February 2026

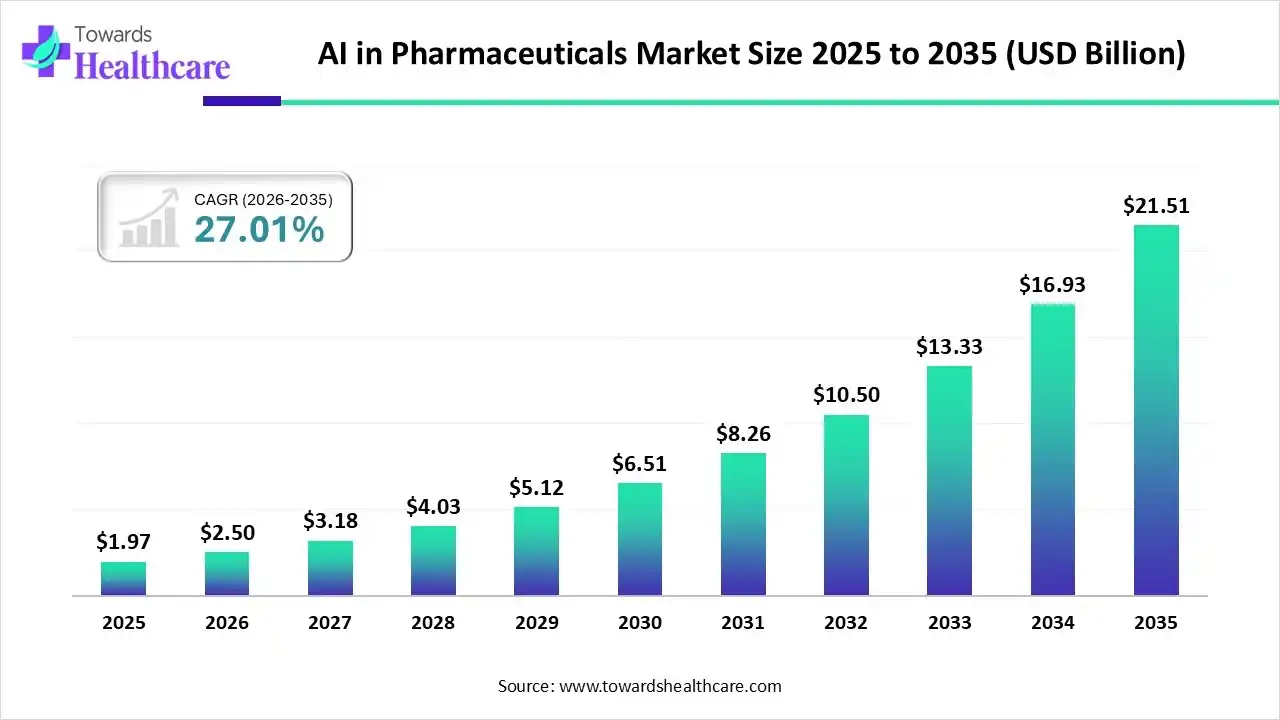

The global AI in pharmaceuticals market size is calculated at US$ 1.97 billion in 2025, grew to US$ 2.5 billion in 2026, and is projected to reach around US$ 21.51 billion by 2035. The market is expanding at a CAGR of 27.01% between 2026 and 2035.

Because AI seamlessly integrates data, computational power, and algorithms, it is transforming conventional drug discovery and development models. This synergy speeds up development timelines, lowers costs, and improves drug research's efficiency, accuracy, and success rates. AI has shown notable advancements in a number of fields, including small-molecule drug design, target discovery and validation, drug characterization, and clinical trial acceleration, when combined with machine learning (ML) and deep learning (DL).

| Key Elements | Scope |

| Market Size in 2025 | USD 1.97 Billion |

| Projected Market Size in 2035 | USD 21.51 Billion |

| CAGR (2026 - 2035) | 27.01% |

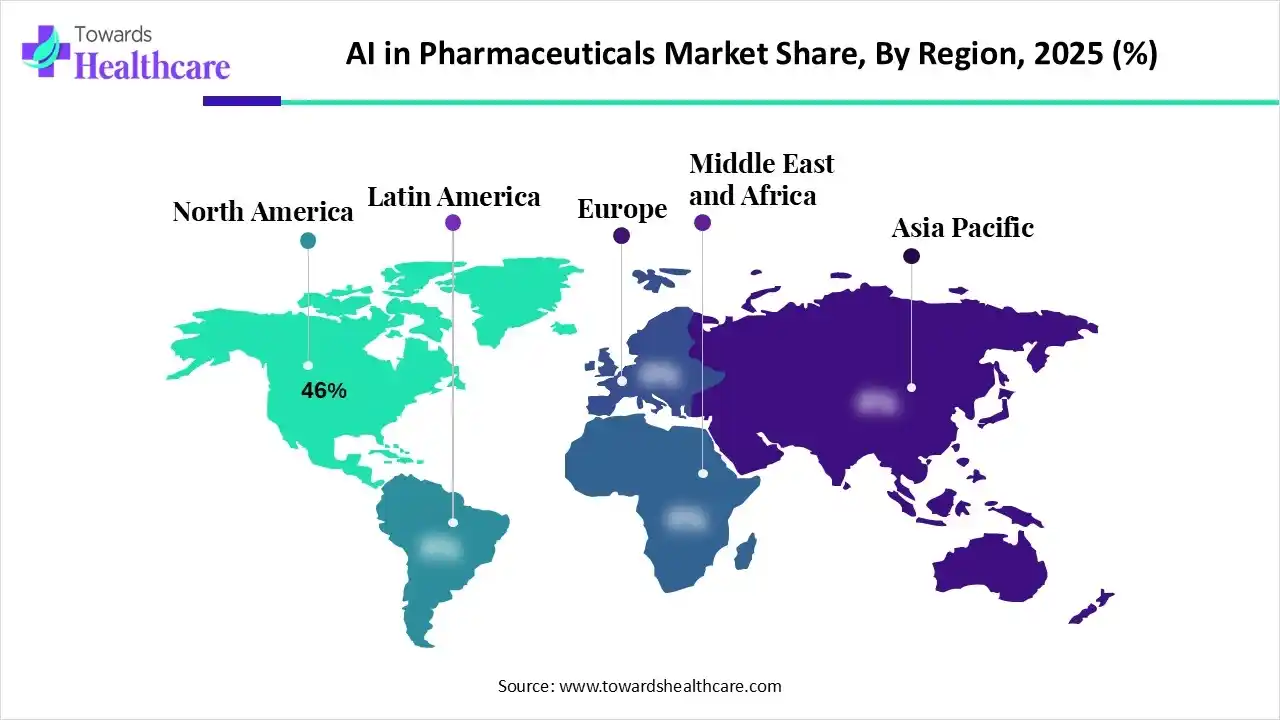

| Leading Region | North America by 46% |

| Market Segmentation | By Application, By Technology, By Drug Type, By Deployment Mode, By End User, By Region |

| Top Key Players | Exscientia, Insilico Medicine, BenevolentAI, Atomwise, BioAge Labs, XtalPi, Recursion Pharmaceuticals, Valo Health, Deep Genomics, Absci Corporation, IBM Watson Health, NVIDIA Corporation, Microsoft Azure AI, Google DeepMind, Schrödinger, Inc., Cloud Pharmaceuticals, Cyclica (Recursion), Ardigen S.A., Owkin Inc., Turbine.ai |

The AI in pharmaceuticals market refers to the application of artificial intelligence (AI), machine learning (ML), and deep learning (DL) across various stages of the pharmaceutical value chain, from drug discovery and clinical trials to manufacturing, supply chain management, and commercialization. AI helps accelerate target identification, reduce R&D costs, improve clinical trial design, optimize drug formulation, and enhance patient outcomes. The growing availability of biomedical data, regulatory support for AI-enabled innovation, and partnerships between pharma and AI startups are key factors driving market growth.

Why Drug Discovery Dominated the Market in 2024?

The drug discovery segment dominated the AI in pharmaceuticals market in 2024, accounting for approximately 41% of revenue. Drug development is a laborious and intricate process that has historically depended on trial-and-error experimentation and the experience of drug developers. This paradigm is about to change with the introduction of AI technologies, especially generative AI and large language models.

As of November 6, 2025, 425,499 (76%) of the 557,103 studies listed on ClinicalTrials.gov were interventional trials. About 209,475 of these deal with medications or biologics for the creation of new drugs. 43,674 studies were added in 2024, and 36,226 in 2025.

Clinical Trial & Optimization

The clinical trial design & optimization segment is expected to grow at the fastest rate in the AI in pharmaceuticals market CAGR during the forecast period. Clinical trials are changing in almost every way due to AI. AI has a significant and wide-ranging impact on everything from improving patient monitoring and data analysis to creating smarter trials. Because AI can simulate different scenarios and forecast possible outcomes, it is essential for optimizing trial protocols. Furthermore, a number of AI-based tools use predictive analytics to design safer and more intelligent clinical trials

Precision Medicine

The precision medicine segment is growing significantly in the AI in pharmaceuticals market during 2025-2034. AI is revolutionizing the integration and analysis of genetic, immunological, and medical records data, making it a disruptive force in precision medicine. Integrating AI with various data sets gives doctors a comprehensive picture of their patients. In the medical field, machine learning and deep learning models improve disease prediction, risk assessment, and treatment optimization.

Why Machine Learning (ML) Became Dominant in the Market in 2024?

The machine learning (ML) segment dominated the AI in pharmaceuticals market in 2024, accounting for approximately 44% of revenue. The pharmaceutical industry is changing as a result of machine learning, which is enabling previously unattainable breakthroughs. It now supports choices in drug development and delivery, from forecasting novel compounds' interactions with the body to expediting clinical trials and customizing patient care.

Reinforcement Learning (RL)

The reinforcement learning (RL) segment is expected to grow at the fastest CAGR during the forecast period. RL is a machine learning paradigm that optimizes sequential treatment strategies and addresses uncertainties to improve clinical decision-making for medical professionals. In order to improve results and resource efficiency, RL uses patient data to develop individualized treatment plans.

Deep Learning (DL)

The deep learning (DL) segment is growing significantly in the AI in pharmaceuticals market during 2025-2034. By locating drug targets, forecasting protein binding, and facilitating personalized medicine via genomic data analysis, DL speeds up drug discovery. It improves patient stratification and biomarker discovery in clinical trials and aids in the development of safer medications by looking for adverse events in real-world data.

What made Small Molecules Dominant in the Market in 2024?

The small molecules segment dominated the AI in pharmaceuticals market in 2024, accounting for approximately 56% of revenue because globally, 81 FIC medications received approval in 2023 and 2024. Small-molecule drugs account for a larger share (51.9%), demonstrating the discovery of novel chemical entities. 42 FIC small-molecule drugs and 173 novel small-molecule drugs were approved in 2023 and 2024. Synthetic small-molecule medications, which are created and synthesized artificially, make up the majority of novel small-molecule medications and FIC medications (76.4%). Endogenous materials (8.6%) and natural products (6.3%) are also important sources for FIC drug research and development.

Biologics

The biologics segment is expected to grow at the fastest CAGR in the AI in pharmaceuticals market during the forecast period, as the post-COVID era has seen an unprecedented surge in demand for biologics, including vaccines. To meet this increasing demand, nations such as the U.S., Sweden, China, India, Japan, and the United Kingdom have begun building sophisticated biomanufacturing facilities. By building these facilities or acquiring existing locations through mergers and acquisitions, large pharmaceutical companies are entering the biologics market.

Vaccines

The vaccines segment is growing significantly in the AI in pharmaceuticals market during 2025-2034 because immunization is essential for primary healthcare, an unassailable human right, and for preventing and controlling infectious disease outbreaks. Currently, vaccinations prevent between 3.5 and 5 million deaths annually from diseases like measles, influenza, tetanus, pertussis (whooping cough), and diphtheria.

How the Cloud-Based Segment Became Dominant & Fastest in the Market?

The cloud-based segment dominated the AI in pharmaceuticals market in 2024, accounting for approximately 72% of revenue, and is expected to grow at the fastest CAGR during the forecast period. Pharmaceutical firms can revolutionize patient care by using cloud-based AI to optimize processes, boost productivity, and customize therapies. To handle massive volumes of medical data, cloud platforms offer the scalability, security, and real-time data access needed. With the help of these cloud-based infrastructures, AI can improve decision-making in areas such as supply chain management, clinical trials, drug discovery, and patient engagement. It can also automate complicated tasks and extract actionable insights.

On-Premises

The on-premises segment is growing significantly in the AI in pharmaceuticals market during 2025-2034. An effective substitute is on-premise LLM deployment, which puts AI capabilities inside the firewall to protect private information, intellectual property, and legal obligations.

Which End-User Dominated the Market in 2024?

The pharmaceutical & biotechnology companies segment dominated the AI in pharmaceuticals market in 2024, accounting for approximately 49% of revenue. Pharmaceutical & biotechnology companies have now integrated AI in every step from the supply chain to drug supply. AI has become part of drug discovery, data analysis, process optimization, decision-making, patient support, and more.

Contract Research Organizations (CROs)

The contract research organizations (CROs) segment is expected to grow at the fastest CAGR during the forecast period. Pharma and biotech companies face very high product demand driven by the rise in chronic conditions and an aging population. As a result, these companies reach out to CROs to manage various functions. CROS utilizes AI to smoothly handle tasks, ultimately leading to enhanced efficiency, accuracy, time & cost management.

Academic & Research Institutes

The academic & research institutes segment is growing significantly in the AI in pharmaceuticals market during 2025-2034. Academic & research institutes are involved in drug discovery, precision medicine, and other pharma-related tasks. Therefore, these institutions use AI across various processes to enhance overall operations.

North America dominated the AI in pharmaceuticals market with a share of approximately 46% in 2024 because of things like the high cost of healthcare in the area per person, the increased investment in medical technology, including artificial intelligence, the growing need for patient-centered methods, the emphasis on cutting down on the time and expense of drug development, and research on rare diseases. Growth is further fueled by the increasing emphasis on quality control and regulatory compliance, the development of healthcare and drug-discovery infrastructure, and the rising demand for digital technologies in North America.

One of the main forces behind the AI in pharmaceuticals market’s growth has been government action. The following are some significant programs in the U.S. and other countries that specifically encourage the development of pharmaceutical plants.

FDA PreCheck (2025): It was introduced on August 7, 2025, with the goal of removing years of bureaucratic red tape in the building of plants. The FDA Commissioner described it as a component of lessening reliance on foreign drug suppliers.

May 2025 Executive Order: An order signed by President Trump instructs the FDA to expedite the approval process for U.S. pharmaceutical plants.

Asia Pacific is estimated to host the fastest-growing AI in pharmaceuticals market during the forecast period. The market is expanding rapidly in the region, driven by countries such as China and India. Asia Pacific businesses are developing AI technologies to accelerate drug development and discovery, improving the effectiveness of clinical trials and addressing unmet medical needs.

China's innovative drug industry has reached its "DeepSeek Moment" as the global pharmaceutical landscape undergoes significant restructuring. Due to innovation and globalization, Chinese biopharmaceutical companies, once largely viewed as copycats, are now becoming important players on the international scene. With 94 deals totaling US$51.9 billion in 2024, a 26% year-over-year increase, China's innovative drug license-out transactions reached record highs in both volume and value.

Europe is expected to grow at a significant CAGR in the AI in pharmaceuticals market during the forecast period, driven by strong government backing, the growing use of AI in drug development, and collaboration between tech and pharmaceutical companies. As nations like Germany, the United Kingdom, and France take the lead in AI research and development, significant investments are being made.

The UK's thriving global biopharmaceutical sector is bolstered by a top-tier talent pool and a long-term vision, as well as a partnership with the government. Researchers from the UK have been instrumental in international scientific initiatives and discoveries. In addition, the UK has spearheaded numerous innovative, first-of-its-kind research initiatives, including the establishment of the 100,000 Genomes Project, the National Institute for Health Research, and the UK Biobank.

South America is expected to grow significantly in the AI in pharmaceuticals market during the forecast period. South America is witnessing rapid AI integration in drug research, diagnostics, and clinical trial analytics. Over 60 regional initiatives are focusing on predictive modeling, patient stratification, and data harmonization, transforming healthcare efficiency and drug development capabilities across key Latin markets.

Brazil’s pharmaceutical AI growth is accelerating through 80-plus tech partnerships optimizing genomic analysis, hospital workflows, and patient outcomes. Government-backed innovation programs and smart data infrastructure are nurturing domestic AI startups advancing drug design and digital therapeutics nationwide.

The Middle East and Africa are expected to grow at a lucrative CAGR in the AI in pharmaceuticals market during the forecast period. Across the Middle East and Africa, AI is reshaping pharma with over 100 health-tech deployments in supply chain, pharmacovigilance, and clinical intelligence. Regional innovation hubs are improving accessibility, data governance, and AI-driven decision-making in medicine development and healthcare delivery.

The UAE leads with national AI strategies driving pharma automation, precision medicine, and drug discovery. Through collaborations with Nvidia, G42, and global biotech firms, over 45 AI pilot projects now enhance regulatory speed, manufacturing, and patient-centered innovation.

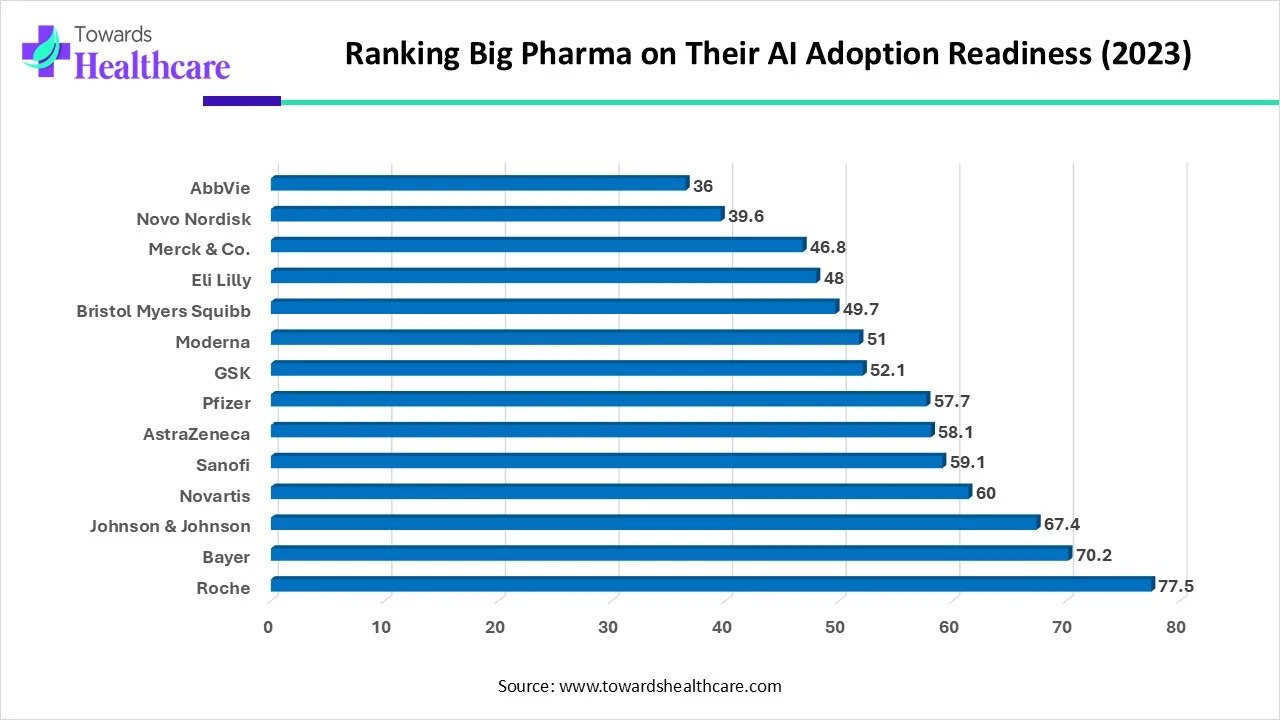

The image highlights how prepared major pharmaceutical companies are to adopt and integrate artificial intelligence into their operations as of 2023. Roche leads the list with the highest AI readiness score of 77.5, showing that it has invested heavily in digital transformation and advanced analytics. Bayer and Johnson & Johnson follow closely, with scores of 70.2 and 67.4, indicating that these companies also prioritize AI-driven innovation in research, development, and operations.

Novartis, Sanofi, and AstraZeneca sit in the middle of the ranking with scores ranging from 58 to 61, reflecting strong AI adoption but still room for deeper integration. Pfizer also remains close to this cluster with a score of 57.7, showing consistent progress in modernizing its data and AI capabilities.

Companies like GSK, Moderna, and Bristol Myers Squibb fall into the 50-point range, meaning they have adopted AI but may still be building the necessary infrastructure, talent, or strategy to reach higher maturity levels.

Further down the list, Eli Lilly, Merck & Co., Novo Nordisk, and AbbVie show comparatively lower readiness, with scores between 36 and 48. These scores suggest that although they have started adopting AI, they may still face challenges such as slower digital transformation, limited data integration, or more cautious investment approaches.

Overall, the table shows a clear gap between the early leaders who aggressively pursue AI innovations and those who are still developing foundational capabilities. This spread also reflects how differently each company prioritizes AI as a strategic driver for competitiveness, efficiency, and scientific advancement.

Company Overview: Global pharmaceutical company focused on innovative medicines, generic and biosimilar pharmaceuticals (Sandoz spin-off completed in 2023), and eye care. AI plays a central role in its "unbossed" strategy, aiming to transform drug discovery, clinical development, manufacturing, and commercialization.

Corporate Information

History and Background

History and Background: Novartis traces its roots back to the 18th century. The 1996 merger created a global life science leader. It has been an early and aggressive adopter of digital technologies, particularly AI and Machine Learning, to revitalize its R&D productivity and operational efficiency.

Key Milestones/Timeline:

Business Overview

Key Developments and Strategic Initiatives

Mergers & Acquisitions: Focus is generally on smaller, targeted AI/tech partnerships rather than large AI company acquisitions, preferring to build in-house capabilities and strategic alliances.

Partnerships & Collaborations:

Technological Capabilities/R&D Focus

Competitive Positioning

Recent News and Updates

Company Overview: Global pioneer in pharmaceuticals and diagnostics. Roche is highly committed to personalized healthcare, using data and AI to integrate therapeutic and diagnostic offerings. Its AI strategy is critical for pathology, diagnostics, and targeted oncology drug discovery.

Corporate Information

History and Background

History and Background: Over 125 years of history, with major contributions in vitamins and pharmaceuticals. The acquisition of Genentech in 2009 solidified its leadership in biotechnology. The unique integration of the Pharmaceuticals and Diagnostics divisions positions it to leverage vast amounts of real-world patient and diagnostic data, which is key for its AI strategy in personalized healthcare.

Key Milestones/Timeline:

Business Overview

Key Developments and Strategic Initiatives

Competitive Positioning

SWOT Analysis:

Recent News and Updates

| Company | Key Contributions | Core Offerings | Focus Areas | Strategic Highlights |

| Exscientia | Pioneers AI-driven drug design, integrating deep learning with precision chemistry for faster candidate discovery. | Centaur Chemist platform, predictive modeling, discovery partnerships. | Oncology, immunology, metabolic disorders. | Combined with Recursion in 2024 to enhance end-to-end AI drug development. |

| Insilico Medicine | Uses generative AI and biology models to discover and develop novel therapeutics. | Pharma.AI suite, Chemistry42, target discovery tools. | Fibrosis, oncology, and rare diseases. | Launched AI-designed drug INS018_055, entering clinical trials in 2025. |

| BenevolentAI | Integrates knowledge graphs and ML for target identification and validation. | Benevolent Platform, data integration tools. | Inflammatory diseases, neurology. | Expanded AstraZeneca partnership in 2025 for novel target discovery. |

| Atomwise | Applies structure-based deep learning for small-molecule drug discovery acceleration. | AtomNet technology, screening as a service. | Oncology, infectious diseases, CNS. | Partnered with Bayer and Eli Lilly for AI-driven molecule discovery. |

| BioAge Labs | Uses AI and omics data to identify longevity-related drug targets. | Age-related biomarker analysis platform. | Aging, metabolic, and cardiovascular diseases. | Advanced multiple AI-identified candidates into early clinical stages.. |

Read further to see how top players are reshaping the AI in Pharmaceuticals Market: https://www.towardshealthcare.com/companies/ai-in-pharmaceuticals-companies

By Application

By Technology

By Drug Type

By Deployment Mode

By End User

By Region

February 2026

February 2026

February 2026

February 2026