

- Kuwait

- Oman

- Bahrain

- South Africa

- Egypt

- Rest of MEA