February 2026

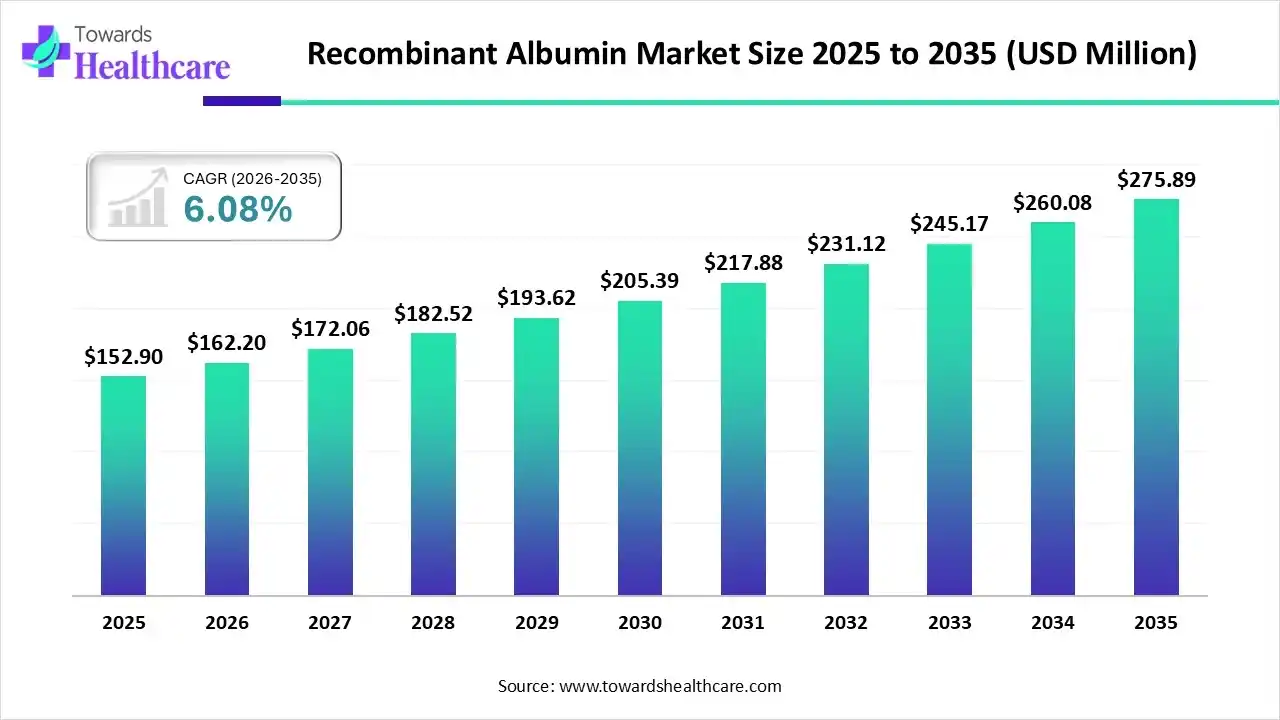

The global recombinant albumin market size was estimated at USD 152.9 million in 2025 and is predicted to increase from USD 162.2 million in 2026 to approximately USD 275.89 million by 2035, expanding at a CAGR of 6.08% from 2026 to 2035.

The growing diseases are increasing the demand for recombinant albumin across various regions. The presence of large populations, advanced healthcare, and industries is increasing their use in the development of various effective therapeutic products and diagnostic solutions. AI is also being used to enhance their properties and applications, where companies are also investing and launching their new products, promoting the market growth.

| Key Elements | Scope |

| Market Size in 2026 | USD 162.2 Million |

| Projected Market Size in 2035 | USD 275.89 Million |

| CAGR (2026 - 2035) | 6.08% |

| Leading Region | Asia Pacific |

| Market Segmentation | By Dosage Form, By Application, By End User, By Region |

| Top Key Players | Albumedix, Biocon Limited, Merck KGaA, InVitria, FUJIFILM Wako Pure Chemical Corp., HiMedia Laboratories Pvt. Ltd., Shandong Chuangxin Biotechnology, NCPC Genetech Biotechnology, Wuhan Healthgen Biotechnology Corp., ProSpec-Tany TechnoGene Ltd., Cyagen Biosciences |

The recombinant albumin market is driven by increasing demand for safety, ethically sourced, and high-purity alternatives to plasma-derived albumin. The recombinant albumin refers to the albumin developed by recombinant DNA technology, by inserting the albumin gene into a host organism. They are used for the development of cell culture, media supplements, biologics , vaccines , drug delivery systems, diagnostic tests, regenerative medicines, and cell & gene therapies.

The use of AI in the optimization of recombinant albumin is increasing, where it is also being used in the prediction of their stability, aggregation risk, and binding capacity. It also enhances their yield and identification of their mutations, reducing their errors. AI also detects deviations and abnormalities, reducing the chances of their failure. This is increasing the use of AI in enhancing the recombinant albumin properties, optimization, and enhancing their applications.

Due to growing focus on the development of cell and gene therapies and regenerative medicine, the demand for recombinant albumin is increasing.

The recombinant albumin is being used in the development of albumin-based nanoparticles and albumin fusion therapeutics to enhance the drug delivery properties.

The increasing chronic diseases are increasing the demand for recombinant albumin for the development of vaccines, diagnostics, and therapeutics.

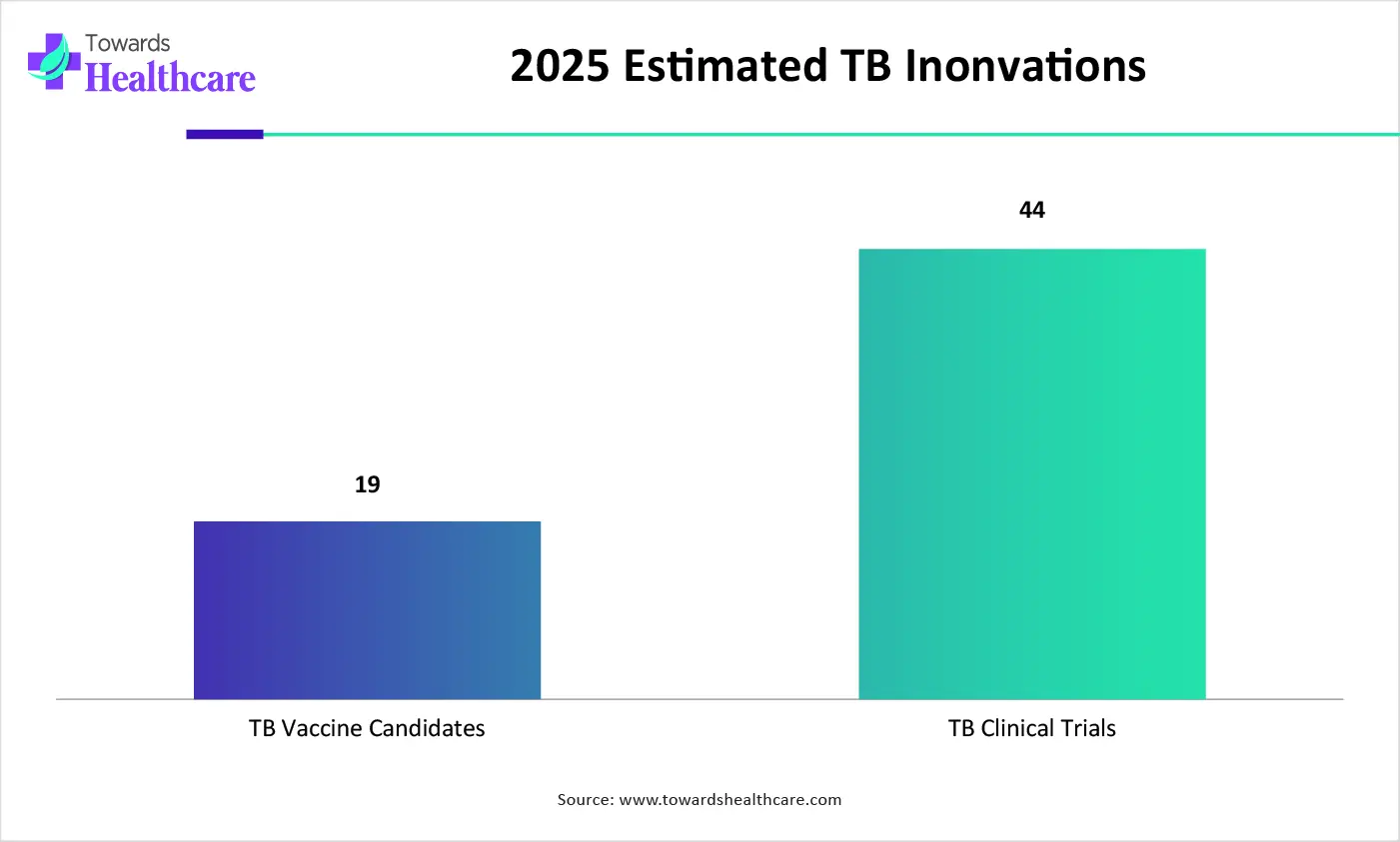

| Innovations | Estimation |

| TB Vaccine Candidates | 19 |

| TB Clinical Trial Phases | 44 |

Why Did the Solution Segment Dominate in the Recombinant Albumin Market in 2025?

The solution segment held the largest share of the market in 2025, due to its stability. At the same time, it also provided ease of administration and rapid onset of action, which increased their acceptance rates. Moreover, their easy formulation also increased the development of ready-to-use solutions, which increased their adoption rates.

Powder

The powder segment is expected to show the fastest growth rate during the predicted time, due to its enhanced shelf life. Their use is increasing due to their reconstitution flexibility and easier storage. Furthermore, their easy transportation and low risk of chemical degradation are also increasing their use.

Which Application Type Segment Held the Dominating Share of the Recombinant Albumin Market in 2025?

The therapeutics segment held the dominating share of the market in 2025, due to its increasing applications. This, in turn, increased their use in the treatment of shock, liver diseases, and burns. Additionally, growth in the use of human albumin innovations and an increase in disease burden also increased their use in emergency situations.

Diagnostics

The diagnostics segment is expected to show the highest growth during the upcoming years, due to growing R&D. This, in turn, is increasing its use in the development of cell cultures and assays. At the same time, their reduced risk of contamination and technological advancements are driving their demand.

What Made the Pharmaceutical & Biotechnology Industry the Dominant Segment in the Recombinant Albumin Market in 2025?

The pharmaceutical & biotechnology industry segment led the market in 2025, due to growth in the development of various therapeutics. They were used in forming various IV therapies, vaccines, and medications. At the same time, they were also used in the development of various cell culture applications, where the investments promoted their adoption rates.

Hospital & Clinics

The hospital & clinics segment is expected to show the fastest growth rate during the forthcoming years, due to growing liver disease. This, in turn, is driving the demand for ready-to-use products, where the growing number of critical cases and burn cases is also contributing to the same. Additionally, their safety profile is also increasing their acceptance rates.

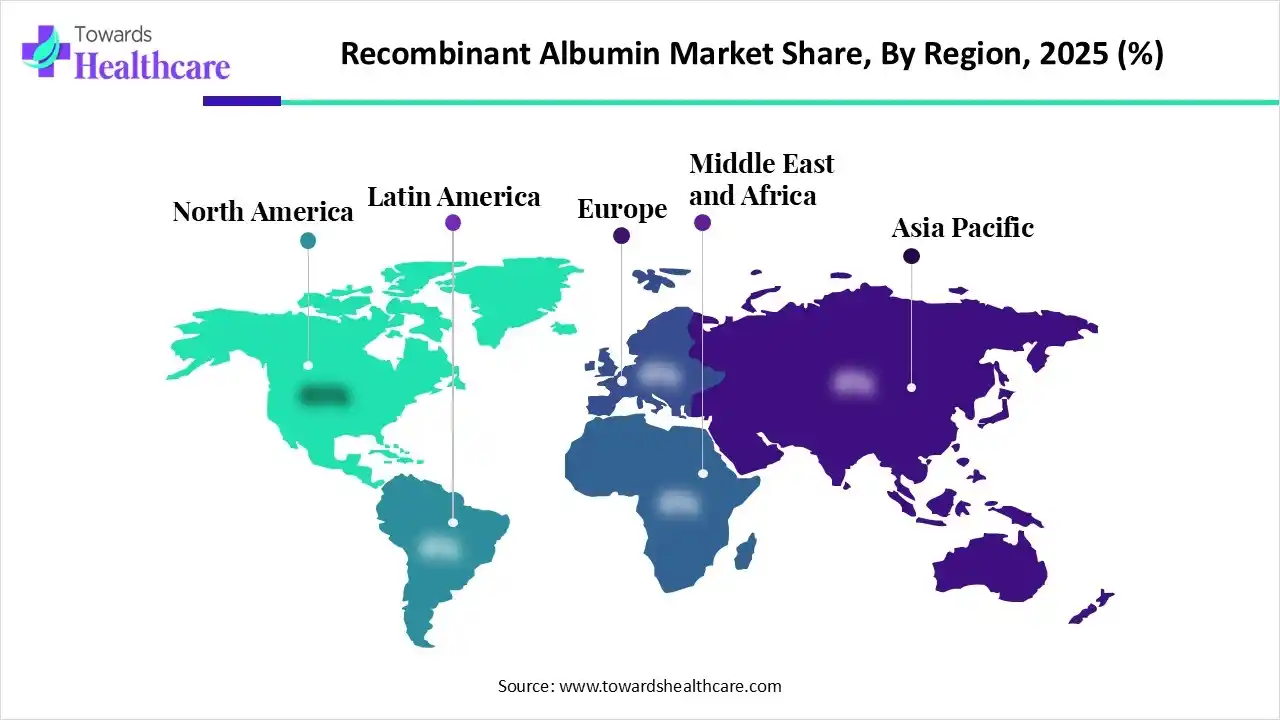

Asia Pacific dominated the recombinant albumin market in 2025, due to the presence of a large population, which increased the incidence of diseases, driving the demand for recombinant albumin therapeutic products. They were also used in the development of various diagnostic solutions, where the expanding healthcare sector also increased their adoption rates. Furthermore, the growth in R&D activities and government initiatives also contributed to the market growth.

There is a rise in the disease burden in China, which is increasing the demand for effective therapeutic and accurate diagnostics, driving the demand for recombinant albumin. Moreover, the presence of a robust healthcare sector and industries is also increasing their use, which is backed by investments from various sources, accelerating their innovations.

North America is expected to host the fastest-growing recombinant albumin market during the forecast period, due to the presence of the advanced healthcare sector. This, in turn, is increasing the use of IV recombinant albumin solutions and increasing the development of various diagnostics. At the same time, growing safety awareness is also increasing their use, where their rising cell culture applications are also enhancing the market growth.

Due to the presence of well-developed industries and the healthcare sector, the use of recombinant albumin products is increasing across the U.S. The growing vaccination program and chronic diseases are increasing their use in the development of various effective treatments and diagnostic options. Moreover, their safety profile is also increasing their use for various applications.

Europe is expected to grow significantly in the recombinant albumin market during the forecast period, due to the presence of robust pharmaceutical industries. This is increasing the demand for recombinant albumin for various R&D activities. They were also used across the hospital and clinics for the treatment of liver diseases and burns. Moreover, the growth in the development of biologics, vaccines, and cell cultures is also increasing their demand, which is promoting the market growth.

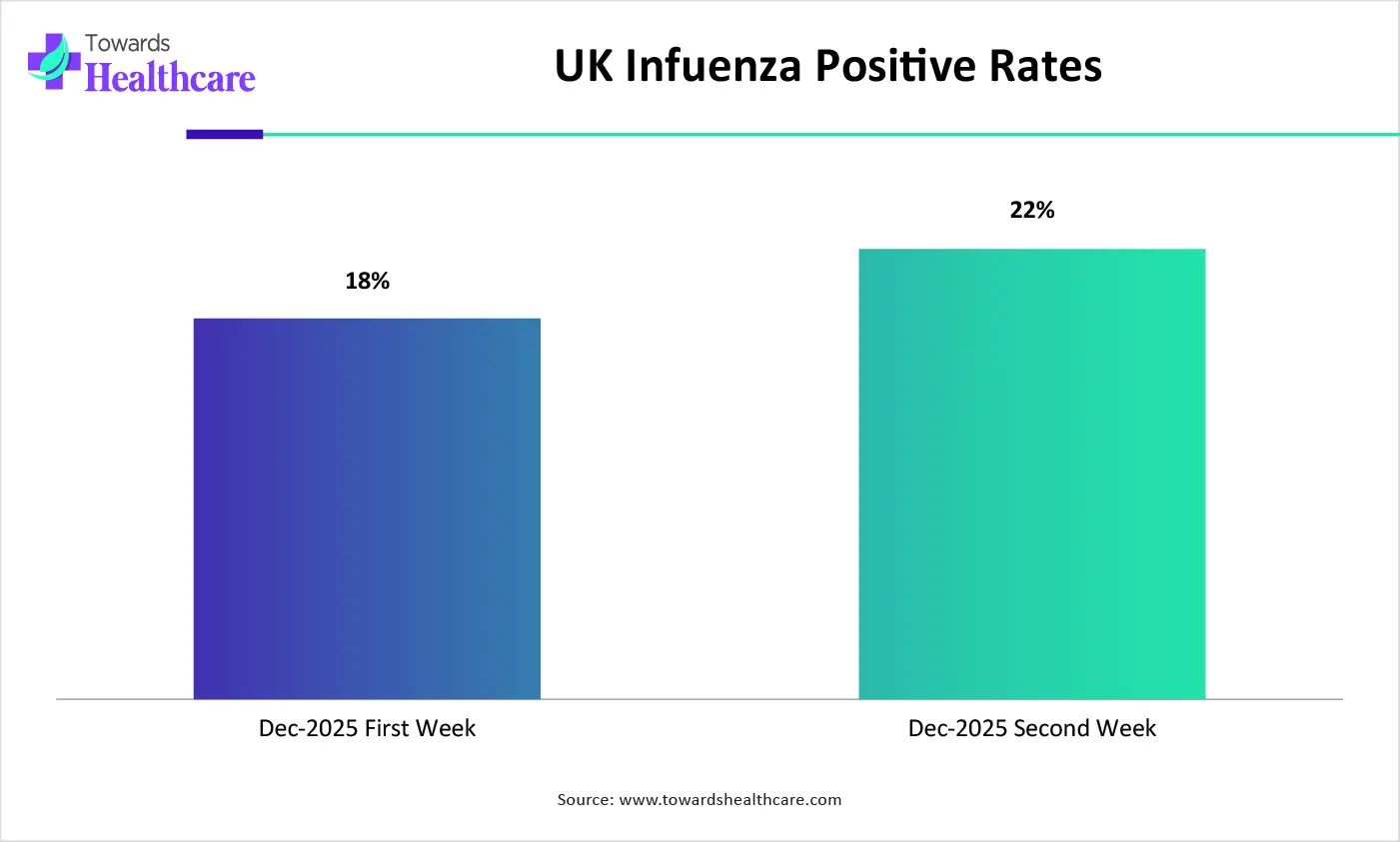

The UK consists of a well-established healthcare sector, which utilizes recombinant albumin for the treatment of various conditions. This, in turn, is driving various innovations, where they are being used in the development of vaccines and diagnostics. Additionally, their low infection risk and reduced chances of contamination are also increasing their use for R&D activities.

| December 2025 | Influenza Positive Rates |

| First week | 18% |

| Second week | 22% |

| Companies | Headquarters | Recombinant Albumin Products |

| Albumedix | Nottingham, UK | Recombumin Alpha and Recombumin Prime |

| Biocon Limited | Karnataka, India | Erprosafe |

| Merck KGaA | Darmstadt, Germany | Recombinant human serum albumin products |

| InVitria | Kansas, U.S. | Exbumin |

| FUJIFILM Wako Pure Chemical Corp. | Osaka, Japan | Recombinant human albumin reagents and products |

| HiMedia Laboratories Pvt. Ltd. | Mumbai, India | Provides Recombinant human albumin |

| Shandong Chuangxin Biotechnology | Shandong, China | Produces recombinant albumin |

| NCPC Genetech Biotechnology | Shijiazhuang, China | Manufactures recombinant human albumin |

| Lazuline Biotech Private Limited | Hyderabad, India | Produces recombinant human albumin |

| Wuhan Healthgen Biotechnology Corp. | Wuhan, China | Manufactures recombinant human albumin |

| ProSpec-Tany TechnoGene Ltd. | Rehovot, Israel | Provides recombinant human albumin |

| Cyagen Biosciences | California, U.S. | Offers recombinant albumin products |

By Dosage Form

By Application

By End User

By Region

February 2026

February 2026

February 2026

February 2026