January 2026

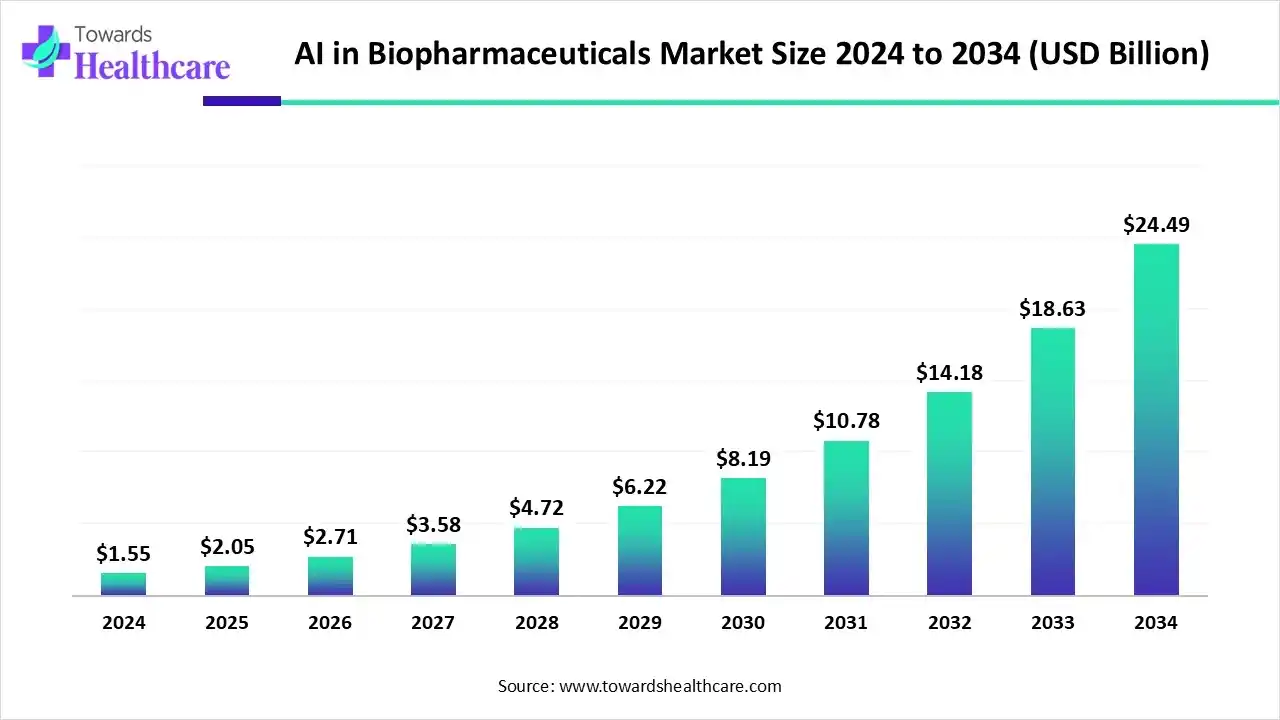

The AI in biopharmaceuticals market size is calculated at US$ 1.55 billion in 2024, grew to US$ 2.05 billion in 2025, and is projected to reach around US$ 24.49 billion by 2034. The market is expanding at a CAGR of 32.27% between 2025 and 2034.

The AI in biopharmaceuticals market has transformed drug discovery, precision medicine, and pharmaceutical research by improving biopharmaceutical commercialization. It encompasses market analysis and strategy, regulatory approval, brand development, product launch and post-launch activities, patient support and education, and market access and reimbursement. Biopharmaceutical leaders are prioritizing predictive analytics, digital engagement, and real-time personalization.

| Table | Scope |

| Market Size in 2025 | USD 2.05 Billion |

| Projected Market Size in 2034 | USD 24.49 Billion |

| CAGR (2025 - 2034) | 32.27% |

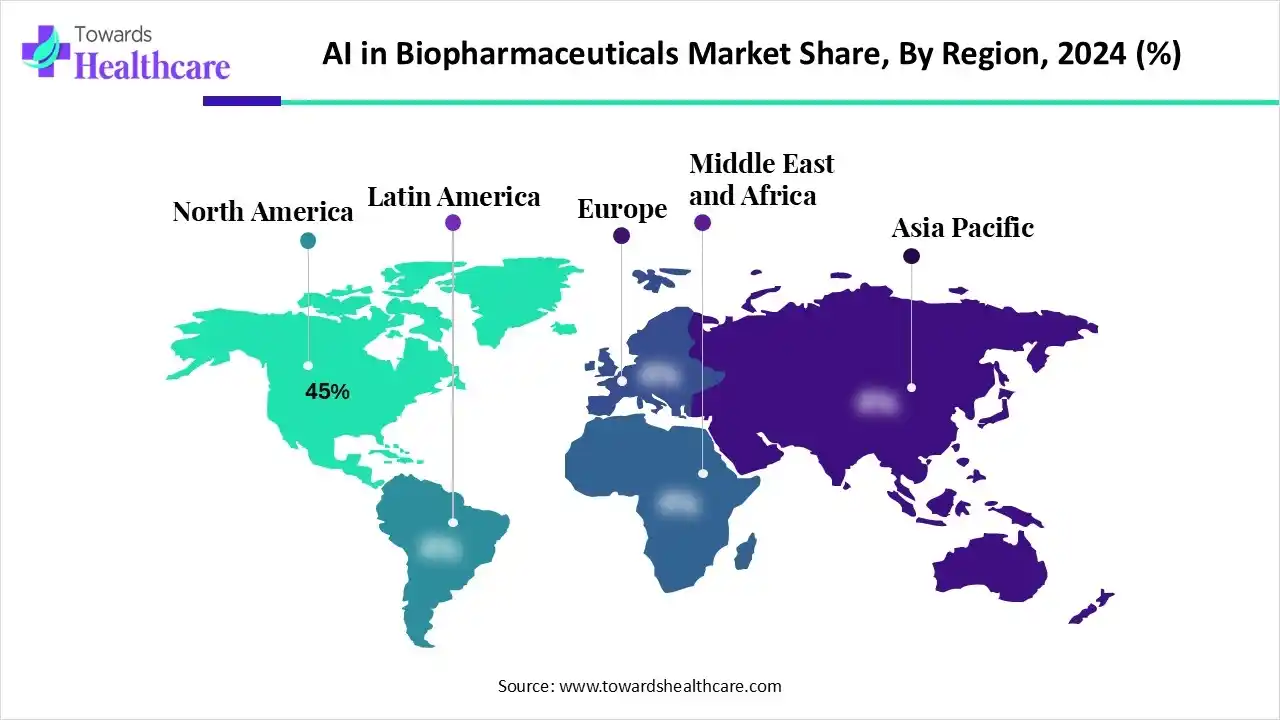

| Leading Region | North America by 45% |

| Market Segmentation | By Application/Value-chain Use, By Therapeutic Focus/Use Case, By Technology/Methodology, By Deployment/Delivery Model, By Region |

| Top Key Players | Insilico Medicine, Exscientia, Atomwise, BenevolentAI, Recursion Pharmaceuticals, Schrödinger, Deep Genomics, Relay Therapeutics, Valo Health, Numerate, BenchSci, Owkin, Causal AI/BioSymetrics, Cloud Pharmaceuticals, Arctoris/Benchling-adjacent tool providers, TwoXAR/Healx, Boston- and Silicon Valley-based AI drug startups, Large cloud/tech providers enabling enterprise AI, Leading CROs & CDMOs integrating AI capabilities, Academic spinouts and translational AI labs commercializing platforms |

The urgent need to streamline preclinical research, improve success rates of clinical trials, and tailor treatment plans drives the adoption of artificial intelligence in the biopharmaceutical industry. The AI in biopharmaceuticals market covers software, platforms, and services that apply artificial intelligence (machine learning, deep learning, generative models, computer vision, natural language processing, and hybrid approaches) across the biopharma value chain.

This includes AI for drug discovery (target ID, hit generation, lead optimization), preclinical modeling and in-vitro/in-vivo prediction, clinical trial design and patient selection, manufacturing process optimization and quality control, regulatory intelligence & pharmacovigilance, and commercial analytics (market access, RWE, promotional optimization). Solutions range from niche models and point tools to enterprise platforms and CDMO-integrated services.

Growth is driven by pressure to shorten R&D timelines, reduce attrition, lower development costs, increase availability of biological and real-world datasets, and wider acceptance of AI-augmented decision-making in R&D and manufacturing.

The drug discovery segment dominated the market in 2024, with a revenue share of approximately 45%, owing to the wide applications of AI in the analysis of vast datasets, de novo drug design, and prediction of trial outcomes. The drug discovery and development process is accelerated by improved cost efficiency, increased speed, and higher success rates. AI improves trial design and monitoring and streamlines patient recruitment.

The clinical development & trials segment is expected to grow at the fastest CAGR in the market during the forecast period due to enhanced preclinical trials and optimized drug formulations by the insertion of AI into clinical development. AI enables personalized medicine, enhances clinical trial efficiency, and speeds up drug discovery and development. AI allows the identification and optimization of new drug candidates, the monitoring of patient safety, and the refinement of trial design.

The oncology segment dominated the market in 2024, with a revenue share of approximately 28%, owing to the accelerated drug discovery, biomarker discovery, and precision oncology. AI improves diagnosis and monitoring, and streamlines clinical trials in cancer research. AI assists in patient selection, adaptive trial design, and risk assessment.

The neurology segment is estimated to grow at the fastest rate in the market during the predicted timeframe due to the immense role of AI in diagnosis, early detection, treatment, management, research, and drug development. AI used in neuroimaging can automate the analysis of PET, MRI, and CT scans to detect abnormalities. The wearables and biosensors equipped with AI algorithms help with early detection of severe health conditions like epilepsy and Parkinson's disease.

The deep learning segment dominated the market in 2024, with a revenue share of approximately 28%, owing to the use of AI to support clinical decisions in treating neurological conditions. Neurologists understand clinical AI, which helps in diagnosis and patient care. AI assists in procedural tasks and human communication.

The generative models segment is anticipated to grow at a notable rate in the market during the upcoming period due to the critical role of AI in predictive modeling, antibody design and optimization, manufacturing, and supply chain. The generative AI models accelerate drug design, discovery, and optimization of novel drugs. Machine learning algorithms enable virtual screening of potential drug candidates.

The cloud-based SaaS & platforms segment dominated the market in 2024, with a revenue share of approximately 62%, owing to improved computational power and scalability. The segment is expected to sustain the position during the forecast period due to improved data integration and data management, as well as advanced data analytics. AI-enabled platforms ensure compliance and security through robust security features and regulations.

North America dominated the market in 2024, with a revenue share of approximately 45%, owing to the largest adoption of AI, pharma HQs, VC funding, and cloud infrastructure. America’s AI action plan drives the establishment of laboratory infrastructure, supports novel scientific organizations, and strengthens the data infrastructure. The American Hospital Association (AHA) announced that many agencies are collaborating on pharmaceutical manufacturing projects using AI. The public-private partnerships are driven by organizations like the Department of Energy (DoE) and the National Science Foundation (NSF) that accelerate drug discovery and validate new therapies.

The Trump administration launched an AI-driven drug manufacturing initiative, supported by the U.S. Department of Health and Human Services (HHS) and the Defense Advanced Research Projects Agency (DARPA), to advance U.S. pharmaceutical manufacturing through advanced technologies, including machine learning, artificial intelligence, and informatics. The U.S. introduced AI-powered domestic drug manufacturing, driven by public-private partnerships, utilization of cutting-edge technologies, and specific innovative projects. Moreover, the 3D printing revolution, improved manufacturing, automation, and real-time optimization.

Asia Pacific is expected to grow at the fastest CAGR in the market during the forecast period due to a growing biotech activity, data availability, and AI manufacturing uptake. Asia Pacific governments implement targeted programs to provide capital and infrastructure for early-stage R&D. These efforts attract more private capital investments, and companies embrace new tools to streamline testing, code faster, and improve quality. This region is rapidly inserting AI into its application development and maintenance (ADM) operations. A growing number of enterprises across this region are adopting AI-based ADM services to improve operational efficiency and ensure software reliability.

The Government of India stated that over ₹10,300+ crore were allocated over five years for the IndiaAI mission. Moreover, over 6 million people were employed in the tech and AI ecosystem. India accounts for around 1.8 lakh startups that have used AI in their products and services.

Europe is seen to grow at a notable rate in the market in 2024, led by strong translational research and regulatory-driven AI adoption. The European Commission (EC) introduced two strategies that will speed up the adoption of AI, enhance innovations, and maintain the competitiveness of Europe. The European Union (EU) also launched two strategies to advance AI in Science and industry. Europe remains a global leader with innovative AI applications. The EU has expanded access to high-performance computing through AI Gigafactories for researchers and startups.

The leading companies that offer AI-driven technologies aim to expand their operations into Germany. These AI applications in Germany encompass drug discovery, orphan drugs, cell and gene therapy, and precision medicine. AI is driving robust healthcare infrastructure, cutting-edge research facilities, and a strong commitment to medical improvements.

By Application/Value-chain Use

By Therapeutic Focus/Use Case

By Technology/Methodology

By Deployment/Delivery Model

By Region

January 2026

January 2026

January 2026

January 2026